A capacidade de gerenciar pagamentos internacionais de forma eficaz permite que as empresas se expandam para além de seus mercados domésticos, obtenham cadeias de suprimento globais e aproveitem os diversos pools de talentos.

Mas enviar e receber pagamentos internacionais pode ser complexo. Regulamentações financeiras, riscos geopolíticos e taxas de câmbio flutuantes podem apresentar desafios significativos. Dominar as nuances dos pagamentos internacionais é essencial para qualquer empresa que pretenda operar e prosperar em um marketplace global.

Abordamos aqui os tipos comuns de pagamentos internacionais, as redes que os viabilizam e como as empresas podem gerenciá-los com êxito.

Neste artigo:

- O que são pagamentos internacionais?

- Quais as diferenças entre pagamentos internacionais e pagamentos nacionais

- Para que servem os pagamentos internacionais?

- Tipos de pagamentos internacionais

- Sistemas de pagamento internacionais

- Melhores práticas para enviar e receber pagamentos internacionais

O que são pagamentos internacionais?

Os pagamentos internacionais, também conhecidos como pagamentos transfronteiriços, são transações em que o pagador e o beneficiário estão baseados em países diferentes. Esses pagamentos são essenciais para empresas que têm fornecedores, contratados, funcionários, clientes ou parceiros internacionais.

Essas transações frequentemente envolvem a transferência de dinheiro de uma moeda para outra. Dada a natureza global dessas transações, as empresas que enviam ou recebem pagamentos internacionais devem seguir cuidadosamente as regulamentações, as práticas bancárias e as taxas de câmbio dos países de origem e recebimento. Discutimos abaixo as práticas recomendadas para envio e recebimento de pagamentos internacionais.

Os pagamentos internacionais são essenciais para o comércio global, pois facilitam o comércio entre países e permitem que as empresas expandam suas operações para além das fronteiras nacionais. Esses pagamentos abrangem uma ampla gama de atividades comerciais, incluindo o pagamento de mercadorias a fornecedores no exterior, a remuneração de funcionários internacionais e o recebimento de pagamentos de clientes estrangeiros.

Qual a diferença entre pagamentos internacionais e pagamentos nacionais

Pagamentos internacionais e pagamentos nacionais têm uma finalidade básica: transferir fundos de uma entidade para outra. No entanto, eles diferem significativamente em seus processos, complexidades e os fatores que os afetam. Estas são as principais diferenças entre pagamentos internacionais e nacionais:

Câmbio

Os pagamentos nacionais envolvem apenas uma moeda, enquanto pagamentos internacionais geralmente envolvem a conversão de moedas. Isso expõe as empresas ao risco cambial, pois o valor das moedas pode variar entre o início e a conclusão da transação.Conformidade regulatória

Os pagamentos nacionais normalmente seguem um conjunto único de regulamentos bancários e financeiros locais. Por outro lado, os pagamentos internacionais devem obedecer às regras dos países de origem e de recebimento, o que pode ser mais complexo e difícil de navegar.Tempo de processamento

Os pagamentos nacionais costumam ter um tempo de processamento mais rápido devido a procedimentos bancários mais simples. Os pagamentos internacionais, no entanto, muitas vezes demandam mais tempo, pois precisam passar por mais sistemas bancários e verificações.Custos de transação

Os pagamentos nacionais costumam ser mais baratos para as empresas, devido ao menor número de intermediários e menores custos de processamento. Os pagamentos internacionais tendem a custar mais caro às empresas, devido às tarifas de conversão de moedas, tarifas de wire transfer e encargos impostos por bancos intermediários e receptores.Fatores de risco

Os pagamentos internacionais envolvem riscos adicionais, incluindo riscos geopolíticos, sanções e maior vulnerabilidade a fraudes de pagamento. O cenário regulatório pode mudar rapidamente em alguns países, aumentando o risco geral. Com pagamentos que atravessam fronteiras internacionais, também há maior chance de não conformidade acidental.Intermediários

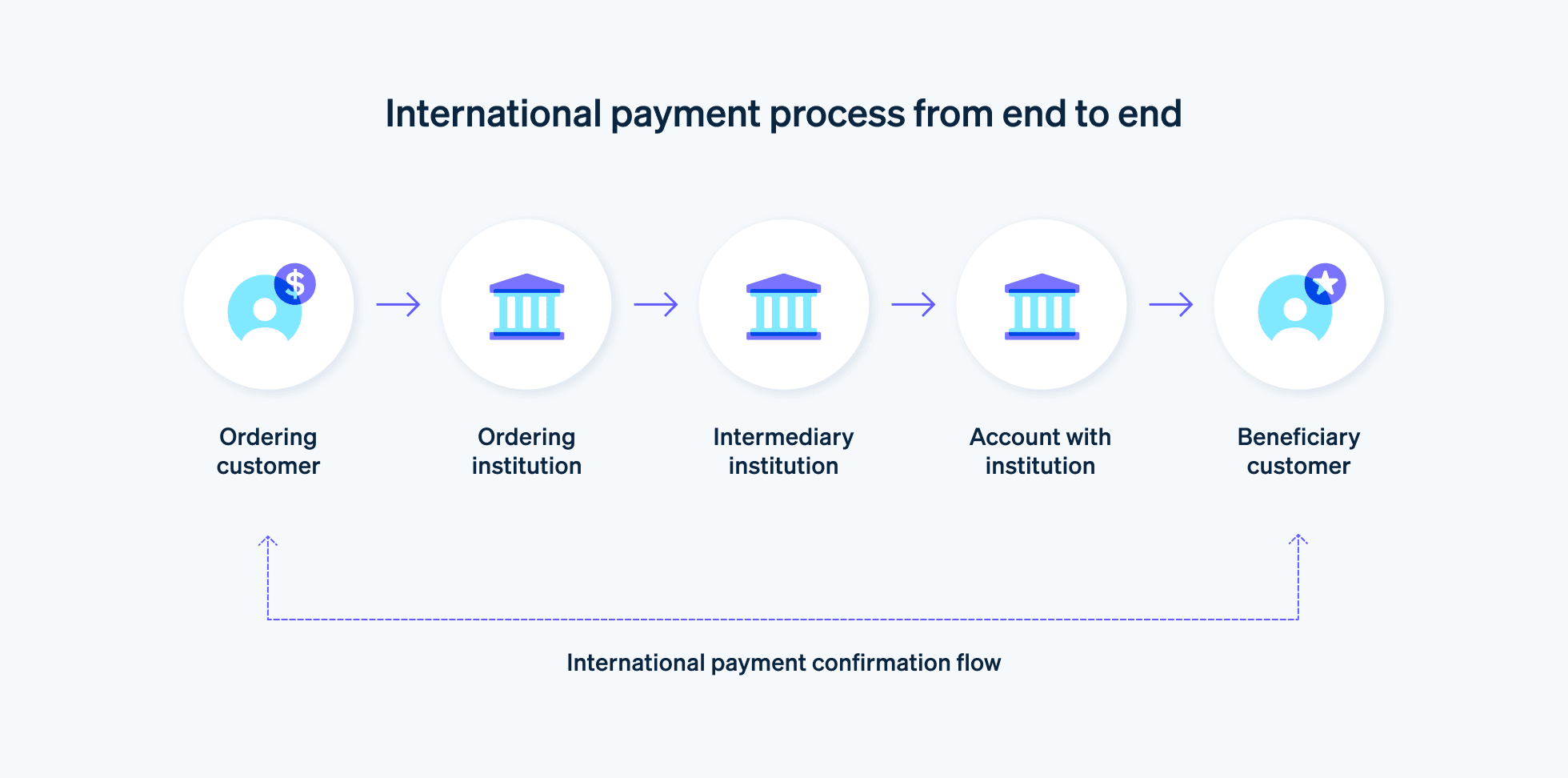

Os pagamentos nacionais geralmente envolvem poucos intermediários, muitas vezes apenas os bancos de envio e recebimento. Os pagamentos internacionais, por outro lado, podem envolver várias instituições financeiras em diferentes países, além de redes de pagamento, cada uma com seus próprios procedimentos e taxas.

Embora os dois tipos de pagamento tenham a mesma função básica, os pagamentos internacionais envolvem complexidades adicionais que exigem planejamento e gerenciamento cuidadosos por parte das empresas.

Para que servem os pagamentos internacionais?

Pagamentos internacionais são usados para diversas finalidades no comércio global:

Compra de bens e serviços

Muitas empresas adquirem bens, matérias-primas ou serviços de fornecedores estrangeiros para aproveitar a eficiência de custos, a qualidade ou outros benefícios. Por exemplo, um fabricante de automóveis dos EUA pode comprar peças específicas de um fornecedor na Alemanha. Para pagar o fornecedor, o fabricante americano deve fazer um pagamento internacional.Pagamento de salários a funcionários ou fornecedores internacionais

Com a popularização do trabalho remoto, as empresas geralmente trabalham com funcionários ou prestadores de serviços independentes de diversos países. Por exemplo, uma startup de tecnologia com sede no Reino Unido pode contratar um engenheiro de software da Índia, cujo salário a startup paga com pagamentos internacionais.Pagamento de dividendos ou juros

Quando uma corporação tem investidores internacionais ou pede dinheiro emprestado de credores internacionais, ela precisa fazer pagamentos internacionais. Por exemplo, se uma empresa chinesa vender ações na Bolsa de Valores de Nova York e tiver acionistas americanos, precisa enviar dividendos a esses acionistas usando pagamentos internacionais. Da mesma forma, se uma empresa brasileira emprestar dinheiro de um banco no Japão, deve pagar juros com pagamento internacionais.Atividades de investimento

As empresas podem investir em negócios, projetos ou imóveis em países estrangeiros. Por exemplo, se uma empresa de venture capital australiana investir numa startup de tecnologia de Singapura, precisa transferir fundos por meio de um pagamento internacional.Aquisição de ativos

As empresas podem comprar ativos em outros países durante suas operações ou estratégias de expansão. Por exemplo, uma mineradora canadense pode adquirir uma mina na África do Sul e fazer o pagamento dessa compra com uma transação internacional.Transações no mercado financeiro

Ao negociar em mercados financeiros estrangeiros, as empresas muitas vezes precisam fazer pagamentos transfronteiriços. Se um fundo de hedge europeu comprar ações dos EUA, por exemplo, precisa fazer um pagamento internacional.Pagamento de viagens e despesas

Quando os funcionários viajam a trabalho para o exterior e incorrem em despesas que a empresa precisa cobrir, a empresa pode liquidar esses pagamentos com uma transação internacional. Por exemplo, quando um executivo mexicano viaja a trabalho para a França, a empresa pode pagar o hotel francês com um pagamento internacional.Caridade

As empresas muitas vezes contribuem para organizações de caridade estrangeiras em seus projetos de responsabilidade social corporativa. Por exemplo, após um desastre natural nas Filipinas, uma empresa na Suécia pode contribuir para o socorro das vítimas com um pagamento internacional.

Com a crescente interconexão da economia global, pagamentos internacionais serão cada vez mais essenciais para as mais diversas transações comerciais. Entender esses usos pode ajudar a planejar suas operações internacionais e estratégias financeiras, além de expandir suas possibilidades para o futuro.

Tipos de pagamentos internacionais

Os pagamentos internacionais podem assumir várias formas, e a escolha depende de fatores como custo, tamanho da transação, velocidade de transferência e os requisitos específicos do remetente e do destinatário.

Veja alguns tipos comuns de pagamentos internacionais:

Wire transfers

As wire transfers são um método confiável e seguro para enviar grandes quantias de dinheiro internacionalmente. Normalmente, as wire transfers são usadas para transações significativas, como a compra de propriedades ou o pagamento de fornecedores no exterior. Bancos e instituições financeiras geralmente lidam com essas transferências, que são feitas diretamente de banco para banco.Cheques internacionais

Embora menos comuns devido ao seu tempo de processamento mais lento, os cheques internacionais são outra opção para pagamentos transfronteiriços. São cheques físicos emitidos pelo banco de um país e que podem ser sacados em outro país. Eles podem ser usados para diversas finalidades, como pagar fornecedores ou enviar dinheiro para pessoas físicas.Corretoras de câmbio (forex)

As corretoras de câmbio podem ajudar empresas e indivíduos a converter e transferir dinheiro internacionalmente a taxas de câmbio competitivas. Esses serviços são frequentemente usados para transferências recorrentes ou de grande porte, como pagamento de funcionários ou fornecedores no exterior, pois podem proporcionar economia de custos em comparação com as transferências bancárias tradicionais.Ordens de pagamento internacionais

As ordens de pagamento internacionais, que são pré-pagas e, portanto, consideradas mais seguras do que algumas outras opções de pagamento, são frequentemente usadas para enviar quantias menores de dinheiro para o exterior (como para presentes pessoais ou pequenas compras).Plataformas de pagamento online

Plataformas de pagamento online como a Stripe são muito usadas para pagamentos internacionais, particularmente para transações de comércio eletrônico. Essas plataformas são muito usadas para transações menores devido à sua facilidade de uso e velocidade, mas também podem lidar com transações maiores.Transferências de criptomoedas

Embora criptomoedas como Bitcoin e Ethereum não sejam universalmente aceitas, elas oferecem o potencial para transferências internacionais rápidas e de baixo custo, sem a necessidade de um sistema bancário tradicional. Elas geralmente são usadas em transações ponto a ponto ou por empresas que adotaram criptomoedas como forma de pagamento.

Cada tipo de pagamento internacional tem seus pontos fortes e fracos, e a melhor opção depende das necessidades e circunstâncias específicas das empresas envolvidas. Os fatores a serem considerados incluem o tamanho e a frequência da transação, os países envolvidos, o custo e a velocidade do método e as preferências ou requisitos do remetente e do destinatário.

Sistemas de pagamento internacionais

Sistemas de pagamento internacionais são necessários para viabilizar as transações transfronteiras. Esses sistemas fornecem a infraestrutura para a transferência de fundos entre instituições financeiras, muitas vezes abrangendo diferentes países e moedas. Veja alguns dos principais sistemas de pagamento internacionais:

SWIFT (Society for Worldwide Interbank Financial Telecommunication)

SWIFT é uma cooperativa de propriedade dos membros que fornece serviços de mensagens seguras usadas por mais de 11.000 instituições financeiras em mais de 200 países. Embora o SWIFT não transfira fundos em si, ele envia ordens de pagamento que são liquidadas por contas que as instituições têm umas com as outras para esse fim. O SWIFT é usado para diferentes tipos de transações internacionais, incluindo transferências de dinheiro, cartas de crédito e transações de títulos.SEPA (Área Única de Pagamentos em Euros)

SEPA simplifica a forma como os pagamentos sem dinheiro são feitos em toda a Europa. Os consumidores, as empresas e as administrações públicas europeias podem enviar e receber transferências de crédito, pagamentos por débito direto e pagamentos por cartão nas mesmas condições, direitos e obrigações básicas, independentemente da sua localização na Europa.Fedwire (Federal Reserve Wire Network)

Operado pelo Federal Reserve dos Estados Unidos, o Fedwire é um sistema de liquidação bruta em tempo real para transferências eletrônicas de fundos. As instituições financeiras usam o Fedwire para pagamentos nacionais e internacionais de alto valor e tempo crítico em dólares americanos.CHAPS (Sistema Automatizado de Pagamento da Câmara de Compensação)

CHAPS é um sistema de pagamentos baseado no Reino Unido que oferece transferências de fundos no mesmo dia para transações de alto valor. Embora atenda principalmente transferências nacionais, também pode ser usado para certos tipos de transações internacionais em libras esterlinas ou euros.TARGET2 (Trans-European Automated Real-time Gross Settlement Express Transfer System)

Este é o sistema de liquidação bruta em tempo real (SLBTR) do euro. É usado para transferências de grande valor em euros entre bancos em países da União Europeia.CLS (Continuous Linked Settlement)

Trata-se de um sistema especializado para eliminar o risco de liquidação de câmbio. Ela liquida simultaneamente os dois lados de uma transação de câmbio nas moedas de seus 18 membros, que incluem muitas das maiores economias do mundo.CIPS (China International Payment System)

Lançado pelo Banco Popular da China, o CIPS facilita a compensação e liquidação de transações em renminbi (RMB) nacionais e offshore, com o objetivo de internacionalizar a moeda chinesa.

Esses sistemas são fundamentais para o funcionamento do sistema financeiro global e permitem que os fundos fluam através das fronteiras de forma rápida, segura e eficiente. Cada um tem seu próprio foco, seja um tipo específico de transação (como o SWIFT), uma moeda específica (como TARGET2 para euros) ou uma região geográfica (como SEPA para a Europa).

Melhores práticas para enviar e receber pagamentos internacionais

O gerenciamento de pagamentos internacionais pode ser complexo, e as empresas precisam adotar algumas práticas recomendadas para garantir que as transações sejam seguras, compatíveis e eficientes. Veja algumas práticas recomendadas:

Entenda os custos

Antes de escolher uma forma de pagamento internacional, entenda todos os custos envolvidos. Isso inclui tarifas de transação, tarifas de conversão de moedas e possíveis tarifas bancárias intermediárias.Mantenha-se a par das taxas de câmbio

As taxas de câmbio flutuam constantemente e podem impactar significativamente o custo dos pagamentos internacionais. Monitore regularmente essas taxas para entender o impacto em suas transações e considere estratégias de hedge para gerenciar o risco cambial.Garanta a conformidade regulatória

Diferentes países têm regulamentações diferentes para transações financeiras. O descumprimento pode acarretar consequências legais e multas onerosas, sem falar nos danos à reputação da sua empresa. É importante entender e cumprir as regulamentações nos países de envio e recebimento e em quaisquer outras jurisdições pertinentes.Mantenha registros precisos

A manutenção de registros precisos e completos é crucial para fins de auditoria, conformidade regulatória e gerenciamento financeiro eficaz. Mantenha registros detalhados de todas as transações de pagamento internacionais, incluindo data, valor, taxa de câmbio, tarifas e detalhes da outra parte.Verifique os dados do beneficiário

Sempre verifique os dados do beneficiário antes de enviar um pagamento internacional. Pequenos erros em números de conta, routing numbers ou endereços podem causar atrasos, tarifas adicionais ou o envio do pagamento para a conta incorreta.Use formas de pagamento seguras e confiáveis

Use sempre métodos seguros e confiáveis para enviar pagamentos internacionais. Considere a reputação e a confiabilidade do provedor de serviços de pagamento, as medidas de segurança e o suporte ao cliente em caso de problemas.Estabeleça condições claras de pagamento nos contratos

Ao lidar com clientes ou fornecedores internacionais, descreva claramente as condições de pagamento nos contratos. Isso inclui a moeda de pagamento, quem é responsável por tarifas de transação, prazos de pagamento e possíveis multas por atraso.Fique atento a possíveis fraudes

Infelizmente, pagamentos internacionais podem ser alvo de fraudes. Cuidado com golpes comuns, como phishing ou golpes de faturas falsas, e treine sua equipe para reconhecer e responder a eles. Verifique sempre todas as alterações nos dados de pagamento e considere usar formas de pagamento seguras que ofereçam proteção contra fraudes.

Seguindo essas práticas recomendadas, as empresas podem executar pagamentos internacionais sem problemas e em conformidade, mitigando os riscos associados e aproveitando as oportunidades de crescimento que os pagamentos internacionais podem apresentar. Para saber como aceitar pagamentos internacionais de clientes, leia nosso guia aqui.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.