En kreditkortsavgift är en extra avgift som ett företag kan lägga till en transaktion när en kund betalar med ett kreditkort. Syftet med denna tilläggsavgift är att täcka de kostnader som företaget ådrar sig för hantering av kreditkortsbetalningar. Dessa avgifter, som företag betalar till kreditkortsföretag och betalleverantörer utgör vanligtvis en procentandel av transaktionsvärdet och utgör en betydande kostnad. Under 2022 betalade amerikanska företag över 160 miljarder USD i behandlingsavgifter för att acceptera cirka 10 biljoner USD i betalningar gjorda med kreditkort, betalkort eller förbetalda kort.

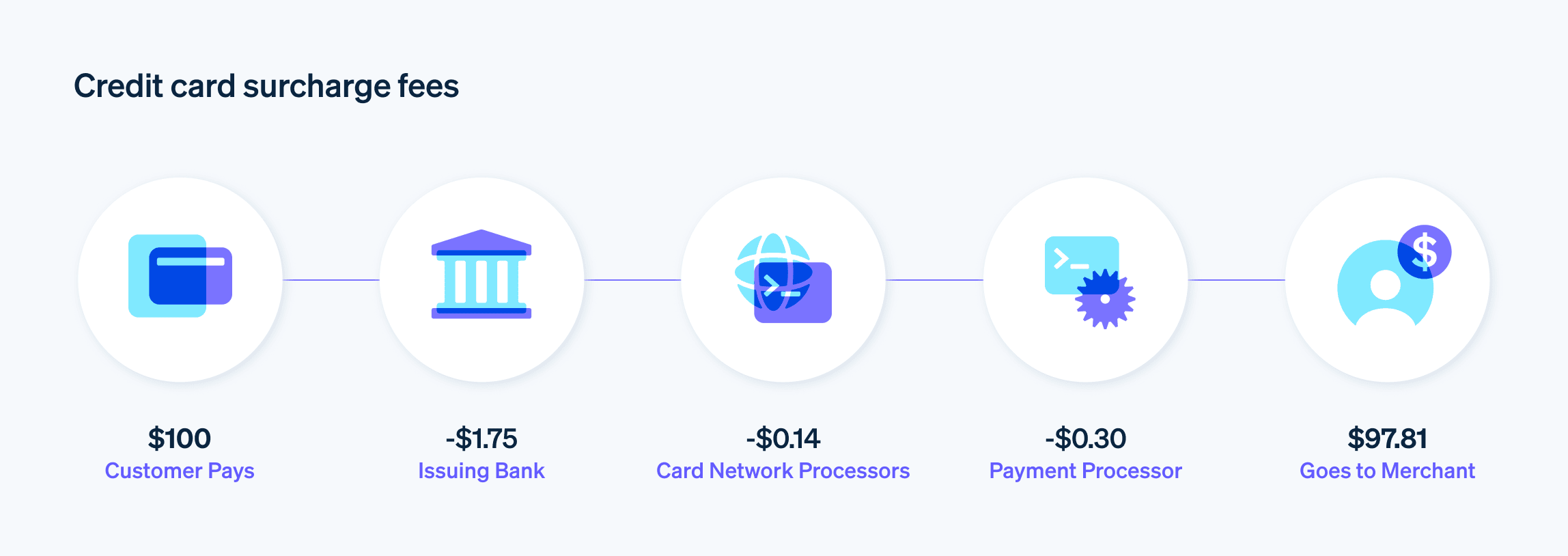

Tilläggsavgiften kan variera beroende på avtalet mellan företaget och dess betalleverantör. Ofta är avgiften en liten procentandel av det totala transaktionsbeloppet. Avsikten med tilläggsavgiften är att kompensera företagets kostnader för att acceptera kreditkort, och inkluderar avgifter som interchange-avgifter, bedömningsavgifter och betalleverantörsavgifter.

I den här artikeln analyserar vi noggrant de kreditkortsavgifter företag tar ut: hur de fungerar, vilka fördelar de kan ge och bästa praxis för att implementera kreditkortsavgifter på ett strategiskt sätt utan att undergräva kundnöjdheten. Det här är vad du bör veta.

Vad innehåller den här artikeln?

- Varför tar företag ut kreditkortsavgifter?

- Regler för tilläggsavgifter för kreditkort

- Vilka faktorer bör företag tänka på innan de tar ut tilläggsavgifter?

- Bästa praxis för tilläggsavgiftspolicyer

- För- och nackdelar med kreditkortsavgifter

- Alternativ till kreditkortsavgifter

Varför tar företag ut kreditkortsavgifter?

Företag tar ut kreditkortsavgifter för att kompensera för kostnaderna associerade med hantering av kreditkortstransaktioner. När kunder betalar med kreditkort debiteras företag avgifter från sin bank eller betalleverantör. Dessa avgifter kan inkludera en procentandel av transaktionsbeloppet plus en fast avgift per transaktion. Företagen tar ut tilläggsavgifter i syfte att täcka dessa kostnader i stället för att absorbera dem, vilket kan vara särskilt viktigt för små företag eller företag med små vinstmarginaler.

Utöver de direkta behandlingsavgifterna, finns det andra kostnader i samband med att acceptera kreditkort. Dessa inkluderar kostnaderna för att underhålla nödvändig hårdvara och mjukvara, samt efterlevnad av säkerhetsstandarder för att skydda kortinnehavarens uppgifter. Kreditkortsbedrägerier är ett annat problem, och företag bär ofta kostnaden för återkrediteringar vid bedrägliga transaktioner.

Tilläggsavgifter kan också vara ett strategiskt beslut för företag. Företag kan använda dem som ett sätt att uppmuntra kunder att använda alternativa betalningsmetoder som medför lägre eller inga behandlingsavgifter, t.ex. kontanter eller bankkort.

Regler för tilläggsavgifter för kreditkort

I USA har inte alla delstater samma regler kring tilläggsavgifter för kreditkort. Här är en översikt över regelverket i olika jurisdiktioner.

Nationella regler om tilläggsavgifter i USA

- Tilläggsavgifter för kreditkort är i allmänhet tillåtna i USA.

- Dessa tilläggsavgifter läggs till kreditkortstransaktionerna för att täcka behandlingsavgifterna.

- Tilläggsbeloppet är vanligtvis en procentandel av transaktionen.

- Företag måste informera kunderna om tilläggsavgiften före transaktionen.

- Kreditkortsnätverk (t.ex. Visa och Mastercard) har riktlinjer för tilläggsavgifter. Dessa inkluderar tilläggsavgiftsgränser och krav på att både nätverket och kunderna måste informeras om dem.

Delstatsspecifika regler

- Kalifornien: Tidigare var tilläggsavgifter förbjudna, men de senaste lagändringarna tillåter dem under vissa villkor.

- Colorado: Tilläggsavgifter är tillåtna, men med särskilda upplysningskrav.

- Connecticut: Tilläggsavgifter för kreditkort är inte tillåtna.

- Florida: Hade ett förbud mot tilläggsavgifter, men den rättsliga utvecklingen har tillåtit dem under vissa omständigheter.

- Kansas: Tilläggsavgifter tillåts, men företagen måste uppfylla upplysningskrav och krav på transparens.

- Maine: Tilläggsavgifter är tillåtna, med förbehåll för vissa villkor och upplysningskrav.

- Massachusetts: Tilläggsavgifter för kreditkort är inte tillåtna.

- New York: Hade tidigare ett förbud, men efter domstolsbeslut är tilläggsavgifter tillåtna under förutsättning att strikta upplysningskrav uppfylls.

- Oklahoma: Tilläggsavgifter är tillåtna, förutsatt att företagen uppfyller sin upplysningsskyldighet.

- Texas: Tillåter tilläggsavgifter under förutsättning att vissa kundavsieringsskyldigheter uppfylls.

Varje delstat har sitt eget sätt att reglera kreditkortsavgifter, vilket återspeglas av olika policyer för konsumentskydd och affärsverksamhet. Medan vissa delstater tillåter tilläggsavgifter under vissa förusättningar, har andra strängare regler eller direkta förbud. Företag som är verksamma internationellt eller i flera delstater har en skyldighet att vara medvetna om dessa regler och följa dem. Annars riskerar de juridiska problem och andra komplikationer.

Globala överväganden

- I vissa länder utanför USA regleras tilläggsavgifter antingen annorlunda eller är förbjudna.

- Efterlevnad av lokala lagar och regler från kreditkortsnätverk är särskilt viktigt för multinationella företag.

Vilka faktorer bör företag tänka på innan de tar ut tilläggsavgifter?

Innan företag tar ut tilläggsavgifter bör de ta hänsyn till följande faktorer:

Efterlevnad av lagar och regler

För det första måste företag se till att det är lagligt att ta ut tilläggsavgifter i deras delstat eller region. Detta innebär att du måste förstå lokala lagar och förordningar om tilläggsavgifter.Kreditkortsnätverkens regler

Företag måste förstå och följa de regler som fastställts av kreditkortsnätverk som Visa, Mastercard och American Express. Dessa regler inkluderar tilläggsavgiftsgränser och krav på att informera kunden.Transparens för kunderna

Tydlig kommunikation med kunderna om eventuella tillkommande avgifter är avgörande. Företag kan uppnå detta genom synliga skyltar, information på webbplatser eller muntliga meddelanden under transaktioner.Effekt på kundernas beteende

Fundera på hur tilläggsavgifter kan påverka kundernas val. Vissa kunder kan välja alternativa betalningsmetoder eller till och med vända sig till ett annat företag om de anser att tilläggsavgiften är orättvis.Lönsamhetsanalys

Företag måste bedöma om de ytterligare intäkterna från tilläggsavgifter uppväger den potentiella förlusten av kunder som söker andra alternativ på grund av de extra avgifterna.Administrativa kostnader

Implementering och hantering av tilläggsavgifter kan kräva ändringar i faktureringssystem och ytterligare administrativt arbete.Marknadsposition och konkurrens

Det är viktigt att veta hur konkurrenterna hanterar kreditkortsavgifter. Om konkurrenterna absorberar dessa kostnader kan en tilläggsavgift innebära en nackdel för ett företag.Kundrelationer och kundnöjdhet

Vissa kunder kan se tilläggsavgifter som en betydande nackdel, så det är viktigt att väga ekonomiska vinster mot kundnöjdhet.Hur ofta kreditkortstransaktioner genomförs

Företag med stora volymer kreditkortstransaktioner kan uppleva att tilläggsavgifter hjälper till att kompensera för behandlingsavgifter, medan företag med färre kreditkortsköp kan se begränsad inverkan.Alternativa betalningsincitament

I stället för att förlita sig på tilläggsavgifter kan en mer kundvänlig metod vara att ge kunderna incitament att använda betalningsmetoder med lägre avgifter som kontanter eller betalkort.

Ett noggrant övervägande av dessa faktorer kan hjälpa företag att fatta ett välgrundat beslut om huruvida de ska införa tilläggsavgifter och hur de ska göra det på ett sätt som balanserar deras ekonomiska behov med kundernas förväntningar och juridiska krav.

Bästa praxis för tilläggsavgiftspolicyer

Företag måste hitta en bra balans vad gäller tilläggsavgifter: de måste täcka sina kostnader men också hålla kunderna nöjda. Att ta ut en för hög tilläggsavgift för kreditkortsbetalningar kan spara pengar på transaktionsavgifter, men det kan riskera kundnöjdhet och lojalitet.

Bästa praxis för att implementera tilläggsavgiftspolicyer innebär noggrant övervägande på flera områden:

Säkerställa efterlevnad av lagar och förordningar

Se till att din tilläggsavgiftspolicy följer lokala lagar och kreditkortsnätverkens bestämmelser. Detta inkluderar att följa eventuella begränsningar för högsta tillåtna tilläggsavgift och se till att dina tilläggsavgifter täcker kostnaden för transaktionsbehandling men inte genererar någon vinst.Upprätthålla transparent kommunikation med kunder

Informera kunderna om tilläggsavgiftspolicyn på ett direkt och tydligt sätt. Du kan göra detta genom att använda synliga skyltar på fysiska platser, explicita omnämnanden under transaktioner och meddelanden på webbplatser och kvitton. Det är viktigt att kunderna är medvetna om tilläggsavgiften innan de slutför sin transaktion.Fastställa en rimlig tilläggsavgiftsnivå

Tilläggsavgiften ska vara på en nivå som täcker dina kostnader men som också är rättvis mot kunderna. Överdrivna tilläggsavgifter kan skrämma bort kunder. En vanlig praxis är att sätta tilläggsavgiften på en nivå som motsvarar vad kreditkortsföretagen tar ut för transaktionen.Genomföra regelbundna granskningar och justeringar

Granska och justera dina tilläggsavgifter regelbundet om det behövs, särskilt om dina behandlingskostnader ändras. Detta säkerställer att dina tilläggsavgifter förblir i linje med verkliga kostnader och lagkrav.Utbilda personal

Utbilda din personal så att de kan förklara tilläggsavgiftspolicyn på ett effektivt sätt för kunderna. Personalen ska kunna svara på frågor och förklara varför tilläggsavgiften finns och hur den beräknas.Erbjuda flera betalningsalternativ

Erbjud kunderna en mängd olika betalningsalternativ, inklusive sådana som inte medför tilläggsavgifter som kontanter och betalkort. Vissa företag erbjuder även rabatter för betalningar utan kreditkort.Analysera kundfeedback

Var uppmärksam på kundfeedback kring tilläggsavgiften. För att upprätthålla positiva kundrelationer bör du justera din strategi om du finner en betydande nivå av missnöje eller förvirring hos kunderna.Dokumentera policyn

Se till att din tilläggspolicy är väldokumenterad. Inforamtion om hur tilläggsavgiften beräknas, hur den tillämpas och all relevant information om efterlevnad av lagstiftningen, bör inkluderas. Den här dokumentationen kan vara användbar för personalutbildning och för att hantera eventuella frågor från kunderna.Undvika diskriminering mellan olika korttyper

Tillämpa tilläggsavgiften enhetligt för alla typer av kreditkort om lokala lagar och avtal med kreditkortsnätverk tillåter detta. Att diskriminera mellan olika korttyper kan leda till komplikationer och missnöje hos kunderna.Regelbunden övervakning av lagändringar

Håll dig informerad om ändringar i lagar och regler från kreditkortsnätverken. Tillämpningen av tilläggsavgifter kan påverkas av nya lagar, domstolsbeslut eller ändringar i kreditkortsnätverkens policyer. Regelbundna uppdateringar verifierar kontinuerlig efterlevnad och operativ effektivitet.

Företag som följer dessa förfaringssätt kan införa tilläggsavgiftspolicyer som är rättvisa, lagliga, transparenta och som har minimal påverkan på kundrelationerna.

För- och nackdelar med kreditkortsavgifter

Ett företags tilläggsavgiftspolicy bör återspegla den typ av kundupplevelse som det vill erbjuda. Även om den ekonomiska fördelen med att få tillbaka transaktionskostnaderna är uppenbar är det viktigt att ta hänsyn till den större bilden och överväga hur tilläggsavgifter påverkar kundrelationer och kundernas utgiftsbeslut. Här är en snabb titt på för- och nackdelarna med kreditkortsavgifter.

Fördelar med att införa en tilläggsavgiftspolicy

Transaktionskostnaderna återfås

En av de största fördelarna för företag är möjligheten att täcka de kostnader som uppstår vid behandling av kreditkortsbetalningar, vilket kan inkludera procentbaserade avgifter, avgifter per transaktion och månadsavgifter från betalleverantörer.Minskar omkostnaderna

Genom att lägga till en tilläggsavgift kan företag minska omkostnaderna i samband med kreditkortstransaktioner, vilket potentiellt gör produkter eller tjänster mer överkomliga genom att inte priset behöver höjas generellt.Uppmuntrar till alternativa betalningar

Tilläggsavgifter kan uppmuntra kunder att använda alternativa, billigare betalningsmetoder som kontanter eller bankkort, vilket kan leda till lägre totala transaktionsavgifter för företag.

Nackdelar med att införa en tilläggsavgiftspolicy

Negativ kundreaktion

Kunder kan uppfatta tilläggsavgifter negativt och se dem som en straffavgift för att de använder sin föredragna betalningsmetod. Detta kan leda till missnöje eller potentiell förlust av affärer till konkurrenter som inte lägger till sådana avgifter.Komplexitet i prissättningen

Att införa tilläggsavgifter kan komplicera prisstrukturen, vilket kan leda till förvirring på försäljningsstället eftersom kunderna kanske inte är medvetna om den extra kostnaden förrän i sista minuten.Minskad spendering

Vissa kunder kan ändra sina utgiftsvanor för att undvika kreditkortsköp, vilket kan innebära att företag riskerar att gå miste om större försäljning.Regulatorisk navigering

Att hålla jämna steg med regler och efterlevnadskrav kan vara skrämmande. Dessa regler kan variera beroende på plats och till och med beroende på kreditkortsnätverk, och de kräver noggrann övervakning.

Alternativ till kreditkortsavgifter

Företag har en rad alternativ att överväga om de vill undvika att ta ut kreditkortsavgifter. Några exempel:

Använda kostnadseffektiva betalleverantörer

Betalleverantörer som Stripe erbjuder konkurrenskraftiga priser och prisstrukturer som kan minska transaktionskostnaderna. Genom att analysera olika betalleverantörer och välja en med lägre avgifter kan ett företag minska eller eliminera behovet av att lägga till tilläggsavgifter.Välja optimala kassasystem

Välja rätt POS-system är nyckeln till transaktioner. Vissa system erbjuder förmånligare priser eller är mer anpassade till ett företags specifika transaktionsmönster. Ett POS-system som enkelt integreras med affärsverksamheten kan minska behandlingstiderna och kostnaderna.Förhandla med handlartjänster

Företag kan förhandla om villkoren med sin leverantör av handlartjänster. Vissa leverantörer kan erbjuda lägre priser baserat på transaktionsvolym eller långsiktig kundlojalitet.Incitament för billigare betalningsmetoder

Att ge rabatter vid användning av kontanter, checkar eller ACH-överföringar kan motivera kunder att använda dessa billigare metoder. Detta kan indirekt minska volymen av kreditkortstransaktioner och tillhörande avgifter.Batchbearbetning av transaktioner

Genom att behandla transaktioner i omgångar snarare än individuellt kan företag minska de transaktionsavgifter som ofta tas ut av kreditkortsbehandlare.Införande av en serviceavgift

Istället för en specifik kreditkortsavgift tar vissa företag ut en liten serviceavgift på alla transaktioner. Detta kan vara en mer tilltalande metod för kunderna och kan undvika den negativa uppfattningen i samband med tilläggsavgifter för kreditkort.Erbjuda medlemskap eller lojalitetsprogram

Genom att införa program som inkluderar betalningshanteringsavgifter i medlemskostnaden kan behandlingskostnaderna fördelas över en större bas, vilket minskar påverkan på enskilda transaktioner.Minska andelen betalningar med kreditkort som accepteras

Vissa företag begränsar accepterande av kreditkort för små transaktioner, eftersom avgifter skulle ta en betydande del av intäkterna.Förbättra den operativa effektiviteten

Att effektivisera ditt företags verksamhet för att minska kostnaderna kan kompensera för betalningshanteringsavgifter. Det kan handla om att optimera lagerhanteringen, minska slöseriet eller förbättra kundservicen för att öka retentionen.Möjliggör kostnadsabsorption

Vissa företag kan besluta att absorbera avgifterna och balansera detta genom att justera priserna något för alla produkter och tjänster.

Att välja rätt alternativ för kreditkortsavgifter bör vara en förlängning av ett företags engagemang för kundservice och passa in i dess verksamhet. Målet är att förbli lönsam samtidigt som transaktionerna är rättvisa och bekväma för kunderna.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.