Accepting card payments is becoming more and more important for businesses in Germany—and that includes small-scale entrepreneurs. The growing popularity of cashless payment methods is not a passing trend, but a sustainable development that is here to stay. Small-scale entrepreneurs need to stay competitive and meet their customers’ expectations.

In this article, we’ll explain everything small-scale entrepreneurs need to know about card payment options. We’ll also take a close look at the benefits of accepting card payments and provide guidance on how to integrate them into your business. You will also find information on the costs involved.

What’s in this article?

- How can small-scale entrepreneurs accept card payments?

- What are the benefits of card payments for small-scale entrepreneurs?

- Are small-scale entrepreneurs allowed or required to offer card payments?

- What are the costs of card payments for small-scale entrepreneurs?

How can small-scale entrepreneurs accept card payments?

Small-scale entrepreneurs must meet several technical, organizational, and legal requirements if they want to accept card payments.

First, they must choose a payment service provider. Banks or specialized companies such as Stripe provide payment services such as the processing of card payments. Business owners must open a merchant account and agree to a contract, which is used to define the conditions and fees for using the payment service.

With Stripe Terminal, small-scale entrepreneurs can accept payments at the point of sale (POS) and receive the necessary hardware in the next step. This could be a precertified card reader such as the S700 or a mobile device such as the BBPOS WisePad 3. However, an existing iPhone or Android smartphone may be used, in combination with Stripe’s Tap to Pay service.

Regardless of the card payment system chosen, it is important to ensure that a stable internet connection is available on-site. This is key for accepting card payments at the point of sale. You should also investigate how card payments can be integrated into your accounting software.

Card readers designed for small-scale entrepreneurs are easy to use and require little maintenance. However, it’s important that anyone handling payments is properly trained. This will help minimize handling errors and ensure a smooth process. Small-scale entrepreneurs that previously accepted only cash payments often display “No card payments” signs at the point of sale. These signs can be replaced with messages such as “Card payments now accepted” once the chosen card payment system is operational.

After introducing card payments, you should inform customers that a new payment option is now available. If, as a small-scale entrepreneur, you usually inform your customers by other means, such as a newsletter, you should also use this channel to announce the new payment option.

Accepting card payments for small-scale entrepreneurs also involves meeting certain legal requirements. It is important to understand the legal requirements that affect the business, such as those related to tax law, the Payment Services Supervision Act (ZAG), and the Money Laundering Act (GwG). Since card payments involve the processing of personal data, you must comply with the provisions of the General Data Protection Regulation (GDPR). These regulations stipulate, among other things, that customers must be informed about the type and purpose of data processing (see Article 13 of the GDPR). This information can be communicated through signs or notices at the checkout, for example.

You can find more information in our articles on accepting credit cards as a small business and accepting credit card payments without a card reader.

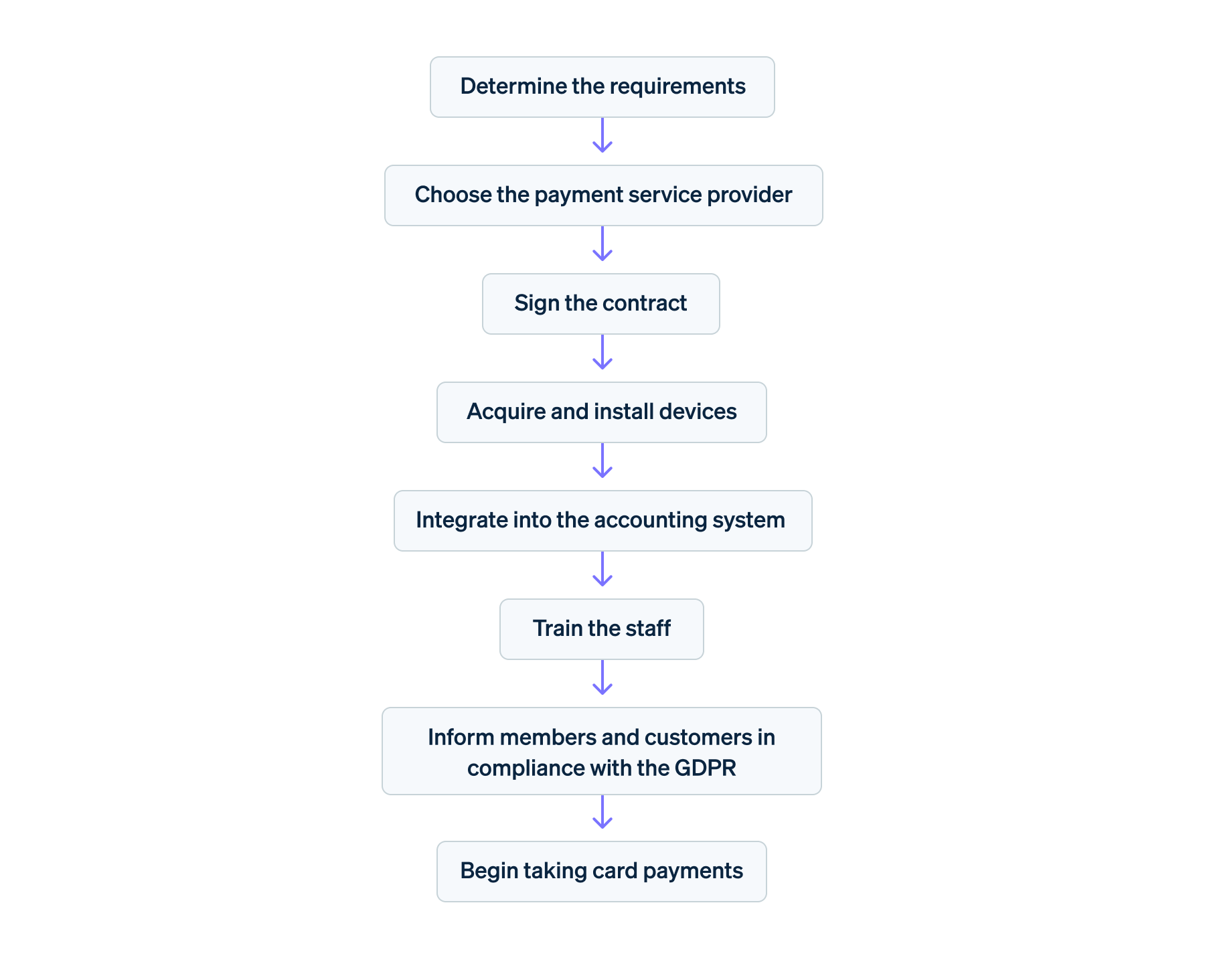

Flowchart: Implementing card payments for small-scale entrepreneurs

What are the benefits of card payments for small-scale entrepreneurs?

While not mandatory, small-scale entrepreneurs should consider offering card payments as a payment option. This has several advantages:

- Increased customer satisfaction: Card payments are fast and convenient, which is why many people prefer to pay with a debit or credit card rather than cash: in 2023, card payments in Germany accounted for nearly 62% of retail sales, up from about 42% in 2013. The majority of customers now expect to be able to pay by card, so they might become dissatisfied if this option is not available. Conversely, offering card payments can improve customer satisfaction and loyalty, especially as faster processing minimizes queues and improves service. Modern card terminals also allow customers to pay not only with debit and credit cards, but also with mobile wallets.

- Increase in turnover: Various studies on the psychology of money and payment behavior suggest that people perceive paying with a card as less “painful” than paying with cash. This is because when paying with a card, shoppers tend to focus more on the product itself, while paying with cash, they tend to focus more on the cost. Card payments are more abstract and customers perceive the physical loss of money less strongly compared to cash payments. As a result, shoppers tend to spend more and are often willing to accept higher prices when they have the option to pay by card. Accepting card payments can increase customers’ willingness to buy and boost sales for small-scale entrepreneurs.

- Security benefits: For small-scale entrepreneurs, reducing the amount of cash in their stores also means increased security and a reduced risk of theft and robbery. Card payments also eliminate the possibility of accepting counterfeit money. For customers, card payments at small-scale entrepreneurs also have security benefits: if they don’t have to carry cash, it can’t be lost or stolen.

- Simplified bookkeeping: Card payments are automatically documented, reducing manual work for small-scale entrepreneurs. Accounting becomes more efficient, faster, and with fewer errors. Payment service providers such as Stripe provide interfaces to popular accounting programs. This enables seamless integration and quick importation of transaction data. This already structured data can be used to generate financial reports and prepare tax returns.

- Better financial planning: Electronic payments are typically credited to the business account faster than cash deposits. This improves liquidity and makes financial planning easier. In addition, card payments can be transparently tracked at any time and used for detailed analysis.

- Brand enhancement: Accepting card payments can help small-scale entrepreneurs present their businesses as modern, professional, and customer-oriented—thereby enhancing their image. As a modern payment method, card payments have a direct impact on public perception. In today’s digital age, businesses that only accept cash might be seen as outdated, especially by younger customers.

For more details on the potential benefits of card payments for businesses and customers, see our article on cashless payments.

Are small-scale entrepreneurs allowed or required to offer card payments?

In Germany, small-scale entrepreneurs are not legally required to provide card payment options via girocard or credit card. It’s up to each business owner to decide whether they want to accept card payments. Conversely, this means that small-scale entrepreneurs are generally allowed to offer their customers the option to pay by card, for example, when purchasing products.

What are the costs of card payments for small-scale entrepreneurs?

Small-scale entrepreneurs should carefully assess the costs associated with implementing card payments beforehand. They should also clarify the specific needs and the scope of the payment service. Small-scale entrepreneurs should first decide whether they want to use their own smartphone with Tap to Pay, or buy a stand-alone card reader.

A card reader can be purchased for a reasonable two- or three-digit amount. Individual transactions will also incur minor fees. Visit our pricing overview page for more information.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.