Återförsök efter misslyckade betalningar inträffar när ett företag försöker behandla en betalning efter att ett första betalningsförsök misslyckats. Detta är ett vanligt scenario vid onlinebetalningar, abonnemangsbetalningar och återkommande betalningar. Företags primära mål med återförsök är att slutföra en transaktion utan att behöva be om ytterligare åtgärder från kunden.

Nedan tar vi en titt på varför betalningar misslyckas, varför det är viktigt att göra nya betalningsförsök och vilken taktik företag bör använda för att lyckas med betalningsåterförsök. Den globala betalningsmarknaden förväntas överstiga 3 biljoner USD år 2027, så det är viktigt för företag att förstå hur man hanterar återförsök efter misslyckade betalningar. Nedan följer allt du behöver veta.

Vad innehåller den här artikeln?

- Varför misslyckas vissa betalningar?

- Varför återförsök är viktiga för intäktsåtervinning

- Hur fungerar återförsök efter misslyckade betalningar?

- Utmaningar för företag i samband med återförsök

- Bästa metoder för att hantera återförsök

- Hur Stripe kan hjälpa dig

Varför misslyckas vissa betalningar?

Det finns många anledningar till att betalningar misslyckas. Vanliga orsaker är:

Tekniska skäl

Systemavbrott: Betalningssystem kan drabbas av tillfälliga avbrott på grund av tekniska problem, överbelastning eller underhåll.

Nätverksproblem: Dålig internetuppkoppling eller störningar kan störa kommunikationen mellan kunden, företaget och betalleverantören.

Programvarufel: Buggar eller fel i betalningsprogramvaran kan leda till felaktig behandling och misslyckade transaktioner.

Säkerhetsöverträdelser: Cyberattacker och andra säkerhetsproblem kan äventyra betalningssystem och orsaka störningar.

Kundrelaterade skäl

Otillräckliga medel: Detta är en av de vanligaste orsakerna till misslyckade betalningar, särskilt när det gäller återkommande betalningar.

Felaktiga uppgifter: Felaktig inmatning av kortuppgifter, t.ex. nummer, utgångsdatum eller CVV-kod, kan resultera i en nekad transaktion.

Utgångna kort: Försök att använda ett utgånget kort kommer att leda till att betalningen nekas.

Överskriden kreditgräns: Om en kund överskrider sin kreditkortsgräns utlöser detta en avvisning från den utfärdande banken.

Bedräglig aktivitet: Banker kan neka misstänkta transaktioner för att skydda sina kunder från bedrägerier, även om dessa transaktioner är legitima betalningsförsök.

Företagsrelaterade skäl

Föråldrat betalningssystem: Företag som använder föråldrade eller inkompatibla betalningssystem kan stöta på kompatibilitetsproblem.

Faktureringsfel: Felaktig eller ofullständig faktureringsinformation kan orsaka förseningar eller avvisningar.

Otillräckliga åtgärder för att förebygga bedrägerier: Svaga säkerhetsåtgärder kan göra företag sårbara för bedrägliga transaktioner, vilket leder till återkrediteringar och misslyckade betalningar.

Andra skäl

Problem relaterade till kortutfärdaren: Bankrelaterade problem, som systemunderhåll eller spärrade kort, kan också orsaka misslyckade betalningar.

Internationella transaktioner: Valutaomvandlingar och avgifter för internationella transaktioner kan leda till nekade betalningar eller kräva ytterligare verifieringar innan de kan genomföras.

Fel vid abonnemang eller återkommande betalningar: Problem med automatiska faktureringssystem eller inaktuell betalningsinformation kan leda till misslyckade transaktioner för abonnemang eller återkommande betalningar.

Varför återförsök är viktiga för intäktsåtervinning

Återförsök efter misslyckade betalningar är nyckeln till ett företags hantering av intäktsåtervinning och kundbortfall. Här förklarar vi varför:

Minskar ofrivilligt kundbortfall

Uteblivna betalningar leder ofta till ofrivilligt kundbortfall när kunder oavsiktligt lämnar prenumerationstjänster; inte för att de valde att lämna, utan för att betalningshinder kom i vägen för deras abonnemangsförnyelse. Genom att försöka genomföra misslyckade betalningar igen kan företag lösa dessa problem och behålla kunder som de annars kanske skulle förlorat.Förbättrar kundupplevelsen

Med enkla återförsök slipper kunderna ange sina betalningsuppgifter på nytt och behöver inte kontakta kundsupporten för att lösa betalningsproblem. Denna smidiga process sparar tid och minskar potentiell frustration, vilket leder till en mer positiv kundupplevelse.Ger ett konsekvent kassaflöde

Återförsök efter misslyckade betalningar är viktiga för att upprätthålla ett stabilt kassaflöde. Genom att återvinna intäkter från transaktioner som ursprungligen misslyckades får företag en stabilare och mer förutsägbar intäktsström.Möjliggör smarta strategier för återförsök

Genom att analysera data från misslyckade betalningar kan du ta fram en smart strategi för återförsök. Genom att till exempel förstå de vanligaste tidpunkterna för lyckade transaktioner eller de typiska orsakerna till misslyckande transaktioner kan företag utforma en strategi för återförsök för att öka antalet genomförda transaktioner.Minskar tjänsteavbrott

För företag med en abonnemangsmodell är en tjänst utan avbrott nyckeln till kundnöjdhet. Återförsök vid misslyckade betalningar hjälper till att undvika avbrott, vilket säkerställer att kunderna kan fortsätta använda tjänsten på det sätt som de förväntar sig.Minskar driftskostnaderna

Det är resurskrävande att hantera varje misslyckad betalning manuellt. Automatiserade system för återförsök efter misslyckade betalningar minskar behovet av omfattande administrativt arbete, vilket minskar driftskostnaderna och gör det möjligt för personalen att fokusera på mer strategiska uppgifter.Ökar antalet genomförda transaktioner

Återförsök ger företag en andra chans att behandla en transaktion, vilket ökar framgångsfrekvensen, något som är avgörande för att utvärdera betalningshanteringssystemets ekonomiska hälsa och effektivitet.Maximerar kundernas livstidsvärde

Kundens livstidsvärde är ett viktigt mått för företag, särskilt för de som använder sig av abonnemangsmodeller. Genom att förhindra ofrivilligt kundbortfall med återförsök kan företag upprätthålla långsiktiga relationer med kunderna och maximera intäktspotentialen från varje kund över tid.Anpassning baserat på betalningsmetod

Olika betalningsmetoder har olika frekvenser av misslyckande – och anledningar till dessa misslyckanden. Företag kan utveckla anpassade mekanismer för betalningsåterförsök för att tillgodose olika betalningsmetoders specifika krav och egenskaper, vilket effektiviserar processen för återförsök efter misslyckade transaktioner.Säkerställer regelefterlevnad

Betalleverantörer måste följa en rad lagstadgade krav, som kan variera beroende på region och betalningsmetod. Rätt utformade mekanismer för återförsök säkerställer efterlevnad genom att ta hänsyn till dessa regler och i slutändan undvika potentiella juridiska och ekonomiska påföljder.

Hur fungerar återförsök efter misslyckade betalningar?

Återförsök efter misslyckade transaktioner kan fungera på många olika sätt beroende på betalningssystemets egenskaper och orsaken till att betalningen misslyckades. Så här ser det vanligtvis ut:

Baserat på orsaken till misslyckandet

Metoden för att försöka genomföra en betalning igen beror ofta på den specifika orsaken till det ursprungliga misslyckandet. Om en betalning till exempel misslyckas på grund av otillräckligt saldo kan ett nytt försök att ta betalt schemaläggas till ett senare datum, vilket ger kunden tid att åtgärda problemet. För ett tekniskt fel kan det nya försöket däremot inträffa nästan omedelbart.Strategier för tajming

Tidpunkten för ett nytt betalningsförsök är viktig. Vissa system använder fasta intervall, medan andra använder varierande intervall baserat på tidigare transaktionsdata och kundbeteenden. Det kan exempelvis vara bättre att försöka igen tidigt på morgonen för vissa demografiska grupper vissa dagar, eftersom detta sammanfaller med löneutbetalningar.Smarta algoritmer för återförsök

Avancerade betalningssystem använder maskininlärningsalgoritmer för att analysera tidigare transaktionsdata. Dessa algoritmer kan förutsäga den optimala tidpunkten och metoden för att försöka genomföra en misslyckad betalning igen, vilket ökar chanserna att lyckas. Algoritmerna tar hänsyn till faktorer som transaktionshistorik, tid på dygnet, betalningsmetod och till och med veckodag.Flera betalningsmetoder

I scenarier där kunderna har flera betalningsmetoder registrerade kan en misslyckad transaktion med en metod automatiskt utlösa ett nytt försök med en alternativ metod. Detta minskar förseningen i betalningsbehandlingen och förbättrar chanserna för en lyckad betalning.Kundmeddelanden

Vissa system integrerar kundmeddelanden som en del av processen för att genomföra misslyckade betalningar igen. Det innebär att kunderna informeras om den misslyckade betalningen och det kommande nya försöket. På så sätt får kunderna en möjlighet att uppdatera sina betalningsuppgifter vid behov. Den här typen av transparens kan förbättra kundernas förtroende och minska ofrivilligt kundbortfall.Regelefterlevnad

Återförsök måste följa bank- och finansregler, som kan variera beroende på region. Det finns regler gällande antalet tillåtna återförsök, varaktigheten mellan återförsök och krav på kundkommunikation.Anpassningsbara gränser för återförsök

Företag sätter ofta gränser för antalet återförsök efter en misslyckad betalning för att undvika frustration hos kunderna och potentiella bankavgifter. Dessa gränser kan vanligtvis anpassas baserat på affärsbehov och kundprofiler.Olika branschmetoder

Olika branscher kan ha olika metoder för återförsök efter misslyckade betalningar. Abonnemangstjänster kan till exempel vara mer generösa med återförsök jämfört med plattformar för engångsköp, vilket återspeglar företagets kontinuerliga kundrelationer.Sekundära åtgärder

I de fall där återförsök kontinuerligt misslyckas kan sekundära åtgärder aktiveras. Detta kan involvera att kontakta kunden för att få ny betalningsinformation eller, när det gäller abonnemang, tillfälligt stänga av tjänsten tills problemet är löst.Integration med CRM-system

Mekanismer för återförsök är ofta integrerade med CRM-system. Detta gör det möjligt för företag att få en helhetsbild av kundens interaktioner med företaget, vilket möjliggör personliga strategier för nya betalningsförsök som tar hänsyn till kundens övergripande relation och värde för företaget.

Utmaningar för företag i samband med återförsök

Återförsök efter misslyckade betalningar kan vara förenade med utmaningar för betalningssystem. Här är några vanliga hinder som du kan stöta på och metoder för att övervinna dem:

Utmaning: Skilja mellan olika typer av transaktionsfel

I ett komplext betalningssystem kan det vara svårt att skilja mellan olika typer av misslyckade transaktioner. Misslyckade transaktioner kan bero på allt från enkla problem som nätverksavbrott till mer komplexa problem som fel med multifaktorautentisering eller problem med kreditgränser. Varje typ av fel kräver en distinkt strategi och felaktig kategorisering av dessa fel kan leda till ineffektiva strategier för återförsök, ökade driftskostnader och/eller missnöje från kunderna.

Lösning: Avancerad diagnostisk analys

Genom att implementera avancerad diagnostisk analys med maskininlärning kan du dela upp och kategorisera transaktionsfel på ett mer exakt sätt, vilket hjälper dig skilja mellan tillfälliga och beständiga feltyper och möjliggör skräddarsydda strategier för återförsök och förbättrade framgångsfrekvenser.

Utmaning: Optimera algoritmer för återförsök

Standardalgoritmer för återförsök saknar ofta flexibiliteten att anpassa sig efter olika felscenarier. De tar inte hänsyn till variabler som kundbeteenden, transaktionstyper eller specifika felkoder. Återförsök vid fel tidpunkter och med fel intervaller kan förvärra felfrekvenserna och ineffektiviteter i driften.

Lösning: Dynamisk schemaläggning av återförsök

Att utveckla en dynamisk algoritm för återförsök som anpassar sig baserat på olika faktorer ökar sannolikheten för lyckade transaktioner. Den här databaserade taktiken kan optimera tidpunkten och frekvensen för nya försök att ta betalt och balansera antalet lyckade försök med driftskostnader och kundupplevelsen.

Utmaning: Regelefterlevnad och säkerhet vid återförsök

Det är en komplicerad men viktig uppgift att se till att varje återförsök att ta betalt följer föränderliga regler och säkerhetsprotokoll. Kraven på efterlevnad och digital säkerhet förändras ständigt och kräver att företag uppdaterar sina processer kontinuerligt. Bristande efterlevnad eller säkerhetsöverträdelser vid återförsök kan leda till betydande risker, både gällande företagets anseende och juridiska processer.

Lösning: Kontinuerlig efterlevnadsövervakning och avancerad kryptering

Implementering av kontinuerlig efterlevnadsövervakning och avancerade krypteringstekniker garanterar att återförsök är både säkra och kompatibla. Regelbundna uppdateringar och revisioner av dessa system är nödvändiga för att ligga steget före nya hot och regeländringar.

Utmaning: Minimering av driftskostnader för återförsök

Återförsök att ta betalt ökar driftskostnaderna, och manuella åtgärder i processen, i kombination med ökade transaktionsavgifter och kundtjänstförfrågningar, kan snabbt öka dessa kostnader. Det är en svår balansgång att hantera dessa utgifter på ett effektiv sätt, samtidigt som man upprätthåller en hög frekvens av lyckade återförsök.

Lösning: Nyttokostnadsanalys och processautomatisering

En grundlig nyttokostnadsanalys av olika strategier för återförsök kan identifiera de bästa metoderna för ditt företag. Automatisering av processen för återförsök minskar det manuella arbetet och tillhörande kostnader, samtidigt som konsekvens och noggrannhet i återförsöken bibehålls.

Utmaning: Införliva ny betalningsteknik och nya betalningsmetoder

Utvecklingen av betalningstekniker och betalningsmetoder innebär en utmaning när det gäller att hålla betalningssystemen uppdaterade och kompatibla. Underlåtenhet att snabbt anpassa sig till nya betalningsmetoder kan leda till förlorade transaktioner och minskad kundnöjdhet.

Lösning: Flexibel systemarkitektur

Att bygga ett flexibelt betalningssystem gör det enklare att snabbt anpassa sig till ny teknik. Detta innebär att skapa flexibla API:er och modulära systemkomponenter som kan integrera nya betalningsplattformar och tekniker, vilket säkerställer att systemet förblir relevant och effektivt.

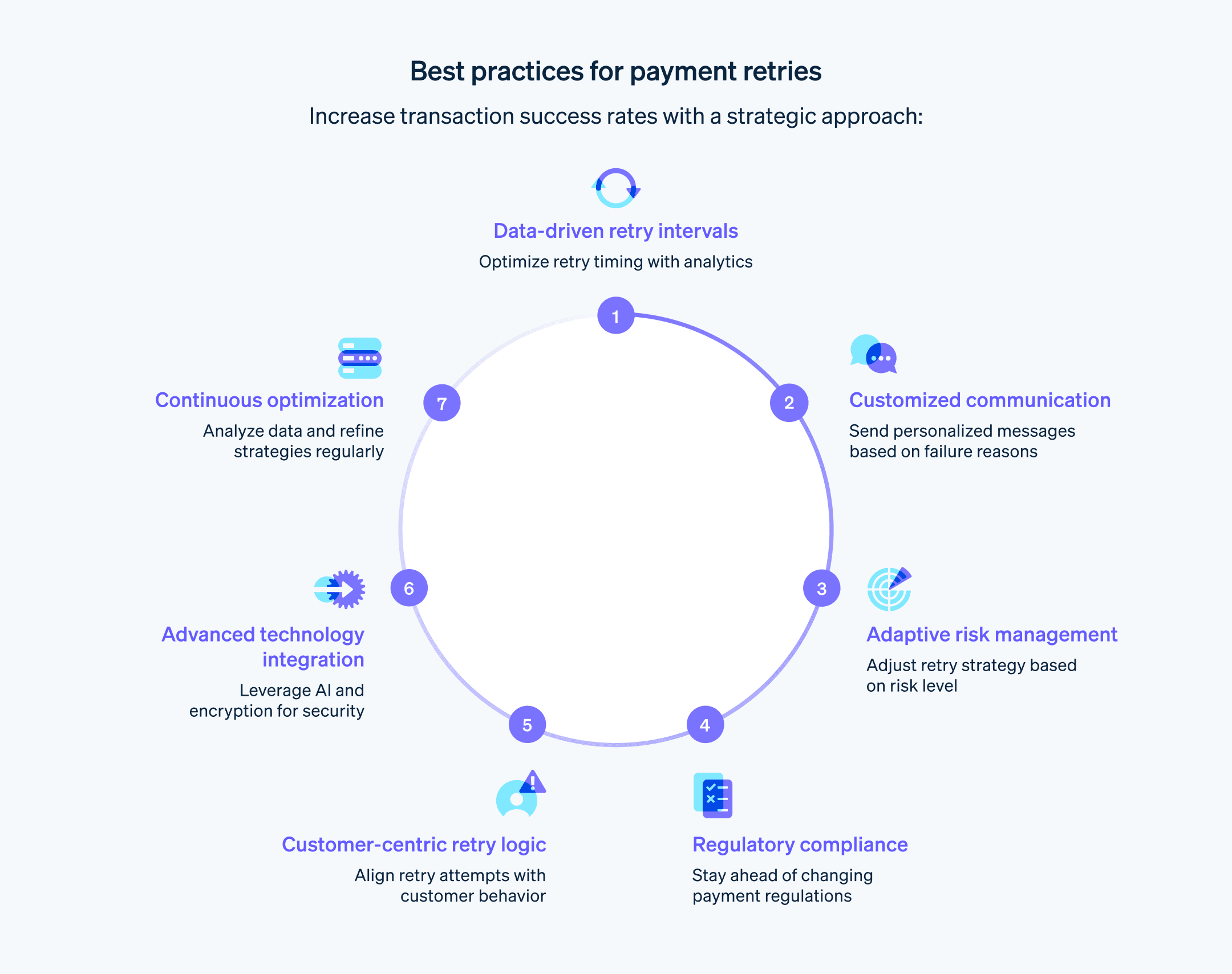

Bästa metoder för att hantera återförsök

Det finns många olika strategier för intäktsåtervinning och hantering av betalningspåminnelser. När du utvecklar ditt företags strategi för återförsök efter misslyckade betalningar ska du följa de här metoderna:

Databaserade intervall för återförsök

Använd avancerad analys för att fastställa de optimala återförsöksintervallen. Analysera kundernas betalningsmönster, transaktionstyper och historiska framgångsfrekvenser för att upprätta skräddarsydda scheman för nya betalningsförsök. Den här metoden går längre än generiska scheman för nya betalningsförsök och använder data för att förutsäga de mest effektiva tiderna för återförsök, vilket ökar sannolikheten för lyckade transaktioner.Anpassade kommunikationsstrategier

Utveckla en kommunikationsplan som är anpassad till processen för återförsök. Detta innebär att skicka anpassade meddelanden till kunder baserat på orsaken till den misslyckade transaktionen. Om en betalning exempelvis misslyckas på grund av ett utgånget kort bör kommunikationen vägleda kunden så att hen uppdaterar sin betalningsinformation. A/B-testning kan hjälpa dig att förfina dessa tekniker för att avgöra vad som fungerar bäst för din kundbas.Adaptiv riskhantering

Integrera en dynamisk riskbedömningsmodell i processen för återförsök. Den här modellen bör utvärdera den risk som är förknippad med olika typer av misslyckade transaktioner och justera strategin för återförsök i enlighet med detta. För scenarier med hög risk, till exempel misstänkta bedrägerier, bör systemet automatiskt eskalera problemet till en manuell granskning eller ett team som är specialiserat på bedrägeriidentifiering.Efterlevnad av regelverk

Håll dig uppdaterad om globala och regionala regeländringar som påverkar betalningsåterförsök och implementera system som uppdateras automatiskt för att anpassa sig efter nya bestämmelser. Detta är särskilt viktigt för internationella företag som måste anpassa sig efter olika regelverk i olika regioner, ett marknadssegment som växer: gränsöverskridande betalningar uppgick till 150 biljoner USD under 2022, en ökning med 13 % jämfört med föregående år.Kundcentrerad återförsökslogik

Implementera ett kundcentrerat perspektiv när du implementerar en återförsöksstrategi. Det innebär att förstå kundernas önskemål och beteenden, samt att anpassa återförsöksprocessen så att den passar dessa preferenser. Vissa kunder kanske föredrar återförsök på specifika dagar i månaden eller efter ett kundmeddelande.Avancerad teknikintegration

Använd den senaste tekniken inom betalningshantering och cybersäkerhet. Detta inkluderar användning av AI och maskininlärning för prediktiv analys, blockkedja för säker transaktionsregistrering och avancerade krypteringsmetoder för dataskydd. Den senaste tekniken förbättrar inte bara effektiviteten i din återförsöksprocess utan ökar också säkerheten och kundernas förtroende.Kontinuerlig processoptimering

Granska och optimera dina processer för betalningsåterförsök regelbundet. Detta bör vara ett pågående arbete som omfattar granskning av prestandamått och kundåterkoppling. Använd dessa insikter för att förfina dina strategier och anpassa dig till förändrade marknadsförhållanden och kundbehov.

Så kan Stripe hjälpa dig

Stripe har inbyggda funktioner som företag kan använda för att skapa en effektiv strategi för intäktsåtervinning, hantering av betalningspåminnelser och betalningsåterförsök. Så här kan Stripe hjälpa dig:

Automatiserad återförsökslogik

Stripes automatiserade återförsökslogik är utformad för att optimera tidpunkten och frekvensen för betalningsåterförsök. Systemet använder maskininlärning för att analysera historiska betalningsdata och hjälper till att avgöra när det är bäst att försöka genomföra en misslyckad betalning igen, vilket ökar chanserna för lyckade debiteringar samtidigt som antalet onödiga försök minskar.Smarta verktyg för hantering av betalningspåminnelser

Stripe tillhandahåller avancerade verktyg för att driva in utestående betalningar som företag kan anpassa utifrån specifika behov. Dessa verktyg skickar automatiska meddelanden till kunder när en betalning misslyckas och påminner dem om att uppdatera sina betalningsuppgifter. Företag kan konfigurera Stripes system för att skicka dessa påminnelser med specifika intervall och via olika kommunikationskanaler som e-post eller sms.Anpassningsbara faktureringscykler

Med Stripe kan du anpassa faktureringscykler och scheman för återförsök för att passa olika kundsegment. Denna flexibilitet möjliggör ett mer skräddarsytt tillvägagångssätt för betalningar, vilket kan vara särskilt användbart för abonnemangsbaserade modeller eller företag med olika kundbaser.Analys och rapportering i realtid

Stripe erbjuder omfattande analys- och rapporteringsfunktioner som ger insikter i realtid om betalningstransaktioner. Dessa funktioner inkluderar detaljerade rapporter om misslyckade betalningar, andel lyckade återförsök och kundreaktioner på betalningspåminnelser. Analyser är viktiga för att kontinuerligt förfina och förbättra dina strategier för intäktsåtervinning.Regelefterlevnad och säkerhet

Stripe följer de högsta standarderna för efterlevnad och säkerhet, vilket garanterar att nya betalningsförsök och betalningspåminnelser är säkra och följer alla tillämpliga lagar. Stripe följer Payment Card Industry Data Security Standards (PCI DSS) och använder avancerade krypteringsmetoder för att skydda känsliga data.Integration med CRM och bokföringsprogram

Stripes plattform kan enkelt integreras med ett brett utbud av CRM- och redovisningsprogram, vilket underlättar en övergripande strategi för intäktsåtervinning och hantering av betalningspåminnelser som håller kunddata och ekonomiska register synkroniserade och uppdaterade.Anpassade regler och maskininlärningsmodeller

Företag kan skapa anpassade regler för betalningsåterförsök och hantering av betalningspåminnelser på Stripes plattform. Dessutom kan Stripes maskininlärningsmodeller förutsäga och identifiera potentiella betalningsproblem innan de inträffar, vilket möjliggör proaktiva åtgärder för att förhindra förlorade intäkter.Globala betalningsmetoder och valutor

Stripe stöder ett brett utbud av betalningsmetoder och mer än 135 valutor, vilket gör det till en idealisk lösning för företag med en global kundbas. Detta garanterar att betalningsåterförsök är så inkluderande och anpassningsbara som möjligt och tillgodoser de betalningsmetoder som kunder från olika regioner föredrar.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.