The convenience, speed, and reach of the internet have prompted a diverse range of businesses to incorporate online payment systems into their websites. With many payment processing options available today, it’s easier than ever to accept payments on your business website.

Accepting and processing payments online expands a business’s potential customer base, streamlines operations, and reflects a customer preference for digital payment options. Businesses are feeling pressure to cultivate a simple, secure transaction experience on their websites to stay competitive.

How to implement online payments depends on a number of factors for each business, including what it sells and which customer segments and markets it targets. You should understand your specific business needs before accepting payments on your website. Below is an overview of how online payments work, the risks and benefits to consider, and how to get started.

What’s in this article?

- Can you accept credit card payments on a website?

- Which types of businesses need to accept payments on a website?

- How much does it cost to accept payments on a website?

- Benefits and risks of accepting payments on a website

- How to accept payments from customers on a website

Can you accept credit card payments on a website?

Yes, it’s possible to accept credit card payments on a website. Businesses can do this by integrating a secure payment processing system that handles customer transactions. Modern payment providers such as Stripe have made it easy for websites to handle these payments, ensuring that the process is secure and efficient for both parties.

Which types of businesses need to accept payments on a website?

In the past, only certain businesses—such as ecommerce retailers and software-as-a-service (SaaS) businesses—needed to accept online payments through a website. But as digital-payment technology has advanced and the functionality and use cases have diversified, many more types of businesses have started accepting payments online.

The following types of businesses may need to accept payments on their websites:

- Ecommerce retailers selling physical goods, such as clothing or electronics, require the ability to accept online payments. Ecommerce payments are immediate and can cross borders.

- Businesses offering digital products or services—such as software, music, e-books, or online courses—thrive online, where payment processing is an important part of the customer journey.

- Subscription services—whether they’re for streaming content, online magazines, or membership sites—rely heavily on automated recurring payments, a feature enabled by online payment systems.

- Nonprofit organizations accept donations online, increasing the ease and reach of their fundraising efforts.

- Travel and hospitality businesses, such as hotels and airlines, have moved their booking systems online, simplifying the reservation process and providing a smoother customer experience.

- Food delivery and online grocery services need online payment systems to complete transactions swiftly and securely, ensuring customer satisfaction.

- Event organizers for concerts, theater performances, and sports events use online payments to simplify ticket sales, making the process more convenient for attendees.

- Professional service providers—such as consultants, freelancers, and educators—accept online payments for appointments and services.

- Real estate agencies now accept rental and purchase payments online, reducing paperwork and expediting the payment process.

These types of businesses each have different requirements for online payment systems. But they all need secure, efficient, user-friendly ways to accept payments online from customers and donors.

How much does it cost to accept payments on a website?

The cost can vary significantly depending on several factors, including the payment processing service you choose, the transaction volume, and the type of payments you accept. Here’s an overview of the basic fees commonly associated with accepting payments online:

Payment processing fees

Most payment processors charge a fee for each transaction, typically a small percentage of the transaction amount plus a fixed fee. For details about Stripe’s pricing, go here.Monthly fees

Some payment processors charge a monthly fee for access to their services, especially for advanced features such as subscription billing, fraud protection, and other value-added services. These fees can range from a few dollars per month to several hundred dollars per month. Stripe does not charge monthly fees.Setup fees

While many payment processors do not charge a setup fee, some do. This is especially common if you are setting up a merchant account for your business. Stripe does not charge setup fees.Chargeback fees

If a customer disputes a charge and it results in a chargeback, the payment processor may charge a fee. This can cost $15–$25 or more per chargeback. Stripe doesn’t charge a separate fee for chargebacks, although businesses are responsible for paying the disputed transaction amount and the card network’s chargeback fee.Fees associated with certain card types

Certain types of cards, such as business credit cards or rewards credit cards, may incur higher processing fees.

This is a brief overview of typical fees you might encounter while enabling online payments for your business, but it’s not exhaustive. Rates and fees can vary from one provider to another, and they also vary depending on the business’s industry, what they’re selling, where they’re operating, their volume of sales, and their common payment methods. Review the pricing details and terms of service carefully before choosing a payment processing service.

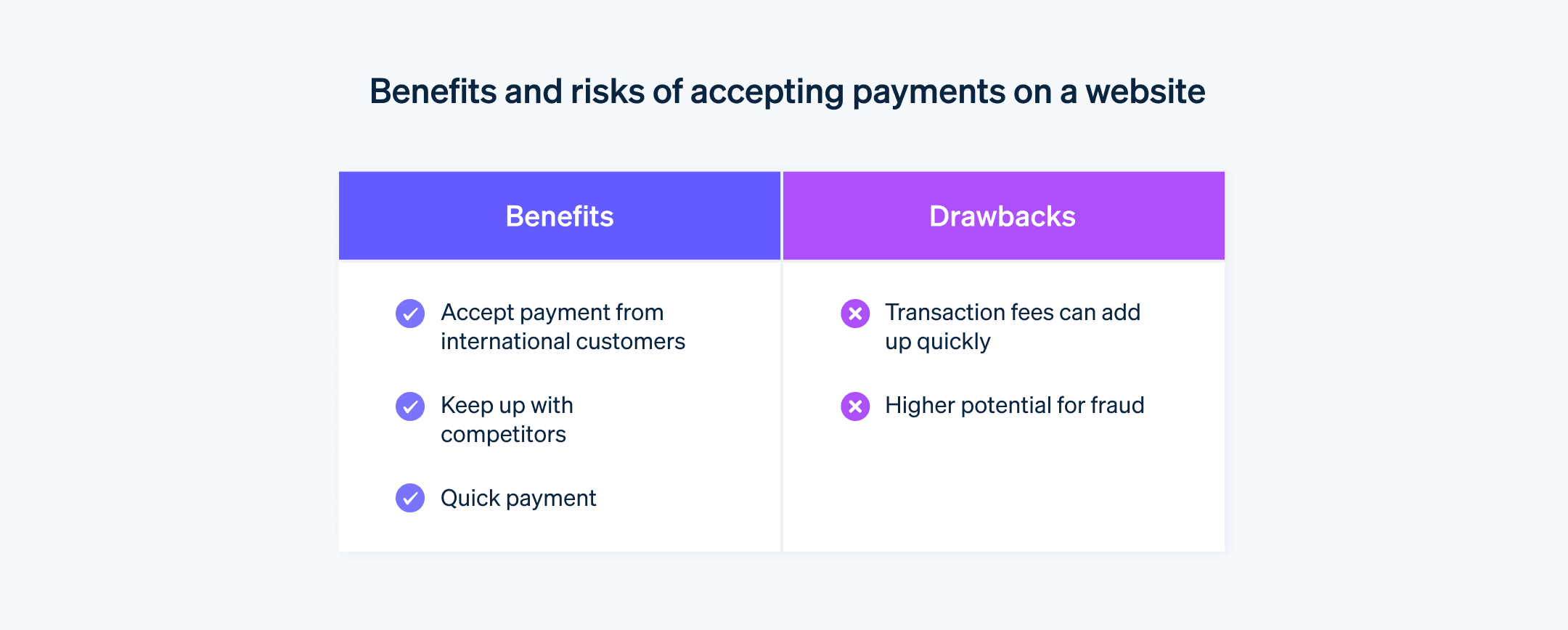

Benefits and risks of accepting payments on a website

Accepting payments on a website makes transactions easy for customers and expands market reach for businesses. But accepting online payments comes with both benefits and risks:

Benefits

Increased convenience

Offering online payments enables customers to make purchases from any location with internet access. This includes mobile transactions, and many customers prefer to shop on their smartphones. This round-the-clock availability can significantly boost sales and satisfy customer expectations.Expanded reach

By accepting online payments, businesses can sell their products and services to customers all over the world. This reach eliminates the geographical limitations of brick-and-mortar stores.More efficient operations

Typically, online payment systems are equipped with tools for tracking sales, managing invoices, and monitoring customer data. These features allow businesses to automate numerous administrative tasks, which reduces manual workload and enhances operational efficiency.Improved cash flow

Online transactions are processed almost instantaneously, which can improve a business’s cash flow and enable more agile financial management.

Risks

Fraud and security issues

Online transactions are susceptible to cyber threats, including fraudulent activities and data breaches. Businesses must invest in robust security protocols and encryption technologies to safeguard sensitive customer information and maintain trust. One way to achieve this is by choosing a payment provider that offers these features and services. Read more here about Stripe’s built-in, comprehensive measures to protect payments and to detect, prevent, and respond to fraud.Chargebacks

Chargebacks, in which customers dispute a transaction and request a return of funds, can be costly. They result in revenue loss and also incur fees. Frequent chargebacks can harm a business’s reputation and might lead to increased scrutiny—and possibly higher fees—from payment processors.Technical issues

Website crashes or technical glitches can lead to lost sales and frustration for customers, as well as lasting damage to a business’s reputation. Regular maintenance and prompt troubleshooting are necessary to ensure a smooth user experience, which is important for preserving existing customer loyalty and generating positive word-of-mouth for potential new customers.Regulatory compliance

All businesses must comply with laws and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS). Navigating these requirements can be complex and time consuming, but noncompliance can result in hefty fines and damage to a business’s reputation.

Understand these benefits and risks when implementing an online payment system. A well-considered strategy can help you maximize gains, mitigate potential challenges, and build efficient operations from the start.

How to accept payments from customers on a website

Accepting payments on a website is a multifaceted process that involves selecting the right tools and integrating them into your site. There are multiple solutions available, each catering to different business needs and use cases, and each solution has a distinct setup process. But in most cases, the overall steps involved in setting up and deploying website payments look similar. Here’s an overview:

1. Identify your business needs

The first step is understanding your business’s specific requirements. Do you need to process one-time payments, recurring subscriptions, or both? Does your business operate in multiple countries and require support for different currencies and payment methods? Do you need the ability to split payments between multiple recipients? Your answers will inform the type of payment solution that’s right for you.

2. Choose a payment processor

After identifying your needs, choose a payment processor that provides the functions that are important to you and ideally integrates with your existing operational systems with minimal friction. Consider factors such as transaction fees, security measures, supported payment methods, and customer support.

3. Create an account with the payment processor

Creating an account usually involves filling out a form with information about your business and possibly going through a verification process. To get started with a new Stripe account, go here.

4. Integrate the payment processor into your website

This step will look a little different depending on your website and which payment processing provider you choose. Most payment processors provide prebuilt plugins or APIs for integration. If you’re using a popular ecommerce platform such as Shopify, WooCommerce, or Magento, it might offer a ready-made integration. If you’re building a custom site, you might need to hire a developer to integrate the payment API. If you’re looking for a payment processing provider that is equipped for a wide range of business sizes and use cases, Stripe has a library of developer-friendly APIs, as well as low-code and prebuilt solutions.

5. Configure your payment settings

Choose the currencies and payment options you want to accept. At this stage some businesses might also want to set up subscription models, recurring payments, and buy now, pay later (BNPL) options.

6. Test your payment system

Use the payment processor’s testing mode to simulate transactions and make sure everything is working properly. This helps identify and fix any issues before your customers encounter them.

7. Launch your payment system

Once you’ve tested your payment system thoroughly, you can switch it to live mode and start accepting payments.

8. Manage your transactions

Regularly monitor your transactions, handle any disputes or chargebacks, and track your sales performance. Most payment processors provide dashboards or analytics tools to help with this.

9. Adhere to compliance and accounting requirements

Ensure you comply with all necessary regulations and standards, such as PCI DSS, which governs how businesses should handle credit card data. If you offer subscriptions or accept delayed or recurring payments, you’ll also need to make sure you’re handling revenue recognition correctly.

By systematically integrating a payment system into your website, you can choose a model that fits your business, supports your customers’ preferred payment methods, and provides an intuitive, protected, trust-building transaction experience. For more information about how Stripe powers payments for businesses online, start here.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.