การชําระเงินที่ถูกปฏิเสธสร้างความซับซ้อนให้กับหลายอย่างๆ สำหรับทุกฝ่ายที่เกี่ยวข้อง ลูกค้าจะแปลกใจว่าเกิดข้อผิดพลาดอะไรขึ้นกับบัตรหรือบัญชี ในขณะที่ธุรกิจเองก็ไม่แน่ใจว่าจะทําธุรกรรมได้เสร็จสมบูรณ์หรือไม่ การชําระเงินทุกประเภทอาจจะถูกปฏิเสธได้ทั้งนั้น โดยอาจเกิดขึ้นเมื่อลูกค้านําสินค้าเต็มรถเข็นมาชำระเงินกับแคชเชียร์ เมื่อคลิก "ชําระเงิน" บนเว็บไซต์ของธุรกิจ หรือเมื่อเกิดข้อผิดพลาดกับการตั้งค่าการชําระเงินตามแบบแผนล่วงหน้าของลูกค้า

การปฏิเสธบัตรอาจเกิดขึ้นได้ด้วยเหตุผลหลายประการและอาจทําให้สูญเสียโอกาสในการขายในที่สุด หากต้องการหลีกเลี่ยงเหตุการณ์แบบนี้ คุณต้องทําความเข้าใจว่าธุรกรรมบัตรเครดิตนั้นได้รับการอนุมัติอย่างไรและสาเหตุใดบ้างที่อาจทําให้เกิดการปฏิเสธ ผู้ประมวลผลการชําระเงินจะออกรหัสการปฏิเสธที่แสดงถึงเหตุผลในการปฏิเสธธุรกรรม ธุรกิจต่างๆ จึงควรศึกษาวิธีการจำแนกและทำความเข้าใจรหัสเหล่านี้เพื่อจะได้รับมือกับธุรกรรมที่ถูกปฏิเสธและกู้คืนการขายได้สําเร็จ

บทความนี้ให้ข้อมูลอะไรบ้าง

- การอนุมัติบัตรคืออะไร

- รหัสการปฏิเสธคืออะไร

- ประเภทการปฏิเสธบัตร

- รายการรหัสการปฏิเสธบัตร

การอนุมัติบัตรคืออะไร

การอนุมัติบัตรคือขั้นตอนการอนุมัติที่ตรวจสอบว่าเจ้าของบัตรมีเงินทุนเพียงพอที่จะชำระให้กับการซื้อที่พยายามดําเนินการหรือไม่ โดยเป็นขั้นตอนที่เกิดขึ้นเบื้องหลังเมื่อมีการประมวลผลธุรกรรมผ่านบัตร

สําหรับธุรกรรมที่จุดขาย ลูกค้าจะรูด แตะ หรือเสียบบัตรเข้าไปในเครื่องอ่านบัตร ส่วนในการซื้อออนไลน์ ลูกค้าจะป้อนข้อมูลการชําระเงินของตนเมื่อได้รับแจ้ง เทอร์มินัลของธุรกิจจะส่งข้อมูลสําหรับธุรกรรมนั้นไปที่สถาบันผู้รับบัตร (หรือที่เรียกว่า "ธนาคารผู้รับบัตร ซึ่งเป็นสถาบันการเงินที่เป็นตัวแทนของธุรกิจ

จากนั้น สถาบันผู้รับบัตรจะส่งธุรกรรมไปยังเครือข่ายบัตร และตรวจสอบให้แน่ใจว่ามีการฝากเงินในบัญชีที่ถูกต้อง สถาบันผู้รับบัตรส่งคําขอต่อบริษัทผู้ออกบัตร (หรือที่เรียกว่า "ธนาคารผู้ออกบัตร) ซึ่งเป็นสถาบันทางการเงินที่ออกบัตรชําระเงินให้แก่เจ้าของบัตร

บริษัทผู้ออกบัตรจะตรวจสอบบัญชีของเจ้าของบัตรและพิจารณาว่ามีเงินทุนหรือเครดิตที่ใช้ได้เพียงพอสำหรับธุรกรรมให้เสร็จสมบูรณ์หรือไม่ หากมี บริษัทผู้ออกบัตรจะรับเงินดังกล่าวจากบัญชีของเจ้าของบัตรและส่งต่อไปให้สถาบันผู้รับบัตร จากนั้น สถาบันผู้รับบัตรจะฝากเงินเข้าบัญชีของธุรกิจ

รหัสการปฏิเสธคืออะไร

โดยทั่วไปแล้ว รหัสปฏิเสธมักจะเป็นรหัสข้อผิดพลาดที่เป็นตัวเลข 2 หลักที่แสดงถึงสาเหตุที่ธุรกรรมบัตรถูกปฏิเสธ แม้ว่ารหัสอาจมีต้นทางมาจากแหล่งต่างๆ แต่มักมาจากธนาคารผู้ออกบัตร ผู้ประมวลผลการชําระเงิน หรือเครือข่ายเครดิต

ธุรกิจจะไม่เห็นรหัสเหมือนกันเสมอไป หากธุรกิจใช้ผู้ประมวลผลการชําระเงินเช่น Stripe ธุรกิจอาจเห็นรหัสการปฏิเสธอื่นๆ ที่แตกต่างกัน ซึ่งบ่งชี้ว่าเพราะเหตุใดธุรกรรมจึงดําเนินการไม่สําเร็จ พร้อมทั้งระบุสาเหตุเพื่อความสะดวกในการแก้ไขปัญหาและทําธุรกรรมให้เสร็จสิ้น

ประเภทการปฏิเสธบัตร

การปฏิเสธบัตรมีหลายประเภท จากการศึกษาของ Ethoca สาเหตุที่พบบ่อยที่สุดที่บัตรถูกปฏิเสธคือเงินหรือวงเงินไม่เพียงพอ โดยคิดเป็น 44% ของการปฏิเสธทั้งหมด ธุรกิจไม่สามารถทําอะไรได้มากนักในกรณีเหล่านี้ เนื่องจากเป็นปัญหาของเจ้าของบัตรเอง แต่การเสนอวิธีการชำระเงินแบบซื้อตอนนี้ จ่ายทีหลังซึ่ง Stripe รองรับจะช่วยลดการปฏิเสธบัตรที่มีสาเหตุมาจากเงินทุนไม่เพียงพอได้ นอกจากนี้ เจ้าของบัตรอาจต้องย้ายเงินจากบัญชีอื่นมายังบัญชีที่มีเงินไม่เพียงพอเพื่อทําธุรกรรมให้เสร็จสมบูรณ์

สาเหตุที่พบบ่อยอีกประการหนึ่งที่ทำให้บัตรถูกปฏิเสธก็คือข้อมูลไม่ถูกต้อง ปัญหานี้พบได้บ่อยในการทําธุรกรรมออนไลน์ ซึ่งเจ้าของบัตรจะต้องป้อนหมายเลขบัตรและ CVV รวมถึงวันหมดอายุด้วยตัวเอง โดย 1 ใน 5 ของการปฏิเสธบัตรเกิดขึ้นเมื่อลูกค้าทําผิดพลาดและป้อนข้อมูลที่ไม่ถูกต้อง การแก้ไขทําได้ง่ายๆ โดนให้เจ้าของบัตรป้อนข้อมูลอีกครั้งอย่างถูกต้อง

นอกจากนี้ การชําระเงินด้วยบัตรยังอาจถูกปฏิเสธเนื่องจากกิจกรรมถูกสงสัยว่าเป็นการฉ้อโกง ซึ่งเกิดขึ้นได้เมื่อเจ้าของบัตรทำการซื้อจํานวนมากหรือทำธุรกรรมจํานวนมากในระยะเวลาสั้นๆ เจ้าของบัตรแก้ไขปัญหานี้ได้โดยการติดต่อกับธนาคารผู้ออกบัตรและยืนยันตัวตน ซึ่งจะเป็นการอนุมัติการเรียกเก็บเงิน

บางครั้งบัตรอาจถูกปฏิเสธเนื่องจากยังไม่ได้เปิดใช้งานบัตร ซึ่งแก้ไขได้โดยให้เจ้าของบัตรดําเนินการตามขั้นตอนการเปิดใช้งานที่ระบุไว้จนเสร็จสิ้น ในทํานองเดียวกัน บัตรที่หมดอายุแล้วจะถูกปฏิเสธเช่นกัน ในกรณีนี้เจ้าของบัตรจะต้องใช้ตัวเลือกการชําระเงินแบบอื่น ชิปหรือแถบแม่เหล็กของบัตรเสียหายก็อาจทําให้ถูกปฏิเสธด้วยเช่นกันหากเทอร์มินัลไม่สามารถอ่านบัตรได้ ในกรณีนี้ วิธีแก้ไขปัญหาคือให้ป้อนข้อมูลบัตรด้วยตัวเองหรือใช้การชําระเงินแบบไร้สัมผัส (ถ้ามี)

นอกจากนี้ บัตรจะถูกปฏิเสธหากเทอร์มินัลดังกล่าวทำงานเข้ากันไม่ได้กับเครือข่ายบัตรที่เชื่อมโยงกับบัตร ตัวอย่างเช่น หากบัตรใช้เครือข่ายบัตร American Express แต่เทอร์มินัลไม่ได้สื่อสารกับ American Express คุณจะไม่สามารถประมวลผลธุรกรรมได้ โซลูชันอย่าง Stripe ทํางานร่วมกับเครือข่ายบัตรขนาดใหญ่เกือบทุกเครือข่ายทั้งในสหรัฐอเมริกาและทั่วโลก จึงช่วยหลีกเลี่ยงการถูกปฏิเสธบัตรที่มีสาเหตุมาจากระบบไม่รองรับเครือข่ายบัตร

รายการรหัสการปฏิเสธบัตร

ด้านล่างนี้คือรายการรหัสการปฏิเสธบัตรที่อาจปรากฏขึ้นหากผู้ประมวลผลพิจารณาแล้วว่าไม่สามารถประมวลผลธุรกรรมได้ รหัสแต่ละรหัสจะแสดงเหตุผลว่าเพราะเหตุใดการชำระเงินจึงถูกปฏิเสธ

- 01: โปรดติดต่อบริษัทผู้ออกบัตร

- 02: โปรดติดต่อบริษัทผู้ออกบัตร (เงื่อนไขพิเศษ)

- 03: ผู้ค้าไม่ถูกต้อง

- 04: ยึดบัตร (ไม่ใช่การฉ้อโกง)

- 05: ถูกปฏิเสธจากบริษัทผู้ออกบัตร

- 06: ข้อผิดพลาด

- 07: ยึดบัตร (การฉ้อโกง)

- 10: อนุมัติเฉพาะบางส่วน

- 12: ธุรกรรมไม่ถูกต้อง

- 13: ยอดเงินไม่ถูกต้อง

- 14: หมายเลขบัญชีไม่ถูกต้อง

- 15: ไม่มีบริษัทผู้ออกบัตรนี้

- 19: ธุรกรรมซ้ำ

- 21: ไม่ได้ดำเนินการใดๆ

- 25: ไม่พบข้อมูลในระบบ

- 28: ไฟล์ไม่พร้อมสำหรับการอัปเดตชั่วคราวหรือเสียหาย

- 41: บัตรได้รับแจ้งสูญหาย, ยึดบัตร

- 43: บัตรถูกขโมย, ยึดบัตร

- 51: เงินไม่เพียงพอ

- 52: ไม่มีบัญชีกระแสรายวัน

- 53: ไม่มีบัญชีออมทรัพย์

- 54: บัตรหมดอายุ

- 55: PIN ไม่ถูกต้อง

- 57: ธุรกรรมไม่ได้รับอนุญาต—บัตร

- 58: ธุรกรรมไม่ได้รับอนุญาต—เทอร์มินัล

- 59: บัตรต้องสงสัยว่าอาจมีการฉ้อโกง

- 61: เกินวงเงินการอนุมัติ

- 62: รหัสบริการไม่ถูกต้อง/ถูกจำกัด

- 63: ละเมิดความปลอดภัย

- 64: ธุรกรรมไม่เป็นไปตามข้อกำหนด AML

- 65: เกิดวงเงินการถอน

- 70: ต้องระบุข้อมูล PIN

- 75: ใส่ PIN ผิดเกินจำนวนครั้งที่อนุญาต

- 76: การปรับคืนที่ไม่ได้ร้องขอ

- 78: ถูกบล็อก, การใช้งานครั้งแรก

- 79: ปรับคืนแล้ว

- 82: ผลลัพธ์ CAM, dCVV, iCVV หรือ CVV เป็นลบ

- 85: ไม่มีเหตุผลให้ปฏิเสธ

- 86: ยืนยัน PIN ไม่ได้

- 91: บริษัทผู้ออกบัตรหรือ Switch ไม่พร้อมให้บริการ

- 92: ไม่สามารถกำหนดเส้นทางธุรกรรมได้

- 93: ไม่สามารถทำธุรกรรมจนเสร็จสมบูรณ์—ละเมิดกฎหมาย

- 96: ข้อผิดพลาดภายในระบบ

- 97: CVV ไม่ถูกต้อง

- 9G: ถูกบล็อกโดยเจ้าของบัตร/ติดต่อเจ้าของบัตร

- 1A: ต้องตรวจสอบสิทธิ์ลูกค้าเพิ่มเติม

- R0: หยุดการเรียกเก็บเงินตามแบบแผนล่วงหน้าตามคำขอของลูกค้า

- R1: หยุดการเรียกเก็บเงินตามแบบแผนล่วงหน้าตามคำขอของลูกค้า

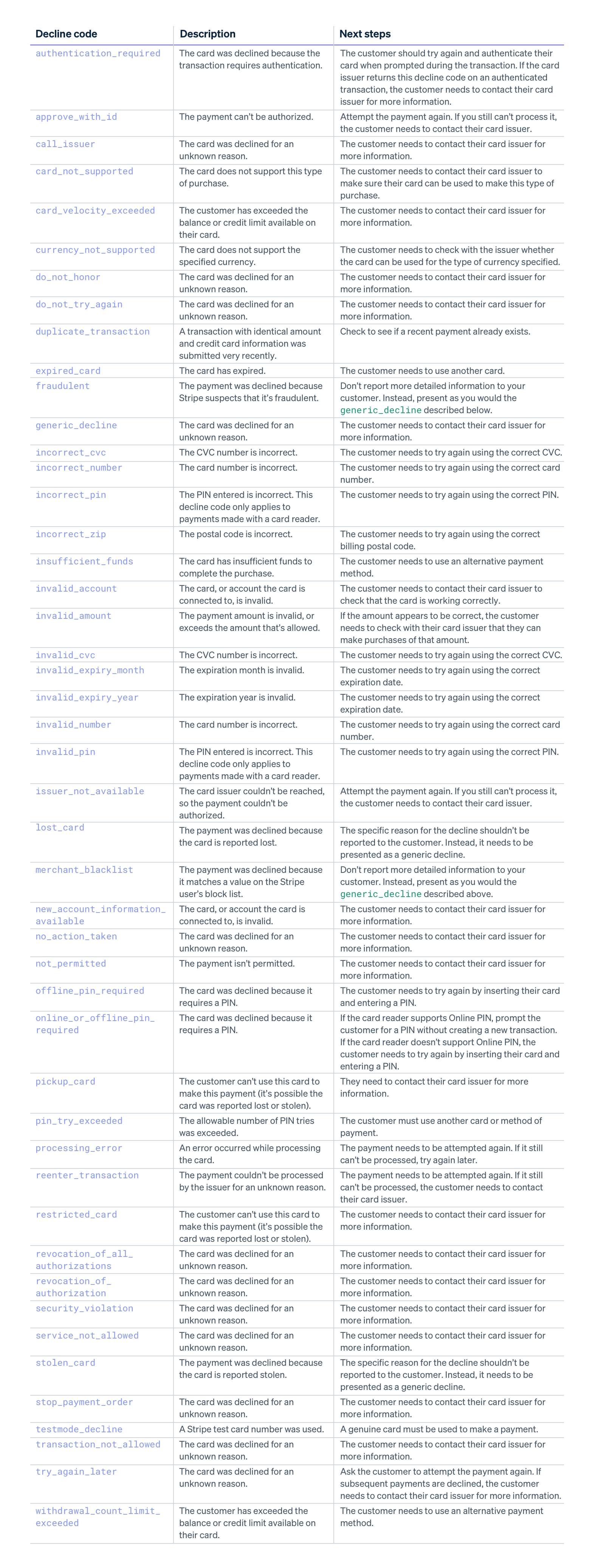

Stripe ใช้รหัสการปฏิเสธการชำระเงินของตัวเอง ซึ่งครอบคลุมสาเหตุที่เป็นไปได้หลายประการเช่นเดียวกับรหัสการปฏิเสธการชำระเงินแบบเดิม แต่อธิบายปัญหาได้ชัดเจนกว่า รหัสปฏิเสธการชำระเงินของ Stripe มีดังนี้

หากต้องการข้อมูลเพิ่มเติมเกี่ยวกับการจัดการการปฏิเสธและธุรกรรมที่ไม่สําเร็จกับ Stripe โปรดเริ่มต้นที่นี่

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ