Your business’s point of sale system, also referred to as a POS system, is more than just a tool for accepting payments—it’s an important component of an excellent customer experience. However, small businesses often face challenges such as limited staff, tight budgets, and the need to manually track inventory, which can lead to inefficiencies and lost revenue. Many also struggle with managing multiple sales channels or syncing online and in-person transactions.

Modern POS systems solve those problems by automating inventory tracking, generating sales reports, and offering user-friendly interfaces that require minimal training. They support multiple payment types, integrate with accounting and ecommerce tools, and provide cloud access so businesses can manage everything in one place. Affordable hardware options and scalable pricing models also make it easier for small businesses to get started.

A reliable, easy-to-use POS system is an important tool for businesses of all sizes. Below, we’ll cover what you should know about POS systems, including how they work and how they help small businesses.

What’s in this article?

- What to look for in a POS system for a small business

- What are the different kinds of POS systems?

- What do POS systems cost?

- How do POS systems work?

- How Stripe can help

What to look for in a POS system for a small business

A point-of-sale (POS) system includes payments hardware and POS software that enables businesses to accept payments from customers. Some additional functions that POS systems perform for small businesses include:

- Updating inventory

- Tracking sales

- Managing a cash drawer

- Barcode scanning

- Clocking employees in and out

- Running reports on sales and other data

- Managing customer accounts and rewards

When choosing a POS system for your small business, prioritize ease of use. A user-friendly interface will make it easier to onboard employees quickly, which is particularly important in fast-paced retail or service environments.

Look for POS systems that have an app you can access on mobile devices such as smartphones and tablets since these options are more flexible and easier to use. If you use a POS system that supports Tap to Pay, you can accept contactless in-person payments with an iPhone or Android device.

Another key factor to consider is software integration. Your small business’s POS system should easily connect with your existing tools, such as accounting software, inventory management platforms, and loyalty programs. Choosing a POS system that integrates with those you already use helps avoid duplicate data entry, reduce errors, and offers a clearer view of business operations in real time.

What are the different kinds of POS systems?

How a POS system looks and what components it contains will vary by industry. For example, a retail shop might benefit from barcode scanning and receipt printing, while a service-based business might prioritize scheduling and tipping features. Here’s a look at different kinds of POS systems.

Retail

In retail, POS systems focus on fast checkouts, barcode scanning, and inventory tracking. These systems help retailers manage product variants such as size and color, process returns or exchanges, and generate detailed sales reports. Payments are often taken at the counter, although some retailers use POS systems that allow them to accept payments anywhere in the store.

Restaurants

POS systems for restaurants support order entry, kitchen communication, table management, and payment processing—all in one system. Features such as menu customization, order modifiers, split checks, and tip tracking streamline front-of-house and back-of-house workflows. Many restaurant POS systems also integrate with online ordering, delivery platforms, and inventory management tools, helping restaurants improve accuracy. Restaurants that operate out of a food truck or at pop-up locations often use POS systems that support Tap to Pay so they can accept contactless payments using only an iPhone or Android device.

Hotels and resorts

In hotels and resorts, POS systems need to integrate with property management systems (PMS) to provide a smooth guest experience, whether payments are made at a front desk, restaurant, bar, or retail shop. Features often include inventory tracking, staff management, and detailed reporting. Centralizing transactions and guest data is important for hotels to operate and bill efficiently, especially since charges are made at multiple locations throughout the property.

Beauty salons

Salon POS systems cater to appointment scheduling, service and product sales, and staff commissions, helping improve the staff and customer experience. They typically include client profiles and inventory management to help salons sell products alongside their services. Although payments are often made at the front desk, POS systems that can facilitate contactless payments on-the-go give salon staff the ability to collect payment before a client leaves the salon chair.

Service professionals

POS systems for service professionals such as consultants, freelancers, and repair technicians are designed to manage appointment scheduling and invoicing alongside payments. These systems often include mobile payment processing, customer profiles, and integration with scheduling tools. POS systems that support Tap to Pay are ideal for professionals who work at different locations.

Healthcare

POS systems in healthcare settings are specialized to handle administrative and patient-facing tasks. These systems support payment processing, insurance billing, copay collection, and detailed patient record management at clinics and other medical practices. They often integrate with electronic health records (EHR) and practice management software to simplify scheduling, invoicing, and compliance with privacy regulations such as HIPAA in the US.

What do POS systems cost?

POS software is typically priced using one of three models:

- Free: Typically has limited features or hardware requirements and charges per transaction

- Subscription-based: Charges monthly or annual fees

- Custom pricing: Based on business size and customized based on the business’s needs

Businesses usually pay a monthly fee for the POS software, an up-front cost to purchase payments hardware, and transaction fees for payment processing. Costs vary depending on the features included. Using a POS system that supports Tap to Pay can eliminate hardware costs since payments are taken directly on an iPhone or Android device.

When considering free POS systems, be careful. They typically have functional limitations, inconsistent support, and conditions or restrictions. However, POS systems with no monthly fees that charge only transaction fees could work well for small businesses with lower sales volume or seasonal operations.

Total costs for setting up and maintaining a POS system will depend on a few factors, including:

- Number of terminals

- Number of employees

- Number of transactions

- Size of inventory

- Type of business/industry

- Additional features or payment processing support

How do POS systems work?

POS systems usually integrate with a payment processor such as Stripe to facilitate payments. The processor must communicate with three parties:

The customer’s payment method: Customer payment information, such as a credit card number, transmits to the POS system when the customer swipes the magnetic stripe on a card, inserts an EMV chip, or taps for NFC-enabled contactless payment.

The customer’s bank (or other financial institution): The POS system is either hardwired to the internet or connected to Wi-Fi, and electronically communicates with the customer’s financial institution to verify funds are available for the transaction amount.

The business’s payment processing provider: The POS will also electronically communicate with the business’s payment processor. This is often the same company that issued the POS hardware and software, as is the case with Stripe.

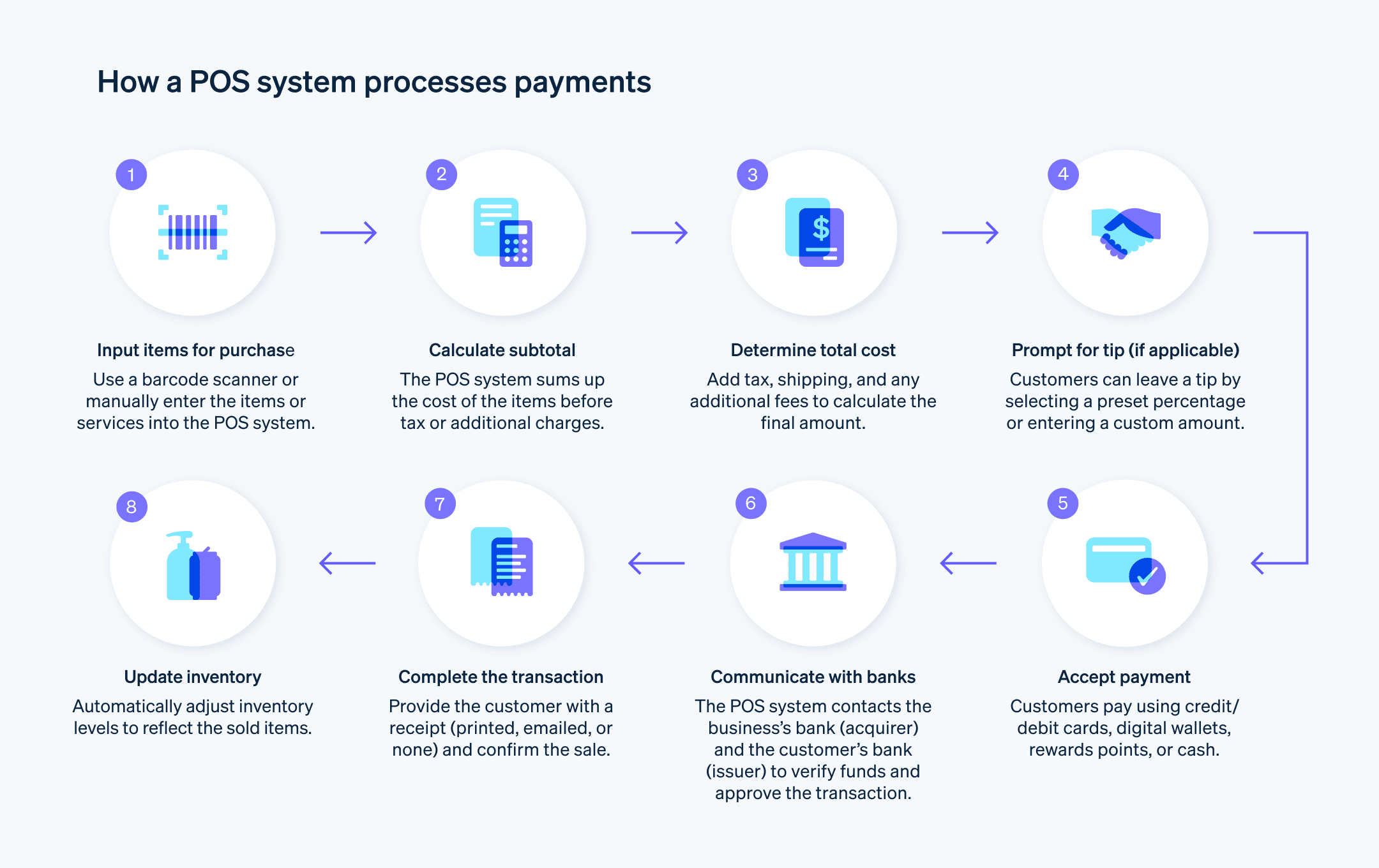

POS systems work differently depending on their components, and these components vary according to business needs. But generally, the steps involved in using a POS system are the same:

1. Input the items for purchase

The business “rings up” the customer by communicating to the POS system about what is being purchased and how much it costs. What this looks like depends on what the customer is buying. If they’re purchasing physical goods in a store, an employee might use a barcode scanner to pull up the items on the connected device they use with their POS system, such as an iPad.

If the customer is paying for a service, such as a therapy session or gardening work, the merchant might select the service from a menu on the POS software on their smartphone or manually input the price and notes about the services rendered.

2. Calculate the subtotal

The POS software calculates the subtotal, which is the total cost of everything the customer is purchasing before additional charges, such as tax, are added.

3. Determine tax, shipping, and total cost

The POS software calculates the total cost, including price, tax, and shipping.

4. Prompt the customer to add a tip (if applicable)

Tipping isn’t relevant for all transactions, but most checkout flows include an option to prompt customers to leave a tip, either by selecting from a range of standard options (usually 10%–25%) or by adding a custom amount.

5. Accept payment

After the POS calculates the total cost of the transaction, the customer submits payment. Most POS terminals are integrated with payment processors that accept a wide variety of payment methods, including credit and debit cards, cards and digital wallets that use NFC-powered contactless payments, gift cards, rewards points, and cash.

6. Communicate with acquiring and issuing banks

If a customer uses a payment method that draws on an outside account, like a credit card, debit card, or digital wallet, the payment processor will transmit the transaction details to the business’s bank, called the “acquiring bank” or “acquirer.” The acquirer communicates with the customer’s bank, called the “issuing bank” or “issuer,” to get approval for the transaction. This usually takes a couple of seconds.

7. Complete transaction

Once the transaction is approved and payment is accepted, customers can typically choose to receive a printed receipt, an emailed receipt, or no receipt.

8. Update inventory

Some point-of-sale systems also update inventory based on what has been sold, offering businesses a real-time view of goods—which is important for ordering new stock and preventing chargebacks.

How Stripe can help

Stripe Terminal powers and integrates with POS systems for high-growth startups, platforms, and enterprises seeking leading payments performance and capabilities. Read our docs to learn more.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.