Klarna is a Swedish fintech company that has established itself as a dominant force in the burgeoning buy now, pay later (BNPL) industry. With a user base of 150 million across 45 countries, Klarna processes 2 million transactions daily, and it collaborates with over 500,000 businesses. These businesses include household names such as Nike, Adidas, and IKEA. Klarna’s large European market share—70% in 2022—solidifies its position as the region’s leading BNPL provider.

Klarna’s offerings cater to diverse customer needs. Its core product—Pay in 3 or Pay in 4, depending on location—allows customers to divide payment into three or four interest-free installments spread over six weeks. The Pay in 30 payment plan provides a 30-day grace period for full payment, interest-free and fee-free. In the US, Klarna offers financing options for larger purchases, with competitive interest rates starting at 7.99%. Also in the US, Klarna offers a virtual card, which allows customers to use Klarna even if businesses don’t directly integrate the service.

Klarna has an extensive global presence in markets across North America, Europe, Asia, and Oceania, and it provides a consistent and accessible payment experience for all users. The BNPL industry is poised for major growth in coming years, and Klarna—with its vast user base, brand recognition, and innovative product offerings—is in a prime position to take on a leading role in this growing payment sector.

This guide will cover what businesses should know about Klarna: how it works, where it’s used, and how to accept it as a payment method.

What’s in this article?

- Where is Klarna used?

- Who uses Klarna?

- How does Klarna work?

- Benefits of accepting Klarna

- Klarna security measures

- Accepting Klarna as a payment method

- Alternatives to Klarna

Where is Klarna used?

Klarna’s global reach extends across 45 markets, each with its own unique customer preferences and regulatory landscapes. Klarna’s primary markets include:

North America

Klarna’s entry into the United States market capitalized on the country’s growing preference for alternative payment methods and flexible financing options, as demonstrated by North America’s growing BNPL sector, valued at over $14 billion in 2022. By integrating with major ecommerce platforms such as Shopify and WooCommerce and popular digital wallets such as Apple Pay and Google Pay, Klarna appealed to tech-savvy customers seeking a quick and convenient checkout experience. Klarna’s North American operations are also in compliance with mandates such as the Consumer Financial Protection Bureau’s lending and data privacy regulations, which encourages user trust and responsible lending practices.Europe

In Europe, Klarna tapped into established BNPL preferences and garnered an impressive 70% market share as of 2022. Building upon its early dominance in markets such as Sweden and Germany, Klarna expanded into other European countries such as the UK and France, tailoring its offerings to local payment habits and regulatory frameworks in each country. This included integrating with popular local payment methods such as iDEAL in the Netherlands and Sofort in Germany, and complying with data protection regulations such as the General Data Protection Regulation (GDPR).Asia

The Asian market presents a unique set of challenges and opportunities for Klarna. The region’s growing ecommerce market offers immense potential for the BNPL company. Here, the company’s strategic focus is on adapting to the region’s preference for mobile-first payment solutions—accomplished in part through partnerships with major digital wallets such as Alipay. Klarna navigates complex regulatory environments in each Asian market and must operate in compliance with data privacy laws such as the Personal Information Protection Law in China and evolving BNPL regulations such as the Reserve Bank of India’s framework for digital lending in India.Australia and New Zealand

In Australia and New Zealand, Klarna can leverage its established brand recognition and user trust to work toward a strong foothold: 40% of Australian users reported using BNPL services in the last six months as of April 2023, demonstrating the market’s potential. Klarna’s strategy in this region includes partnering with major retailers such as H&M, ASOS, and THE ICONIC, in addition to providing competitive interest rates. Klarna operates in compliance with the Australian Securities and Investments Commission (ASIC) and New Zealand’s Financial Markets Authority (FMA) regulations governing financial services.

Who uses Klarna?

Klarna serves a diverse population of customers and integrates with a wide range of business types across 45 global markets. Klarna users vary in age, gender, education, life stage, and community, demonstrating the service’s broad appeal across different customer segments. Klarna customers leverage the service for in-store purchases, online shopping, in-app purchases, and even bill payments. The latest demographic data for Klarna’s customer base is outlined below:

Gender: According to Klarna, 60% of its customers are women and 40% are men.

Education: Klarna reports that 31% of its customers have a university education, highlighting that people of all educational backgrounds use the service.

Life stage: Klarna data shows that 36% of Klarna customers are partnered with children, 27% are single without children, 18% are partnered without children, and 11% are single with children.

Community: Klarna’s data shows that 40% of its customers live in cities, 32% live in suburbs, and 28% live in rural areas.

The industries where Klarna has found the biggest success include:

Retail: Many major retailers include Klarna as a payment option, with adoption rates soaring in the clothing, electronics, and furniture sectors.

Travel and hospitality: Airlines and travel booking platforms such as Expedia often integrate Klarna, allowing travelers to book flights and hotels with flexible payment options.

Health and wellness: Dental clinics, pharmacies, and businesses in the wellness space have adopted Klarna, increasing access for populations that might not be able to pay in full up front.

Automotive: Auto care businesses also accept Klarna as a convenient way to purchase tires and other essentials.

How does Klarna work?

To pay using Klarna, customers simply select it as their preferred payment method at checkout, which may be on an ecommerce website, on a mobile app, or in a physical store. Customers can manage their Klarna accounts through the Klarna app, where they can track their orders, view payment schedules, make payments, and access customer support. When paying with Klarna, customers can choose from the following payment plans:

Pay in full: This option lets a customer pay for a transaction immediately using stored payment credentials. Supported payment methods include bank transfers or direct debit.

Pay in 4: This option spreads out the cost of a purchase over four interest-free installments. The first payment is due at checkout, and the remaining three are spread out over the following six weeks.

Pay in 30: This option gives customers 30 days to pay for their purchase in full, incurring no interest or fees if paid on time.

Long-term loans: Larger purchases can be financed with longer-term loans. Interest rates for this option start at 7.99%.

Not all products are eligible for financing through Klarna. For example, Klarna does not offer financing for services such as haircuts, car repairs, and legal fees—or intangible goods such as music, e-books, and movies. It also won’t finance purchases such as tickets and event passes or financial products such as investments or insurance. In addition, no restricted goods—such as alcohol, tobacco, firearms, and adult content—can be financed through Klarna.

The following product types are typically eligible for Klarna financing, with some restrictions:

Physical goods: Klarna typically allows financing for most tangible products, including clothing, electronics, furniture, appliances, and home goods.

Digital goods: Certain digital products—such as software licenses, online courses, and memberships—may be eligible for Klarna financing.

Travel: Klarna offers financing options for booking flights, hotels, and vacation packages through specific travel partners.

Gift cards: Some gift cards may be eligible for Klarna financing, but restrictions may apply depending on the issuer and the type of gift card.

Preorders: Klarna may allow financing for preorders of certain products, but the payment schedule may differ from standard financing options.

Custom-made or personalized items: Eligibility for custom or personalized items depends on the product and the specific business.

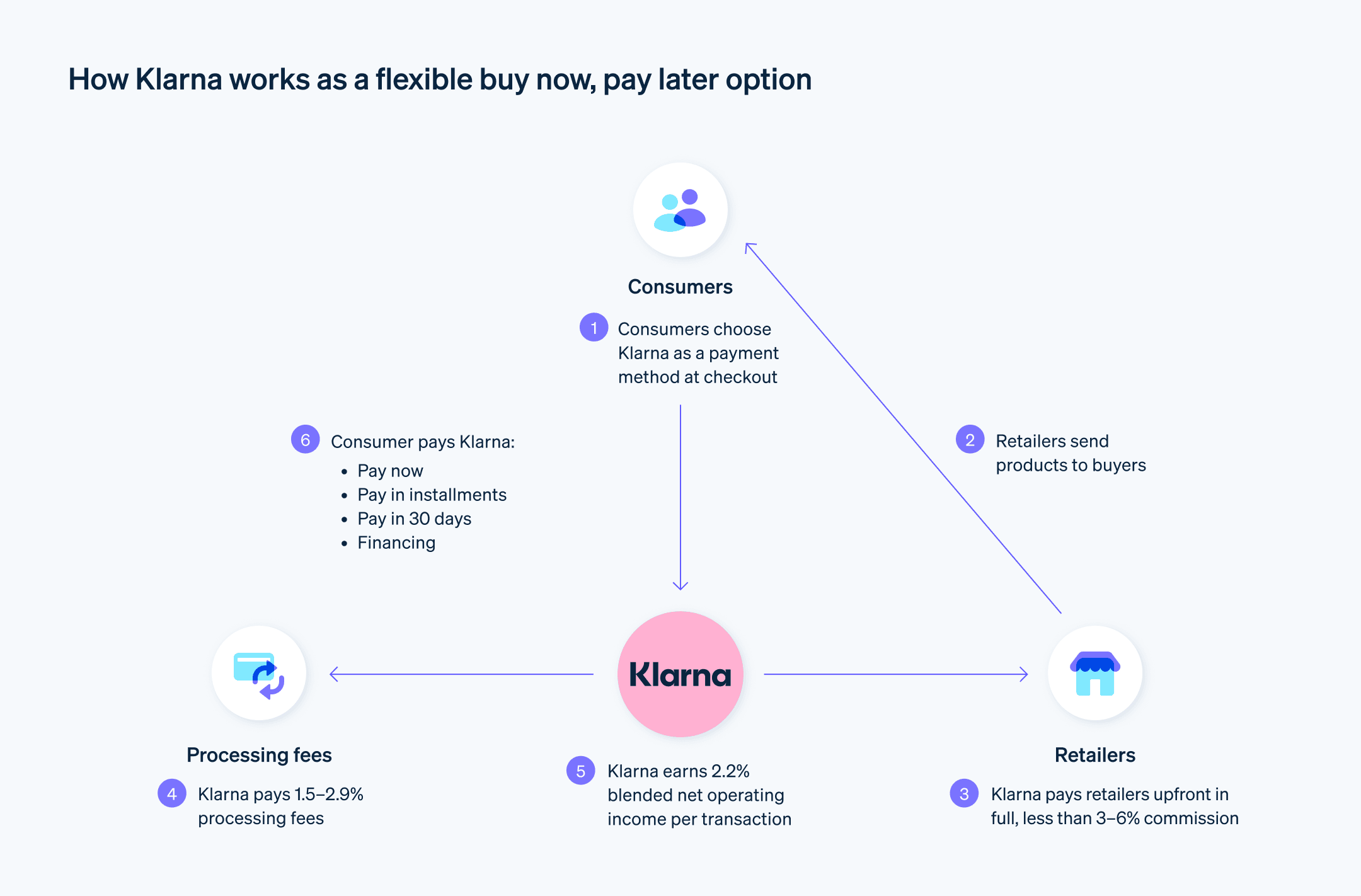

And here’s how Klarna works on the business side:

Integration: Businesses can integrate Klarna with their existing point-of-sale (POS) systems and online platforms through various application programming interfaces (APIs) and plugins.

Processing transactions: When a customer chooses Klarna at checkout, Klarna instantly verifies their identity and creditworthiness. Upon approval, Klarna advances the purchase amount to the business, assuming the risk of nonpayment. By using a distributed architecture to ensure scalability and reliability, Klarna can handle high transaction volumes and maintain uptime even during peak periods.

Settling funds: Klarna settles the transaction amount with the business within two to three business days, typically via bank transfer or ACH payment.

Benefits of accepting Klarna

Faster checkouts: Klarna’s processing speeds reduce checkout times, minimizing customer queues and boosting operational efficiency.

Automated processes: Klarna replaces manual tasks with automated functionalities, reducing payment processing costs and freeing up resources for strategic initiatives.

Customer insights: Klarna provides a wealth of real-time data on customer behavior, preferences, and demographics. This empowers businesses to refine marketing campaigns, product offerings, and inventory management to optimize resource allocation, business planning, and overall performance.

Increased purchase frequency: Klarna’s intuitive interface and flexible payment options create a convenient shopping experience. And providing flexible payment options can increase purchase frequency by 20%, according to a 2020 Klarna report.

Increased purchase power: Klarna’s flexible payment options empower customers to purchase higher-value items. By offering this type of payment flexibility, businesses could potentially experience an increase in average order value of up to 68%, per Klarna’s 2020 report.

Reduced cart abandonment: Klarna’s streamlined checkout process minimizes cart abandonment, particularly on mobile devices, with one retailer reporting a 200% increase in sales conversions during the holiday season in Klarna’s 2020 report.

Diverse revenue streams: Klarna helps businesses unlock new revenue streams through innovative solutions such as Pay in 30 and other financing options.

Fraud prevention: Klarna’s sophisticated security measures mitigate fraudulent activities, protecting businesses from financial losses and safeguarding revenue integrity.

Competitive advantage: Businesses that accept Klarna can distinguish themselves from competitors and attract tech-savvy customers. Businesses can also boost brand perception by demonstrating a commitment to innovative, customer-centric payment methods. Embracing Klarna and its integration with emerging technologies positions businesses at the forefront of the ever-evolving digital environment.

Klarna security measures

Data encryption: Klarna uses advanced encryption methods to secure data transmission, converting sensitive information such as credit card numbers and personal details into a secure code to reduce the risk of data breaches. Klarna uses AES-256 encryption, one of the strongest encryption standards, to secure data both at rest and in transit. This level of encryption ensures that even if data is intercepted, it remains unreadable without the correct decryption key.

Regulatory compliance: As a payment service provider, Klarna adheres to PCI DSS requirements. This compliance mandates regular security audits and ensures that Klarna maintains a secure environment for handling cardholder data. Klarna also adheres to global data protection regulations, including the GDPR in Europe, California Consumer Privacy Act (CCPA) in the US, and similar laws in other jurisdictions. This compliance involves stringent controls over data handling and consumer privacy.

Two-factor authentication (2FA): For customer accounts, Klarna employs 2FA, an extra layer of security that requires not only a password and username but also something that only the customer has on their person—such as a physical token or a smartphone app—to approve transactions. This reduces the risk of unauthorized account access.

Tokenization: In Klarna’s payment process, tokenization is employed to replace sensitive payment data with a unique identifier or token. This process means that card details are not stored or transmitted during the transaction, which greatly reduces the risk of fraud.

Strong customer authentication (SCA): In line with the European Union’s revised Payment Services Directive (PSD2) regulation, Klarna implements SCA for transactions. SCA requires electronic payments to be authenticated using at least two of the following three elements: something the customer knows (such as a password), something the customer has (such as a mobile device), or something the customer physically is (i.e., biometric information such as a fingerprint or facial recognition).

Regular security audits and updates: Klarna conducts regular security audits to identify and address vulnerabilities. These audits are key for maintaining high security standards and keeping the platform’s defenses up-to-date against evolving cyber threats. Klarna’s proactive vulnerability management practices, which include regular assessments and penetration testing, are important for identifying and fixing potential security weaknesses.

Secure APIs for businesses: Klarna provides businesses with secure API interfaces for integration, which protect any data exchanged between Klarna and the business’s systems.

Data protection: Klarna has policies in place for protecting customer data, including limiting data access to authorized personnel and using secure storage solutions. Data loss prevention (DLP) tools are significant for safeguarding against both internal and external data leaks, ensuring sensitive information doesn’t fall into the wrong hands.

Fraud prevention: Klarna uses sophisticated risk management algorithms powered by machine learning to detect and prevent fraudulent activities. These systems are dynamic, meaning they evolve constantly based on new data and become more effective over time. The use of velocity limits to monitor transaction patterns adds an additional layer of security, effectively limiting the impact of potentially fraudulent high-volume transactions.

Identity verification: Klarna’s identity verification measures are multifaceted and include address and phone verification, as well as sophisticated digital methods such as 3D Secure authentication.

Accepting Klarna as a payment method

To accept Klarna as a payment method, businesses need to meet specific technical, legal, and regulatory requirements.

Business registration and licenses: Businesses must be legally registered and hold all necessary licenses in the regions where they operate.

Ecommerce platform compatibility: Businesses must have an online store that’s able to integrate with Klarna. Klarna has plugins and APIs for popular ecommerce platforms such as Shopify, WooCommerce, Magento, and others. Businesses will need to program the connection of Klarna’s payment gateway with their business’s online checkout system using these APIs or plugins.

Internet connection: Businesses must have a stable and reliable internet connection to process Klarna transactions.

Legal and regulatory compliance: Businesses must comply with all applicable tax laws, including the collection and remittance of sales taxes. They must also operate in compliance with PCI DSS for secure handling of payment card information; implement Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures to verify customer identities and prevent fraudulent activities; and comply with data privacy laws such as GDPR in Europe or CCPA in California.

Businesses that meet these requirements can complete the following steps to accept Klarna payments:

Register for a Klarna merchant account: Complete the registration process with Klarna and activate your account. The registration process may involve evaluation of the business’s financial stability and creditworthiness. If the registration is approved, businesses will receive a merchant agreement from Klarna, which they should review carefully.

Integrate the Klarna system: Configure the Klarna API or install the Klarna plugin on your ecommerce platform to link the Klarna payment system to your business’s online store.

Add Klarna as a payment method: Add Klarna as a payment option in the checkout process. Conduct thorough testing to ensure Klarna works smoothly within your online store.

Businesses that want to accept Klarna payments with Stripe as their payment processor will have their own setup process. The business will first need to ensure that its ecommerce platform or website is compatible with Stripe, and it will need to meet all the same requirements as businesses that want to accept Klarna payments directly—including compliance with all relevant local laws and regulations.

The steps to process Klarna payments through Stripe are outlined below:

Account setup: Businesses must have an existing Stripe account or create one through Stripe’s account setup process, which involves providing business details and bank information.

Stripe API integration: Businesses must integrate Stripe’s API into their ecommerce platform. Stripe provides extensive documentation and Software Development Kits (SDKs) for various programming languages to facilitate this process.

Klarna activation: Businesses will need to activate Klarna as a payment method within their Stripe account, which might involve additional verification or approval processes by both Stripe and Klarna.

Configure Klarna payments: Businesses will configure Klarna as a payment method within the Stripe Dashboard or via API, specifying the payment methods they want to offer (e.g., Pay in 4) and the regions where they will accept Klarna.

Test functionality: Businesses should use Stripe’s test environment to ensure that Klarna payments work as expected. Stripe provides test credentials that businesses can use to simulate Klarna transactions.

Display user agreement: The business’s website should include a user agreement and privacy policy that cover the use of Klarna and Stripe, detailing how customer data is handled and processed.

Monitor transactions: Businesses should regularly monitor transactions for any issues or unusual patterns, and be prepared to work with Stripe and Klarna to resolve any potential problems.

Alternatives to Klarna

Klarna has many competitors in the BNPL space. Below are Klarna’s main competitors in various global markets.

North America

Affirm: Rivaling Klarna in popularity, Affirm boasts a strong presence in the US and Canada. It has flexible payment plans, including longer terms and interest-bearing options, which appeal to a broad customer base. Affirm integrates with major ecommerce platforms and provides strong customer service, but its fees for businesses tend to be higher than with Klarna.

Afterpay: Australian company Afterpay has carved out a sizable market share in North America, particularly among younger generations. Its interest-free, short-term payment plans resonate well with budget-conscious customers. However, Afterpay’s late fees can be hefty for customers, and businesses may face higher chargeback rates.

PayPal Credit: Leveraging its existing user base, PayPal has branched into the BNPL sector with its integrated PayPal Credit service. While PayPal provides a seamless checkout experience for customers familiar with PayPal, its fees can be unclear and complex for both businesses and customers.

Europe

Clearpay: Clearpay—which has a strong foothold in Europe—provides similar features to Afterpay, including interest-free, short-term payment plans tailored to younger customers. However, Clearpay’s late fees can be substantial, potentially impacting businesses’ relationships with customers.

Ratepay: Ratepay is a German-based BNPL provider with flexible payment options and competitive fees for both businesses and customers. It features a strong focus on risk management and fraud prevention, minimizing financial risks for businesses. However, its reach is mainly restricted to European markets, which limits its global appeal.

Asia Pacific

Zip: Zip is a swiftly growing BNPL player in Australia and New Zealand, providing flexible payment plans that range from short-term to longer-term options. Its user-friendly platform and strong brand recognition attract a large customer base, but its fees can be higher than some competitors and its international presence is still limited.

Atome: Atome is a Singapore-based BNPL provider that’s quickly expanding across Asia, particularly Southeast Asia. It leverages partnerships with major ecommerce platforms and local businesses to reach a broad customer base, but its focus on younger demographics means it may not be suitable for all businesses.

FOMO Pay: Singapore-based company FOMO Pay is a rising star in Asia’s BNPL scene, targeting the growing demand for flexible payment options with interest-free installment plans and integration with leading ecommerce platforms. FOMO Pay’s limited operating scope and young user base may not be ideal for all businesses, however.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.