As empresas dos EUA pagaram cerca de US$ 137,8 bilhões em tarifas de processamento de cartão em 2021. As comissões interbancárias, também conhecidas como tarifas de passagem de cartão, foram responsáveis por 70% a 90% dessas tarifas de processamento de cartão. Para empresas que aceitam pagamentos com cartão dos clientes, as comissões interbancárias afetam os custos operacionais, as estratégias de preços e seu modelo de negócios. Ignorar essas tarifas pode gerar despesas desnecessárias que reduzem os lucros.

Abaixo, explicamos como funcionam as comissões interbancárias, discutimos suas implicações para as empresas e fornecemos estratégias para gerenciar esses custos de forma eficaz. Ao entender as comissões interbancárias, as empresas podem transformar possíveis obstáculos financeiros em oportunidades de crescimento. Veja tudo que você precisa saber.

Neste artigo:

- O que são comissões interbancárias?

- Como são calculadas as comissões interbancárias?

- Modelos de preços de comissão interbancária

- Como funcionam as comissões interbancárias?

- Como as comissões interbancárias afetam as empresas

- Como reduzir as comissões interbancárias

O que são comissões interbancárias?

Comissões interbancárias são tarifas de transação cobradas entre bancos para processar pagamentos com cartão de crédito e débito. Quando um cliente faz uma compra usando um cartão, o banco adquirente da empresa paga a tarifa de intercâmbio ao banco emissor do titular do cartão.

Bandeiras de cartão definem comissões interbancárias, que normalmente são uma porcentagem do valor da transação mais uma tarifa fixa. A comissão interbancária depende de vários fatores, como tipo de cartão utilizado (crédito ou débito), tipo de transação (presencial ou online), setor da empresa e região onde a transação ocorre.

As comissões interbancárias têm várias finalidades:

Remuneração dos bancos emissores: as comissões interbancárias compensam o banco emissor pelo fornecimento e manutenção do cartão de pagamento, gerenciamento das contas associadas e gerenciamento do risco envolvido na concessão de crédito.

Incentivos para bancos emissores: comissões interbancárias mais altas podem incentivar os bancos emissores a promover cartões de pagamento para os clientes. Isso incentiva os titulares a usarem os cartões, beneficiando os bancos e as bandeiras de cartão.

Manutenção de redes: as comissões interbancárias apoiam a manutenção e a operação das bandeiras de cartão. Elas ajudam a cobrir os custos associados à infraestrutura de rede, prevenção de fraudes e outros serviços prestados pelas bandeiras.

Custos de aquisição: bancos adquirentes, que gerenciam o processamento de pagamentos para as empresas, pagam as comissões interbancárias como parte de sua estrutura de custos. As tarifas ajudam a cobrir as despesas dos bancos emissores no processamento de transações com cartões e incentivam-nos a oferecer serviços de aceitação de cartões.

As comissões interbancárias são diferentes das outras cobradas pelas empresas, como as de serviços do comerciante, cobradas pelos bancos adquirentes ou processadores de pagamentos para gerenciar transações com cartão em nome da empresa.

Algumas jurisdições têm comissões interbancárias regulamentadas porque elas podem afetar os custos das empresas e potencialmente os preços para os clientes. Regulamentos e negociações entre várias partes interessadas podem influenciar a estrutura e o impacto das comissões interbancárias em diferentes regiões.

Como são calculadas as comissões interbancárias?

Vários fatores definem as comissões interbancárias. As bandeiras de cartão (Visa, Mastercard, Discover e American Express) definem as comissões considerando:

Tipo de cartão: cada tipo de cartão pode ter comissões interbancárias diferentes. Por exemplo, cartões de recompensas, cartões empresariais e cartões premium normalmente têm comissões interbancárias mais altas do que cartões de débito ou crédito padrão. Bancos emissores costumam usar comissões interbancárias para financiar programas de recompensas.

Método de transação: a forma como o cartão é processado também afeta a comissão interbancária. Por exemplo, as transações com cartão presente, nas quais os clientes passam, inserem ou aproximam fisicamente um cartão de um terminal em um ponto de venda (POS), geralmente têm taxas mais baixas do que as transações com cartão não presente, como pagamentos online ou por telefone. Essa diferença é devido ao aumento do risco de fraude em transações com cartão não presente.

Código de categoria do comerciante (MCC): o tipo de empresa ou setor também influencia a comissão interbancária. Diferentes tipos de empresas têm diferentes níveis de risco e diferentes volumes médios de transação, que se refletem em seu MCC.

Valor da transação: normalmente, a comissão interbancária é uma porcentagem do valor total da transação, acrescida de uma tarifa fixa. Assim, transações maiores incorrem em comissões interbancárias maiores em termos absolutos, embora possam ser menores como porcentagem da transação.

Dados de processamento: certos detalhes do processamento também podem afetar a taxa. Por exemplo, a tarifa pode ser mais alta para transações em que os dados do cartão são inseridos manualmente ou transações não liquidadas em um determinado período, dados o risco elevado de erro ou fraude.

A fórmula para calcular as comissões interbancárias é complexa e depende das bandeiras de cartão, mas geralmente envolve uma combinação dos fatores acima. Cada bandeira de cartão publica suas próprias taxas interbancárias duas vezes ao ano, em abril e outubro. Essas tarifas podem mudar, embora as taxas de comissão interbancárias de cartão para o consumidor tenha um teto de 0,2% para cartões débito e 0,3% para cartões de crédito na União Europeia.

Veja a seguir as comissões interbancárias de cada uma das principais bandeiras de cartão dos EUA a partir de 2023:

Visa

A comissão interbancária da Visa depende de vários fatores, incluindo o tipo de cartão, o método de transação e o setor de atuação da empresa.

Mastercard

Da mesma forma que a Visa, a comissão interbancária da Mastercard varia com base em vários fatores.

Discover

A taxas de intercâmbio da Discover também depende do tipo de cartão, do método de transação e do setor.

American Express

A American Express opera de forma ligeiramente diferente, e muitas vezes atua como banco emissor e bandeira de cartão.

Modelos de preços interbancários

Os processadores de pagamentos usam três tipos principais de modelos de preços para cobrar das empresas as comissões interbancárias associadas às transações com cartão. É importante que as empresas entendam esses modelos de preços, pois eles afetam o custo de aceitar pagamentos com cartão. Visão geral dos três modelos principais mais um menos comum:

Preços de comissão mais margem (também conhecido como preços cost-plus): Esse modelo é considerado o mais transparente. Com a comissão mais margem, a empresa paga a comissão interbancária exata determinada pelas bandeiras de cartão, mais uma margem definida pelo processador de pagamentos. A margem geralmente é uma pequena porcentagem fixa, uma taxa fixa por transação ou ambas. Como a comissão interbancária varia para cada transação, o custo total pode variar, mas a empresa sempre sabe exatamente quanto o processador está cobrando sobre o custo básico.

Preços escalonados: neste modelo, o processador agrupa as transações em diferentes níveis, normalmente três: qualificado, intermediário e não qualificado, cada um com sua própria taxa. Os níveis são baseados nos fatores de risco e recompensa das transações. Por exemplo, as transações feitas com cartões de crédito básicos, que não são de recompensas, podem cair no nível qualificado com a taxa mais baixa, enquanto aquelas feitas com cartões de recompensas premium podem cair no nível não qualificado com a taxa mais alta. A dificuldade desse modelo é que, muitas vezes, não fica claro em qual nível uma transação específica se encaixará, o que dificulta a previsão de custos.

Preço fixo: esse é o modelo de preços mais simples, no qual a empresa paga uma porcentagem fixa, uma tarifa fixa por cada transação ou ambos, independentemente do tipo de cartão ou método de transação. A taxa não depende da comissão interbancária. É previsível, mas geralmente é mais alta do que o que a empresa poderia pagar com comissão mais margem. Esse modelo é comum em provedores de serviços de pagamento e costuma ser preferido por pequenas empresas com baixo volume de vendas.

Preço da assinatura/associação: esse modelo é mais incomum. As empresas pagam uma mensalidade e recebem custos de transação mais baixos. As comissões interbancárias ainda são repassadas para a empresa, assim como na comissão mais margem, mas a margem do processador geralmente é uma taxa fixa por transação, em vez de porcentagem.

Cada modelo tem vantagens e desvantagens. A melhor opção depende das características específicas da empresa, como volume de vendas, valor médio das transações e tipos de cartões usados pelos clientes.

Como funcionam as comissões interbancárias?

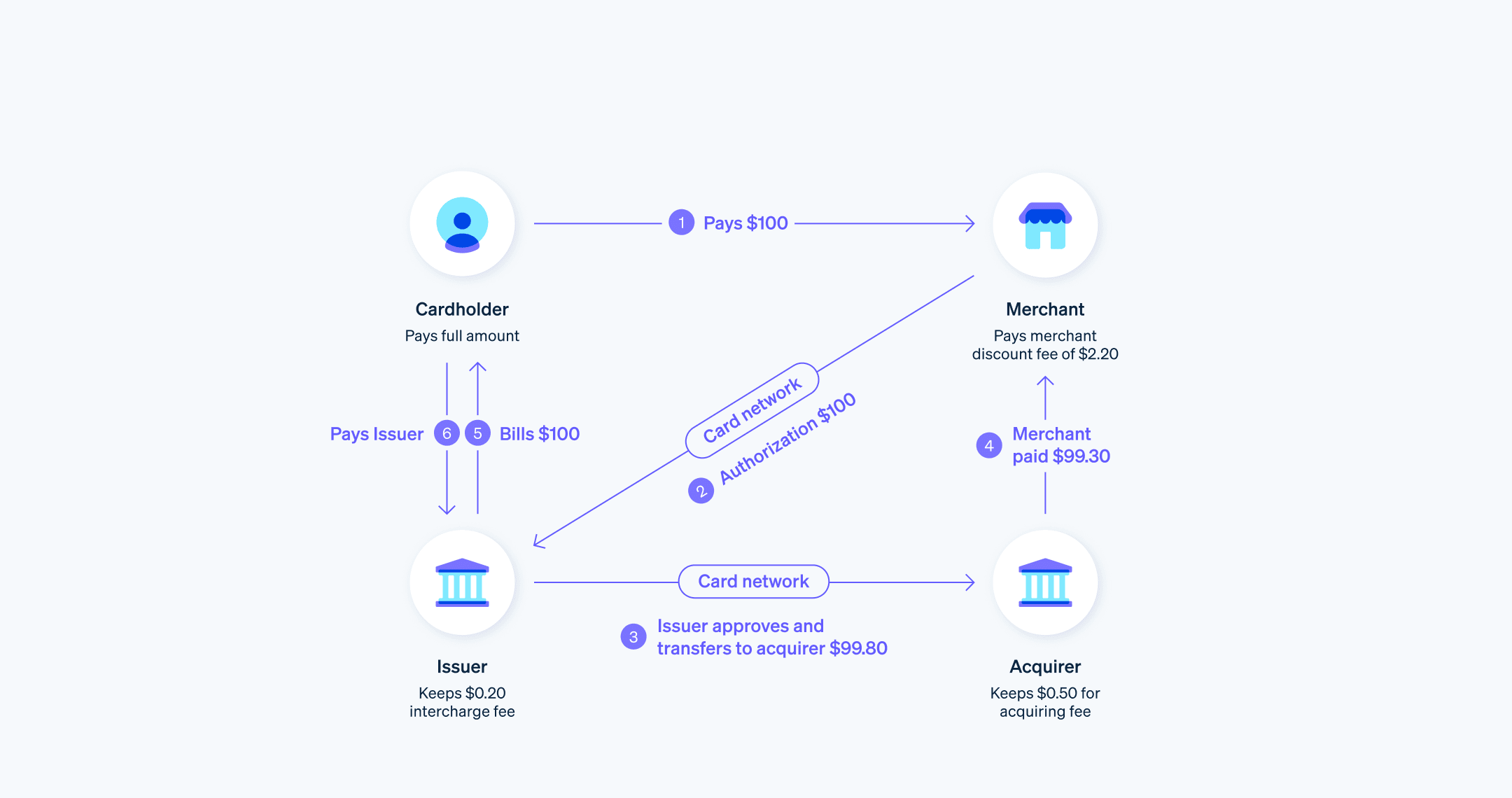

Comissões interbancárias estão envolvidas em todas as transações com cartão. Explicação simplificada:

Início da transação: quando o cliente usa um cartão de crédito ou débito para fazer uma compra, os dados da transação são enviados da empresa para o banco adquirente.

Transação autorização o banco adquirente envia os dados da transação para a bandeira do cartão, que os repassa ao banco emissor.

Aprovação da transação: o banco emissor confere a conta do titular do cartão, confirma se há fundos ou créditos suficientes e devolve uma autorização pela bandeira do cartão para o banco adquirente e, finalmente, de volta para a empresa.

Liquidação: ao final do dia útil, a empresa envia todas as transações autorizadas do dia ao banco adquirente em lote. O banco adquirente envia esse lote às bandeiras de cartão para liquidação. A bandeira do cartão encaminha cada transação para o banco emissor correto e debita o valor adequado da conta do banco emissor.

Pagamento para a empresa: a bandeira do cartão transfere o valor total do lote para o banco adquirente, subtraídas as comissões interbancárias. O banco adquirente então deposita os fundos na conta da empresa menos suas próprias tarifas.

A comissão interbancária faz parte do valor total da transação transferida pelo banco adquirente para o banco emissor. Ela remunera o banco emissor pelo seu papel no processo de transação, incluindo o risco que assume ao garantir o pagamento e o valor que proporciona ao emitir cartões e manter contas de titulares de cartão.

Como as comissões interbancárias afetam as empresas

As comissões interbancárias podem afetar significativamente as empresas, especialmente aquelas que dependem muito de transações com cartões. Veja algumas áreas da empresa que podem ser afetadas:

Custos operacionais: As comissões interbancárias são uma parte significativa dos custos das empresas para aceitar pagamentos com cartão. Para cada transação com cartão, uma parte é destinada a essas tarifas. Para empresas que trabalham com margens reduzidas ou grandes volumes de transações com cartão, essas tarifas podem se acumular e afetar significativamente os resultados.

Decisões de preços: para absorver o custo das comissões interbancárias, as empresas podem precisar ajustar suas estratégias de preços. Para isso, pode ser preciso aumentar os preços de bens ou serviços ou estabelecer valores mínimos para pagamentos com cartão. Essas decisões podem afetar a competitividade e a satisfação do cliente.

Fluxo de caixa: as comissões interbancárias podem afetar o fluxo de caixa de uma empresa, porque são deduzidas do valor da transação antes de serem depositadas na conta bancária da empresa. Isso significa que as empresas devem considerar essas tarifas em seu planejamento financeiro e previsão.

Modelo de negócios: as comissões interbancárias também podem influenciar o modelo de negócios. Por exemplo, algumas empresas podem incentivar pagamentos em dinheiro ou cartão de débito, que normalmente têm comissões interbancárias mais baixas do que transações com cartão de crédito. Alguns podem cobrar uma tarifa adicional para transações com cartão de crédito, quando isso é legal, ou não aceitar cartões.

Escolha do processador de pagamentos: as comissões interbancárias também podem influenciar a escolha do processador de pagamentos pela empresa. Processadores diferentes usam modelos de preços diferentes. O melhor processador de pagamentos para uma determinada empresa depende do volume e do tamanho das transações, dos tipos de cartões usados pelos clientes e da tolerância à variabilidade dos custos.

Como reduzir as comissões interbancárias

A redução das comissões interbancárias pode ser complexa porque as bandeiras de cartão definem as tarifas segundo vários fatores. No entanto, as empresas podem empregar algumas estratégias para ajudar a minimizar esses custos:

Negociar com o processador: se a sua empresa processa um volume elevado de transações, é possível negociar tarifas mais baixas com o processador de pagamentos.

Escolher o processador de pagamentos certo: como vimos acima, processadores de pagamentos diferentes usam modelos de preços diferentes. Dependendo das circunstâncias da sua empresa, você pode reduzir custos escolhendo um processador com um modelo de preços mais alinhado aos seus padrões de transação.

Melhorar as práticas de processamento de cartões: muitas vezes, as empresas podem se qualificar para comissões interbancárias mais baixas seguindo as práticas recomendadas das bandeiras de cartão para processamento de cartões, como:

- Liquidação imediata de transações: é melhor liquidar transações com seu processador o quanto antes, normalmente dentro de 24 horas.

- Processamento seguro de dados de cartão: tecnologias de processamento seguro, como criptografia ponto a ponto e tokenização, podem ajudar as empresas a se qualificarem para comissões interbancárias mais baixas.

- Fornecer de dados completos de transações: para alguns tipos de cartões, principalmente corporativos e governamentais, o fornecimento de dados adicionais de transação (conhecidos como dados de Nível 2 e Nível 3) pode reduzir as comissões interbancárias.

- Liquidação imediata de transações: é melhor liquidar transações com seu processador o quanto antes, normalmente dentro de 24 horas.

Incentivar a transações com cartão de débito ou dinheiro: As transações com cartão de débito normalmente incorrem em comissões interbancárias mais baixas do que as transações com cartão de crédito. Da mesma forma, as transações em dinheiro não têm comissões interbancárias. Incentivar os clientes a usar cartões de débito ou dinheiro em espécie pode ajudar a reduzir os custos de intercâmbio.

Implementar uma sobretaxa ou taxa de serviço: em algumas regiões, as empresas podem adicionar uma taxa de serviço para transações com cartão de crédito e cobrir o custo das comissões interbancárias. No entanto, essa prática é regulamentada e não é permitida em todas as áreas ou para todos os tipos de cartões, e pode ser repelida pelos clientes.

Analisar regularmente os extratos de processamento: as comissões interbancárias podem mudar duas vezes por ano. Portanto, é importante revisar seus extratos de processamento para acompanhar as mudanças e entender todas as tarifas cobradas.

Embora a redução das comissões interbancárias possa melhorar os resultados de uma empresa, é preciso considerar o impacto de qualquer mudança na experiência do cliente. A melhor solução é equilibrar o retorno financeiro com a melhor experiência para os clientes. Para saber mais sobre o modelo de preços da Stripe, acesse aqui.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.