ธุรกิจในสหรัฐฯ ชำระค่าธรรมเนียมการประมวลผลบัตรกว่า $1.378 แสนล้านในปี 2021 ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างบัตร หรือที่เรียกว่าค่าธรรมเนียมการรูดบัตร คิดเป็น 70% ถึง 90% ของค่าธรรมเนียมการประมวลผลบัตรทั้งหมด สําหรับธุรกิจที่รับชําระเงินด้วยบัตรจากลูกค้า ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารจะส่งผลต่อค่าใช้จ่ายในการดําเนินงาน กลยุทธ์ค่าบริการ และโมเดลธุรกิจของลูกค้า การมองข้ามค่าธรรมเนียมเหล่านี้อาจทําให้เกิดค่าใช้จ่ายที่ไม่จําเป็นซึ่งจะลดผลกําไรของคุณ

ด้านล่างนี้เราจะอธิบายการทํางานของค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร ผลกระทบที่มีต่อธุรกิจ และมอบกลยุทธ์ในการจัดการค่าใช้จ่ายเหล่านี้อย่างมีประสิทธิภาพ ธุรกิจต่างๆ สามารถเปลี่ยนอุปสรรคด้านการเงินให้กลายเป็นโอกาสสําหรับการเติบโตได้โดยการทําความเข้าใจค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร ต่อไปนี้คือสิ่งที่คุณต้องรู้

บทความนี้ให้ข้อมูลอะไรบ้าง

- ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารคืออะไร

- ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารมีวิธีการคำนวณอย่างไร

- โมเดลค่าบริการค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร

- ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารมีวิธีการทำงานอย่างไร

- ผลกระทบของค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารที่มีต่อธุรกิจ

- วิธีที่ธุรกิจสามารถลดค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารคืออะไร

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารคือค่าธรรมเนียมธุรกรรมที่เรียกเก็บระหว่างธนาคารต่างๆ เพื่อประมวลผลการชําระเงินด้วยบัตรเครดิตและบัตรเดบิต เมื่อลูกค้าซื้อสินค้าโดยใช้บัตร ธนาคารผู้รับบัตรของธุรกิจจะจ่ายค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารให้ธนาคารผู้ออกบัตรของเจ้าของบัตร

เครือข่ายบัตรจะกําหนดค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร ซึ่งปกติแล้วจะเป็นเปอร์เซ็นต์ของยอดธุรกรรมบวกค่าธรรมเนียมคงที่ ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารจะขึ้นอยู่กับปัจจัยต่างๆ ซึ่งรวมถึงประเภทของบัตรที่ใช้ (บัตรเครดิตหรือเดบิต) ประเภทของธุรกรรม (ที่จุดขายหรือทางออนไลน์) อุตสาหกรรมของธุรกิจ และภูมิภาคที่เกิดธุรกรรมนั้นๆ

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารนั้นจะถูกนำไปใช้เพื่อวัตถุประสงค์ต่างๆ ดังนี้

ค่าตอบแทนสำหรับธนาคารผู้ออกบัตร: ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารเป็นค่าตอบแทนแก่ธนาคารผู้ออกบัตรสําหรับการให้บริการและรักษาบัตรชําระเงิน การจัดการบัญชีที่เกี่ยวข้อง และการจัดการความเสี่ยงที่เกี่ยวข้องกับการขยายวงเงินเครดิต

เงินจูงใจสําหรับธนาคารผู้ออกบัตร: ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารที่สูงขึ้นอาจกระตุ้นให้ธนาคารผู้ออกบัตรโปรโมตบัตรชําระเงินแก่ลูกค้า การทําเช่นนี้จะช่วยให้เจ้าของบัตรเลือกใช้บัตรใบนั้น ซึ่งเป็นประโยชน์ต่อธนาคารและเครือข่ายบัตร

การบํารุงรักษาเครือข่าย: ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารจะใช้เพื่อสนับสนุนการบํารุงรักษาและการดำเนินงานเครือข่ายบัตร ฟังก์ชันเหล่านี้ช่วยครอบคลุมค่าใช้จ่ายเกี่ยวกับโครงสร้างพื้นฐานของเครือข่าย มาตรการป้องกันการฉ้อโกง และบริการอื่นๆ ที่เครือข่ายจัดหาให้

ค่าใช้จ่ายในการรับบัตร: ธนาคารผู้รับบัตร ซึ่งอํานวยความสะดวกในการประมวลผลการชําระเงินสําหรับธุรกิจ จะจ่ายค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร โดยเป็นส่วนหนึ่งของโครงสร้างค่าใช้จ่าย ค่าธรรมเนียมเหล่านี้จะช่วยครอบคลุมค่าใช้จ่ายของธนาคารผู้ออกบัตรในการประมวลผลธุรกรรมผ่านบัตร และมอบสิ่งจูงใจให้ธนาคารเหล่านั้นให้บริการรับชําระเงินผ่านบัตร

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารอาจแตกต่างจากค่าธรรมเนียมอื่นๆ ของธุรกิจ เช่น ค่าธรรมเนียมการให้บริการของผู้ค้า ซึ่งเรียกเก็บจากธนาคารผู้รับบัตรหรือผู้ประมวลผลการชําระเงินสําหรับการจัดการธุรกรรมผ่านบัตรในนามของธุรกิจ

เขตอํานาจศาลบางแห่งได้ควบคุมค่าธรรมเนียมธุรกรรมผ่านธนาคาร เนื่องจากอาจส่งผลต่อค่าใช้จ่ายของธุรกิจและราคาของลูกค้า ระเบียบข้อบังคับและการเจรจาต่อรองระหว่างผู้มีส่วนเกี่ยวข้องหลายฝ่ายอาจส่งผลต่อโครงสร้างและค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารในภูมิภาคต่างๆ

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารมีวิธีการคำนวณอย่างไร

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารจะคำนวณโดยอิงจากหลายปัจจัย ซึ่งเป็นค่าธรรมเนียมที่เครือข่ายบัตรกำหนด ได้แก่ Visa, Mastercard, Discover และ American Express และอาจแตกต่างกันอย่างมากตามปัจจัยดังต่อไปนี้

ประเภทบัตร: บัตรประเภทต่างๆ มีอัตราธุรกรรมผ่านบัตรระหว่างธนาคารที่แตกต่างกัน ตัวอย่างเช่น บัตรรางวัล บัตรธุรกิจ และบัตรพรีเมียมมักจะมีค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารที่สูงกว่าเมื่อเทียบกับบัตรเดบิตหรือบัตรเครดิตแบบมาตรฐาน ธนาคารผู้ออกบัตรมักจะใช้ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารเพื่อเป็นเงินทุนสำหรับโปรแกรมรางวัล

วิธีการธุรกรรม: วิธีการประมวลผลของบัตรยังส่งผลต่อค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารเช่นกัน ตัวอย่างเช่น ธุรกรรมแบบแสดงบัตร โดยที่ลูกค้ารูดบัตร เสียบ หรือแตะบัตรบนเทอร์มินัลระบบบันทึกการขาย (POS) มักจะมีค่าธรรมเนียมต่ำกว่าธุรกรรมแบบไม่แสดงบัตร เช่น การชำระเงินออนไลน์หรือการชำระเงินผ่านระบบโทรศัพท์ ความแตกต่างนี้เกิดจากความเสี่ยงที่เพิ่มขึ้นของการฉ้อโกงในธุรกรรมที่ไม่ใช้บัตร

รหัสหมวดหมู่ผู้ค้า (MCC): ประเภทของธุรกิจหรืออุตสาหกรรมยังมีผลต่อค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารด้วย ธุรกิจประเภทต่างๆ มีระดับความเสี่ยงและขนาดธุรกรรมเฉลี่ยที่แตกต่างกัน ซึ่งจะสะท้อนออกมาใน [MCC](https://stripe.com/guides/merchant-category-codes "Stripe | Merchant category codes (MCCs) ของแต่ละธุรกิจ

ขนาดของธุรกรรม: โดยทั่วไปค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารคือเปอร์เซ็นต์ของยอดธุรกรรมทั้งหมดบวกค่าธรรมเนียมคงที่ ธุรกรรมที่มีขนาดใหญ่ขึ้นจะมีค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารที่สูงขึ้น แต่อาจน้อยกว่าในเมื่อคิดเป็นเปอร์เซ็นต์จากยอดธุรกรรม

รายละเอียดการประมวลผล รายละเอียดที่เจาะจงเกี่ยวกับวิธีประมวลผลธุรกรรมอาจส่งผลต่ออัตราค่าธรรมเนียมดังกล่าวด้วย ตัวอย่างเช่น ธุรกรรมที่มีการป้อนข้อมูลบัตรด้วยตัวเอง หรือธุรกรรมที่ไม่ได้ชำระเงินภายในเวลาที่กำหนด อาจถูกเรียกเก็บเงินในอัตราที่สูงขึ้นเนื่องด้วยความเสี่ยงที่เพิ่มขึ้นจากข้อผิดพลาดหรือการฉ้อโกง

สูตรคำนวณค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารนั้นมีความซับซ้อนและแตกต่างกันไปในแต่ละเครือข่ายบัตร แต่โดยทั่วไปแล้วมักจะใช้ปัจจัยข้างต้นกัน เครือข่ายบัตรแต่ละเครือข่ายเผยแพร่อัตราธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารของตัวเองปีละ 2 ครั้งในเดือนเมษายนและเดือนตุลาคม อัตราเหล่านี้อาจมีการเปลี่ยนแปลงได้ แม้ว่าค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารสำหรับผู้บริโภค จะกำหนดไว้ที่ 0.2% สำหรับบัตรเดบิต และ 0.3% สำหรับบัตรเครดิตในสหภาพยุโรป

นี่คืออัตราค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารสำหรับเครือข่ายบัตรรายใหญ่ในสหรัฐฯ แต่ละเครือข่ายในปี 2023:

Visa

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารของ Visa ขึ้นอยู่กับปัจจัยหลายประการ รวมถึงประเภทของบัตร วิธีทำธุรกรรม และอุตสาหกรรมของธุรกิจ

Mastercard

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารของ Mastercard คล้ายกับ Visa ตรงที่จะแตกต่างกันไปตามปัจจัยหลายประการ

Discover

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารของ Discover จะขึ้นอยู่กับประเภทของบัตร วิธีทำธุรกรรม และอุตสาหกรรม

American Express

American Express ดำเนินงานแตกต่างไปเล็กน้อย โดยมักจะทำหน้าที่เป็นธนาคารผู้ออกบัตรและเครือข่ายบัตร

โมเดลค่าบริกาค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร

ผู้ประมวลผลการชําระเงินใช้โมเดลค่าบริการหลัก 3 ประเภทเพื่อเรียกเก็บเงินจากธุรกิจสําหรับค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารที่เชื่อมโยงกับธุรกรรมผ่านบัตร ธุรกิจจะต้องเข้าใจโมเดลค่าบริการเหล่านี้ให้ดีเพราะส่งผลกระทบต่อค่าใช้จ่ายในการรับชําระเงินผ่านบัตร ต่อไปนี้คือภาพรวมของโมเดลหลัก 3 แบบ และโมเดลอีกรูปแบบที่ได้รับความนิยมน้อยกว่า

ค่าบริการบวกค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร (หรือที่เรียกว่าราคาบวกต้นทุน): โมเดลค่าบริการนี้ถือว่าโปร่งใสที่สุด เมื่อใช้โมเดลค่าบริการบวกค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร ธุรกิจจะต้องจ่ายค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารที่แน่นอนซึ่งเครือข่ายบัตรกำหนด พร้อมด้วยการบวกราคาเพิ่มที่กำหนดโดยผู้ประมวลผลการชำระเงิน การบวกราคาเพิ่มมักจะคิดเป็นเปอร์เซ็นต์คงที่ พร้อมด้วยค่าธรรมเนียมคงที่ต่อธุรกรรม หรือทั้งสองอย่าง เนื่องจากค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารจะแตกต่างกันไปในแต่ละธุรกรรม ค่าใช้จ่ายทั้งหมดจึงอาจผันผวน แต่ธุรกิจจะทราบอยู่เสมอว่าผู้ประมวลผลเรียกเก็บค่าใช้จ่ายพื้นฐานมากน้อยเพียงใด

ค่าบริการแบบแบ่งระดับ: ในโมเดลนี้ ผู้ประมวลผลจะจัดกลุ่มธุรกรรมออกเป็นระดับต่างๆ ซึ่งโดยปกติแล้วจะอยู่ใน 3 ระดับ ได้แก่ ผ่านเกณฑ์ ผ่านเกณฑ์บางส่วน ไม่ผ่านเกณฑ์ โดยแต่ละระดับมีอัตราต่างกัน ระดับจะขึ้นอยู่กับปัจจัยความเสี่ยงและรางวัลจากธุรกรรม ตัวอย่างเช่น ธุรกรรมที่ทำด้วยบัตรเครดิตพื้นฐานที่ไม่มีรางวัลอาจอยู่ในระดับผ่านเกณฑ์ โดยมีอัตราต่ำสุด ในขณะที่ธุรกรรมที่ทำด้วยบัตรรางวัลพรีเมียมอาจอยู่ในระดับที่ไม่ผ่านเกณฑ์ และมีอัตราสูงสุด ความท้าทายของโมเดลนี้ก็คือมักจะไม่ชัดเจนว่าธุรกรรมหนึ่งๆ จะอยู่ในระดับใด ซึ่งทำให้คาดเดาค่าใช้จ่ายได้ยากขึ้น

ค่าบริการอัตราคงที่: นี่คือโมเดลค่าบริการที่ง่ายที่สุด ซึ่งธุรกิจต้องจ่ายเป็นเปอร์เซ็นต์คงที่ ค่าธรรมเนียมคงที่สําหรับธุรกรรมทุกรายการ หรือทั้งคู่ โดยไม่คํานึงถึงประเภทบัตรหรือวิธีการทําธุรกรรม อัตรานี้ไม่ผันผวนตามค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร ทําให้คาดการณ์ได้ แต่ปกติแล้วจะสูงกว่าค่าบริการบวกค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร โมเดลนี้เป็นรูปแบบที่พบบ่อยสําหรับผู้ให้บริการชําระเงิน และมักเป็นที่นิยมในหมู่ธุรกิจขนาดเล็กที่มียอดขายต่ำ

ค่าบริการสำหรับการชำระเงินตามรอบบิล/การเป็นสมาชิก: นี่คือโมเดลที่ไม่ค่อยพบได้ทั่วไป ซึ่งธุรกิจจะต้องจ่ายค่าธรรมเนียมการเป็นสมาชิกรายเดือน เพื่อให้มีค่าใช้จ่ายในการทําธุรกรรมที่ต่ําลง ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารยังคงเป็นภาระของธุรกิจ ซึ่งคล้ายกับโมเดลค่าบริการบวกค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร แต่การบวกราคาเพิ่มของผู้ประมวลผลมักจะเป็นค่าธรรมเนียมต่อธุรกรรมคงที่ แทนที่จะคิดเป็นเปอร์เซ็นต์

ทั้งนี้ แต่ละโมเดลก็มีข้อดีและข้อเสียต่างกันไป ตัวเลือกที่ดีที่สุดจะขึ้นอยู่กับรายละเอียดเฉพาะของธุรกิจ ซึ่งปกติแล้วจะรวมถึงยอดขาย ขนาดธุรกรรมเฉลี่ย และประเภทบัตรที่ลูกค้ามักจะใช้

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารมีวิธีการทำงานอย่างไร

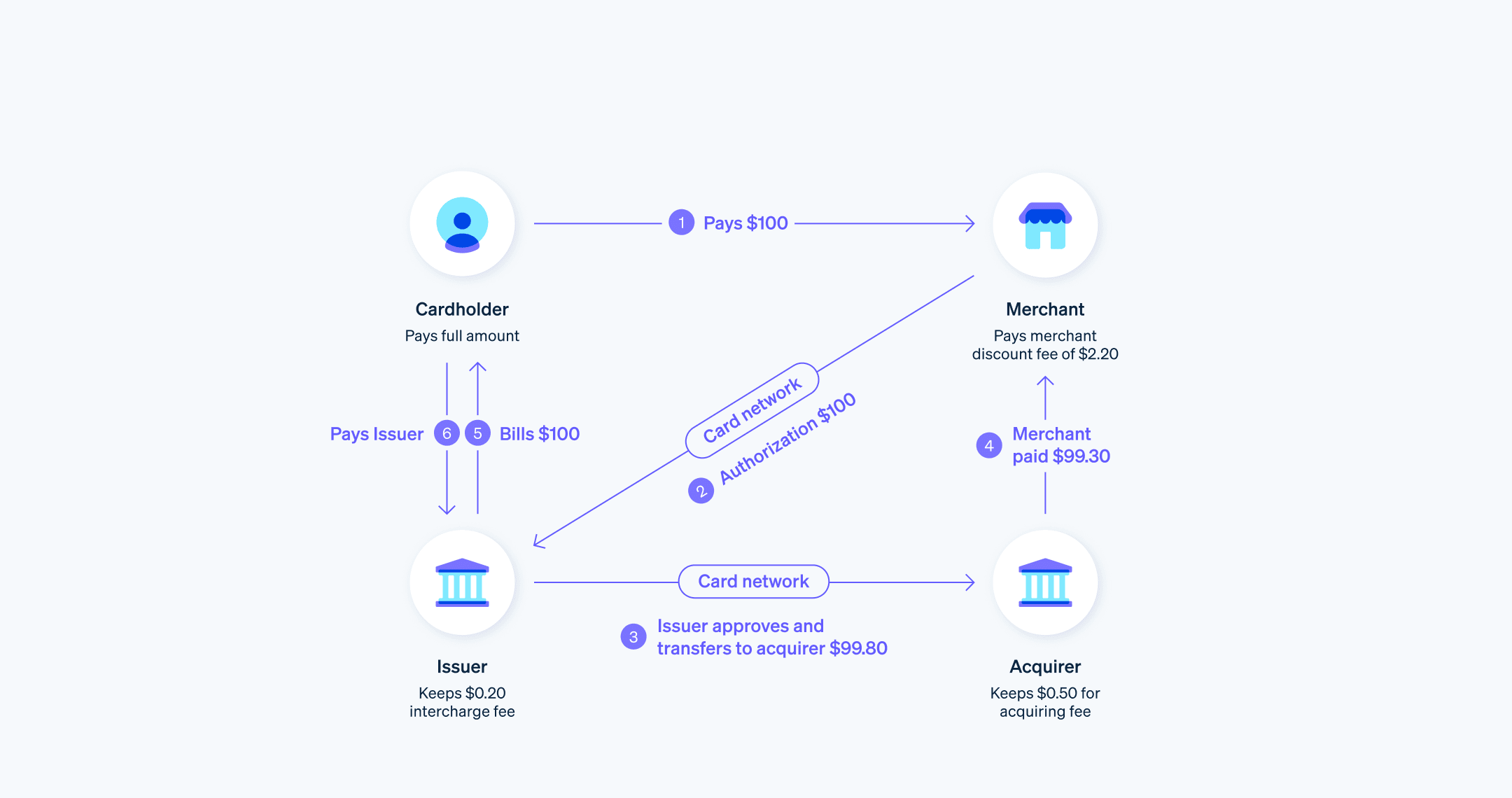

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารมีส่วนเกี่ยวข้องกับธุรกรรมผ่านบัตรทุกรายการ คําอธิบายอย่างง่ายเกี่ยวกับวิธีการทํางานมีดังนี้

การเริ่มต้นธุรกรรม: เมื่อลูกค้าใช้บัตรเครดิตหรือบัตรเดบิตในการซื้อ ข้อมูลธุรกรรมจะถูกส่งจากธุรกิจไปยังธนาคารผู้รับบัตร

การอนุมัติธุรกรรม: จากนั้นธนาคารผู้รับบัตรจะส่งข้อมูลธุรกรรมไปยังเครือข่ายบัตร ซึ่งจะส่งต่อไปยังธนาคารผู้ออกบัตร

การอนุมัติธุรกรรม: ธนาคารผู้ออกบัตรจะตรวจสอบบัญชีของเจ้าของบัตร เพื่อยืนยันว่าเงินหรือเครดิตที่ใช้ได้นั้นเพียงพอ จากนั้นจะส่งการอนุมัติผ่านเครือข่ายบัตรไปให้ธนาคารผู้รับบัตร ซึ่งสุดท้ายจะส่งกลับมาที่ธุรกิจ

การชําระเงิน: เมื่อสิ้นสุดวันทําการ ธุรกิจจะส่งธุรกรรมที่ได้รับอนุญาตของทั้งวันไปให้ธนาคารผู้รับบัตรเป็นกลุ่ม ธนาคารผู้รับบัตรจะส่งธุรกรรมชุดนี้ให้เครือข่ายบัตรเพื่อทำการชําระเงิน เครือข่ายบัตรจะส่งธุรกรรมแต่ละรายการไปยังธนาคารผู้ออกบัตรที่ถูกต้อง แล้วหักเงินในจํานวนที่เหมาะสมจากบัญชีของธนาคารผู้ออกบัตร

การชําระเงินให้กับธุรกิจ: เครือข่ายบัตรจะโอนยอดรวมของธุรกรรมชุดนี้ไปยังธนาคารผู้รับบัตร โดยหักค่าธรรมเนียมการทําธุรกรรมผ่านบัตรระหว่างธนาคาร จากนั้นธนาคารผู้รับบัตรจะฝากยอดเงิน หลังจากหักลบด้วยค่าธรรมเนียมใดๆ ไปยังบัญชีของธุรกิจ

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารนี้เป็นส่วนหนึ่งของยอดรวมของธุรกรรมที่ธนาคารผู้รับบัตรจะโอนไปยังธนาคารผู้ออกบัตร โดยเป็นค่าใช้จ่ายให้ธนาคารผู้ออกบัตรสำหรับบทบาทของในการประมวลผลธุรกรรม ซึ่งรวมถึงความเสี่ยงที่ธนาคารต้องแบกรับโดยการรับประกันการชำระเงิน และคุณค่าที่ธนาคารมอบให้โดยการออกบัตรและการรักษาบัญชีผู้ถือบัตร

ผลกระทบของค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารที่มีต่อธุรกิจ

ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารอาจส่งผลอย่างมากต่อธุรกิจ โดยเฉพาะอย่างยิ่งธุรกิจที่ทำธุรกรรมผ่านบัตรเป็นจํานวนมาก ต่อไปนี้เป็นบางพื้นที่ในธุรกิจที่อาจได้รับผลกระทบ

ค่าดําเนินการ: ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารเป็นส่วนสําคัญของค่าใช้จ่ายที่ธุรกิจต้องจ่ายเพื่อรับชําระเงินผ่านบัตร สําหรับธุรกรรมผ่านบัตรทุกรายการ ระบบจะคิดค่าธรรมเนียมเหล่านี้ ธุรกิจที่มีผลกําไรไม่มากหรือทำธุรกรรมผ่านบัตรในปริมาณมาก ค่าธรรมเนียมเหล่านี้อาจเพิ่มพูนอย่างรวดเร็วและส่งผลอย่างมากต่อผลกําไร

การตัดสินใจเกี่ยวกับค่าบริการ: ธุรกิจอาจต้องปรับกลยุทธ์ค่าบริการเพื่อประหยัดค่าใช้จ่ายด้านค่าธรรมเนียมการทําธุรกรรมบัตรระหว่างธนาคาร ซึ่งอาจหมายถึงการเพิ่มราคาสินค้าหรือบริการหรือการคิดยอดธุรกรรมขั้นต่ําสําหรับการชําระเงินด้วยบัตร การตัดสินใจเหล่านี้อาจส่งผลกระทบต่อความสามารถในการแข่งขันและความพึงพอใจของลูกค้า

กระแสเงินสด: ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารอาจส่งผลกระทบต่อกระแสเงินสดของธุรกิจ เนื่องจากโดยปกติแล้วระบบจะหักค่าธรรมเนียมจากยอดธุรกรรมก่อนฝากเข้าบัญชีธนาคารของธุรกิจ ซึ่งหมายความว่าธุรกิจจะต้องคำนึงถึงค่าธรรมเนียมเหล่านี้เมื่อทำการวางแผนและคาดการณ์ทางการเงิน

โมเดลธุรกิจ: ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารอาจส่งผลต่อโมเดลธุรกิจด้วยเช่นกัน ตัวอย่างเช่น ธุรกิจบางแห่งอาจจูงใจให้ชําระเงินด้วยเงินสดหรือบัตรเดบิต ซึ่งปกติแล้วจะมีค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารน้อยกว่าธุรกรรมผ่านบัตรเครดิต ขณะที่บางแห่งอาจเรียกเก็บค่าธรรมเนียมเพิ่มเติมสำหรับธุรกรรมผ่านบัตรเครดิต ในตำแหน่งที่ตั้งที่ดำเนินการได้ตามกฎหมาย หรือไม่ยอมรับบัตรเลย

การเลือกผู้ประมวลผลการชําระเงิน: ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารยังมีผลต่อการเลือกผู้ประมวลผลการชําระเงินของธุรกิจอีกด้วย ผู้ประมวลผลแต่ละรายใช้การคิดค่าบริการในรูปแบบที่แตกต่างกันไป ผู้ประมวลผลการชําระเงินที่ดีที่สุดสําหรับธุรกิจหนึ่งๆ นั้นจะขึ้นอยู่กับปริมาณและขนาดของธุรกรรม ประเภทของบัตรที่ลูกค้าใช้ และระดับการยอมรับความผันผวนของค่าใช้จ่าย

วิธีที่ธุรกิจสามารถลดค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร

การลดค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารอาจมีความซับซ้อนเนื่องจากเครือข่ายบัตรกําหนดอัตราซึ่งจะแตกต่างกันไปตามปัจจัยมากมาย อย่างไรก็ตาม ธุรกิจต่างๆ สามารถใช้กลยุทธ์บางอย่างเพื่อลดค่าใช้จ่ายเหล่านี้ได้

การเจรจาต่อรองกับผู้ประมวลผลของคุณ: หากธุรกิจของคุณประมวลผลธุรกรรมจํานวนมาก คุณอาจเจรจากับผู้ประมวลผลการชําระเงินเพื่อขอรับอัตราที่ต่ําลง

การเลือกผู้ประมวลผลการชําระเงินที่เหมาะสม: ดังที่กล่าวมาข้างต้น ผู้ประมวลผลการชําระเงินแต่ละรายจะใช้โมเดลค่าบริการที่แตกต่างกัน คุณอาจลดค่าใช้จ่ายได้โดยการเลือกผู้ประมวลผลที่มีโมเดลค่าบริการที่สอดคล้องกับรูปแบบธุรกรรมของคุณได้ดีขึ้น ทั้งนี้ขึ้นอยู่กับสถานการณ์ของธุรกิจ

การปรับปรุงแนวทางการประมวลผลบัตร: ธุรกิจมักจะมีสิทธิ์รับค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารที่ลดลง โดยดําเนินการตามแนวทางปฏิบัติที่ดีที่สุดสําหรับการประมวลผลบัตรของเครือข่ายบัตร ขั้นตอนต่างๆ มีดังนี้

- ชําระเงินธุรกรรมทันที: วิธีการที่ดีที่สุดคือการชําระธุรกรรมกับผู้ประมวลผลโดยเร็วที่สุด ซึ่งปกติแล้วควรใช้เวลาไม่เกิน 24 ชั่วโมง

- การจัดการข้อมูลบัตรอย่างปลอดภัย: การใช้เทคโนโลยีการประมวลผลที่ปลอดภัย เช่น การเข้ารหัสแบบจุดต่อจุดและการแปลงเป็นโทเค็นจะช่วยให้ธุรกิจมีสิทธิ์ได้รับอัตราธุรกรรมผ่านบัตรระหว่างธนาคารที่ถูกลง

- การให้ข้อมูลธุรกรรมอย่างครบถ้วน: สําหรับบัตรบางประเภท โดยเฉพาะบัตรองค์กรและบัตรที่รัฐบาลออกให้ การให้ข้อมูลธุรกรรมเพิ่มเติม (เรียกว่าข้อมูลระดับ 2 และระดับ 3) อาจทําให้อัตราค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารต่ําลง

- ชําระเงินธุรกรรมทันที: วิธีการที่ดีที่สุดคือการชําระธุรกรรมกับผู้ประมวลผลโดยเร็วที่สุด ซึ่งปกติแล้วควรใช้เวลาไม่เกิน 24 ชั่วโมง

สนับสนุนการทําธุรกรรมผ่านบัตรเดบิตหรือเงินสด: โดยปกติแล้ว ธุรกรรมผ่านบัตรเดบิตจะมีค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารที่ถูกกว่าธุรกรรมผ่านบัตรเครดิต ในทํานองเดียวกัน ธุรกรรมเงินสดจะไม่มีค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร การส่งเสริมให้ลูกค้าใช้บัตรเดบิตหรือเงินสดจะช่วยลดค่าใช้จ่ายในการทําธุรกรรมผ่านบัตรระหว่างธนาคารได้

การคิดค่าธรรมเนียมเพิ่มเติมหรือค่าธรรมเนียมการบริการ: ในบางพื้นที่ ธุรกิจสามารถคิดค่าธรรมเนียมเพิ่มเติมหรือค่าธรรมเนียมการบริการสําหรับธุรกรรมบัตรเครดิต เพื่อให้ครอบคลุมค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคาร อย่างไรก็ตาม แนวทางปฏิบัตินี้อยู่ภายใต้การกำกับดูแลและไม่ได้รับอนุญาตในทุกพื้นที่หรือสําหรับบัตรทุกประเภท และอาจไม่เป็นที่นิยมในหมู่ลูกค้า

ตรวจสอบรายการการประมวลผลของคุณอยู่เป็นประจํา: ค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารอาจเปลี่ยนแปลงได้ 2 ครั้งต่อปี ดังนั้นคุณควรตรวจสอบรายการการประมวลผลของคุณเป็นประจํา เพื่อให้ทราบถึงการเปลี่ยนแปลงต่างๆ และทําความเข้าใจค่าธรรมเนียมทั้งหมดที่ระบบเรียกเก็บ

แม้ว่าการลดค่าธรรมเนียมธุรกรรมผ่านบัตรระหว่างธนาคารจะช่วยเพิ่มผลกําไรได้ แต่ธุรกิจก็ยังควรพิจารณาถึงผลกระทบที่อาจมีต่อประสบการณ์ของลูกค้าด้วย ทางออกที่ดีที่สุดคือการสร้างสมดุลระหว่างผลตอบแทนทางการเงินกับประสบการณ์ที่มีประสิทธิภาพที่สุดสําหรับลูกค้า หากต้องการข้อมูลเพิ่มเติมเกี่ยวกับโมเดลค่าบริการของ Stripe โปรดไปที่นี่

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ