The rapid growth of e-commerce and digital payments has transformed the way businesses and customers interact. Digital payments are expected to account for nearly $11.5 trillion in transactions in 2024. With an estimated 70% of customers preferring digital payment options, businesses must be prepared not only to cater to their customers by supporting digital payment methods, but also to ensure their payment solutions are well-functioning, reliable, and secure.

Selecting the right payment service provider (PSP) is an important decision that can significantly affect a company’s overall performance, customer experience, and potential growth. The ideal PSP should streamline payment processes, offer robust security, support multiple payment methods and currencies, and provide valuable analytics to aid decision-making.

This guide will examine the factors that businesses need to consider when choosing a PSP.

What’s in this article?

- What are payment service providers?

- What do payment service providers do?

- Payment service providers vs. merchant account providers

- Benefits of using a payment service provider

- How to choose a payment service provider

What are payment service providers?

Payment service providers (PSPs) are companies that facilitate electronic payment transactions among various parties, such as customers, businesses, and banks. They enable businesses to accept a wide range of payment methods, including credit cards, debit cards, digital wallets, and bank transfers, via a single platform or integration. PSPs provide the necessary infrastructure, security measures, and compliance with regulations to allow businesses to process payments securely and efficiently.

What do payment service providers do?

PSPs play an important role in enabling electronic payment transactions between businesses and customers. They provide a range of services to ensure secure, efficient, and integrated payment processing.

Here’s an overview of what PSPs offer:

Payment gateway

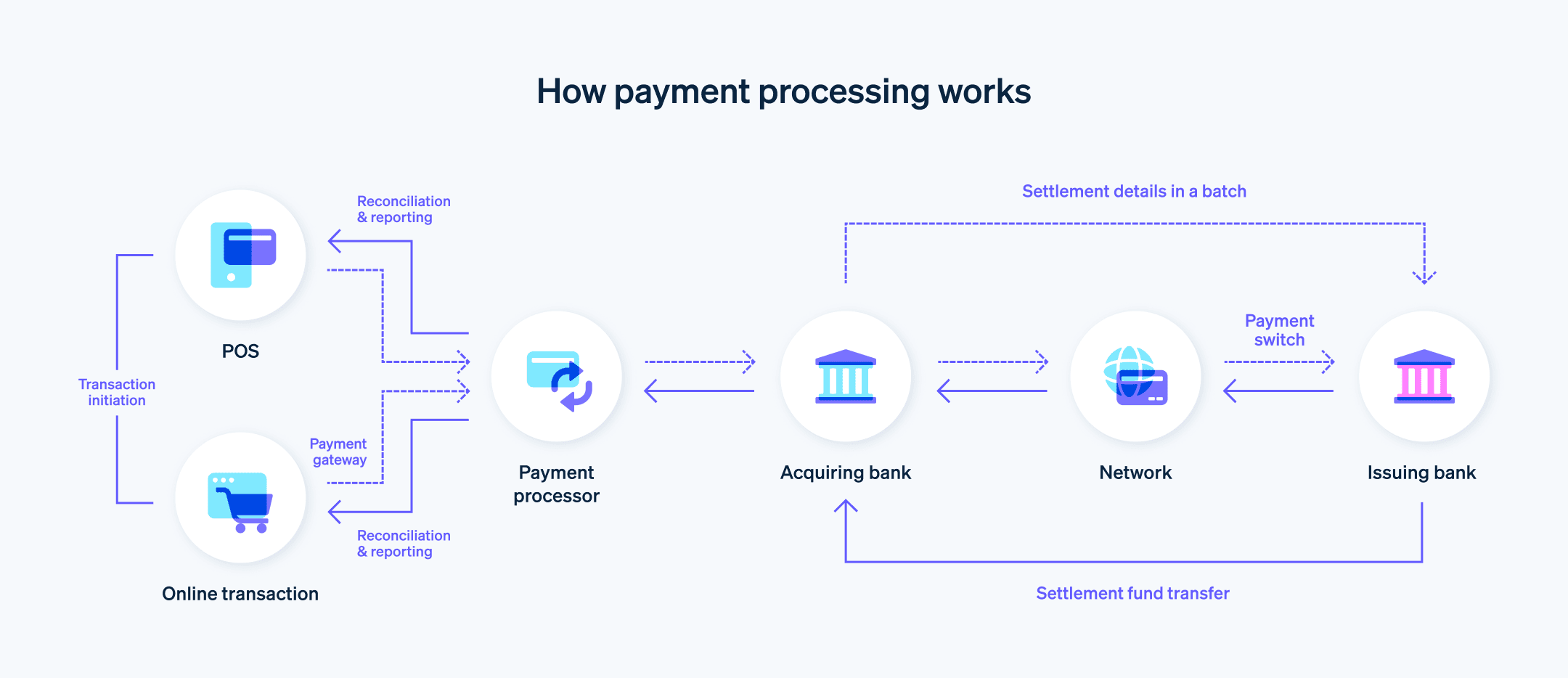

PSPs offer a secure online portal, called a payment gateway, that connects businesses’ websites or applications to their payment processing system. This allows for the secure transmission of payment information between customers, businesses, and banks.Payment processing

PSPs handle the process of authorising, clearing, and settling transactions. They communicate with the customer’s bank or card issuer to verify the transaction details, check for sufficient funds, and obtain authorisation. Once the transaction has been authorised, PSPs facilitate the transfer of funds between the customer’s account and the business’s account. We’ll explain the differences between PSPs and merchant account providers further down.Fraud detection and prevention

PSPs employ advanced tools and systems to identify and prevent fraudulent transactions. They monitor transaction patterns and use machine learning algorithms to detect suspicious activities, protecting businesses from chargebacks and other potential risks associated with fraud.Compliance and security

PSPs are responsible for ensuring that their systems and processes comply with the necessary industry standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS). This ensures that sensitive payment data is stored, processed, and transmitted securely, reducing the risk of data breaches and fraud.Currency conversion

For businesses that operate internationally, PSPs provide currency conversion services, which allow businesses to accept payments in multiple currencies and settle transactions in their preferred currency.Reporting and analytics

PSPs offer detailed reporting and analytics tools that provide businesses with important insights into their transactions, customer behaviour, and overall business performance. This helps businesses make data-backed decisions and optimise their payment processes.Customer support

PSPs typically provide customer support to businesses, addressing any questions or issues that may arise during the payment process.

Payment service providers enable businesses to accept a wide range of payment methods, facilitate global commerce, and ensure the security and efficiency of electronic payment transactions.

Payment service providers vs merchant account providers

Both payment service providers and merchant account providers are involved in making electronic payment transactions possible for businesses. However, they serve different purposes and offer distinct services. Here’s a breakdown:

Payment service providers

- PSPs are companies that offer a range of services to facilitate electronic payment transactions among parties, such as customers, businesses, and banks.

- PSPs provide a payment gateway, which is a secure online portal that connects a business’s website or application to its payment processing system.

- PSPs allow businesses to accept multiple payment methods via a single platform or integration.

- PSPs handle payment processing, fraud detection and prevention, currency conversion, reporting, analytics, and customer support.

- PSPs usually operate with a shared or aggregated merchant account, meaning that several businesses share a single account for processing payments. This can make it easier and faster for businesses to start accepting payments. For example, Stripe provides merchant account functionality to its payment services customers, which eliminates the need for a business to open its own merchant account.

Merchant account providers

- Merchant account providers are typically banks or financial institutions that offer businesses a dedicated merchant account. A merchant account is a specialised account that allows businesses to accept and process electronic payments, such as credit and debit card transactions.

- In addition to providing a merchant account, which is essential for processing and settling transactions, merchant account providers may also provide a payment gateway (although this is not always the case).

- To obtain a merchant account, businesses must undergo a more thorough underwriting process, which involves evaluating the business’s financial stability, credit history, and potential risk.

- Merchant account providers generally offer more customised pricing and may have lower transaction fees compared to PSPs, especially for high-volume businesses.

- Merchant account providers may be more suitable for larger businesses or those with specific needs that a PSP cannot meet.

The main difference between PSPs and merchant account providers is the type of account they provide for processing payments. PSPs offer a more streamlined, one-stop-shop solution with an aggregated merchant account, while merchant account providers offer a dedicated merchant account that serves only one business. Additionally, PSPs don’t require the same kind of application and underwriting process that merchant account providers typically require.

Benefits of using a payment service provider

Using a PSP offers several benefits for businesses, particularly those that operate online or conduct electronic payment transactions. Here’s a rundown of the benefits of using a PSP:

They’re easy to set up and integrate

PSPs tend to provide easy-to-use APIs and integration tools, allowing businesses to start accepting payments on their websites or applications with minimal setup. This can save time and effort by eliminating the need to establish a dedicated merchant account and integrate a separate payment gateway.They offer a wide range of payment methods

PSPs enable businesses to accept a wide range of payment methods, such as credit cards, debit cards, digital wallets, and bank transfers, via a single platform. This simplifies payment processing, creates a convenient and effortless customer experience, and helps businesses stay competitive by offering the payment methods that customers in different markets prefer.They enable global reach

PSPs facilitate international transactions by supporting multiple currencies and payment methods popular in different countries. This allows businesses to expand their reach, attract customers from around the world, and tap into new markets.Security and compliance is easier

PSPs are responsible for ensuring that their systems and processes comply with the necessary industry standards and regulations, such as the PCI DSS. This provides a secure environment for processing transactions and reduces the burden of compliance on businesses.They offer strong fraud detection and prevention

PSPs employ advanced tools and systems to identify and prevent fraudulent transactions. By monitoring transaction patterns and using machine learning algorithms, PSPs can detect suspicious activities and protect businesses from chargebacks and other potential risks associated with fraud.Reporting and analytics

PSPs usually offer detailed reporting and analytics tools that provide businesses with insights into their transactions, customer behaviour, and overall business performance. This helps businesses make informed decisions and optimise their payment processes. On top of whatever reporting and analytics a PSP provides itself, most PSPs easily integrate with third-party analytics and reporting tools for even more comprehensive and actionable data around payments.Simplified pricing and billing

PSPs typically have transparent and straightforward pricing structures, making it easier for businesses to understand and manage their payment processing costs. Some PSPs also provide consolidated billing, which simplifies financial management for businesses.They’re built to support scalability

PSPs can cater for businesses of all sizes and offer features that can easily scale as a business grows. This means that businesses can continue using the same PSP as they expand, without needing to switch providers or establish new payment processing arrangements.They tend to excel with customer support

PSPs typically provide dedicated customer support to help businesses address any questions or issues that may arise during the payment process. This can be particularly valuable for small businesses that may not have the resources to manage payment processing issues in-house.

Of course, not every PSP is the same, and some will offer certain features and services that others don’t. For a business, the challenge is twofold:

- Reach an understanding of your exact needs, expectations, and requirements for payment services.

- Narrow down the list of all possible PSPs to find the provider that’s best equipped to satisfy your needs, both in the short term and in the future.

How to choose a payment service provider

Choosing the right PSP can help businesses provide a smooth and secure payment experience for their customers, while optimising operational efficiency and revenue growth.

Here are some factors to consider when assessing your options:

Supported payment methods

Ensure that the PSP supports the payment methods popular among your target customers, such as credit cards, debit cards, digital wallets, and buy now, pay later (BNPL). Offering multiple payment options can improve customer satisfaction and increase the likelihood that a customer will complete a sale.Currency support

If your business operates internationally or plans to expand to global markets, choose a PSP that supports multiple currencies and provides currency conversion services. For example, Stripe supports over 135 currencies, making it a suitable choice for businesses operating internationally or looking to expand to global markets.Integration and compatibility

Evaluate how easy it is to integrate the PSP with your existing website, e-commerce platform, or application. For instance, Stripe provides easy-to-use APIs, plugins, and SDKs that simplify the process of integration with your existing website, e-commerce platform, or application. Stripe’s compatibility with various technology stacks ensures that businesses can quickly start accepting payments.Pricing and fees

Compare the fees and pricing structures of different PSPs. Some may charge a flat fee per transaction, while others may charge a percentage based on the transaction value. Also, consider any additional fees, such as setup fees, monthly fees, chargeback fees, and currency conversion fees. Stripe offers a transparent and straightforward pricing structure, which includes a percentage-based fee per transaction, along with a fixed fee.Security and compliance

Choose a PSP that adheres to industry-standard security practices and complies with regulations, such as the PCI DSS. This ensures that sensitive payment data is stored, processed, and transmitted securely, reducing the risk of data breaches and fraud. For example, Stripe is a certified PCI Service Provider Level 1, which is the most stringent level of certification available in the payments industry.Fraud detection and prevention

Opt for a PSP that offers robust fraud detection and prevention tools. This can help maintain your reputation and minimise financial losses. Stripe’s advanced fraud detection and prevention tools, including a machine learning-based solution Radar, help protect businesses from fraudulent transactions and chargebacks.Reporting and analytics

Select a PSP that provides detailed reporting and analytics tools, which can yield valuable insights into your transactions, customer behaviour, and overall business performance. These insights can help you make informed decisions and improve your payment processes.Customer support

Evaluate the quality of the PSP’s customer support services. Look for responsive and knowledgeable customer support to address issues and ensure a smooth payment experience for your customers. Learn more about Stripe’s chat, email, and phone support options here.Scalability

Consider whether the PSP can accommodate your business’s growth and changing needs. As your business expands, you may require additional features, payment methods, or increased transaction volume. Choose a PSP that can scale with your business and adapt to your changing requirements. Stripe caters for businesses of all sizes and can easily scale as a business grows. Its features and capabilities can accommodate the evolving needs of businesses, making it a reliable long-term PSP solution.Reputation and reviews

Research the PSP’s reputation in the industry and read reviews from other businesses that use their services. This can give you a better understanding of the PSP’s reliability, performance, and level of customer support.

Selecting the right payment service provider can significantly impact your business’s success. By carefully comparing different PSPs, you can find the one that best aligns with your business’s needs, ensuring a secure and smooth payment experience for your customers.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.