With global ecommerce sales projected to reach nearly $6 trillion in 2023, it’s clear that card-not-present (CNP) transactions are a significant part of the transaction mix for many businesses. However, card-present (CP) transactions also continue to play an important role, especially for businesses that maintain physical locations. In order to consider their advantages, potential challenges, and suitability for different business models, businesses must first understand these transaction types in depth.

We’ll cover the differences between CP and CNP transactions, examining their unique characteristics and exploring how businesses can evaluate and select the best option for their needs. We’ll also outline the role of payment processing providers in this decision-making process, and the benefits these partners can bring to businesses navigating this complex landscape.

What’s in this article?

- What is a card-present transaction?

- Benefits and challenges of card-present transactions

- What is a card-not-present transaction?

- Benefits and challenges of card-not-present transactions

- Card-present vs. card-not-present transactions: How to choose what’s best for your business

What is a card-present transaction?

A card-present (CP) transaction refers to a payment method in which the cardholder presents their physical credit or debit card to the business at the point of sale. Most of the time, this takes place in a brick-and-mortar store, where the customer either swipes, dips, or taps their card at a card reader.

The distinguishing feature of a CP transaction is that both the cardholder and payment card are physically present, enabling the business to validate the transaction in real time. CP transactions use electronic card readers or point-of-sale (POS) terminals to read the card’s information and often require a signature or PIN from the cardholder to complete the transaction.

Benefits and challenges of card-present transactions

CP transactions are the backbone of everyday commerce and represent the type of transactions most consumers use when making in-store purchases. Like any type of transaction, CP transactions present their own set of advantages and challenges that businesses must understand.

Benefits

Enhanced security

One of the primary benefits of CP transactions is increased security. The physical presence of both the cardholder and the card at the point of sale makes it possible for the salesperson to verify the cardholder’s identity, thereby reducing the likelihood of fraudulent transactions.Lower transaction costs

Since CP transactions are considered less risky than card-not-present transactions, the processing fees for CP transactions are often lower. This can mean significant cost savings for businesses over time.Instant payment processing

CP transactions are processed in real-time, and businesses receive confirmation of successful payment immediately. This means transactions are completed swiftly, enhancing the customer’s shopping experience.

Challenges

Need for physical hardware

CP transactions require a physical POS system to process the payment card. This can be a hurdle for small businesses or businesses in remote locations that may find it difficult to acquire or maintain these systems.Potential for hardware failure

Any hardware, including POS terminals, can malfunction or break down, potentially disrupting business operations. Businesses must be prepared to address these issues quickly to prevent loss of sales.Exposure to card-present fraud

While CP transactions are considered more secure, they are not immune to fraud. There is still a risk of counterfeit cards, stolen cards, or card skimming, in which fraudulent actors capture card data from the magnetic stripe.Limited to in-person sales

By definition, CP transactions are possible only when the customer is physically present, which limits the reach of the business’s market compared to online transactions.

What is a card-not-present transaction?

A card-not-present (CNP) transaction refers to a transaction that takes place online, over the phone, or via mail order, in which the cardholder does not present the physical card to the business at the time of the payment. In these situations, the business must rely on the customer to provide the necessary card details (i.e., card number, expiration date, and CVV code) to process the payment.

Since these transactions can carry a higher risk of fraud due to the lack of physical card verification, they usually require additional security measures, such as address verification service (AVS) or the use of security codes.

Benefits and challenges of card-not-present transactions

CNP transactions have grown increasingly common due to the rise of digital and remote business operations. They facilitate global commerce, giving customers the flexibility to make purchases anywhere, anytime, without needing to be physically present at a business’s brick-and-mortar location. But these transactions also carry inherent risks—most notably, an increased potential for fraud. It’s vital that businesses understand the pros and cons of CNP transactions so they can manage these transactions effectively.

Benefits

Broadening market reach

CNP transactions break down geographic barriers by allowing businesses to cater to customers across the globe. This can greatly expand a business’s customer base and potential revenue.Enhancing customer convenience

CNP transactions make it possible for customers to shop at any time and from any location, enhancing the overall shopping experience.Reducing operational costs

Maintaining physical stores comes with myriad overhead costs, such as rent, utility bills, and staff wages. CNP transactions, which often require fewer resources to manage, can help reduce these costs.Increasing sales opportunities

CNP transactions offer businesses additional sales opportunities like online impulse buys, upselling, and cross-selling, which are more difficult to execute in a physical store environment.

Challenges

Increased risk of fraud

Since the cardholder is not present during the transaction, it’s more difficult for the business to verify the customer’s identity, leading to a higher risk of fraudulent transactions.Higher processing fees

Due to the higher risk associated with CNP transactions, payment processors typically charge higher fees for these types of transactions.Customer trust issues

Since the transaction occurs remotely, customers may have security concerns about providing their card details, which could potentially impact conversion rates.Dispute and chargeback risks

CNP transactions are more prone to disputes and chargebacks, in part because the customer can make a purchase without being physically present at a brick-and-mortar location to verify what they’re purchasing.

While CNP transactions are becoming increasingly common—and necessary—as more and more commerce shifts online, it’s important for businesses to consider both the opportunities and challenges they present. The key to managing CNP transactions successfully lies in mitigating the risks while maximizing the benefits, such as implementing robust fraud prevention mechanisms and choosing a reliable payment processor that provides secure CNP transaction processing.

Card-present vs. card-not-present transactions: How to choose what’s best for your business

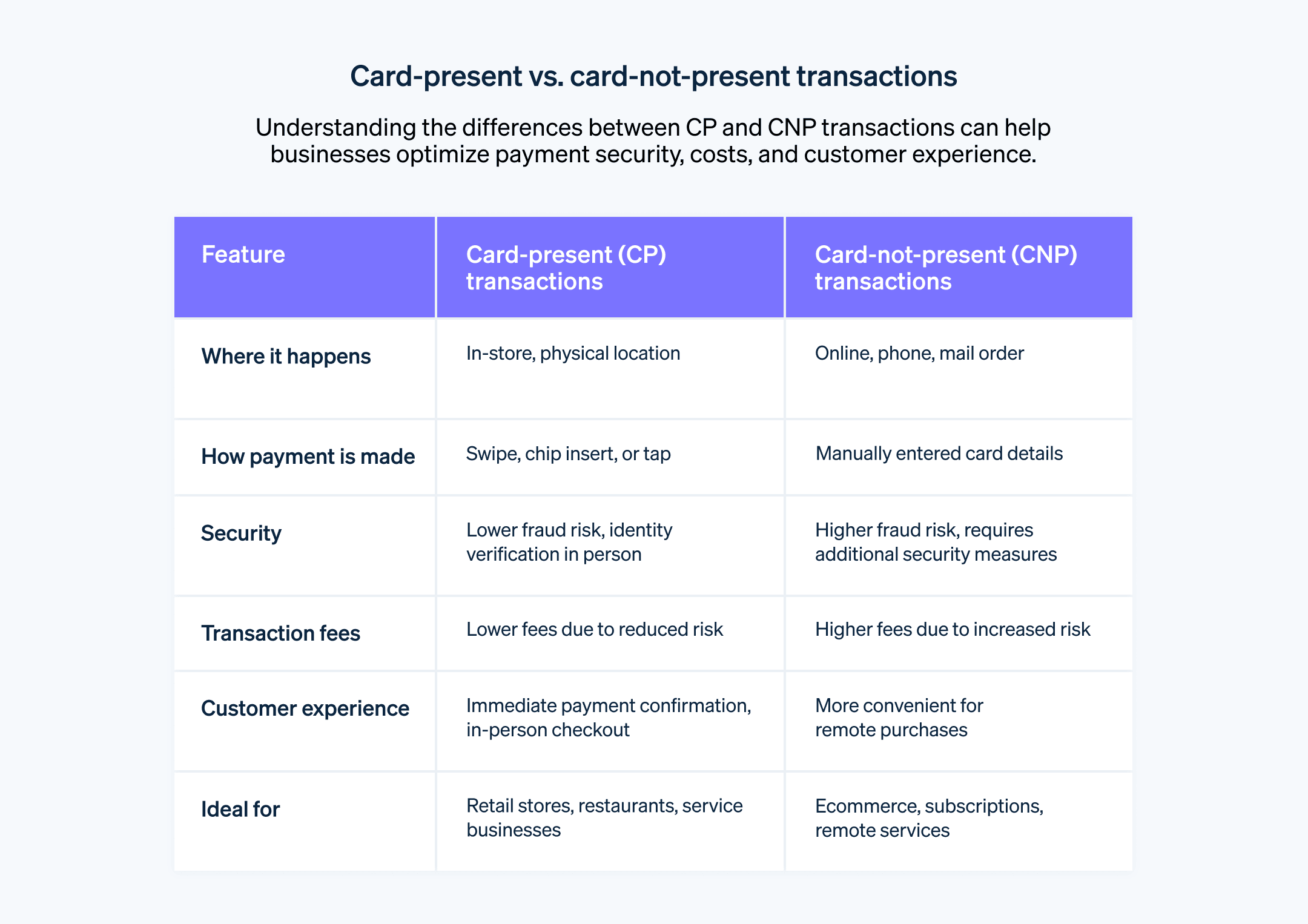

When choosing between CP and CNP transactions, businesses should consider their broader operating model and customer expectations.

CP transactions are linked, historically, to brick-and-mortar establishments where customers or salespeople swipe, insert, or tap physical cards at a terminal. CNP transactions, on the other hand, have become synonymous with the rise of ecommerce, because the physical card is not present at the point of sale; instead, the customer types in their payment details. However, for many businesses, particularly those with a mix of online and in-person sales, the decision isn’t either-or. Often, a hybrid approach is suitable.

The key differences between these transaction types lie in the way they handle customer data, transaction fees, and fraud prevention needs. While CP transactions offer lower transaction fees, they can limit a business’s reach to their physical location and require an investment in POS equipment. Meanwhile, CNP transactions allow businesses to expand their reach globally, but they demand a more robust security infrastructure due to higher fraud risks.

Your choice should align with your business’s scale, target audience, and sales environments. If you operate a local boutique or a restaurant, CP transactions might be your go-to choice. If you run an ecommerce site or a subscription-based business that targets customers from different geographical locations, CNP transactions would fit your operations better.

For businesses with multiple sales channels, such as a brick-and-mortar store with an online shopping option, it’s essential to have a payment processing solution that can handle both transaction types efficiently. It’s not a matter of choosing one over the other—it’s finding the right mix based on your unified sales strategy.

Working with a reliable payment processing provider to make this decision is essential. Your payment processing provider can offer valuable advice based on industry expertise, scalable solutions tailored to your business needs, and support in maintaining compliance and addressing security concerns.

Ultimately, optimizing your payment process boils down to understanding the key differences between CP and CNP transactions and how they impact your business. These considerations can help enhance your transaction efficiency while improving your overall customer experience.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.