E-handeln har expanderat inom B2B-området under de senaste åren. En rapport visar att nästan 23 % av all försäljning kommer att ske online år 2027. Till följd av detta förväntar sig kunderna mer av alla delar av e-handeln.

Betalningsmetoder är en central del av den upplevelsen, och det är viktigt för företag att erbjuda en rad betalningsalternativ för att tillgodose kundernas preferenser och behov.

Att konfigurera betalinfrastruktur och behandlingslösningar är en viktig del av att konfigurera betalningsmetoder för e-handel. Här är vad du behöver veta om hur du använder rätt betalningsmetoder för att säkerställa en säker, tillförlitlig och användarvänlig betalningsupplevelse som är optimerad för konvertering.

Vad innehåller den här artikeln?

- Vad är ett e-handelsbetalningssystem?

- Populära betalningsmetoder för e-handel

- Hur man bestämmer vilka betalningsmetoder för e-handel som ska erbjudas

- Hur man implementerar ett betalningssystem för e-handel

- Så kan Stripe Payments hjälpa till

Vad är ett betalningssystem för e-handel?

E-handeln har förändrat hur företag verkar, genom att erbjuda en plattform för företag av alla storlekar där de kan nå en bredare publik och verka på global skala. Det erbjuder flera fördelar jämfört med traditionella fysiska butiker, såsom tillgänglighet dygnet runt, global räckvidd och lägre driftskostnader. Men e-handel kräver en viss typ av betalningssystem.

Ett system för betalning av e-handel är ett digitalt ramverk som gör det möjligt för företag att ta emot betalningar via internet. Kunder kan köpa produkter eller tjänster online med olika betalningsmetoder, t.ex. kredit- och bankkort, digitala plånböcker (t.ex. Apple Pay, Google Pay) och köp nu, betala senare. För både B2C-modeller (business-to-consumer) och B2B-modeller (business-to-business) är en betalningsgateway kärnan i systemet för e-handelsbetalningar. Gatewayen möjliggör onlinebetalningar genom att fungera som en mellanhand mellan webbutiken och betalleverantören och krypterar de betalningssuppgifter som kunderna skickar och vidarebefordrar dem för behandling.

Eftersom det alltid finns en risk för bedrägerier vid behandling av e-handelsbetalningar använder dessa betalningar starka funktioner för att identifiera och förebygga bedrägerier. Maskininlärningsalgoritmer kan analysera stora mängder data snabbt för att identifiera mönster och avvikelser i dina betalningar och blockera högrisktransaktioner innan de genomförs. IP-spårning och geolokalisering är också användbara för att identifiera ovanlig – och eventuellt bedräglig – betalningsaktivitet på en e-handelswebbplats.

Ett pålitligt betalningssystem skapar förtroende hos kunderna och säkerställer att onlineshopping förblir bekvämt och säkert – oavsett vad du säljer.

Populära betalningsmetoder för e-handel

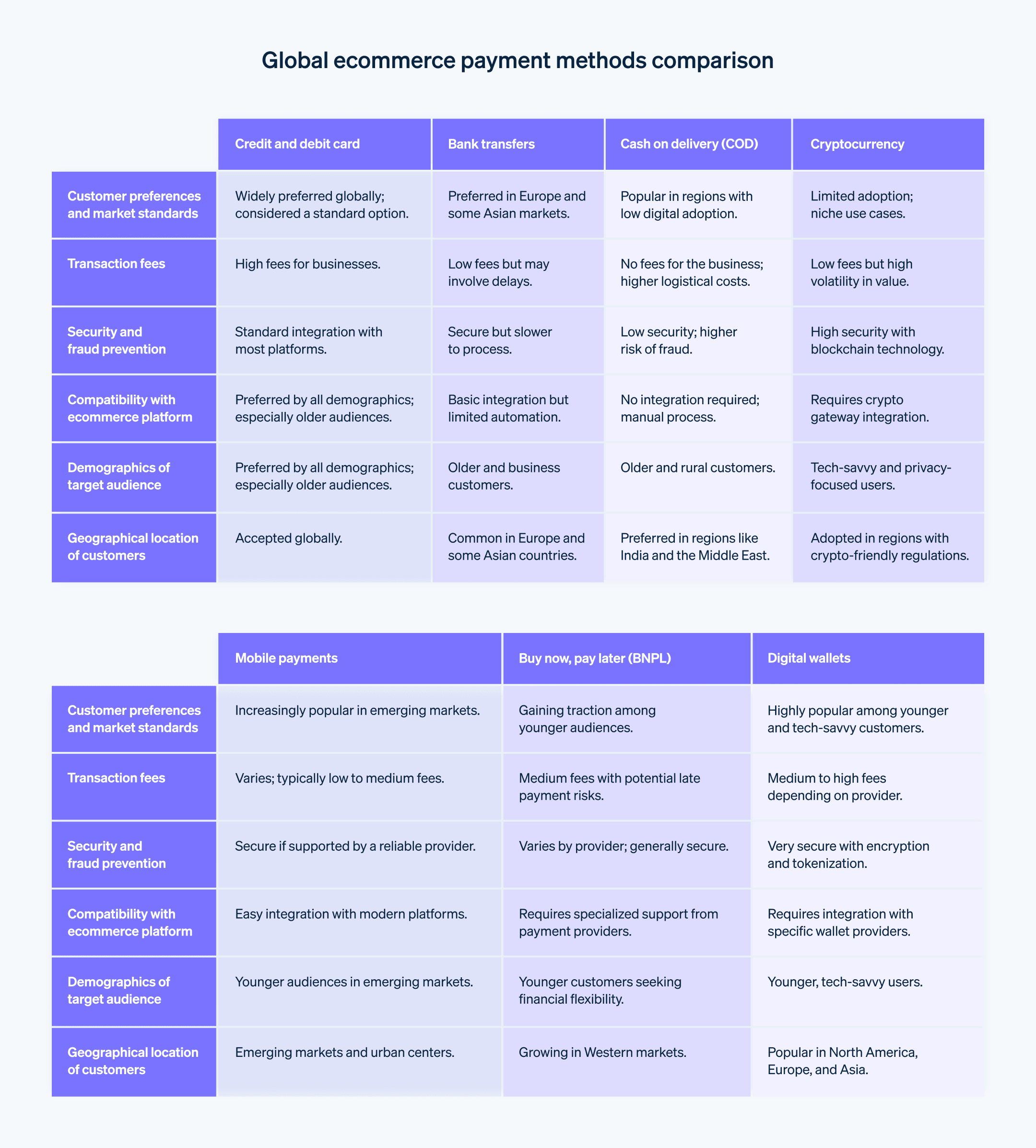

I takt med att e-handeln snabbt har expanderat har även konsumenternas tillgång till betalningsmetoder. Kundernas preferenser kring betalningsmetoder för e-handel varierar avsevärt i olika delar av världen, och det utvecklas ständigt. Globalt sett är kredit- och bankkort och digitala plånböcker de mest populära betalningsmetoderna för e-handel, men andra betalningsmetoder som banköverföringar och leverans mot betalning är fortsatt populära i vissa regioner. Användningen av mobila betalningar ökar också, särskilt på marknader med hög smartphone-användning.

Här är några av de mest populära globala betalningsmetoderna för e-handel som finns tillgängliga idag:

Kredit- och bankkort

Kredit- och bankkort är de vanligaste betalningsmetoderna för e-handelstransaktioner. De gör det möjligt för kunderna att utföra betalningar snabbt och bekvämt.E-plånböcker

E-plånböcker, som PayPal, Apple Pay och Google Pay, har blivit allt populärare. De gör det möjligt för kunder att lagra betalningsinformation på ett säkert sätt och göra betalningar med bara några få klick. 2020 började e-plånböcker hålla jämna steg med kreditkort som den mest populära digitala betalningsmetoden i USA.Banköverföringar

Banköverföringar, även kallade elektroniska överföringar av medel, gör det möjligt för kunder att överföra pengar från sitt bankkonto till företagets bankkonto. Banköverföringar används runt om i världen, men de är särskilt populära i Europa och Asien. En undersökning från Europeiska centralbanken visar att banköverföringar stod för 45 % av e-handelsbetalningarna i Europeiska unionen 2020.Leverans mot betalning/postförskott

Leverans mot betalning är en betalningsmetod där kunderna betalar för sina köp när de får dem, inte tidigare. Denna betalningsmetod är vanlig i länder där kredit- och bankkortsanvändningen är låg. Till exempel föredrog cirka 83 % av kunderna i Indien leverans mot betalning när de betalade för onlineköp.Mobila betalningar

Mobila betalningar gör det möjligt för kunder att betala med sina mobila enheter. Mobil e-handel kommer att stå för 59 % av den totala e-handeln, vilket motsvarar 4,01 biljoner dollar 2025.Köp nu, betala senare

Köp nu, betala senare (BNPL) är ett betalningsalternativ som gör det möjligt för kunder att köpa varor eller tjänster direkt och betala vid ett senare datum, ofta med ränta eller avgifter.Kryptovaluta

Kryptovaluta, som Bitcoin och Ethereum, är en digital valuta som kan användas för att göra e-handelstransaktioner. Denna betalningsmetod blir mer allmänt accepterad av online-återförsäljare.Förbetalda kort

Förbetalt kort är en typ av bankkort som laddas med en viss summa pengar och som kunder kan använda för att betala för onlineköp, precis som de skulle göra med ett vanligt bankkort.

Hur man bestämmer vilka betalningsmetoder för e-handel som ska erbjudas

Det finns flera faktorer som företag bör tänka på när de väljer vilka betalningsmetoder för e-handel som ska erbjudas:

Kundpreferenser och marknadsstandarder

Använd marknadsundersökningar för att bestämma vilka betalningsmetoder som ska erbjudas. För att säkerställa att din e-handelsupplevelse är konkurrenskraftig måste du förstå hur din målkund föredrar att betala för varor eller tjänster och vilka betalningsmetoder dina konkurrenter erbjuder. Till exempel, om majoriteten av dina kunder föredrar att använda digitala plånböcker utöver kreditkortsbetalningar, bör du erbjuda dessa alternativ.Transaktionsavgifter

Överväg och jämför transaktionsavgifterna som är kopplade till varje betalningsmetod. Kreditkort har till exempel vanligtvis högre transaktionsavgifter jämfört med andra betalningsmetoder. Företag bör väga dessa avgifter mot de potentiella fördelarna med att erbjuda just den betalningsmetoden, såsom ökad konverteringsgrad eller kundnöjdhet.Säkerhet och förebyggande av bedrägerier

E-handelsföretag bör erbjuda säkra betalningsmetoder som skyddar både dem själva och deras kunder från bedrägerier. Betalningsmetoder som använder tvåfaktorsautentisering, kryptering och bedrägeriidentifiering är i allmänhet ett bättre val än de med färre säkerhetsfunktioner.Kompatibilitet med e-handelsplattformen

E-handelsföretag bör se till att deras betalningssystem är kompatibelt med deras e-handelsplattform. Vissa betalningsmetoder kan kräva ytterligare integrationsarbete, vilket kan vara kostsamt och tidskrävande. Att arbeta med en betalleverantör som Stripe kan minimera den tid och ansträngning det kräver att installera och underhålla din betalinfrastruktur.Målgruppens demografi

E-handelsföretag bör ta hänsyn till sin målgruppsdemografi och de betalningsmetoder som är populära bland dessa grupper. Yngre målgrupper kanske föredrar e-plånböcker, medan äldre målgrupper kan föredra mer traditionella betalningsmetoder som kreditkort eller banköverföringar. Det är därför det är så viktigt att välja rätt betalleverantör.Kundernas geografiska läge

Det är viktigt att förstå hur betalningspreferenserna kan variera mellan olika marknader. Ta hänsyn till kundernas geografiska plats och välj en betalningsgateway som kan underlätta vanliga betalningsmetoder i dessa områden. Leverans mot betalning kan vara en populär betalningsmetod i vissa länder, medan banköverföringar kan vara vanligare i andra. Stripe stödjer över 135 valutor och ledande betalningsmetoder runt om i världen.

Så implementerar man ett betalningssystem för e-handel

Följ dessa steg för att implementera ett betalningssystem för e-handel:

Välj en betalleverantör

Vissa betalleverantörer slår ihop betalningsgateways och betalleverantörstjänster medan andra erbjuder dem separat. Oavsett vilken typ du väljer, se till att du förstår leverantörens prisstruktur, godkända betalningsmetoder och förmågan att skala upp när din betalningsvolym ökar.

Skapa ett handlarkonto:

Innan du kan ta emot betalningar måste du skapa ett handlarkonto hos din leverantör. Hur denna process ser ut beror på leverantören, men det inkluderar vanligtvis att ange företagets uppgifter och verifiera din identitet.

Integrera din betalleverantör med din webbplats

När du har valt en leverantör måste du ansluta betalningsgatewayen till din e-handelsplattform eller webbplats. Stora plattformar gör det vanligtvis enkelt att ansluta din leverantör till din onlinebutik, men det här steget innebär mer arbete om du ansluter manuellt till din egen webbplats. Du måste skaffa unika identifierare som kallas API-nycklar (application programming interface) och lägga till dem i din webbplats kod.

Testa systemet

Använd en testmiljö som kallas sandlåda för att testa olika betalningsmetoder och se till att din betalningsgateway interagerar med din webbplats på rätt sätt. Se till att allt fungerar smidigt innan du lanserar för kunderna.

Hur Stripe Payments kan hjälpa till

Stripe Payments erbjuder en enhetlig, global betalningslösning som hjälper alla företag – från växande startupföretag till globala företag – att ta emot betalningar online, fysiskt och runt om i världen.

Det här kan Stripe Payments hjälpa till med:

- Optimera din upplevelse i kassan: Skapa en smidig upplevelse för kunden och spara tusentals teknikertimmar med förbyggda användargränssnitt för betalningar, tillgång till över 100 betalningsmetoder och Link, Stripes e-plånbok.

- Expandera till nya marknader snabbare: Nå kunder över hela världen och minska komplexiteten och kostnaderna för hantering av flera valutor med gränsöverskridande betalningsalternativ, tillgängliga i 195 länder och för över 135 valutor.

- Skapa en enhetlig betalningsupplevelse fysiskt och online: Bygg en enhetlig handelsupplevelse i alla digitala och fysiska kanaler för att personanpassa interaktioner, belöna lojalitet och öka intäkterna.

- Förbättrad betalningsprestanda: Öka intäkterna med en rad anpassningsbara, lättkonfigurerade betalningsverktyg, inklusive kodfritt skydd mot bedrägeri och avancerade funktioner för att förbättra auktoriseringstider.

- Snabbare utveckling med en flexibel och pålitlig plattform för tillväxt: Bygg vidare på en plattform som är utformad för att skala upp med dig, med 99,999 % upptid och branschledande tillförlitlighet.

Läs mer om hur Stripe Payments kan driva dina betalningar online och i fysisk miljö, eller börja idag.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.