O rápido crescimento do comércio eletrônico e dos pagamentos digitais transformou a interação entre empresas e clientes. Os pagamentos digitais devem atingir quase US$ 9,5 trilhões em transações em 2023. Estima-se que 70% dos clientes prefiram opções de pagamento digital. As empresas devem estar preparadas não apenas para atender seus clientes com formas de pagamento digitais, mas também para garantir que suas soluções de pagamento funcionem bem, sejam confiáveis e seguras.

Selecionar o provedor de serviços de pagamento (PSP) certo é uma decisão importante que pode afetar significativamente o desempenho geral, a experiência do cliente e o crescimento da empresa. O PSP ideal deve simplificar os processos de pagamento, oferecer segurança robusta, aceitar várias formas de pagamento e moedas e fornecer análises úteis para suas decisões.

Este guia examina os fatores que as empresas precisam considerar ao escolher um PSP.

Neste artigo:

- O que são prestadores de serviços de pagamento?

- O que fazem os prestadores de serviços de pagamento?

- Provedores de serviços de pagamento e provedores de contas de comerciante.

- Vantagens de usar um provedor de serviços de pagamento

- Como escolher um prestador de serviços de pagamento

O que são provedores de serviços de pagamento?

Os provedores de serviços de pagamento (PSPs) são empresas que facilitam transações de pagamento eletrônico entre várias partes, como clientes, empresas e bancos. Permitem que as empresas aceitem as mais diversas formas de pagamento, como cartões de crédito e débito, carteiras digitais e transferências bancárias, por meio de uma única plataforma ou integração. Os PSPs fornecem a infraestrutura necessária, as medidas de segurança e a conformidade com os regulamentos para permitir que as empresas processem pagamentos com segurança e eficiência.

O que fazem os provedores de serviços de pagamento?

Os PSP têm papel importante na viabilização de transações de pagamento eletrônico entre empresas e clientes. Eles fornecem diversos serviços para garantir um processamento seguro, eficiente e integrado.

Visão geral do que os PSPs oferecem:

Gateway de pagamentos

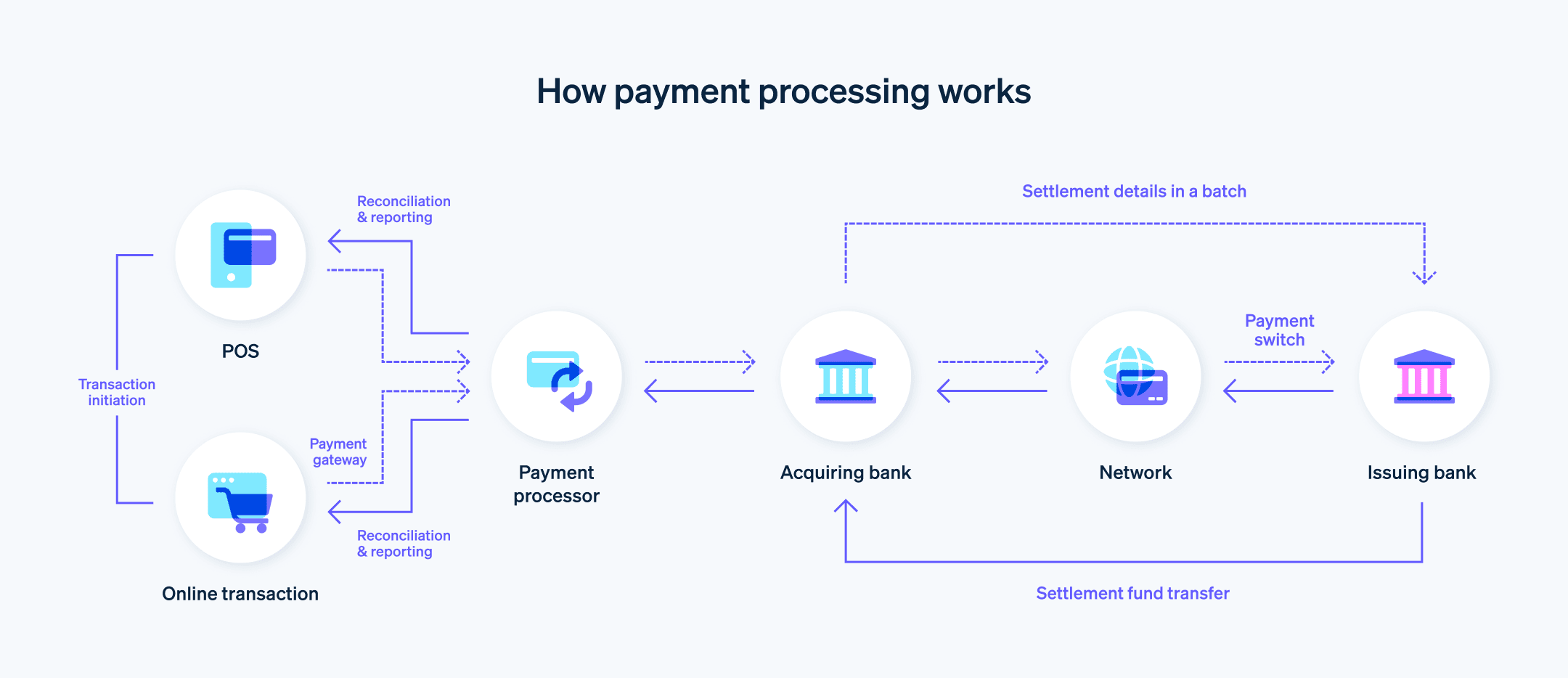

Os PSPs oferecem um portal online seguro, chamado gateway de pagamentos, que conecta os sites ou aplicativos das empresas ao seu sistema de processamento de pagamentos. Isso permite a transmissão segura de informações de pagamento entre clientes, empresas e bancos.Processamento de pagamentos

Os PSPs gerenciam o processo de autorização, compensação e liquidação de transações. Eles se comunicam com o banco do cliente ou emissor do cartão para verificar os detalhes da transação, verificar se há fundos suficientes e obter autorização. Uma vez autorizada a transação, os PSPs facilitam a transferência de fundos entre a conta do cliente e a conta da empresa. Explicaremos as diferenças entre PSPs e provedores de contas de comerciante mais adiante.Detecção e prevenção de fraudes

Os PSPs empregam ferramentas e sistemas avançados para identificar e prevenir transações fraudulentas. Eles monitoram padrões de transação e usam algoritmos de machine learning para detectar atividades suspeitas, protegendo as empresas contra estornos e outros riscos potenciais associados a fraudes.Conformidade e segurança

Os PSPs são responsáveis por garantir que seus sistemas e processos estejam em conformidade com os padrões e regulamentos necessários do setor, como o Payment Card Industry Data Security Standard (PCI DSS). Isso garante que os dados de pagamento confidenciais sejam armazenados, processados e transmitidos com segurança, reduzindo o risco de violações de dados e fraudes.Conversão de moedas

Para empresas que operam internacionalmente, os PSPs fornecem serviços de conversão de moedas, os quais permitem que as empresas aceitem pagamentos em várias moedas e liquidem transações em sua moeda preferida.Relatórios e análises

Os PSPs oferecem ferramentas detalhadas de relatórios e análises que fornecem informações importantes sobre suas transações, o comportamento do cliente e o desempenho geral da empresa, ajudando as empresas a tomarem decisões baseadas em dados e otimizar seus processos de pagamento.Atendimento ao cliente

Normalmente, os PSPs fornecem atendimento e resolvem quaisquer dúvidas ou problemas que possam surgir durante o processo de pagamento.

Os provedores de serviços de pagamento permitem que as empresas aceitem as mais diversas formas de pagamento, facilitam o comércio global e garantem a segurança e a eficiência das transações de pagamento eletrônico.

Provedores de serviços de pagamento e provedores de contas de comerciante.

Provedores de serviços de pagamento e conta de comerciante provedores estão envolvidos na viabilização de transações de pagamento eletrônico para as empresas. No entanto, eles têm propósitos serviços distintos. Entenda:

Prestadores de serviços de pagamento

- PSPs são empresas que oferecem diversos serviços para facilitar transações de pagamento eletrônico entre as partes, como clientes, empresas e bancos.

- Os PSPs fornecem um gateway de pagamentos, que é um portal online seguro que conecta o site ou aplicativo de uma empresa ao seu sistema de processamento de pagamentos.

- Os PSPs permitem que as empresas aceitem várias formas de pagamento através de uma única plataforma ou integração.

- Os PSPs processam pagamentos, serviços de detecção e prevenção de fraudes, conversão de moedas, relatórios, análises e atendimento ao cliente.

- Normalmente, os PSPs operam com uma conta de comerciante compartilhada ou agregada, o que significa que várias empresas compartilham uma única conta para processar pagamentos. Assim, as empresas podem começar a aceitar pagamentos com mais facilidade e rapidez. Por exemplo, a Stripe fornece funções de conta de comerciante aos clientes de serviços de pagamento, o que dispensa a empresa de abrir sua própria conta de comerciante.

Provedores de contas de comerciantes

- Normalmente, os provedores de contas de comerciante são bancos ou instituições financeiras que oferecem uma conta de comerciante exclusiva para a empresa. Uma conta de comerciante é uma conta especializada que permite às empresas aceitar e processar pagamentos eletrônicos, como transações com cartão de crédito e débito.

- Além de fornecer uma conta de comerciante, que é essencial para processar e liquidar transações, os provedores de contas de comerciante também podem fornecer um gateway de pagamentos, mas nem sempre.

- Para obter uma conta de comerciante, as empresas precisam passar por um processo de avaliação de risco mais completo, com avaliação da estabilidade financeira, histórico de crédito e potencial de risco.

- Os provedores de contas de comerciante geralmente oferecem preços mais personalizados e podem ter tarifas de transação mais baixas em comparação com os PSPs, especialmente para empresas de alto volume.

- Os fornecedores de contas de comerciante podem ser mais adequados para empresas grandes ou com necessidades específicas que um PSP não consegue satisfazer.

A principal diferença entre PSPs e provedores de contas de comerciante é o tipo de conta que eles fornecem para processar pagamentos. Os PSPs oferecem uma solução mais otimizada, com vários componentes juntos e uma conta de comerciante agregada, enquanto os provedores de contas de comerciante oferecem uma conta de comerciante exclusiva que atende apenas uma empresa. Além disso, os PSPs não exigem o mesmo tipo de processo de cadastro e avaliação de risco que os provedores de contas de comerciante normalmente exigem.

Vantagens de usar um provedor de serviços de pagamento

Um PSP oferece várias vantagens para as empresas, especialmente as que operam online ou realizam transações de pagamento eletrônico. Resumo das vantagens de usar um PSP:

São fáceis de configurar e integrar

Os PSPs tendem a fornecer APIs e ferramentas de integração fáceis de usar, permitindo que as empresas comecem a aceitar pagamentos em seus sites ou aplicativos com o mínimo de configuração. A dispensa da abertura de uma conta de comerciante exclusiva e integração de um gateway de pagamentos separado pode economizar tempo e trabalho.Eles oferecem as mais diversas formas de pagamento

Os PSPs permitem que as empresas aceitem uma grande variedade de formas de pagamento, como cartões de crédito, cartões de débito e carteiras digitais e transferências bancárias, por meio de uma única plataforma. Isso simplifica o processamento de pagamentos, cria uma experiência de cliente conveniente e fácil e ajuda as empresas a se manterem competitivas, oferecendo as formas de pagamento preferidas pelos clientes de diferentes mercados.Possibilitam alcance global

Os PSPs permitem transações internacionais, aceitando várias moedas e formas de pagamento populares em diferentes países. Com isso, as empresas podem expandir seu alcance, atrair clientes de todo o mundo e explorar novos mercados.Segurança e conformidade ficam mais fáceis

Os PSPs são responsáveis por garantir que seus sistemas e processos estejam em conformidade com os padrões e regulamentos necessários do setor, como o PCI DSS. Isso proporciona um ambiente seguro para o processamento de transações e reduz o trabalho das empresas com conformidade.Detecção e prevenção avançada de fraudes

Os PSPs empregam ferramentas e sistemas avançados para identificar e prevenir transações fraudulentas. Monitorando padrões de transações e usando algoritmos de machine learning, os PSPs podem detectar atividades suspeitas e proteger as empresas contra estornos e outros riscos associados a fraudes.Relatórios e análises

Normalmente, os PSPs oferecem ferramentas detalhadas de relatórios e análises com insights sobre transações, comportamento do cliente e desempenho geral da empresa, o que ajuda a tomar decisões embasadas e otimizar processos de pagamento. Além dos relatórios e análises, a maioria dos PSPs integra-se facilmente com ferramentas de análise e relatórios de terceiros, gerando dados ainda mais abrangentes e úteis sobre pagamentos.Simplificação de preços e cobrança

Normalmente, os PSPs têm estruturas de preços transparentes e diretas, o que facilita a compreensão e o gerenciamento dos custos de processamento de pagamentos para as empresas. Alguns PSPs também fornecem faturamento consolidado, o que simplifica a gestão financeira para as empresas.Eles são feitos para crescer

Os PSPs podem atender a empresas de todos os tamanhos e oferecem recursos facilmente dimensionáveis à medida que uma empresa cresce. Assim, as empresas podem continuar usando o mesmo PSP conforme crescem, sem precisar mudar de provedor ou estabelecer novos sistemas de processamento de pagamento.Eles tendem a se destacar no atendimento ao cliente

Normalmente, os PSPs fornecem atendimento exclusivo para ajudar as empresas a resolverem todas as dúvidas ou problemas durante o processo de pagamento. Isso pode ser muito útil para pequenas empresas que não têm recursos para gerenciar problemas de processamento de pagamentos internamente.

Claro que nem todos os PSP são iguais, e alguns oferecem recursos e serviços que outros não têm. Para uma empresa, o desafio é duplo:

- Entender exatamente suas necessidades, expectativas e requisitos para serviços de pagamento.

- Reduzir a lista de todos os PSPs disponíveis e escolher o mais bem equipado para satisfazer suas necessidades, tanto no curto prazo quanto no futuro.

Como escolher um provedor de serviços de pagamento

Escolher o melhor PSP ajuda a oferecer pagamentos tranquilos e seguros para seus clientes, otimizando a eficiência operacional e o crescimento da receita.

Alguns fatores que devem ser considerados ao avaliar suas opções:

Formas de pagamento aceitas

Verifique se o PSP aceita as formas de pagamento populares entre os clientes-alvo, como cartões de crédito, cartões de débito, carteiras digitais e compre agora e pague depois (BNPL). Oferecer várias opções de pagamento pode melhorar a satisfação do cliente e aumentar a probabilidade de que ele finalize a compra.Moedas diferentes

Se a sua empresa opera internacionalmente ou pretende expandir-se para mercados globais, escolha um PSP que aceite várias moedas e forneça serviços de conversão de moedas. Por exemplo, a Stripe aceita mais de 135 moedas, ou seja, é uma boa opção para empresas que operam ou pretendem operar em mercados globais.Integração e compatibilidade

Avalie se é fácil integrar o PSP ao seu site, plataforma de comércio eletrônico ou aplicativo. Por exemplo, a Stripe oferece APIs, plugins e SDKs fáceis de usar que simplificam o processo de integração com seu site, plataforma de e-commerce ou aplicativo. A compatibilidade da Stripe com várias tecnologias garante que as empresas comecem a aceitar pagamentos em pouco tempo.Preços e tarifas

Compare as tarifas e as estruturas de preços de diferentes PSPs. Alguns podem cobrar uma tarifa fixa por transação, enquanto outros podem cobrar uma porcentagem da transação. Além disso, considere as tarifas adicionais, como taxas de configuração, taxas mensais, tarifas de estorno e tarifas de conversão de moeda. A Stripe oferece uma estrutura de preços transparente e direta, com uma porcentagem por transação e uma tarifa fixa.Segurança e conformidade

Escolha um PSP que cumpra as práticas de segurança padrão do setor e cumpra regulamentos como o PCI DSS. Isso garante que os dados de pagamento confidenciais sejam armazenados, processados e transmitidos com segurança, reduzindo o risco de violações de dados e fraudes. Por exemplo, a Stripe é um provedor de serviços PCI certificado nível 1, que é o nível mais rigoroso de certificação disponível no setor de pagamentos.Detecção e prevenção de fraudes

Opte por um PSP que ofereça ferramentas robustas de detecção e prevenção de fraudes, o que protege sua reputação e minimiza perdas financeiras. As ferramentas avançadas de detecção e prevenção de fraudes da Stripe, como a solução baseada em machine learning do Radar, ajudam a proteger as empresas contra transações fraudulentas e estornos.Relatórios e análises

Selecione um PSP com ferramentas detalhadas de relatórios e análises, que possam gerar informações valiosas sobre suas transações, o comportamento do cliente e o desempenho geral da empresa. Esses insights ajudam você a tomar decisões embasadas e melhorar seus processos de pagamento.Atendimento ao cliente

Avalie a qualidade do atendimento ao cliente do PSP. Procure um suporte ágil e experiente para resolver problemas e garantir uma experiência de pagamento tranquila para seus clientes. Saiba mais sobre as opções de suporte por chat, e-mail e telefone da Stripe aqui.Escalabilidade

Considere se o PSP pode acompanhar o crescimento e novas necessidades da sua empresa. Conforme seus negócios se expandem, você pode precisar de mais recursos, formas de pagamento ou aumento no volume de transações. Escolha um PSP que possa crescer com a sua empresa e adaptar-se às suas novas necessidades. A Stripe atende empresas de todos os portes e pode expandir conforme a empresa cresce. Seus recursos e capacidades podem acomodar a evolução das empresas, o que faz dela uma solução de PSP confiável no longo prazo.Reputação e avaliações

Pesquise a reputação do PSP no setor e leia comentários de outras empresas que utilizam os seus serviços para ter uma ideia da confiabilidade, desempenho e nível de atendimento ao cliente do PSP.

Selecionar o provedor de serviços de pagamento ideal pode ter consequências significativas para o sucesso da sua empresa. Comparando cuidadosamente diferentes PSPs, você pode encontrar o mais alinhado às necessidades da sua empresa, garantindo uma experiência de pagamento segura e tranquila para os seus clientes.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.