Uma transação sem apresentação de cartão (CNP) é uma compra feita remotamente, sem processar um cartão físico em máquina de cartão ou terminal (e inserção manual do PIN). Forma de compra cada vez mais popular, as transações CNP cresceram 23% em 2021. Por isso, é importante que as empresas que vendem online entendam como aceitá-las com segurança.

Explicamos os diferentes tipos de transações CNP, por que elas podem apresentar um risco de fraude e como aceitá-las com segurança.

Neste artigo:

- O que é uma transação CNP?

- Por que as transações CNP apresentam risco de fraude

- Como aceitar transações CNP com segurança:

- Online

- Por telefone

- Presencial e manualmente

- Online

- Tarifas e custos de processamento de transações CNP

O que é uma transação CNP?

Para ser considerada uma transação CNP, nem o cartão de crédito nem o titular do cartão podem estar presentes durante o pagamento.

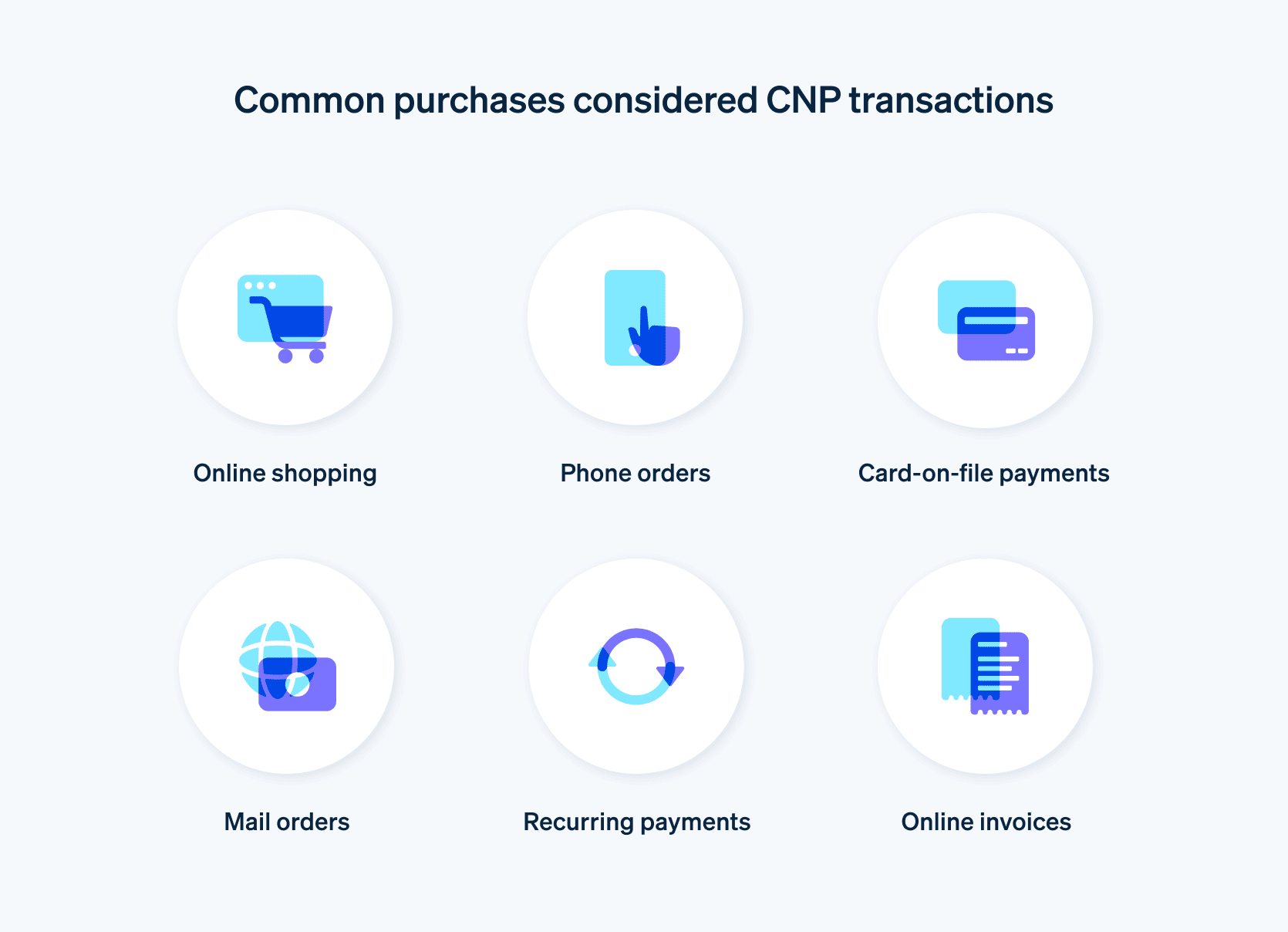

Muitas compras comuns são consideradas transações CNP, incluindo:

Compras online: o cliente compra produtos ou serviços por um site ou link de pagamento, inserindo os dados do cartão e o endereço de cobrança. Os pedidos podem ser enviados para o endereço de escolha do cliente ou retirados na loja.

Pedidos por telefone: o cliente faz uma compra por telefone, indicando os dados do cartão e de cobrança para um vendedor que processa a cobrança.

Pagamentos com cartão: o cliente paga a compra com a forma de pagamento que enviou previamente à empresa e aprovou para uso futuro.

Encomendas por correio: o cliente compra produtos ou serviços pelo correio, preenchendo os dados de cobrança em formulário físico e enviando-os à empresa. No passado,os clientes faziam pedidos pelo correio por meio de um catálogo da loja.

Pagamentos recorrentes: pagamentos automáticos deduzidos do cartão de crédito ou da conta bancária de um cliente em intervalos acordados, contra bens e serviços adquiridos numa assinatura. Quando o cliente faz o pagamento inicial, os dados de faturamento são armazenados no sistema da empresa e utilizados para cada pagamento subsequente.

Faturas online: o cliente usa um sistema de pagamento online para pagar uma fatura da empresa. O pagamento pode ser feito com formas de pagamento armazenadas ou novas, inclusive cartões de crédito e débito, transferências bancárias e carteiras digitais.

Por que as transações CNP apresentam risco de fraude

Como as transações CNP são processadas sem a presença física do cliente (ou do cartão de crédito) para verificação, abre-se uma oportunidade para fraudes. As fraudes de CNP acontecem quando as informações de faturamento do titular do cartão são comprometidas e obtidas por um indivíduo não autorizado que as utiliza para fazer compras. A pessoa que comete a fraude rouba as credenciais de pagamento do titular do cartão, como número do cartão, código CVC/CVV e data de validade, e usa esses dados para fazer compras.

Além de afetar o cliente, as fraudes de CNP reduzem a perda de receita das empresas, porque muitas fraudes geram estornos. Quando o cliente percebe uma transação falsa em seu cartão, pode contestar o pagamento junto ao banco emissor e solicitar um reembolso. Isso significa que a empresa não só perdeu o valor da venda, como também forneceu um produto ou serviço gratuito ao fraudador. A empresa também pode precisar pagar uma tarifa se incorrer em muitos estornos. Para empresas com maior risco de fraude com cartão, a Stripe oferece proteção adicional contra estorno.

Como aceitar transações CNP com segurança:

Devido aos vários problemas causados pelas fraudes CNP, é essencial oferecer o processo de pagamento mais seguro possível.

Veja a seguir diferentes maneiras de evitar fraudes de CNP com diferentes formas de pagamento:

Online

Na página de checkout online, capture o máximo possível de informações precisas do cliente, como tipo de cartão, número da conta, data de validade e CVC. Dados adicionais ajudam a garantir que o cliente tenha o cartão físico em seu poder, o que significa que é mais provável que ele seja o titular legítimo do cartão. Também ajuda a estabelecer um sistema de verificação de endereço (AVS), que pede ao cliente para verificar o endereço de cobrança e o código postal durante uma transação (já que a maioria dos golpistas não tem acesso a essas informações).

O Radar for Fraud Teams, um conjunto de ferramentas integradas à Stripe, é uma opção poderosa que ajuda os empresários a combater fraudes. O sistema de machine learning da plataforma analisa vastos conjuntos de dados de transações de clientes, como endereços IP geolocalizados e horários de checkout, para descobrir possíveis golpistas. Você pode definir uma lista de critérios, usando uma combinação de seus próprios dados de fraude e dados comportamentais da Stripe, para bloquear transações suspeitas e realizar análises manuais. Quando você mesmo aprova essas transações filtradas, fica mais bem preparado para detectar e interromper fraudes.

A página de checkout da Stripe permite capturar todas as informações de faturamento necessárias durante uma transação. Ela acelera e simplifica o processo de checkout para o cliente, com recursos inteligentes como busca de endereço, validação de cartão em tempo real e reconhecimento do emissor do cartão de crédito.

As regras são outro recurso do Radar que pode ajudar a combater fraudes. Elas permitem configurar filtros com seus próprios critérios para que pagamentos que cumpram critérios específicos de alto risco (por exemplo: o pagamento vem de uma região onde fraudes são frequentes) possam ser automaticamente bloqueados.

Por telefone

Se você receber um pedido por telefone, é importante proteger os dados recebidos do cliente em conformidade com os requisitos de PCI. Se você for cliente da Stripe, pode inserir manualmente uma cobrança com os dados recebidos por telefone pelo Dashboard.

Presencial e manualmente

Para transações presenciais, as empresas podem implementar verificações de identidade adicionais para reduzir o risco de fraude, como pedir um documento de identidade com foto. Os empresários também devem usar serviços de criptografia para proteger todos os dados de cartão armazenados.

Tarifas e custos de processamento de transações CNP

Embora as empresas paguem tarifas por cada transação com cartão de crédito, as taxas de processamento para CNP geralmente são mais altas do que aquelas para transações com cartões físicos, pois acarretam riscos adicionais. As tarifas dependem do setor e da margem do processador de pagamentos. Em geral, as tarifas e custos seguem a fórmula abaixo:

Percentual da transação + Custo fixo por transação

Para clientes da Stripe nos EUA, a tarifa é de 2,9% + 30 centavos por cobrança concretizada no cartão. Leia o nosso guia de preços para saber mais sobre as tarifas de mercado e os recursos incluídos.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.