Het accepteren van kaartbetalingen wordt steeds belangrijker voor bedrijven in Duitsland, ook voor kleine ondernemers. De groeiende populariteit van cashless betaalmethoden is geen tijdelijke trend, maar een blijvende ontwikkeling. Kleine ondernemers moeten concurrerend blijven en aan de verwachtingen van hun klanten voldoen.

In dit artikel leggen we uit wat kleine ondernemers moeten weten over kaartbetalingen. We kijken ook naar de voordelen van het accepteren van kaartbetalingen en geven tips over hoe je dit in je bedrijf kunt integreren. Daarnaast vind je hier informatie over de kosten.

Wat staat er in dit artikel?

- Hoe kunnen kleine ondernemers kaartbetalingen accepteren?

- Wat zijn de voordelen van kaartbetalingen voor kleine ondernemers?

- Mogen of moeten kleine ondernemers kaartbetalingen aanbieden?

- Wat kost het voor kleine ondernemers om kaartbetalingen aan te bieden?

Hoe kunnen kleine ondernemers kaartbetalingen accepteren?

Kleine ondernemers moeten aan een aantal technische, organisatorische en juridische eisen voldoen als ze kaartbetalingen willen accepteren.

Eerst moeten ze een betalingsdienstaanbieder kiezen. Banken of gespecialiseerde bedrijven zoals Stripe bieden betalingsdiensten aan, zoals het verwerken van kaartbetalingen. Ondernemers moeten een merchant account openen en akkoord gaan met een contract, waarin de voorwaarden en kosten voor het gebruik van de betalingsdienst staan.

Met Stripe Terminal kunnen kleine ondernemers betalingen accepteren op het verkooppunt (POS) en krijgen ze in de volgende stap de benodigde hardware. Dit kan een vooraf gecertificeerde kaartlezer zijn, zoals de S700, of een mobiel apparaat, zoals de BBPOS WisePad 3. Je kunt echter ook een bestaande iPhone of Android-smartphone gebruiken, in combinatie met de Tap to Pay-dienst van Stripe.

Ongeacht het gekozen kaartbetalingssysteem is het belangrijk om ervoor te zorgen dat er ter plaatse een stabiele internetverbinding beschikbaar is. Dit is essentieel voor het accepteren van kaartbetalingen op het verkooppunt. Je moet ook onderzoeken hoe kaartbetalingen kunnen worden geïntegreerd in je boekhoudsoftware.

Kaartlezers voor kleine ondernemers zijn makkelijk te gebruiken en hebben weinig onderhoud nodig. Het is wel belangrijk dat iedereen die met betalingen werkt, goed is getraind. Dit helpt fouten te voorkomen en zorgt voor een soepel proces. Kleine ondernemers die voorheen alleen contant geld accepteerden, hebben vaak bordjes met 'Geen kaartbetalingen' bij de kassa. Deze bordjes kunnen worden vervangen door berichten als 'Kaartbetalingen nu mogelijk' zodra het gekozen kaartbetalingssysteem werkt.

Nadat je kaartbetalingen hebt ingevoerd, moet je je klanten laten weten dat er nu een nieuwe betaaloptie beschikbaar is. Als je als kleine ondernemer je klanten meestal via andere kanalen informeert, zoals een nieuwsbrief, moet je dit kanaal ook gebruiken om de nieuwe betaaloptie aan te kondigen.

Het accepteren van kaartbetalingen voor kleine ondernemers houdt ook in dat je aan bepaalde wettelijke vereisten moet voldoen. Het is belangrijk om te weten welke wettelijke vereisten van invloed zijn op je bedrijf, zoals die met betrekking tot het belastingrecht, de Wet op het toezicht op betalingsdiensten (ZAG) en de Wet op het witwassen van geld (GwG). Omdat kaartbetalingen het verwerken van persoonsgegevens met zich meebrengen, moet je voldoen aan de bepalingen van de Algemene Verordening Gegevensbescherming (AVG). Deze verordening schrijft onder andere voor dat klanten moeten worden geïnformeerd over het soort gegevens dat wordt verwerkt en het doel daarvan (zie artikel 13 van de AVG). Deze informatie kan bijvoorbeeld worden verstrekt via borden of mededelingen bij de kassa.

Meer info vind je in onze artikelen over het accepteren van creditcards als klein bedrijf en het accepteren van creditcardbetalingen zonder kaartlezer.

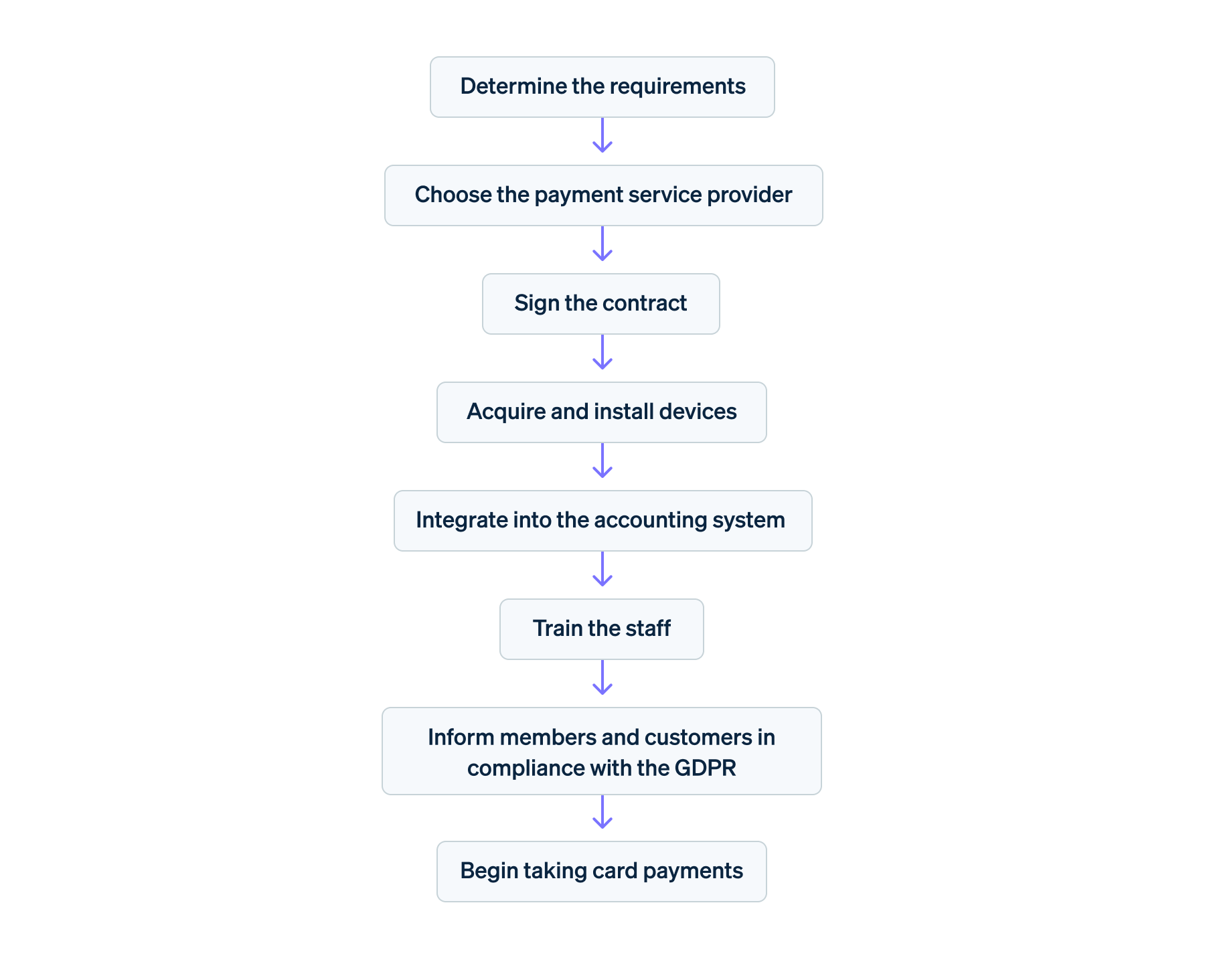

Stroomschema: kaartbetalingen implementeren voor kleine ondernemers

Wat zijn de voordelen van kaartbetalingen voor kleine ondernemers?

Hoewel het niet verplicht is, zouden kleine ondernemers moeten overwegen om kaartbetalingen als betaaloptie aan te bieden. Dit heeft een paar voordelen:

- Hogere klanttevredenheid: Kaartbetalingen zijn snel en handig, daarom betalen veel mensen liever met een pinpas of creditcard dan met contant geld: in 2023 waren kaartbetalingen in Duitsland goed voor bijna 62% van de detailhandelsverkopen, tegenover ongeveer 42% in 2013. De meeste klanten verwachten tegenwoordig dat ze met een kaart kunnen betalen, dus als deze optie niet beschikbaar is, kunnen ze ontevreden raken. Omgekeerd kan het aanbieden van kaartbetalingen de klanttevredenheid en loyaliteit verbeteren, vooral omdat een snellere verwerking wachtrijen minimaliseert en de service verbetert. Met moderne kaartterminals kunnen klanten niet alleen met debet- en creditcards betalen, maar ook met mobiele portemonnees.

- Omzetstijging: Verschillende studies over de psychologie van geld en betaalgedrag laten zien dat mensen betalen met een kaart als minder 'pijnlijk' ervaren dan betalen met contant geld. Dit komt omdat shoppers bij het betalen met een kaart meer op het product zelf letten, terwijl ze bij het betalen met contant geld meer op de kosten letten. Kaartbetalingen zijn abstracter en klanten voelen het fysieke verlies van geld minder sterk dan bij contante betalingen. Daardoor geven shoppers vaak meer uit en zijn ze vaak bereid hogere prijzen te accepteren als ze met een kaart kunnen betalen. Het accepteren van kaartbetalingen kan de koopbereidheid van klanten vergroten en de omzet van kleine ondernemers verhogen.

- Veiligheidsvoordelen: Voor kleine ondernemers betekent minder contant geld in hun winkel ook meer veiligheid en minder risico op diefstal en beroving. Met kaartbetalingen is er ook geen kans op vals geld. Voor klanten hebben kaartbetalingen bij kleine ondernemers ook veiligheidsvoordelen: als ze geen contant geld bij zich hoeven te hebben, kan het ook niet kwijtraken of gestolen worden.

- Eenvoudigere boekhouding: Kaartbetalingen worden automatisch geregistreerd, waardoor kleine ondernemers minder handmatig werk hebben. De boekhouding wordt efficiënter, sneller en met minder fouten. Betalingsdienstaanbieders zoals Stripe bieden interfaces voor populaire boekhoudprogramma's. Dit maakt een naadloze integratie en snelle import van transactiegegevens mogelijk. Deze reeds gestructureerde gegevens kunnen worden gebruikt om financiële rapporten te genereren en belastingaangiften voor te bereiden.

- Betere financiële planning: Elektronische betalingen worden doorgaans sneller bijgeschreven op de zakelijke rekening dan contante stortingen. Dit verbetert de liquiditeit en maakt financiële planning eenvoudiger. Bovendien kunnen kaartbetalingen op elk moment transparant worden gevolgd en gebruikt voor gedetailleerde analyse.

- Merkverbetering: Door kaartbetalingen te accepteren, kunnen kleine ondernemers hun bedrijf laten zien als modern, professioneel en klantgericht, waardoor hun imago wordt verbeterd. Als moderne betaalmethode hebben kaartbetalingen direct invloed op hoe mensen je bedrijf zien. In dit digitale tijdperk kunnen bedrijven die alleen contant geld accepteren, vooral door jongere klanten, als ouderwets worden gezien.

Voor meer info over de mogelijke voordelen van kaartbetalingen voor bedrijven en klanten, check ons artikel over cashless betalingen.

Mogen of moeten kleine ondernemers kaartbetalingen aanbieden?

In Duitsland hoeven kleine ondernemers niet per se kaartbetalingen via girocard of creditcard aan te bieden. Het is aan elke ondernemer om te beslissen of ze kaartbetalingen willen accepteren. Dit betekent dus dat kleine ondernemers hun klanten meestal de mogelijkheid kunnen geven om met een kaart te betalen, bijvoorbeeld bij het kopen van producten.

Wat kost het voor kleine ondernemers om met kaart te betalen?

Kleine ondernemers moeten van tevoren goed kijken naar de kosten van het accepteren van kaartbetalingen. Ze moeten ook duidelijk maken wat ze precies nodig hebben en hoe groot de betalingsdienst moet zijn. Kleine ondernemers moeten eerst beslissen of ze hun eigen smartphone met Tap to Pay willen gebruiken of een aparte kaartlezer willen kopen.

Een kaartlezer kun je kopen voor een redelijk bedrag van twee of drie cijfers. Voor individuele transacties worden ook kleine kosten in rekening gebracht. Controleer onze prijsoverzicht pagina voor meer info.

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.