Chargeback fraud is a growing problem that affects businesses of all types and sizes. According to a report by Juniper Research, chargeback fraud cost businesses an estimated $20 billion in 2021. Chargebacks can occur for many reasons, including errors made by the business or customer dissatisfaction with a product or service.

However, customers sometimes use chargebacks to avoid returning items and seeking a refund, and fraudulent actors use them to steal from businesses. In both cases, the negative impacts of chargebacks can do serious harm to a business’s financial health and reputation.

The first step in detecting, preventing, and responding to chargeback fraud involves understanding what chargeback fraud is, how it works, and which businesses are the most vulnerable. Below is a brief overview covering what businesses need to know about chargeback fraud, including the steps you can take to minimize your risk and how to respond to fraudulent chargebacks when they occur.

What’s in this article?

- What are chargebacks?

- What is chargeback fraud?

- What types of businesses are affected by chargeback fraud?

- How to prevent chargeback fraud

- How chargeback fraud hurts businesses

- How Stripe can help

What are chargebacks?

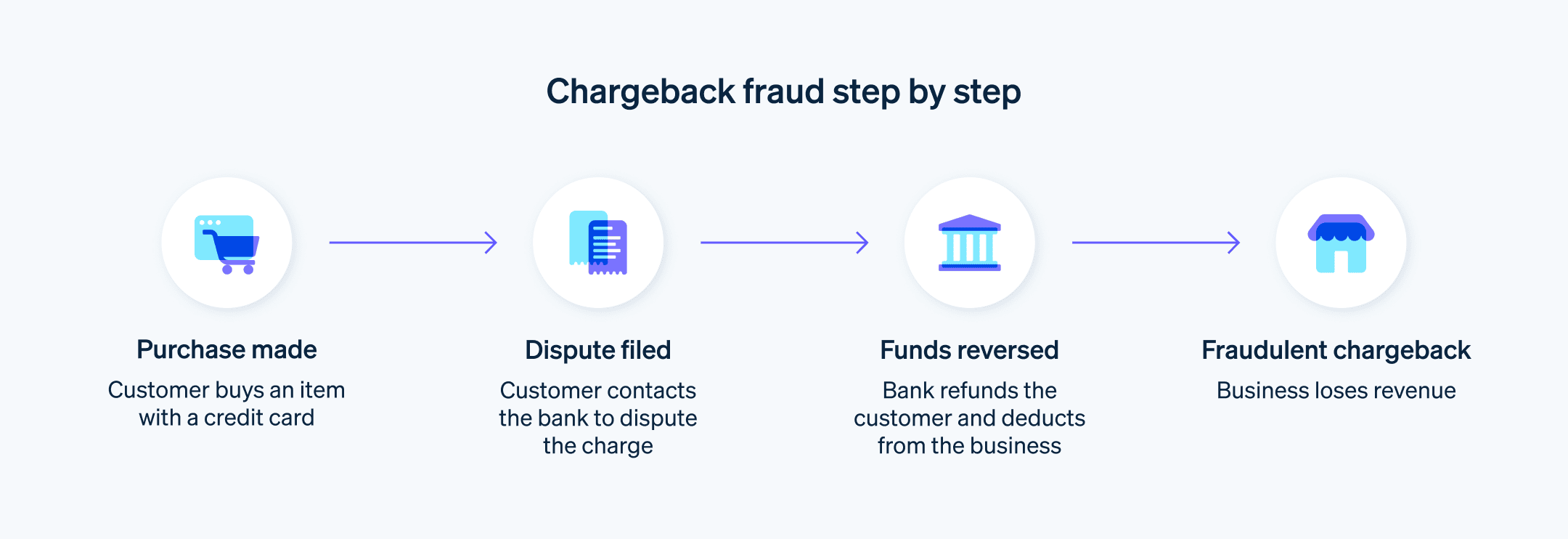

Chargebacks are a type of transaction reversal that occurs when a customer disputes a charge with their bank or credit card company. Chargebacks can occur for a variety of reasons, such as fraud, dissatisfaction with a product or service, or errors made by the business. When a chargeback occurs, the customer’s bank or credit card company refunds the disputed amount to the customer and deducts the amount from the business’s account.

For businesses, chargebacks can result in financial losses, damage to their reputation, higher fees from payment processors, and even losing the ability to accept credit card payments. To compound these issues, fraudulent actors sometimes use chargebacks as a tool to steal from businesses.

What is chargeback fraud?

Chargeback fraud occurs when a customer intentionally disputes a charge in order to receive a refund, while keeping the product or service. The customer may claim they did not receive the product, that the product was defective, or that the transaction was unauthorized. There are several types of chargeback fraud, including:

Friendly fraud

Friendly fraud occurs when a cardholder makes a legitimate purchase but later disputes the charge, claiming they did not authorize it or that the goods or services were not as described. Sometimes this happens when the cardholder forgets that they made the charge, doesn’t recognize it on the billing statement, and assumes it was fraud. In some cases of friendly fraud, the cardholder may even receive the merchandise and then file a chargeback, claiming that they never received it.Return fraud

Return fraud happens when an individual returns an item to a retailer, claiming that the product is faulty, defective, or otherwise not satisfactory—despite the fact that the product is in good condition or has been tampered with (or used). This often accompanies a chargeback request, particularly if the retailer’s return policy is unclear.Digital-goods chargebacks

Digital-goods fraud occurs when a customer disputes a charge for a digital product, such as a software license or online course, after accessing and using the product. This can be difficult for businesses to prevent, since the customer may have already downloaded the product—but the business cannot know this for certain.Subscription fraud

Subscription fraud occurs when a customer disputes a recurring charge for a subscription service, such as a streaming service, after receiving several months of service. The customer may claim they did not authorize the recurring charge or that they canceled the subscription but were still charged.

What types of businesses are affected by chargeback fraud?

Chargeback fraud can affect any business that accepts credit card payments, regardless of size or industry. However, some businesses are particularly vulnerable to chargeback fraud:

Businesses that sell high-value products or services, such as luxury goods or travel accommodations, are at higher risk of chargeback fraud, since fraudulent actors may see an opportunity to obtain the product or service for free by filing a fraudulent chargeback claim.

Online retailers and service providers have a higher risk of chargeback fraud. Online transactions are more difficult to verify than in-person transactions, making it easier for fraudulent actors to dispute charges and obtain refunds. Digital products such as software or online courses are particularly vulnerable to chargeback fraud, because the customer can easily claim they did not receive the product or did not find it satisfactory.

Subscription-based businesses, such as streaming services or subscription boxes, also have a higher risk of chargeback fraud. Customers may forget they signed up for the service or may not recognize the recurring charge on their credit card statement, leading them to dispute the charge and file a chargeback claim. Or customers may claim they did not authorize a subscription that they have, in fact, been using.

While these industries are especially high risk, any business that processes credit card transactions is at risk of chargeback fraud. Therefore, it’s important for businesses of all types and sizes to be aware of chargeback fraud and take proactive measures to protect themselves. This includes implementing fraud-prevention tools, providing excellent customer service, and managing chargebacks effectively.

How to prevent chargeback fraud

As diverse as chargeback fraud tactics are, there are a number of ways businesses can protect themselves. Here are measures that businesses can take to prevent and combat chargeback fraud:

Improve customer service

Improving customer service can reduce the likelihood of chargebacks resulting from dissatisfaction with a product or service. By providing top-notch customer service and making it as easy as possible for customers to reach you if they have a question or problem, businesses can address customer concerns and more effectively prevent customers from initiating chargebacks.Provide clear return and refund policies

Many chargebacks occur because it’s easier for customers to initiate a chargeback than it is to navigate a business’s return or exchange policy. One way you can reduce the number of fraudulent chargebacks is to simplify your return policy so that it’s as easy for customers as filing a chargeback. Creating detailed and accommodating return and refund policies—and clearly communicating these policies to customers—can prevent return fraud by ensuring that customers understand return and refund processes.Use robust fraud-prevention tools

Robust fraud-prevention tools, such as Stripe Radar, can detect and prevent fraudulent transactions before they result in chargebacks. Radar uses machine-learning algorithms to analyze transaction data and flag suspicious activity.Manage chargebacks effectively

Effective chargeback management can help businesses dispute fraudulent chargebacks and recover lost revenue. Businesses should track chargeback data, analyze the reasons for chargebacks, and dispute those that are fraudulent or unwarranted.

For a deeper exploration of how businesses can prevent chargebacks, see our guide.

How chargeback fraud hurts businesses

Chargeback fraud can have a significant negative impact on businesses of all sizes. For small- and medium-sized businesses, which tend to operate with tighter margins, the financial hit from chargebacks can be even greater. For large enterprises, each individual chargeback might not do as much damage, but there’s a greater possibility for chargeback fraud to take place on a larger scale—which can quickly add up. Here are some ways in which chargeback fraud can affect businesses:

Financial losses

Like other types of fraud, chargeback fraud can result in significant financial losses for businesses. In addition to losing revenue from fraudulent transactions, businesses may also have to pay chargeback fees and other associated costs. If chargebacks become too frequent or severe, they can contribute to insolvency for the business.Damage to reputation

Frequent chargebacks can lead to negative reviews and social media comments that harm a business’s image and credibility. If a brand becomes associated with fraud, customers may view the business as unreliable or risky, which can lead to reduced customer loyalty and the loss of future sales.Operational costs

Dealing with chargebacks can be time-consuming and expensive for businesses. Businesses may have to spend a significant amount of time and resources investigating chargebacks, providing evidence, and disputing fraudulent claims, which can divert resources from growing the customer base, developing and launching new products or services, and focusing on retention efforts. Any amount of time a business spends fighting chargebacks is time they’re not spending on nurturing the business.Increased fraud-prevention costs

To prevent chargeback fraud, businesses may need to invest in additional fraud-prevention measures such as fraud-detection software, security systems, and staff training. These additional costs can add up quickly and impact a business’s bottom line.High chargeback ratios

If a business has a high chargeback ratio (the number of chargebacks compared to the number of sales), it can result in penalties from payment processors or credit card issuers. High chargeback ratios can also lead to higher processing fees or the loss of merchant accounts.

How Stripe can help

Stripe’s range of commerce solutions for businesses of all sizes and stages encompasses sophisticated and aggressive fraud-prevention and fraud-detection measures—including protection against chargeback fraud. Here are some ways Stripe empowers customers to fight chargebacks and other commerce-related fraud:

Automated chargeback responses

Stripe offers automated chargeback responses, which can help businesses respond to chargebacks quickly and efficiently. When a business receives a chargeback, Stripe can automatically generate a response based on predefined rules and evidence, saving businesses time and energy.Chargeback-management tools

Stripe offers chargeback-management tools that can help businesses effectively manage chargebacks when they do occur. These tools provide businesses with detailed information about chargebacks, including the reason for the chargeback and the evidence needed to dispute it. This can help businesses make informed decisions about whether to dispute a chargeback or issue a refund.Easy dispute-evidence submission

Stripe provides businesses with a simple and streamlined process for submitting evidence to dispute chargebacks. Businesses can upload evidence directly to their Dashboard, including receipts, shipping information, and customer communication. This can help businesses dispute fraudulent chargebacks and recover lost revenue.

Stripe’s chargeback protection sits within a broad suite of fraud-detection tools, working in combination with Stripe Radar, that can help businesses identify and prevent fraudulent transactions before they result in chargebacks. These tools use machine-learning algorithms to analyze transaction data and identify patterns that may indicate fraud. By working with Stripe to detect and prevent fraudulent transactions, businesses can reduce the risk of chargeback fraud.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.