Global online payment fraud losses in 2022 reached $41 billion, a figure expected to balloon to $48 billion by the end of 2023. Combating payment fraud—and mitigating its devastating financial and reputational damage—has become a top priority for businesses. Beyond payment fraud’s immediate financial losses, businesses also face potential erosion of customer trust and loyalty, as well as increased scrutiny from regulators and law enforcement agencies. To combat this growing threat, organizations are turning to machine learning.

Machine learning, a subfield of artificial intelligence (AI), offers a powerful and adaptive solution to tackle the complex and evolving nature of payment fraud. By mobilizing large datasets and advanced algorithms, machine learning can identify patterns and anomalies that indicate fraudulent behavior, making it possible for businesses to detect and prevent fraud in real time. Ultimately, machine learning can help businesses uphold a secure environment around payments to protect their customers, revenue, and reputation.

We’ll cover the benefits of machine learning for fraud prevention and how businesses can use this tool in different payment scenarios.

What’s in this article?

- What is machine learning?

- How is machine learning used in fraud prevention and detection?

- Machine learning fraud certification

- Examples of machine learning for fraud detection

How AI is transforming payments: Strategies for unlocking revenue growth

Learn how AI can optimize the entire payments lifecycle—from checkout to dispute management—to help you increase revenue, reduce costs, and provide a better customer experience. Download the report.

What is machine learning?

Machine learning is a subfield of AI that focuses on developing algorithms and models that give computers the ability to learn from data, identify patterns from within the data, and make decisions based on their learnings.

There are three main types of machine learning:

Supervised learning

Supervised learning is a type of machine learning in which a computer is taught to make predictions or decisions based on examples. Think of it like a student learning from a teacher: the teacher provides the student with a set of problems and correct answers to those problems, and the student studies these examples, learning to recognize patterns. When the student faces a new problem, they can use their previous knowledge to find the correct answer.

In supervised learning, the computer algorithm is given a dataset with both the input data (problems) and the correct output (answers). The algorithm studies this dataset and learns the relationship between the input and output. Eventually, the algorithm can make predictions or decisions for new data that it has not seen before.

Unsupervised learning

Unsupervised learning is a type of machine learning in which a computer learns to identify patterns or structures in data without being given any specific examples or correct answers. This is similar to how a detective would try to solve a case without any initial leads—by looking for clues and connections in the available information to uncover hidden patterns or relationships. In unsupervised learning, the computer algorithm is given a dataset with only input data, without any corresponding correct outputs (answers). The algorithm’s job is to analyze this data and discover underlying patterns.

Reinforcement learning

Reinforcement learning is a type of machine learning in which a computer learns to make decisions by interacting with an environment and receiving feedback in the form of rewards or penalties. Think of how you might train a dog to perform tricks. When the dog performs the trick correctly, you offer it a treat (a reward), and when the dog doesn’t do the trick, you may give it a gentle correction (a penalty). Over time, the dog learns to perform the trick correctly to maximize the number of treats it receives.

In reinforcement learning, the computer algorithm, often called an agent, explores an environment and makes decisions. For each decision it makes, it receives feedback as either a reward or a penalty. The algorithm’s goal is to learn the best strategy, or policy, to make decisions that maximize its cumulative rewards over time. It does this through trial and error, adapting and improving its strategy based on the feedback.

Machine learning techniques are used in many different scenarios, including natural language processing, image and speech recognition, medical diagnosis, financial analysis, and autonomous vehicles.

How is machine learning used in fraud prevention and detection?

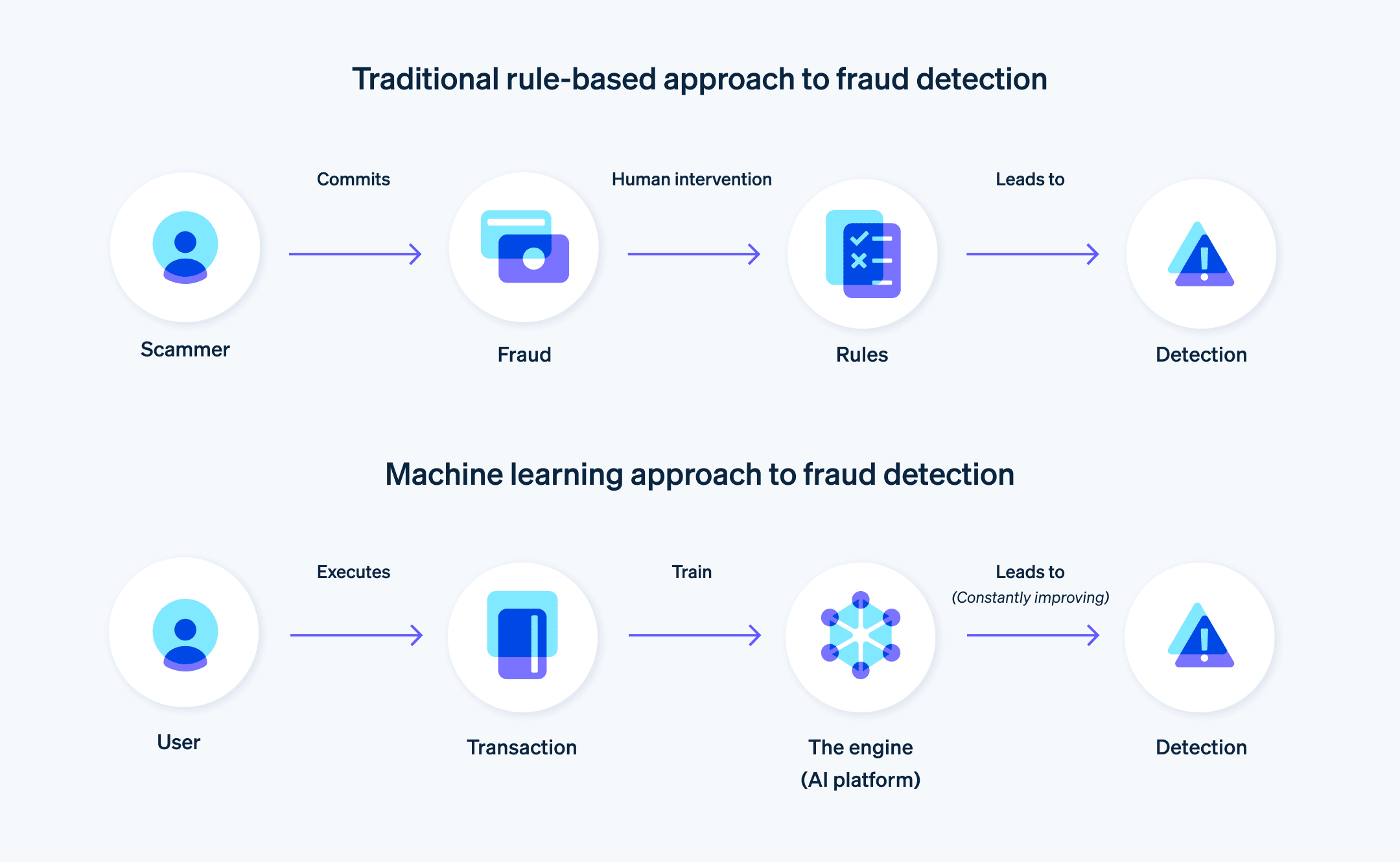

Increasingly, machine learning is being used in fraud prevention and detection due to its ability to analyze large quantities of data, identify patterns, and adapt to new information. Some common applications of machine learning in fraud prevention include:

Anomaly detection

Machine learning algorithms can identify unusual patterns or deviations from normal behavior in transactional data. By “training” on historical data, the algorithms learn to recognize legitimate transactions and flag suspicious activities that may indicate fraud.Risk scoring

Machine learning models can assign risk scores to transactions or user accounts based on various factors, such as transaction amount, location, frequency, and past behavior. Higher risk scores indicate a higher likelihood of fraud, enabling organizations to prioritize their resources and focus on specific transactions or accounts that warrant further investigation.Network analysis

Fraudulent actors often collaborate and form networks to carry out their activities. Machine learning techniques like graph analysis can help uncover these networks by analyzing relationships between entities (such as users, accounts, or devices) and identifying unusual connections or clusters.Text analysis

Machine learning algorithms can analyze unstructured text data, such as emails, social media posts, or customer reviews, to identify patterns or keywords that may indicate fraud or scams.Identity verification

Machine learning models can analyze and verify user-provided information, such as images of identification documents or facial recognition data, to ensure that an individual is who they claim to be and prevent identity theft.Adaptive learning

One of the key strengths of machine learning is its ability to learn and adapt to new information. As fraudulent actors change their tactics, machine learning models can be retrained on new data, allowing them to stay up-to-date and better equipped to detect emerging fraud patterns.

Using machine learning in fraud prevention can be a powerful way for organizations to enhance their detection capabilities, reduce the risk of false positives, and improve overall security and customer experience.

Machine learning fraud certification

Machine learning fraud certification is a type of professional certification or training program that focuses on the application of machine learning techniques in fraud detection and prevention. The goal of this certification is to provide individuals with the knowledge, skills, and tools necessary to apply machine learning in the fight against fraud.

Machine learning fraud certification programs typically cover:

Fundamentals of machine learning: An introduction to the basic concepts and principles of machine learning, including supervised, unsupervised, and reinforcement learning techniques, as well as the most commonly used algorithms.

Data preparation and preprocessing: Techniques for cleaning, transforming, and preparing data for use in machine learning models, including how to handle missing or noisy data (corrupted or otherwise unusable data), feature engineering, and data normalization.

Model training and evaluation: Methods for training machine learning models, selecting appropriate algorithms, optimizing model parameters, and evaluating model performance using metrics such as accuracy, precision, recall, and F1 score (a measure of precision and recall).

Fraud detection techniques: An overview of various machine learning–based approaches used in fraud detection, such as anomaly detection, risk scoring, network analysis, text analysis, and identity verification.

Implementation and deployment: Best practices for implementing and engaging machine learning models in a production environment, including model versioning, monitoring, and maintaining model performance over time.

Ethics and regulations: A discussion of ethical considerations and regulatory compliance related to machine learning and fraud prevention, such as data privacy, fairness, and explainability (the ability to explain to a human what a machine learning model does from input to output).

Earning a machine learning fraud certification can help professionals demonstrate their expertise in this specialized field, making them valuable assets for organizations that want to improve their fraud detection capabilities. There are many types of professionals who may benefit from such a certification, including data scientists, analysts, fraud investigators, and cybersecurity specialists.

Examples of machine learning for fraud detection

Businesses that deal with customer payments can apply machine learning–based fraud detection and prevention for different payment scenarios:

In-person payments

Credit card fraud detection

Machine learning algorithms can analyze transaction data (e.g., time, location, amount, and business) to identify patterns and flag potentially fraudulent transactions in real time. For instance, if a customer’s card is used in two far-apart locations within a short time frame, the system can flag the transactions as suspicious.Point-of-sale (POS) anomaly detection

Machine learning can monitor POS transactions and identify unusual patterns. For instance, if an employee processed an unusually high number of refunds or discounts, that may indicate internal fraud or theft.

Mobile payments

Device fingerprinting

Machine learning models can analyze device-specific information (e.g., device model, operating system, IP address) to create a unique “fingerprint” for each user. This helps detect fraudulent activities, such as account takeovers or multiple accounts that are linked to a single device.Behavioral biometrics

Machine learning can analyze user behavior patterns, such as typing speed, swipe gestures, or app usage, to verify the user’s identity and detect any anomalies that may suggest fraud.

Ecommerce

Account takeover prevention

Machine learning can monitor user login patterns and detect unusual activities, such as multiple failed login attempts or login attempts from new devices or locations, which may indicate an account takeover attempt.Friendly fraud detection

Machine learning can identify patterns related to friendly fraud, in which customers make a purchase and later claim that the transaction was unauthorized or that they never received the product. Models can analyze factors such as customer purchase history, return rates, and chargeback patterns to flag potential friendly fraud cases.

Other relevant use cases

Invoice fraud detection

Machine learning can analyze invoices and related documentation to identify discrepancies, such as duplicate invoices, mismatched amounts, or suspicious vendor details, which may indicate fraud.Loyalty program fraud detection

Machine learning can monitor customer behavior within loyalty programs, such as points accumulation, redemptions, and account activity, to identify and flag potential fraud or abuse.

By implementing machine learning–based fraud detection and prevention systems, businesses can better protect themselves and their customers from fraud, reduce financial losses, and improve customer trust and satisfaction.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.