Ecommerce has expanded across the B2B space in recent years. One report says that nearly 23% of all sales will be conducted online by 2027. As a result, customers expect more from every part of the ecommerce experience.

Payment methods are a central part of that experience, and it’s important for businesses to offer a range of payment options to accommodate customers’ preferences and needs.

Finding the right payments infrastructure and processing solutions is an integral part of setting up ecommerce payment methods. Here’s how to use the right payment methods to ensure a secure, reliable, and user-friendly payment experience that is optimized for conversion.

What’s in this article?

- What is an ecommerce payment system?

- Popular ecommerce payment methods

- How to decide which ecommerce payment methods to offer

- How to implement an ecommerce payment system

- How Stripe Payments can help

What is an ecommerce payment system?

Ecommerce has transformed the way businesses operate, providing a platform for companies of all sizes to reach a wider audience and operate on a global scale. It offers several advantages over traditional brick-and-mortar stores, such as 24/7 availability, global reach, and lower operating costs. But ecommerce businesses require a specific type of payment system.

An ecommerce payment system is a digital framework that allows businesses to accept payments over the internet. Customers can purchase products or services online using various payment methods, such as credit and debit cards, digital wallets (e.g., Apple Pay, Google Pay), and buy now, pay later (BNPL). For both business-to-consumer (B2C) and business-to-business (B2B) models, a payment gateway is at the heart of the ecommerce payment system. The gateway makes online payments possible by acting as an intermediary between the online store and the payment processor, encrypting the payment data customers submit and forwarding it for processing.

Because there’s always a risk of fraud with ecommerce payment processing, these payment systems use strong fraud detection and prevention features. Machine learning algorithms can analyze large volumes of data quickly to identify patterns and anomalies within your payments and block high-risk transactions before they go through. IP tracking and geolocation are also useful for identifying unusual—and possibly fraudulent—payment activity on an ecommerce site.

A reliable payment system builds trust with customers and ensures that online shopping remains convenient and safe—no matter what you’re selling.

Popular ecommerce payment methods

As ecommerce has expanded at a rapid rate, so have the payment methods available to consumers. Customer preferences around ecommerce payment methods vary considerably in different parts of the world, and the field is constantly evolving. Globally, credit and debit cards and digital wallets are the most popular ecommerce payment methods, but other payment methods, such as bank transfers and cash on delivery (COD), remain popular in certain regions. The use of mobile payments is also growing, particularly in markets with high smartphone penetration.

Here are some of the most popular global ecommerce payment methods available today:

Credit and debit cards

Credit and debit cards are the most common payment methods for ecommerce transactions. They allow customers to make payments quickly and conveniently.Digital wallets

Digital wallets, such as PayPal, Apple Pay, and Google Pay, have become increasingly popular. They allow customers to store payment information securely and make payments with just a few clicks. In 2020, digital wallets started pacing alongside credit cards as the most popular online payment method in the US.Bank transfers

Bank transfers, also known as electronic funds transfers (EFTs), allow customers to transfer money from their bank account to the business’s bank account. While bank transfers are used around the world, they are particularly popular in Europe and Asia. A survey by the European Central Bank reports that bank transfers accounted for 45% of ecommerce payments in the European Union in 2020.Cash on delivery (COD)

COD is a payment method in which customers pay for their purchases when they receive them, not before. This payment method is common in countries where credit and debit card usage is low. For example, around 83% of customers in India preferred COD when paying for online purchases.Mobile payments

Mobile payments allow customers to pay using their mobile devices. Mobile commerce will be responsible for 59% of total retail ecommerce sales, accounting for $4.01 trillion in 2025.Buy now, pay later

Buy now, pay later (BPNL) is a payment option that allows customers to purchase goods or services up front and delay payment until a later date, often with interest or fees.Cryptocurrency

Cryptocurrency, such as Bitcoin and Ethereum, is a digital currency that can be used to make ecommerce transactions. This payment method is becoming more widely accepted by online retailers.Prepaid cards

Prepaid cards are a type of debit card that is loaded with a specific amount of money, which a customer can use to pay for online purchases, just as they would with a regular debit card.

How to decide which ecommerce payment methods to offer

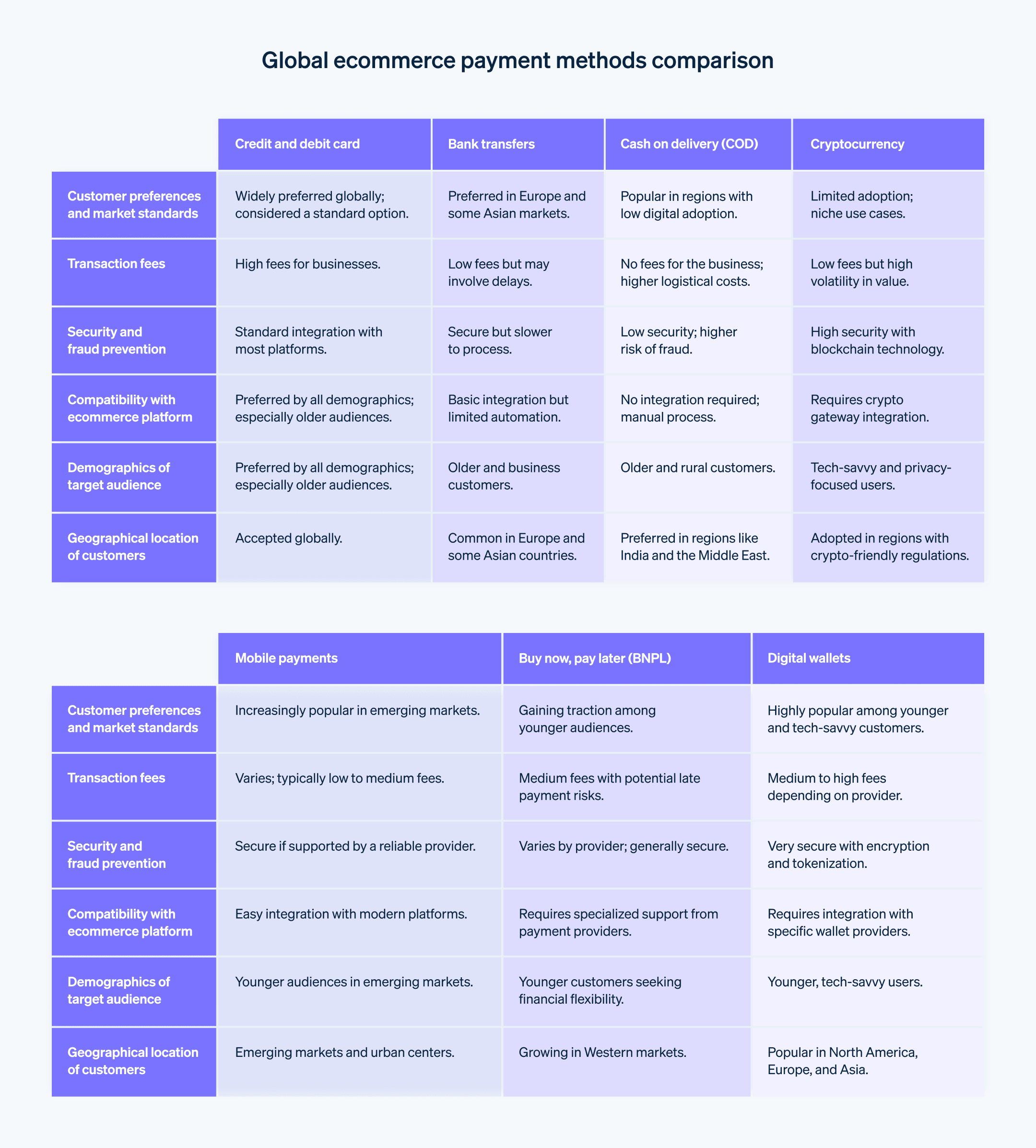

There are several factors that businesses should consider when choosing what ecommerce payment methods to offer:

Customer preferences and market standards

Use market research to decide which payment methods to offer. To ensure that your ecommerce experience is competitive, you need to understand how your target customer prefers to pay for goods or services and what payment methods your competitors are offering. For example, if the majority of your customers prefers using digital wallets in addition to credit card payments, offer those options.Transaction fees

Consider and compare the transaction fees associated with each payment method. Credit cards, for example, typically have higher transaction fees compared to other payment methods. Businesses should weigh these fees against the potential benefits of offering that payment method, such as increased conversion rates or customer satisfaction.Security and fraud prevention

Ecommerce businesses should offer secure payment methods to protect themselves and their customers from fraud. Payment methods that use two-factor authentication, encryption, and fraud detection are generally a better choice than those with fewer security features.Compatibility with ecommerce platform

Ecommerce businesses should ensure that their payment system is compatible with their ecommerce platform. Some payment methods may require additional integration work, which can be costly and time-consuming. Working with a payment provider like Stripe can minimize the time and effort it takes to set up and maintain your payments infrastructure.Demographics of target audience

Ecommerce businesses should consider their target audience demographics and the payment methods that are popular among those groups. Younger audiences may prefer digital wallets, while older audiences may prefer more traditional payment methods such as credit cards or bank transfers. This is why choosing the right payment processing provider is so important.Geographical location of customers

It’s important to identify how payment preferences can vary across different markets. Consider the geographical location of your customers and choose a payment gateway that can facilitate common payment methods in those areas. Cash on delivery may be a popular payment method in some countries, while bank transfers may be more common in others. Stripe supports more than 135 currencies and leading payment methods around the world.

How to implement an ecommerce payment system

To implement an ecommerce payment system, follow these steps:

Choose a payments provider

Some payments providers bundle payment gateway and payment processor services while others offer them separately. Whichever type you choose, make sure you understand the provider’s pricing structure, accepted payment methods, and ability to scale as your payment volume increases.

Create a merchant account

Before you can accept any payments, you need to set up a merchant account with your provider. The specifics of this process will depend on your provider, but it typically includes providing your business details and verifying your identity.

Integrate your payments provider with your site

Once you’ve selected a provider, you need to connect the payment gateway to your ecommerce platform or website. Major platforms usually make it simple to connect your provider to your online shop, but this step will involve more work if you’re manually connecting to your own website. You’ll need to get unique identifiers known as application programming interface (API) keys and add them to your website’s code.

Test the system

Use a testing environment, known as a “sandbox,” to try out different payment methods and make sure your payment gateway is interacting with your website correctly. Ensure everything is running smoothly before going live for customers.

How Stripe Payments can help

Stripe Payments provides a unified, global payments solution that helps any business—from scaling startups to global enterprises—accept payments online, in person, and around the world.

Stripe Payments can help you:

- Optimize your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs, access to 100+ payment methods, and Link, Stripe’s digital wallet.

- Expand to new markets faster: Reach customers worldwide and reduce the complexity and cost of multicurrency management with cross-border payment options, available in 195 countries across 135+ currencies.

- Unify payments in person and online: Build a unified commerce experience across online and in-person channels to personalize interactions, reward loyalty, and grow revenue.

- Improve payments performance: Increase revenue with a range of customizable, easy-to-configure payment tools, including no-code fraud protection and advanced capabilities to improve authorization rates.

- Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments, or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.