Som företagare är du förmodligen väl medveten om att din relation med en kund inte slutar efter att de har slutfört sin transaktion. Från det ögonblick en kund bestämmer sig för att göra ett köp sker en rad åtgärder som var och en erbjuder en möjlighet att skapa entusiasm och samhörighet med ditt företag – eller att få transaktionen att spåra ur och förlora kunden för gott. Fastän konverteringen av en kund allmänt betraktas som "mållinjen" är sanningen den att allt från en mindre än säker webbplats till otydliga leveransuppgifter till oåtkomlig kundservice kan leda till den mörka sidan av en genomförd betalning: återkrediteringar.

Det är säkert att anta att varje företagare skulle föredra att behålla så mycket intäkter som möjligt, men även de bäst utformade konverteringstrattarna leder ibland till en situation där en kund vill ha tillbaka sina pengar efter att ha slutfört ett köp. Nedan går vi igenom allt om återkrediteringar: vad de är, hur de fungerar, vad som orsakar dem och hur företagare kan arbeta proaktivt för att förhindra dem.

Vad innehåller den här artikeln?

- Vad är en återkreditering (chargeback)?

- Återkreditering jämfört med återbetalning

- Vanliga orsaker till återkrediteringar

- Hur fungerar återkrediteringar?

- Hur mycket kostar återkrediteringar företag?

- Sätt att förhindra återkrediteringar

- Så här bestrider du en återkreditering

Vad är en återkreditering (chargeback)?

En återkreditering (chargeback) är en återföring av medel efter ett köp med bank- eller kreditkort som inleds när kunden lämnar in en tvist om debiteringen till sin bank eller kreditkortsleverantör. Återkrediteringar initieras nästan alltid av kunder, men företag kan också begära dem (även om detta inte händer ofta).

De goda nyheterna om återkrediteringar: Den globala återkrediteringsfrekvensen i förhållande till antalet transaktioner tenderar att minska år efter år, vilket innebär att det sker färre återkrediteringar varje år jämfört med det totala antalet transaktioner. Detta kan tillskrivas flera faktorer som företag investerar i – av vilka vi tar upp de flesta nedan.

De dåliga nyheterna: Återkrediteringar är fortfarande ett utbrett och kostsamt problem som är förknippat med affärsbedrägerier i allmänhet. Enligt en studie släppt av Juniper Research beräknades e-handelsföretag förlora ungefär 20 miljarder USD på grund av bedrägerier 2021, en ökning med 18 % jämfört med de 17,5 miljarder USD som gick förlorade 2020. Och enligt rapporten The True Cost of Fraud från LexisNexis slutar det med att företag betalar 3,75 USD för varje 1,00 USD i återkrediteringar.

Återkreditering jämfört med återbetalning

En återbetalning är när företaget återbetalar pengar till kunden, medan en återkreditering är när kundens bank eller kreditkortsleverantör återkallar debiteringen och drar tillbaka pengarna från företaget. I båda fallen returneras pengarna till kunden. Skillnaden mellan en återkreditering och en återbetalning är i första hand en fråga om vilken part som initierar återföringen av medel, men det finns några andra viktiga skillnader:

- Vem är aktivt involverad?

Vid återkrediteringar är det den utfärdande banken som driver processen och håller kontakt med kunden och företaget under hela processen. Vid återbetalningar kommunicerar kunden vanligtvis direkt med företaget, som sedan initierar återföringen av medel från deras sida. - Vem kontrollerar pengarna?

När det gäller återbetalningar har företaget kontroll över de bestridda medlen, medan det vid återkrediteringar är kundens bank som sitter i förarsätet. Återbetalningar innebär att företaget ber sin betalleverantör att återbetala pengarna till kunden. Innan de initierar denna överföring ligger pengarna där de ligger. Men med en återkreditering kommer kundens bank vanligtvis att gå vidare och dra pengarna i fråga från företagets konto och behålla dem medan de reder ut om återkrediteringsbegäran är giltig. - Hur lång tid tar det?

Om man inte räknar med den tid det tar för kunden och företaget att kommunicera och fatta ett beslut om att en återbetalning faktiskt är motiverad (detta kan ta allt från en kort konversation till flera veckor av e-postmeddelanden) tar själva återbetalningsprocessen vanligtvis tre till sju arbetsdagar. Återkrediteringar kan dock ta allt från några veckor till flera månader, särskilt om företaget bestrider den bestridda debiteringen.

Vanliga orsaker till återkrediteringar

För att kunna ta fram en genomförbar plan för att minska antalet återkrediteringar som ditt företag ådrar sig är det viktigt att förstå de olika orsakerna till att de inträffar. Här är några av de vanligaste scenarierna:

Legitimt bedrägeri:

I huvudsak är detta anledningen till att återkrediteringar finns i första hand. Tanken bakom dem är att ge konsumenterna ett verktyg för att återföra transaktioner som dyker upp på deras konto på grund av bedräglig aktivitet – och legitima bedrägerier utgör fortfarande en stor del av återkrediteringarna."Friendly fraud":

Det här låter så mycket trevligare än vad det är. ”Friendly fraud" är ett samlingsbegrepp för en rad olika återkrediteringar som inte har att göra med legitima bedrägerier. Tekniskt sett är det bara meningen att kortinnehavare ska bestrida en avgift och utlösa en återkreditering av ett begränsat antal skäl. I verkligheten är det många som helt enkelt inte tänker så mycket på om de ska bestrida en avgift eller inte, utan istället använder den som en snabb lösning för en mängd olika situationer. Här är några vanliga exempel:- De känner inte igen debiteringen.

Om någon tittar på sitt kreditkortsutdrag och ser en debitering som de inte kommer ihåg att de har gjort kan de välja att bestrida den och få en återkreditering. Kanske gjorde de köpet och glömde, kanske är det en återkommande avgift för ett abonnemang som de glömt att de hade eller så kanske företagets namn inte syntes tydligt nog på kontoutdraget. Om en transaktion inte ser bekant ut för en kortinnehavare finns det en chans att de bestrider den. - Det uppstår leveransproblem.

Om en vara aldrig kommer fram eller tar längre tid än förväntat kan kunden anta att den är försvunnen och begära en återkreditering. Detta är särskilt troligt om kunden aldrig fick leveransinformation eller ett spårningsnummer, eller om de inte enkelt kunde kontakta företaget för att fråga om status för sin beställning. - De vill undvika returprocessen.

Ofta används återkrediteringar som ett enkelt alternativ till returprocessen. Om en kund är missnöjd med en vara som hen har köpt, anser att företagets returpolicy är svårbegriplig eller krånglig eller vill returnera en vara men redan har passerat den angivna tidsperioden kan kunden göra en återkreditering.

- De känner inte igen debiteringen.

Korrigering av skrivfel:

Misstag händer, och återkrediteringar är en mekanism för att rätta till dem. Om en kund har debiterats mer än en gång, eller om de fortfarande faktureras för ett uppsagt abonnemang, kan de lämna in en tvist till sin bank eller kreditkortsföretag för att åtgärda felen. Den här typen av återkrediteringar är vanligare när debiteringen kommer från ett företag som inte har en lättillgänglig kundtjänst. Om kunden inte enkelt kan begära en återbetalning från företaget kan de överväga en återkreditering som den bästa utvägen.

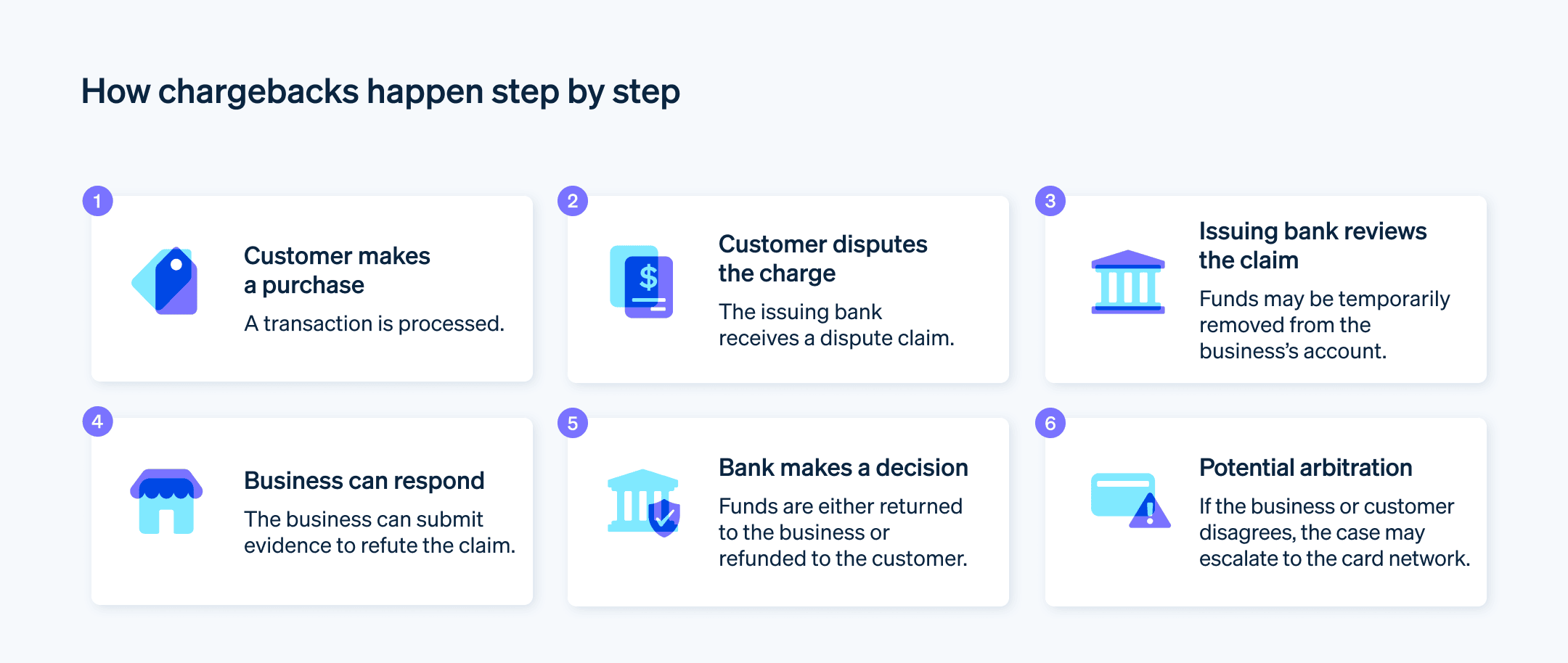

Hur fungerar återkrediteringar?

Återkrediteringar sker först efter att den första transaktionen har avslutats: Betalningen behandlas, pengarna överförs till företagets konto och debiteringen visas på kundens kreditkortsutdrag.

Det är nu återkrediteringsprocessen inleds:

1. Kunden lämnar in en tvist.

När kunden ser en debitering på sitt kontoutdrag som hen tror är bedräglig bestrider hen debiteringen hos den bank eller det finansinstitut som utfärdade kreditkortet som användes för köpet (även kallad den utfärdande banken).

2. Den utfärdande banken initierar återkrediteringen.

När kunden bestrider en debitering påbörjar den utfärdande banken återkrediteringsprocessen.

3. Företaget har möjlighet att motbevisa återkrediteringen.

Så snart en kund begär en återkreditering kommer deras bank att kontakta företagets bank och ge dem en förvarning om att återkreditering har begärts. I det här skedet har företaget möjlighet att tillhandahålla bevis som motbevisar kundens påstående om att debiteringen inte är legitim.

4. Banken fattar ett beslut.

Den utfärdande banken granskar bevisning på båda sidor av återkrediteringstvisten och fattar ett beslut om huruvida man ska gå vidare. Om företaget i det här läget har avböjt att tillhandahålla bevis som stöder debiteringens giltighet godkänner den utfärdande banken i allmänhet kundens begäran om en återkreditering.

5. Om den utfärdande banken beslutar till företagets fördel …

Om kortinnehavarens bank beslutar att debiteringen var giltig och avvisar återkrediteringen returneras inte pengarna till kunden. Om utfärdaren redan hade krediterat kortinnehavarens konto för det bestridda beloppet innan debiteringen undersöktes, och debiteringen sedan visar sig vara giltig, kommer dessa medel eller krediter att debiteras från kortinnehavarens konto på nytt.

6. Om den utfärdande banken beslutar till kundens fördel …

Om banken bedömer att kunden har legitima skäl att begära en återkreditering dras pengarna från företagets konto och krediteras tillbaka till kunden.

7. Skiljeförfarande kan följa på beslutet.

Om banken beslutar till företagets fördel, och kunden fortfarande vill kämpa för återkrediteringen, har kunden möjlighet att begära skiljeförfarande. Detta tar frågan vidare till kreditkortsföretaget. Det är i praktiken en överklagandeprocess för den utfärdande bankens beslut. Kreditkortsföretagen – Visa, American Express, Mastercard, Discover osv. – har sista ordet i en återkrediteringstvist.

Hur mycket kostar återkrediteringar företag?

Avgifterna i samband med återkrediteringar varierar beroende på vilken leverantör av betalningshantering du använder. Stripe tar ut en avgift på 15 USD för varje återkreditering. Andra leverantörers avgifter kan uppgå till 50 USD eller till och med 100 USD. Självklart är målet att ha så få återkrediteringar som möjligt, men eftersom de ändå händer då och då det är viktigt att ta reda på vad din betaltjänstleverantör tar betalt.

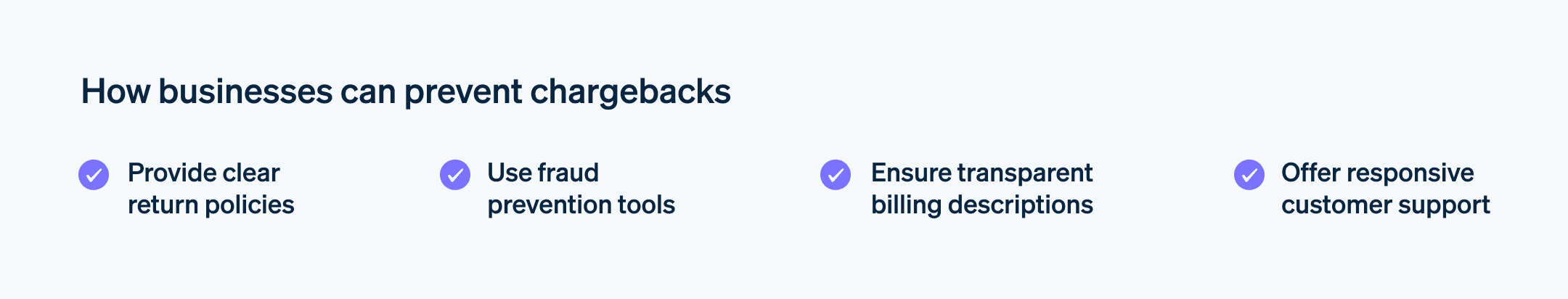

Sätt att förhindra återkrediteringar

Låt oss vara proaktiva i den här frågan. Även de mest vaksamma företagen kommer att uppleva återkrediteringar, men det finns åtgärder du kan vidta för att minimera deras frekvens. Vi har en artikel som går djupare in på de viktiga steg du kan ta för att minska återkrediteringar, men kortfattat är här några av de viktigaste sakerna att tänka på:

- Prioritera säkerheten vid kreditkortsbetalningar.

- Gör returerna så enkla som möjligt.

- Hantera leveransförväntningar.

- Var tillgänglig för dina kunder.

- Se till att ditt riktiga företagsnamn visas på kreditkortsutdrag.

Så här bestrider du en återkreditering

Även om du gör allt i din makt för att förhindra att återkrediteringar sker kommer de oundvikligen att göra det. Och när det händer är det viktigt att ha en handlingsplan för att verifiera äktheten i bedrägeripåståendet och gå vidare, oavsett resultatet. Här är en översikt över hur det går till att bestrida ett återkrediteringsanspråk:

Fastställ tvistens legitimitet.

Om du får ett meddelande om en återkreditering vill du först avgöra om det beror på ett faktiskt bedrägeri eller om ett kundtjänstproblem ligger bakom.Om debiteringen är genuint bedräglig …

Om din inledande utredning av debiteringen visar på bedrägeri bör du informera kundens utfärdande bank om att du inte kommer att bestrida återkrediteringen och att de ska återbetala pengarna till kunden. Det är också bra att informera din betaltjänstleverantör om bedrägeriet och undersöka om det var en isolerad händelse eller ett större problem som påverkade andra transaktioner.Om det är ”friendly fraud” …

Om du undersöker problemet och fastställer att inget faktiskt bedrägeri har inträffat, beror resultatet av processen i slutändan på varför kunden initierade återkrediteringen i första hand. Oavsett vilket kommer du förmodligen att vilja bestrida återkrediteringen, vilket innebär att du måste göra några saker:- Kontakta kunden.

Många återkrediteringssituationer kan hanteras genom att kontakta kunden direkt, uttrycka en önskan om att lösa det problem som fick dem att begära en återkreditering och lyssna på vad de har att säga. I de flesta fall är det värt att försöka engagera kunden i en konversation och komma fram till en lösning på egen hand. Det kan sluta med att du återbetalar dem ändå, men även om det är resultatet är en återbetalning bättre för ditt företag än en återkreditering. - Tillhandahåll bevis för att motbevisa återkrediteringen.

Om det inte fungerar att försöka komma fram till en lösning med kunden och du är säker på att inget verkligt bedrägeri har ägt rum bör du tillhandahålla bevis för detta. Kvitton, bekräftelsenummer, leveransinformation – allt detta kan hjälpa till att bekräfta transaktionens legitimitet. Din betaltjänstleverantör är sannolikt den som kommer att kommunicera med kundens utfärdande bank, så de kan lämna över eventuella bevis. Sedan väntar du på att den utfärdande banken ska fatta ett beslut om huruvida återkrediteringen ska godkännas.

- Kontakta kunden.

Att hantera återkrediteringar är inte någons favoritdel av att göra affärer, men att vidta både proaktiva och defensiva åtgärder mot dem kan minimera intäktsförluster och störningar i de roligare aspekterna av att driva ditt företag. En mer grundlig guide till hur man förhindrar återkrediteringar hittar du här. Och för att utforska hur Stripe Radar hjälper företag att bekämpa återkrediteringar kan du klicka här.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.