Payment retries are when a business attempts to process a payment after a failed first attempt. This is a common scenario in online payments, subscriptions, and recurring billing models. For businesses, the primary goal of payment retries is to complete a transaction successfully without requiring additional action from the customer.

Below, we’ll look at why payment failures happen, why payment retries are important, and what tactics businesses should use to successfully retry a payment. With the global payments market expected to exceed $3 trillion in revenue by 2027, it’s important for businesses to understand payment retries and how to manage them effectively. Here’s what you need to know.

What’s in this article?

- Why do failed payments happen?

- Why payment retries are an important part of revenue recovery

- How do payment retries work?

- Challenges for businesses around payment retries

- Best practices for payment retries

- How Stripe can help

Why do failed payments happen?

There are many reasons why payments fail. Common reasons include:

Technical reasons

System outages: Payment processing systems can experience temporary outages due to technical problems, overloading, or maintenance.

Network issues: Poor internet connectivity or disruptions can interrupt the communication between the customer, business, and payment processor.

Software errors: Bugs or glitches in the payment software can lead to incorrect processing and failed transactions.

Security breaches: Cyberattacks and other security issues can compromise payment systems and cause disruptions.

Customer-related reasons

Insufficient funds: This is one of the most common reasons for failed payments, particularly around recurring payments.

Incorrect information: Entering card details incorrectly—such as the number, expiration date, or CVV code—can result in a declined transaction.

Expired cards: Attempting to use an expired card will lead to payment failure.

Exceeded credit limit: If a customer exceeds their credit card limit, this will trigger a decline from the issuing bank.

Fraudulent activity: Banks may decline suspicious transactions to protect their customers from fraud, even if these transactions were legitimate payment attempts.

Business-related reasons

Outdated payment system: Businesses that use outdated or incompatible payment systems may encounter compatibility issues.

Billing errors: Incorrect or incomplete billing information can cause delays or declines.

Insufficient fraud prevention measures: Weak security measures can make businesses vulnerable to fraudulent transactions, leading to chargebacks and payment failures.

Other reasons

Card issuer problems: Problems with banks, such as system maintenance or card deactivation, can also cause payment failures.

International transactions: Currency conversions and international transaction fees can trigger declines or require additional verification before payments can proceed.

Subscription or recurring payment errors: Issues with automatic billing systems or outdated payment information kept on file can lead to failed transactions for subscriptions or recurring services.

Why payment retries are an important part of revenue recovery

Payment retries are key to a business’s revenue recovery and churn management program. Here’s why:

Reduces involuntary churn

Payment failures often result in involuntary churn, when customers unintentionally drop out of subscription services not because they chose to leave, but because payment hurdles got in the way of their subscription renewal. By retrying failed payments, businesses can resolve these issues, retaining customers they might otherwise lose.Improves customer experience

Easy payment retries allow customers to bypass reentering their payment details or reaching out to customer support to resolve payment issues. This smooth process saves time and reduces frustration, leading to a more positive customer experience.Improves cash flow consistency

Payment retries play an important role in maintaining consistent cash flow by recovering revenue from transactions that failed initially, providing a more stable and predictable revenue stream for businesses.Allows for smart retry strategies

Analyzing data from failed payments can inform smart retry strategies. For instance, understanding the most common times for successful transactions or the typical reasons for failures can guide the logistics of retries and increase their success rate.Minimizes loss of service

For businesses with a subscription model, maintaining continuous service is key to customer satisfaction. Payment retries help avoid disruptions caused by payment failures, ensuring that customers continue to receive the service they expect without interruption.Reduces operational costs

Addressing each failed payment manually is resource-intensive. Automated payment retry systems alleviate the need for extensive administrative intervention, reducing operational costs and allowing staff to focus on more strategic tasks.Increases successful transaction rates

Payment retries offer businesses a second chance at processing a transaction, increasing the rate of success, which is key in assessing the financial health and efficiency of the payment processing system.Maximizes lifetime value of customers

Customer lifetime value (CLTV) is an important metric for businesses, especially those with subscription models. By preventing involuntary churn through payment retries, businesses can maintain long-term relationships with customers and maximize the revenue potential from each customer over time.Adapts to varied payment methods

Different payment methods have varying failure rates and reasons for those failures. Businesses can develop customized retry mechanisms to cater to the specific requirements and characteristics of different payment methods, making the retry process more effective.Ensures regulatory compliance

Payment processing must adhere to a range of regulatory requirements, which can vary by region and payment method. Properly designed payment retry mechanisms ensure compliance by taking these regulations into consideration, ultimately avoiding potential legal and financial penalties.

How do payment retries work?

Payment retries can work in many different ways depending on the nature of the payment system and the reason why the payment failed. Here’s a breakdown:

Based on reason for failure

The method of retrying a payment often depends on the specific reason for the initial failure. For instance, if a payment fails because of insufficient funds, the retry might be scheduled for a later date, giving the customer time to rectify the issue. In contrast, for a technical error, the retry might occur almost immediately.Timing strategies

The timing of a retry is important. Some systems use fixed intervals, while others employ varying intervals based on past transaction data and customer behavior. For example, retrying early in the morning might be more successful for certain demographics on certain days, as this coincides with salary direct deposits.Smart retry algorithms

Advanced payment systems use machine learning algorithms to analyze past transaction data. These algorithms can predict the optimal time and method for retrying a failed payment, increasing the chances of success. They consider factors such as transaction history, time of day, payment method, and even day of the week.Multiple payment methods

In scenarios where customers have multiple payment methods on file, a failed transaction on one method can automatically trigger a retry with an alternative method. This reduces the delay in payment processing and improves the chances of successful recovery.Customer notifications

Some systems integrate customer notifications as part of the retry process. That means customers are informed about the payment failure and the upcoming retry, and are given the option of updating their payment information if needed. This transparency can improve customer trust and reduce involuntary churn.Compliance and regulation adherence

Payment retries must comply with banking and financial regulations, which can vary by region. This includes adhering to rules about the number of retries allowed, the duration between retries, and customer communication requirements.Customizable retry limits

Businesses often set limits on the number of retries for a failed payment to avoid customer frustration and potential bank fees. These limits are typically customizable based on business needs and customer profiles.Diverse industry practices

Different industries may have distinct practices for payment retries. For example, subscription services might have more lenient retry schedules compared to one-time purchase platforms, reflecting the ongoing nature of their customer relationships.Fallback procedures

In cases where retries continually fail, fallback procedures are activated. These might include reaching out to the customer for new payment information, or in the case of subscriptions, temporary suspension of services until the issue is resolved.Integration with customer relationship management (CRM) systems

Payment retry mechanisms are often integrated with CRM systems. This allows businesses to gain a holistic view of the customer's interaction with the business, enabling personalized retry strategies that consider the customer's overall relationship and value to the business.

Challenges for businesses around payment retries

In any payment system, dealing with payment retries can come with many challenges. Here are some common obstacles you might face and how to overcome them:

Challenge: Distinguishing between transaction failure types

In a complex payment system, differentiating between types of transaction failures can be difficult. Failures can range from simple issues such as network downtime to more complex scenarios including multifactor authentication failures or credit limit issues. Each type of failure requires a distinct strategy, and incorrectly categorizing them can lead to ineffective retry strategies, increased operational costs, and/or customer dissatisfaction.

Solution: Advanced diagnostic analytics

Implementing sophisticated diagnostic analytics with machine learning can dissect and categorize transaction failures more accurately, helping to differentiate between transient and persistent failure types and allowing for tailored retry strategies and improved success rates.

Challenge: Optimizing retry algorithms

Standard retry algorithms often lack the flexibility to adapt to different failure scenarios. They don’t consider variables such as customer behavior, transaction type, or specific error codes. Incorrect retry intervals and frequencies, on the other hand, can exacerbate failure rates and operational inefficiencies.

Solution: Dynamic retry scheduling

Developing a dynamic retry algorithm that adjusts based on different factors increases the likelihood of successful transactions. This data-driven tactic can optimize retry timing and frequency, balancing success rates with operational costs and customer experience.

Challenge: Regulatory compliance and security in retries

Ensuring that each payment retry adheres to evolving regulatory standards and security protocols is a complicated but important task. The demands of compliance and digital security are constantly shifting and require businesses to update processes on an ongoing basis. Noncompliance or security breaches in retries can lead to substantial legal and reputational risks.

Solution: Continuous compliance monitoring and advanced encryption

Implementing continuous compliance monitoring and advanced encryption techniques guarantees that retries are both secure and compliant. Regular updates and audits of these systems are necessary for staying ahead of emerging threats and regulatory changes.

Challenge: Minimizing operational costs of payment retries

Payment retries increase operational costs, and manual interventions in the retry process, coupled with increased transaction fees and customer service inquiries, can quickly escalate these costs. Managing these expenses efficiently while maintaining a high success rate in retries is a delicate balance.

Solution: Cost-benefit analysis and process automation

A thorough cost-benefit analysis of different retry strategies can identify the best ones for your business. Automating the retry process reduces manual labor and associated costs, while maintaining consistency and accuracy in retries.

Challenge: Incorporating new payment technologies and methods

The evolution of payment technologies and methods presents a challenge in keeping payment systems up-to-date and compatible. Failure to quickly adapt to new payment methods can result in lost transactions and reduced customer satisfaction.

Solution: Agile system architecture

Building an agile payment system architecture allows for quick adaptation to new technologies. This involves creating flexible APIs and modular system components that can integrate emerging payment platforms and technologies, ensuring the system remains relevant and efficient.

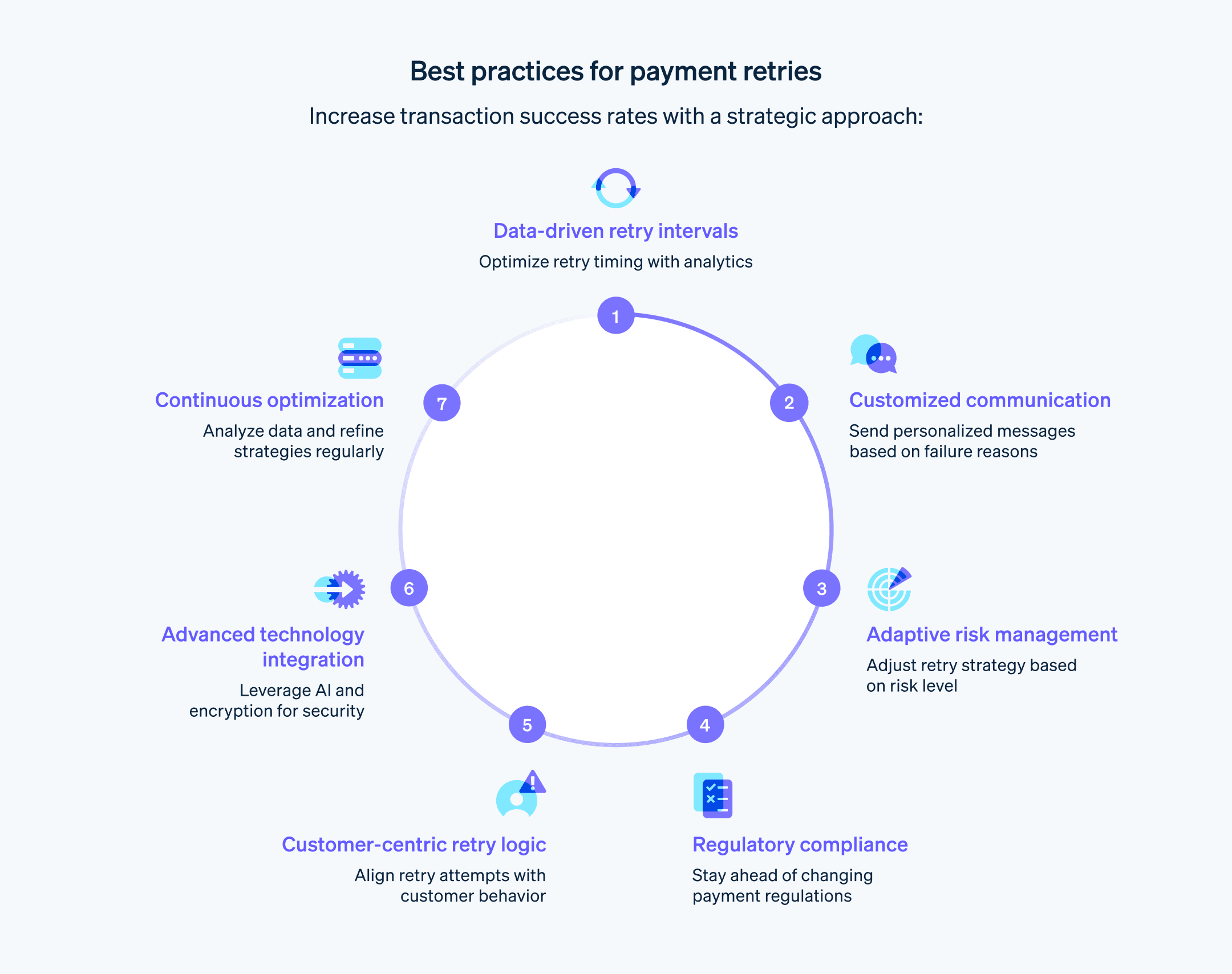

Best practices for payment retries

There’s a huge amount of variation that can exist between different revenue recovery and dunning management strategies. When you’re developing your business’s payment retry strategy, follow these best practices:

Data-driven retry intervals

Use advanced analytics to determine the optimal retry intervals. Analyze customer payment patterns, transaction types, and historical success rates to establish tailored retry schedules. This approach moves beyond generic retry timelines, using data to predict the most effective times for retry attempts, and increasing the likelihood of successful transactions.Customized communication strategies

Develop a communication plan that is aligned with the retry process. This involves sending customized messages to customers based on the transaction failure reason. For instance, if a payment fails because of an expired card, the communication should guide the customer on updating their payment information. A/B testing can help you refine these messages to determine what resonates with your customer base.Adaptive risk management

Integrate a dynamic risk assessment model into your retry process. This model should evaluate the risk associated with different types of transaction failures and adjust the retry strategy accordingly. For high-risk scenarios, such as suspected fraud, the system should automatically escalate the issue to a manual review or specialized fraud detection team.Regulatory compliance

Stay on top of global and regional regulatory changes that affect payment retries, and implement systems that automatically update to accommodate new regulations. This is particularly important for international businesses that experience regulatory variance across jurisdictions, a segment that is growing: cross-border payments reached $150 trillion in 2022, a 13% increase from the previous year.Customer-centric retry logic

Implement a customer-centric perspective in your retry logic. This involves understanding customer preferences and behaviors, and customizing the retry process to suit these preferences. For example, some customers may prefer retries on specific days of the month or after receiving a notification.Advanced technology integration

Use the latest technologies in payment processing and cybersecurity. This includes using AI and machine learning for predictive analytics, blockchain for secure transaction recording, and advanced encryption methods for data protection. Staying up-to-date with the latest technology not only improves the efficiency of your retry process but also boosts security and customer trust.Continuous process optimization

Regularly review and optimize your payment retry processes. This should be an ongoing effort that includes monitoring performance metrics and customer feedback. Use these insights to refine your strategies and adapt to changing market conditions and customer needs.

How Stripe can help

Stripe has built-in features that businesses can use to create a streamlined strategy for addressing revenue recovery, dunning management, and payment retries. Here’s how Stripe can help:

Automated retry logic

Stripe's automated retry logic is designed to optimize the timing and frequency of payment retries. This system uses machine learning to analyze historical payment data, helping to determine the best times to retry a failed payment, which increases the chances of successful charges while reducing unnecessary attempts.Smart dunning tools

Stripe provides advanced dunning tools that businesses can customize based on specific needs. These tools send automated notifications to customers when a payment fails, reminding them to update their payment information. Businesses can configure Stripe's dunning system to send these reminders at specific intervals and through different communication channels such as email or SMS.Customizable billing cycles

With Stripe, you can customize billing cycles and retry schedules to suit different customer segments. This flexibility allows for a more tailored approach to payment collection, which can be particularly useful for subscription-based models or businesses with diverse customer bases.Real-time analytics and reporting

Stripe provides comprehensive analytics and reporting features that provide real-time insights into payment transactions. This includes detailed reports on failed payments, success rates of retries, and customer responses to dunning efforts. These analytics are important for continually refining and improving your revenue recovery strategies.Compliance and security

Stripe adheres to the highest standards of compliance and security, guaranteeing that payment retries and dunning efforts are secure and regulatory-compliant. Stripe follows Payment Card Industry Data Security Standards (PCI DSS) and employs advanced encryption methods to protect sensitive data.Integration with CRM and accounting software

Stripe’s platform can easily integrate with a wide range of CRM and accounting software, facilitating a cohesive revenue recovery and dunning management strategy that keeps customer data and financial records synchronized and up-to-date.Custom rules and machine learning models

Businesses can create custom rules for payment retries and dunning management within Stripe’s platform. Additionally, Stripe’s machine learning models can predict and identify potential payment issues before they occur, allowing for proactive measures to prevent revenue loss.Global payment methods and currencies

Stripe supports a wide range of payment methods and more than 135 currencies, making it ideal for businesses with a global customer base. This guarantees that payment retries are as inclusive and adaptable as possible, catering to the preferred payment methods of customers from different regions.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.