เนื่องจากมีวิธีการชำระเงินให้เลือกใช้มากขึ้นเรื่อยๆ ทั่วโลก พฤติกรรมและความคาดหวังของลูกค้าจึงเปลี่ยนไป ในปี 2024 การใช้เงินสดทั่วโลกลดลง 4% โดยมีการเปลี่ยนไปใช้การชำระเงินดิจิทัลแทนอย่างมีนัยสำคัญ

แม้ว่าความนิยมของวิธีการชำระเงินหนึ่งๆ จะขึ้นอยู่กับสถานที่ที่ลูกค้าอยู่ สิ่งที่ลูกค้าซื้อ และลูกค้าซื้อสินค้าออนไลน์หรือที่ร้านค้าจริง ลูกค้ายังคงคาดหวังให้ธุรกิจเสนอตัวเลือกการชำระเงินที่รวดเร็ว ปลอดภัย และยืดหยุ่น

ในบทความนี้ เราจะอธิบายวิธีเลือกชุดตัวเลือกการชำระเงินที่ปรับแต่งให้เหมาะกับธุรกิจของคุณและลูกค้า วิธีตั้งค่าระบบการชำระเงินที่ติดตั้งเพื่อรองรับวิธีการชำระเงินเหล่านั้น และสิ่งที่จำเป็นสำหรับการรับการชำระเงินหลากหลายรูปแบบจากลูกค้า โดยสิ่งที่คุณควรรู้มีดังนี้

เนื้อหาหลักในบทความ

- เหตุใดการรองรับวิธีการชำระเงินที่หลากหลายจึงเป็นสิ่งสำคัญ

- วิธีแบ่งการชำระเงินให้ใช้วิธีการชำระเงินหลายวิธี

- วิธีตัดสินใจว่าจะยอมรับวิธีการชำระเงินใดบ้าง

- วิธีตั้งค่าระบบการชำระเงินเพื่อรองรับวิธีการชำระเงินที่หลากหลาย

- ประเภทของวิธีการชำระเงินและวิธีรับการชำระเงิน

- Stripe Payments ช่วยอะไรได้บ้าง

เหตุใดการรองรับวิธีการชำระเงินที่หลากหลายจึงเป็นสิ่งสำคัญ

ในขณะที่อุตสาหกรรมการชำระเงินพัฒนาไปอย่างต่อเนื่อง ธุรกิจควรนำเสนอวิธีการชำระเงินที่หลากหลายเพื่อตอบสนองความคาดหวังของลูกค้าที่เพิ่มขึ้น เหตุผลที่ธุรกิจควรเพิ่มวิธีการชำระเงินให้หลากหลายมีดังนี้

ความสะดวกสบายสำหรับลูกค้า: ลูกค้ามีความต้องการและข้อจำกัดที่แตกต่างกันเกี่ยวกับวิธีการชำระเงิน การยอมรับวิธีการที่หลากหลายจะส่งผลให้ธุรกิจตอบสนองความต้องการได้หลากหลายขึ้น และช่วยให้ผู้ซื้อดำเนินการซื้อให้เสร็จสิ้นได้ง่ายขึ้น

เพิ่มยอดขายและอัตราการเปลี่ยนเป็นลูกค้าจริง: การยอมรับตัวเลือกการชำระเงินเพิ่มเติมจะเพิ่มยอดขายและปรับปรุงอัตราการเปลี่ยนเป็นลูกค้าจริง เนื่องจากลูกค้ามีโอกาสน้อยลงที่จะละทิ้งรถเข็น

ยกระดับประสบการณ์และความพึงพอใจของลูกค้า: การนำเสนอตัวเลือกการชำระเงินที่หลากหลายจะแสดงให้เห็นว่าธุรกิจให้ความสำคัญกับลูกค้า ซึ่งช่วยปรับปรุงประสบการณ์การช้อปปิ้งโดยรวมและเพิ่มความพึงพอใจและความภักดีของลูกค้า

เข้าถึงฐานลูกค้าที่กว้างขึ้น: กลุ่มประชากรที่แตกต่างกันอาจชอบวิธีการชำระเงินที่แตกต่างกัน ตัวอย่างเช่น ลูกค้าอายุน้อยอาจชอบกระเป๋าเงินดิจิทัลหรือแอปแบบเพียร์ทูเพียร์ (P2P) ในขณะที่ลูกค้าที่มีอายุมากกว่าอาจเลือกใช้บัตรเครดิตหรือการโอนเงินผ่านธนาคารมากกว่า

ปรับปรุงการจัดการกระแสเงินสด: วิธีการชำระเงินที่แตกต่างกันใช้เวลาในการประมวลผลที่แตกต่างกันไป การรับวิธีการชำระเงินผสมผสานหลายแบบจะช่วยให้ธุรกิจได้รับการชำระเงินบางรายการเร็วกว่าปกติ ซึ่งช่วยในการจัดการกระแสเงินสด

แข่งขันกับคู่แข่งได้: การยอมรับตัวเลือกการชำระเงินที่หลากหลายกำลังเริ่มเป็นแนวทางปฏิบัติที่เป็นมาตรฐานในหลายอุตสาหกรรม เมื่อธุรกิจในปัจจุบันยอมรับวิธีการชำระเงินที่หลากหลายมากขึ้น ธุรกิจที่ไม่ปรับตัวก็อาจเสียเปรียบ

ปรับตัวให้เข้ากับตลาดโลก: หากธุรกิจดำเนินกิจการระหว่างประเทศหรือวางแผนที่จะขยายธุรกิจ ก็ควรยอมรับวิธีการชำระเงินที่ได้รับความนิยมในภูมิภาคและประเทศต่างๆ

ลดการพึ่งพาผู้ให้บริการชำระเงินรายเดียว: การใช้วิธีการชำระเงินวิธีเดียวอาจมีความเสี่ยง หากมีปัญหาด้านเทคนิคหรือการเปลี่ยนแปลงนโยบายของผู้ให้บริการ การมีทางเลือกอื่นจะช่วยรักษาความต่อเนื่องทางธุรกิจ

- การรักษาความปลอดภัยและการป้องกันการฉ้อโกง: วิธีการชำระเงินที่แตกต่างกันมาพร้อมกับฟีเจอร์การรักษาความปลอดภัยและกลไกป้องกันการฉ้อโกงที่แตกต่างกัน การเสนอตัวเลือกที่หลากหลายจะช่วยปกป้องธุรกิจและลูกค้าของธุรกิจได้

- การรักษาความปลอดภัยและการป้องกันการฉ้อโกง: วิธีการชำระเงินที่แตกต่างกันมาพร้อมกับฟีเจอร์การรักษาความปลอดภัยและกลไกป้องกันการฉ้อโกงที่แตกต่างกัน การเสนอตัวเลือกที่หลากหลายจะช่วยปกป้องธุรกิจและลูกค้าของธุรกิจได้

รับมือกับความก้าวหน้าและแนวโน้มทางเทคโนโลยี: เมื่อเทคโนโลยีพัฒนาขึ้น วิธีการชำระเงินก็ก้าวหน้าไปพร้อมกัน การติดตามเทคโนโลยีและเทรนด์การชำระเงินล่าสุดอยู่เสมอ เช่น การชำระเงินผ่านอุปกรณ์เคลื่อนที่และคริปโต จะช่วยให้ธุรกิจตามทันการเปลี่ยนแปลงของโลก

การปฏิบัติตามกฎและข้อกำหนดทางกฎหมาย วิธีการชำระเงินบางวิธีอาจเหมาะสำหรับการปฏิบัติตามข้อกำหนดทางกฎหมายในบางอุตสาหกรรมหรือภูมิภาคมากกว่าวิธีอื่นๆ

วิธีแบ่งการชำระเงินให้ใช้วิธีการชำระเงินหลายวิธี

หากลูกค้าขอให้แบ่งการชำระเงินให้ใช้วิธีการชำระเงินหลายวิธี ต่อไปนี้คือวิธีที่ธุรกิจสามารถแบ่งการชำระเงินไปให้วิธีการชำระเงินหลายวิธีได้

1. ยืนยันว่าระบบที่คุณใช้รองรับการชำระเงินแบบแยกส่วน

ตรวจสอบระบบบันทึกการขาย (POS) หรือผู้ประมวลผลการชำระเงินของคุณว่ารองรับการชำระเงินหลายประเภทสำหรับธุรกรรมเดียวหรือไม่

2. ถามลูกค้าว่าต้องการแบ่งการชำระเงินอย่างไร

ดูว่าลูกค้าต้องการใช้วิธีการชำระเงินกี่วิธีและจำนวนเงินที่จะชำระในแต่ละวิธี ยืนยันว่าแต่ละยอดรวมกันเป็นยอดรวมที่ต้องชำระ

3. ป้อนการชำระเงินส่วนแรก

เริ่มประมวลผลการชำระเงินส่วนแรกโดยป้อนเป็นการชำระเงินบางส่วนลงใน POS หรือผู้ประมวลผลการชำระเงินของคุณ รอการยืนยันก่อนดำเนินการต่อ

4. ป้อนการชำระเงินส่วนที่เหลือ

หลังจากการชำระเงินส่วนแรกสำเร็จ ให้ป้อนการชำระเงินส่วนที่เหลือทีละรายการ ตรวจสอบให้แน่ใจว่าธุรกรรมแต่ละรายการได้รับการยืนยันแล้ว

วิธีตัดสินใจว่าจะยอมรับวิธีการชำระเงินใดบ้าง

ตรวจสอบว่าธุรกิจของคุณพร้อมที่รับวิธีการชำระเงินที่ลูกค้าของคุณชอบใช้แล้วหรือยัง วิธีพิจารณาหาวิธีการชำระเงินเหล่านี้ ได้แก่

การวิเคราะห์ลูกค้าขั้นสูง: ใช้เครื่องมืออย่าง Google Analytics, ซอฟต์แวร์การจัดการความสัมพันธ์ลูกค้า (CRM) หรือแพลตฟอร์มการวิเคราะห์เฉพาะทางสำหรับฟินเทค วิเคราะห์ข้อมูลลูกค้าเพื่อเข้าถึงข้อมูลประชากรของลูกค้า พฤติกรรมการซื้อ และความต้องการด้านการชำระเงิน แบ่งกลุ่มฐานลูกค้าและวิเคราะห์รูปแบบการใช้จ่าย

เทรนด์การชำระเงินเฉพาะอุตสาหกรรม: ศึกษาเทรนด์การชำระเงินในอุตสาหกรรมของคุณ คุณสามารถทำได้โดยการเข้าร่วมการประชุม สมัครรับวารสารการค้า และติดต่อพูดคุยเพื่อนร่วมอุตสาหกรรม บางอุตสาหกรรมอาจหันมาสนใจเทคโนโลยีการชำระเงินที่เฉพาะเจาะจง (เช่น การชำระเงินด้วยเทคโนโลยีการสื่อสารระยะใกล้ (NFC) ในร้านค้าปลีก รูปแบบการสมัครสมาชิกสำหรับบริการซอฟต์แวร์)

การวิเคราะห์โดยละเอียดเกี่ยวกับต้นทุน-ผลประโยชน์ของวิธีการชำระเงิน: พิจารณาค่าธรรมเนียมธุรกรรม ค่าใช้จ่ายในการนำไปใช้งาน ค่าใช้จ่ายในการบำรุงรักษา ค่าธรรมเนียมการดึงเงินคืน และผลกระทบที่อาจเกิดขึ้นกับกระแสเงินสด ใช้การสร้างแบบจำลองทางการเงินเพื่อคาดการณ์ผลกระทบของวิธีการชำระเงินแบบต่างๆ ที่ส่งผลต่อผลกำไรของคุณ

การประเมินความปลอดภัยเชิงลึก: ทำงานร่วมกับผู้เชี่ยวชาญด้านเทคโนโลยีสารสนเทศ (IT) และการรักษาความปลอดภัยทางไซเบอร์เพื่อประเมินฟีเจอร์การรักษาความปลอดภัยของแพลตฟอร์มการชำระเงินต่างๆ ซึ่งรวมถึงการปฏิบัติตามมาตรฐาน เช่น มาตรฐานการรักษาความปลอดภัยข้อมูลสำหรับอุตสาหกรรมบัตรชำระเงิน (PCI DSS) สำหรับธุรกรรมบัตรเครดิต มาตรฐานการเข้ารหัสข้อมูล และ ฟังก์ชันการตรวจจับการฉ้อโกง

แนวโน้มและการคาดการณ์ด้านการนำเทคโนโลยีมาใช้: ติดตามเทคโนโลยีการชำระเงินที่เกิดขึ้นใหม่ เช่น การชำระเงินแบบบล็อกเชน ไบโอเมตริก หรือระบบการชำระเงินที่ขับเคลื่อนด้วย AI และคาดการณ์ว่าเทคโนโลยีเหล่านี้จะถูกนำมาใช้ในตลาดของคุณได้อย่างไร ลองปรึกษากับผู้เชี่ยวชาญด้านฟินเทคหรือนักคาดการณ์เทคโนโลยี

การวิเคราะห์การขายหลายช่องทาง: ธุรกิจที่มีช่องทางการขายหลายช่องทางสามารถวิเคราะห์วิธีการชำระเงินที่เหมาะกับแต่ละช่องทางที่สุด เช่น ตัวเลือกการชำระเงินผ่านอุปกรณ์เคลื่อนที่อาจได้รับความนิยมในช่องทางออนไลน์ ในขณะที่วิธีการแบบดั้งเดิม เช่น เงินสดหรือบัตรเครดิต อาจเป็นตัวเลือกอันดับต้นๆ ในร้านค้าจริง

การวิเคราะห์ตลาดระหว่างประเทศ: ธุรกิจทั่วโลกควรทำการวิเคราะห์ที่เฉพาะเจาะจงสำหรับตลาด ซึ่งรวมถึงการทำความเข้าใจความต้องการด้านการชำระเงินในท้องถิ่น สภาพแวดล้อมด้านกฎระเบียบ ความเสี่ยงในการแลกเปลี่ยนสกุลเงิน และโอกาสในการเป็นพาร์ทเนอร์กับผู้ให้บริการในท้องถิ่น

การรวบรวมข้อมูลด้านการแข่งขัน: ใช้เครื่องมือและบริการขั้นสูงสำหรับการวิเคราะห์การแข่งขัน จับตามองคู่แข่งโดยตรงตลอดจนผู้นำในอุตสาหกรรมและผู้สร้างนวัตกรรม มองหารูปแบบในวิธีการชำระเงินที่พวกเขายอมรับ

การประเมินฟังก์ชันผสานการทำงาน: ประเมินฟังก์ชันการผสานการทำงานของวิธีการชำระเงินที่แตกต่างกันด้วยสแต็กเทคโนโลยีของคุณ รวมถึงการวางแผนทรัพยากรองค์กร (ERP), CRM, ซอฟต์แวร์การบัญชี และเครื่องมืออื่นๆ ในการทำงาน เป้าหมายคือการสร้างขั้นตอนการทำงานที่ราบรื่นและเป็นอัตโนมัติซึ่งช่วยลดการภาระการทำงานของเจ้าหน้าที่ให้เหลือน้อยที่สุด

กลไกรวบรวมความคิดเห็นของลูกค้าแบบมีโครงสร้าง: พัฒนาวิธีแบบมีโครงสร้างเพื่อรวบรวมความคิดเห็นจากลูกค้าเกี่ยวกับความต้องการด้านการชำระเงิน ซึ่งอาจมีการใช้เทคนิคการทำแบบสำรวจขั้นสูง การสนทนากลุ่ม หรือการรับฟังผ่านโซเชียลมีเดีย

การทดลองนำร่องและการทดสอบ A/B: ดำเนินการทดลองนำร่องด้วยวิธีการชำระเงินที่แตกต่างกันในสภาพแวดล้อมที่มีการควบคุม ใช้การทดสอบ A/B เพื่อเปรียบเทียบประสิทธิภาพ ความพึงพอใจของลูกค้า และประสิทธิผลการดำเนินงาน

วิธีตั้งค่าระบบการชำระเงินเพื่อรองรับวิธีการชำระเงินที่หลากหลาย

เมื่อทราบแล้วว่าต้องการเสนอวิธีการชำระเงินแบบใดให้ลูกค้า ตรวจสอบให้แน่ใจว่าคุณรองรับวิธีการชำระเงินเหล่านี้ได้ ต่อไปนี้คือประเด็นสำคัญที่ควรพิจารณาเมื่อประเมินและตั้งค่าระบบการประมวลผลการชำระเงิน

1. เลือกเกตเวย์การชำระเงินและผู้ประมวลผล: เกตเวย์และผู้ประมวลผลของคุณควรรองรับวิธีการชำระเงินที่คุณเลือก ไม่ว่าจะเป็นบัตรเครดิต/เดบิต กระเป๋าเงินดิจิทัลและอื่นๆ อย่าลืมประเมินค่าบริการ เวลาในการประมวลผลธุรกรรม และประวัติความน่าเชื่อถือด้วย

2. ผสานการทำงานกับระบบของคุณ: ตรวจสอบให้แน่ใจว่าระบบการชำระเงินทำงานร่วมกับการตั้งค่าธุรกิจของคุณ เช่น แพลตฟอร์มอีคอมเมิร์ซ ซอฟต์แวร์ทางการเงิน และระบบ CRM การผสานการทำงานนี้จะช่วยให้กระบวนการเป็นไปโดยอัตโนมัติและรักษาบันทึกได้แม่นยำ

3. ปฏิบัติตามมาตรฐานด้านการรักษาความปลอดภัย: ระบบของคุณควรเป็นไปตามมาตรฐานด้านการรักษาความปลอดภัย เช่น PCI DSS สำหรับการจัดการบัตรเครดิต มีกลไกการตรวจจับและป้องกันการฉ้อโกงที่รัดกุม และปฏิบัติตามกฎหมายคุ้มครองข้อมูลที่เกี่ยวข้องทั้งหมด

4. สร้างอินเทอร์เฟซผู้ใช้ที่เข้าใจง่าย: อินเทอร์เฟซการชำระเงินควรตรงไปตรงมาสำหรับลูกค้าและมีตัวเลือกวิธีการชำระเงินที่ชัดเจน ส่วนแบ็กเอนด์ควรใช้งานง่ายสำหรับการจัดการธุรกรรม การคืนเงิน และการเข้าถึงรายงาน

5. ต้องเข้ากันได้กับอุปกรณ์เคลื่อนที่: เนื่องจากผู้คนทำธุรกรรมบนอุปกรณ์เคลื่อนที่กันมากขึ้น ระบบของคุณควรใช้งานบนอุปกรณ์เคลื่อนที่ได้และรองรับการชำระเงินด้วยกระเป๋าเงินและแอปบนอุปกรณ์เคลื่อนที่

6. รับชำระเงินหลายสกุลเงินและการชำระเงินระหว่างประเทศ: หากธุรกิจของคุณดำเนินธุรกิจทั่วโลก ระบบควรพร้อมประมวลผลหลายสกุลเงินและปฏิบัติตามกฎด้านการชำระเงินระหว่างประเทศ

7. ความสามารถในการขยายระบบ: เลือกระบบที่จะขยายไปพร้อมกับธุรกิจของคุณเพื่อรองรับปริมาณธุรกรรมที่เพิ่มขึ้นและวิธีการชำระเงินแบบใหม่อย่างมีประสิทธิภาพ

8. ให้บริการสนับสนุนลูกค้าที่เชื่อถือได้: เลือกผู้ให้บริการที่ขึ้นชื่อด้านการสนับสนุนลูกค้าที่ยอดเยี่ยมซึ่งสามารถช่วยในการตั้งค่าและดูแลปัญหาการดำเนินงานที่จะเกิดขึ้นอย่างต่อเนื่อง

9. เข้าถึงการฝึกอบรมและแหล่งข้อมูลที่ครอบคลุม: การเข้าถึงการฝึกอบรมและแหล่งข้อมูลโดยละเอียดสำหรับคุณและทีมของคุณเป็นสิ่งสำคัญในการรักษาประสิทธิภาพและลดข้อผิดพลาด

10. ทดสอบให้ครอบคลุมก่อนเปิดตัว: ทดสอบระบบอย่างละเอียดเพื่อระบุและแก้ไขปัญหา การทดสอบนี้ควรครอบคลุมวิธีการชำระเงินทั้งหมด และรวมถึงสถานการณ์ต่างๆ เช่น การคืนเงินและธุรกรรมล้มเหลว

11. ดำเนินการตรวจสอบและวิเคราะห์ธุรกรรม: ใช้ฟังก์ชันติดตามเพื่อระบุแนวโน้ม จัดการการเงินอย่างมีประสิทธิภาพ และตัดสินใจเกี่ยวกับธุรกิจโดยมีข้อมูลครบถ้วน

12. ระบบสำรองและแผนการกู้คืนข้อมูล: วางระบบสำรองและขั้นตอนการกู้คืนข้อมูลในกรณีที่ระบบล้มเหลวและเพื่อป้องกันการสูญเสียข้อมูล

ประเภทของวิธีการชำระเงินและวิธีรับการชำระเงิน

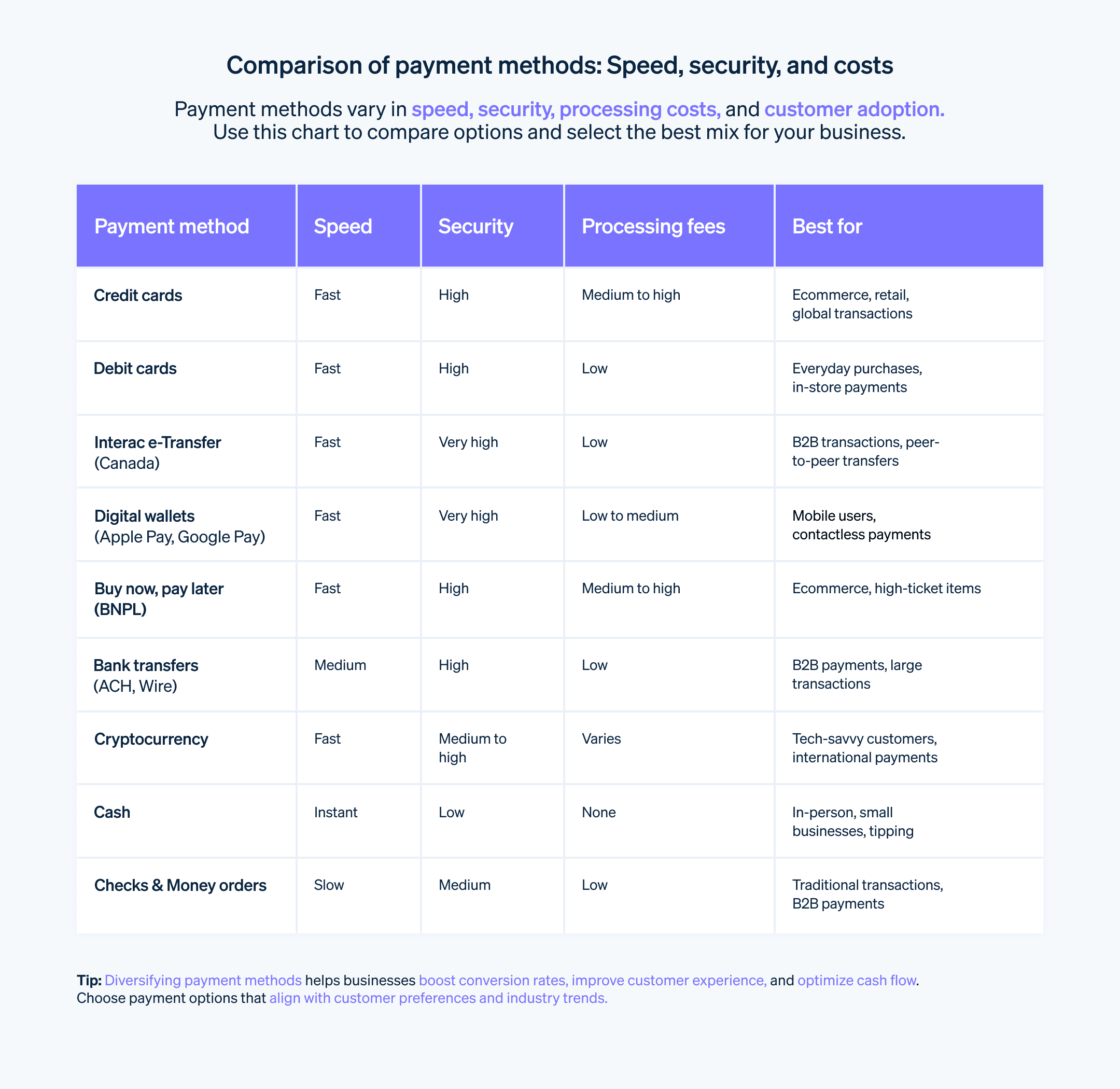

วิธีการชำระเงินมีหลายประเภท และผู้ให้บริการชำระเงินสมัยใหม่มีวิธีการมากมายให้คุณเลือกใช้ได้โดยไม่ต้องตั้งค่าเพิ่มเติม ตัวอย่างวิธีการที่นิยมใช้กันที่คุณควรทราบมีดังนี้

วิธีการแบบดั้งเดิม

เงินสด: แม้เงินสดจะได้รับความนิยมลดลง แต่ก็ยังคงเป็นทางเลือกที่ยอมรับกันอย่างกว้างขวาง โดยเฉพาะสำหรับธุรกรรมมูลค่าไม่สูง

เช็ค: เช็คยังคงใช้โดยคนบางกลุ่มที่ชื่นชอบวิธีการชำระเงินแบบกระดาษ แต่มีเวลาดำเนินการนานกว่าและเสี่ยงที่จะเกิดการฉ้อโกง

ใบสั่งจ่ายเงิน: ใบสั่งจ่ายเงินรับประกันเงินทุน แต่มีข้อเสียเช่นเดียวกับเช็ค

การโอนเงินต่างชาติ: การโอนเงินต่างชาติมักใช้สำหรับการธุรกรรมที่มีมูลค่าสูงหรือการชำระเงินระหว่างประเทศ

การรับชำระเงินด้วยวิธีแบบดั้งเดิม

เงินสด

อุปกรณ์: ไม่จำเป็นต้องใช้อุปกรณ์เพิ่มเติม แค่มีเครื่องบันทึกเงินสดหรือลิ้นชักนิรภัยที่กำหนดโดยเฉพาะก็พอแล้ว

ข้อควรพิจารณา: ความเสี่ยงด้านความปลอดภัยในการจัดการเงินสด ต้องทำการนับด้วยตนเองและการฝากเงินด้วยตนเอง เสี่ยงต่อการถูกโจรกรรมหรือสูญหาย

เช็ค

อุปกรณ์: เครื่องพิมพ์เช็คสำหรับเก็บข้อมูลบัญชีที่ถูกต้อง ตราประทับรับรอง เครื่องอ่านเช็คเสริม เพื่อให้สามารถดำเนินการได้เร็วขึ้น

ขั้นตอน: ยืนยันตัวตนและลายเซ็น ตรวจสอบว่ามีเงินทุนที่เพียงพอ (ซึ่งอาจต้องโทรหาธนาคาร) รับรองและฝากเช็คภายในเวลาที่กำหนดไว้ล่วงหน้า

ข้อควรพิจารณา: ระยะเวลาในการประมวลผลอาจใช้เวลานาน เช็คอาจเด้งได้ และอาจมีความเสี่ยงที่จะถูกฉ้อโกง

ใบสั่งจ่ายเงิน

อุปกรณ์: เครื่องพิมพ์เช็ค ตราประทับรับรอง เครื่องอ่านเช็คเสริม

ขั้นตอน: ยืนยันตัวตน ลายเซ็น และจำนวนเงิน รับรองและฝากเงิน

ข้อควรพิจารณา: การตรวจสอบรายละเอียดผู้ออกเช็คและสถานที่ซื้อสามารถลดความเสี่ยงที่จะถูกฉ้อโกงได้

การโอนเงินต่างชาติ

ข้อกำหนด: ต้องมีข้อมูลลูกค้า เช่น รายละเอียดบัญชีธนาคาร, Routing Number, จำนวนเงิน และรหัสอ้างอิง จำเป็นต้องมีบัญชีธนาคารในการรับการโอนเงิน

ข้อควรพิจารณา: ค่าธรรมเนียมสำหรับผู้ส่งและผู้รับ รวมถึงความล่าช้าที่อาจเกิดขึ้นนั้นขึ้นอยู่กับธนาคารที่เกี่ยวข้อง

เคล็ดลับสำหรับวิธีการแบบดั้งเดิมทั้งหมด

แสดงวิธีการชำระเงินที่ยอมรับให้ชัดเจน: แจ้งให้ลูกค้าทราบในขั้นตอนการชำระเงินหรือบนใบแจ้งหนี้

กำหนดขั้นตอนการฝากเงิน: จัดเก็บและฝากเงินสด/เช็คอย่างปลอดภัยเป็นประจำ

ฝึกอบรมพนักงานเกี่ยวกับการป้องกันการฉ้อโกง: ระบุกิจกรรมที่น่าสงสัยและใช้โปรโตคอลการยืนยัน

พิจารณาบริการจัดการเงินสด: ซึ่งอาจเป็นบริการรถหุ้มเกราะหรือเงินสดหยอดเหรียญสำหรับธุรกิจขนาดใหญ่

วิธีการแบบใช้บัตร

บัตรเครดิต: บัตรเครดิตให้ความสะดวกสบาย ใช้กันอย่างแพร่หลาย และช่วยให้ลูกค้าสามารถชำระเงินภายหลัง โดยต้องเสียดอกเบี้ยหรือได้รับคะแนนสะสม

บัตรเดบิต: บัตรเดบิตคล้ายกับบัตรเครดิต แต่จะหักเงินออกจากบัญชีธนาคารของลูกค้าโดยตรง

บัตรเติมเงิน: จำเป็นต้องเติมเงินล่วงหน้า

การชำระเงินแบบไร้สัมผัส: เทคโนโลยี NFC ช่วยให้สามารถชำระเงินด้วยการแตะได้ทันทีผ่านบัตรหรือกระเป๋าเงินดิจิทัล

การรับชำระเงินด้วยบัตร

บัตรเครดิตและบัตรเดบิต

อุปกรณ์และซอฟต์แวร์: ระบบบันทึกการขาย (POS) ที่มีเครื่องอ่านบัตร (เทอร์มินัลกายภาพหรือเครื่องอ่านผ่านอุปกรณ์เคลื่อนที่) บัญชีผู้ค้า และเกตเวย์การชำระเงินล้วนจำเป็นต่อการประมวลผลธุรกรรมอย่างปลอดภัย

ขั้นตอน: เมื่อลูกค้ารูด เสียบ หรือแตะบัตร การทำธุรกรรมก็จะได้รับการอนุมัติ และธุรกิจของคุณจะได้รับการยืนยันการชำระเงิน

ข้อควรพิจารณา: การปฏิบัติตามข้อกำหนดของ PCI สำหรับการรักษาความปลอดภัยของข้อมูล ค่าธรรมเนียมการทำธุรกรรม และ การจัดการการดึงเงินคืน

บัตรเติมเงิน

ระบบ POS ส่วนใหญ่รองรับ ผ่านกระบวนการเดียวกับบัตรเครดิต/เดบิต

ข้อควรพิจารณา: ยืนยันยอดคงเหลือของบัตรก่อนรับชำระเงินเพื่อหลีกเลี่ยงปัญหาเกี่ยวกับเงินไม่เพียงพอ บัตรเติมเงินบางแบบมีฟังก์ชันที่จำกัด

การชำระเงินแบบไร้สัมผัส

อุปกรณ์: เครื่องอ่านบัตรที่ใช้ NFC สำหรับธุรกรรมแบบแตะเพื่อชำระเงิน

ข้อควรพิจารณา: แม้ว่าการชำระเงินแบบไร้สัมผัสจะได้รับความนิยมเพิ่มขึ้น แต่ลูกค้าบางรายอาจยังคงชอบวิธีแบบดั้งเดิมอยู่

วิธีการชำระเงินดิจิทัล/ออนไลน์

เกตเวย์การชำระเงินออนไลน์: แพลตฟอร์มเช่น PayPal, Stripeหรือ Square ผสานการทำงานกับเว็บไซต์หรือแอปเพื่อรับชำระเงินออนไลน์

กระเป๋าเงินดิจิทัล: Apple Pay, Google Pay และ Samsung Pay จัดเก็บข้อมูลการชำระเงินแบบดิจิทัลเพื่อการชำระเงินที่รวดเร็วและปลอดภัย

ซื้อตอนนี้ จ่ายทีหลัง (BNPL): บริการซื้อตอนนี้ จ่ายทีหลังต่างๆ เช่น Klarna หรือ Affirm เปิดให้ลูกค้าแบ่งการชำระเงินออกเป็นงวดๆ ได้

คริปโต: ธุรกิจส่วนใหญ่ไม่รับชำระเงินด้วย Bitcoin, Ethereum และสกุลคริปโตอื่นๆ มากนัก

การรับวิธีการชำระเงินดิจิทัล/ออนไลน์

เกตเวย์การชำระเงินออนไลน์

เลือกผู้ให้บริการ: เปรียบเทียบฟีเจอร์และค่าธรรมเนียมของตัวเลือกยอดนิยม เช่น Stripe หรือ PayPal ก่อนที่จะเลือกตัวเลือกสุดท้าย

เชื่อมต่อกับเว็บไซต์หรือแอปของคุณ: ทำตามคำแนะนำในการผสานการทำงานจากผู้ให้บริการ

ตั้งค่าตัวเลือกการชำระเงิน: กำหนดสกุลเงิน บัตรที่ยอมรับ และฟีเจอร์เพิ่มเติมต่างๆ

จัดการธุรกรรม: เข้าถึงประวัติการทำธุรกรรม กระทบยอดการชำระเงิน และจัดการการคืนเงิน

กระเป๋าเงินดิจิทัล

เปิดใช้งานการรองรับกระเป๋าเงินหลักๆ: Apple Pay, Google Pay, Samsung Pay เป็นต้น

__ ความเข้ากันได้ของระบบ POS:__ ตรวจสอบให้แน่ใจว่าเครื่องอ่านบัตรหรือระบบชำระเงินรองรับการชำระเงินแบบไร้สัมผัส.

การรับรู้ของลูกค้า: โปรโมตตัวเลือกการชำระเงินด้วยกระเป๋าเงินดิจิทัลระหว่างการชำระเงิน

ซื้อตอนนี้ จ่ายทีหลัง

ร่วมมือกับผู้ให้บริการซื้อตอนนี้ จ่ายทีหลัง เลือกบริการเช่น Klarna หรือ Affirm ที่ตรงกับกลุ่มเป้าหมายและโมเดลธุรกิจของคุณ

ผสานการทำงานกับการชำระเงิน: เสนอตัวเลือกซื้อตอนนี้ จ่ายทีหลังควบคู่ไปกับวิธีการชำระเงินอื่นๆ

จัดการการชำระเงินแบบผ่อนชำระ: ตั้งค่าการหักเงินอัตโนมัติและขั้นตอนปฏิบัติสำหรับการจัดการค่าธรรมเนียมการชำระเงินล่าช้าหรือการผิดชำระหนี้ที่อาจเกิดขึ้น

คริปโต

เลือกผู้ประมวลผลการชำระเงินคริปโต: เปรียบเทียบความปลอดภัย ค่าธรรมเนียมธุรกรรม และสกุลเงินที่รองรับ

แสดงคริปโตที่ยอมรับให้ชัดเจน: แจ้งให้ลูกค้าทราบในขั้นตอนการชำระเงินหรือบนใบแจ้งหนี้

เข้าใจความผันผวนของคริปโต: เตรียมพร้อมสำหรับความผันผวนของราคาและความเสี่ยงที่อาจเกิดขึ้นกับคริปโต

วิธีการชำระเงินใหม่ๆ

Open Banking: การแชร์ข้อมูลทางการเงิน กับผู้ให้บริการบุคคลที่สามผ่านอินเทอร์เฟซการเขียนโปรแกรมแอปพลิเคชัน (API) เพื่อเพิ่มประสิทธิภาพการชำระเงิน

การชำระเงินด้วยรหัส QR: รหัสที่สแกนได้ที่เชื่อมโยงกับแอปชำระเงินจะช่วยอำนวยความสะดวกในการทำธุรกรรมที่รวดเร็วและไร้การสัมผัส

การเปิดรับวิธีการชำระเงินใหม่ๆ

Open Banking

เป็นพาร์ทเนอร์กับผู้ให้บริการ Open Banking เลือกบริการที่มีชื่อเสียงซึ่งปฏิบัติตามกฎระเบียบและมาตรฐานความปลอดภัย

เชื่อมต่อกับเว็บไซต์หรือแอปของคุณ: ทำตามคำแนะนำในการรักษาความปลอดภัยการผสานการทำงาน API จากผู้ให้บริการ

ขอความยินยอมจากลูกค้า: อธิบายประโยชน์ของการให้บริการ Open Banking อย่างชัดเจนและขอความยินยอมอย่างชัดเจนเพื่อเข้าถึงข้อมูลทางการเงินของลูกค้า

อำนวยความสะดวกในการชำระเงินจากบัญชีจนถึงบัญชี: ช่วยให้ลูกค้าชำระเงินจากบัญชีธนาคารของตนได้ ซึ่งมักจะมีค่าธรรมเนียมต่ำกว่าการทำธุรกรรมผ่านบัตรแบบดั้งเดิม

การชำระเงินด้วยรหัส QR

เลือกผู้ให้บริการชำระเงินหรือแอป: ตัวเลือกยอดนิยม ได้แก่ PayPal, Venmo, Alipayและ WeChat Pay

สร้างรหัส QR: สร้างรหัส QR สำหรับธุรกรรมหรือผลิตภัณฑ์แต่ละรายการ แล้วลิงก์กับบัญชีการชำระเงินของคุณ

แสดงและชำระเงิน: วางรหัส QR ที่เคาน์เตอร์ชำระเงิน บนฉลากผลิตภัณฑ์ ในใบแจ้งหนี้ หรือรหัสทางออนไลน์สำหรับให้ลูกค้าสแกนด้วยกล้องสมาร์ทโฟนเพื่อเริ่มต้นการชำระเงิน

เคล็ดลับ

ความร่วมมือกับธนาคารและฟินเทค: ทำงานร่วมกับสถาบันการเงินเพื่อนำเสนอนวัตกรรมด้านโซลูชันและบริการด้านการชำระเงิน

การชำระเงินข้ามพรมแดน: สำรวจศักยภาพของ Open Banking เพื่ออำนวยความสะดวกในการทำธุรกรรมระหว่างประเทศด้วยค่าธรรมเนียมที่น้อยกว่าและระยะเวลาดำเนินการที่รวดเร็วขึ้น

การผสานการทำงานกับโปรแกรมสะสมคะแนน: เชื่อมโยงรหัส QR กับคะแนนสะสมหรือส่วนลดเพื่อเพิ่มการมีส่วนร่วมของลูกค้า

วิธีอื่นๆ

ตัวเลือกการชำระเงินเหล่านี้ประกอบด้วยการชำระเงินตามใบแจ้งหนี้และการชำระเงินตามรอบบิล

การรับชำระเงินด้วยวิธีอื่น

การชำระเงินตามใบแจ้งหนี้

ซอฟต์แวร์หรือเทมเพลตใบแจ้งหนี้: เลือกแพลตฟอร์มหรือสร้างใบแจ้งหนี้ที่ระบุรายละเอียดบริการ ค่าใช้จ่าย และวันครบกำหนด

ตัวเลือกการชำระเงิน: รับชำระเงินหลายวิธี เช่น เกตเวย์การชำระเงินออนไลน์ การประมวลผลบัตรเครดิต การโอนเงินผ่านธนาคาร หรือเช็ค

ช่องทางการจัดส่ง: ส่งใบแจ้งหนี้ทางอิเล็กทรอนิกส์ผ่านอีเมลหรือพอร์ทัลออนไลน์ หรือเสนอเวอร์ชันที่สามารถพิมพ์ได้สำหรับวิธีการชำระเงินแบบดั้งเดิม

การแจ้งเตือนการชำระเงิน: ตั้งค่าการแจ้งเตือนอัตโนมัติเมื่อใกล้ถึงวันครบกำหนดชำระ และนำระบบติดตามผลมาใช้กับการชำระเงินที่ล่าช้า

การชำระเงินตามรอบบิล

แพลตฟอร์มการจัดการการชำระเงินตามรอบบิล: เลือกบริการ เช่น Stripe Billing เพื่อจัดการการชำระเงินตามแบบแผนล่วงหน้าอย่างปลอดภัย

แพ็กเกจและค่าบริการสำหรับการชำระเงินตามรอบบิล: กำหนดระดับการชำระเงินตามรอบบิล ที่แตกต่างกันซึ่งมีฟีเจอร์และตัวเลือกค่าบริการเฉพาะตัว

รักษาความปลอดภัยข้อมูลลูกค้า: ใช้มาตรการรักษาความปลอดภัยของข้อมูลเพื่อปกป้องรายละเอียดการชำระเงินที่จัดเก็บไว้

กระบวนการยกเลิก: เปิดให้ลูกค้ายกเลิกหรือจัดการการชำระเงินตามรอบบิลได้ง่ายภายในแพลตฟอร์ม

ตัวเลือกการเรียกเก็บเงินที่ยืดหยุ่น: เสนอการเรียกเก็บเงินรายปี รายเดือน หรือแบ่งชำระตามสัดส่วน โดยขึ้นอยู่กับโมเดลธุรกิจของคุณ

เคล็ดลับ

ขั้นตอนการชำระเงินเข้าใจง่าย: อำนวยความสะดวกให้ลูกค้าชำระใบแจ้งหนี้หรือจัดการการชำระเงินตามรอบบิลได้ง่ายๆ

ความยืดหยุ่นในการชำระเงิน: ตอบสนองความต้องการของลูกค้าที่หลากหลายด้วยการนำเสนอวิธีการชำระเงินที่หลากหลาย

การสื่อสารที่ชัดเจน: แจ้งใบแจ้งหนี้ ข้อกำหนดการชำระเงิน และรายละเอียดการชำระเงินตามรอบบิลอย่างชัดเจนเพื่อไม่ให้เกิดความสับสน

ระบบทำงานอัตโนมัติ: ใช้ซอฟต์แวร์และ ระบบอัตโนมัติเพื่อจัดการใบแจ้งหนี้ การเรียกเก็บเงินตามรอบบิล และการแจ้งเตือนการชำระเงินอย่างมีประสิทธิภาพ

การวิเคราะห์ข้อมูลการชำระเงิน: ติดตามแนวโน้มการชำระเงินและพฤติกรรมของลูกค้าเพื่อปรับปรุงกระบวนการเรียกเก็บเงินและกลยุทธ์ด้านค่าบริการ

การชำระเงินบางส่วน: สำหรับใบเรียกเก็บที่มียอดสูง ลูกค้าจะชำระเงินตามใบแจ้งหนี้แบบผ่อนชำระได้

การทดลองใช้ฟรีหรือข้อเสนอพิเศษ: ดึงดูดผู้สมัครใช้บริการรายใหม่ด้วยการทดลองใช้ฟรีแบบจำกัดเวลาหรือการลดราคา

Stripe Payments ช่วยอะไรได้บ้าง

Stripe Payments มอบโซลูชันการชำระเงินระดับโลกแบบครบวงจรที่ช่วยให้ธุรกิจใดๆ ตั้งแต่สตาร์ทอัพที่กำลังเติบโตไปจนถึงองค์กรระดับโลกรับชำระเงินออนไลน์ ที่จุดขาย และทั่วโลกได้

Stripe Payments ช่วยคุณทำสิ่งต่อไปนี้ได้

- เพิ่มประสิทธิภาพให้ประสบการณ์การชำระเงินของคุณ: สร้างประสบการณ์ที่ราบรื่นให้กับลูกค้าและประหยัดเวลาในการทำงานวิศวกรรมได้หลายพันชั่วโมงด้วย UI การชำระเงินที่สร้างไว้ให้แล้ว, สิทธิ์เข้าถึงวิธีการชำระเงินมากกว่า 125 วิธี และ Link ซึ่งเป็นกระเป๋าเงินที่สร้างโดย Stripe

- ขยายไปสู่ตลาดใหม่ๆ ได้เร็วขึ้น: เข้าถึงลูกค้าทั่วโลกและลดความซับซ้อนและค่าใช้จ่ายในการจัดการหลายสกุลเงินด้วยตัวเลือกการชำระเงินข้ามพรมแดนที่มีให้บริการใน 195 ประเทศและกว่า 135 สกุลเงิน

- รวมการชำระเงินที่จุดขายและทางออนไลน์ไว้ด้วยกัน: สร้างประสบการณ์การค้าแบบแพลตฟอร์มรวมในช่องทางออนไลน์และที่จุดขายเพื่อปรับแต่งการโต้ตอบ ตอบแทนความภักดี และเพิ่มรายได้

- ปรับปรุงประสิทธิภาพการชำระเงิน: เพิ่มรายรับด้วยเครื่องมือการชำระเงินที่กำหนดเองได้และปรับแต่งได้ง่ายๆ ซึ่งรวมถึงระบบป้องกันการฉ้อโกงแบบไม่ต้องเขียนโค้ดและความสามารถขั้นสูงเพื่อเพิ่มอัตราการอนุมัติ

- เดินหน้าได้เร็วขึ้นด้วยแพลตฟอร์มที่ยืดหยุ่นและเชื่อถือได้เพื่อการเติบโต: สร้างบนแพลตฟอร์มที่ออกแบบมาเพื่อขยับขยายไปพร้อมกับคุณ โดยมีระยะเวลาให้บริการที่แทบจะไม่หยุดทำงานเลย และมีความน่าเชื่อถือระดับแนวหน้าของวงการ

ดูข้อมูลเพิ่มเติมเกี่ยวกับวิธีที่ Stripe Payments สามารถช่วยให้คุณรับการชำระเงินออนไลน์และที่จุดขายได้ หรือเริ่มใช้งานเลยวันนี้

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ