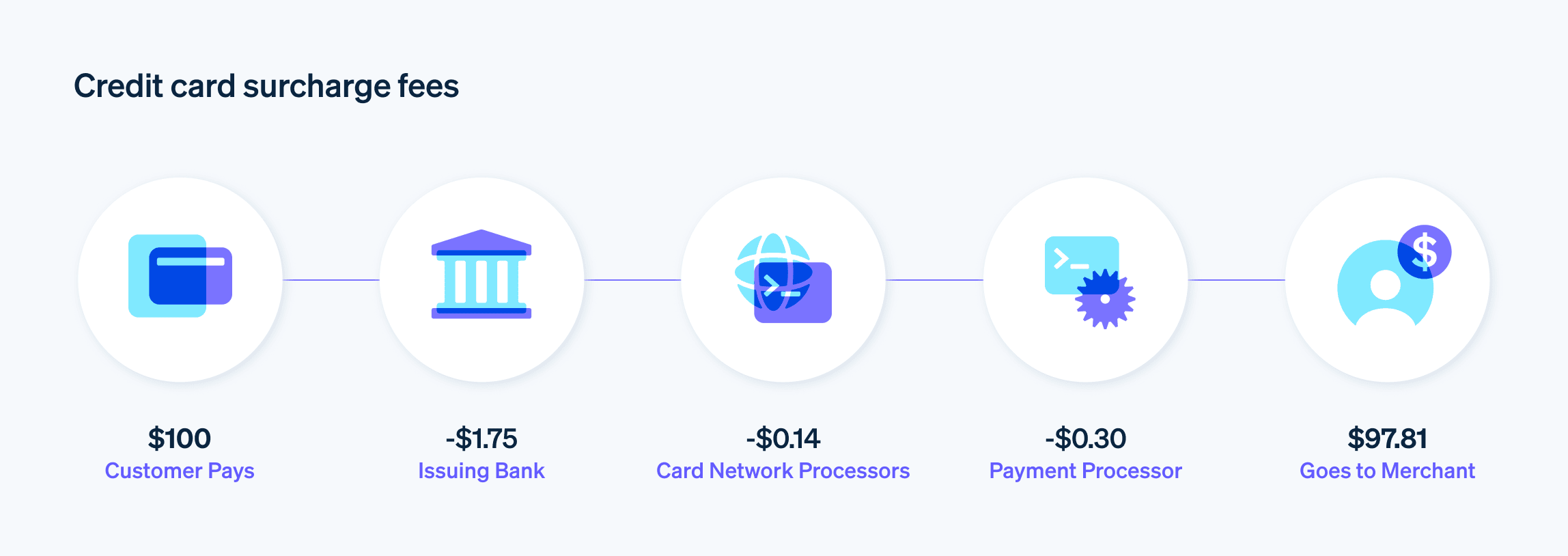

A credit card surcharge is an additional fee that a business may add to a transaction when a customer pays with a credit card. The purpose of this surcharge is to cover the costs that the business incurs for processing credit card payments. These fees, which businesses pay to credit card companies and payment processors, are typically a percentage of the transaction value—and they represent a significant cost. In 2022, US businesses paid over $160 billion in processing fees to accept about $10 trillion in credit, debit, and prepaid card payments.

The surcharge can vary based on the agreement between the business and its payment processor. Often, the fee is a small percentage of the total transaction amount. The intention behind the surcharge is to offset the business’s cost of accepting credit cards, which includes fees such as interchange fees, assessment fees, and payment processor fees.

Below is a deep dive into credit card surcharges for businesses: how they work, what benefits they can provide, and best practices for implementing credit card surcharges in a strategic way that doesn’t undermine customer satisfaction. Here’s what you should know.

What’s in this article?

- Why do businesses apply credit card surcharges?

- Rules of credit card surcharges

- What factors should businesses consider before applying surcharges?

- Best practices for surcharge policies

- The pros and cons of credit card surcharges

- Alternatives to credit card surcharges

Why do businesses apply credit card surcharges?

Businesses apply credit card surcharges to offset the costs associated with processing credit card transactions. When customers pay with a credit card, businesses incur fees from their bank or payment processor. These fees can include a percentage of the transaction amount plus a fixed charge per transaction. Businesses apply surcharges with the intention of recovering these costs instead of absorbing them, which can be particularly important for small businesses or those with thin profit margins.

In addition to direct processing fees, there are other costs related to accepting credit cards. These include the costs of maintaining the necessary hardware and software, as well as compliance with security standards to protect cardholder data. Credit card fraud is another concern, and businesses often bear the cost of chargebacks in the case of fraudulent transactions.

Surcharges can also be a strategic decision for businesses. Businesses may use them as a way to encourage customers to use alternative payment methods that incur lower or no processing fees, such as cash or debit cards.

Rules of credit card surcharges

In the US, not every state has the same regulations around credit card surcharges. Here’s an overview of the regulatory environment in different jurisdictions.

Nationwide rules on surcharges in the US

- Credit card surcharges are generally permissible in the United States.

- These surcharges are added to credit card transactions to cover processing fees.

- The surcharge amount is typically a percentage of the transaction.

- Businesses must inform customers about the surcharge before the transaction.

- Credit card networks (such as Visa and Mastercard) have guidelines on surcharges. These include surcharge limits and notification requirements for both the network and customers.

State-specific rules

- California: Previously banned surcharges, but recent legal changes have allowed them under certain conditions.

- Colorado: Surcharges are allowed, but with specific disclosure requirements.

- Connecticut: Prohibits credit card surcharges.

- Florida: Had a ban on surcharges, but legal developments have allowed them under certain circumstances.

- Kansas: Allows surcharges, but businesses must comply with disclosure and transparency requirements.

- Maine: Surcharges are permitted, subject to certain conditions and disclosures.

- Massachusetts: Prohibits credit card surcharges.

- New York: Previously had a ban, but legal rulings have allowed surcharges with strict disclosure requirements.

- Oklahoma: Surcharges are allowed, provided businesses adhere to disclosure rules.

- Texas: Permits surcharges, with specific requirements for notifying customers.

Each state has its own way of regulating credit card surcharges, reflecting different policies on consumer protection and business operations. While some states allow surcharges with certain conditions, others have stricter rules or outright bans. Businesses that operate internationally or in multiple states have an obligation to be aware of these regulations and comply with them; otherwise they risk legal issues and other complications.

Global considerations

- In some countries outside the US, surcharges are either regulated differently or prohibited.

- Compliance with local laws and credit card network rules is particularly important for multinational businesses.

What factors should businesses consider before applying surcharges?

Before applying surcharges, businesses should consider these factors:

Legal compliance

First, businesses must make sure that applying surcharges is legal in their state or region. This means understanding local-specific laws and regulations regarding surcharges.Credit card network rules

Businesses must understand and comply with the rules set by credit card networks such as Visa, Mastercard, and American Express. These rules include limits on surcharge amounts and requirements for customer notification.Customer transparency

Clear communication with customers about any additional charges is key. Businesses can achieve this through visible signage, statements on websites, or verbal notifications during transactions.Impact on customer behavior

Consider how surcharges might influence customer choices. Some customers may choose alternative payment methods, or even different businesses if they feel the surcharge is unfair.Cost-benefit analysis

Businesses should assess whether the additional revenue from surcharges outweighs the potential loss of business from customers who might seek alternatives due to the extra fees.Administrative overhead

Implementing and managing surcharges may require changes to billing systems and additional administrative work.Market position and competition

It’s important to know how competitors handle credit card fees. If competitors are absorbing these costs, adding a surcharge might put a business at a disadvantage.Customer relations and satisfaction

Some customers may see surcharges as a substantial drawback, so it’s important to balance financial gains with customer satisfaction.Frequency of credit card transactions

Businesses with high volumes of credit card transactions may find that surcharges help offset processing fees, but businesses with fewer credit card purchases may see limited impact.Alternative payment incentives

Instead of relying on surcharges, providing incentives for customers to use lower-fee payment methods such as cash or debit cards can be a more customer-friendly method.

Carefully considering these factors can help businesses make an informed decision about whether to implement surcharges, and how to do so in a way that balances their financial needs with customer expectations and legal requirements.

Best practices for surcharge policies

Businesses have to strike a delicate balance with surcharges: they need to cover their costs but also keep customers happy. Tacking on too high a surcharge for credit card payments might save money on transaction fees, but it can risk customer happiness and loyalty.

Best practices for implementing surcharge policies require careful consideration in several areas:

Ensuring compliance with laws and regulations

Make sure your surcharge policy complies with local laws and credit card network regulations. This includes adhering to any restrictions on the maximum allowable surcharge, and making sure that your surcharges cover the cost of transaction processing but do not generate profit.Maintaining transparent communication with customers

Disclose the surcharge policy to customers in a direct and clear way. You can do this through visible signage at physical locations, explicit mentions during transactions, and statements on websites and receipts. It’s important that customers are aware of the surcharge before they complete their transaction.Setting reasonable surcharge levels

Set surcharges at a level that covers your costs but is also fair to customers. Excessive surcharging can drive customers away. A common practice is to set the surcharge at a level equivalent to what credit card companies charge you for transactions.Conducting regular reviews and adjustments

Regularly review and adjust your surcharge rates if necessary, especially if your processing costs change. This ensures that your surcharges remain in line with real costs and legal requirements.Educating staff

Train your staff so they can explain the surcharge policy effectively to customers. Staff should be able to answer questions and provide explanations about why the surcharge is in place and how it’s calculated.Offering multiple payment options

Provide customers with a variety of payment options, including those that do not incur surcharges such as cash and debit cards. Some businesses also offer discounts for non-credit-card payments.Analyzing customer feedback

Pay attention to customer feedback around the surcharge. In order to maintain positive customer relationships, adjust your strategy if you find measurable customer dissatisfaction or confusion.Documenting the policy

Make sure your surcharge policy is well-documented. This should include details on how the surcharge is calculated, how it’s applied, and any relevant legal compliance information. This documentation can be useful for staff training and addressing any customer inquiries.Avoiding discrimination among card types

Apply the surcharge uniformly across all types of credit cards if your local laws and agreements with credit card networks allow. Discriminating between card types can lead to complications and customer dissatisfaction.Monitoring for legal changes regularly

Stay informed about changes in laws and credit card network rules. Surcharging practices can be affected by new laws, court decisions, or changes in credit card network policies. Regular updates verify ongoing compliance and operational efficiency.

Businesses that follow these practices can implement surcharge policies that are fair, legal, transparent, and minimally disruptive to customer relations.

The pros and cons of credit card surcharges

A business’s surcharge policy should reflect the kind of customer experience it wants to provide. While the financial upside of recouping transaction costs is obvious, it’s important to consider the bigger picture of how surcharges play into customer relationships and influence the way customers spend. Here’s a quick look at the pros and cons of credit card surcharges.

Pros of implementing a surcharge policy

Recovers transaction costs

One of the main benefits for businesses is the ability to recover the costs incurred from processing credit card payments, which can include percentage-based fees, per-transaction fees, and monthly fees from payment processors.Reduces overhead

By adding a surcharge, businesses can reduce the overhead associated with credit card transactions, potentially making products or services more affordable by avoiding the need to raise prices across the board.Encourages alternative payments

Surcharges can incentivize customers to use alternative, less expensive payment methods such as cash or debit cards, which can result in lower overall transaction fees for businesses.

Cons of implementing a surcharge policy

Negative customer reaction

Customers may view surcharges negatively, perceiving them as a penalty for using their preferred payment method. This can lead to dissatisfaction or the potential loss of business to competitors who don’t add such charges.Complexity in pricing

Implementing surcharges can complicate the pricing structure, potentially leading to confusion at the point of sale as customers may not be aware of the additional cost until the last minute.Inhibition of spending

Some customers may alter their spending habits to avoid credit card purchases, which could mean businesses risk losing out on larger sales.Regulatory navigation

Keeping up with regulations and compliance requirements can be daunting. These rules can vary by location and even by credit card network, and they require diligent oversight.

Alternatives to credit card surcharges

Businesses have a range of options to consider if they want to sidestep credit card surcharges. These include:

Using cost-effective payment processors

Payment processors such as Stripe provide competitive rates and pricing structures that may reduce transaction costs. By analyzing different payment processors and selecting one with lower fees, a business may reduce or eliminate the need to add surcharges.Choosing optimal point-of-sale systems

Selecting the right point-of-sale (POS) system is key for transactions. Some systems offer more favorable rates or are more tailored to business-specific transaction patterns. A POS system that integrates easily with business operations can reduce processing times and costs.Negotiating with merchant services

Businesses can negotiate terms with their merchant services provider. Some providers may offer lower rates based on transaction volume or long-term customer loyalty.Incentivizing lower-cost payment methods

Giving discounts for using cash, check, or ACH transfers can motivate customers to use these lower-cost methods. This can indirectly reduce the volume of credit card transactions and associated fees.Batching transactions

By processing transactions in batches rather than individually, businesses can reduce the per-transaction fees often charged by credit card processors.Implementing a service fee

Instead of a specific credit card surcharge, some businesses apply a small service fee to all transactions. This can be a more palatable method for customers and may avoid the negative perception associated with credit card surcharges.Offering membership or loyalty programs

Introducing programs that include payment processing fees in the membership cost can distribute the processing costs over a larger base, reducing the impact on individual transactions.Reducing card payment acceptance

Some businesses limit credit card acceptance for small transactions, since fees would take a sizable portion of the revenue.Improving operational efficiency

Streamlining business operations to cut costs can offset payment processing fees. This might involve optimizing inventory management, reducing waste, or improving customer service to increase retention.Allowing cost absorption

Some businesses may decide to absorb the fees, balancing this by adjusting prices slightly across all products and services.

Choosing the right credit card surcharge alternative should be an extension of a business’s commitment to customer service and fit with its operations. The goal is to stay profitable while keeping transactions fair and convenient for customers.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.