เมื่อธุรกิจเติบโตขึ้น ความต้องการโซลูชันการชำระเงินดิจิทัลที่รักษาข้อมูลของลูกค้าให้ปลอดภัยโดยไม่กระทบต่อประสบการณ์ออนไลน์ก็เพิ่มขึ้นตามไปด้วย 3D Secure ซึ่งเป็นโปรโตคอลการตรวจสอบสิทธิ์ยอดนิยมสำหรับการปกป้องการชำระเงิน ถือเป็นทางออกหนึ่งสำหรับความท้าทายนี้ ใน 3D Secure 2 โครงสร้างที่มีอยู่เดิมได้รับการยกระดับ โดยเน้นการเสริมการป้องกันที่แข็งแกร่งยิ่งขึ้นและมอบประสบการณ์การที่ราบรื่นยิ่งขึ้นให้กับลูกค้า

การเพิ่มขึ้นของการทำธุรกรรมผ่านอุปกรณ์เคลื่อนที่และธุรกรรมดิจิทัลได้เปิดทางให้กับโปรโตคอลอย่าง 3D Secure 2 โดยคาดว่าตลาดการตรวจสอบสิทธิ์การชำระเงินแบบ 3D Secure ทั่วโลกจะมีมูลค่า 1.2 พันล้านดอลลาร์ในปี 2023 ธุรกิจต้องการระบบที่ผสานรวมกับแพลตฟอร์มที่ตนมีอยู่อย่างมีประสิทธิภาพ พร้อมให้การป้องกันที่แข็งแกร่งในขณะที่ยกระดับประสบการณ์การชำระเงิน ด้านล่างนี้จะอธิบายว่า 3D Secure คืออะไร ทำงานอย่างไร และธุรกิจต่างๆ สามารถนำไปใช้เพื่อช่วยปรับและเพิ่มประสิทธิภาพระบบการชำระเงิน พร้อมกับตอบสนองความต้องการของลูกค้าได้อย่างไร

เนื้อหาหลักในบทความ

- 3D Secure คืออะไร

- 3D Secure ทำงานอย่างไร

- ประโยชน์ของการติดตั้งใช้งาน 3D Secure

- 3D Secure 1 เทียบกับ 3D Secure 2

- ความเข้าใจผิดที่พบบ่อยเกี่ยวกับ 3D Secure

- ความท้าทายและข้อเสียของ 3D Secure

- วิธีนำ 3D Secure มาใช้กับระบบการชำระเงินของคุณ

- Stripe Payments ช่วยอะไรได้บ้าง

3D Secure คืออะไร

3D Secure ซึ่งย่อมาจาก "Three-Domain Secure" เป็นโปรโตคอลการตรวจสอบสิทธิ์ที่เพิ่มการตรวจสอบยืนยันอีกชั้นหนึ่งสำหรับธุรกรรมบัตรเครดิตและบัตรเดบิตออนไลน์ โปรโตคอลนี้ได้รับการพัฒนาครั้งแรกโดย Visa ภายใต้ชื่อ "Verified by Visa"

แม้ว่าธุรกรรมทั่วไปจะต้องใช้เพียงรายละเอียดของบัตรและรหัสความปลอดภัย แต่ธุรกรรม 3D Secure จะแจ้งให้เจ้าของบัตรใส่รหัสผ่านเพิ่มเติม รหัสแบบใช้ครั้งเดียวที่ส่งไปยังอุปกรณ์เคลื่อนที่ หรือการยืนยันด้วยข้อมูลไบโอเมตริก โดยขั้นตอนนี้มักจะเกิดขึ้นในหน้าต่างป๊อปอัปหรืออินเทอร์เฟซในแอป

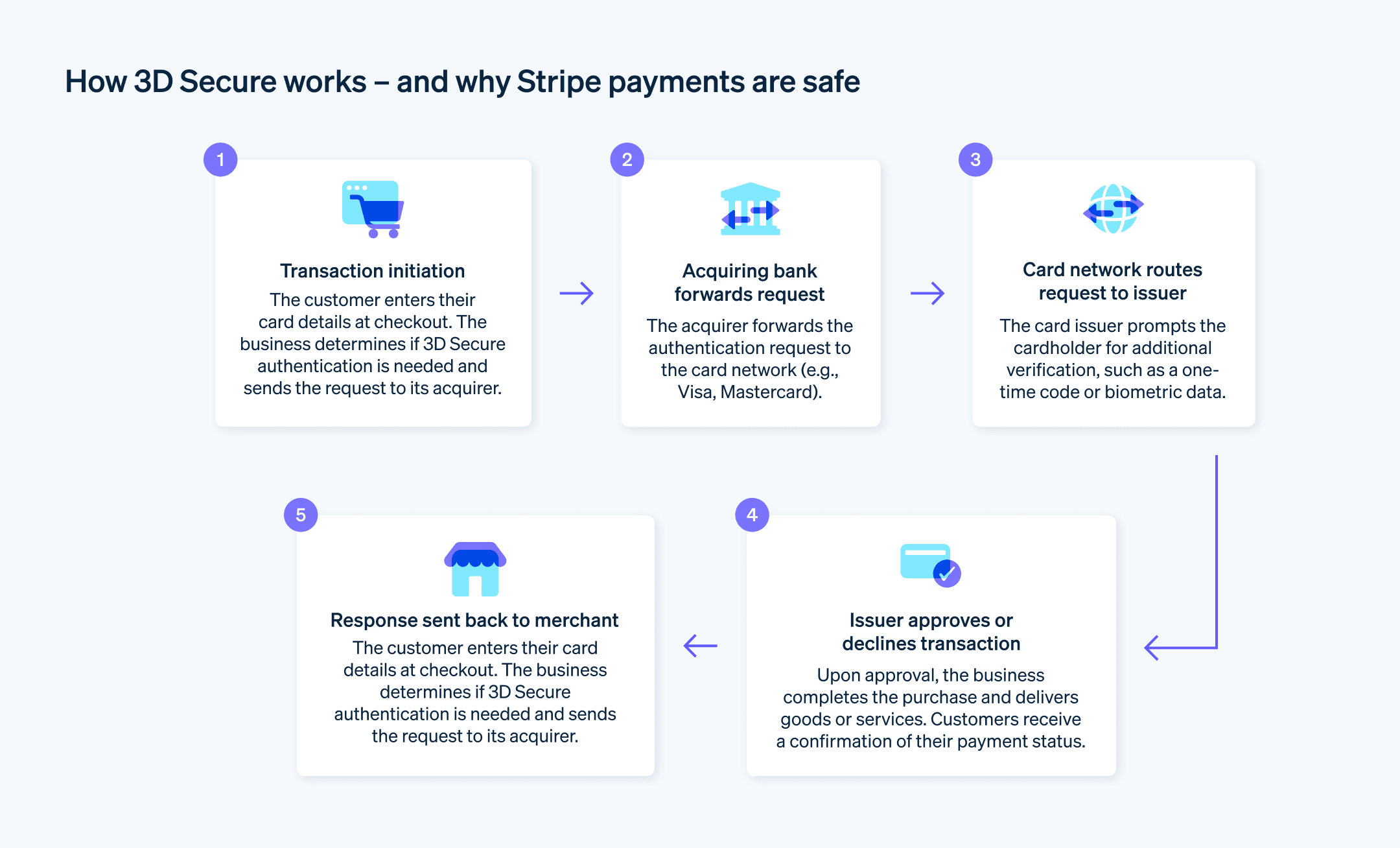

3D Secure ทำงานอย่างไร

กระบวนการ 3D Secure เป็นการดำเนินการหลายขั้นตอนแบบหลายฝ่ายที่ให้การรักษาความปลอดภัยอีกชั้นหนึ่งสำหรับธุรกรรมออนไลน์ โปรโตคอลขึ้นอยู่กับการโต้ตอบระหว่างผู้บริษัทผู้ออกบัตร ผู้รับชำระเงิน และโดเมนการทำงานร่วมกัน ด้านล่างนี้จะแจกแจงแต่ละขั้นตอนของกระบวนการ

- ลูกค้าเริ่มการทำธุรกรรม: เมื่อลูกค้าตัดสินใจซื้อสินค้าหรือบริการออนไลน์ ลูกค้าจะป้อนรายละเอียดของบัตรในเว็บไซต์ของธุรกิจ

- ธุรกิจขอการตรวจสอบสิทธิ์: เซิร์ฟเวอร์ของธุรกิจรับรู้ถึงความจำเป็นที่จะต้องมีการตรวจสอบสิทธิ์แบบ 3D Secure และส่งคำขอให้บริษัทผู้ออกบัตรตรวจสอบสิทธิ์เจ้าของบัตร

- ลูกค้าให้การตรวจสอบสิทธิ์เพิ่มเติม: จากนั้นบริษัทผู้ออกบัตรจะข้อข้อมูลเพิ่มเติมจากเจ้าของบัตร ซึ่งปกติจะดำเนินการผ่านหน้าต่างป๊อปอัปหรืออินเทอร์เฟซในแอป

- บริษัทผู้ออกบัตรตรวจสอบสิทธิ์ธุรกรรม: เมื่อเจ้าของบัตรให้ข้อมูลที่ร้องขอแล้ว บริษัทผู้ออกบัตรจะประเมินเพื่อตรวจสอบสิทธิ์ธุรกรรมแล้วส่งผลการตรวจสอบสิทธิ์กลับมา

- การทำธุรกรรมเสร็จสมบูรณ์: ลูกค้าทำธุรกรรมเสร็จสมบูรณ์และธุรกิจส่งมอบสินค้าหรือบริการ

ประโยชน์ของการติดตั้งใช้งาน 3D Secure

ความเสี่ยงต่อธุรกรรมที่เป็นการฉ้อโกงที่ลดลง

เทคโนโลยี 3D Secure จะตรวจสอบธุรกรรมแบบเรียลไทม์โดยขอให้ลูกค้าดำเนินขั้นตอนการระบุตัวตนเพิ่มเติม ซึ่งช่วยลดธุรกรรมที่ไม่ได้รับอนุญาตลงได้อย่างมากและส่งผลให้ธุรกิจมีค่าใช้จ่ายที่เกี่ยวข้องกับการฉ้อโกงลดลง จำนวนการดึงเงินคืนที่ลดลงยังช่วยให้ได้รับคะแนนจากธนาคารสูงขึ้นอีกด้วย ในปี 2024 ความสูญเสียจากการฉ้อโกงในอีคอมเมิร์ซทั่วโลกมีมูลค่ารวมประมาณ 44.3 พันล้านดอลลาร์ ซึ่งสะท้อนให้เห็นถึงขนาดของปัญหาธุรกรรมที่เป็นการฉ้อโกงที่ธุรกิจต้องเผชิญเพิ่มความไว้วางใจและความมั่นใจของลูกค้า

สำหรับนักช้อป การตรวจสอบสิทธิ์เพิ่มขึ้นอีกชั้นถือเป็นสัญญาณว่าการทำธุรกรรมนั้นปลอดภัย ความมั่นใจที่เพิ่มขึ้นนี้สามารถสะท้อนผ่านวงจรการเป็นลูกค้า ซึ่งช่วยเปลี่ยนผู้ซื้อครั้งเดียวให้เป็นลูกค้าประจำ และเปลี่ยนผู้ซื้อเป็นครั้งคราวให้กลายเป็นผู้สนับสนุนแบรนด์การปฏิบัติตามมาตรฐานด้านการกำกับดูแล

การปฏิบัติตามกฎหมายเป็นส่วนหนึ่งที่หลีกเลี่ยงไม่ได้ในการทำธุรกิจในยุคดิจิทัล หน่วยงานกำกับดูแลมักจะอัปเดตแนวทางอยู่เสมอและการตามให้ทันก็อาจเป็นเรื่องยาก การนำ 3D Secure มาใช้จะช่วยให้คุณปฏิบัติตามข้อกำหนดและหลีกเลี่ยงค่าปรับจำนวนมากและความยุ่งยากทางกฎหมายได้ ชื่อเสียงด้านการปฏิบัติตามข้อกำหนดอย่างเคร่งครัดสามารถกลายเป็นจุดเด่นที่สร้างความแตกต่างในตลาด โดยทำให้ลูกค้าที่มีข้อกังวลเลือกแพลตฟอร์มของคุณแทนคู่แข่งที่มีระบบความปลอดภัยน้อยกว่า

3D Secure 1 เทียบกับ 3D Secure 2

EMVCo เปิดตัวการอัปเดตสำหรับ 3D Secure 2 (จาก 3D Secure 1) ในเดือนตุลาคม 2016 แต่ธุรกิจ บริษัทผู้ออกบัตร และ เกตเวย์การชำระเงินไม่ได้นำมาใช้ในทันที โดยมีการผลักดันให้นำ 3D Secure 2 มาใช้ในวงกว้างในปี 2019 อันเป็นผลมาจากระเบียบข้อบังคับใหม่หลายข้อ รวมถึงคำสั่งว่าด้วยบริการชำระเงินฉบับปรับปรุง (PSD2) ของสหภาพยุโรปและข้อกำหนดสำหรับการตรวจสอบสิทธิ์ลูกค้าแบบรัดกุม (SCA)

แม้ว่าทั้ง 3D Secure 1 และ 3D Secure 2 จะเป็นโปรโตคอลการตรวจสอบสิทธิ์สำหรับการชำระเงินด้วยบัตรเครดิตออนไลน์ แต่ก็มีความแตกต่างอย่างมากในการออกแบบและประสบการณ์ของลูกค้า โดยความแตกต่างมีดังนี้

ประสบการณ์ของลูกค้า

- 3D Secure 1: ระบบเปลี่ยนเส้นทางลูกค้าไปที่หน้าการตรวจสอบสิทธิ์แยกต่างหาก ซึ่งบางครั้งก็ส่งผลให้ประสบการณ์การชำระเงินมีปัญหาติดขัด

- 3D Secure 2: ส่วนหนึ่งออกแบบมาเพื่อปรับปรุงประสบการณ์ของลูกค้า โดยช่วยลดการหยุดชะงักระหว่างการชำระเงิน โดยปกติแล้ว เฉพาะธุรกรรมที่มีความเสี่ยงสูงเท่านั้นที่ต้องมีการตรวจสอบสิทธิ์เพิ่มเติม

การผสานการทำงานกับอุปกรณ์เคลื่อนที่

- 3D Secure 1: เนื่องจากวิธีการนี้ไม่ได้สร้างขึ้นมาเพื่อประสบการณ์การใช้งานบนอุปกรณ์เคลื่อนที่โดยเฉพาะ บางครั้งวิธีนี้ก็นำไปสู่หน้าการตรวจสอบสิทธิ์ที่ล่าช้าหรือแสดงในรูปแบบแปลกๆ บนอุปกรณ์เคลื่อนที่

- 3D Secure 2: ออกแบบมาสำหรับการใช้งานบนอุปกรณ์เคลื่อนที่ซึ่งได้รับการเพิ่มประสิทธิภาพมาเพื่อให้ผสานการทำงานบนอุปกรณ์เคลื่อนที่ได้ราบรื่นขึ้น และทำงานกับแอปและเบราว์เซอร์บนอุปกรณ์เคลื่อนที่ได้อย่างง่ายดาย

จุดข้อมูล

- 3D Secure 1: ใช้จุดข้อมูลน้อยกว่าในขั้นตอนการตรวจสอบสิทธิ์

- 3D Secure 2: ใช้จุดข้อมูลมากกว่า (เช่น ประวัติธุรกรรมและข้อมูลอุปกรณ์) ในการประเมินตามความเสี่ยง วิธีนี้จะช่วยให้ตรวจสอบสิทธิ์ได้อย่างชาญฉลาดยิ่งขึ้น ซึ่งธุรกรรมที่มีความเสี่ยงต่ำอาจไม่จำเป็นต้องมีการยืนยันเพิ่มเติม

ขั้นตอนที่ราบรื่น

- 3D Secure 1: โดยทั่วไปแล้ว เจ้าของบัตรจะต้องใช้รหัสผ่านหรือการตรวจสอบสิทธิ์แบบคงที่บางรูปแบบ

- 3D Secure 2: ใช้ "ขั้นตอนที่ราบรื่น" ซึ่งตรวจสอบสิทธิ์ธุรกรรมบางรายการได้โดยไม่ต้องมีการโต้ตอบกับเจ้าของบัตร

ขอบเขตธุรกรรม

- 3D Secure 1: เน้นการทำธุรกรรมแบบไม่ต้องแสดงบัตรเป็นหลัก

- 3D Secure 2: ขยายขอบเขตและครอบคลุมธุรกรรมประเภทต่างๆ เพิ่มเติม เช่น การชำระเงินผ่านอุปกรณ์เคลื่อนที่และธุรกรรมผ่านบัตรที่บันทึกไว้ในระบบ

ข้อบังคับและการปฏิบัติตามข้อกำหนด

- 3D Secure 1: เกิดขึ้นก่อนข้อบังคับการชำระเงินออนไลน์สมัยใหม่บางฉบับ

- 3D Secure 2: ออกแบบมาเพื่อให้ปฏิบัติตามคำสั่งว่าด้วยบริการชำระเงินฉบับปรับปรุง (PSD2) ของสหภาพยุโรป โดยเฉพาะข้อกำหนดการตรวจสอบสิทธิ์ลูกค้าแบบรัดกุม (SCA) สำหรับธุรกรรมออนไลน์

การสื่อสารกับบริษัทผู้ออกบัตรและธุรกิจ

- 3D Secure 1: มีวิธีการที่จำกัดสำหรับบริษัทผู้ออกบัตรและธุรกิจเพื่อสื่อสารเกี่ยวกับธุรกรรม

- 3D Secure 2: ช่วยให้บริษัทผู้ออกบัตรและธุรกิจสื่อสารกันได้โดยตรงมากขึ้น ทำให้สามารถตัดสินใจแบบเรียลไทม์โดยอิงตามความเสี่ยงของธุรกรรม

โปรโตคอลทั้งสองแบบให้สภาพแวดล้อมที่ปลอดภัยสำหรับธุรกรรมบัตรเครดิตออนไลน์ แต่การนำ 3D Secure 2 ไปใช้ทำให้เกิดความก้าวหน้าในด้านประสบการณ์ของลูกค้า การเพิ่มประสิทธิภาพการทำธุรกรรมผ่านอุปกรณ์เคลื่อนที่ และวิธีการตรวจสอบสิทธิ์ที่ปรับเปลี่ยนได้ เวอร์ชันใหม่นี้ช่วยให้มีโซลูชันการค้าออนไลน์ที่ทันสมัยและใช้งานง่ายยิ่งขึ้นขึ้น

ความเข้าใจผิดที่พบบ่อยเกี่ยวกับ 3D Secure

มีความเข้าใจผิดหลายประการเกี่ยวกับ 3D Secure ที่อาจส่งผลต่อการตัดสินใจของธุรกิจในการนำเทคโนโลยีดังกล่าวมาใช้ การตระหนักถึงความเข้าใจผิดทั่วไปเหล่านี้เป็นสิ่งสำคัญเมื่อตัดสินใจเลือกอย่างชาญฉลาด ต่อไปนี้คือรายละเอียดเพิ่มเติม

ความเข้าใจผิดข้อที่ 1: 3D Secure เป็นโซลูชันที่ป้องกันการฉ้อโกงได้อย่างสมบูรณ์

แม้ว่า 3D Secure จะช่วยลดความเสี่ยงของธุรกรรมที่เป็นการฉ้อโกงได้อย่างมาก แต่ก็ไม่มีระบบใดที่สมบูรณ์แบบ เทคโนโลยีนี้ทำหน้าที่เสมือนสุนัขเฝ้ายามที่ได้รับการฝึกมาอย่างดี มากกว่าจะเป็นกำแพงของป้อมปราการที่ไม่มีวันเจาะทะลุ ดังนั้น กลยุทธ์ที่สมดุลควรประกอบด้วยมาตรการรักษาความปลอดภัยหลายชั้น ซึ่งรวมถึงแต่ไม่จำกัดเพียง 3D Secure เพื่อรับมือกับกิจกรรมฉ้อโกงหลากหลายรูปแบบได้อย่างมีประสิทธิภาพที่สุด

ความเข้าใจผิดข้อที่ 2: 3D Secure ทำให้ธุรกรรมช้าลง

มีความคิดที่ว่า 3D Secure อาจทำให้ขั้นตอนการทำธุรกรรมล่าช้าโดยไม่จำเป็น อย่างไรก็ตาม การตรวจสอบสิทธิ์ที่เพิ่มขึ้นอีกสองสามวินาทีสามารถประหยัดเวลาได้ในระยะยาวโดยการลดจำนวนธุรกรรมที่ต้องตรวจสอบการฉ้อโกง โดยโอกาสที่จะสามารถลดค่าธรรมเนียมการดึงเงินคืนและค่าใช้จ่ายที่เกี่ยวข้องกับการฉ้อโกงอื่นๆ นั้นสามารถชดเชยความล่าช้าเพียงเล็กน้อยในการทำธุรกรรมได้

ความเข้าใจผิดข้อที่ 3: 3D Secure มีไว้สำหรับอุตสาหกรรมที่มีความเสี่ยงสูงเท่านั้น

บางคนเชื่อว่า 3D Secure มีประโยชน์เฉพาะสำหรับภาคส่วนต่างๆ เช่น สินค้าฟุ่มเฟือยหรือการพนันออนไลน์ ซึ่งการทำธุรกรรมที่มีมูลค่าสูงนั้นเป็นเรื่องปกติ อย่างไรก็ตาม เรื่องนี้ไม่เป็นความจริง ธุรกิจในภาคส่วนต่างๆ สามารถได้ประโยชน์จากการรักษาความปลอดภัยที่เพิ่มขึ้น แม้กระทั่งธุรกิจที่ไม่ได้ดำเนินงานในอุตสาหกรรมที่มีความเสี่ยงสูง 3D Secure ก็เปรียบเสมือนกรมธรรม์ประกันภัย การมีไว้แล้วไม่ได้ใช้ ย่อมดีกว่าเวลาต้องใช้แล้วไม่มี

ความท้าทายและข้อเสียของ 3D Secure

แม้ 3D Secure จะมีประโยชน์หลายประการ แต่ก็ยังมีความท้าทายและข้อเสียหลายประการที่ธุรกิจอาจต้องเผชิญเมื่อนำเทคโนโลยีนี้ไปใช้งาน

ความติดขัดที่เพิ่มขึ้นในการชำระเงิน

การเพิ่ม 3D Secure โดยไม่สร้างอุปสรรคเพิ่มเติมในขั้นตอนการชำระเงินอาจเป็นเรื่องที่ท้าทาย ธุรกิจย่อมไม่ต้องการให้ลูกค้าออกจากกระบวนการทำธุรกรรมเนื่องจากต้องดำเนินขั้นตอนการตรวจสอบสิทธิ์ที่ยุ่งยาก แม้ว่าจุดประสงค์ของ 3D Secure คือการเพิ่มความปลอดภัยอีกชั้นหนึ่ง แต่หากลูกค้ามองว่าสิ่งนี้เป็นความไม่สะดวก ก็มีแนวโน้มที่จะไม่ดำเนินการซื้อให้เสร็จสมบูรณ์ความซับซ้อนในประสบการณ์ของลูกค้า

การเพิ่มหลายขั้นตอนให้กับขั้นตอนการชำระเงินอาจทำให้ประสบการณ์ของลูกค้าซับซ้อนเกินไป ยิ่งขั้นตอนการชำระเงินยุ่งยากเท่าใด ลูกค้าก็ยิ่งล้มเลิกความตั้งใจที่จะชำระเงินมากเท่านั้น ประสบการณ์การชำระเงินควรราบรื่นที่สุดเท่าที่จะเป็นไปได้ในขณะที่ยังคงรักษามาตรการรักษาความปลอดภัยที่จำเป็น ซึ่งเป็นความสมดุลที่บางครั้งก็ยากที่จะรักษาไว้เมื่อนำ 3D Secure มาใช้ความต้องการด้านการปฏิบัติงาน

การติดตั้งใช้งาน 3D Secure มักต้องใช้การเปลี่ยนแปลงของระบบและกระบวนการที่มีอยู่ ซึ่งอาจเกี่ยวข้องกับการอัปเดตโครงสร้างพื้นฐานด้านไอทีและการฝึกอบรมของพนักงาน รวมทั้งการที่ฝ่ายบริการลูกค้ามีเครื่องมือเพียงพอที่จะจัดการกับข้อสอบถามต่างๆ ได้ ธุรกิจอาจต้องลงทุนกับเวลาและทรัพยากรค่อนข้างมากในระยะแรก ซึ่งอาจทำให้ธุรกิจบางแห่งไม่สามารถนำเทคโนโลยีมาใช้ได้ข้อกังวลเกี่ยวกับความรับผิด

แม้ว่า 3D Secure จะโอนความรับผิดบางอย่างสำหรับธุรกรรมที่เป็นการฉ้อโกงออกจากธุรกิจ แต่เงื่อนไขและข้อกำหนดที่ควบคุมการโอนความรับผิดเหล่านี้อาจซับซ้อน และไม่ได้ครอบคลุมทุกกรณีของการฉ้อโกง ธุรกิจจึงยังคงต้องดำเนินมาตรการป้องกันการฉ้อโกงอย่างรอบคอบ ความรู้สึกปลอดภัยที่ผิดไปจากความเป็นจริงอาจทำให้ธุรกิจลดความระมัดระวังลง ซึ่งอาจนำไปสู่ผลกระทบเชิงลบในระยะยาว

แม้ว่า 3D Secure จะมีความท้าทายที่อาจเกิดขึ้น แต่การวางแผนที่เหมาะสมสามารถชดเชยปัญหาเหล่านี้ได้ ทางเลือกหนึ่งสำหรับธุรกิจคือการทำงานร่วมกับผู้ให้บริการการชำระเงินที่แข็งแกร่งและครอบคลุม เช่น Stripe

วิธีนำ 3D Secure มาใช้กับระบบการชำระเงินของคุณ

การนำ 3D Secure มาใช้กับระบบการชำระเงินจะเพิ่มการรักษาความปลอดภัยขึ้นอีกชั้นที่ทำหน้าที่เป็นมาตรการป้องกันธุรกรรมที่เป็นการฉ้อโกง Stripe ให้การสนับสนุนที่ครอบคลุมสำหรับ 3D Secure 2 ซึ่งเป็นโปรโตคอลความปลอดภัยเวอร์ชันขั้นสูงและเป็นมิตรกับผู้ใช้มากขึ้น ต่อไปนี้คือสิ่งที่ควรพิจารณาเกี่ยวกับการนำไปใช้งาน:

การเชื่อมต่อการทำงานกับ API ของ Stripe

Stripe รองรับการใช้งาน 3D Secure 2 ผ่าน API การชำระเงินและฟีเจอร์ Checkout การผสานรวมเครื่องมือเหล่านี้เข้ากับระบบจะช่วยปกป้องธุรกรรมที่มีความเสี่ยงสูงจากการฉ้อโกงที่อาจเกิดขึ้น ข้อได้เปรียบหลักของการใช้การผสานการทำงานของ Stripe คือฟังก์ชันในการใช้ 3D Secure 2 เมื่อธนาคารของเจ้าของบัตรรองรับ และเปลี่ยนกลับเป็น 3D Secure 1 เมื่อจำเป็นการเน้นที่แอปพลิเคชันบนอุปกรณ์เคลื่อนที่

แอปบนอุปกรณ์เคลื่อนที่ต้องใช้ขั้นตอนธุรกรรมที่ราบรื่น SDK สำหรับ iOS และ Android ของ Stripe สามารถทำงานได้ในตรวจสอบสิทธิ์ในแอป ซึ่งเป็นการสร้างประสบการณ์โดยตรงสำหรับลูกค้า การดำเนินการนี้จะป้องกันไม่ให้ระบบเปลี่ยนเส้นทางลูกค้าไปยังหน้าภายนอกระบบ ซึ่งอาจขัดขวางขั้นตอนการชำระเงินได้ แม้ว่าหากธนาคารไม่รองรับ 3D Secure 2 แต่ SDK สำหรับอุปกรณ์เคลื่อนที่ของ Stripe จะแสดง 3D Secure 1 ในมุมมองเว็บที่ผสานรวมอยู่ในแอปของคุณการให้ความสำคัญกับประสบการณ์ของลูกค้า

มีการพัฒนา 3D Secure 2 โดยคำนึงถึงสมาร์ทโฟน ทำให้ธนาคารสามารถอัปเดตวิธีการตรวจสอบสิทธิ์ได้ ตัวอย่างเช่น ลูกค้าอาจตรวจสอบสิทธิ์การชำระเงินโดยใช้ลายนิ้วมือหรือ Face ID แทนรหัสผ่านหรือข้อความแบบเดิม เทคโนโลยีใหม่นี้ส่งเสริมประสบการณ์การทำธุรกรรมที่ดีขึ้นโดยมีการหยุดชะงักน้อยลงผสานรวมกับขั้นตอนการชำระเงินบนเว็บและอุปกรณ์เคลื่อนที่ได้

3D Secure 2 ออกแบบมาเพื่อให้ผสานรวมขั้นตอนการตรวจสอบสิทธิ์ไว้ในทั้งการชำระเงินบนเว็บและอุปกรณ์เคลื่อนที่ และลดความจำเป็นในการเปลี่ยนเส้นทางของทั้งหน้าเว็บ หากลูกค้ายืนยันตัวตนบนเว็บไซต์หรือแอปพลิเคชันของคุณ ลูกค้าจะเห็นข้อความแจ้งเกี่ยวกับ 3D Secure ภายในขั้นตอนการชำระเงินติดตามข่าวสารล่าสุดเกี่ยวกับระเบียบข้อบังคับ

หากคุณทำธุรกิจในยุโรป การบังคับใช้การตรวจสอบสิทธิ์ลูกค้าแบบรัดกุม (SCA) คือกุญแจสำคัญ ข้อบังคับ SCA กำหนดให้ใช้การตรวจสอบสิทธิ์ที่เข้มงวดมากขึ้นสำหรับการชำระเงินในยุโรป ทำให้ลูกค้าได้รับประโยชน์จากประสบการณ์การใช้งาน 3D Secure 2 อย่างมาก การใช้ 3D Secure 2 ช่วยให้ธุรกิจลดผลกระทบเชิงลบต่อการเปลี่ยนเป็นลูกค้าแบบชำระเงินได้ใช้ความยืดหยุ่นของ 3D Secure 2

ความยืดหยุ่นของ Stripe ในการใช้งานร่วมกับโปรโตคอล 3D Secure 2 ทำให้ธุรกรรมบางอย่างสามารถข้ามการตรวจสอบสิทธิ์และใช้ขั้นตอนที่ "ราบรื่น" ได้ โดยเฉพาะอย่างยิ่งหากมองว่าธุรกรรมนั้นมีความเสี่ยงต่ำ อย่างไรก็ตาม หากผู้ให้บริการชำระเงินขอการยกเว้นและธุรกรรมใช้วิธีที่ "ราบรื่น" สิทธิประโยชน์ด้านการโอนความรับผิดก็อาจไม่มีผล

การนำ 3D Secure 2 มาใช้กับระบบการชำระเงินจะช่วยป้องกันการฉ้อโกงไปพร้อมๆ กับการสร้างความมั่นใจว่าประสบการณ์การชำระเงินจะใช้งานง่ายที่สุดเท่าที่จะเป็นไปได้ การใช้เครื่องมือของ Stripe และปฏิบัติตามแนวทางข้างต้นจะช่วยให้ธุรกิจสร้างสมดุลระหว่างความปลอดภัยกับความสะดวกในการใช้งานได้

Stripe Payments ช่วยอะไรได้บ้าง

Stripe Payments มอบโซลูชันการชำระเงินระดับโลกแบบครบวงจรที่ช่วยให้ธุรกิจทุกขนาด ตั้งแต่บริษัทสตาร์ทอัพที่กำลังเติบโตไปจนถึงองค์กรระดับโลกรับชำระเงินออนไลน์ ที่จุดขาย และทั่วโลกได้

Stripe Payments สามารถช่วยคุณทำสิ่งต่อไปนี้

- เพิ่มประสิทธิภาพให้ประสบการณ์การชำระเงินของคุณ: สร้างประสบการณ์ที่ราบรื่นให้กับลูกค้าและประหยัดเวลาในการทำงานวิศวกรรมได้หลายพันชั่วโมงด้วย UI การชำระเงินที่สร้างไว้ให้แล้ว, สิทธิ์เข้าถึงวิธีการชำระเงินมากกว่า 125 วิธี และ Link ซึ่งเป็นกระเป๋าเงินที่สร้างโดย Stripe

- ขยายไปสู่ตลาดใหม่ๆ ได้เร็วขึ้น: เข้าถึงลูกค้าทั่วโลกรวมทั้งลดความซับซ้อนและค่าใช้จ่ายในการจัดการหลายสกุลเงินด้วยตัวเลือกการชำระเงินข้ามพรมแดนที่มีให้บริการใน 195 ประเทศและกว่า 135 สกุลเงิน

- รวมการชำระเงินที่จุดขายและทางออนไลน์ไว้ด้วยกัน: สร้างประสบการณ์การค้าแบบแพลตฟอร์มรวมในช่องทางออนไลน์และที่จุดขายเพื่อปรับแต่งการโต้ตอบ ตอบแทนลูกค้าประจำ และเพิ่มรายรับ

- ปรับปรุงประสิทธิภาพการชำระเงิน: เพิ่มรายรับด้วยเครื่องมือการชำระเงินที่กำหนดเองได้และปรับแต่งได้ง่ายๆ ซึ่งรวมถึงระบบป้องกันการฉ้อโกงแบบไม่ต้องเขียนโค้ดและความสามารถขั้นสูงเพื่อเพิ่มอัตราการอนุมัติ

- เดินหน้าได้เร็วขึ้นด้วยแพลตฟอร์มที่ยืดหยุ่นและเชื่อถือได้เพื่อการเติบโต: สร้างบนแพลตฟอร์มที่ออกแบบมาเพื่อขยับขยายไปพร้อมกับคุณ โดยมีระยะเวลาให้บริการ 99.999% โดยแทบจะไม่หยุดทำงานเลย และมีความน่าเชื่อถือระดับแนวหน้าของวงการ

ดูเพิ่มเติมว่า Stripe Payments ช่วยให้คุณสามารถรับการชำระเงินออนไลน์และที่จุดขายได้อย่างไร หรือเริ่มใช้งานเลยวันนี้

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ