Recurring payments have the potential to transform businesses. They generate predictable revenue, significantly reduce administrative tasks, and foster strong, lasting relationships with customers. The global value of recurring payments in 2022 was $130 billion, and is projected to grow to $268 billion by 2033.

Recurring payments can improve the payment experience for customers, and businesses using a recurring payment model can reduce churn rates. For businesses, recurring payments provide dependable revenue and the ability to forecast future income with a higher degree of accuracy.

Below, we’ll explain how to set up a recurring payment model and help you access these substantial benefits for your business.

What’s in this article?

- How to set up recurring payments

- Benefits of recurring payments for businesses

- What type of businesses offer recurring payments?

- What to consider when implementing a recurring payment model

- How Stripe Billing can help

- See how Stripe Billing measures up

How to set up recurring payments

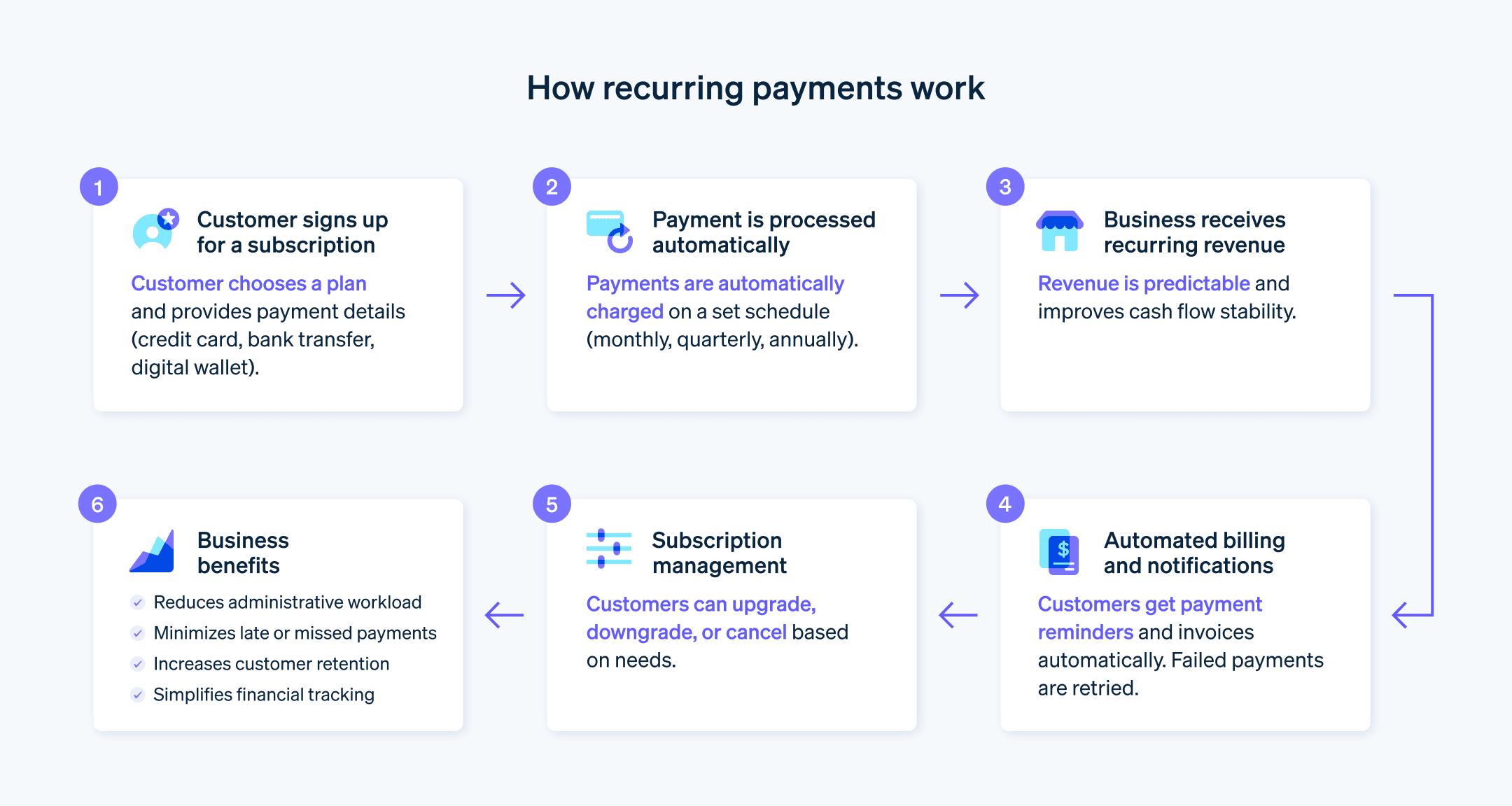

Recurring payments, also known as subscription payments or auto-pay, are payments that are automatically charged to a customer’s credit card or bank account on a prearranged, scheduled basis. They’re commonly used for utility bills, gym memberships, subscription services, and software licenses.

Typically, recurring payments occur monthly, but they can also happen weekly, quarterly, or yearly. Recurring payments are convenient for customers, since they no longer need to remember to make individual payments. Additionally, service interruptions caused by missed payments are less likely. For businesses, recurring payments provide predictable revenue and reduce administrative costs.

Here’s a step-by-step guide to setting up recurring payments:

1. Understand your business needs: Make sure you have a clear understanding of your business model and needs. Is your product or service suited for a recurring payment structure? This model is most beneficial for businesses that offer subscription-based services, memberships, or long-term contracts.

2. Choose a suitable pricing model: There are different pricing models to consider for recurring payments: flat-rate, tiered, per-user, usage-based, and freemium, among others. The best model will depend on your specific product or service, customer base, and overall business strategy.

3. Select a reliable payment gateway: Choose a secure, reliable payment gateway that is PCI DSS compliant and offers features such as automated payment retries, dunning management, and simple integrations with your existing business systems.

4. Compliance check: Ensure that your recurring payment model complies with all applicable laws and regulations. This may include local laws in your country of operation, international regulations if you operate globally, and financial regulations related to secure payment processing.

5. Set up your recurring payment system: Use your payment gateway to set up your recurring payment system. This will involve setting the payment frequency (e.g., weekly, monthly, annually), setting the price according to your chosen pricing model, and possibly segmenting your customers based on their subscription tier or usage.

6. Offer multiple payment options: For a smoother customer experience, provide multiple payment options, including credit and debit cards, bank transfers, and digital wallets. This flexibility increases the chances of customers choosing your service and sticking with it.

7. Handle customer authorization: Before you can start charging customers on a recurring basis, you’ll need to get their explicit consent. Put a system in place to capture and store this authorization securely.

8. Communicate clearly: Clear communication builds trust and reduces customer complaints and disputes. Ensure your customers understand the terms and conditions of the recurring payment, including the amount, billing cycle, and how they can cancel or modify the subscription.

9. Plan for failed payments: Even with a reliable payment gateway, you’ll need a strategy for dealing with failed payments. Consider setting up automated retries, sending email notifications to customers, and possibly suspending services until payment is successful.

10. Provide customer support: Excellent customer support can significantly enhance the customer experience. Your support team should be trained to handle all queries related to recurring payments, and resolve issues quickly.

Setting up recurring payments requires careful planning and implementation, but the effort can pay off in the form of more predictable revenue, improved cash flow, and higher customer retention.

Benefits of recurring payments for businesses

Recurring payments offer many benefits to businesses. Here are some of the key advantages:

Predictability of revenue

Instead of not knowing when and if customers will make one-off payments, businesses can count on a steady stream of income at regular intervals. This helps with financial planning and makes budgeting more accurate and reliable, allowing businesses to plan for future growth and invest in infrastructure.Improved cash flow

Recurring payments significantly improve cash flow by providing businesses with a steady stream of income, which makes it easier for businesses to manage their expenses, pay their bills on time, invest in growth, and maintain financial stability.Cost efficiency

By automating the billing process, businesses reduce the administrative burden and cost associated with manual billing and collection.Increased customer retention

Recurring payments can increase customer retention. When customers sign up for automatic billing, they are likely to continue using the service, given the ease and convenience of the payment process.Opportunity for upselling and cross-selling

With an existing financial relationship and payment system in place, customers are more likely to consider additional offerings from the business. This can increase revenue and customer loyalty.Simplified accounting

Recurring payments simplify the accounting process. Tracking revenue becomes easier, and the process of reconciling accounts is simpler. This can reduce errors, save time, and make it easier to track financial performance.Environmentally friendly

Digital billing eliminates the need for paper invoices, reducing the business’s carbon footprint. This aligns with a growing consumer preference for eco-friendly practices.

What type of businesses offer recurring payments?

Recurring payments have become a standard billing practice in many industries. Here are some examples of businesses across different sectors that use recurring payment options:

Subscription services: From streaming platforms such as Netflix or Spotify to digital news outlets, subscription services charge a recurring fee, usually monthly or annually, for access to their content.

Utilities: Utility providers, such as those supplying electricity, water, gas, or internet services, often use recurring payments to ensure consistent service and smooth financial operations.

Fitness and wellness centers: Many gyms and wellness centers, such as yoga or Pilates studios, offer memberships based on recurring payments, often charged monthly.

Software-as-a-service (SaaS) companies: SaaS providers, such as Adobe or Salesforce, typically charge a recurring subscription fee for access to their software platforms. SaaS companies focusing on AI usually follow a hybrid pricing model, charging for usage in addition to a subscription fee.

Insurance companies: Recurring payments are standard in the insurance industry, where premiums are usually paid monthly, quarterly, or annually.

Telecommunication companies: Phone and internet service providers frequently bill customers on a recurring basis to ensure uninterrupted connectivity.

Nonprofit organizations: Many charities and nonprofit organizations offer an option for donors to set up recurring donations, providing a consistent flow of funds to support their cause.

Meal delivery and grocery services: Businesses that provide meal kits or regular grocery deliveries often use a recurring payment model, typically charging customers weekly or monthly.

Online learning platforms: Platforms offering online courses or educational content, such as Coursera or MasterClass, typically use recurring payments for their subscription services.

Cloud storage providers: Companies offering cloud storage services, such as Google Drive or Dropbox, often use recurring payments for their premium storage plans.

Rental services: Property managers, car leasing companies, and equipment rental businesses might use recurring payments to streamline their billing process and ensure regular income.

These are just a few examples of the wide range of businesses that use recurring payments.

What to consider when implementing a recurring payment model

Setting up a recurring payment model for your business can help ensure predictable revenue and improve customer retention. However, implementing this kind of system requires careful planning and consideration.

Here are some points to consider:

Understand your business needs

Ask yourself if your business would benefit from a recurring payment model. Businesses with regular, ongoing services, such as subscriptions, memberships, or long-term contracts, are usually well-suited for recurring payments.Choose the right pricing model

There are several pricing models for recurring payments, including flat-rate, tiered, usage-based, and freemium. The best model for your business will depend on your product or service, customer base, and market conditions. Research and compare these models to decide which one is most suitable for your offerings.Ensure compliance

Setting up recurring payments means complying with legal and financial regulations. This includes compliance with the Payment Card Industry Data Security Standard (PCI DSS) and other applicable laws and regulations, depending on your location and the nature of your business.Provide transparency

Make sure your customers fully understand the terms and conditions of the recurring payment, including how much they will be charged, when the transaction will happen, and how they can cancel the recurring payment. Transparency builds trust and helps prevent future disputes.Offer flexible payment options

Offer a variety of payment options, such as credit and debit cards, bank transfers, and digital wallets. Consider offering different billing cycles, such as monthly, quarterly, or annually, to cater to different customer preferences.Invest in a reliable payment gateway

A reliable payment gateway is important for handling recurring payments. Look for a solution that offers automation, security, and integration with your existing systems. Your payment gateway should also be able to handle failed payments and send reminders for upcoming payments.Manage failed payments

Plan for how you will handle failed payments. This could include setting up automated retries, notifying the customer, or pausing the service until payment is received. Communicate your policy for failed payments clearly to your customers.Provide excellent customer support

Customers should be able to easily contact your support team if they have questions or issues with their recurring payments. Training your team to handle these queries can enhance customer satisfaction and help retain your customers.

How Stripe Billing can help

Stripe Billing lets you bill and manage customers however you want—from simple recurring billing to usage-based billing and sales-negotiated contracts. Start accepting recurring payments globally in minutes—no code required—or build a custom integration using the API.

Stripe Billing can help you:

Offer flexible pricing: Respond to user demand faster with flexible pricing models, including usage-based, tiered, flat-fee plus overage, and more. Support for coupons, free trials, prorations, and add-ons is built-in.

Expand globally: Increase conversion by offering customers’ preferred payment methods. Stripe supports 100+ local payment methods and 130+ currencies.

Increase revenue and reduce churn: Improve revenue capture and reduce involuntary churn with Smart Retries and recovery workflow automations. Stripe recovery tools helped users recover over $6.5 billion in revenue in 2024.

Boost efficiency: Use Stripe’s modular tax, revenue reporting, and data tools to consolidate multiple revenue systems into one. Easily integrate with third-party software.

Learn more about Stripe Billing, or get started today.

See how Stripe Billing measures up

See how Stripe compares to other recurring billing providers in the 2025 Gartner® Magic Quadrant™ for Recurring Billing Applications.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.