A 2022 report found that online transactions accounted for 20% of total retail sales worldwide and are projected to reach 24% by 2026. Third-party payment processors are now more important than ever, facilitating swift and secure payments for many types of businesses—from fledgling startups to established online retailers.

For most businesses that handle customer transactions, it’s important to understand these platforms. The right payment processor can help your business optimize customer experience, streamline operations, and access new markets more effectively. Here’s what you need to know about third-party payment processors—and how to choose the right one for your business.

What’s in this article?

- What is a third-party payment processor?

- How does third-party payment processing work?

- Pros and cons of working with a third-party payment processor

- Choosing a third-party payment processor

What is a third-party payment processor?

A third-party payment processor is a service that allows businesses to accept online payments. These payment processors facilitate transactions between the customer and the business by transferring funds from the customer’s bank or credit account to the business’s bank account.

How does third-party payment processing work?

Third-party payment processors enable businesses to accept various online payment methods, without setting up and maintaining their own merchant account with a bank. This is a significant benefit, particularly for small or new businesses, since working with a payment processor can be a quicker, more accessible way to begin accepting online payments.

A traditional merchant account is a type of bank account that enables businesses to accept payments in a variety of ways, most commonly debit or credit cards and digital wallets. In this model, each business has a unique merchant account, and these accounts come with underwriting requirements and fees, such as setup fees, monthly fees, and transaction fees. Generally, merchant accounts also require a longer setup process than third-party payment processors do.

Third-party payment processors, such as Stripe, aggregate all of their clients’ transactions into a single merchant account, effectively giving businesses access to the functionality of a merchant account without having to go through the time-consuming process of opening one themselves.

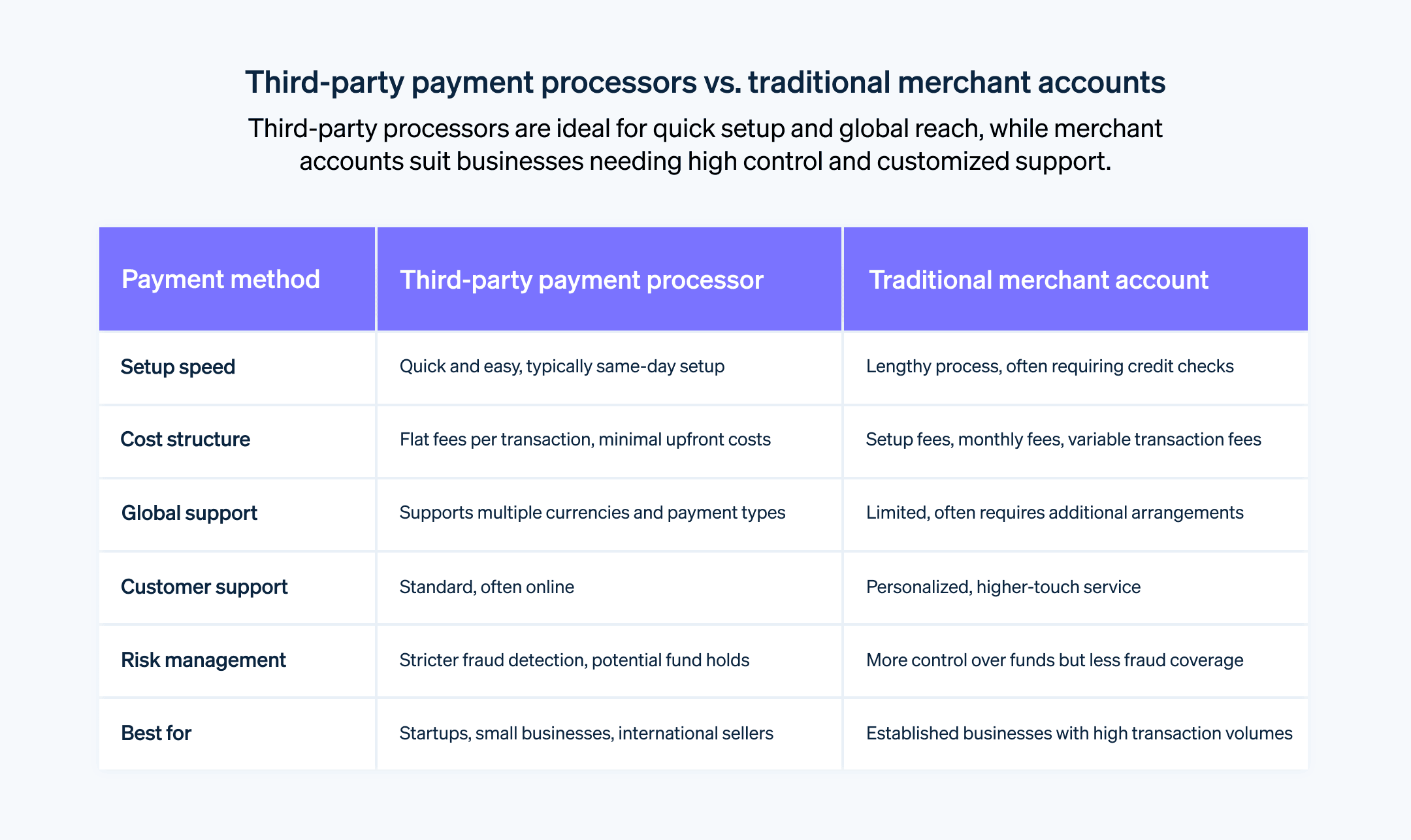

Here’s an overview of the key differences between a third-party payment processor and a merchant account:

Speed and simplicity

For businesses, setting up a third-party payment processor is generally quicker and easier than opening a merchant account. With a traditional merchant account, the setup process can be lengthy and often requires a detailed credit check and a review of the business’s financial stability.Cost structure

Typically, third-party processors charge a flat fee per transaction, while merchant accounts often charge a mixture of setup fees, monthly fees, and variable transaction fees. For small businesses or those with lower sales volumes, the cost structure of a third-party processor can be more favorable than that of a merchant account.Risk management

Because third-party processors aggregate transactions from many businesses, they often have stricter fraud detection systems and may be more likely to freeze accounts or hold funds when they detect suspicious activity.Customer support

Merchant accounts usually offer more personalized customer support, while third-party processors, due to the large number of businesses they work with, often offer standard online support that is less personalized.Payment flexibility

Third-party processors often support a wider range of payment methods and currencies, which can be beneficial for businesses that operate internationally or want to offer their customers more payment options. For example, Stripe supports more than 135 currencies, which gives businesses the ability to operate in a wide range of global markets and receive payouts in their preferred currency.

While third-party payment processors offer an easy and quick way for businesses to start accepting online payments, they also come with their own risks. Choosing between a third-party processor and a traditional merchant account will depend on a business’s specific needs and circumstances.

Pros and cons of working with a third-party payment processor

Working with third-party payment processors can offer numerous advantages to businesses, especially for small businesses or startups. However, payment processors come with their own set of challenges. Here are the pros and cons of third-party payment processors:

Pros

Ease of setup

Third-party payment processors are usually easier and faster to set up compared to traditional merchant accounts. Stripe, for example, allows businesses to start accepting payments quickly using a library of developer-friendly APIs with low-code or prebuilt solutions.Lower initial costs

There are generally no setup fees or monthly fees for third-party payment processors, making them a more affordable option for small businesses or those with lower sales volumes. Here’s an overview of Stripe’s simple, transparent pricing structure.Global transactions

They often support a wide range of currencies and payment methods, making it easier for businesses to sell to customers worldwide.Simplified payment process

They handle all aspects of the payment process, including payment security, fraud detection, and compliance with payment industry regulations.

Cons

Higher transaction fees

Third-party payment processors often charge higher per-transaction fees compared to traditional merchant accounts. However, this is not always the case and depends on which provider you’re working with.Increased risk of holds or freezes

Since processors deal with a large number of businesses, they sometimes automatically freeze accounts or hold funds when they detect suspicious activity.Less control

With a third-party processor, the business has less control over the transaction process and must rely on the processor’s systems and rules.Less customer support

Due to the high volume of businesses they serve, third-party processors may not provide the same level of customer service as a dedicated merchant account. This is not always the case, but it’s important to keep in mind as you evaluate your options.

Of course, not all third-party payment processors have the same pros and cons. They vary depending on the qualities of the provider and how well it fits the needs of a particular business.

Choosing a third-party payment processor

Choosing the right third-party payment processor can be an important decision for your business. The right processor can simplify your payment operations, make transactions smoother for your customers, and even expand your potential market. However, the wrong choice can lead to unnecessarily high fees, service disruptions, or issues with customer transactions. With so many options available, consider your business’s specific needs and circumstances before making a decision. Here are a few important factors to keep in mind:

Understand your business needs

Every business is unique. Consider factors such as sales volume, average transaction size, the type of products or services you sell, and the payment methods your customers prefer. For instance, if you’re running an online store that serves international customers, you’ll want a processor that supports multiple currencies and payment methods. A small business with a few brick-and-mortar retail locations in a finite market might not need the same type of support.

Evaluate fee structure

Different payment processors have different fee structures. Some charge a flat fee per transaction, while others may charge a percentage of the transaction value. Look out for any hidden fees, such as chargeback fees, monthly fees, or termination fees. Understand these costs and how they’ll impact your bottom line.

Consider the payment methods supported

Your customers might prefer different payment methods, such as credit cards, debit cards, digital wallets, or bank transfers. Choosing a payment processor that supports a wide range of payment methods can improve the customer experience and potentially increase sales.

Check the processor’s reputation and reliability

Look for reviews or testimonials from other businesses. Research the reliability of the processor’s service and how often they experience downtime. Also, consider the processor’s customer-service reputation. If you choose to work with it and you run into an issue, you’ll want timely and helpful customer support, ideally on a variety of channels (email, chat, phone, etc.).

Evaluate security

Ensure that the payment processor complies with all relevant security standards, such as PCI DSS (the Payment Card Industry Data Security Standard). It should use encryption and other security measures to protect your customers’ payment information.

Consider scalability

As your business grows, your payment processing needs may change. Choose a processor that can scale with your business and handle increased transaction volumes as needed.

Choosing a third-party payment processor is a significant decision. By giving yourself time to research your options and make an informed choice, you can partner with a payment processor that will support your business goals.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.