Uit een rapport uit 2022 bleek dat online transacties goed waren voor 20% van de totale verkopen in de detailhandel wereldwijd en zal naar verwachting in 2026 24% bedragen. Externe betalingsverwerkers zijn nu belangrijker dan ooit en maken snelle en veilige betalingen mogelijk voor vele typen ondernemingen, van beginnende start-ups tot gevestigde online retailers.

Voor de meeste ondernemingen die klanttransacties afhandelen, is het belangrijk om deze platforms te begrijpen. De juiste betalingsverwerker kan je onderneming helpen de klantervaring te optimaliseren, activiteiten te stroomlijnen en effectiever toegang te krijgen tot nieuwe markten. Dit is wat je moet weten over externe betalingsverwerkers en hoe je de juiste kiest voor je onderneming.

Wat staat er in dit artikel?

- Wat is een externe betalingsverwerker?

- Hoe werkt de verwerking van betalingen door derden?

- Voor- en nadelen van het werken met een externe betalingsverwerker

- Het kiezen van een externe betalingsverwerker

Wat is een externe betalingsverwerker?

Een externe betalingsverwerker is een dienst waarmee ondernemingen online betalingen kunnen ontvangen. Deze betalingsverwerkers maken transacties mogelijk tussen de klant en de onderneming door geld over te maken van de bankrekening of kredietrekening van de klant naar de bankrekening van de onderneming.

Hoe werkt de verwerking van betalingen door derden?

Externe betalingsverwerkers stellen ondernemingen in staat om verschillende online betaalmethoden te accepteren, zonder een eigen verkopersaccount op te zetten en te onderhouden bij een bank. Dit is een aanzienlijk voordeel, vooral voor kleine of nieuwe ondernemingen, aangezien het werken met een betalingsverwerker een snellere en laagdrempelige manier kan zijn om online betalingen te accepteren.

Een traditioneel verkopersaccount is een type bankrekening waarmee ondernemingen op verschillende manieren betalingen kunnen accepteren, meestal debit- of creditcards en digitale wallets. In dit model heeft elke onderneming een uniek verkopersaccount, en deze accounts worden geleverd met risico-evaluatievereisten en -kosten, zoals opstartkosten, maandelijkse kosten en transactiekosten. Over het algemeen is voor verkopersaccounts ook een langer configuratieproces nodig dan bij externe betalingsverwerkers.

Externe betalingsverwerkers, zoals Stripe, voegen alle transacties van hun klanten samen in één verkopersaccount, waardoor ondernemingen in feite toegang krijgen tot de functionaliteit van een verkopersaccount zonder dat ze zelf het tijdrovende proces hoeven te doorlopen om er een te openen.

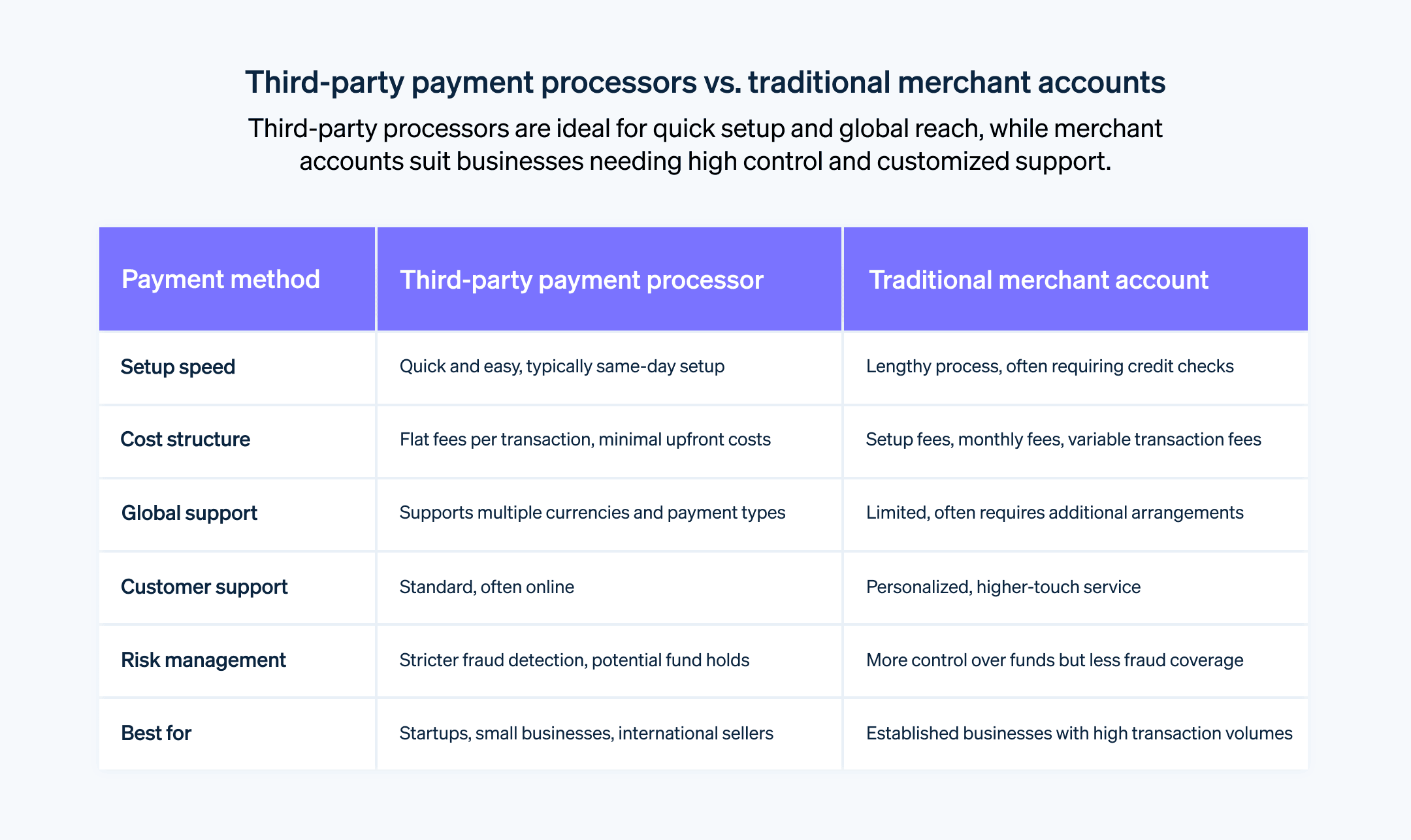

Hier volgt een overzicht van de belangrijkste verschillen tussen een externe betalingsverwerker en een verkopersaccount:

Snelheid en eenvoud

Voor ondernemingen is het opzetten van een externe betalingsverwerker over het algemeen sneller en gemakkelijker dan het openen van een verkopersaccount. Met een traditioneel verkopersaccount kan het installatieproces lang duren en vereist het vaak een gedetailleerde kredietcontrole en een beoordeling van de financiële stabiliteit van de onderneming.Kostenstructuur

Doorgaans rekenen externe verwerkers een vast bedrag per transactie, terwijl voor een verkopersaccount vaak een combinatie van installatiekosten, maandelijkse kosten en variabele transactiekosten in rekening worden gebracht. Voor kleine ondernemingen of ondernemingen met een lager verkoopvolume kan de kostenstructuur van een externe verwerker gunstiger zijn dan die van een verkopersaccount.Risicomanagement

Omdat externe verwerkers transacties van veel ondernemingen samenvoegen, hebben ze vaak striktere fraudedetectiesystemen en is de kans groter dat rekeningen worden geblokkeerd of geld wordt vastgehouden wanneer verdachte activiteiten worden ontdekt.Klantenondersteuning

Verkopersaccounts bieden meestal meer persoonlijke klantenondersteuning, terwijl externe verwerkers, vanwege het grote aantal ondernemingen waarmee ze werken, vaak standaard online ondersteuning bieden die minder gepersonaliseerd is.Flexibele betalingen

Externe verwerkers ondersteunen vaak een breder scala aan betaalmethoden en valuta's, wat gunstig kan zijn voor ondernemingen die internationaal actief zijn of hun klanten meer betaalopties willen bieden. Zo ondersteunt Stripe meer dan 135 valuta's, waarmee ondernemingen op verschillende markten wereldwijd actief kunnen zijn en uitbetalingen kunnen ontvangen in de valuta van hun voorkeur.

Externe betalingsverwerkers bieden ondernemingen een gemakkelijke en snelle manier om online betalingen te accepteren, maar ze brengen ook hun eigen risico's met zich mee. De keuze tussen een externe verwerker en een traditioneel verkopersaccount hangt af van de specifieke behoeften en omstandigheden van een onderneming.

Voor- en nadelen van het werken met een externe betalingsverwerker

Werken met externe betalingsverwerkers kan ondernemingen allerlei voordelen bieden, vooral voor kleine ondernemingen of start-ups. Betalingsverwerkers brengen echter hun eigen uitdagingen met zich mee. Dit zijn de voor- en nadelen van externe betalingsverwerkers:

Voordelen

Eenvoudige op te zetten

Externe betalingsverwerkers zijn doorgaans eenvoudiger en sneller op te zetten dan traditionele verkopersaccounts. Stripe stelt ondernemingen bijvoorbeeld in staat om betalingen snel te accepteren met behulp van een bibliotheek aan gebruiksvriendelijke API's voor oplossingen die weinig code vereisen of zelfs gebruiksklaar zijn.Lagere initiële kosten

Er zijn over het algemeen geen opstartkosten of maandelijkse kosten voor externe betalingsverwerkers, waardoor ze een meer betaalbare optie zijn voor kleine ondernemingen of ondernemingen met een lager verkoopvolume. Hier vind je een overzicht van de eenvoudige, transparante prijsstructuur van Stripe.Wereldwijde transacties

Ze ondersteunen vaak een breed scala aan valuta's en betaalmethoden, waardoor het voor ondernemingen gemakkelijker wordt om aan klanten over de hele wereld te verkopen.Vereenvoudigd betaalproces

Ze handelen alle aspecten van het betaalproces af, waaronder betalingsbeveiliging, fraudedetectie en naleving van de regelgeving van de betalingsindustrie.

Nadelen

Hogere transactiekosten

Vergeleken met traditionele verkopersaccounts brengen externe betalingsverwerkers vaak hogere kosten per transactie in rekening. Dit is echter niet altijd het geval en hangt af van met welke provider je samenwerkt.Verhoogd risico op blokkering of bevriezing

Aangezien verwerkers met een groot aantal ondernemingen te maken hebben, bevriezen ze soms automatisch accounts of houden ze geld vast wanneer ze verdachte activiteiten ontdekken.Minder controle

Met een externe verwerker hebben ondernemingen minder controle over het transactieproces en zijn ze afhankelijk van de systemen en regels van de verwerker.Minder klantenondersteuning

Vanwege het grote aantal ondernemingen dat ze bedienen, bieden externe verwerkers mogelijk niet hetzelfde niveau van klantenservice als een speciaal verkopersaccount. Dit is niet altijd het geval, maar het is belangrijk om in gedachten te houden bij het vergelijken van de opties.

Natuurlijk hebben niet alle externe betalingsverwerkers dezelfde voor- en nadelen. Ze variëren afhankelijk van de kwaliteiten van de aanbieder en hoe goed deze past bij de behoeften van een bepaalde onderneming.

Het kiezen van een externe betalingsverwerker

Het kiezen van de juiste externe betalingsverwerker kan een belangrijke beslissing zijn voor je onderneming. De juiste verwerker kan je betalingsactiviteiten vereenvoudigen, transacties soepeler maken voor je klanten en zelfs je potentiële markt vergroten. Een verkeerde keuze kan echter leiden tot onnodig hoge kosten, serviceonderbrekingen of problemen met klanttransacties. Met zoveel opties tot je beschikking, moet je rekening houden met de specifieke behoeften en omstandigheden van je onderneming voordat je een beslissing neemt. Hier zijn een paar belangrijke factoren om rekening mee te houden:

Maak de behoeften van je onderneming inzichtelijk

Elke onderneming is uniek. Houd rekening met factoren als het verkoopvolume, de gemiddelde transactieomvang, de soort producten of diensten die je verkoopt en de betaalmethoden waaraan je klanten de voorkeur geven. Als je bijvoorbeeld een webshop runt die internationale klanten bedient, wil je een verwerker die meerdere valuta's en betaalmethoden ondersteunt. Een kleine onderneming met een paar fysieke winkellocaties in een eindige markt heeft misschien niet dezelfde soort ondersteuning nodig.

Evalueer de kostenstructuur

Verschillende betalingsverwerkers hebben verschillende kostenstructuren. Sommige rekenen een vast bedrag per transactie, terwijl andere een percentage van de transactiewaarde in rekening brengen. Let op verborgen kosten, zoals kosten voor chargebacks, maandelijkse kosten of beëindigingskosten. Krijg inzicht in deze kosten en hoe ze van invloed zijn op je bedrijfsresultaten.

Overweeg de ondersteunde betaalmethoden

Je klanten geven misschien de voorkeur aan verschillende betaalmethoden, zoals creditcards, debitcards, digitale wallets of bankoverschrijvingen. Als je een betalingsverwerker kiest die verschillende betaalmethoden ondersteunt, kun je de klantervaring verbeteren en mogelijk je omzet verhogen.

Controleer de reputatie en betrouwbaarheid van de verwerker

Zoek naar beoordelingen of ervaringen van andere ondernemingen. Onderzoek de betrouwbaarheid van de service van de verwerker en hoe vaak ze downtime ervaren. Houd ook rekening met de reputatie van de verwerker op het gebied van klantenservice. Als je ervoor kiest om ermee te werken en je loopt tegen een probleem aan, dan wil je tijdige en behulpzame klantenondersteuning, idealiter via verschillende kanalen (e-mail, chat, telefoon enz.).

Evalueer de beveiliging

Zorg ervoor dat de betalingsverwerker voldoet aan alle relevante beveiligingsnormen, zoals PCI DSS (de Payment Card Industry Data Security Standard). De verwerker moet versleuteling en andere beveiligingsmaatregelen gebruiken om de betalingsgegevens van je klanten te beschermen.

Denk aan schaalbaarheid

Naarmate je onderneming groeit, kunnen je behoeften op het gebied van betalingsverwerking veranderen. Kies een verwerker die met je onderneming mee kan groeien en die zo nodig grotere transactievolumes kan verwerken.

Het kiezen van een externe betalingsverwerker is een belangrijke beslissing. Door jezelf de tijd te geven om je opties te onderzoeken en een weloverwogen keuze te maken, kun je samenwerken met een betalingsverwerker die je zakelijke doelstellingen ondersteunt.

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.