Accepting payments over the phone can be a strategic move for businesses, allowing them to reach new markets, capture sales they might otherwise lose, and create a more accommodating customer experience. However, accepting phone payments is not without challenges. From data security considerations to higher processing fees, businesses must navigate potential pitfalls carefully. We’ll cover how businesses can accept payments over the phone effectively and securely.

What’s in this article?

- Is it possible to accept credit card payments over the phone?

- What types of businesses need to accept payments over the phone?

- How much does it cost to accept payments over the phone?

- Benefits and risks of accepting payments over the phone

- How to accept payments from customers over the phone

Is it possible to accept credit card payments over the phone?

Yes—this process is often referred to as MOTO payments (mail order/telephone order). It’s a type of card-not-present (CNP) transaction, meaning that the business manually enters the customer’s credit card information into the payment system, rather than having the customer present their card in person.

What types of businesses need to accept payments over the phone?

Several types of businesses can benefit from accepting payments over the phone due to their specific operational models or customer service strategies:

Service providers

Businesses providing services like home repairs, consulting, or catering may find phone payments useful for securing bookings or taking deposits.Remote sales businesses

Companies that sell products over the phone, such as telemarketers or catalog-based businesses, can process phone payments during a call.Restaurants and takeaways

Establishments offering food delivery or pickup services often take card payments over the phone.Travel agencies and hotels

These businesses may take payments over the phone for bookings, especially for customized travel plans or group bookings.Medical practices and pharmacies

Health services can take phone payments for telehealth appointments or prescription orders.Professional services

Lawyers, accountants, or freelancers may take phone payments for their services, particularly for retainer fees or invoices.

How much does it cost to accept payments over the phone?

The cost to accept payments over the phone will depend on your payment processor and the terms of your merchant agreement. Generally, because such payments are considered CNP transactions, the fees can be higher than for in-person, card-present transactions. This is due to the elevated risk of fraud and chargebacks that come with card-not-present transactions. These rates are subject to change and may be different based on your specific agreement with the processor. There may be additional fees associated with chargebacks, refunds, international transactions, or the use of a virtual terminal. For example, Stripe charges 2.9% + 30¢ per successful card charge for online transactions and 2.7% + 5¢ per transaction for in-person payments using Stripe Terminal.

Benefits and risks of accepting payments over the phone

Accepting payments over the phone provides businesses with a convenient and flexible way to process payments from customers. For many businesses, it can also open up new sales opportunities. However, like all methods of payment, it comes with its own set of advantages and potential drawbacks.

Benefits of accepting payments over the phone

Convenience and accessibility

Phone payments can be made from anywhere customers have phone service, providing a convenient option for customers who may not be able to visit your physical location or navigate your online payment system.Improved cash flow and optimized revenue potential

By allowing immediate payment, over-the-phone transactions can help to capture sales that might not take place otherwise. Businesses can quickly secure bookings, orders, or services, reducing the risk of unpaid invoices.Personalized customer service

Phone transactions allow businesses to engage with customers directly, answer any questions, and upsell or cross-sell products or services.Expanded customer base

With the ability to take payments over the phone, businesses have the potential to reach a wider customer base, including people who prefer phone transactions or are unlikely to engage with online payments.

Risks and considerations for accepting payments over the phone

Higher processing fees

Payments over the phone usually have higher processing fees since they are considered CNP transactions and have a greater risk of fraud and chargebacks.Increased risk of fraud

Because payments over the phone do not involve a physical card that businesses can verify, these transactions can be more susceptible to fraud. Businesses need to take necessary precautions to verify the identity of the caller and authenticity of the card information provided.Data security

Handling sensitive card information over the phone requires adherence to PCI-DSS (Payment Card Industry Data Security Standard) rules to protect customer data. These standards are more difficult to ensure when dealing with payments over the phone. Failure to comply with these standards can lead to fines.Manual entry errors

Manually entering card information increases the possibility of human error, which can lead to transaction issues and customer dissatisfaction.

While accepting payments over the phone can provide distinct advantages for businesses, it’s important to implement rigorous security protocols and train staff appropriately to manage associated risks.

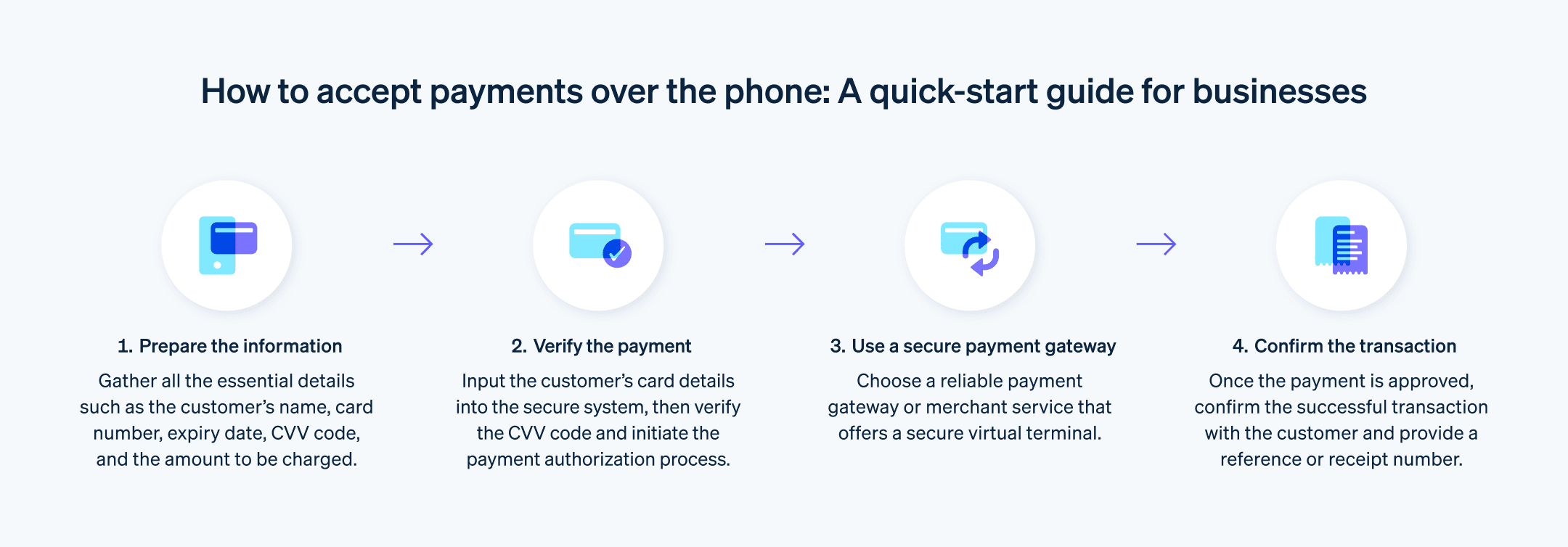

How to accept payments from customers over the phone

Accepting payments over the phone can work in a variety of ways depending on the payment method used and the business’s overall payment system. Below we’ll go through the general process of accepting payments over the phone using a service like Stripe. Please note that some details might vary depending on the specific payment processor.

Set up your account

First, you need to set up a merchant account with a payment processing service. During this setup process, you’ll provide the necessary business and banking information.Use a virtual terminal

Most payment processors provide what’s called a “virtual terminal,” which is an online version of a physical credit card terminal or point-of-sale (POS) system. With Stripe, you can accept a built-in virtual terminal directly in the Dashboard.Take payment details over the phone

When a customer wishes to make a payment, you will need to ask for their credit card information. This includes the card number, expiration date, and CVV code. You might also need their ZIP code or other identifying information, depending on the level of security verification that your processor requires. Always ensure that you do this in a secure and confidential manner, adhering to data protection best practices.Enter the payment information

In your virtual terminal, manually enter the customer’s credit card information and the amount to be charged. For Stripe, this is done in the Payments section of the Dashboard, by clicking “+Create” and then “Payment”.Process the payment

Once you’ve entered the necessary information, you can submit the payment for processing. The payment processor handles the transaction with the cardholder’s bank and updates you when the transaction is approved or declined.Provide a receipt

After the transaction, you should provide a receipt to the customer. Many payment processors can automatically send a digital receipt via email. With Stripe, you can do this by toggling to “Send a receipt email” when you create a payment.Maintain proper records

Keeping track of transactions is vital for accounting and potential dispute resolution. Your payment processor should provide detailed records of each transaction, accessible through your merchant account dashboard.Secure data handling

Since you’re dealing with sensitive personal information, it’s important to ensure all conversations and data handling comply with PCI-DSS regulations. Avoid writing down credit card information and never store card data without proper security measures in place.

Learn more about accepting payments over the phone with Stripe here.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.