ด้วยยอดขายอีคอมเมิร์ซทั่วโลกที่คาดการณ์ว่าจะสูงถึง 6 ล้านล้านดอลลาร์สหรัฐในปี 2023 เป็นที่ชัดเจนว่าธุรกรรมแบบไม่ต้องแสดงบัตร (CNP) เป็นส่วนผสมสําคัญสำหรับธุรกิจจำนวนมาก อย่างไรก็ตาม ธุรกรรมแบบแสดงบัตร (CP) ยังคงมีบทบาทสําคัญเช่นกัน โดยเฉพาะอย่างยิ่งสําหรับธุรกิจที่มีที่ตั้งทางกายภาพ ธุรกิจจะต้องเข้าใจประเภทธุรกรรมเหล่านี้อย่างลงลึกก่อนที่จะพิจารณาถึงข้อดี ความท้าทายที่อาจเกิดขึ้น และความเหมาะสมกับโมเดลธุรกิจต่างๆ

เราจะอธิบายข้อแตกต่างระหว่างธุรกรรมแบบ CP กับธุรกรรมแบบ CNP โดยพิจารณาลักษณะเฉพาะและสํารวจว่าธุรกิจจะประเมินและเลือกตัวเลือกที่ดีที่สุดสําหรับความต้องการของตนเองได้อย่างไร นอกจากนี้เราจะอธิบายถึงบทบาทของผู้ให้บริการประมวลผลการชําระเงินในขั้นตอนการตัดสินใจนี้ รวมทั้งประโยชน์ที่พันธมิตรเหล่านี้สามารถมอบให้ธุรกิจต่างๆ ที่กำลังดำเนินงานในสภาพแวดล้อมที่ซับซ้อนนี้

บทความนี้ให้ข้อมูลอะไรบ้าง

- ธุรกรรมแบบแสดงบัตรคืออะไร

- ประโยชน์และความท้าทายของธุรกรรมแบบแสดงบัตร

- ธุรกรรมแบบไม่ต้องแสดงบัตรคืออะไร

- ประโยชน์และความท้าทายของธุรกรรมแบบไม่ต้องแสดงบัตร

- ธุรกรรมแบบแสดงบัตรเทียบกับธุรกรรมที่ไม่ต้องแสดงบัตรจริง: วิธีเลือกตัวเลือกที่ดีที่สุดสําหรับธุรกิจของคุณ

ธุรกรรมแบบแสดงบัตรคืออะไร

ธุรกรรมแบบแสดงบัตรจริง (CP) หมายถึงวิธีการชําระเงินที่เจ้าของบัตรแสดงบัตรเครดิตหรือบัตรเดบิตตัวจริงให้กับธุรกิจที่จุดขาย โดยส่วนใหญ่จะเกิดขึ้นในร้านค้าแบบมีหน้าร้าน ซึ่งลูกค้าจะรูด เสียบ หรือแตะบัตรที่เครื่องอ่านบัตร

คุณสมบัติที่โดดเด่นของธุรกรรมแบบ CP คือทั้งเจ้าของบัตรและบัตรชําระเงินมีการแสดงตัวจริง ทําให้ธุรกิจสามารถตรวจสอบธุรกรรมได้แเจ้าของบัตร:บบเรียลไทม์ ธุรกรรมแบบ CP ใช้เครื่องอ่านบัตรหรือเทอร์มินัลระบบบันทึกการขาย (POS)เพื่ออ่านข้อมูลบัตร และมักจะกําหนดให้เจ้าของบัตรลงลายมือชื่อหรือกด PIN เพื่อทําธุรกรรมให้เสร็จสิ้น

ประโยชน์และความท้าทายของธุรกรรมแบบแสดงบัตรจริง

ธุรกรรมแบบ CP เป็นหัวใจหลักของการค้าที่เกิดขึ้นในทุกวัน และธุรกรรมประเภทที่ผู้บริโภคส่วนใหญ่ใช้เมื่อซื้อสินค้าจากหน้าร้าน เช่นเดียวกับธุรกรรมประเภทอื่น ธุรกรรมแบบ CP มีข้อดีและความท้าทายที่ธุรกิจต้องทำความเข้าใจ

ข้อดี

ระบบความปลอดภัยขั้นสูง

ประโยชน์หลักอย่างหนึ่งของธุรกรรมแบบ CP คือความปลอดภัยที่เพิ่มขึ้น การแสดงตัวของทั้งผู้ถือบัตรและตัวบัตร ณ จุดขายทำให้พนักงานสามารถยืนยันตัวตนของผู้ถือบัตรได้ จึงจะช่วยลดโอกาสเกิดธุรกรรมที่เป็นการฉ้อโกงลดค่าใช้จ่ายในการทําธุรกรรม

เนื่องจากธุรกรรมแบบ CP ถือว่ามีความเสี่ยงน้อยกว่าธุรกรรมแบบไม่ต้องแสดงบัตร ค่าธรรมเนียมการประมวลผลสําหรับธุรกรรม CP จึงมักต่ํากว่า ซึ่งหมายถึงธุรกิจสามารถประหยัดต้นทุนได้อย่างมีนัยสำคัญเมื่อเวลาผ่านไปประมวลผลการชําระเงินทันที

ธุรกรรม CP มีการประมวลผลแบบเรียลไทม์ โดยธุรกิจจะได้รับการยืนยันรายการชําระเงินที่สําเร็จทันที หมายความว่าธุรกรรมจะเสร็จสมบูรณ์อย่างรวดเร็ว ซึ่งเป็นการยกระดับประสบการณ์การช็อปปิ้งของลูกค้า

ความท้าทาย

ต้องการใช้อุปกรณ์ฮาร์ดแวร์

ธุรกรรมแบบ CP ต้องใช้ชุดอุปกรณ์POSเพื่อประมวลผลบัตรชําระเงิน ซึ่งอาจเป็นอุปสรรคสำหรับธุรกิจขนาดเล็กหรือธุรกิจที่อยู่ห่างไกลที่อาจหาหรือดูแลรักษาระบบอุปกรณ์เหล่านี้ได้ยากความเสี่ยงที่ฮาร์ดแวร์จะไม่ทำงาน

ฮาร์ดแวร์ใดก็ตามรวมถึงเทอร์มินัล POS อาจทํางานผิดปกติหรือเสียหายได้ ซึ่งอาจส่งผลกระทบต่อการดําเนินธุรกิจ ดังนั้นธุรกิจจะต้องเตรียมพร้อมแก้ไขปัญหาเหล่านี้อย่างรวดเร็วเพื่อป้องกันการสูญเสียยอดขายความเสี่ยงต่อการฉ้อโกงจากการใช้บัตรตัวจริง

แม้ธุรกรรมแบบ CP จะถือว่าปลอดภัยกว่า แต่ก็ใช่ว่าจะไม่มีการฉ้อโกงเลย ทั้งนี้ยังมีความเสี่ยงที่จะมีการใช้บัตรปลอม บัตรที่ขโมยมา หรือการคัดลอกข้อมูลบัตรซึ่งมิจฉาชีพจะคัดลอกข้อมูลบัตรจากแถบแม่เหล็กใช้ได้เฉพาะการขายแบบต่อหน้า

ตามคำจำกัดความแล้ว ธุรกรรมแบบ CP เกิดขึ้นได้ต่อเมื่อลูกค้ามาแสดงตนเท่านั้น ซึ่งเป็นการจํากัดการเข้าถึงตลาดของธุรกิจเมื่อเทียบกับธุรกรรมออนไลน์

ธุรกรรมแบบไม่ต้องแสดงบัตรคืออะไร

ธุรกรรมแบบไม่ต้องแสดงบัตรจริง (CNP) หมายถึงธุรกรรมที่เกิดขึ้นทางออนไลน์ ทางโทรศัพท์ หรือคําสั่งซื้อทางไปรษณีย์ซึ่งเจ้าของบัตรไม่ได้แสดงบัตรตัวจริงต่อธุรกิจขณะที่ชําระเงิน ในกรณีเหล่านี้ธุรกิจต้องให้ลูกค้าให้รายละเอียดที่จำเป็นเกี่ยวกับบัตร (เช่น หมายเลขบัตร วันหมดอายุ และรหัส CVV) เพื่อประมวลผลการชําระเงิน

เนื่องจากธุรกรรมเหล่านี้มีความเสี่ยงในการฉ้อโกงสูงเพราะไม่มีการยืนยันจากตัวบัตรจริง จึงมักต้องใช้มาตรการรักษาความปลอดภัยเพิ่มเติม เช่น บริการยืนยันที่อยู่ (AVS) หรือการใช้รหัสความปลอดภัย

ประโยชน์และความท้าทายของธุรกรรมแบบไม่ต้องแสดงบัตร

ธุรกรรมแบบ CNP มีจํานวนเพิ่มขึ้นเรื่อยๆ เนื่องจากความนิยมในการดําเนินธุรกิจทั้งในแบบดิจิทัลและระยะไกล โดยอํานวยความสะดวกให้การค้าทั่วโลก เพิ่มความยืดหยุ่นให้ลูกค้าซื้อสินค้าและบริการได้ทุกที่ทุกเวลาโดยไม่จําเป็นต้องแสดงตัวในสถานที่ตั้งของธุรกิจแบบเดิม แต่ธุรกรรมเหล่านี้ก็มีความเสี่ยงอยู่ โดยเฉพาะโอกาสเกิดการฉ้อโกงที่เพิ่มขึ้น ธุรกิจควรเข้าใจข้อดีข้อเสียของธุรกรรมแบบ CNP เพื่อให้จัดการธุรกรรมเหล่านี้ได้อย่างมีประสิทธิภาพ

ข้อดี

การเข้าถึงตลาดที่กว้างขึ้น

ธุรกรรมแบบ CNP ทลายอุปสรรคทางภูมิศาสตร์โดยช่วยให้ธุรกิจสามารถตอบสนองความต้องการของลูกค้าทั่วโลก ซึ่งช่วยขยายฐานลูกค้าและโอกาสด้านรายรับของธุรกิจได้อย่างมากเพิ่มความสะดวกแก่ลูกค้า

ธุรกรรมแบบ CNP ทำให้ลูกค้าซื้อของได้ทุกที่ทุกเวลา ซึ่งช่วยปรับปรุงประสบการณ์การช็อปปิ้งโดยรวมให้ดีขึ้นลดค่าใช้จ่ายในการดำเนินงาน

การมีหน้าร้านมีค่าใช้จ่ายในการดำเนินงานมากมาย เช่น ค่าเช่า ค่าสาธารณูปโภคและค่าแรงพนักงาน ธุรกรรมแบบ CNP ซึ่งมักใช้ทรัพยากรในการจัดการน้อยกว่าจึงช่วยลดต้นทุนเหล่านี้ได้เพิ่มโอกาสในการขาย

ธุรกรรมแบบ CNP ช่วยให้ธุรกิจมีโอกาสในการขายเพิ่มขึ้น เช่น การซื้อทางออนไลน์แบบไม่ได้วางแผนล่วงหน้า การขายเพิ่ม และการขายพ่วง ซึ่งมักทำในสภาพแวดล้อมแบบหน้าร้านได้ยากกว่า

ความท้าทาย

ความเสี่ยงจากการฉ้อโกงเพิ่มขึ้น

เนื่องจากไม่มีการแสดงตัวผู้ถือบัตรขณะทําธุรกรรม ธุรกิจจึงยืนยันตัวตนของลูกค้าได้ยากกว่า ทําให้มีความเสี่ยงต่อธุรกรรมที่เป็นการฉ้อโกงสูงขึ้นค่าธรรมเนียมการประมวลผลที่สูงกว่า

เนื่องจากธุรกรรมแบบ CNP มีความเสี่ยงสูงกว่า ผู้ประมวลผลการชําระเงินจึงมักเรียกเก็บค่าธรรมเนียมสําหรับธุรกรรมประเภทเหล่านี้แพงกว่าปัญหาด้านความเชื่อมั่นของลูกค้า

เนื่องจากธุรกรรมเกิดขึ้นจากทางไกล ลูกค้าจึงอาจมีข้อกังวลเกี่ยวกับความปลอดภัยในการให้รายละเอียดบัตร ซึ่งอาจส่งผลต่ออัตราการเปลี่ยนเป็นลูกค้าความเสี่ยงต่อการโต้แย้งการชําระเงินและการดึงเงินคืน

ธุรกรรมแบบ CNP มีแนวโน้มที่จะเกิดการโต้แย้งการชําระเงินและการดึงเงินคืนมากกว่า ส่วนหนึ่งเป็นเพราะลูกค้าสามารถทําการซื้อได้โดยไม่ต้องแสดงตัวในสถานที่จริงเพื่อยืนยันว่ากําลังซื้ออะไร

เนื่องจากธุรกรรมแบบ CNP ได้รับความนิยมและจำเป็นมากขึ้นเรื่อยๆ เพราะการซื้อขายเปลี่ยนมาใช้ช่องทางออนไลน์มากขึ้น ธุรกิจต่างๆ จึงต้องพิจารณาทั้งโอกาสและความท้าทายที่มีอยู่ด้วย กุญแจสําคัญในการจัดการธุรกรรมแบบ CNP ให้ประสบความสําเร็จคือการลดความเสี่ยงไปพร้อมๆ กับการเพิ่มประโยชน์ให้ได้สูงสุด เช่น การใช้กลไกการป้องกันการฉ้อโกงที่รัดกุม และการเลือกผู้ประมวลผลการชําระเงินที่น่าเชื่อถือซึ่งให้บริการประมวลผลธุรกรรมแบบ CNP ที่ปลอดภัย

ธุรกรรมแบบแสดงบัตรเทียบกับธุรกรรมที่ไม่ต้องแสดงบัตรจริง: วิธีเลือกตัวสิ่งที่ดีที่สุดสําหรับธุรกิจของคุณ

ขณะพิจารณาเลือกระหว่างการใช้ธุรกรรมแบบ CP หรือ CNP ธุรกิจควรคำนึงถึงโมเดลการดําเนินงานในภาพกว้างและความคาดหวังของลูกค้า

ในอดีตธุรกรรมแบบ CP จะเชื่อมโยงกับสถานประกอบการแบบมีหน้าร้าน ซึ่งลูกค้าหรือพนักงานขายจะ รูด เสียบ หรือแตะบัตรตัวจริงที่เทอร์มินัล ในทางกลับกัน ธุรกรรมแบบ CNP เกิดขึ้นพร้อมกับการแพร่หลายของอีคอมเมิร์ซเนื่องจากลูกค้าเป็นผู้พิมพ์รายละเอียดการชำระเงินเข้าไปในระบบโดยไม่มีการแสดงบัตรตัวจริงที่จุดขาย อย่างไรก็ตามสําหรับธุรกิจจํานวนมากดยเฉพาะอย่างยิ่งธุรกิจที่มีการขายทั้งแบบออนไลน์และที่หน้าร้าน การตัดสินใจไม่ใช่การเลือกใช้อย่างใดอย่างหนึ่ง เพราะมักจะต้องใช้วิธีการแบบผสมผสาน

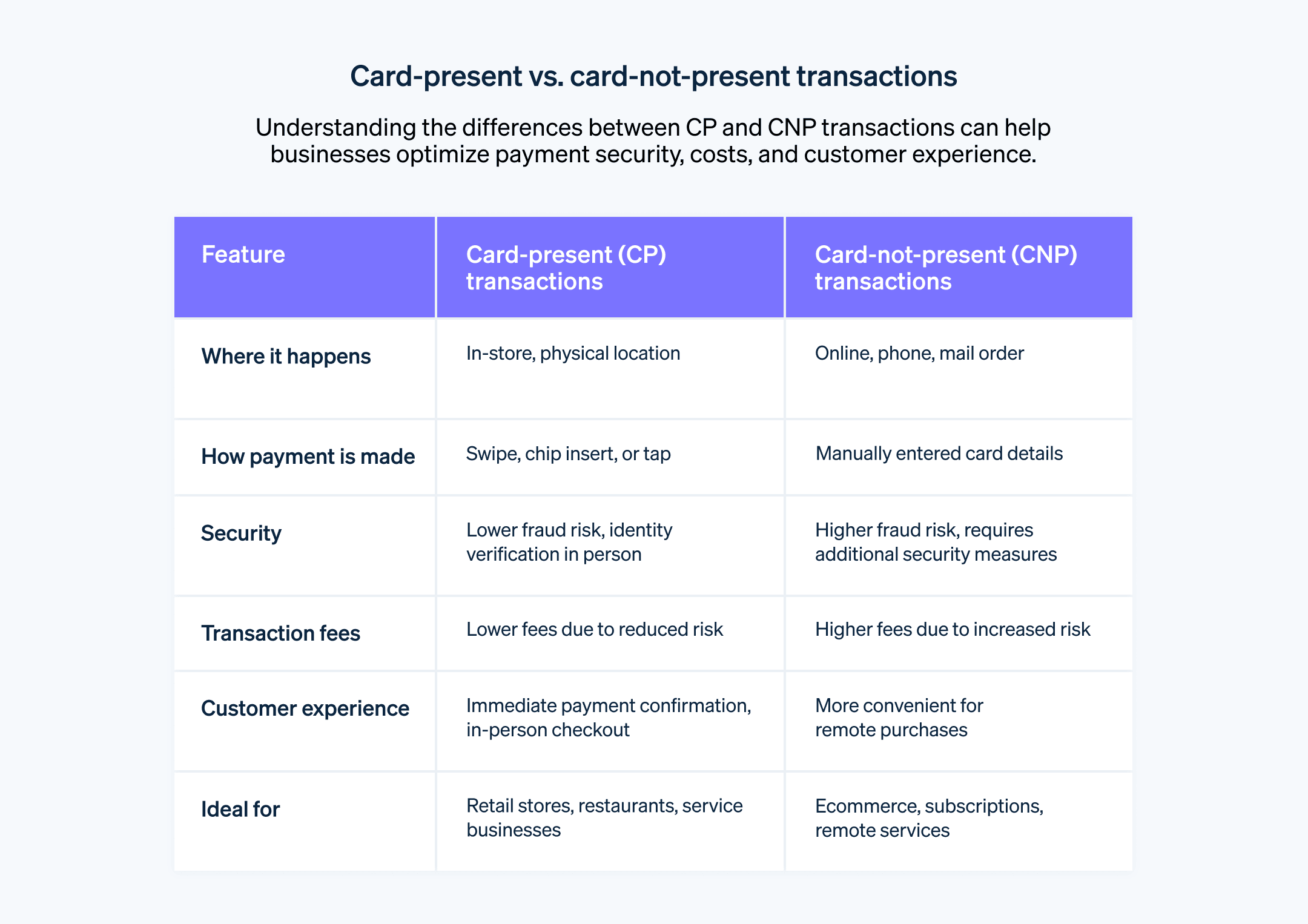

ข้อแตกต่างที่สําคัญระหว่างธุรกรรมประเภทเหล่านี้คือวิธีการจัดการกับข้อมูลลูกค้า ค่าธรรมเนียมธุรกรรม และความต้องการด้านการป้องกันการฉ้อโกง แม้ว่าธุรกรรมแบบ CP จะมีค่าธรรมเนียมธุรกรรมต่ำกว่า แต่ก็จํากัดโอกาสของธุรกิจให้อยู่แค่ในสถานที่ตั้งทางกายภาพและต้องมีการลงทุนในอุปกรณ์ POS ในขณะที่ธุรกรรมแบบ CNP เปิดโอกาสให้ธุรกิจขยายการเข้าถึงตลาดได้ทั่วโลก แต่ก็ต้องใช้โครงสร้างพื้นฐานด้านการรักษาความปลอดภัยที่มีประสิทธิภาพมากขึ้นเนื่องจากความเสี่ยงต่อการฉ้อโกงสูง

ดังนั้นตัวเลือกของคุณจึงควรสอดคล้องกับขนาดธุรกิจ กลุ่มเป้าหมาย และสภาพแวดล้อมทางการขาย หากคุณทำธุรกิจร้านบูติกหรือร้านอาหารในท้องถิ่น ธุรกรรมแบบ CP อาจเป็นทางเลือกของคุณ หากคุณทำธุรกิจอีคอมเมิร์ซหรือธุรกิจแบบบริการสมาชิก ที่มีลูกค้ากลุ่มเป้าหมายอยู่ในหลายสถานที่ตั้งทางภูมิศาสตร์ ธุรกรรมแบบ CNP น่าจะเหมาะกับธุรกิจของคุณมากกว่า

สำหรับธุรกิจที่มีช่องทางการขายหลายช่องทาง เช่น ร้านค้าแบบหน้าร้านที่มีตัวเลือกให้ซื้อสินค้าออนไลน์ได้ ก็จำเป็นต้องใช้โซลูชันการประมวลผลการชําระเงินที่สามารถจัดการธุรกรรมทั้งสองประเภทได้อย่างมีประสิทธิภาพ ดังนั้นประเด็นสำคัญไม่ได้อยู่ที่การเลือกอย่างใดอย่างหนึ่ง แต่อยู่ที่การเลือกส่วนผสมที่ลงตัวที่ตอบโจทย์กลยุทธ์การขายในภาพรวมของคุณ

การทํางานร่วมกับผู้ให้บริการประมวลผลการชําระเงินที่น่าเชื่อถือเพื่อตัดสินใจเรื่องนี้จึงเป็นสิ่งสําคัญ ผู้ให้บริการประมวลผลการชําระเงินสามารถให้คําแนะนําที่เป็นประโยชน์ ด้วยความเชี่ยวชาญในอุตสาหกรรม โซลูชันที่ปรับให้ตรงกับความต้องการของธุรกิจคุณ และให้การสนับสนุนด้านการปฏิบัติตามข้อกําหนดและรับมือกับข้อกังวลด้านความปลอดภัย

ท้ายที่สุดแล้ว การเพิ่มประสิทธิภาพให้กับขั้นตอนการชําระเงินของคุณอยู่ที่การเข้าใจถึงข้อแตกต่างที่สําคัญระหว่างธุรกรรมแบบ CP กับธุรกรรม CNP และผลกระทบที่มีต่อธุรกิจของคุณ ข้อควรพิจารณาเหล่านี้จะช่วยเพิ่มประสิทธิภาพในการทําธุรกรรม ไปพร้อมๆ กับการปรับปรุงประสบการณ์ของลูกค้าโดยรวม

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ