De marktwaarde van de wereldwijde e-commerceomzet zal naar verwachting groeien tot $ 6,35 biljoen, uiterlijk in 2027. Aangezien klanten steeds meer de voorkeur geven aan digitale transacties, lopen bedrijven die zich niet aanpassen het risico achter te blijven en potentiële klanten en inkomsten te verliezen aan concurrenten.

Online afrekenprocessen kunnen van invloed zijn op het aantal transacties dat klanten succesvol afronden. In een enquête onder online shoppers bleek dat 18% van de achtergelaten winkelwagentjes werden toegeschreven aan een inefficiënt of omslachtig afrekenproces. En naarmate e-commerce groeit, neemt ook de cybercriminaliteit in verband met online betalingen toe. Ondernemingen moeten beide problemen aanpakken door klanten een eenvoudige, efficiënte online betaalervaring te bieden die ook zeer veilig is en is toegerust om zich ontwikkelende fraude.

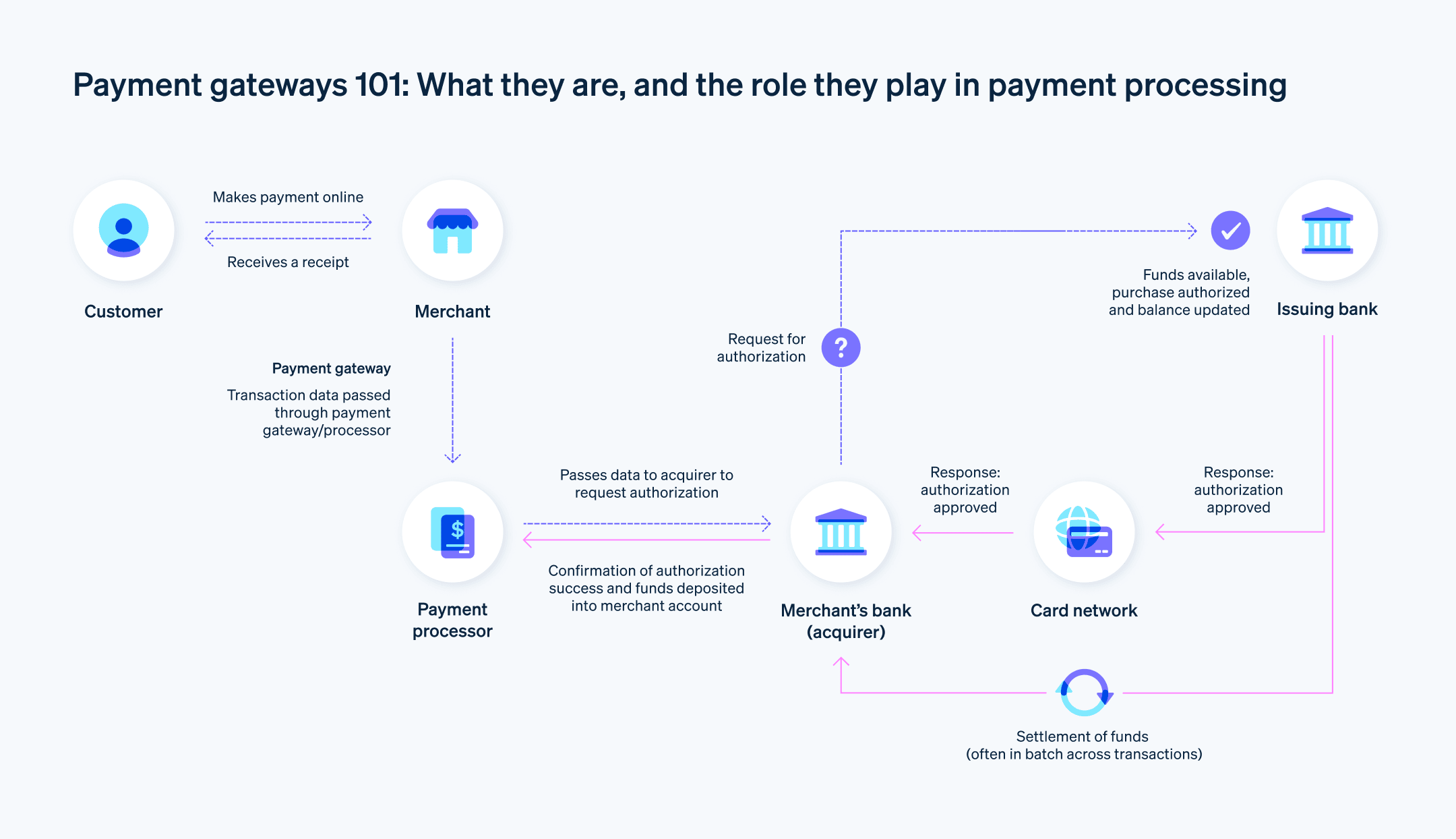

Betaalgateways spelen een sleutelrol bij het bereiken van dit complexe en belangrijke doel. Hieronder bespreken we wat bedrijven moeten weten over wat betaalgateways zijn, hoe ze werken, wat hun centrale rol is in e-commerce en hoe ze werken in een breder betalingsverwerkingssysteem.

Wat staat er in dit artikel?

- Wat zijn betaalgateways?

- Wat doet een betaalgateway?

- Wat is het verschil tussen een betaalgateway en een betaalterminal?

- Wat is het verschil tussen een betaalgateway en een betalingsverwerker?

- Hoe werkt een betaalgateway?

Wat zijn betaalgateways?

Een betaalgateway is een technologieplatform dat fungeert als tussenpersoon bij elektronische financiële transacties. Het stelt fysieke en online bedrijven in staat om verschillende betaalmethoden, zoals creditcards, debitcards en digitale wallets, op een veilige en efficiënte manier te accepteren, verwerken en beheren. De betaalgateway overbrugt de kloof tussen de klant, het bedrijf en hun respectievelijke financiële instellingen in één platform, en brengt doorgaans kosten in rekening voor elke keer dat een transactie wordt verwerkt.

Wat doet een payment gateway?

Een betaalgateway vervult verschillende belangrijke functies om ervoor te zorgen dat betalingen veilig, efficiënt en nauwkeurig zijn:

Encryptie

Wanneer een klant zijn betaalgegevens invoert tijdens het online afrekenen, versleutelt de betaalgateway de gegevens. Dit beschermt het tegen ongeoorloofde toegang of diefstal terwijl het wordt verzonden tussen het apparaat van de klant, de server van het bedrijf en de financiële instellingen.Verbinding met betalingsverwerker

De betaalgateway verbindt de klantgerichte checkout van een bedrijf met de betalingsverwerker.Autorisatie

De betaalgateway stuurt de versleutelde transactiegegevens door naar de accepterende bank van het bedrijf, die de informatie vervolgens doorstuurt naar de uitgevende bank van de klant of de relevante betalingsverwerker. De uitgevende bank of betalingsverwerker verifieert de transactiegegevens, waaronder het rekeningsaldo van de klant en de geldigheid van de betaalmethode, voordat de transactie wordt goedgekeurd of afgewezen. De betaalgateway ontvangt het antwoord en stuurt het terug naar het bedrijf.Gegevensverzameling en rapportage

Betaalgateways bieden bedrijven vaak waardevolle gegevens die hen kunnen helpen bij het analyseren en beheren van hun transacties. Het kan hierbij gaan om transactiegeschiedenis, terugbetalingsbeheer en andere gegevenspunten waarmee bedrijven trends kunnen identificeren en hun betalingsactiviteiten kunnen verbeteren.Fraudedetectie en -preventie

Om het risico op frauduleuze transacties, betaalgateways gebruiken geavanceerde beveiligingsmaatregelen zoals algoritmen voor fraudedetectie, adresverificatiesystemen (AVS) en CVV (Card Verification Value) controles. Deze maatregelen helpen potentieel frauduleuze transacties te identificeren en te blokkeren voordat ze kunnen worden verwerkt.

Wat is het verschil tussen een betaalgateway en een betaalterminal?

Betaalgateways en betaalterminals vergemakkelijken beide de verwerking van betalingen, maar ze zijn geschikt voor verschillende omgevingen en transactiemethoden. Dit zijn de belangrijkste verschillen tussen de twee:

Transactie-omgeving

Betaalgateway. Een betaalgateway is in de eerste plaats ontworpen voor online transacties, voornamelijk voor e-commercewebsites, mobiele applicaties en andere digitale platforms.

Betaalterminal: Een betaalterminal, ook wel POS of creditcardterminal genoemd, is een fysiek apparaat dat wordt gebruikt in fysieke winkels, restaurants en andere fysieke winkelomgevingen. Het stelt klanten in staat om betalingen te doen met creditcards, betaalpassen of contactloze betaalmethoden zoals smartphones met near-field communication (NFC) technologie.

Hoewel betaalgateways meestal worden gebruikt voor online transacties, kunnen ze ook worden geïntegreerd met fysieke transactiesystemen, afhankelijk van de provider en hun aanbod. In dergelijke gevallen kunnen betaalgateways elektronische transacties in fysieke winkelomgevingen vergemakkelijken.

Betalingsverwerking

Betaalgateway. De betaalgateway fungeert tijdens een online transactie als tussenpersoon tussen de klant, het bedrijf en hun respectievelijke financiële instellingen. Het versleutelt gevoelige gegevens, vergemakkelijkt transactieautorisatie en stroomlijnt de afwikkeling van geld.

Betaalterminal: Een betaalterminal doet meestal hetzelfde werk als een betaalgateway, maar ondersteunt fysieke in plaats van online transacties. Het leest de betaalkaart of contactloos betaalapparaat van de klant, communiceert met de relevante financiële instellingen voor transactieautorisatie en drukt ontvangstbewijzen af. De klant maakt verbinding met de accepterende bank of betalingsverwerker van het bedrijf via een telefoonlijn, internetverbinding of mobiel netwerk.

Veiligheidsmaatregelen

Betaalgateway. Om de veiligheid van online transacties te garanderen, maken betaalgateways gebruik van coderingsprotocollen zoals Secure Sockets Layer (SSL) of Transport Layer Security (TLS), algoritmen voor fraudedetectie, AVS en CVV-controles.

Betaalterminal: Net als betaalgateways gebruiken terminals beveiligingsmaatregelen zoals versleuteling van kaartgegevens en naleving van de PCI DSS-vereisten (Payment Card Industry Data Security Standard), terwijl ze ook beveiligingsmaatregelen ondersteunen voor kaarttransacties, zoals EMV-chiptechnologie.

Integratie

Betaalgateway. Het integreren van een betaalgateway in een e-commerceplatform, website of mobiele app vereist meestal technische kennis en het gebruik van API's of kant-en-klare plug-ins.

Betaalterminal: Het instellen van een betaalterminal is meestal een eenvoudiger proces, waarbij het apparaat fysiek moet worden geïnstalleerd en verbinding moet worden gemaakt met het POS systeem, internet of telefoonlijn van het bedrijf.

Wat is het verschil tussen een betaalgateway en een betalingsverwerker?

Betaalgateways en betalingsverwerkers zijn twee belangrijke onderdelen van elektronische financiële transacties, met name in e-commerce, maar ze hebben verschillende functies. Hier is een uitleg van hun verschillen:

Betaalgateway

Rol: Een betaalgateway treedt op als tussenpersoon tussen de klant, het bedrijf en hun respectievelijke financiële instellingen tijdens een online transactie. Het verzendt gevoelige betalingsinformatie op een veilige manier en vergemakkelijkt de autorisatie van transacties.

Belangrijkste functies: De betaalgateway versleutelt transactiegegevens, stuurt deze door naar de accepterende bank of betalingsverwerker van het bedrijf, ontvangt het goedkeurings- of afwijzingsantwoord van de transactie en communiceert de transactiestatus naar de website of app van het bedrijf.

Beveiliging. Betaalgateways gebruiken beveiligingsmaatregelen om frauduleuze transacties te voorkomen en betalingsgegevens te beschermen wanneer deze het betalingssysteem van het bedrijf binnenkomen. Betaalgateways doen dit met behulp van maatregelen zoals coderingsprotocollen (SSL of TLS), algoritmen voor fraudedetectie, AVS en CVV-controles om gevoelige gegevens te beschermen en frauduleuze transacties te voorkomen.

Integratie. Betaalgateways integreren doorgaans met e-commerceplatforms, websites of mobiele apps met behulp van API's of kant-en-klare plug-ins.

Betalingsverwerker

Rol: Een betalingsverwerker, ook wel aanbieder van handelsdiensten, is een bedrijf dat de verwerking van de transactie afhandelt. Dit omvat de autorisatie en voldoening van geld tussen de uitgevende bank van de klant, de accepterende bank van het bedrijf en de relevante betalingsnetwerken (bijv. Visa, Mastercard).

Belangrijkste functies: De betalingsverwerker verifieert de transactiegegevens, controleert het rekeningsaldo van de klant en de geldigheid van de betaalmethode, keurt de transactie goed of weigert en faciliteert de overdracht van geld tussen de rekening van de klant en het bedrijf tijdens het afwikkelingsproces.

Beveiliging. Terwijl betaalgateways zich meer richten op het verifiëren van transacties en het voorkomen van betalingsfraude op het verkooppunt, gebruiken betalingsverwerkers beveiligingsmaatregelen om de hoogste normen voor de bescherming van betalingsgegevens te handhaven. Betalingsverwerkers moeten voldoen aan de PCI DSS-vereisten, die de veilige verwerking en opslag van kaarthoudergegevens garanderen.

Relatie met het bedrijf: Betalingsverwerkers hebben vaak een directe contractuele relatie met het bedrijf, waaronder het verstrekken van een handelaarsaccount. Met dit type bankrekening kunnen bedrijven elektronische betalingen accepteren en verwerken.

Een betaalgateway is een tool die de autorisatie van online transacties veilig verzendt en faciliteert, terwijl een betalingsverwerker een bedrijf is dat samenwerkt met verkopers om de verwerking af te handelen, inclusief de autorisatie en afwikkeling van geld tussen de betrokken partijen. PayPal is bijvoorbeeld een betalingsverwerker, maar geen betaalgateway. Beide componenten werken samen om soepele, veilige en efficiënte elektronische financiële transacties te garanderen.

Hoe werkt een betaalgateway?

Hier volgt een stapsgewijze uitleg over hoe een betaalgateway werkt tijdens een online transactie:

1. Beginnen met transacties

De klant selecteert de producten of diensten die hij wil kopen op de website of app van het bedrijf en gaat vervolgens naar de afrekenpagina. Ze voeren hun betaalgegevens in, zoals creditcardgegevens of aanmeldgegevens voor een digitale wallet.

2. Versleuteling van betaalgegevens

Zodra de klant zijn betalingsinformatie indient, versleutelt de betaalgateway de gegevens met behulp van SSL- of TLS-protocollen. Deze versleuteling zorgt ervoor dat gevoelige informatie tijdens de overdracht wordt beschermd tegen ongeoorloofde toegang of diefstal.

3. Gegevensoverdracht naar de server van het bedrijf

De versleutelde betalingsinformatie wordt vervolgens naar de server van het bedrijf gestuurd, die de gegevens veilig opslaat en doorstuurt naar de betaalgateway voor verdere verwerking.

4. Transactiegegevens doorsturen

De betaalgateway ontvangt de versleutelde transactiegegevens van de server van het bedrijf en stuurt deze door naar de betalingsverwerker en de accepterende bank van het bedrijf, de financiële instelling die verantwoordelijk is voor het verwerken van de betaling namens het bedrijf.

5. Verificatie van transactie

De acquiring bank stuurt de transactiegegevens voor autorisatie door naar de accepterende bank van de klant of de juiste betalingsverwerker. De uitgevende bank of betalingsverwerker verifieert de transactiegegevens, waaronder het rekeningsaldo van de klant en de geldigheid van de betaalmethode.

6. Goedkeuring of weigering van transactie

Op basis van de verificatie wordt de transactie door de uitgevende bank of betalingsverwerker goedgekeurd of afgewezen. Dit antwoord wordt via de accepterende bank en betaalgateway teruggestuurd naar de server van het bedrijf.

7. Communicatie over de status van de transactie

De betaalgateway stuurt de transactiestatus (goedgekeurd of geweigerd) naar de website of app van het bedrijf, die vervolgens het juiste bericht aan de klant toont. Als de transactie is goedgekeurd, gaat het bedrijf verder met de uitvoering van de bestelling. Bij weigering wordt de klant hiervan op de hoogte gebracht en kan hij/zij worden gevraagd een andere betaalmethode te proberen.

Betaalgateways vergemakkelijken en beveiligen het online transactieproces door gegevens te versleutelen, transactieautorisatie te verkrijgen, geld over te maken en rapportagetools aan het bedrijf te bieden.

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.