Businesses that accept electronic payments through multiple channels—in-person, online, and mobile—need to work through various complexities. This includes selecting a suitable payment processor, an important decision that can affect long-term success and impact multiple parts of the business.

As more businesses expand globally, there is a growing need for multi-currency and localized payment options. To address these evolving demands, business owners and entrepreneurs should be well-informed about the key factors to consider when choosing a payment processor.

Below, we’ll define what a payment processor is, discuss how payment processing providers work, and describe the various aspects of payment processing, from fees and pricing structures to security measures and global support.

What’s in this article?

- What is a payment processor?

- What do payment processors do?

- How do payment processors work?

- How to choose a payment processor

What is a payment processor?

A payment processor is a company or service that facilitates electronic transactions—such as payments made with credit cards, debit cards, or digital wallets—between businesses and their customers. Payment processors enable businesses to accept various forms of payment securely and quickly and facilitate the transfer of funds from the customer's account to the business's account.

What do payment processors do?

Payment processors play an important role in the electronic payment ecosystem, enabling businesses to accept and process various forms of payment from customers. Here's an overview of the primary functions of a payment processor:

Transaction facilitation

When a customer makes a purchase, the payment processor receives the transaction details and securely transmits this information to the appropriate parties, including the issuing bank (customer's bank) and acquiring bank (business's bank), via the card network.Authorization and authentication

The payment processor requests authorization from the issuing bank to ensure the customer has sufficient funds or credit available. It also verifies the customer's identity and the validity of the payment method to minimize fraud and unauthorized transactions.Encryption and security

To protect sensitive financial data, payment processors use encryption and tokenization to securely transmit transaction data between the customer, business, and banks. They also need to comply with the Payment Card Industry Data Security Standard (PCI DSS) to maintain a secure environment for handling cardholder information.Settlement and funding

Once a transaction is authorized, the payment processor coordinates the transfer of funds from the issuing bank to the acquiring bank. The merchant account is then credited with the transaction amount, minus any applicable fees.Data for reporting and analytics

Payment processors produce data about customer payments that can be used to generate transaction reports, analytics, and insights to help businesses track sales, identify trends, and manage their businesses more effectively.Fraud detection and chargeback management

Payment processors use advanced algorithms and tools to monitor transactions for fraudulent activity, helping businesses minimize their exposure to fraud. They may also provide support and assistance in handling chargebacks and disputes.Support for multiple currencies and payment methods

To help businesses expand globally, many payment processors offer support for multiple currencies and popular local payment methods. For example, Stripe supports more than 135 currencies, allowing businesses to do business globally and receive payouts in local currencies.

How do payment processors work?

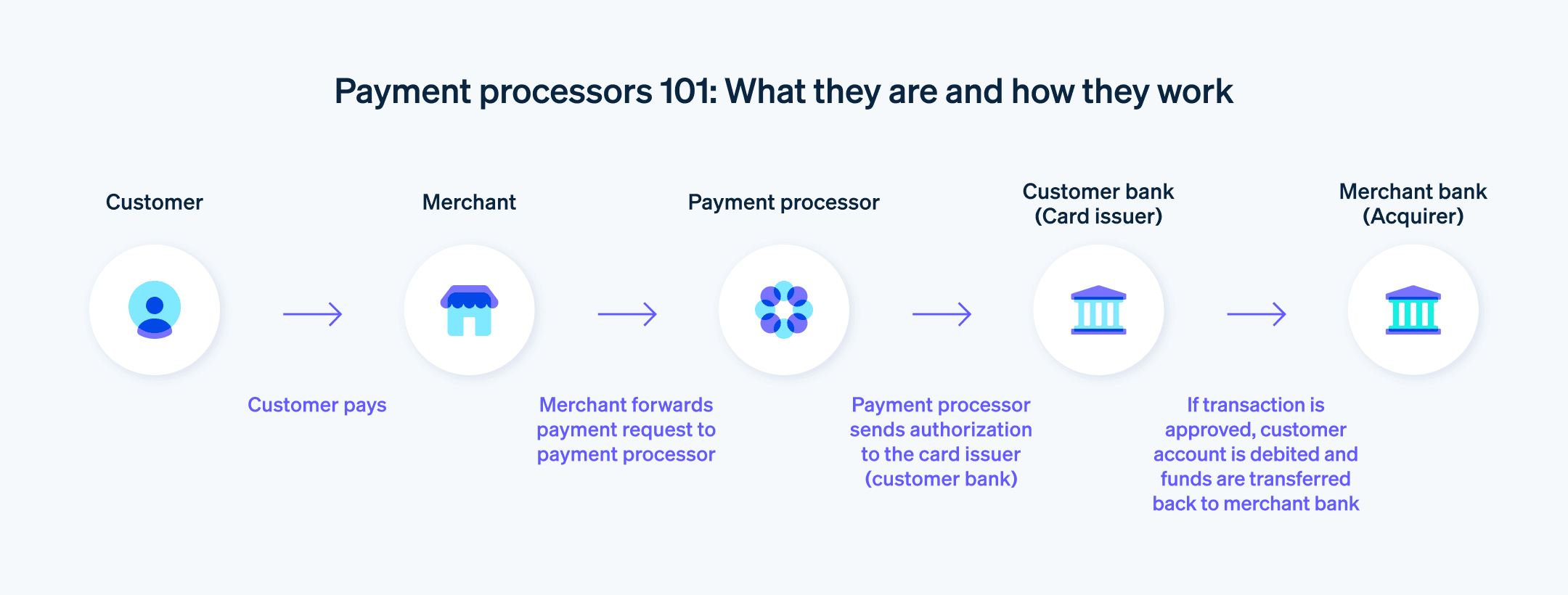

Payment processors facilitate electronic transactions between customers and businesses—but businesses may not be aware of the details of this process. To understand how payment processors work, let's describe a typical payment processing flow in detail:

Customer initiates payment

When a customer makes a purchase, they provide their payment information—such as a credit card or digital wallet—to the business. This can occur in-person at a point-of-sale (POS) terminal, online through an ecommerce website, via a mobile app, or through payment links.Transaction data encryption

The business's payment system encrypts the transaction data, ensuring it is securely transmitted to the payment processor. This encryption helps prevent fraudulent actors from intercepting and misusing sensitive customer information.Transaction data transmission

The encrypted transaction data is sent from the business to the payment processor, which then forwards the information to the acquiring bank.Acquiring bank to issuing bank

The acquiring bank forwards the transaction details to the issuing bank through the appropriate card network (e.g., Visa, Mastercard, or American Express) for authorization.Authorization request

The issuing bank reviews the transaction details and checks if the customer has sufficient funds or credit available. It also confirms the authenticity of the payment method and the customer's identity, to mitigate the risk of fraud.Authorization response

If the issuing bank approves the transaction, it sends an authorization code back to the acquiring bank through the card network. If the transaction is declined, the issuing bank sends a decline message with a decline code that explains why the translation was not approved.Processor receives response

The payment processor receives the response from the acquiring bank and forwards it to the business. If the transaction is authorized, the business can proceed with the sale. If it's declined, the business must request an alternative payment method from the customer.Transaction completion

Once the transaction is authorized, the business delivers the goods or services to the customer. At this point, the transaction is considered complete, although the actual transfer of funds is still yet to occur.Capture and settlement

“Capture” refers to the transferring of funds from a customer's account to a merchant account for a particular transaction. Typically, at the end of the day, the business sends a batch of authorized transactions to the payment processor for settlement. The payment processor then submits this batch to the acquiring bank, which initiates the process of transferring funds from the issuing bank to the merchant account. This transfer usually takes 1–3 business days, depending on the specific processor and bank involved.

While this is the general process that payment processors follow, there are some variations and special considerations for different types of payments and payment scenarios, based on payment method and industry. For a closer look at the specifics of payment processing for software-as-a-service (SaaS) companies, take a look here. And for a deeper examination of online payment processing, read our guide on the topic.

How to choose a payment processor

Payment processors directly impact the customer experience, transaction security, cash flow, and overall efficiency of the payment process. Choosing a payment processor requires a good understanding of exactly what you need, both now and in the future as your business grows and evolves. With that in mind, here are some factors you should consider when selecting a payment processor:

Fees and pricing

Understand the fee structure of the payment processor, which may include setup fees, transaction fees, monthly fees, chargeback fees, and currency conversion fees. Look for a pricing model that aligns with your business's transaction volume and anticipated growth. Some processors offer tiered pricing or flat rates, while others charge based on a percentage of each transaction plus a fixed fee. For details about Stripe’s pricing model, go here.Accepted payment methods

Ensure the payment processor supports the payment methods your customers are most likely to use. These could include credit cards, debit cards, digital wallets, buy now, pay later (BNPL), and any locally relevant payment options. For instance, cash on delivery (COD) is widely used in some markets, but not at all in others. Offering a variety of payment methods can increase customer satisfaction and conversion rates.Security and compliance

Verify that the payment processor adheres to industry standards, such as the PCI DSS, to ensure a secure environment for handling sensitive customer information. Additionally, consider the processor's fraud detection and prevention capabilities, as well as their support for secure technologies such as tokenization and encryption. For more details about how Stripe approaches security and facilitates easy compliance adherence for businesses, read here.International support

If your business operates in multiple countries or plans to expand globally, look for a payment processor that supports multiple currencies and popular local payment methods. Also, assess their currency conversion fees and international transaction fees.Integration and compatibility

Choose a payment processor that is compatible with your existing ecommerce platform, POS system, or other business software. Most processors provide easy-to-use APIs, plugins, or SDKs that allow for seamless integration with various platforms. Read more about Stripe’s payment APIs here.Ease of use and customer experience

Evaluate the checkout user experience for customers as well as the reporting and transaction management experience for businesses. The interface should be intuitive, user-friendly, and efficient.Customer support

Assess the quality and availability of the payment processor's customer support. Ideally, they should offer 24/7 support through multiple channels—such as phone, email, and live chat—like Stripe does. Check online reviews and testimonials to gauge the responsiveness and helpfulness of their support team.Scalability and flexibility

As your business grows, your payment processing needs will evolve. Look for a processor that can scale with your business and offers features such as subscription billing, invoicing, and recurring payments. Think about what your payment processing needs might look like in five years and make sure the payment processor is able to support your future business needs.Contract terms and cancellation policies

Review the payment processor's contract terms, including any minimum requirements, early termination fees, or other potential limitations. Look for a processor with transparent and flexible terms that suit your business needs.

By carefully considering these factors, businesses can select a payment processor that best aligns with their specific requirements, ensuring a simple and secure payment experience across channels for their internal teams and their customers.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.