En transaktion utan att kortet är närvarande (CNP) är ett köp som görs på distans, utan bearbetning av ett fysiskt kort via en kortterminal (och utan att manuellt ange en PIN-kod). Denna typ av transaktioner har blivit en allt populärare metod för att handla och ökade med 23 % under 2021, så det är viktigt att företag som säljer online förstår hur man tar emot dem på ett säkert sätt.

I den här artikeln förklarar vi de olika typerna av CNP-transaktioner, varför de kan utgöra en bedrägeririsk och hur man tar emot dem på ett säkert sätt.

Vad innehåller den här artikeln?

- Vad är en CNP-transaktion?

- Därför utgör CNP-transaktioner en bedrägeririsk

- Så här tar man emot CNP-transaktioner på ett säkert sätt:

- Online

- Via telefon

- Manuellt och i fysisk miljö

- Online

- Avgifter och kostnader för behandling av CNP-transaktioner

Vad är en CNP-transaktion?

För att kategoriseras som en CNP-transaktion får varken kreditkortet eller kortinnehavaren vara närvarande vid betalningen.

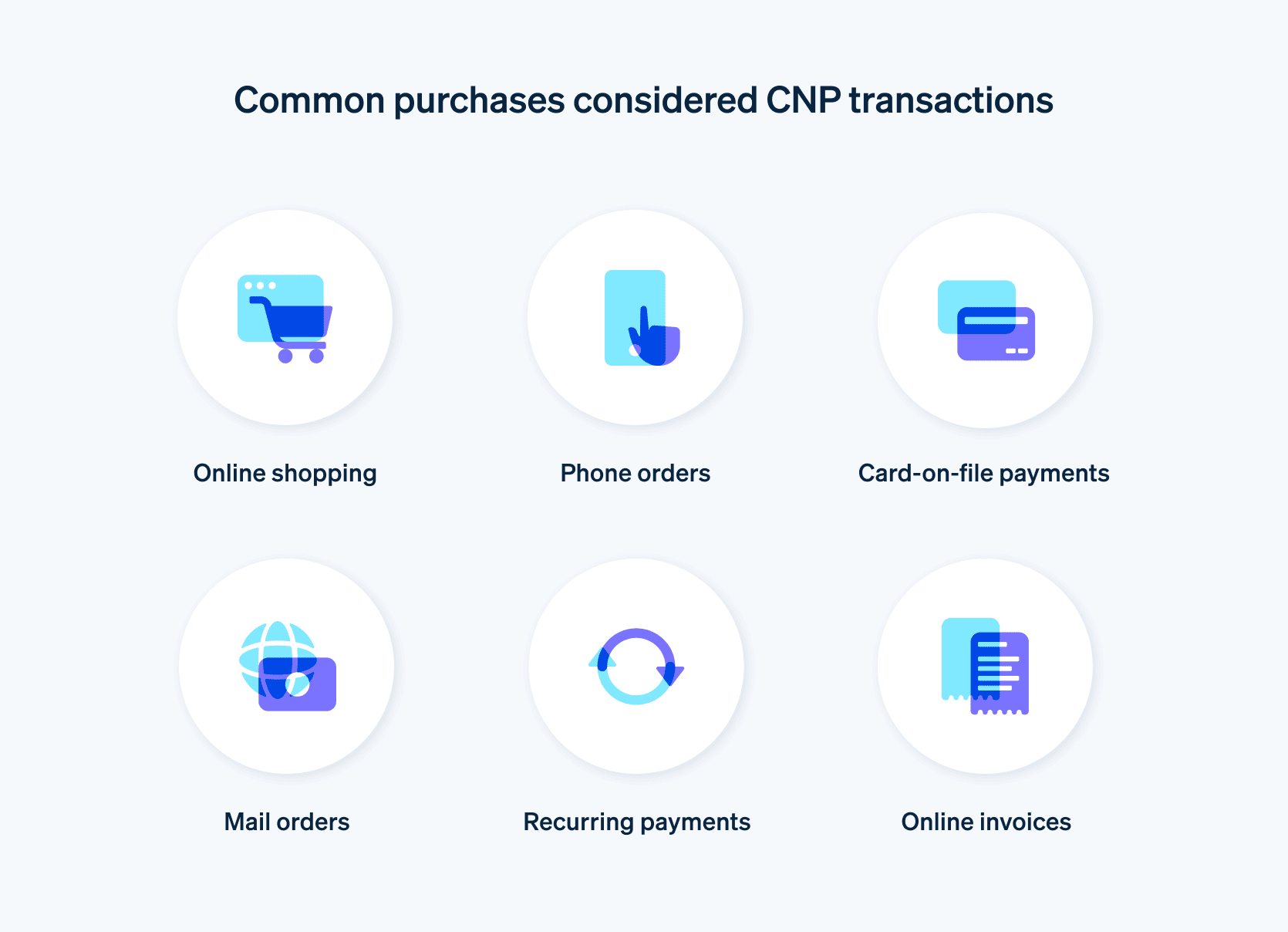

Många vanliga köp betraktas som CNP-transaktioner, inklusive:

När man handlar på nätet: En kund köper varor eller tjänster via en webbplats eller betalningslänk genom att ange sina kortuppgifter och faktureringsadress. Beställningar kan skickas till kundens valda adress eller hämtas i butik.

Beställning via telefon: En kund gör ett köp via telefon genom att uppge sina kortuppgifter och sin faktureringsinformation till en säljare som behandlar debiteringen.

Betalningar med sparat kort: En kund betalar för ett köp med en betalningsmetod som de tidigare skickat till företaget och godkänt för framtida användning.

Postorder: En kund köper varor eller tjänster via postorder genom att fylla i sin faktureringsinformation på ett fysiskt beställningsformulär och skicka det till företaget. Historiskt sett har kunder beställt på postorder genom kataloger.

Återkommande betalningar: Detta är automatiska betalningar som dras från en kunds kreditkort eller bankkonto enligt ett överenskommet intervall för varor och tjänster som köps som en del av ett abonnemang. När kunden gör den första betalningen sparas kundens faktureringsinformation i företagets system och används vid varje efterföljande betalning.

Onlinefakturor: En kund använder ett onlinebetalningssystem för att betala en faktura från ett företag. Dessa kan betalas med antingen sparade eller nya betalningsmetoder, inklusive kredit- och bankkort, banköverföringar och digitala plånböcker.

Därför utgör CNP-transaktioner en bedrägeririsk

Eftersom CNP-transaktioner behandlas utan att kunden (eller kreditkortet) är fysiskt närvarande för verifiering utgör detta ett tillfälle för bedrägeri. CNP-bedrägeri inträffar när en kortinnehavares faktureringsinformation komprometteras och erhålls av en obehörig person som använder den för att göra köp. Personen som begår bedrägeriet stjäl kortinnehavarens betalningsuppgifter, såsom kortnummer, CVC-/CVV-kod och utgångsdatum, och använder informationen för att göra köp.

CNP-bedrägerier påverkar inte bara kunden, utan leder också till att företaget förlorar intäkter, eftersom bedrägliga debiteringar ofta leder till återkrediteringar (chargebacks). När en kund upptäcker en bedräglig transaktion på sitt kort kan hen välja att reklamera betalningen hos den utfärdande banken och begära en återbetalning. Detta innebär att företaget inte bara har förlorat värdet av försäljningen, utan också har tillhandahållit en gratis produkt eller tjänst till bedragaren. Företaget kan också behöva betala en avgift om det uppstår för många återkrediteringar. För företag som har en högre risk för kortbedrägeri erbjuder Stripe ytterligare skydd mot återkrediteringar.

Så här tar man emot CNP-transaktioner på ett säkert sätt

På grund av de många problem som orsakas av CNP-bedrägerier är det viktigt för företag att bygga en så säker betalningsprocess som möjligt.

Här är olika sätt att undvika CNP-bedrägerier för olika betalningsmetoder:

Online

Inhämta så mycket korrekt kundinformation som möjligt på betalningssidan i onlinekassan, till exempel korttyp, kontonummer, utgångsdatum och CVC-kod. Att kräva ytterligare information hjälper till att säkerställa att kunden har det fysiska kortet i sin besittning, vilket innebär att det är mer sannolikt att det är den legitima kortinnehavaren som handlar. Det kan även hjälpa att etablera ett system för adressverifiering, som ber din kund att verifiera faktureringsadressen och postnumret under en transaktion (eftersom de flesta bedragare inte har tillgång till denna information).

Radar for Fraud Teams, som är en uppsättning verktyg integrerade i Stripe, är ett kraftfullt alternativ som hjälper företagare att bekämpa bedrägerier proaktivt. Plattformens maskininlärningssystem analyserar stora mängder data från kundtransaktioner – som IP-adressernas platsinformation och kassatider – för att få insikter om potentiella bedrägliga användare. Du kan ange olika kriterier genom att använda en kombination av dina egna bedrägeridata och Stripes beteendeinformation för att blockera misstänkta transaktioner och utföra manuella granskningar. Genom att själv godkänna dessa filtrerade transaktioner är du bättre rustad för att upptäcka och stoppa bedräglig aktivitet.

På Stripes Checkout-sida kan du samla in all nödvändig faktureringsinformation under en transaktion. Det snabbar upp och förenklar betalningsprocessen i kassan avsevärt för kunden, tack vare smarta funktioner som uppslagning av adress, kortvalidering i realtid och identifiering av kreditkortsutgivare.

Regler är en annan Radar-funktion som kan hjälpa till att bekämpa bedrägerier. Med dessa kan du använda egna kriterier för att konfigurera filter så att betalningar som uppfyller specifika högriskkriterier (till exempel att betalningen kommer från en geografisk plats där bedrägliga transaktioner är vanligt förekommande) blockeras automatiskt.

Via telefon

Om du tar emot en beställning via telefon är det viktigt att skydda informationen du får från kunden i enlighet med PCI-kraven. Om du är kund hos Stripe kan du manuellt ange en debitering med information som du fått via telefon via Dashboard.

Manuellt och i fysisk miljö

För transaktioner i fysisk miljö kan företag kräva ytterligare identitetsverifiering för att minska risken för bedrägeri, till exempel genom att be om fotolegitimation. Företagare bör också använda krypteringstjänster för att skydda alla lagrade kortuppgifter.

Avgifter och kostnader för behandling av CNP-transaktioner

Företag debiteras en avgift för alla genomförda kreditkortstransaktioner, men behandlingsavgifter för CNP-transaktioner är i allmänhet högre än för de med fysiska kort, eftersom de medför ytterligare risk. Avgifterna varierar beroende på bransch och betalleverantörens påslag. I allmänhet följer avgifterna och kostnaderna formeln nedan:

Procentandel av transaktion + fast kostnad per transaktion

För Stripe-kunder i USA är avgiften 2,9 % + 0,30 USD per genomförd kortdebitering. Läs vår prisguide för att lära dig mer om avgifterna på din marknad och vilka funktioner som ingår.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.