Het opslaan van een betaalkaart verwijst naar de praktijk waarbij een bedrijf de kaartgegevens van een klant opslaat in zijn betalingssysteem, waardoor transacties sneller en gemakkelijker kunnen worden uitgevoerd. In situaties met terugkerende facturatie, zoals abonnementsdiensten of regelmatige aankopen, kan het bedrijf automatisch de bewaarde betaalkaart belasten zonder dat de klant elke keer opnieuw zijn gegevens hoeft in te voeren.

Er is een aanzienlijke markt voor dit soort betalingen. De gemiddelde Amerikaan had in 2024 13 betaalde abonnementen op media- en entertainmentplatforms.

Voor het opslaan van klantenkaarten moeten bedrijven een hoog niveau van beveiliging handhaven. Bedrijven die de veiligste en meest gemakkelijke klantervaring willen bieden, moeten begrijpen hoe bewaarde kaarten werken en welke risico's en uitdagingen er zijn bij het opslaan en gebruiken van betaalmethoden van klanten. Bedrijven zijn verantwoordelijk voor het beschermen van deze gevoelige informatie tegen ongeoorloofde toegang en voor het naleven van de voorschriften inzake gegevensbescherming. Dit is wat je moet weten.

Wat staat er in dit artikel?

- Wat zijn transacties met bewaarde kaarten?

- Wanneer een bewaarde betaalkaart gebruiken

- Hoe werken bewaarde kaarten?

- Wat is het verschil tussen bewaarde creditcards en tokenisatie?

- Voor- en nadelen van het opslaan van creditcardgegevens

- Welke alternatieven hebben bedrijven voor het opslaan van creditcards?

- Hoe Stripe Payments kan helpen

Wat zijn transacties met bewaarde kaartgegevens?

Transacties met bewaarde kaartgegevens zijn betalingen die worden gedaan met kaartgegevens die door een bedrijf veilig zijn opgeslagen voor toekomstig gebruik. Deze informatie omvat meestal het kaartnummer, de vervaldatum en de naam van de kaarthouder. De kaarthouder geeft het bedrijf toestemming om zijn kaartgegevens op te slaan en te gebruiken voor terugkerende betalingen of afrekenen met één klik.

Wanneer een bewaarde betaalkaart gebruiken

De manier waarop we betaalkaarten van klanten bewaren, is flink veranderd. Vroeger schreven bedrijven de kaartgegevens van klanten op, zodat ze aankopen konden doen op hun rekening. Dit werkte goed voor vaste klanten, vaak in kleine, lokale winkels, en was gebaseerd op vertrouwen.

Naarmate bedrijven groeiden en transacties complexer werden, namen digitale oplossingen het over. Tegenwoordig gebruiken bedrijven versleutelde systemen om de kaartgegevens van klanten voor creditcards en debitcards op te slaan, waardoor transacties sneller verlopen en het risico op fraude afneemt. Door deze verandering is het voor moderne bedrijven gemakkelijker geworden om terugkerende betalingen te beheren en kunnen klanten zonder gedoe aankopen doen. Hieronder volgen enkele soorten bedrijven die vaak gebruikmaken van bewaarde kaarten:

Abonnementsdiensten: Veel bedrijven bieden diensten aan waarvoor regelmatige betalingen nodig zijn, zoals maandelijkse abonnementen voor software, streamingplatforms of lidmaatschapsclubs. Door een creditcard op te slaan, kunnen deze bedrijven de betaalkaart van de klant automatisch belasten tijdens elke facturatiecyclus. Hierdoor is het niet meer nodig om elke keer handmatig te betalen, waardoor de dienstverlening ononderbroken kan doorgaan.

Andere bedrijven met terugkerende bestellingen: Net als bij abonnementsdiensten gebruiken sommige bedrijven, vooral in de voedings- en detailhandel, bewaarde creditcards voor terugkerende bestellingen. Klanten die regelmatig dezelfde producten of items bestellen, kunnen profiteren van dit systeem omdat het tijd en moeite bespaart door automatische nabestellingen en facturatie.

Horeca en verhuur: Hotels en autoverhuurbedrijven houden creditcards op bestand om incidentele kosten te dekken. Een klant geeft bij het inchecken een creditcard op om mogelijke extra kosten, zoals roomservice of schade aan het voertuig, te dekken, wat het afrekenproces gemakkelijker maakt.

Nutsbedrijven en dienstverleners: Veel nutsbedrijven en dienstverleners raden klanten aan om een creditcard te laten opslaan voor maandelijkse facturen, bijvoorbeeld voor elektriciteit, water of internetdiensten. Deze methode zorgt ervoor dat facturen op tijd worden betaald en vermindert het risico op serviceonderbrekingen vanwege gemiste factuurbetalingen.

Gezondheidszorg: In de gezondheidszorg, met name bij langdurige behandelingen, helpt het opslaan van een creditcard bij het vereenvoudigen van het betalingsproces. Het maakt snelle facturatie mogelijk voor regelmatige afspraken of behandelingen, zonder dat klanten elke keer opnieuw een betaling hoeven te verrichten.

E-commerceverkopers: E-commerceplatforms slaan vaak kaartgegevens op om sneller afrekenen mogelijk te maken. Dit kan vooral handig zijn voor klanten in situaties waarin een snelle afhandeling van de transactie belangrijk is, zoals tijdens flash sales of bij de aankoop van populaire items die snel uitverkocht kunnen raken.

Nooddiensten: Sommige diensten, zoals pechhulp of noodreparaties, slaan een creditcard op om de dienstverlening te versnellen zonder zich zorgen te hoeven maken over vooruitbetaling.

Hoe werkt ‘kaart op bestand’?

Hier is een overzicht van het proces:

Eerste instelling: Eerst geeft de klant zijn kaartgegevens aan het bedrijf. Dit gebeurt meestal tijdens een aankoop of wanneer de klant zich aanmeldt voor een dienst. De kaartgegevens van de klant, zoals het kaartnummer, de vervaldatum en (indien van toepassing) kaartverificatiecode (CVV), worden ingevoerd in het betalingssysteem van het bedrijf.

Gegevensopslag: Nadat de klant zijn gegevens heeft verstrekt, slaat het bedrijf deze informatie op in zijn betalingsverwerkingssysteem. Deze opslag moet voldoen aan de normen voor gegevensbeveiliging om de informatie te beschermen tegen ongeoorloofde toegang. De gegevens worden vaak versleuteld of getokeniseerd voor extra beveiliging.

Autorisatie voor toekomstig gebruik: De klant stemt er doorgaans mee in dat het bedrijf zijn betaalkaart belast voor toekomstige transacties. Deze overeenkomst maakt meestal deel uit van de algemene voorwaarden van de dienst en kan details bevatten over hoe de betaalkaart zal worden gebruikt, voor welke doeleinden en hoe de klant deze autorisatie kan annuleren.

Automatische facturatie: Voor terugkerende betalingen, zoals abonnementen of maandelijkse diensten, zal het bedrijf automatisch de bewaarde betaalkaart belasten op de afgesproken tijdstippen. Hierdoor hoeft de klant niet elke keer handmatig een betaling te doen.

Stroomlijning van transacties: In situaties zoals online winkelen levert een bewaarde creditcard een beter afrekenproces op. Klanten kunnen aankopen sneller voltooien zonder elke keer hun kaartgegevens in te voeren.

Beveiligingsmaatregelen: Bedrijven moeten beveiligingsmaatregelen nemen om bewaarde creditcardgegevens te beschermen. Dit omvat het naleven van industrienormen zoals de Payment Card Industry Data Security Standard (PCI DSS), het gebruik van beveiligde servers en het waarborgen dat hun betaalgateways veilig zijn tegen inbreuken.

Kaartgegevens actualiseren: Als een kaart verloopt of wordt vervangen, moeten klanten hun bij het bedrijf bewaarde kaartgegevens actualiseren. Sommige bedrijven sturen meldingen wanneer de vervaldatum van een kaart bijna is verstreken om klanten er zo aan te herinneren hun gegevens bij te werken.

Controle en toegang voor klanten: Meestal kunnen klanten hun bewaarde creditcardgegevens bekijken en beheren, vaak via een klantenaccountportaal. Ze kunnen kaartgegevens bijwerken, een betaalkaart verwijderen of een betaalkaart toevoegen als dat nodig is.

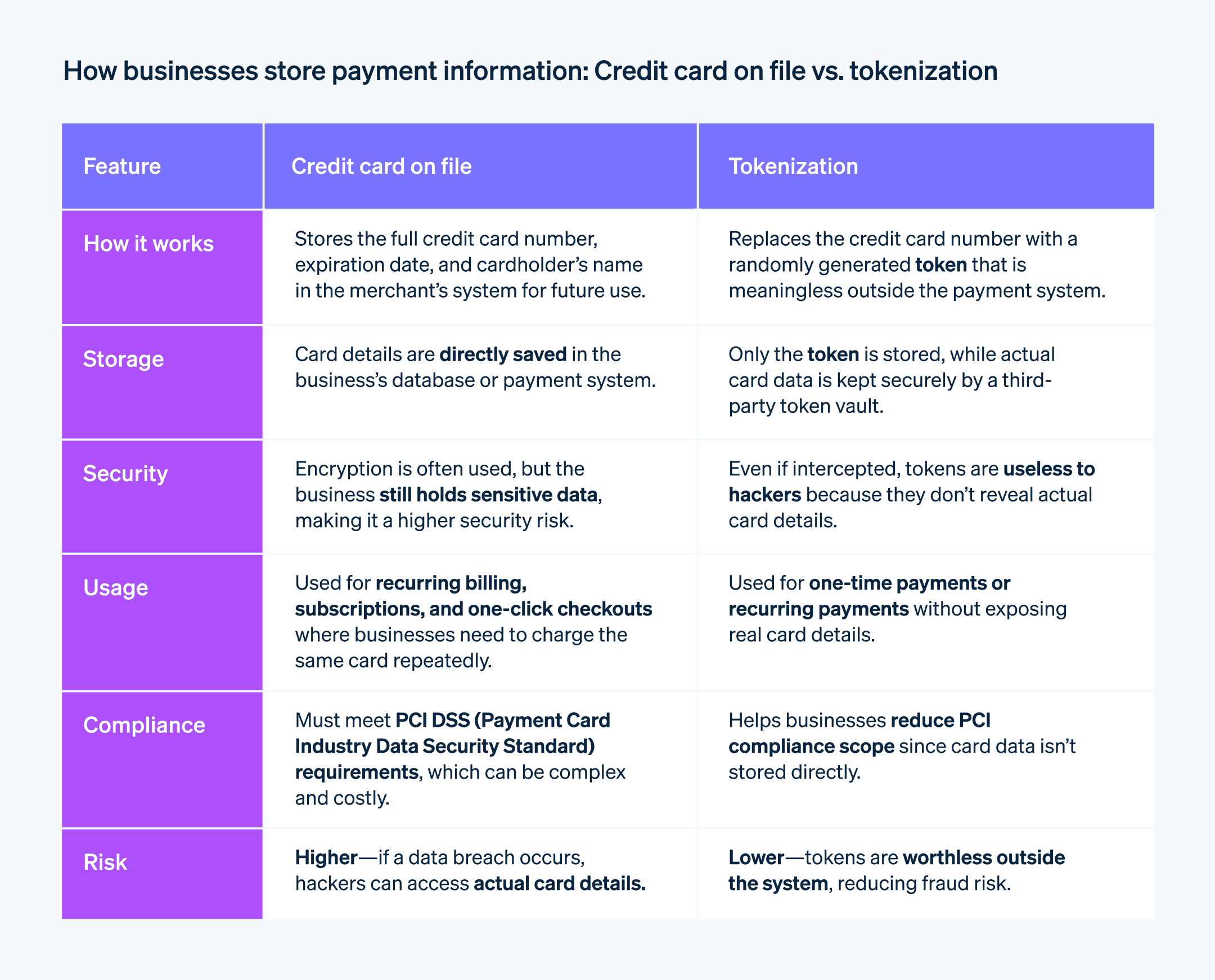

Wat is het verschil tussen bewaarde creditcards en tokenisatie?

Het opslaan van een creditcard en tokenisatie zijn twee verschillende dingen in betalingsverwerking, hoewel ze vaak samen worden gebruikt voor extra veiligheid en gemak. Hier volgt een beschrijving van elk concept en hoe ze worden toegepast:

Bewaarde kaart

Als een bedrijf een creditcard opslaat, betekent dit dat het de creditcardgegevens van de klant, zoals het kaartnummer, de vervaldatum en de naam van de kaarthouder, opslaat in zijn betalingssysteem. Hierdoor kan het bedrijf de betaalkaart belasten voor transacties zonder dat de klant zijn gegevens opnieuw hoeft in te voeren. Deze methode wordt veel gebruikt voor terugkerende betalingen of abonnementen. Het opslaan van creditcardgegevens vereist echter strenge beveiligingsmaatregelen om te beschermen tegen datalekken en om te voldoen aan de industrienormen.

Tokenisatie

Tokenisatie is een beveiligingsmaatregel die creditcardgegevens beschermt. Bij dit proces worden creditcardgegevens vervangen door een unieke identificatiecode, een zogenaamd token, dat kan worden gebruikt voor transacties zonder dat de creditcardgegevens worden blootgesteld. De echte kaartgegevens worden veilig opgeslagen in een tokenkluis, die vaak wordt beheerd door een externe dienstverlener. Wanneer een transactie wordt verwerkt, wordt het token (en niet de echte kaartgegevens) via de betalingsnetwerken verzonden. Zelfs als het token wordt onderschept, blijven de echte creditcardgegevens veilig.

Voor- en nadelen van het opslaan van creditcardgegevens

Het opslaan van een creditcard is voor veel bedrijven de standaardpraktijk. Hier zijn enkele mogelijke voor- en nadelen om rekening mee te houden:

Voordelen

Verbeterde cashflow: Door een creditcard op te slaan, kunnen bedrijven snellere facturatie- en incassoprocessen implementeren. Dit geldt met name voor bedrijven met terugkerende inkomsten-modellen, zoals abonnementsdiensten. Door het facturatieproces te automatiseren, kunnen bedrijven rekenen op een consistente instroom van geld, waardoor er minder behoefte is aan handmatige facturatie en opvolging van betalingen.

Meer gemak voor klanten: Door een creditcard op te slaan, worden transacties sneller en makkelijker voor klanten. Dit gemak kan de klantervaring verbeteren, wat mogelijk leidt tot meer klanttevredenheid en loyaliteit. In e-commerce scenario's kan dit ook leiden tot snellere afrekenprocessen, waardoor het aantal verlaten winkelwagentjes afneemt.

Minder administratieve rompslomp: Automatische facturatie vermindert de administratieve rompslomp die gepaard gaat met handmatige betalingsverwerking. Dit kan de arbeidskosten en de tijd die aan administratieve taken wordt besteed verminderen, waardoor medewerkers zich kunnen concentreren op productievere activiteiten.

Meer verkoopkansen: Wanneer klanten een creditcard in het systeem hebben opgeslagen, zijn ze misschien eerder geneigd om impulsaankopen te doen of extra diensten aan te schaffen, omdat ze weten dat het betalingsproces is vereenvoudigd. Dit kan de gemiddelde transactiewaarde verhogen en de verkoop stimuleren.

Nadelen

Beveiligings- en compliancevereisten: Het opslaan van creditcardgegevens brengt de verantwoordelijkheid met zich mee om te zorgen dat de gegevens steeds veilig zijn. Bedrijven moeten voldoen aan PCI DSS en andere relevante normen voor gegevensbescherming, wat een aanzienlijke investering in veilige opslagoplossingen en doorlopende beveiligingsmaatregelen kan vergen.

Risico op datalekken: Het bewaren van gevoelige klantgegevens verhoogt het risico op datalekken. Als de beveiligingssystemen van een bedrijf worden gesaboteerd, kan dit leiden tot financieel verlies, reputatieschade en juridische gevolgen. De gevolgen van een datalek kunnen voor kleine bedrijven bijzonder ernstig zijn.

Kosten van betalingsverwerking: Hoewel het opslaan van creditcardgegevens het factureren kan vergemakkelijken, brengt het ook kosten met zich mee. Betalingsverwerkers brengen doorgaans kosten in rekening voor transacties. Bedrijven kunnen ook te maken krijgen met chargebacks of betwiste kosten, wat extra kosten en administratief werk met zich mee kan brengen.

Beheer van kaartgegevensupdates: Bedrijven moeten de vervaldata en updates van kaarten bijhouden. Dit kan een complexe taak zijn, vooral met een groot klantenbestand. Als kaartgegevens niet tijdig worden bijgewerkt, kan dit leiden tot geweigerde transacties en onderbrekingen in de dienstverlening, wat van invloed kan zijn op de relatie met de klant.

Welke alternatieven hebben bedrijven voor het opslaan van creditcards?

Het opslaan van een kaart is niet de enige optie voor bedrijven die de betaalervaring voor klanten willen vereenvoudigen. Als alternatief is er keuze uit een verscheidenheid aan betaalmethoden en technologieën die verschillende niveaus van beveiliging en gemak bieden, waaronder:

Directe bankoverschrijvingen (ACH): Bedrijven kunnen gebruikmaken van Automated Clearing House-overschrijvingen, waarbij klanten betalen vanaf hun bankrekening. Deze methode brengt meestal lagere transactiekosten met zich mee dan creditcardverwerking en kan net zo handig zijn voor terugkerende betalingen, hoewel de verwerking mogelijk langer duurt.

Digitale wallets en betaaldiensten: Diensten zoals PayPal, Apple Pay, Google Pay of andere mobiele betalingssystemen stellen klanten in staat om hun betalingsgegevens veilig op te slaan en betalingen te doen zonder creditcardgegevens aan het bedrijf te verstrekken. Deze diensten bieden vaak een sterke encryptie en een snel betalingsproces.

Cryptovaluta-betalingen: Het accepteren van cryptocurrencies kan bedrijven helpen transactiekosten te minimaliseren en betalingsopties te bieden die niet gebonden zijn aan traditionele banksystemen. Cryptocurrencies kunnen een hoog beveiligingsniveau bieden door de blockchain-technologie, hoewel ze misschien minder handig zijn vanwege hun volatiliteit en de aan het gebruik ervan verbonden leercurve.

Prepaid-accounts: Bedrijven kunnen klanten geld vooraf op een rekening laten storten, waarvan dan bij elke aankoop wordt afgeschreven. Dit kan een veiligere betaalmethode zijn omdat er een limiet is aan het beschikbare geld, en het kan ook klantloyaliteit stimuleren.

Mobiele POS-systemen: Bedrijven kunnen mobiele POS-systemen gebruiken voor persoonlijke transacties. Deze systemen accepteren verschillende betaalmethoden, waaronder creditcards, zonder dat de kaartgegevens hoeven te worden opgeslagen. Ze hebben vaak sterke beveiligingsfuncties en bieden het gemak van onmiddellijke betalingsbevestiging.

Factuurbetalingen: Voor business-to-business (B2B) transacties of geleverde diensten kan een bedrijf facturen met betalingsvoorwaarden versturen. Klanten kunnen deze facturen op verschillende manieren betalen, zoals met cheques, bankoverschrijvingen of online betaalportalen waarvoor het bedrijf geen betaalgegevens hoeft op te slaan.

Biometrische betalingssystemen: Biometrische betalingssystemen gebruiken vingerafdrukken of gezichtsherkenning om betalingen te verifiëren. Ze kunnen een hoge mate van veiligheid en gemak bieden, omdat er geen fysieke kaarten of wachtwoorden nodig zijn.

Contactloze betalingen: Met Tap to pay-technologie kunnen klanten betalen door een betaalkaart of mobiel apparaat tegen een lezer te houden. Dit kan sneller en net zo veilig zijn als traditionele creditcardtransacties, zonder dat het bedrijf gegevens hoeft op te slaan.

Bij het vergelijken van deze alternatieven met de card-on-file-methode is het belangrijk om rekening te houden met het feit dat het niveau van veiligheid en gemak varieert. Digitale wallets bieden bijvoorbeeld hetzelfde gemak als een creditcard op file, maar voegen een extra beveiligingslaag toe doordat de kaartgegevens niet aan het bedrijf worden getoond. Directe bankoverschrijvingen bieden mogelijk meer veiligheid vanwege de aard van de transactie, maar kunnen minder handig zijn vanwege de langere verwerkingstijd. Elk alternatief heeft zijn eigen voor- en nadelen, die bedrijven moeten afwegen op basis van hun specifieke behoeften, de voorkeuren van hun klanten en hun operationele capaciteit.

Hoe Stripe Payments kan helpen

Stripe Payments biedt een uniforme, wereldwijde betaaloplossing waarmee elke onderneming, van groeiende start-ups tot internationale ondernemingen, online, fysieke en overal ter wereld betalingen kan ontvangen.

Stripe Payments kan je helpen met het volgende:

Je afrekenervaring te optimaliseren: creëer een probleemloze klantervaring en bespaar duizenden technische uren met vooraf gebouwde betaalinterfaces, toegang tot 125+ betaalmethoden en Link, een wallet gebouwd door Stripe.

Sneller uit te breiden naar nieuwe markten: bereik klanten over de hele wereld en verminder de complexiteit en kosten van multivalutabeheer met grensoverschrijdende betaalopties, beschikbaar in 195 landen in 135+ valuta's.

Fysieke en online betalingen samen te voegen: bouw een unified commerce-ervaring op via online en fysieke kanalen om interacties te personaliseren, loyaliteit te belonen en inkomsten te laten groeien.

De betaalprestaties verbeteren: verhoog inkomsten met een reeks aanpasbare, eenvoudig te configureren betaaltools, waaronder no code-fraudebescherming en geavanceerde mogelijkheden om autorisatiepercentages te verbeteren.

Sneller te werken met een flexibel, betrouwbaar platform voor groei: bouw voort op een platform dat is ontworpen om met je mee te groeien, met een uptime van 99,999% en toonaangevende betrouwbaarheid.

Lees meer over hoe Stripe Payments je online en fysieke betalingen kan stimuleren, of ga er vandaag nog mee aan de slag.

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.