信用卡支付手续费是商家为处理信用卡交易而向金融机构和支付处理商支付的费用。商家如果想让自己的支付系统保持健康、长期的利润率,就需要深入了解其运作方式。仅在 2024 年,美国商家支付的手续费就超过 1870 亿美元。

本文将解释什么是支付处理 费用、其运作方式,以及商家如何为所有销售渠道选择合适的支付解决方案。

本文内容

- 什么是支付处理?

- 付款处理涉及哪些费用?

- 信用卡付款手续费是如何确定的?

- 每个卡组织的信用卡手续费

- 如何降低信用卡和付款处理成本

- Stripe 支付能在哪些方面提供帮助

什么是支付处理?

支付处理 是指以电子方式将资金从客户转移到商家的流程。通常,支付处理涉及电子支付方式,如信用卡、借记卡 和数字钱包。

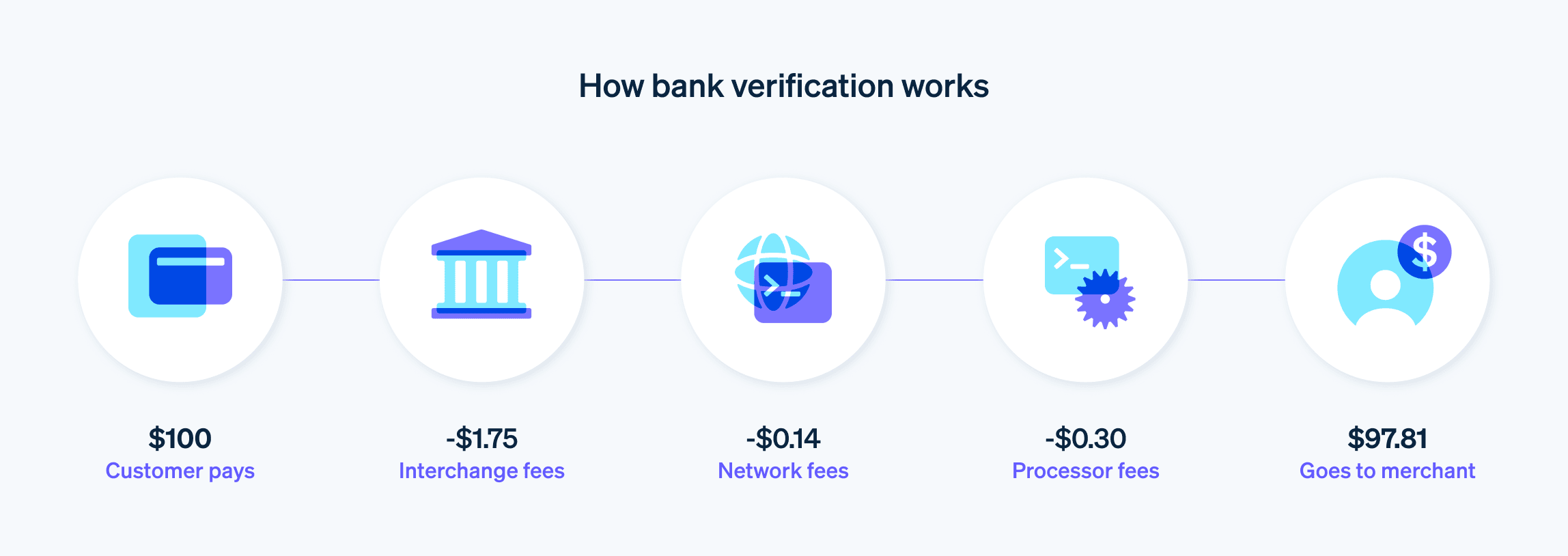

该流程包括授权、清算和结算 持卡人、商家、收单行、发卡行 和支付网络 之间的交易。该流程还包括支付网关 和支付服务商,它们充当中间人,以促进这些实体之间的通信和数据交换,确保交易高效、有效且安全。

付款处理涉及哪些费用?

与支付处理相关的费用可能因支付处理商、交易类型以及商家与处理商之间的具体安排而不同。支付处理中涉及的一些常见费用包括:

交易费用

每笔交易都会产生交易手续费,手续费可能包括交易额的一定百分比,以及每笔交易的固定费用。费率会因多种因素而异,例如银行卡类型、交易时是刷卡、插卡还是手动输入银行卡信息,以及行业或企业类型。月费

有些支付处理商可能会收取固定的月费,以覆盖账户维护、报告和客户支持等费用。Stripe 不收取任何月费或设置费。终端或设备费用

商家可能需要购买或租赁支付处理设备,例如信用卡终端或销售点 (POS) 系统。这些可能会产生一次性费用或经常性费用。支付网关费用

对于线上交易,商家可能需要支付网关,这也会产生相关费用。这些费用可能包括设置费、月费和交易手续费。PCI 合规费用

为了确保安全地处理持卡人数据,商家必须遵守支付卡行业数据安全标准 (PCI DSS)。有些处理商会收取一定的费用,以帮助商家维持合规,或者对不合规行为处以罚款。撤单费用

如果客户对交易提出争议并申请撤单,支付处理商可能会收取一定费用,以支付处理和调查争议的成本。提前终止或取消费用

如果企业决定在约定的期限结束前终止与支付处理商的合同,则处理商可能会向他们收取提前终止费。杂费

这些费用可能包括附加服务的费用,例如账户设置费、对账单费或批量费用。

信用卡付款手续费是如何确定的?

银行卡手续费是专门针对涉及信用卡的交易收取的支付手续费。决定银行卡手续费的参与方包括卡组织、发卡行和支付处理商。

商家折扣率 (MDR) 是指商家为每笔信用卡或借记卡交易支付的总费用,通常在 1% 到 3% 之间。此费用涵盖与处理付款相关的成本,包括支付给发卡行的交换费和支付给支付处理商的费用。

银行卡手续费主要有三种:

交换费

交换费 由卡组织(美国的 Visa、万事达、Discover 和美国运通)设定,并支付给持卡人的发卡行。通常,交换费是交易额的百分比和固定的单笔交易费用的组合。这些费用因多种因素而不同,例如银行卡的类型(信用卡、借记卡、奖励卡、企业卡等)、交易类型(刷卡、插卡、挥卡、手动输入 或在线)以及商家所在的行业。评估或网络费用

卡组织也会收取这些费用,用于支付卡组织基础设施的运营和维护成本。评估费通常是交易额的一小部分,并且在不同的卡组织之间可能略有差异。处理商或商家服务费

支付处理商或商家服务提供商 会收取这些费用,以覆盖其在促进信用卡交易中的作用。处理商费用可以是固定的单笔交易费用,也可以是交易额的百分比,或者两者的组合。

每个卡组织的信用卡手续费

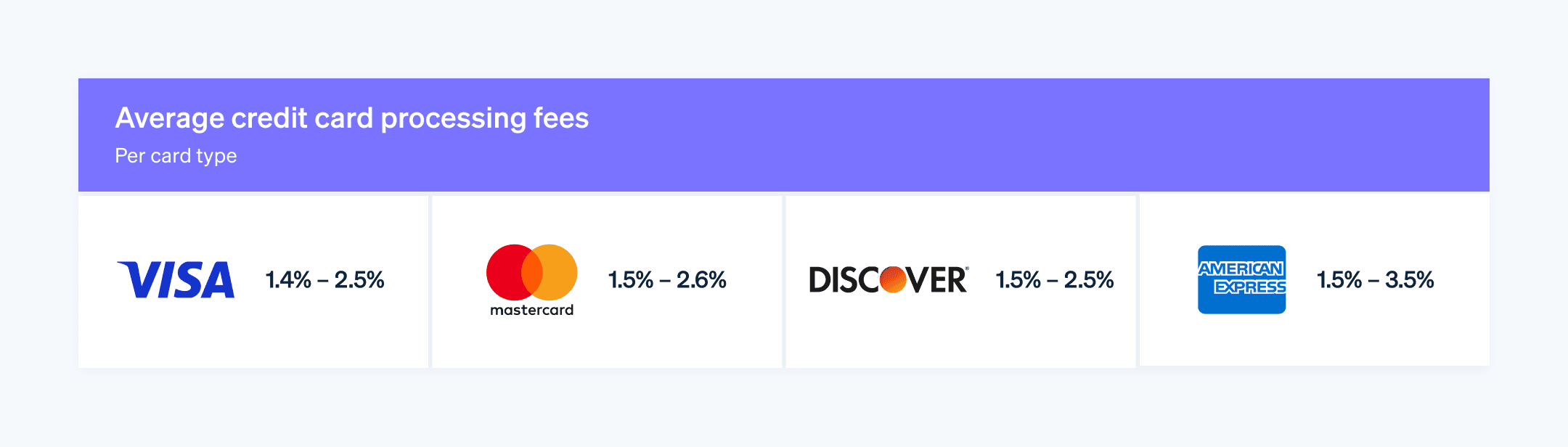

银行卡手续费可能因卡组织而异,因为每个卡组织都有自己的交换费和评估费。以下是与主要卡组织相关的费用概览:

Visa

Visa 的交换费 取决于多种因素,包括银行卡类型、交易方式和商家所在的行业。费用范围约为每笔交易 1.15% + 0.05 美元到 2.4% + 0.10 美元。万事达卡 (Mastercard)

与 Visa 类似,万事达卡的交换费 也因多种因素而异。费用范围约为每笔交易 1.15% + 0.05 美元到 2.5% + 0.10 美元。发现卡 (Discover)

Discover 的交换费 也取决于银行卡类型、交易方式和行业。费用范围通常为每笔交易 1.4% + 0.05 美元到 2.4% + 0.10 美元。美国运通卡 (American Express)

美国运通的运作方式 与其他卡组织略有不同:它通常既是发卡行,又是卡组织。美国运通的费用通常约为每笔交易 1.43% + 0.10 美元到 3.30% + 0.10 美元。

请注意,这些都是大致范围,具体交易的实际费用可能会有所不同。商家应咨询其支付处理商和卡组织的价格表,以获取关于信用卡手续费的最新信息。

如何降低信用卡和付款处理成本

尽管有些成本和费用是固定的,但商家可以减少部分信用卡和付款手续费。以下是一些可供参考的策略:

比较您的选择

研究不同的支付服务商及其费用结构,找到最适合您当前支付处理方式,以及未来业务增长规划的方案。选择正确的定价模式

选择适合您企业的定价模式。例如,与分层定价相比,交换费加成定价通常更透明且更具成本效益;而统一费率定价可能更有利于交易量较小的企业。降低欺诈和撤单的风险

实施诸如地址验证 (AVS) 和银行卡验证值 (CVV) 检查等安全措施,可以最大限度地降低欺诈交易和撤单 的风险,从而降低手续费。接受线下银行卡支付

尽可能使用最具成本效益的交易处理方式。例如,与非面对面银行卡交易相比,使用读卡器 进行的线下交易通常手续费更低。利用成本更低的支付方式

鼓励客户尽可能使用成本较低的支付方式,例如借记卡或数字钱包,这些方式的手续费可能低于信用卡。定期审查手续费

定期查看您的付款手续费和账单,确保您没有被收取不必要的费用,或者高于最初约定的费率。批量交易

在一天结束时批量处理交易,而不是单独处理每笔交易。这可以最大限度地减少单笔交易费用,并降低总体人工成本。保持 PCI 合规性

确保您的企业符合 PCI DSS 标准,以避免不合规费用,并降低安全漏洞的风险,否则可能会导致支付服务商对企业处以高额罚款和更高费用。使用行业特定的程序

某些卡组织提供针对特定组织(例如,某些类型的非营利组织和教育组织)量身定制的计划,这些计划可提供更低的手续费。检查您的企业是否符合这些计划。设置信用卡最低消费金额

设置信用卡最低消费金额可以抵消小额交易的手续费。根据电子支付新规,只要商家对所有接受的信用卡都采用相同的最低消费额度,则允许设置最高 10 美元的信用卡最低消费额度。将银行卡手续费转嫁给客户

在美国大多数州,只要商家遵守卡组织规则和州法律,则可以将附加费加到信用卡交易中,以涵盖手续费,这样做是合法的。但是,有些州对附加费有限制或有具体要求。

Stripe 支付能在哪些方面提供帮助

Stripe Payments 提供统一的全球支付解决方案,帮助各种规模的商家(从初创公司到全球企业)在线上线下以及在全球范围内收款。

Stripe 支付可以帮您:

- 优化结账体验: 通过预构建的支付用户界面、超过 100 种支付方式以及 Stripe 构建的钱包 Link,营造顺畅的客户体验,并节省数千个工程时。

- 更快拓展新市场: 具备跨境支付选项,覆盖全球客户,并降低多币种管理的复杂性和成本,可在 195 个国家/地区提供超过 135 种货币。

- 统一线上和线下支付: 构建跨线上和线下渠道的一体化商务体验,以个性化定制互动方式、奖励忠诚度并增加收入。

- 更优的支付性能: 通过一系列可定制、易于配置的支付工具(包括无代码欺诈保护和提高授权率的高级功能)来增加收入。

- 通过灵活、可靠的增长平台更快地发展: 平台旨在与您一同扩大规模,正常运行时间为 99.999%,具有行业领先的可靠性。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。