Failed payments can be a headache most businesses must deal with to some degree, but they can also undermine a business’s efforts to acquire and retain customers. A study found that failed payments cost the global economy more than $118 billion in 2020, revealing just how expensive this part of business can be.

Below, we’ll look at why payments fail and explain the steps businesses can take to figure out causes of failed payments in their systems.

What’s in this article?

- Common causes of failed payments

- How to identify causes of failed payments in your business

- How to approach failed payment recovery: Strategies to use

- Legal considerations for failed payment recovery

- How Stripe can help

Common causes of failed payments

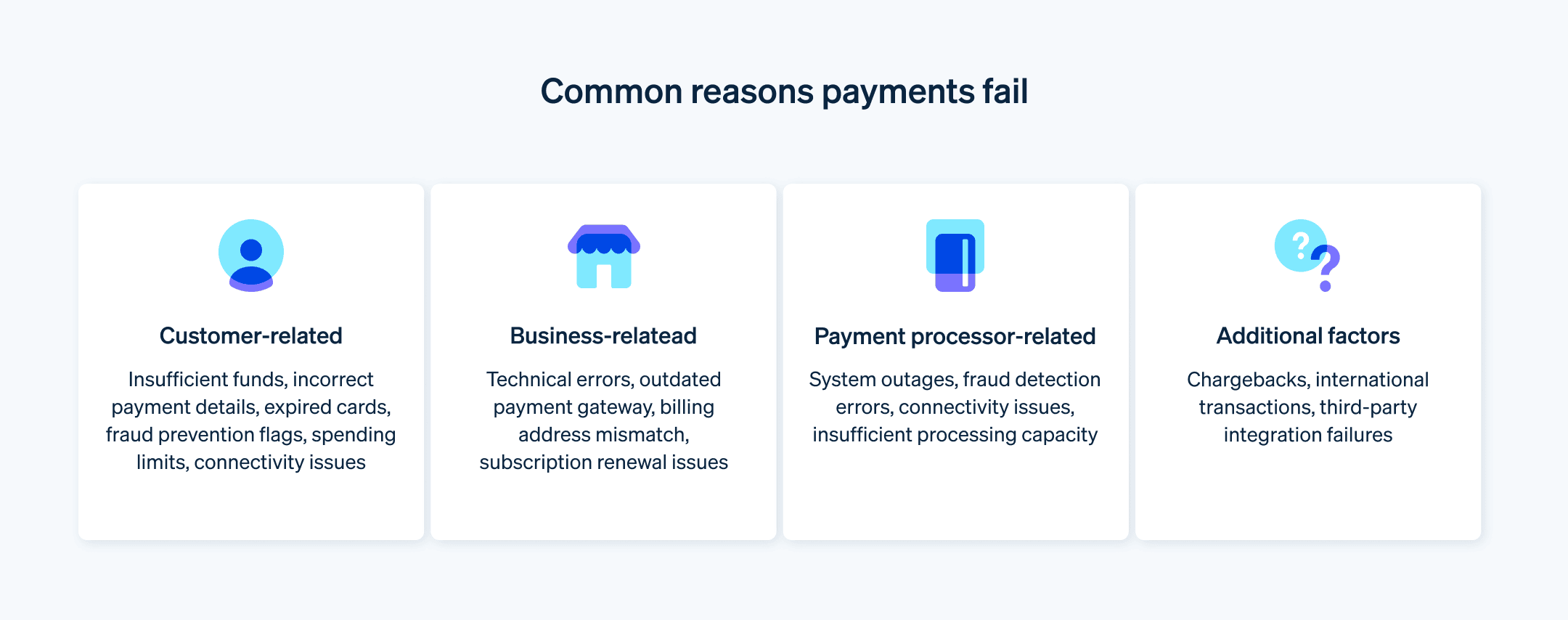

Payment processes, card storage practices, and billing operations can vary between businesses. As a result, failed payments can happen for several reasons. Here are some of the most frequently occurring ones:

Customer-related

Insufficient funds: This is often the leading cause of failed payments. Customers may forget to check their account balance before attempting a transaction, or they may have exceeded their credit limit.

Incorrect payment information: Typos in card numbers, card verification value (CVV) codes, expiration dates, or billing addresses can easily lead to payment failure.

Expired cards: Customers may not realize their cards have expired, or they may not have updated their payment information with the business.

Fraud prevention: Banks and payment processors often use fraud detection algorithms to flag suspicious activity. This can lead to legitimate transactions being declined, especially if the customer is making a large or unusual purchase.

Insufficient credit limit: For credit card transactions, the customer’s available credit limit may not be enough to cover the cost of the purchase.

Account limitations: Some banks and payment processors may have daily or weekly spending limits to prevent fraud. These limits can also cause payments to be declined.

Technical issues: Customers may experience internet connectivity issues or problems with their device that prevent them from completing the payment process.

Business-related

Technical errors: Technical glitches on the business’s website or payment processor can cause transactions to fail.

Incorrectly configured payment gateway: If the business’s payment gateway is not set up correctly, it may not be able to process payments properly.

Outdated software: Outdated software on the business’s website or server can lead to payment failures.

Currency mismatch: If the customer’s billing currency is different from the business’s accepted currency, the transaction may be declined.

Security concerns: Businesses may have security measures in place that prevent certain types of transactions from being processed, even if they are legitimate.

Subscription renewal issues: Recurring payments can fail because of changes in the customer’s payment information, insufficient funds, or expired cards.

Billing address mismatch: If the billing address on the customer’s account does not match the address on their payment method, the transaction may be declined.

Payment processor-related

System outages: Payment processors can experience outages that can prevent transactions from being processed.

Fraud detection errors: Much like banks, payment processors may use fraud detection algorithms that can mistakenly decline legitimate transactions.

Insufficient processing capacity: During peak shopping periods, payment processors may experience high volumes of transactions, which can lead to delays and failures.

Connectivity issues: Problems with the payment processor’s network can lead to transaction failures.

Additional factors

Chargebacks: If a customer disputes a transaction, the issuing bank may issue a chargeback, which will reverse the payment.

Third-party integrations: If the payment process involves third-party integrations, such as with a tax or shipping application programming interface (API), there may be issues that cause the transaction to fail.

International transactions: International transactions can be more prone to failure because of currency exchange issues, varying fraud detection practices, and other factors.

How to identify causes of failed payments in your business

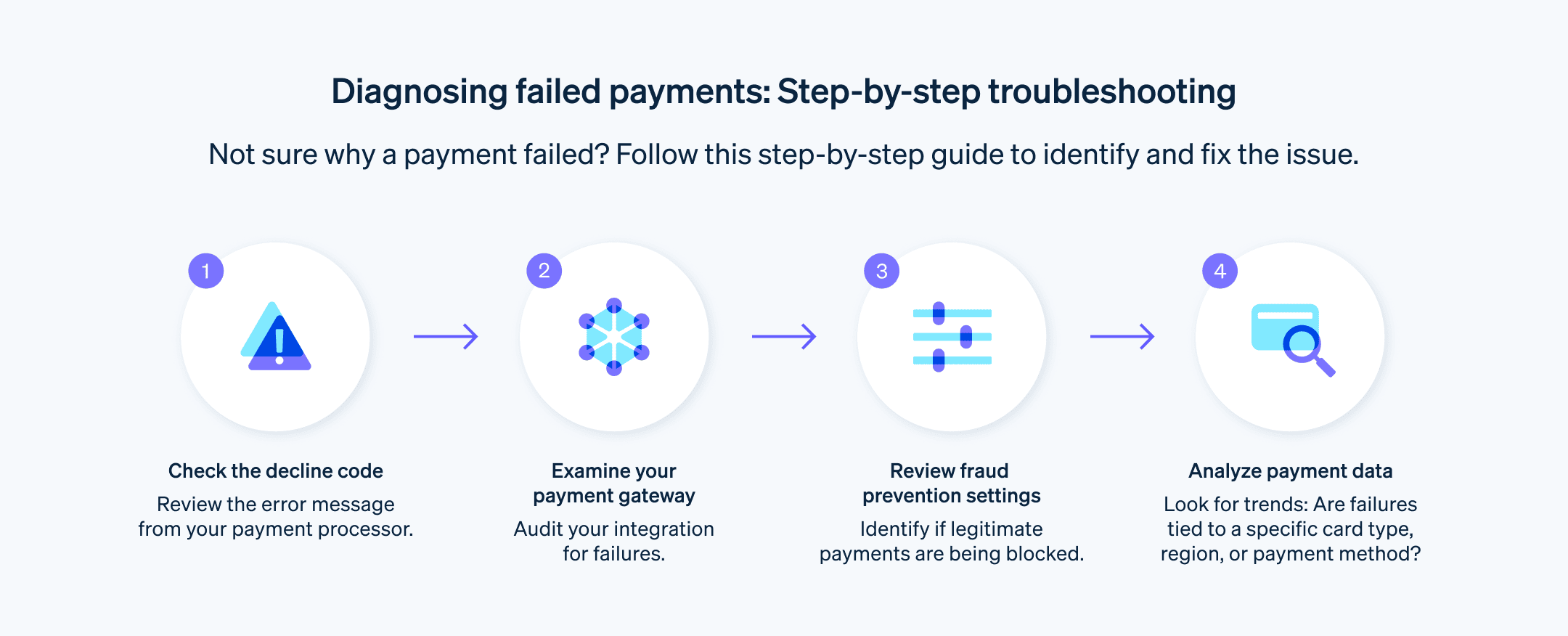

Taking steps to prevent and respond to failed payments is important, but properly addressing these issues depends on knowing why failed payments are happening in your business in the first place. Here’s a step-by-step process to help you figure out the root causes of your failed payments:

Check the decline code: On an individual level, the first step in determining what caused a failed payment is to check the decline code provided by your payment processor. A card decline code is typically a two-digit, alphanumeric error code that explains why a card transaction was declined.

Examine your payment gateway: If you’re investigating multiple failed payments, looking at your payment gateway can often provide answers. Conduct a thorough audit of your gateway integration to compile data about what types of transactions have been failing. An issue could become quickly apparent, but if not, gather as much information as possible.

Review fraud prevention settings: Because fraud detection and prevention tools can sometimes flag legitimate payments, review each setting to determine whether any are set too strictly or may have been erroneously marking payments as suspicious.

Analyze the payment data: Look closely at the data you compiled from your payment gateway and fraud prevention software to try to determine whether there are any factors affecting your business’s payments. It could be a certain payment method, transactions from a specific region, or payments during a particular time of day that are more likely to fail. If a pattern emerges, that’s likely your answer.

How to approach failed payment recovery: Strategies to use

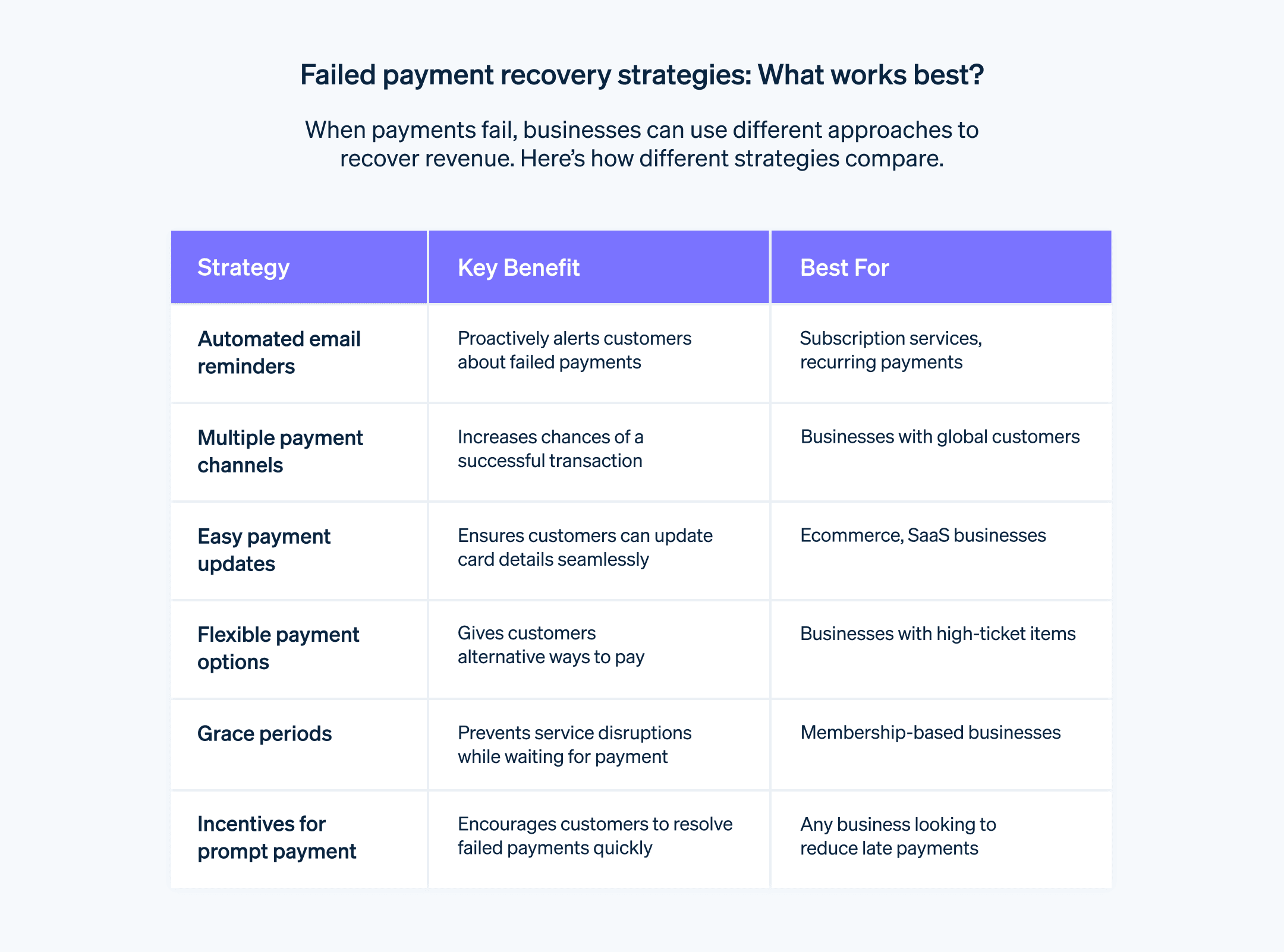

Automatic email reminders

Proactive and timely intervention: Failed payments can be easily forgotten, especially when dealing with recurring subscriptions or monthly bills. Automatic email reminders act as a proactive nudge, reminding customers about outstanding payments. This timely intervention increases the chance of successful payment recovery and reduces the risk of account churn.

Personalized communication: Instead of sending generic reminders, use email personalization to create a more engaging and relevant experience. Address customers by name, mention the specific amount and invoice details, and provide multiple payment options for their convenience. Personalized communications cultivate a positive customer experience and increase the likelihood of prompt payment.

Automated workflow efficiency: Manually managing failed payments is time-consuming and inefficient. Automatic email reminders automate the process, freeing up valuable resources for other tasks. This lets you scale your business without sacrificing payment recovery efforts.

Customized scheduling: Send reminders strategically based on the context of the failed payment. Consider sending the first reminder within 24 hours of the failed attempt, for example, followed by progressively stronger reminders at regular intervals. This strategy makes sure there are timely follow-ups without overwhelming customers.

Multichannel method: Combine email reminders with other communication channels for maximum impact. Consider sending SMS reminders or push notifications to mobile app users for greater reach and responsiveness.

Data-driven optimization: Track the performance of your email reminders, and analyze key metrics such as open rates, click-through rates, and conversion rates. Use this data to refine your email content, subject lines, timing, and frequency for optimal results.

Integration with payment gateways: Many payment gateways have built-in features for automated email reminders. Use these integrations to streamline your workflow and simplify failed payment management.

A/B testing different strategies: Experiment with different email content, subject lines, and sending times to see what resonates best with your customers. This data-driven method lets you personalize your reminders and maximize their effectiveness.

Using automation tools: Use marketing automation platforms or dedicated failed payment recovery software to automate your email reminders. These tools let you create customized workflows, integrate with various systems, and track the performance of your campaigns.

Providing payment assistance: When sending email reminders, consider providing helpful resources or assistance to customers struggling with their payments. This can include providing payment FAQs, alternative payment methods, or installment plans. Demonstrating empathy and willingness to help can go a long way in improving customer satisfaction and encouraging payment completion.

Multiple payment channels

Variety of payment options: Businesses can provide various payment methods such as credit and debit cards, bank transfers, digital wallets, and sometimes cash or check options. This diversity makes it so that if one payment method fails, customers can easily switch to another method.

Technology integration: Integrating technology such as payment gateways that support multiple payment methods helps make the process run smoothly. This integration allows for an easy transition between payment methods without causing substantial disruptions in the customer experience.

Reduced dependency on a single channel: Relying on one payment method can be risky. If that method encounters issues, it can lead to a high number of payment failures. Multiple channels distribute this risk.

Customer preference and accessibility: Different customers have varying preferences and access to payment methods. Some might prefer digital wallets for their convenience, for instance, while others might trust traditional bank transfers more. Giving customers multiple options caters to this varied base.

Geographical considerations: Payment preferences can vary across regions. While credit cards might be popular in one country, mobile payments could be the norm in another. Businesses catering to an international audience must consider these regional preferences.

Reducing transaction abandonment: If a payment fails, having an immediate alternative method can reduce the likelihood of transaction abandonment. This is particularly important in ecommerce, where customers might not return to complete a purchase if they encounter issues.

Compliance and security: Different payment channels have varying compliance and security standards. Businesses must make sure all available channels adhere to necessary regulations and maintain strong security systems to protect customer data and prevent fraud.

Easy payment update options

User-friendly interface: Designing an intuitive and easy-to-use interface where customers can update their payment information is important. This could be part of a mobile app or web portal or through customer service channels.

Automated reminders for expiration: Implementing automated reminders that alert customers before their payment information expires helps in proactively updating details. This reduces the risk of failed transactions because of outdated information.

Multiple update channels: Providing various channels for updating payment information—such as through an app, website, or customer support or via email links—ensures there is accessibility for all customer segments.

Security and privacy: Verifying the payment update process is safe and compliant with data protection regulations is exceedingly important. Customers need to trust that their financial information is handled safely.

Flexibility in payment methods: Letting customers switch between payment methods (such as from a credit card to a direct bank transfer) during the update process can cater to changing customer preferences or circumstances.

Real-time update capability: The system should be capable of processing updates in real time, or as close to it as possible, to avoid delays that might lead to further payment failures.

Clear communication and guidance: Providing accessible instructions and assistance for updating payment information helps in reducing confusion and errors during the update process.

Integration with customer profiles: Linking the payment update system with customer profiles allows for a more personalized strategy and can facilitate easier updates because the system already holds relevant customer information.

Feedback loop for failed transactions: After a failed transaction, directing customers immediately to update their payment information can increase the chances of successful payment recovery.

Automated retry after update: Once the payment information is updated, an automated retry of the failed transaction can help in immediate recovery without requiring additional customer action.

Flexible payment options

Diverse payment methods: Give customers a range of payment methods, including credit and debit cards, bank transfers, digital wallets, and local payment options. This diversity caters to the varied preferences of customers and increases the likelihood of successful transactions.

Easy payment method update: Let customers easily update their payment details. This can be done through user-friendly interfaces on your website or app. Giving customers easy-to-follow instructions and readily available assistance can encourage prompt updates, reducing payment failures because of outdated information.

Automated retry logic: Implement automated retry logic for failed transactions. This involves retrying the transaction at different times or days, considering that temporary issues such as insufficient funds or bank downtime can cause failures.

Flexible payment scheduling: Let customers choose or change their payment dates. This flexibility can tie payment dates to their financial cycles, such as salary deposits, improving the success rate of payments.

Payment plans: Provide payment plans for customers who are facing temporary financial difficulties. This can include extending the payment period or breaking down payments into smaller, more manageable amounts.

Real-time notifications: Send immediate notifications for failed transactions. This keeps customers informed and prompts them to take necessary actions, such as updating payment details or verifying sufficient funds are available.

Customer support: Provide dedicated customer support for payment-related issues. Trained support staff can assist customers in resolving payment failures, finding alternative payment methods, or setting up payment plans.

Data analysis and insights: Regularly analyze payment data to identify trends and issues in failed payments. Insights gained can guide improvements in payment processes and strategies.

Security and compliance: Make sure all payment methods and processes are secure and comply with relevant regulations, such as Payment Card Industry Data Security Standards (PCI DSS) for card payments. This protects against fraud and builds customer trust.

User education: Educate users about the available payment options and best practices for their transactions. This can include FAQs, tutorials, or direct communication through customer support.

Easy integration: Integrate flexible payment options into the customer experience. The process should be intuitive and not disrupt the user as they go through with their transactions.

Customization based on customer segmentation: Tailor payment options based on customer segmentation. Different segments may have varying preferences and financial behaviors, which can inform the most appropriate payment solutions for each group.

Grace periods

Grace periods are designated times in which customers are allowed to resolve payment issues without facing immediate penalties or service disruptions. Effectively implementing grace periods involves getting to know customer needs, regulatory requirements, and the operational implications for your business. Here are some best practices:

Clear communication of grace period terms: Communicate the length of the grace period and the conditions under which it applies. Transparency about these terms helps manage customer expectations and reduces confusion.

Reasonable duration: Set a grace period that is long enough to give customers a fair chance to rectify payment issues but not so long that it will noticeably affect your revenue. The duration might vary based on the industry standard and the service or product.

Automated notifications: Send automated reminders to customers before and during the grace period. These reminders should include the payment due date, the end date of the grace period, and any potential consequences of nonpayment.

Flexible extension options: Consider giving the option to extend the grace period in certain cases, especially for customers with a good payment history or those facing temporary financial hardships.

Incentives for prompt payment

Here are some best practices for implementing incentives for prompt payment:

Appealing incentive options: Provide incentives that are genuinely appealing to your customer base. Common incentives include discounts on future purchases, loyalty points, cash back, or access to exclusive services or products.

Clear communication of terms: Make sure the terms and conditions of the incentive program are communicated to customers in an accessible way. This includes the eligibility criteria, how and when the incentive is awarded, and any limitations or expiration dates.

Easy redemption process: Make the redemption process for any incentives hassle-free. Complicated redemption processes can negate the perceived value of the incentive.

Regular promotion: Actively promote the incentive program through various channels such as emails and in-app notifications and during the checkout process. Regular promotion keeps the program top of mind for customers.

Alignment with business objectives: Design the incentive program in a way that matches your broader business objectives. If increasing repeat purchases is a goal, for instance, consider incentives that encourage spending.

Segmented approach: Tailor incentives to different customer segments based on their purchasing behavior, preferences, and payment history. This targeted strategy can increase the effectiveness of the incentives.

Monitoring and evaluation: Continuously monitor the performance of the incentive program. Evaluate its impact on payment behaviors, and make adjustments based on data-driven insights.

Compliance and ethical considerations: Make sure the incentive program complies with relevant laws and regulations, particularly those related to financial transactions and marketing. It’s also important to consider the ethical implications of your incentive program to avoid encouraging irresponsible financial behavior.

Feedback mechanism: Implement a system to gather customer feedback on the incentive program. This feedback can provide insights into how the program is perceived and how it can be improved.

Scalable and flexible design: Design the program to be scalable and flexible, allowing for adjustments based on changing market conditions, customer behavior, and business needs.

Technological integration: Use technology to automate the tracking and awarding of incentives. This can include integration with payment systems, customer relationship management (CRM) solutions, and marketing tools.

Cost-benefit analysis: Regularly conduct a cost-benefit analysis of the incentive program to make sure it is financially sustainable and is delivering the desired return on investment.

Transparency about changes: If the program changes, promptly communicate the adjustments to customers to maintain trust and program integrity.

Educational content: Provide educational content that helps customers learn the value of the incentives and how they can benefit from participating in the program.

Legal considerations for failed payment recovery

The issue of failed payments is linked to legal and compliance considerations that all businesses must be aware of when dealing with customer payments. Here’s a closer look at those intersections:

Understanding local and international laws: Businesses must be aware of the legal frameworks governing debt collection and payment processing in the jurisdictions they operate in. This includes knowledge of local laws and international regulations, especially if operating across borders.

Compliance with debt collection practices: Adherence to fair debt collection practices is important. This involves knowing what constitutes legal and ethical practices in pursuing unpaid debts, such as restrictions on contacting customers and prohibitions against harassment.

Data protection and privacy: Certifying compliance with data protection laws, such as the European Union’s General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA), is key for maintaining operations. This includes how customer data is used and stored during the payment recovery process.

Clear terms and conditions: Businesses should verify that their terms and conditions around payments and potential recovery actions are easily accessible and acknowledged by customers. This clarity can prevent legal disputes over misunderstandings about payment obligations.

Recordkeeping and documentation: Maintaining accurate records of all communications and transactions with customers is important. This documentation can be especially valuable in case of legal proceedings or disputes over payment recovery efforts.

Understanding bankruptcy and insolvency laws: Familiarity with bankruptcy and insolvency laws is key because it’s possible a customer may declare bankruptcy. Knowing how these laws affect debt recovery processes can help guide businesses.

Training and policies for staff: Providing training for staff involved in payment recovery on legal requirements and ethical practices improves compliance and reduces the risk of legal issues arising from improper conduct.

Contracts with third-party agencies: If using third-party agencies for debt collection, businesses must make sure these agencies also comply with all relevant laws and regulations. Contracts with these agencies should definitively state these requirements.

Interest and fees: Any interest or fees charged on late payments must comply with legal limits and be explicitly communicated to customers in advance. Excessive charges can lead to legal challenges and damage to reputation.

Dispute resolution mechanisms: Implementing fair dispute resolution mechanisms for customers who contest the validity of the debt or the recovery process is important. This helps in resolving issues without resorting to legal action.

Consumer protection laws: Consumer protection laws are designed to safeguard customers from unfair business practices, and businesses should make sure to adhere to them. This includes honest advertising of products and transparency in billing practices.

Accessibility and nondiscrimination: Making sure the payment recovery process is accessible and nondiscriminatory is important. This means considering the needs of all customers, including those with disabilities or those who speak different languages.

Legal review of recovery strategies: Regular legal review of payment recovery strategies and tactics helps in verifying compliance and adapting to any changes in the law.

Communication with legal counsel: Maintaining open lines of communication with legal counsel helps in quickly addressing any legal issues that arise and making sure recovery strategies remain compliant.

How Stripe can help

Stripe’s payment solutions include several features that help businesses prevent and respond to failed payments, including:

Prevent failed payments

Radar: Radar, Stripe’s fraud prevention tool powered by machine learning, can identify and block suspicious transactions before they occur, substantially reducing the risk of fraud and failed payments.

Payment Intents: This feature lets businesses collect all necessary payment information up-front and secure authorization, preventing issues such as insufficient funds or expired cards at the time of payment.

Strong customer authentication (SCA): Stripe supports SCA, a security standard that helps verify cardholders’ identities and further reduce fraud and failed payments.

Dynamic 3D Secure (3DS): This advanced 3DS implementation provides a safe payment experience while further improving fraud protection.

Customizable decline codes: Businesses can define their own decline codes to receive more specific information about failed payments, letting them identify and address the root cause.

Respond to failed payments

Automatic retries: Stripe can automatically retry failed payments with different payment methods or after a specified period, increasing the chances of payment collection.

Payment Links: Businesses can easily create and share Payment Links with customers for convenient payment retries.

Dunning emails: Stripe provides customizable dunning emails that can be automatically sent to customers with outstanding payments, reminding them to pay and providing convenient payment options.

Payment recovery services: Stripe partners with various payment recovery businesses to provide additional services including debt collection and chargebacks assistance.

Detailed insights: Stripe provides comprehensive dashboards and reports that give valuable insights into payment trends, decline rates, and other key metrics, helping businesses identify areas for improvement.

Additional benefits

Global reach: Stripe supports payments in over 135 currencies, letting businesses reach customers worldwide and minimize the risk of failed payments because of currency compatibility issues.

Scalability: Stripe’s technology is designed to handle high volumes of transactions, making sure businesses can effectively process payments even as they grow.

Security: Stripe adheres to the highest security standards and regulations, protecting businesses and customers from fraud and data breaches.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.