Having a card on file refers to the practice of a business keeping a customer’s card information stored in their payment system, which allows for quicker and easier transactions. In recurring billing situations such as subscription services or regular purchases, the business can automatically charge the stored card without requiring the customer to re-enter their information each time.

There’s a substantial market for these types of payments. The average American had 13 paid subscriptions to media and entertainment platforms in 2024.

Storing customer cards requires that businesses maintain a high level of security. Businesses that want to cultivate the safest and most convenient customer experience must understand how cards on file work and the risks and challenges of storing and using customer payment methods. Businesses are responsible for protecting this sensitive information from unauthorized access and complying with data protection regulations. Here’s what you should know.

What’s in this article?

- What are card-on-file transactions?

- When to use card on file

- How does card on file work?

- How is having a credit card on file different from tokenization?

- Pros and cons of keeping a credit card on file

- Alternatives to keeping credit cards on file for businesses

- How Stripe Payments can help

What are card-on-file transactions?

Card-on-file transactions are payments made with card details securely stored by a business for future use. This information typically includes the card number, the expiration date, and the cardholder’s name. The cardholder gives authorization for the business to store their card details and use it for recurring charges or one-click checkouts.

When to use card on file

The practice of keeping customer cards on file has changed substantially. In the past, businesses would write down customer card details, which let customers make purchases on their accounts. This method was practical for regular customers, often in small, local stores, and was built on mutual trust.

As businesses grew and transactions became more complex, digital solutions took over. Now, businesses use encrypted systems to store customer card information for credit and debit cards, making transactions quicker and lowering the risk of fraud. This change has made it easier for modern businesses to manage recurring payments and for customers to make hassle-free purchases. Here are some of the types of businesses that commonly use cards on file:

Subscription services: Many businesses provide services that require regular payments, such as monthly subscriptions for software, streaming platforms, or membership clubs. Having a credit card on file lets these businesses automatically charge the customer’s card during each billing cycle. This setup reduces the need for manual payment each time, allowing for uninterrupted service.

Other businesses with recurring orders: Similar to subscription services, some businesses—especially in the food and retail sectors—use credit cards on file for recurring orders. Customers who regularly order the same products or items can benefit from this system because it saves time and effort through automatic reordering and billing.

Hospitality and rentals: Hotels and car rental companies keep credit cards on file to cover incidental charges. A customer provides a credit card at check-in to cover potential additional expenses, such as room service or vehicle damage, which makes the checkout experience easier.

Utility and service providers: Many utility companies and service providers encourage customers to keep a credit card on file for monthly billings, such as for electricity, water, or internet services. This method ensures bills are paid on time and reduces the risk of service interruptions because of missed bill payments.

Healthcare services: In healthcare, particularly for ongoing treatments, having a credit card on file helps ease the payment process. It allows for quick billing for regular appointments or treatments without customers needing to handle payments each time.

Ecommerce retailers: Ecommerce platforms often store card details to facilitate faster checkouts. This can be especially useful for customers in scenarios where quick transaction completion is a priority, such as during flash sales or for purchasing popular items that might sell out quickly.

Emergency services: Some services, such as roadside assistance or emergency repair services, keep a credit card on file to expedite service dispatch without worrying about payment up front.

How does card on file work?

Here’s an overview of the process:

Initial setup: First, the customer provides their card details to the business. This usually occurs during a purchase or when the customer signs up for a service. The customer’s card information, including the card number, expiration date, and (if applicable) card verification value (CVV), is entered into the business’s payment system.

Data storage: Once the customer has provided their details, the business stores this information in their payment processing system. This storage must be compliant with data security standards to protect the information from unauthorized access. The data is often encrypted or tokenized for added security.

Authorization for future use: The customer typically agrees to let the business charge their card for future transactions. This agreement is usually part of the terms and conditions of the service and might include details on how the card will be used, for what purposes, and how the customer can cancel this authorization.

Automatic billing: For recurring payments, such as subscriptions or monthly services, the business will automatically charge the stored card at the agreed intervals. This process eliminates the need for the customer to manually make a payment each time.

Streamlining transactions: In situations such as online shopping, having a credit card on file improves the checkout process. Customers can complete purchases faster without entering their card details each time.

Security measures: Businesses must implement security measures to protect stored credit card information. This includes complying with industry standards such as the Payment Card Industry Data Security Standard (PCI DSS), using secure servers, and making sure their payment gateways are safe from breaches.

Updating card details: If a card expires or is replaced, customers need to update their card details with the business. Some businesses might provide notifications when a card is close to its expiration date to remind customers to update their information.

Customer control and access: Typically, customers can view and manage their credit card information on file, often through a customer account portal. They can update card details, remove a card, or add one as needed.

How is having a credit card on file different from tokenization?

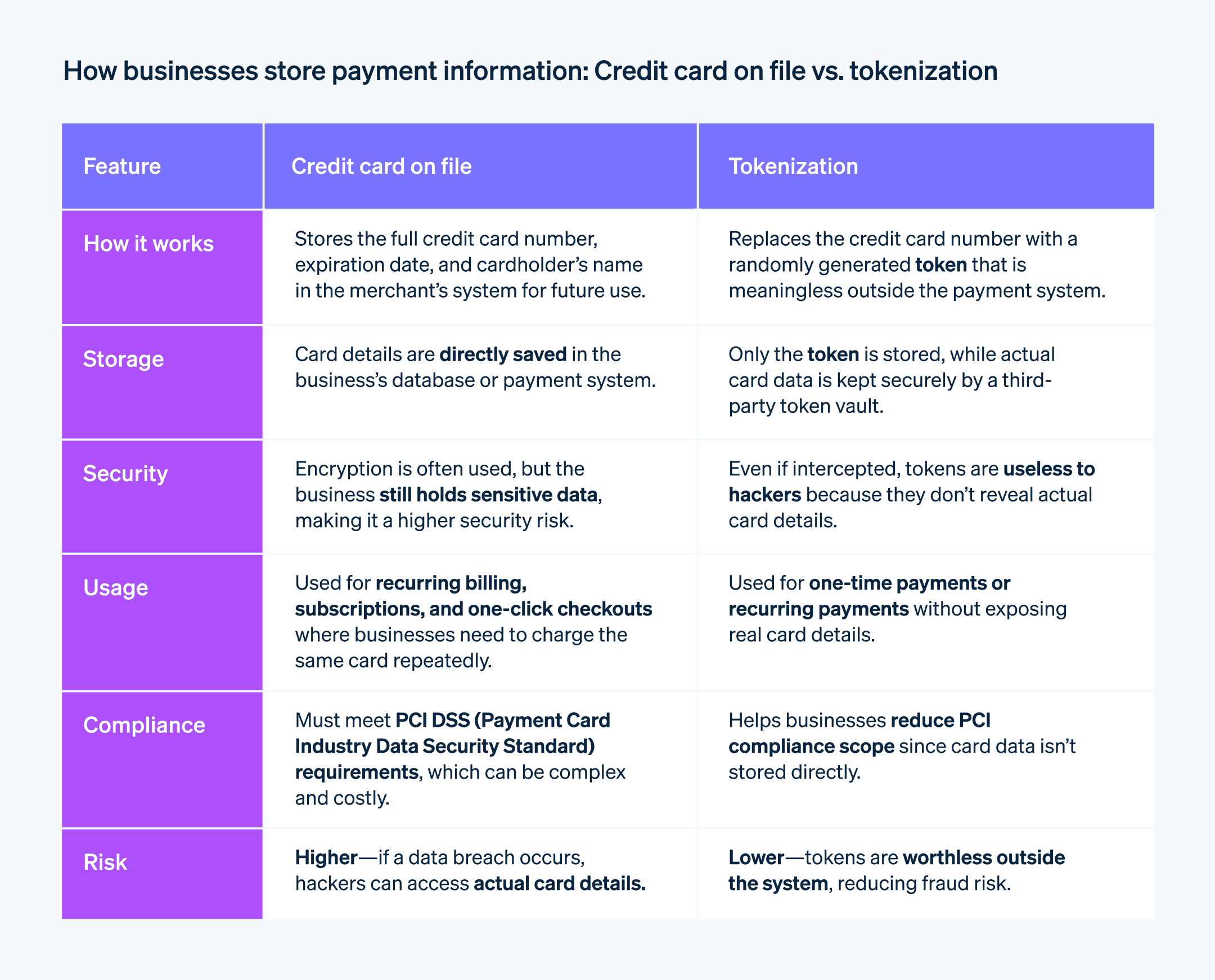

Having a credit card on file and tokenization are two different concepts in payment processing, though they are often used together for increased security and convenience. Here’s a description of each concept and how they are applied:

Card on file

When a business keeps a credit card on file, it means it stores the customer’s credit card details—such as the card number, expiration date, and cardholder’s name—within its payment system. This lets the business charge the card for transactions without requiring the customer to re-enter their details. This method is widely used for recurring payments or subscriptions. However, storing credit card information requires strong security measures to protect against data breaches and comply with industry standards.

Tokenization

Tokenization is a security measure that protects credit card data. This process replaces credit card details with a unique identifier known as a token, which can be used for transactions without exposing the credit card details. The real card data is safely stored in a token vault, which is often managed by a third-party service provider. When a transaction is processed, the token (and not the real card details) is sent through the payment networks. Even if the token is intercepted, the real credit card information remains secure.

Pros and cons of keeping a credit card on file

Storing a credit card on file is standard practice for many businesses. Here are potential benefits and drawbacks to consider:

Pros

Improved cash flow: Keeping a credit card on file means businesses can implement faster billing and collection processes. This is especially true for businesses with recurring revenue models, such as subscription services. Automating the billing process means businesses can count on a consistent inflow of funds, reducing the need for manual invoicing and follow-ups for payments.

Increased customer convenience: Keeping a credit card on file makes transactions quicker and easier for customers. This convenience can improve the customer experience, potentially increasing customer satisfaction and loyalty. In ecommerce scenarios, this can also lead to faster checkouts, reducing cart abandonment rates.

Reduced administrative overhead: Automatic billing reduces the administrative burden associated with manual payment processing. This can reduce labor costs and time spent on administrative tasks, letting staff focus on more productive activities.

More sales opportunities: When customers have a credit card on file, they might be more inclined to make impulse purchases or buy additional services, knowing the payment process is simplified. This can increase the average transaction value and boost sales.

Cons

Security and compliance requirements: Storing credit card information comes with the responsibility of maintaining data security. Businesses must comply with PCI DSS and other relevant data protection standards, which can require a sizable investment in secure storage solutions and ongoing security measures.

Risk of data breaches: Holding sensitive customer data increases the risk of data breaches. If a business’s security systems are compromised, it can lead to financial loss, reputation damage, and legal consequences. The implications of a data breach can be particularly severe for small businesses.

Costs of payment processing: While keeping credit cards on file can facilitate easy billing, it also involves costs. Payment processors typically charge fees for transactions. Businesses might also face chargebacks or disputed charges, which can incur extra costs and administrative work.

Managing card information updates: Businesses need to keep track of card expirations and updates. This can become a complex task, especially with a large customer base. Failing to update card information in a timely manner can lead to declined transactions and interrupted service, potentially affecting customer relationships.

Alternatives to keeping credit cards on file for businesses

Keeping a card on file isn’t the only option for businesses that want to simplify the payment experience for customers. Alternatives include a variety of payment methods and technologies that provide different levels of security and convenience, including:

Direct bank transfers (ACH): Businesses can use Automated Clearing House transfers, in which customers pay from their bank account. This method usually incurs lower transaction fees than credit card processing and can be just as convenient for recurring payments, though it might take longer to process.

Digital wallets and payment services: Services such as PayPal, Apple Pay, Google Pay, or other mobile payment systems let customers store their payment information securely and make payments without providing credit card details to the business. These services often provide strong encryption and a quick payment process.

Cryptocurrency payments: Accepting cryptocurrencies can help businesses minimize transaction fees and provide payment options that are not tied to traditional banking systems. Cryptocurrencies can provide a high level of security because of blockchain technology, though they might be less convenient because of their volatility and the learning curve associated with their use.

Prepaid accounts: Businesses can let customers preload funds into an account, which is drawn down on each purchase. This can be a safer payment method because there’s a limit to the funds available, and it can also encourage customer loyalty.

Mobile POS systems: Businesses can use mobile point-of-sale systems for in-person transactions. These systems can accept different forms of payment, including credit cards, without needing to store the card details on file. They often come with strong security features and the convenience of immediate payment confirmation.

Invoice payments: For business-to-business (B2B) transactions or services rendered, a business can issue invoices with payment terms. Customers can pay these invoices using various methods, including checks, bank transfers, or online payment portals that do not require the business to store payment details.

Biometric payment systems: Biometric payment systems use fingerprints or facial recognition to authenticate payments. They can potentially provide strong security and a high level of convenience because they do not require physical cards or passwords.

Contactless payments: Tap to pay technology lets customers pay by tapping a payment card or mobile device on a reader. This can be quicker and as safe as traditional credit card transactions, without the business needing to store any details.

When comparing these alternatives to the card-on-file method, it’s important to consider that the security and convenience levels vary. Digital wallets, for instance, offer convenience similar to having a credit card on file but add a layer of security by not exposing the card details to the business. Direct bank transfers might provide more security because of the nature of the transaction but can be less convenient because of slower processing times. Each alternative has its own set of trade-offs that businesses must evaluate based on their specific needs, customer preferences, and operational capacity.

How Stripe Payments can help

Stripe Payments provides a unified, global payments solution that helps any business—from scaling startups to global enterprises—accept payments online, in person, and around the world.

Stripe Payments can help you:

Optimize your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs, access to 125+ payment methods, and Link, a wallet built by Stripe.

Expand to new markets faster: Reach customers worldwide and reduce the complexity and cost of multicurrency management with cross-border payment options, available in 195 countries across 135+ currencies.

Unify payments in person and online: Build a unified commerce experience across online and in-person channels to personalize interactions, reward loyalty, and grow revenue.

Improve payments performance: Increase revenue with a range of customizable, easy-to-configure payment tools, including no-code fraud protection and advanced capabilities to improve authorization rates.

Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments, or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.