A declined payment complicates things for everyone involved. The customer suddenly wonders what went wrong with their card or account, while the business is unsure if the transaction can be completed. No type of payment is immune to declines. They can happen when the customer brings their cart full of items to the store register, when they click “check out” on the business’s website, or when something goes wrong with the customer’s recurring-payment setup.

Card declines can occur for various reasons and might lead to a lost sale. Avoiding them requires understanding how credit card transactions are authorized and what can cause a decline. Payment processors provide decline codes that indicate their reason for rejecting a transaction. Businesses should learn to recognize and understand these codes in order to successfully respond to a declined transaction—and potentially salvage the sale.

What’s in this article?

- What is card authorization?

- What is a decline code?

- Types of card declines

- List of card decline codes

What is card authorization?

Card authorization is the approval process that checks to see if a cardholder has sufficient funds to cover the purchase they are attempting to make. It happens behind the scenes when a card transaction is processed.

For an in-person transaction, a customer swipes, taps, or inserts their card into a card reader; for an online purchase, they enter their payment information when prompted. The information for that transaction is sent from the business’s terminal to its acquirer (also called the “acquiring bank”), the financial institution that represents the business.

The acquirer directs the transaction to the correct card network and ensures the funds are deposited in the correct account. The acquirer submits a request to the card issuer (also called the “issuing bank”), the financial institution that issued the payment card to the cardholder.

The issuer examines the cardholder’s account and determines if there are enough funds or available credit to complete the transaction. If there is, the issuer takes that money from the cardholder’s account and sends it to the acquirer, which deposits it in the business’s account.

What is a decline code?

A decline code is typically a two-digit, alphanumeric error code that indicates why a card transaction has been declined. While the code can originate from a number of sources, it often comes from the issuing bank, payment processor, or credit networks.

Businesses won’t always see the exact code. If they are using a payment processor like Stripe, they may see other unique decline codes that indicate why the transaction failed and provide clues for solving the issue and completing the transaction.

Types of card declines

There are many different types of card declines. The most common reason that a card is declined is insufficient funds or credit, accounting for 44% of declines in an Ethoca study. Businesses can’t do much in these cases, since the issue originates with the cardholder. Offering buy now, pay later options, which Stripe supports, can help minimize declines due to insufficient funds. Beyond that, the cardholder may need to move money from another account to the account with insufficient funds, in order to complete the transaction.

Another common reason for card declines is incorrect data. This issue is more common with online transactions, where cardholders are required to enter their card number as well as the card’s CVV and expiration date. One in five card declines occur when a customer makes a mistake and inputs incorrect information. This is easily resolved if the cardholder re-enters their information correctly.

Card payments can also be declined for suspected fraudulent activity, which can be triggered by large purchases or a large volume of transactions over a short period of time. The cardholder can resolve this issue by communicating with their issuing bank and confirming their identity, which will authorize the charges.

Sometimes cards are declined because the card has not been activated yet, which can be resolved if the cardholder completes the specified activation process. Similarly, a card that has expired will be declined, and cardholders will have to use another payment option. Damage to a card’s chip or strip can also lead to a decline if the terminal is unable to read the card. Other options, in this case, are manual entry of card data or contactless payment, if available.

A card will also be declined if the terminal is not compatible with the card network associated with the card. For example, if the card uses the American Express card network and the terminal does not communicate with American Express, then the transaction cannot be processed. Solutions like Stripe work with most major card networks, both in the US and globally, which helps avoid declines related to an unsupported card network.

List of card decline codes

Below is a list of the card decline codes that may appear if a processor determines that a transaction cannot be processed. Each code denotes a different reason for why a payment is declined.

- 01: Refer to issuer

- 02: Refer to issuer (special condition)

- 03: Invalid merchant

- 04: Pick up card (no fraud)

- 05: Do not honor

- 06: Error

- 07: Pick up card (fraud)

- 10: Partial approval

- 12: Invalid transaction

- 13: Invalid amount

- 14: Invalid account number

- 15: No such issuer

- 19: Re-enter transaction

- 21: No action taken

- 25: Unable to locate record in file

- 28: File temporarily not available for update or injury

- 41: Lost card, pick up

- 43: Stolen card, pick up

- 51: Insufficient funds

- 52: No checking account

- 53: No savings account

- 54: Expired card

- 55: Incorrect PIN

- 57: Transaction not permitted—card

- 58: Transaction not permitted—terminal

- 59: Suspected fraud

- 61: Exceeds approval amount limit

- 62: Invalid/restricted service code

- 63: Security violation

- 64: Transaction does not fulfill AML requirement

- 65: Exceeds withdrawal limit

- 70: PIN data required

- 75: Allowable number of PIN entry tries exceeded

- 76: Unsolicited reversal

- 78: Blocked, first use

- 79: Already reversed

- 82: Negative CAM, dCVV, iCVV, or CVV results

- 85: No reason to decline

- 86: Cannot verify PIN

- 91: Issuer or switch unavailable

- 92: Unable to route transaction

- 93: Transaction can’t be completed—violation of law

- 96: System error

- 97: Invalid CVV

- 9G: Blocked by cardholder/contact cardholder

- 1A: Additional customer authentication required

- R0: Recurring charge stopped at customer request

- R1: Recurring charge stopped at customer request

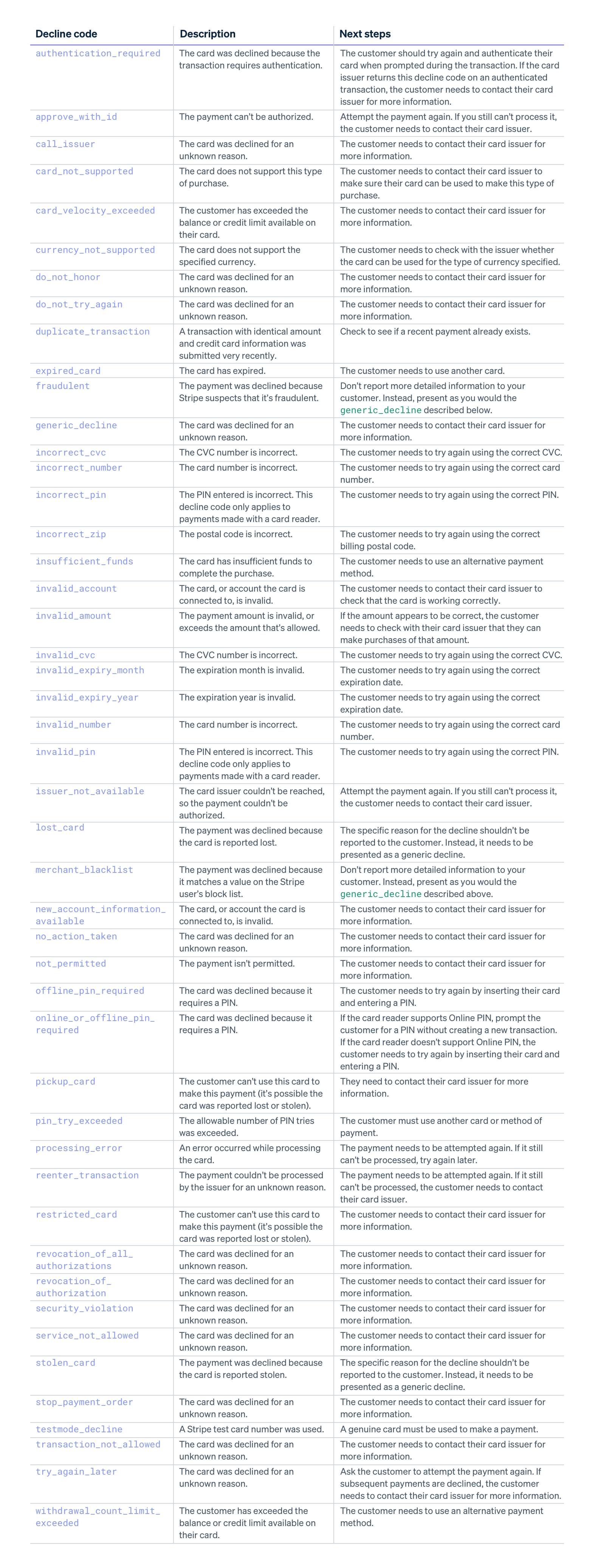

Stripe uses its own decline codes, which cover many of the same potential reasons as the traditional decline codes, but spell out the problem more clearly. The Stripe decline codes are as follows:

For more information about handling declines and failed transactions with Stripe, start here.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.