Embora os pagamentos digitais possam receber mais atenção, os pagamentos MOTO – aqueles feitos por correio e por telefone – ainda ocupam um lugar importante no ecossistema de pagamentos. Qualquer empresa que lida com pedidos por correio e telefone, ou está pensando em adicionar essas opções, precisa entender como implantar pagamentos MOTO de forma segura e estratégica. Abaixo, explicaremos como lidar com pagamentos MOTO no contexto de pagamentos digitais.

O que você encontrará neste artigo?

- O que são pagamentos MOTO?

- Como funcionam os pagamentos MOTO?

- Benefícios dos pagamentos MOTO

- Desvantagens dos pagamentos MOTO

- Como aceitar pagamentos MOTO como empresa

- Quanto custam os pagamentos MOTO?

- Práticas recomendadas para pagamentos MOTO

- Como o Stripe Terminal pode ajudar

O que são pagamentos MOTO?

Os pagamentos MOTO são transações nas quais os clientes fornecem as informações de seu cartão de pagamento às empresas por telefone ou correio, em vez de pessoalmente ou online. A sigla MOTO significa "mail order/telephone order (pedido por correspondência/pedido por telefone)". As empresas usam essas transações paraprocessar pagamentos quando o cartão de débito ou crédito de um cliente não está fisicamente presente. Os pagamentos MOTO eram mais comuns antes do aumento doe-commerce, embora algumas empresas ainda os usem.

Para fazer um pagamento MOTO, o cliente fornece os dados do cartão, que a empresa insere em um sistema de pagamento para concluir a transação. Este processo requer protocolos específicos para garantir a segurança e autenticidade das informações de pagamento fornecidas.

Como funcionam os pagamentos MOTO?

O comércio online introduziu formas de pagamento tecnologicamente avançadas que oferecem maior segurança e conveniência do que os pagamentos MOTO. No entanto, as transações MOTO permanecem relevantes para certos tipos de negócios e clientes. Apesar de sua simplicidade, eles exigem atenção aos detalhes e aderência aprotocolos de segurança para mitigar riscos e fornecer uma opção de pagamento confiável.

Os pagamentos MOTO acontecem quando uma empresa processatransações de crédito ou débito sem a presença física do cartão. O processo normalmente funciona da seguinte forma:

Um cliente decide fazer umacompra por telefone ou por meio de um formulário de pedido de e-mail/correspondência. O cliente então fornecem as informações do cartão verbalmente ou no formulário, incluindo o número do cartão, a data de validade e, às vezes, ocódigo CVV.

O empresa então insere manualmente essas informações em um terminal de pagamento ou umterminal virtual, uma plataforma de pagamento web acessível em um computador ou dispositivo com acesso à Internet.

Para pedidos por telefone, as empresas podem usar um sistema de resposta interativa de voz (IVR) que solicita que o cliente informe os dados do cartão pelo teclado do celular. Isso pode aumentar a segurança, já que a empresa não processa os dados do cartão diretamente.

Uma vez que os detalhes são digitados, o processador de pagamento se comunica com a rede cartão e o banco emissor para autorizar a transação. Isso envolve verificar a validade do cartão, garantir que fundos suficientes estejam disponíveis e aplicarmedidas anti-fraude.

Depois daautorização, o transação é alinhada para liquidação de fundos que são reservados para serem transferidos. No entanto, eles não são transferidos até o final do dia útil, quando a empresa envia todas as transações do dia ao operador para liquidação de fundos.

Durante a liquidação, os fundos são transferidos do banco emissor para aconta do comerciante, menos as taxas cobradas pelo processador de pagamentos. Essa etapa pode levar alguns dias, dependendo do processador de pagamentos e dos bancos envolvidos.

Os pagamentos MOTO também podem envolver outras formas de pagamento, como clientes enviando cheques em papel, fornecendo suas informações de conta bancária para umatransferência bancária, ou mesmo pagando com dinheiro na entrega ou faturamento pós-compra.

Quaisquer que sejam as formas de pagamento que sua empresa use, você deve manter uma documentação completa das transações MOTO para manutenção de registros e resolução de contestações. Isso inclui a data, o valor, a descrição dos bens ou serviços e quaisquer identificadores de cliente.

Benefícios dos pagamentos MOTO

Embora os pagamentos MOTO não sejam necessários para todos os tipos de empresas, eles ainda são relevantes para alguns. Considere se a incorporação de pagamentos MOTO faz sentido para sua empresa. Se isso acontecer, esse tipo de pagamento pode trazer benefícios substanciais, principalmente em termos de acessibilidade e alcance de mercado. Aqui está uma visão geral:

Eles não necessitam de acesso à internet

Os pagamentos MOTO quebram a barreira do acesso à internet. Isso é especialmente importante para alcançar clientes em áreas com pouca ou nenhuma conectividade online, ou grupos demográficos mais velhos que podem estar menos inclinados a fazer compras online. Ao oferecer uma opção de pagamento por telefone ou correio, as empresas podem atender segmentos da população que de outra forma estavam excluídos da economia digital.Ampliação da base de clientes

Ao acomodar uma gama diversificada de preferências de pagamento, as empresas podem oferecer aos clientes uma escolha e atender ao seu nível de conforto. Isso pode facilitar a atração de clientes que hesitam em inserir os dados do cartão online por motivos de segurança ou aqueles que simplesmente preferem falar com um representante por telefone.Comunicação pessoal com potenciais clientes

Para determinados modelos de negócios, como itens de alto valor ou serviços personalizados, em que o atendimento aprofundado ao cliente é essencial, os pagamentos MOTO podem resultar em uma transação mais personalizada. Durante um telefonema, por exemplo, a equipe pode fornecer aconselhamento personalizado, vender serviços ou produtos adicionais e construir um relacionamento que aumente a fidelidade do cliente.Sem dependência de sites ou fluxos de checkout estruturados

Durante os horários de pico ou eventos de alta participação, as empresas podem lidar rapidamente com os pedidos sem exigir que os clientes esperem o carregamento das páginas do site. Isto reduz carrinhos abandonados e vendas perdidas.

Os pagamentos MOTO ainda estão sujeitos a medidas de segurança modernas. As empresas devem aderir a padrões de segurança rígidos para proteger as informações do cliente, usando ferramentas comoserviço de verificação de endereço (AVS) e verificação CVV, o que pode fazer com que os clientes se sintam mais seguros sobre suas transações.

Os sistemas de pagamento digital complementar de pagamentos MOTO, permitem que as empresas forneçam uma combinação de serviços de cliente tradicionais e modernos e demonstrem compromisso com a conveniência e a inclusão cliente.

Desvantagens dos pagamentos MOTO

Os pagamentos MOTO vêm com riscos e desafios que as empresas devem considerar, incluindo:

Aumento do potencial de fraude

Sem um cartão físico, é mais difícil verificar se a pessoa que faz o pagamento é o legítimo titular do cartão. Atores fraudulentos podem tentar usar dados do cartão roubado, sabendo que não há necessidade de apresentar o cartão em si.

Estratégia de mitigação: use medidas de segurança como AVS e exija o código CVV do cartão. Além disso, implemente a autenticação de dois fatores sempre que possível, como enviar um código de confirmação para o celular do titular do cartão.

Estornos e contestações

Há uma probabilidade maior de estornos com pagamentos MOTO, porque os clientes podem não reconhecer um cobrar em seu extrato ou afirmar que nunca autorizaram a transação.

Estratégia de mitigação: Mantenha registros detalhados de transações e interações com clientes. A gravação de chamadas (com consentimento) e o uso de formulários de pedido assinados podem fornecer comprovantes em resoluções de disputas.

Preocupações com a segurança dos dados

O manuseio de informações de pagamento confidenciais por telefone ou correio envolve riscos de violações de dados e acesso não autorizado.

Estratégia de mitigação: Cumpra os requisitos do Padrão de Segurança de Dados do Setor de Cartões de Pagamento (PCI DSS), treine a equipe sobre segurança de dados e garanta que todas as informações escritas sejam armazenadas com segurança e destruídas adequadamente quando não forem mais necessárias.

Tarifas de processamento mais altas

Os processadores de pagamento geralmente cobrem mais por transações MOTO devido ao aumento do risco.

Estratégia de mitigação: Pesquise um processador de pagamentos com taxas competitivas e negocie taxas estabelecido o volume de suas transações e as medidas de segurança que você implementou.

Desafios operacionais

Aceitar pagamentos MOTO pode exigir mais esforço dos funcionários para processar pedidos e pode atrasar as operações, especialmente se você tiver um alto volume de chamadas.

Estratégia de mitigação: Simplifique o processo com sistemas eficientes de recebimento de pedidos (possivelmente uma IVR para chamadas) e treine a equipe para lidar com transações de forma rápida e precisa.

Verificação limitada de clientes

É difícil realizar certas verificações que são possíveis pessoalmente ou com transações digitais.

Estratégia de mitigação: Implementar outros processos de verificação desenvolvidos especificamente para pagamentos MOTO e treine a equipe para procurar sinais de alerta ou inconsistências nos pedidos que possam sugeriratividade fraudulenta.

As empresas que usam pagamentos MOTO devem entender esses riscos de forma proativa e empregar estratégias para mitigá-los. Embora os pagamentos MOTO sejam mais acessíveis, eles exigem maior vigilância e protocolos de segurança rigorosos para proteger empresas e clientes.

Como aceitar pagamentos MOTO como empresa

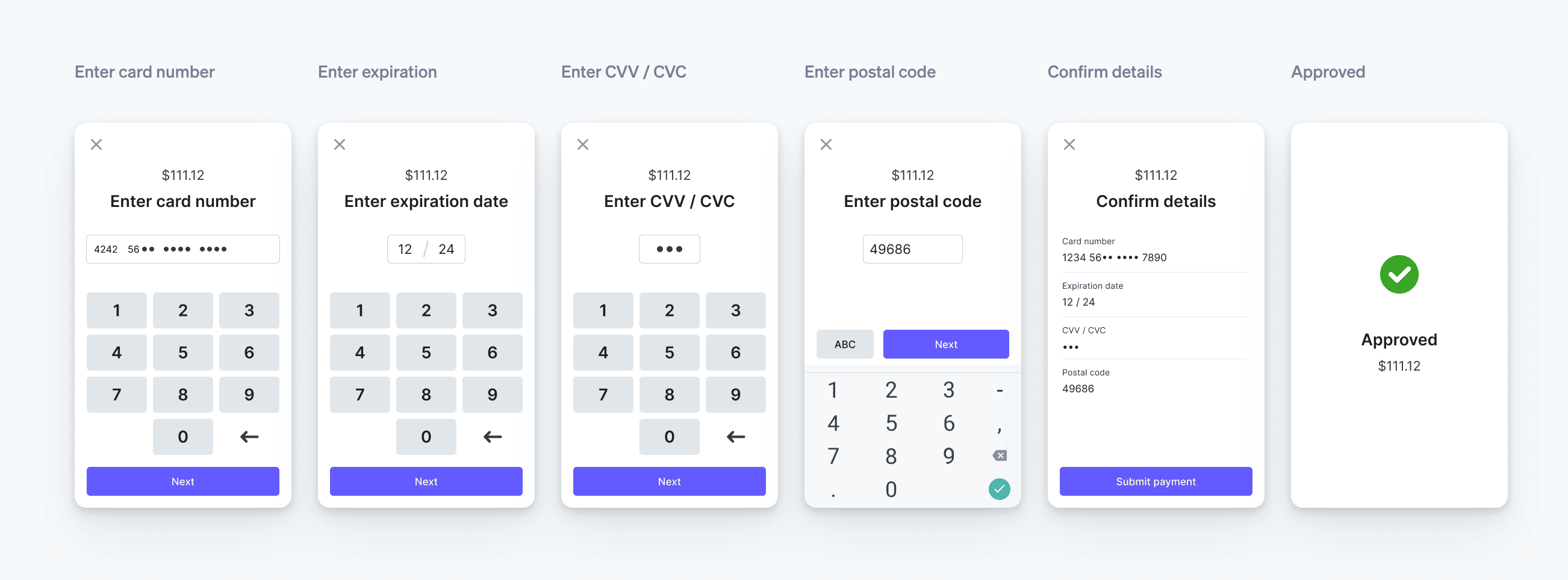

Colocar pagamentos MOTO significa entender a função dos terminais virtuais, que são aplicativos online que permitem que as empresas insiram manualmente os detalhes de pagamento recebidos por telefone ou correio. Eles são versões seguras estabelecido na web dos terminais físicos de ponto de venda (POS) usados em lojas de varejo e são essenciais para o processamento dessas transações.

Os terminais virtuais facilitam os pagamentos MOTO, fornecendo uma maneira segura e eficiente de inserir e processar pagamento informações remotamente. Eles são importantes para empresas que exigem uma solução flexível e confiável para transações com cartão não presente. Eles também mantêm registros de transações que as empresas podem acessar facilmente para relatórios, reembolsos ougerenciamento de estorno.

As empresas interessadas em aceitar pagamentos MOTO devem considerá-los como parte de uma estratégia geral para oferecer soluções de pagamento abrangentes a seus clientes. Aqui está um guia passo a passo para aceitar pagamentos MOTO:

Abra uma conta de comerciante: Comece estabelecendo umaconta de comerciante que está habilitada para transações MOTO. Este é um tipo de conta bancária que permite às empresasaceitarem pagamentos de cartão de crédito e débito.

Escolha um processador de pagamentos: Feche uma parceria com um processador de pagamentos que aceite pagamentos MOTO. O processador deve fornecer um terminal virtual como parte do serviço.

Faça uma verificação de segurança: Confirme se o terminal virtual é compatível com PCI DSS. Configure medidas de segurança adicionais, como verificações AVS e verificação CVV, para reduzir o risco defraude em transações com cartão-não-presente.

Integre o terminal virtual: Integre o terminal virtual às operações da sua empresa. Para isso, pode ser preciso configurá-lo em várias estações de trabalho ou torná-lo acessível a equipes remotas.

Treine o pessoal: Treine sua equipe para usar o terminal virtual. Eles devem entender como processar pagamentos e manter a segurança e a privacidade ao lidar com informações sigilosas do cliente.

Processe uma transação: Para processar um pagamento MOTO, insira os dados de pagamento do cliente no terminal virtual, verifique as informações e envie-as para autorização.

Autorize a transação: O terminal virtual se comunica com o processador de pagamentos para autorizar a transação, garantindo a validade do cartão e a disponibilidade dos fundos.

Conclua a transação: Se a autorização for bem-sucedida, finalize a transação concluindo o pagamento e os fundos serão liquidados para sua conta de comerciante.

A Stripe viabiliza interações financeiras para empresas de todos os tamanhos, e seu terminal virtual está configurado para aceitar pagamentos MOTO. Siga algumas etapas importantes ao processar essas transações com a Stripe:

Crie uma Intenção de Pagamento: Isso é uma declaração aos sistemas da Stripe de que você pretende cobrar o cartão de um cliente. Ao configurar uma Intenção de Pagamento para um pagamento MOTO, você especifica que a forma de pagamento será um cartão.

Processe o pagamento: Usando oTerminal Stripe ouinterface de programação de aplicativos (API), processe o pagamento marcando-o especificamente como um transação MOTO. Isso envolve inserir o número do cartão do titular do cartão, CVC, data de validade e código postal no sistema.

Verifique o estado do leitor: Se estiver usando hardware, verifique se o terminal está no estado correto (como ocioso, aguardando entrada, processando uma transação ou no modo de erro) para processar o pagamento.

Capture o pagamento: Para finalizar a transação, capture o pagamento. Se o status da Intenção de Pagamento for

requires_capture, você precisa confirmar a captura para mover os fundos.

Quanto custam os pagamentos MOTO?

Aceitar pagamentos MOTO normalmente custa um pouco mais do que outros pagamentos com cartão. As taxas de processamento de cartão incluem uma porcentagem do valor da transação, mais uma tarifa fixa, e muitos provedores cobram uma porcentagem maior para pagamentos MOTO devido ao aumento do risco de fraude. Você pode aprender mais sobrePreços da Stripe para pagamentos MOTO aqui.

Práticas recomendadas para pagamentos MOTO

Para pagamentos MOTO, considere as seguintes práticas recomendadas:

Autenticação por voz: Implemente a tecnologia de autenticação por voz. Com o consentimento, as impressões de voz dos clientes podem ser usadas como uma ferramenta de verificação exclusiva para transações telefônicas, aumentando a segurança.

Identificação da linha de chamada: Use recursos de identificação de linha de chamada para comparar chamadas recebidas com um banco de dados de riscos de fraude conhecidos ou transações fraudulentas anteriores, fornecendo um sinalizador imediato para chamadas potencialmente arriscadas.

Conversão dinâmica de moedas: Ofereça aos seusclientes internacionais conversão dinâmicas de moedas. Isso permite que eles ouçam ou vejam o custo de sua compra em suas moedas locais, o que pode melhorar a confiança e a experiência do cliente.

Contas MOTO dedicadas: Configure contas de comerciante dedicadas para transações MOTO para separá-las de outros canais de vendas. Isso pode ajudá-lo a categorizar egerenciar possíveis fraudes de forma mais eficaz.

Tokenization para clientes recorrentes: Use atokenização para armazenar com segurança informações cliente pagamento para compras repetidas. Os tokens são inúteis se interceptados por agentes fraudulentos.

Pontuação de fraude personalizada: Desenvolva um sistema de pontuação de fraudes adaptado ao perfil das transações MOTO, considerando fatores como tamanho da compra, frequência e eventuais anomalias nos padrões de pedidos.

Direcionamento inteligente de chamadas: O roteamento inteligente de chamadas direciona os clientes recorrentes para os agentes com quem já conversaram antes. Esses agentes podem ajudar a detectar se algo está errado com uma transação de um cliente regular.

Análise pós-transação: Faça análises pós-transação com análise de dados para identificar padrões que possam indicar fraude. Isso pode incluir a análise do tempo necessário para fazer um pedido, alguma hesitação em fornecer informações ou inconsistências nos detalhes do pedido.

Opções de pagamento por IVR: Ofereça um sistema de IVR para clientes que preferem não fornecer os dados do cartão diretamente a um agente. Isso pode reduzir erros humanos e exposição de dados.

Educação dos clientes: Eduque proativamente os clientes sobre como uma transação MOTO vai prosseguir, quais informações eles precisarão fornecer e como podem verificar a legitimidade da chamada se não tiverem certeza.

Verificação de acompanhamento: Para transações grandes ou incomuns, use uma chamada de verificação de acompanhamento ou envie uma mensagem de texto com um código único que o cliente deve fornecer para finalizar a venda.

Avaliações regulares da equipe: Avalie regularmente a equipe que lida com pagamentos MOTO para confirmar se eles estão seguindo os protocolos de segurança corretos.

Conformidade com PCI: Empresas que aceitam pagamentos MOTO precisam cumprir o PCI DSS para proteger os dados dos titulares de cartão. Esses padrões incluem armazenar com segurança registros de transações e não reter dados de autenticação confidenciais após a autorização.

Como o Stripe Terminal pode ajudar

O Stripe Terminal permite que as empresas cresçam receita com pagamentos unificado em canais presenciais e online. Ele oferece suporte a novas formas de pagamento, logística de hardware simples, cobertura global e centenas de integrações de POS e comércio para projetar sua pilha de pagamentos ideal. Você pode processar pagamentos MOTO usando Stripe Terminal simplesmente inserindo as informações do cartão no máquina de cartão em vez de tocar ou inserir um cartão físico.

A Stripe oferece comércio unificado para marcas como Hertz, URBN, Lands’ End, Shopify, Lightspeed e Mindbody.

O Stripe Terminal pode ajudar você a:

Comércio unificado: Gerencie pagamentos online e presenciais em uma plataforma global com dados de pagamentos unificados.

Expansão global: Venda para 24 países com um único conjunto de integrações e formas de pagamento populares.

Integração da sua maneira: Desenvolva seu próprio aplicativo de POS personalizado ou conecte com seu ambiente tecnológico existente usando integrações comerciais e POS de terceiros.

Simplificar a logística de hardware: Peça, gerencie e monitore facilmente como máquinas de cartão compatíveis com a Stripe, onde quer que estejam.

Saiba mais sobre o Stripe Terminal ou comece já.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.