Ditt företags POS-system är mer än ett verktyg för att ta emot betalningar – det är en viktig del av en utmärkt kundupplevelse. Småföretag står dock ofta inför utmaningar som begränsad personalstyrka, strama budgetar och behovet av att spåra lager manuellt, vilket kan leda till ineffektivitet och förlorade intäkter. Många har också svårt att hantera flera försäljningskanaler eller synkronisera transaktioner online och i fysisk miljö.

Moderna POS-system löser dessa problem genom att automatisera lagerspårning, generera försäljningsrapporter och erbjuda användarvänliga gränssnitt som kräver minimal utbildning. De har stöd för flera typer av betalningar, integreras med bokförings- och e-handelsverktyg och ger molnåtkomst så att företag kan hantera allt på en plats. Prisvärda hårdvarualternativ och skalbara prismodeller gör det också lättare för småföretag att komma igång.

Ett pålitligt och lättanvänt POS-system är ett viktigt verktyg för företag av alla storlekar. Nedan tar vi upp vad du bör veta om POS-system, inklusive hur de fungerar och hur de hjälper småföretag.

Vad innehåller den här artikeln?

- Vad du ska leta efter hos POS-system för småföretag

- Vilka är de olika typerna av POS-system?

- Vad kostar POS-system?

- Hur fungerar POS-system?

- Så kan Stripe hjälpa till

Vad du ska leta efter hos POS-system för småföretag

Ett POS-system inkluderar betalningshårdvara och POS-programvara som gör det möjligt för företag att ta emot betalningar från kunder. Några ytterligare funktioner som POS-system utför för småföretag inkluderar:

- Uppdatering av lager

- Uppföljning av försäljning

- Hantering av kassalåda

- Streckkodsläsare

- Stämpla in och stämpla ut anställda

- Köra rapporter om försäljning och andra data

- Hantera kundkonton och förmåner

När du väljer ett POS-system för ditt småföretag bör du prioritera användarvänlighet. Ett användarvänligt gränssnitt gör det lättare att genomföra onboarding av anställda snabbt, vilket är särskilt viktigt i snabba detaljhandels- eller servicemiljöer.

Leta efter POS-system som har en app som du kan komma åt på mobila enheter som smartphones och surfplattor eftersom dessa alternativ är mer flexibla och enklare att använda. Om du använder ett POS-system som stödjer Tap to Pay kan du ta emot kontaktlösa betalningar i fysisk miljö med en iPhone- eller Android-enhet.

En annan viktig faktor att tänka på är integration av programvara. Ditt småföretags POS-system ska ansluta enkelt till dina befintliga verktyg, t.ex. bokföringsprogram, lagerhanteringsplattformar och lojalitetsprogram. Genom att välja ett POS-system som integreras med de verktyg du redan använder kan du undvika dubbel datainmatning, minska antalet fel och få en tydligare bild av företagets verksamhet i realtid.

Vilka är de olika typerna av POS-system?

Hur ett POS-system ser ut och vilka komponenter det innehåller varierar beroende på bransch. Till exempel kan en detaljhandelsbutik dra nytta av streckkodsskanning och utskrift av kvitto, medan ett tjänstebaserat företag kan prioritera schemaläggnings- och dricksfunktioner. Här är en titt på olika typer av POS-system.

Detaljhandeln

Inom detaljhandeln fokuserar POS-system på snabb kassahantering, streckkodsskanning och lagerspårning. Dessa system hjälper återförsäljare att hantera produktvarianter som storlek och färg, behandla returer eller byten och generera detaljerade försäljningsrapporter. Betalningar tas ofta emot vid kassadisken, även om vissa återförsäljare använder POS-system som gör att de kan ta emot betalningar var som helst i butiken.

Restauranger

POS-system för restauranger har stöd för beställning, kökskommunikation, bordshantering och betalning – allt i ett system. Funktioner som menyanpassning, beställningsmodifierare, uppdelade notor och dricksspårning effektiviserar arbetsflöden både på kundsidan och bakom kulisserna. Många POS-system för restauranger integreras också med onlinebeställning, leveransplattformar och lagerhanteringsverktyg, vilket hjälper restauranger att förbättra noggrannheten. Restauranger som arbetar från en foodtruck eller i popup-lokaler använder ofta POS-system som har stöd för Tap to Pay så att de kan ta emot kontaktlösa betalningar med endast en iPhone eller Android-enhet.

Hotell och semesteranläggningar

På hotell och semesteranläggningar måste POS-system integreras med fastighetsförvaltningssystem (PMS) för att ge en smidig gästupplevelse, oavsett om betalningar görs i receptionen, restaurangen, baren eller butiker. Funktionerna inkluderar ofta lagerspårning, personalhantering och detaljerad rapportering. Att centralisera transaktioner och gästdata är viktigt för att hotellen ska kunna fungera och faktura effektivt, särskilt eftersom debiteringar görs på flera platser i anläggningen.

Skönhetssalonger

POS-system för salonger tillgodoser behoven för schemaläggning av möten, försäljning av tjänster och produkter samt provisioner till personalen, vilket bidrar till att förbättra upplevelsen för personalen och kunderna. De inkluderar vanligtvis kundprofiler och lagerhantering för att hjälpa salongerna att sälja produkter tillsammans med sina tjänster. Även om betalningar ofta görs i receptionen, ger POS-system som kan underlätta kontaktlösa betalningar salongspersonalen möjlighet att ta betalt innan en kund lämnar salongsstolen.

Servicepersonal

POS-system för servicepersonal som konsulter, frilansare och reparationstekniker är utformade för att hantera schemaläggning av möten och fakturering tillsammans med betalningar. Dessa system inkluderar ofta mobil betalningsbehandling, kundprofiler och integrering med schemaläggningsverktyg. POS-system som har stöd för Tap to Pay är idealiska för yrkesverksamma som arbetar på olika platser.

Hälso- och sjukvård

POS-system i hälso- och sjukvårdsmiljöer är specialiserade för att hantera administrativa uppgifter och patientnära uppgifter. Dessa system har stöd för betalning, fakturering av försäkringar, debitering av egenavgifter och detaljerad patientjournalhantering på kliniker och andra medicinska mottagningar. De integreras ofta med elektroniska patientjournaler (EHR) och programvara för hantering av rutiner för att förenkla schemaläggning, fakturering och efterlevnad av integritetsbestämmelser som HIPAA i USA.

Vad kostar POS-system?

POS-system prissätts vanligtvis med en av tre modeller:

- Kostnadsfria: Har vanligtvis begränsade funktioner eller hårdvarukrav och avgifter per transaktion

- Abonnemangsbaserade: Debiterar månads- eller årsavgifter

- Anpassad prissättning: Baserat på företagets storlek och anpassat baserat på företagets behov

Företag betalar vanligtvis en månadsavgift för POS-systemet, en initial kostnad för att köpa betalningshårdvara och transaktionsavgifter för betalningsbehandling. Kostnaderna varierar beroende på vilka funktioner som ingår. Genom att använda ett POS-system som med stöd för Tap to Pay kan du eliminera hårdvarukostnader eftersom betalningar tas emot direkt på en iPhone- eller Android-enhet.

Var försiktig om du överväger kostnadsfria POS-system. De har vanligtvis funktionsbegränsningar, inkonsekvent support och omfattas av villkor eller begränsningar. POS-system utan månadsavgifter som endast debiterar transaktionskostnader kan dock fungera bra för småföretag med lägre försäljningsvolym eller säsongsbetonad verksamhet.

De totala kostnaderna för att installera och underhålla ett POS-system beror på några faktorer, inklusive:

- Antal terminaler

- Antal anställda

- Antal transaktioner

- Lagerstorlek

- Typ av företag eller bransch

- Ytterligare funktioner eller stöd för betalningshantering

Hur fungerar POS-system?

POS-system integreras vanligtvis med en betalleverantör som Stripe för att underlätta betalningar. Betalleverantören måste kommunicera med tre parter:

Kundens betalningsmetod: Kundens betalningsinformation, t.ex. kreditkortsnummer, överförs till POS-systemet när kunden drar magnetremsan på ett kort, sätter i ett EMV-chip eller trycker för NFC-baserad kontaktlös betalning.

Kundens bank (eller annat finansinstitut): POS-systemet är antingen trådbundet till internet eller anslutet till Wi-Fi och kommunicerar elektroniskt med kundens finansinstitut för att verifiera att medel som motsvarar transaktionsbeloppet är tillgängliga.

Företagets betalleverantör: POS-systemet kommer också att kommunicera elektroniskt med företagets betalleverantör. Det är ofta samma företag som utfärdade POS-systemets hårdvara och mjukvara, vilket är fallet med Stripe.

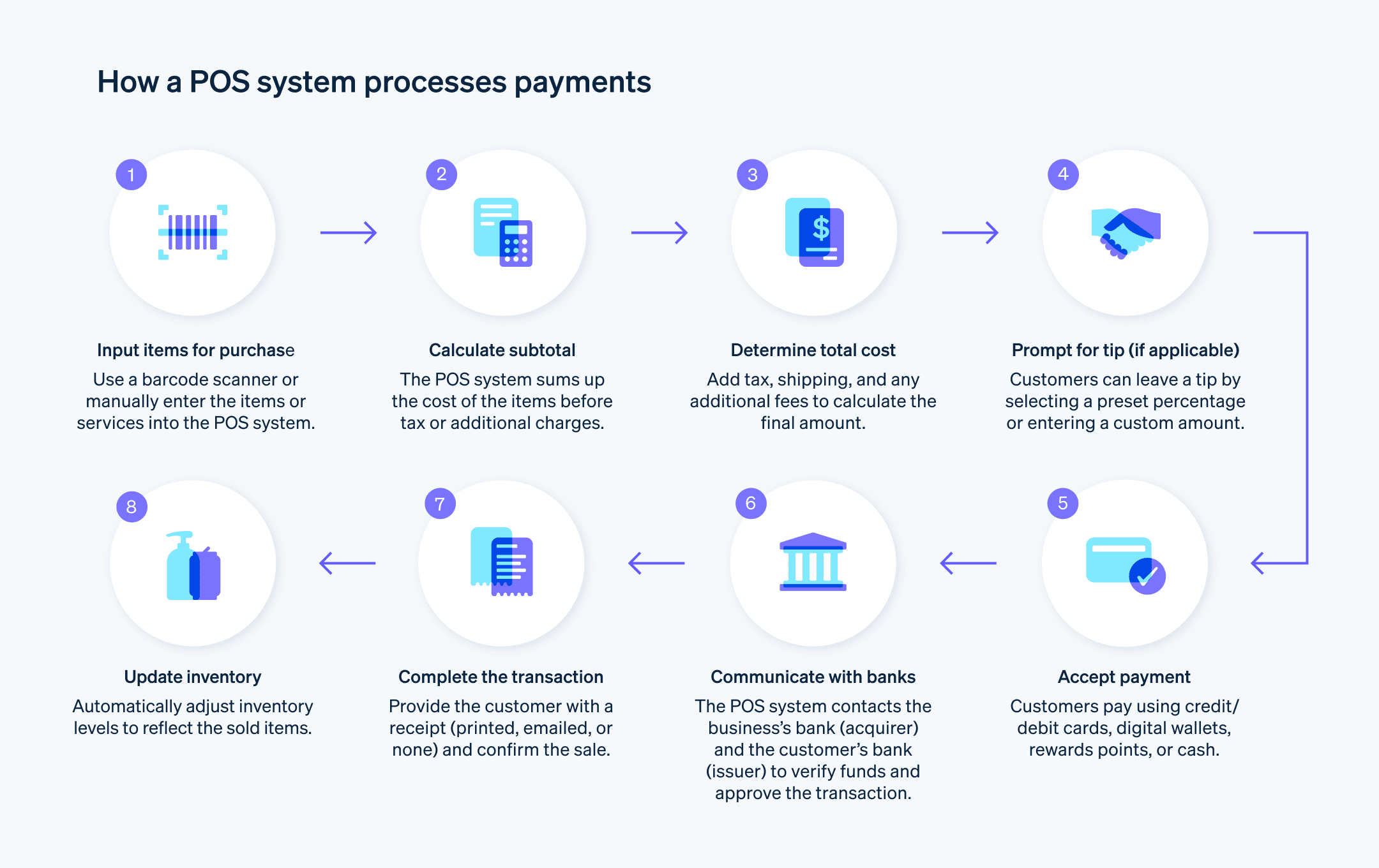

Hur POS-system fungerar beror på komponenterna, och dessa komponenter varierar beroende på företagets behov, men stegen som är involverade i att använda ett POS-system är desamma:

1. Ange artiklarna som ska köpas

Företaget "ringer upp" kunden genom att kommunicera med POS-systemet om vad som köps och hur mycket det kostar. Hur detta ser ut beror på vad kunden köper. Om kunden köper fysiska varor i en butik kan en anställd använda en streckkodsläsare för att visa varorna på den anslutna enheten som de använder med sitt POS-system, till exempel en iPad.

Om kunden betalar för en tjänst, t.ex. en terapisession eller trädgårdsarbete, kan handlaren välja tjänsten från en meny i POS-systemet på sin smartphone eller manuellt mata in priset och anteckningar om de tjänster som tillhandahålls.

2. Beräkna delsumman

POS-systemet beräknar delsumman, vilket är den totala kostnaden för allt som kunden köper innan ytterligare avgifter, till exempel skatt, läggs till.

3. Fastställ skatt, frakt och totalkostnad

POS-systemet beräknar den totala kostnaden, inklusive pris, skatt och frakt.

4. Uppmana kunden att lägga till dricks (om tillämpligt)

Dricks är inte relevant för alla transaktioner, men de flesta kassaflöden innehåller ett alternativ för att uppmana kunderna att lämna dricks, antingen genom att välja från en rad standardalternativ (vanligtvis 10–25 %) eller genom att lägga till ett anpassat belopp.

5. Ta emot betalning

När POS-systemet har beräknat den totala kostnaden för transaktionen skickar kunden betalningen. De flesta POS-terminaler är integrerade med betalleverantörer som tar emot mängd olika betalningsmetoder, inklusive kredit- och bankkort, kort och e-plånböcker som använder NFC-drivna kontaktlösa betalningar, presentkort, belöningspoäng och kontanter.

6. Kommunicera med inlösande och utfärdande banker

Om en kund använder en betalnings metod som utnyttjar ett externt konto, till exempel ett kreditkort, bankkort eller en e-plånbok, kommer betalleverantören att överföra transaktionsuppgifterna till företagets bank – kallad "inlösande bank" eller "inlösare". Inlösaren kommunicerar med kundens bank – kallad "utfärdande bank" eller "utfärdare" – för att få transaktionen godkänd. Detta tar vanligtvis bara ett par sekunder.

7. Slutföra transaktion

När transaktionen har godkänts och betalningen har godtagits kan kunderna vanligtvis välja att få ett utskrivet kvitto, ett kvitto via e-post eller inget kvitto alls.

8. Uppdatera lager

Vissa POS-system uppdaterar också lager baserat på vad som har sålts och erbjuder en realtidsvy av varor – vilket är viktigt för att beställa nya varor och förhindra återkrediteringar.

Så kan Stripe hjälpa till

Stripe Terminal driver och integrerar med POS-system för snabbväxande startup-företag, plattformar och företag som söker ledande betalningsprestanda och funktioner. Läs vår dokumentation för mer information.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.