The ability to manage international payments effectively enables businesses to expand beyond their domestic markets, secure global supply chains, and tap into diverse talent pools.

But sending and receiving international payments can be complex. Financial regulations, geopolitical risks, and fluctuating exchange rates can present significant challenges. Mastering the nuances of international payments is essential for any business that aspires to operate and thrive in a global marketplace.

We’ll cover the common types of international payments, networks that facilitate them, and how businesses can manage them successfully.

What’s in this article?

- What are international payments?

- How international payments are different from domestic payments

- What are international payments used for?

- Types of international payments

- International payment systems

- Best practices for sending and receiving international payments

What are international payments?

International payments, also known as cross-border payments, are transactions in which the payer and the payee are based in different countries. These payments are key for businesses that have international suppliers, contractors, employees, customers, or partners.

These transactions frequently involve the transfer of money from one currency to another. Given the global nature of these transactions, businesses that send or receive international payments must carefully adhere to the regulations, banking practices, and exchange rates of both the originating and receiving countries. We’ll discuss best practices around sending and receiving international payments below.

International payments are crucial to global commerce as they facilitate trade between countries and enable businesses to expand their operations beyond domestic borders. These payments encompass a wide range of business activities, including paying overseas suppliers for goods, compensating international employees, and receiving payments from foreign customers.

How international payments are different from domestic payments

International payments and domestic payments share a basic purpose: transferring funds from one entity to another. However, they differ significantly in their processes, complexities, and the factors that affect them. Here are the primary differences between international and domestic payments:

Currency exchange

Domestic payments involve only one currency, while international payments often involve currency conversion. This exposes businesses to exchange rate risk, as the value of currencies can fluctuate between the time the transaction is initiated and when it is completed.Regulatory compliance

Domestic payments typically follow a single set of local banking and financial regulations. By contrast, international payments must comply with the rules of both the originating and receiving countries, which can be more complex and challenging to navigate.Processing time

Domestic payments tend to have a faster processing time due to simpler banking procedures. International payments, however, often require additional time as they must pass through more banking systems and checkpoints.Transaction costs

Domestic payments are usually less expensive for businesses, due to fewer intermediaries and lower processing costs. International payments tend to cost businesses more, due to currency conversion fees, wire transfer fees, and charges imposed by intermediary and receiving banks.Risk factors

International payments involve additional risks including geopolitical risks, sanctions, and increased vulnerability to payment fraud. The regulatory landscape can change rapidly in some countries, adding to the overall risk. With payments that straddle international borders, there is also a greater chance of accidental noncompliance.Intermediaries

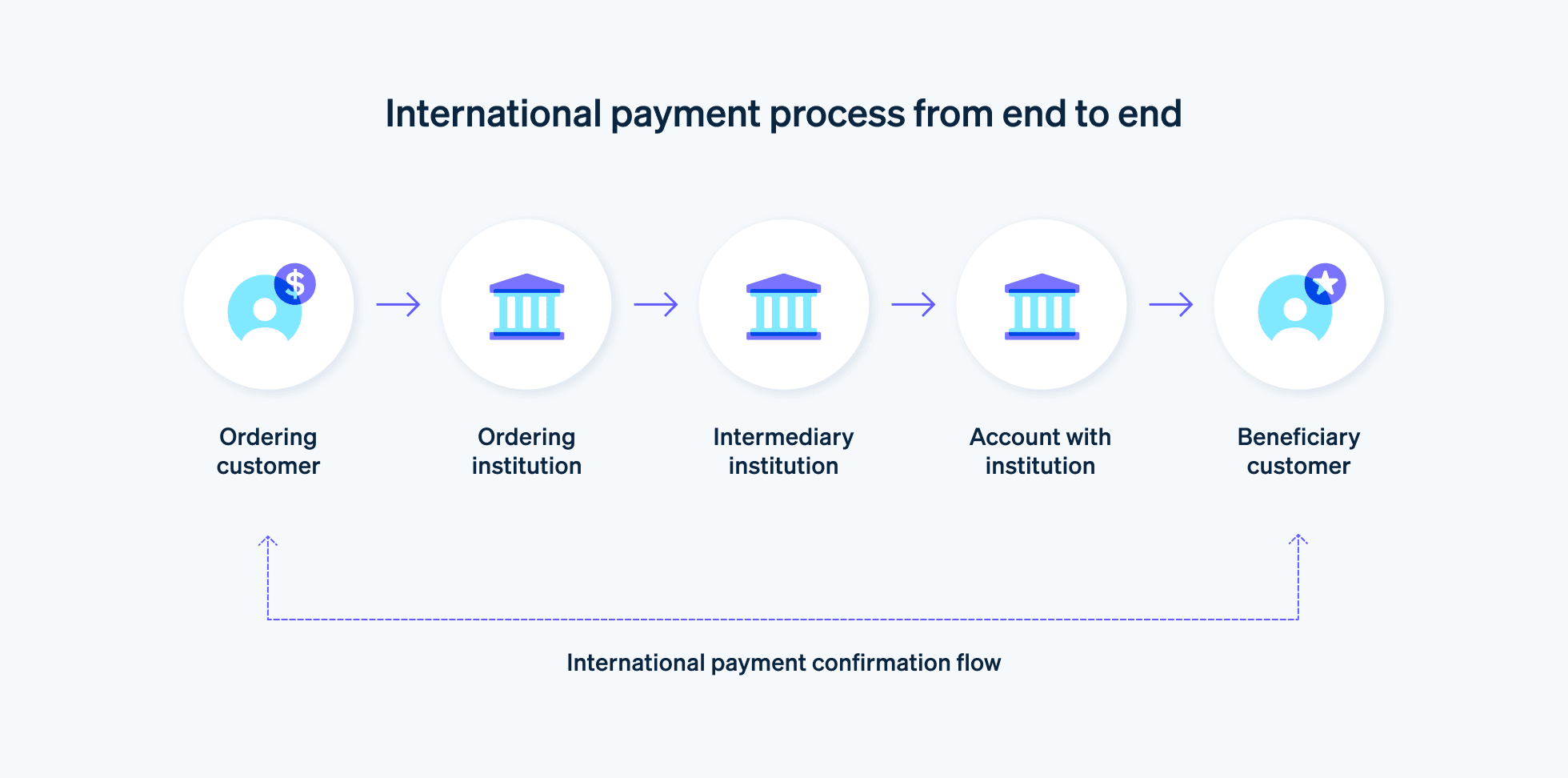

Domestic payments usually involve few intermediaries, often just the sending and receiving banks. International payments, on the other hand, may involve multiple financial institutions in different countries, in addition to payment networks, each with their own procedures and fees.

While both types of payments serve the same basic function, international payments involve additional complexities that necessitate careful planning and management from businesses.

What are international payments used for?

International payments are used for a variety of purposes in global commerce:

Purchasing goods and services

Many businesses source goods, raw materials, or services from overseas suppliers to take advantage of cost efficiencies, quality, or other benefits. For example, a US automobile manufacturer might purchase specific car parts from a supplier in Germany. To pay the supplier, the US manufacturer would make an international payment.Paying salaries to international employees or contractors

With the popularity of remote work, companies often work with employees or independent contractors located in different countries. For instance, a UK-based tech startup might hire a software engineer from India, whose salary the startup would pay using international payments.Paying dividends or interest

When a corporation has international investors or borrows money from international lenders, it needs to make international payments. For example, if a Chinese company lists its shares on the New York Stock Exchange and has American shareholders, it would send dividends to those shareholders using international payments. Similarly, if a Brazilian company borrows from a bank in Japan, it would pay interest through an international payment.Investment activities

Companies might invest in businesses, projects, or real estate in foreign countries. For instance, if an Australian venture capital firm invests in a tech startup in Singapore, they would transfer those funds through an international payment.Acquiring assets

Companies may purchase assets in other countries as part of their operations or expansion strategies. For instance, a Canadian mining company may acquire a mine in South Africa and would make the payment for this purchase with an international transaction.Financial market transactions

When trading in foreign financial markets, companies often need to make cross-border payments. If a European hedge fund buys US stocks, for example, they would use an international payment.Payment for travel and expenses

When employees travel abroad for business reasons and incur expenses that the company needs to cover, the company can settle those payments with an international transaction. For instance, if an executive from a Mexican corporation goes on a business trip to France, the company may pay the French hotel directly with an international payment.Charitable donations

Companies often contribute to foreign charitable organizations as part of their corporate social responsibility efforts. For instance, after a natural disaster in the Philippines, a company in Sweden might donate to relief efforts using an international payment.

As the global economy becomes more interconnected, international payments will continue to play a vital role in facilitating a wide range of business transactions. Understanding these uses can help businesses plan their international operations and financial strategies—and think more expansively about what’s possible for the future.

Types of international payments

International payments can take many forms, and the choice depends on factors such as cost, transaction size, speed of transfer, and the specific requirements of the sender and recipient.

Here are some common types of international payments:

Wire transfers

Wire transfers are a reliable and secure method for sending large amounts of money internationally. Typically, wire transfers are used for significant transactions such as purchasing property or paying overseas suppliers. Banks and financial institutions usually handle these transfers, which are direct bank-to-bank transfers.International checks

Although less common due to their slower processing time, international checks are another option for cross-border payments. These are physical checks drawn on a bank in one country that can be cashed in another country. They can be used for a variety of purposes, such as paying suppliers or sending money to individuals.Foreign exchange (forex) brokers

Forex brokers can help businesses and individuals convert and transfer money internationally at competitive exchange rates. These services are often used for recurring or large transfers, such as paying overseas staff or suppliers, as they can provide cost savings compared to traditional bank transfers.International money orders

International money orders, which are prepaid and therefore considered more secure than some other payment options, are often used for sending smaller amounts of money overseas (such as for personal gifts or small purchases).Online payment platforms

Online payment platforms like Stripe are widely used for international payments, particularly for ecommerce transactions. These platforms are commonly used for smaller transactions due to their ease of use and speed, but can also handle larger transactions.Cryptocurrency transfers

While cryptocurrencies such as Bitcoin and Ethereum are not universally accepted, they offer the potential for low-cost, quick international transfers without the need for a traditional banking system. They are typically used in peer-to-peer transactions or by businesses that have adopted cryptocurrency as a form of payment.

Each type of international payment has its strengths and weaknesses, and the best option depends on the specific needs and circumstances of the businesses involved. Factors to consider include the size and frequency of the transaction, countries involved, cost and speed of the method, and preferences or requirements of both the sender and the recipient.

International payment systems

International payment systems are necessary to facilitating cross-border transactions. These systems provide the infrastructure for transferring funds between financial institutions, often spanning different countries and currencies. Here are some of the major international payment systems:

SWIFT (Society for Worldwide Interbank Financial Telecommunication)

SWIFT is a member-owned cooperative that provides secure messaging services used by more than 11,000 financial institutions in over 200 countries. While SWIFT doesn’t transfer funds itself, it sends payment orders that are settled by accounts that institutions have with each other for this purpose. SWIFT is used for different types of international transactions, including money transfers, letters of credit, and securities transactions.SEPA (Single Euro Payments Area)

SEPA streamlines the way cashless payments are made throughout Europe. European consumers, businesses, and public administrations are able to send and receive credit transfers, direct debit payments, and card payments under the same basic conditions, rights, and obligations, regardless of their location within Europe.Fedwire (Federal Reserve Wire Network)

Operated by the United States Federal Reserve, the Fedwire is a real-time gross settlement system for electronic fund transfers. Financial institutions use Fedwire for high-value, time-critical domestic and international payments in US dollars.CHAPS (Clearing House Automated Payment System)

CHAPS is a UK-based payment system providing same-day fund transfers for high-value transactions. While it primarily serves domestic transfers, it can also be used for certain types of international transactions in sterling or euros.TARGET2 (Trans-European Automated Real-time Gross Settlement Express Transfer System)

This is the real-time gross settlement (RTGS) system for the euro. It’s used for large-value euro transfers between banks in European Union countries.CLS (Continuous Linked Settlement)

This is a specialized system designed to eliminate foreign exchange settlement risk. It simultaneously settles both sides of a foreign exchange transaction in the currencies of its 18 members, which include many of the world’s largest economies.CIPS (China International Payment System)

Launched by the People’s Bank of China, CIPS facilitates the clearing and settlement of both cross-border and offshore Renminbi (RMB) transactions, aiming to internationalize the Chinese currency.

These systems are fundamental to the operation of the global financial system and allow funds to flow across borders quickly, securely, and efficiently. Each has its own focus, whether it’s a particular type of transaction (like SWIFT), a specific currency (like TARGET2 for euros), or a geographical region (like SEPA for Europe).

Best practices for sending and receiving international payments

Managing international payments can be complex, and businesses need to uphold certain best practices to ensure the transactions are secure, compliant, and efficient. Here are several key best practices:

Understand the costs

Before choosing a method for international payments, make sure you understand the full costs involved. This includes transaction fees, currency conversion fees, and any potential intermediary bank fees.Keep abreast of exchange rates

Currency exchange rates fluctuate constantly and can significantly impact the cost of international payments. Regularly monitor these rates to understand their impact on your transactions and consider hedging strategies to manage exchange rate risk.Ensure regulatory compliance

Different countries have different regulations for financial transactions. Noncompliance can lead to legal consequences and costly fines, not to mention damage to your company’s reputation. It’s important to ensure you understand and comply with the regulations in both the sending and receiving countries and any other pertinent jurisdictions.Maintain accurate records

Accurate and thorough record-keeping is crucial for audit purposes, regulatory compliance, and effective financial management. Keep detailed records of all international payment transactions, including the date, amount, exchange rate, fees, and details of the other party.Verify recipient details

Always double-check the details of the recipient before sending an international payment. Small errors in account numbers, routing numbers, or addresses can lead to delays, additional fees, or the payment being sent to the wrong account.Use secure and reliable payment methods

Always use secure and reliable methods for sending international payments. Consider the reputation and reliability of the payment service provider, their security measures, and their customer support in case of problems.Establish clear payment terms in contracts

When dealing with international clients or suppliers, clearly outline payment terms in contracts. This includes the currency of payment, who is responsible for transaction fees, payment deadlines, and any potential late payment penalties.Be aware of potential fraud

Unfortunately, international payments can be a target for fraud. Be aware of common scams, such as phishing attempts or fake invoice scams, and train your staff to recognize and respond to them. Always verify any changes to payment details and consider using secure payment methods that offer fraud protection.

By adhering to these best practices, businesses can execute smooth and compliant international payments while mitigating associated risks and enjoying the growth opportunities that international payments can bring. To learn more about how to accept international payments from customers, read our guide here.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.