Credit card payment processing fees are charges that businesses pay to financial institutions and payment processors for handling credit card transactions. Businesses that want their payment systems to sustain healthy, long-term profit margins need a strong understanding of how they work. In 2024, US businesses paid more than $187 billion in processing fees alone.

This article explains what payment processing fees are, how they work, and how businesses can choose the right payment solutions for all of their sales channels.

What’s in this article?

- What is payment processing?

- What fees are associated with payment processing?

- How are credit card payment processing fees determined?

- Credit card processing fees per card network

- How to reduce credit card and payment processing costs

- How Stripe Payments can help

What is payment processing?

Payment processing refers to the process of electronically moving money from a customer to a business. Typically, payment processing involves electronic payment methods such as credit cards, debit cards, and digital wallets.

The process includes authorizing, clearing, and settling transactions between the cardholder, business, acquiring bank, issuing bank, and payment networks. The process also includes payment gateways and payment processors that act as intermediaries to facilitate communication and data exchange between these entities, ensuring that the transaction is efficient, valid, and secure.

What fees are associated with payment processing?

Fees associated with payment processing can vary depending on the payment processor, the type of transaction, and the business’s specific arrangement with the processor. Some common fees involved in payment processing include:

Transaction fees

Transaction fees, which are charged for each transaction processed, may comprise a percentage of the transaction value and a fixed fee per transaction. Rates can vary based on factors such as the type of card, whether the card is swiped, dipped, or manually keyed in during the transaction, and the industry or business type.Monthly fees

Some payment processors may charge a fixed monthly fee for their services, which can cover account maintenance, reporting, and customer support. Stripe doesn’t charge any monthly fees or setup fees.Terminal or equipment fees

Businesses may need to purchase or lease payment processing equipment, such as credit card terminals or point-of-sale (POS) systems. These can incur one-time or recurring fees.Payment gateway fees

For online transactions, businesses may need a payment gateway, which can incur its own set of fees. These fees may include setup, monthly, and per-transaction fees.PCI compliance fees

To ensure that they handle cardholder data securely, businesses must adhere to the Payment Card Industry Data Security Standard (PCI DSS). Some processors charge a fee for helping businesses maintain compliance or for noncompliance penalties.Chargeback fees

When a customer disputes a transaction and requests a chargeback, payment processors may charge a fee to cover the costs of processing and investigating the dispute.Early termination or cancellation fees

If a business decides to terminate its contract with a payment processor before the end of the agreed-upon term, the processor may charge them an early termination fee.Miscellaneous fees

These may include fees for additional services, such as account-setup fees, statement fees, or batch fees.

How are credit card payment processing fees determined?

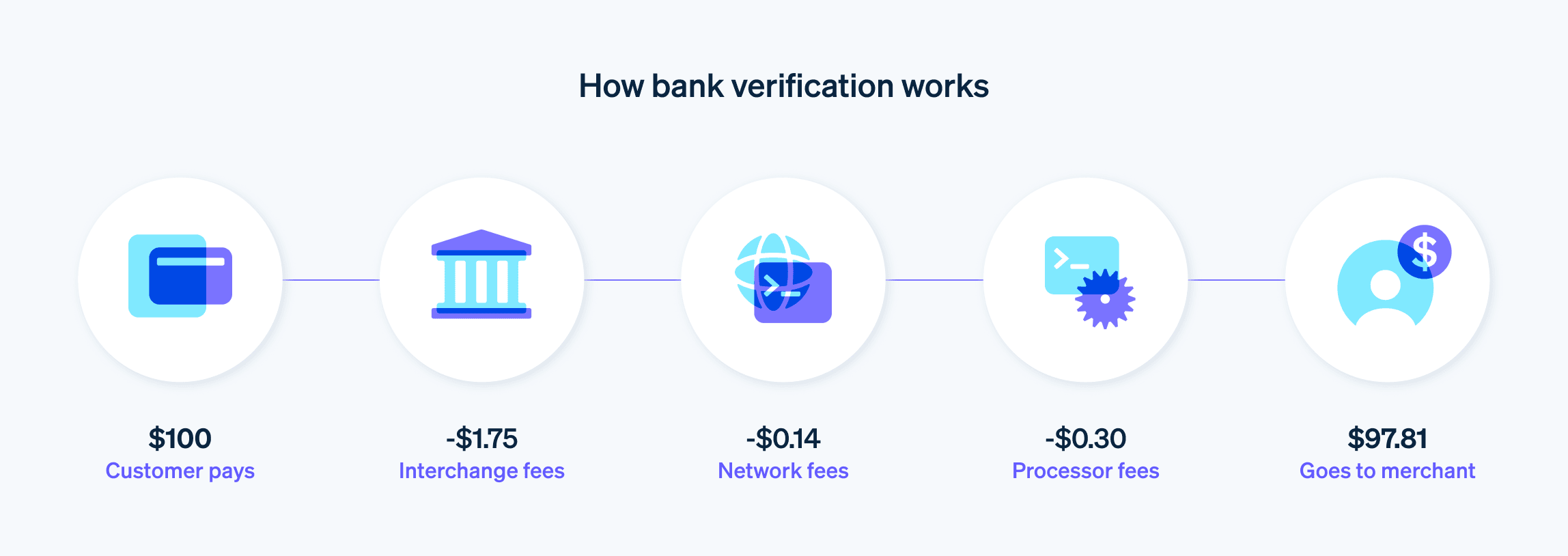

Credit card processing fees are payment processing fees that specifically apply to transactions involving credit cards. Parties that decide on credit card processing fees include card networks, issuing banks, and payment processors.

The Merchant Discount Rate (MDR) is the total fee a merchant pays for each credit or debit card transaction, typically ranging from 1% to 3%. This fee covers costs associated with processing the payment, including interchange fees to card issuers and fees to payment processors.

There are three main types of credit card processing fees:

Interchange fees

Interchange fees are set by the card networks—Visa, Mastercard, Discover, and American Express in the US—and are paid to the cardholder’s issuing bank. Typically, interchange fees are a combination of a percentage of the transaction value and a fixed per-transaction fee. They vary depending on factors such as the type of card (credit, debit, rewards, corporate, etc.), the type of transaction (swiped, dipped, tapped, keyed, or online), and the business’s industry.Assessment or network fees

The card networks also set these fees, which cover the cost of operating and maintaining the card-network infrastructure. Assessment fees are usually a small percentage of the transaction value and may vary slightly between card networks.Processor or merchant services fees

The payment processor or merchant services provider charges these fees for their role in facilitating credit card transactions. The processor’s fees can be a fixed per-transaction fee, a percentage of the transaction value, or a combination of both.

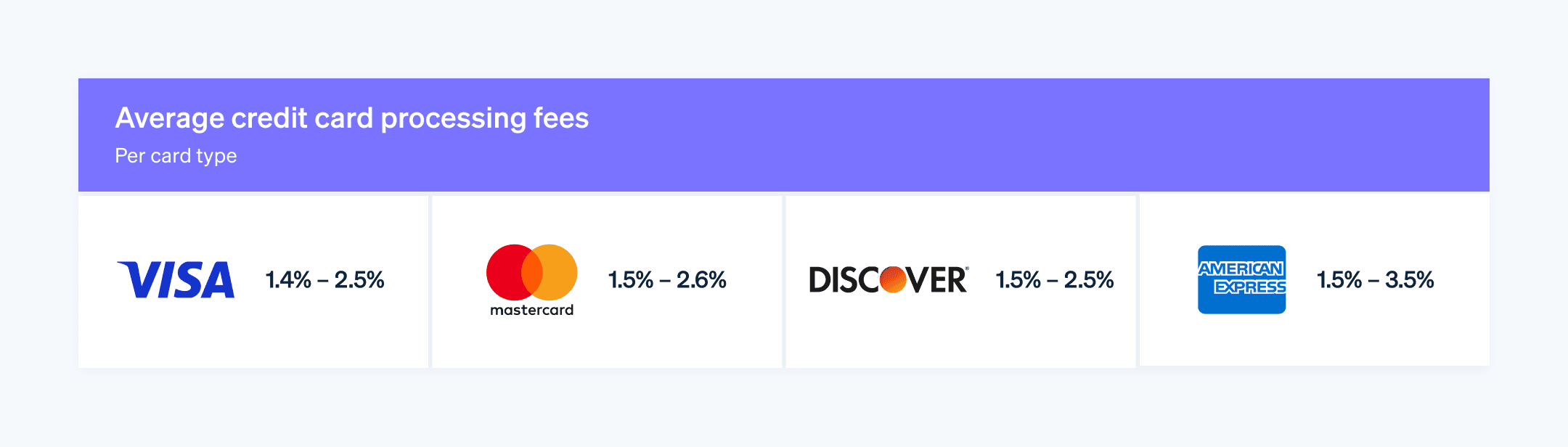

Credit card processing fees per card network

Credit card processing fees can vary by card network, as each network sets its own interchange fees and assessment fees. Here’s an overview of the fees associated with the major card networks:

Visa

Visa’s interchange fees depend on various factors, including the type of card, the transaction method, and the business’s industry. The fees can range from around 1.15% + $0.05 to 2.4% + $0.10 per transaction.Mastercard

Similar to Visa, Mastercard’s interchange fees vary based on multiple factors. The fees can range from approximately 1.15% + $0.05 to 2.5% + $0.10 per transaction.Discover

Discover’s interchange fees also depend on the type of card, transaction method, and industry. The fees generally range from around 1.4% + $0.05 to 2.4% + $0.10 per transaction.American Express

American Express operates in a slightly different way from the other card networks: it often acts as both the issuing bank and the card network. American Express’s fees are typically around 1.43% + $0.10 to 3.30% + $0.10 per transaction.

Keep in mind that these are ranges, and the exact fees for a specific transaction, can vary. Businesses should consult their payment processor and the card networks’ fee schedules for the most up-to-date information on credit card processing fees.

How to reduce credit card and payment processing costs

While some costs and fees are fixed, businesses can reduce some credit card and payment processing costs. Here are some strategies to consider:

Compare your options

Research different payment processors and their fee structures to find the most practical option for how you handle payments now—and for how you plan to grow your business in the future.Opt for the right pricing model

Choose a pricing model that suits your business. For example, interchange-plus pricing is often more transparent and cost effective than tiered pricing, while flat-rate pricing can be beneficial for businesses with smaller transaction volumes.Reduce the risk of fraud and chargebacks

Implementing security measures such as address verification (AVS) and card verification value (CVV) checks can minimize the risk of fraudulent transactions and chargebacks, which can lead to lower processing fees.Accept cards in person

Whenever possible, use the most cost-effective processing method. For example, in-person transactions using a card reader typically have lower fees than card-not-present transactions.Take advantage of lower-cost payment methods

Encourage customers to use lower-cost payment methods when possible, such as debit cards or digital wallets, which can have lower processing fees than credit cards.Regularly review your processing fees

Periodically review your payment processing fees and statements to ensure you’re not being charged unnecessary fees or higher rates than you initially agreed to.Batch transactions

Process transactions in batches at the end of the day instead of processing each transaction individually. This can minimize per-transaction fees and reduce overall labor costs.Maintain PCI compliance

Ensure your business is compliant with PCI DSS to avoid noncompliance fees and reduce the risk of security breaches, which can lead to costly fines and higher fees from your payment processor.Use industry-specific programs

Some card networks offer programs customized to specific organizations—for example, certain types of nonprofits and educational organizations—that provide reduced processing rates. Check if your business qualifies for these programs.Require a minimum amount for credit card sales

Setting a minimum purchase amount for credit card use can offset processing fees on small transactions. According to new rules on electronic payments, a business is allowed to set a credit card minimum of up to $10, as long as that same minimum applies to all the credit cards accepted by that business.Pass along card processing fees to customers

In most US states, it is legal for businesses to add a surcharge to credit card transactions to cover processing fees, provided they comply with card network rules and state laws. However, some states have restrictions or specific requirements regarding surcharges.

How Stripe Payments can help

Stripe Payments provides a unified, global payments solution that helps any business—from scaling startups to global enterprises—accept payments online, in person, and around the world.

Stripe Payments can help you:

- Optimize your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs, access to 100+ payment methods, and Link, a wallet built by Stripe.

- Expand to new markets faster: Reach customers worldwide and reduce the complexity and cost of multicurrency management with cross-border payment options, available in 195 countries across 135+ currencies.

- Unify payments in person and online: Build a unified commerce experience across online and in-person channels to personalize interactions, reward loyalty, and grow revenue.

- Improve payments performance: Increase revenue with a range of customizable, easy-to-configure payment tools, including no-code fraud protection and advanced capabilities to improve authorization rates.

- Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments, or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.