Pagamentos malsucedidos podem ser uma dor de cabeça necessária até certo ponto, mas também podem prejudicar o trabalho de adquirir e reter clientes. Um estudo constatou que pagamentos não efetivados custaram à economia global mais de US$ 118 bilhões em 2020, revelando o quanto essa parte dos negócios pode custar caro.

Abaixo, veremos por que os pagamentos falham e explicamos as etapas que as empresas podem tomar para descobrir as causas das falhas nos pagamentos de seus sistemas.

Neste artigo:

- Causas comuns de falha em pagamentos

- Como identificar as causas de falhas nos pagamentos na sua empresa

- Recuperação de pagamentos com falha: estratégias recomendadas

- Considerações legais para a recuperação de pagamentos malsucedidos

- Como a Stripe pode ajudar

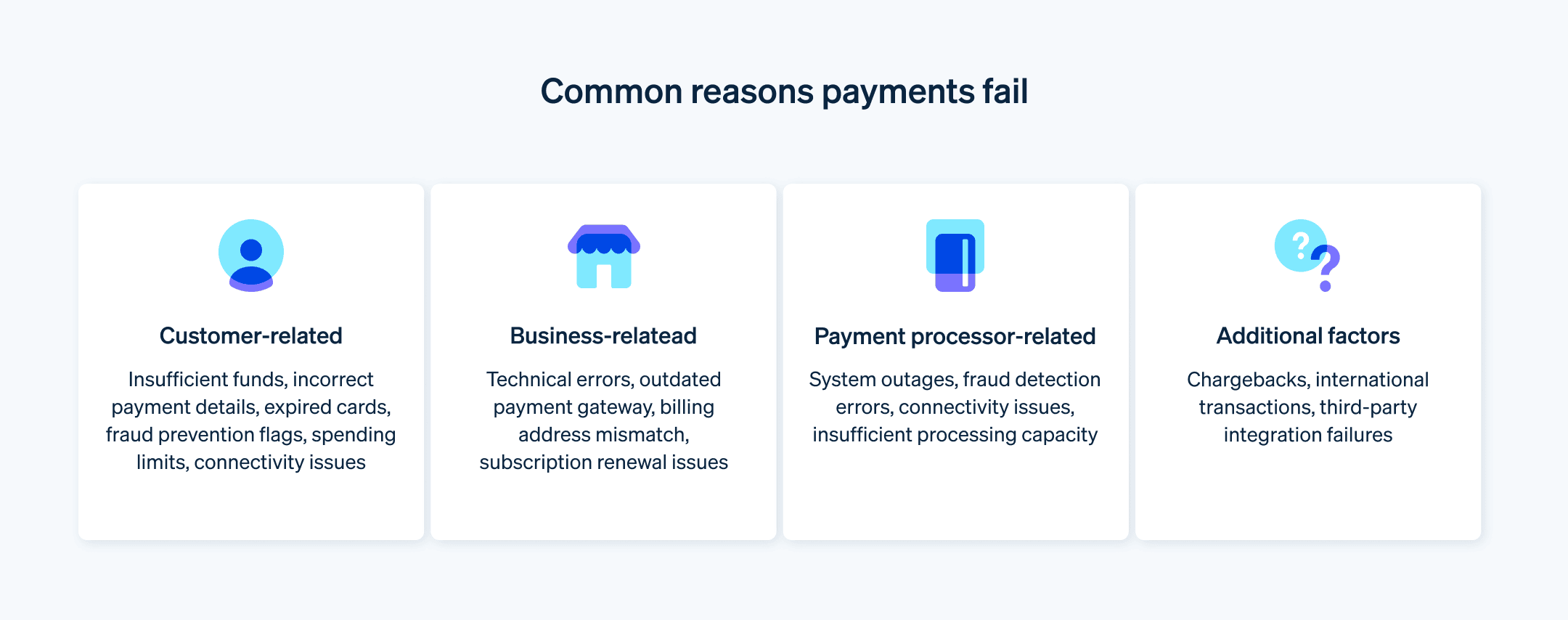

Causas comuns de falha nos pagamentos

Os processos de pagamento, as práticas de armazenamento de cartões e as operações de faturamento podem variar entre as empresas. Por isso, pagamentos malsucedidos podem ocorrer por vários motivos. Alguns dos mais frequentes:

Relacionados ao cliente

Insuficiência de fundos: muitas vezes, essa é a principal causa de falha nos pagamentos. Os clientes podem esquecer de verificar o saldo da conta antes de tentar uma transação ou podem ter excedido o limite de crédito.

Dados de pagamento incorretos: erros de digitação no número do cartão, códigos de valor de verificação de cartão (CVV), data de validade ou endereço de cobrança pode resultar em erro falha no pagamento.

Cartões vencidos: o cliente pode não perceber que o cartão venceu ou esquecer de atualizar os dados de pagamento junto à empresa.

Prevenção de fraudes: bancos e processadores de pagamentos costumam usar algoritmos de detecção de fraudes para sinalizar atividades suspeitas. Isso pode resultar na recusa de transações legítimas, especialmente se o cliente estiver fazendo uma compra grande ou incomum.

Limite de crédito insuficiente: para transações com cartão de crédito, o limite de crédito disponível do cliente pode não ser suficiente para cobrir o custo da compra.

Limitações da conta: alguns bancos e processadores de pagamento podem ter limites de gastos diários ou semanais para evitar fraudes. Esses limites também podem fazer com que os pagamentos sejam recusados.

Questões técnicas: os clientes podem ter problemas de conectividade com a Internet ou com o dispositivo que os impeçam de concluir o processo de pagamento.

Relacionados a negócios

Erros técnicos: falhas técnicas no site ou processador de pagamentos podem causar falha nas transações.

Gateway de pagamentos configurado incorretamente: se o gateway de pagamentos não for configurado corretamente, ele pode não processar pagamentos.

Softwares desatualizados: software desatualizados no site ou servidor da empresa podem resultar em falhas no pagamento.

Divergência de moedas: se a moeda de cobrança do cliente for diferente da moeda aceita pela empresa, a transação pode ser recusada.

Problemas de segurança: as empresas podem implementar medidas de segurança que impeçam o processamento de determinados tipos de transações, mesmo que sejam legítimas.

Problemas de renovação de assinatura: pagamentos recorrentes podem falhar por alterações nos dados de pagamento do cliente, fundos insuficientes ou cartões vencidos.

Divergência no endereço de cobrança: se o endereço de cobrança na conta do cliente não corresponder ao endereço na forma de pagamento, a transação poderá ser recusada.

Relacionados ao processador de pagamentos

Interrupções no sistema: os processadores de pagamentos podem sofrer interrupções que impeçam o processamento das transações.

Erros de detecção de fraudes: assim como os bancos, os processadores de pagamentos usam algoritmos de detecção de fraudes que podem recusar erroneamente transações legítimas.

Capacidade de processamento insuficiente: em pico de compras, os processadores de pagamentos podem receber um volume elevado de transações, o que pode causar atrasos e falhas.

Problemas de conectividade: problemas com a rede do processador de pagamentos podem gerar falhas nas transações.

Outros fatores

Estornos: se o cliente contestar uma transação, o banco emissor poderá emitir um estorno, que anulará o pagamento.

Integrações de terceiros: se o processo de pagamento envolver integrações de terceiros, como com uma interface de programação de aplicativo (API) fiscal ou de remessa, pode haver problemas que façam com que a transação falhe.

Transações internacionais: transações internacionais podem ser mais propensos a falhas devido a problemas de câmbio, detecção de fraude e outros fatores.

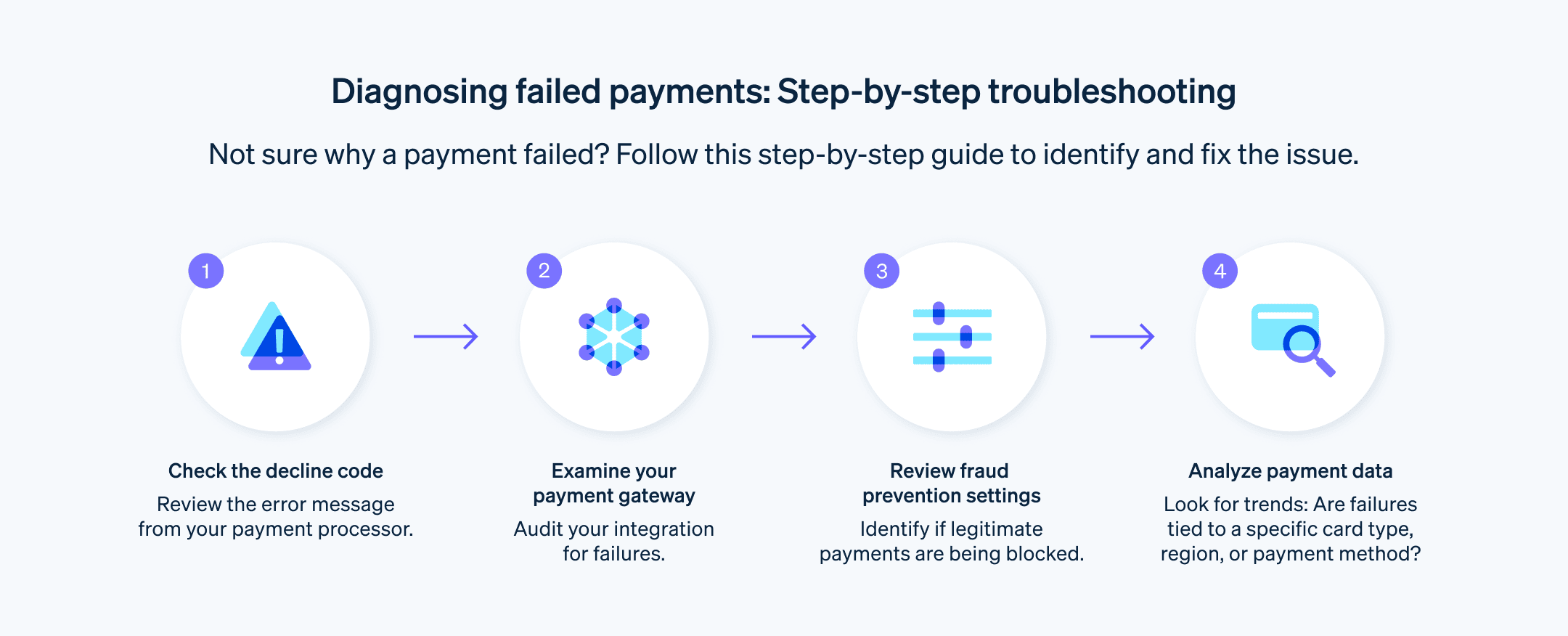

Como identificar as causas das falhas de pagamento na sua empresa

É importante tomar medidas para prevenir e responder a falhas em pagamentos, mas o tratamento adequado dessas questões depende, em primeiro lugar, de saber por que os pagamentos estão falhando em sua empresa. Processo detalhado para descobrir as causas básicas de seus pagamentos não realizados:

Verifique o código da recusa: de forma individual, a primeira etapa para determinar o que causou a falha do pagamento é verificar o código de recusa fornecido pelo seu processador de pagamentos. Um código de recusa de cartão é um código de erro alfanumérico de dois dígitos que explica por que uma transação de cartão foi recusada.

Analise seu gateway de pagamentos: se estiver investigando vários pagamentos, o seu gateway de pagamentos pode fornecer respostas. Faça uma auditoria completa na integração do gateway para coletar dados sobre os tipos de transações com falha. Um problema pode se tornar rapidamente aparente, mas, se não, reúna o máximo de informações possível.

Revise as configurações de prevenção a fraudes: como as ferramentas de detecção e prevenção de fraudes podem sinalizar pagamentos legítimos, analise cada configuração para entender se alguma está muito restritiva ou se está sinalizando pagamentos suspeitos incorretamente.

Analise os dados de pagamento: analise atentamente os dados que você compilou do seu gateway de pagamentos e software de prevenção de fraudes para tentar determinar se há algum fator afetando os pagamentos da sua empresa. Pode ser uma determinada forma de pagamento, transações de uma região específica ou pagamentos durante um determinado período do dia que têm maior probabilidade de falhar. Se surgir um padrão, essa é provavelmente a sua resposta.

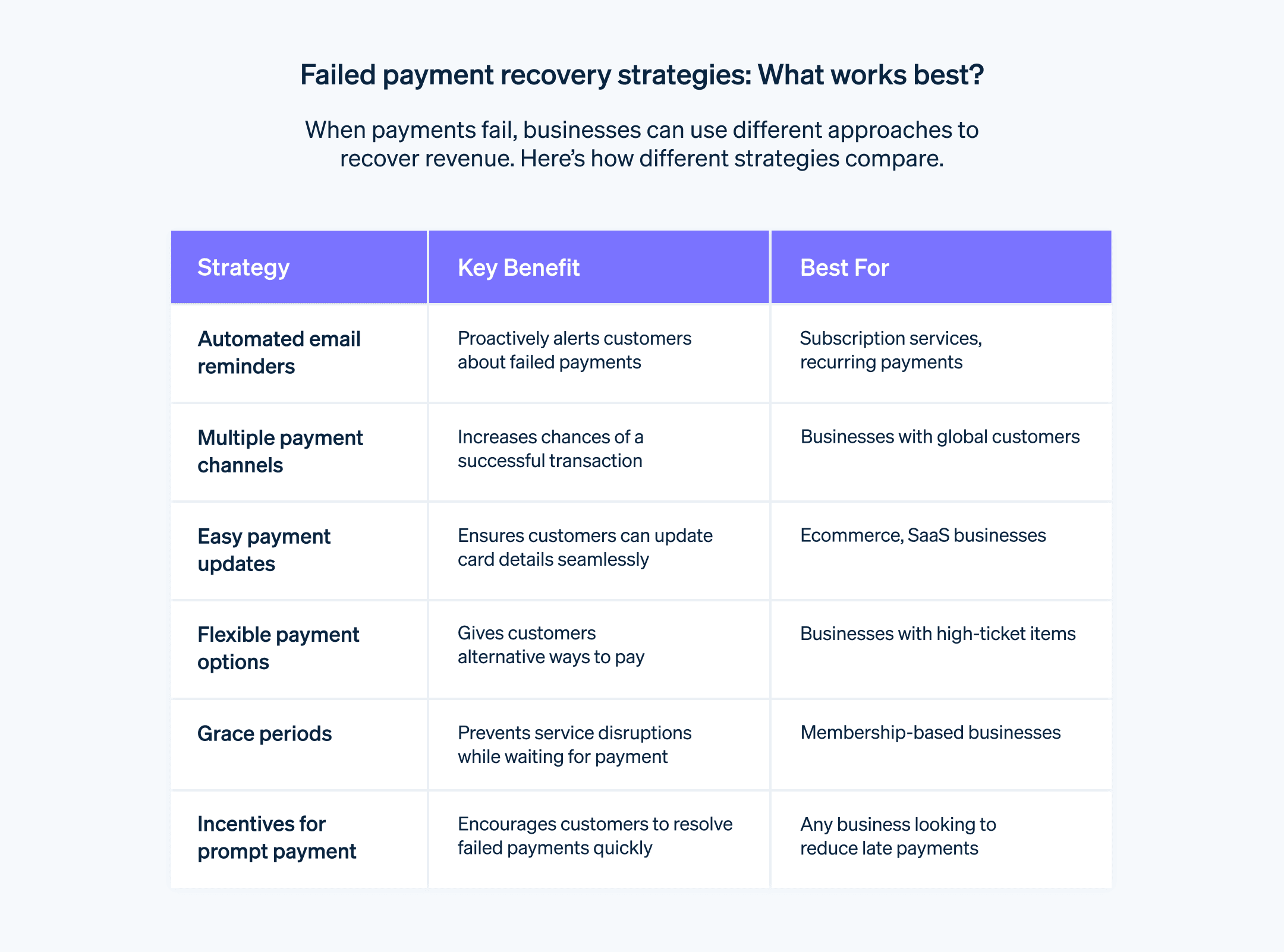

Como abordar a recuperação de pagamentos com falha: Estratégias a serem usadas

Lembretes automáticos por e-mail

Intervenção proativa e oportuna: pode ser fácil esquecer dos pagamentos malsucedidos, principalmente no caso de assinaturas recorrentes ou contas mensais. Os lembretes automáticos por e-mail funcionam como um lembrete proativo, lembrando os clientes sobre pagamentos pendentes. Essa intervenção oportuna aumenta a chance de recuperação bem-sucedida do pagamento e reduz o risco de churn da conta.

Comunicação personalizada: em vez de enviar lembretes genéricos, use e-mails personalizados para oferecer uma experiência mais envolvente e relevante. Chame os clientes pelo nome, mencione o valor específico e os detalhes da fatura e forneça várias opções de pagamento para sua conveniência. Comunicações personalizadas cultivam uma experiência positiva do cliente e aumentam a probabilidade de pagamento imediato.

Eficiência do fluxo de trabalho automatizado: o gerenciamento manual de falhas no gerenciamento de pagamentos é demorado e ineficiente. Lembretes automáticos por e-mail automatizam o processo, liberando recursos valiosos para outras tarefas. Isso permite que você expanda seus negócios sem sacrificar os esforços de recuperação de pagamentos.

Agendamento personalizado: envie lembretes estratégicos, conforme o contexto do pagamento malsucedido. Considere enviar o primeiro lembrete dentro de 24 horas após a falha, por exemplo, seguido por lembretes progressivamente mais fortes em intervalos regulares. Essa estratégia garante que haja acompanhamentos oportunos sem sobrecarregar os clientes.

Método multicanal: combine lembretes de e-mail com outros canais de comunicação para obter o máximo impacto. Considere enviar lembretes por SMS ou notificações push para usuários de aplicativos móveis para maior alcance e capacidade de resposta.

Otimização baseada em dados: acompanhe o desempenho dos seus lembretes por e-mail e analise métricas importantes como taxas de abertura, taxas de cliques e taxas de conversão. Use esses dados para refinar o conteúdo do seu e-mail, linhas de assunto, tempo e frequência para obter resultados ideais.

Integração com gateways de pagamento: muitos gateways de pagamento têm recursos integrados para lembretes automatizados por e-mail. Use essas integrações para otimizar seu fluxo de trabalho e simplificar o gerenciamento de pagamentos com falha.

Testes A/B de diferentes estratégias: experimente e-mails com conteúdos, assuntos e horários de envio diferentes para ver o que funciona melhor com seus clientes. Este método baseado em dados permite personalizar os seus lembretes e maximizar a sua eficácia.

Ferramentas de automação: use plataformas de automação de marketing ou software exclusivo para recuperação de falhas de pagamento para automatizar seus lembretes por e-mail. Essas ferramentas permitem criar fluxos de trabalho personalizados, integrar vários sistemas e acompanhar o desempenho de suas campanhas.

Prestação de assistência para pagamentos: ao enviar lembretes por e-mail, você pode fornecer recursos úteis ou ajuda para clientes que tenham dificuldades com seus pagamentos. Podem ser perguntas frequentes sobre pagamentos, formas de pagamento alternativas ou planos parcelados. Demonstrar empatia e disposição para ajudar pode ajudar muito a melhorar a satisfação do cliente e incentivar a conclusão de pagamentos.

Vários canais de pagamento

Variedade de opções de pagamento: as empresas podem fornecer várias formas de pagamento, como cartões de crédito e débito, transferências bancárias, carteiras digitais e, às vezes, opções em dinheiro ou cheque. Essa diversidade faz com que, se uma forma de pagamento falhar, os clientes possam mudar facilmente para outra.

Tecnologias integradas: a integração de tecnologias como gateways que aceitam várias formas de pagamento facilita o processo. Essa integração facilita a transição entre formas de pagamento sem causar grandes interrupções na experiência do cliente.

Redução da dependência em um único canal: depender de uma forma de pagamento pode ser arriscado. Se houver problemas, isso pode resultar em muitas falhas de pagamento. Vários canais distribuem esse risco.

Preferência do cliente e acessibilidade: cada cliente tem suas preferências e diferente níveis de acesso a cada forma de pagamento. Alguns podem preferir carteiras digitais por sua conveniência, por exemplo, enquanto outros podem confiar mais nas transferências bancárias tradicionais. Oferecer várias opções atende a essa variedade.

Considerações geográficas: as preferências de pagamento podem variar de uma região para outra. Os cartões de crédito podem ser populares em um país, mas os pagamentos por dispositivos móveis podem ser a norma em outro. Empresas que servem um público internacional devem considerar essas preferências regionais.

Redução do abandono de transações: se um pagamento falhar, oferecer uma alternativa imediata pode reduzir o abandono. Isso é particularmente importante no comércio eletrônico, em que os clientes podem não voltar para concluir uma compra se encontrarem problemas.

Conformidade e segurança: os canais de pagamento têm níveis diversos de conformidade e segurança. As empresas devem assegurar que todos os canais disponíveis cumpram as regulamentações necessárias e mantenham sistemas de segurança sólidos para proteger os dados dos clientes e evitar fraudes.

Opções de atualização de pagamentos fáceis

Interface amigável: é importante criar uma interface intuitiva e fácil de usar, onde os clientes possam atualizar os dados de pagamento. Pode ser num aplicativo móvel ou portal da web ou por meio de canais de atendimento ao cliente.

Lembretes automatizados para expiração: a implementação de lembretes automáticos que alertam os clientes antes do vencimento dos dados de pagamento ajuda na atualização proativa dos dados. Isso reduz o risco de falhas nas transações devido a informações desatualizadas.

Vários canais de atualização: oferecer vários canais para atualização de dados de pagamento (como por meio de um aplicativo, site, atendimento ao cliente ou links de e-mail) garante acessibilidade para todos os segmentos de clientes.

Segurança e privacidade: a verificação da segurança do processo de atualização do pagamento e a conformidade com os regulamentos de proteção de dados é extremamente importante. Os clientes precisam confiar que seus dados financeiros são administrados com segurança.

Flexibilidade nas formas de pagamento: permitir que os clientes alternem entre formas de pagamento (como de um cartão de crédito para uma transferência bancária direta) durante o processo de atualização pode atender a mudanças nas preferências ou circunstâncias do cliente.

Capacidade de atualização em tempo real: o sistema deve ser capaz de processar atualizações em tempo real, ou o mais próximo possível dele, para evitar atrasos que possam gerar novas falhas.

Comunicação e orientação claras: fornecer instruções acessíveis e assistência para atualizar dados de pagamento ajuda a reduzir confusões e erros durante o processo de atualização.

Integração com perfis de clientes: vincular o sistema de atualização de pagamentos ao perfil dos clientes permite personalizar sua estratégia e pode facilitar atualizações, pois o sistema já possui informações relevantes do cliente.

Loop de feedback para transações com falha: após uma transação malsucedida, orientar os clientes imediatamente a atualizar os dados de pagamento pode aumentar a probabilidade de recuperar o pagamento.

Repetição automática após a atualização: depois que os dados de pagamento forem atualizados, uma repetição automática da transação pode ajudar na recuperação imediata sem que o cliente precise repetir o pagamento.

Opções de pagamento flexíveis

Diversas formas de pagamento: ofereça diversas formas de pagamento, como cartões de crédito e débito, transferências bancárias, carteiras digitais e opções de pagamentos locais. Essa diversidade atende às variadas preferências dos clientes e aumenta a probabilidade de transações bem-sucedidas.

Atualização fácil da forma de pagamento: permita que os clientes atualizem seus dados de pagamento com facilidade. Para isso, ofereça interfaces amigáveis em seu site ou aplicativo. Instruções fáceis de seguir e assistência prontamente disponível podem incentivar atualizações imediatas, reduzindo falhas em pagamentos por desatualização dos dados.

Repetições automatizadas: implemente uma lógica automática de novas tentativas para transações com falha. É preciso tentar a transação novamente em outros dias ou horário, considerando que problemas temporários, como Insuficiência de fundos ou indisponibilidade do banco, podem causar falhas.

Flexibilidade no cronograma de pagamentos: permita que os clientes escolham ou alterem as datas de pagamento. Com essa flexibilidade, eles podem vincular datas de pagamento a seus ciclos financeiros, como depósitos de salários, melhorando o sucesso dos pagamentos.

Planos de pagamento: forneça planos de pagamento para clientes com dificuldades financeiras temporárias. Podem ser prazos estendidos ou parcelamento dos pagamentos.

Notificações em tempo real: envie notificações imediatas sobre transações com falha. Isso mantém os clientes informados e os encaminha para que tomem as medidas necessárias, como atualizar os dados de pagamento ou verificar se há fundos suficientes disponíveis.

Atendimento ao cliente: tenha atendimento exclusivo para problemas relacionados a pagamentos. A equipe de suporte treinada pode ajudar os clientes a resolver falhas de pagamento, encontrar formas de pagamento alternativas ou configurar planos de pagamento.

Análise de dados e insights: analise regularmente os dados de pagamento para identificar tendências e problemas em pagamentos malsucedidos. Os insights obtidos podem orientar melhorias em processos e estratégias de pagamento.

Segurança e conformidade: verifique se todas as formas e processos de pagamento são seguros e cumprem os regulamentos pertinentes, como Payment Card Industry Data Security Standards (PCI DSS) para pagamentos com cartão. Isso protege contra fraudes e aumenta a confiança do cliente.

Educação de usuários: instrua os usuários sobre as opções de pagamento disponíveis e as práticas recomendadas para suas transações. Podem ser oferecidas seções de perguntas frequentes, tutoriais ou comunicação direta no atendimento ao cliente.

Integração fácil: integre opções de pagamento flexíveis à experiência do cliente. O processo deve ser intuitivo e não atrapalhar o usuário enquanto ele realiza suas transações.

Personalização conforme a segmentação de clientes: personalize as opções de pagamento pela segmentação de clientes. Diferentes segmentos podem ter preferências e comportamentos financeiros diversos, o que pode informar as soluções de pagamento mais adequadas para cada grupo.

Períodos de carência

Os períodos de carência são períodos específicos em que os clientes podem resolver problemas de pagamento sem enfrentar penalidades ou interrupções de serviço imediatas. A implementação eficaz de períodos de carência envolve conhecer as necessidades do cliente, os requisitos regulatórios e as implicações operacionais para a sua empresa. Algumas práticas recomendadas:

Comunicação clara dos termos do período de carência: informe o prazo de carência e as condições em que se aplica. A transparência sobre esses termos ajuda a gerenciar as expectativas dos clientes e reduz confusões.

Duração razoável: defina um período de carência longo o suficiente para que os clientes tenham oportunidade de corrigir problemas de pagamento, mas que não chegue a afetar sua receita. A duração vai depender do padrão do setor e do serviço ou produto.

Notificações automatizadas: envie lembretes automáticos aos clientes antes e durante o período de carência. Esses lembretes devem incluir a data de vencimento do pagamento, o final do período de carência e as possíveis consequências do não pagamento.

Opções flexíveis de prorrogação: você pode oferecer uma prorrogação do período de carência em certos casos, especialmente para clientes com um bom histórico de pagamentos ou que estão com dificuldades financeiras temporárias.

Incentivos para pagamento imediato

Algumas práticas recomendadas para implementar incentivos de pagamento imediato:

Opções de incentivo atraentes: ofereça incentivos genuinamente atraentes para seus clientes. Alguns incentivos comuns são descontos em compras futuras, pontos de fidelidade, cashback ou acesso a serviços ou produtos exclusivos.

Comunicação clara dos termos: comunique de forma acessível os termos e condições do programa de incentivo aos clientes. Isso inclui os critérios de elegibilidade, como e quando o incentivo é concedido e quaisquer limitações ou datas de validade.

Processo de resgate fácil: descomplique o processo de resgate de quaisquer incentivos. Resgates complicados podem anular o valor percebido do incentivo.

Promoção regular: promova ativamente o programa de incentivo em vários canais, como e-mails e notificações no aplicativo, e durante o processo de checkout. A promoção regular faz os clientes lembrarem-se do programa.

Alinhamento com os objetivos do negócio: desenhe o programa de incentivos conforme seus objetivos comerciais mais amplos. Se uma meta for aumentar as compras repetidas, por exemplo, considere incentivos que incentivem os gastos.

Abordagem segmentada: personalize os incentivos para diferentes segmentos de clientes com base no comportamento de compra, preferências e histórico de pagamentos. Esta estratégia direcionada pode aumentar a eficácia dos incentivos.

Monitoramento e avaliação: monitore continuamente o desempenho do programa de incentivo. Avalie seu impacto sobre os comportamentos dos pagamentos e faça ajustes com insights baseados em dados.

Conformidade e questões éticas: o programa de incentivos deve cumprir as leis e regulamentações pertinentes, especialmente sobre transações financeiras e marketing. Também é importante considerar as implicações éticas do seu programa de incentivo para evitar incentivar comportamentos financeiros irresponsáveis.

Mecanismo de feedback: implemente um sistema de feedback para o programa de incentivo. Esse feedback pode esclarecer como o programa é percebido e como pode ser melhorado.

Design expansível e flexível: projete um programa escalável e flexível, permitindo ajustes com base nas mudanças nas condições do mercado, no comportamento do cliente e nas necessidades da empresa.

Integração tecnológica: use a tecnologia para automatizar o rastreamento e a concessão de incentivos. Pode ser uma integração com sistemas de pagamento, soluções de CRM (gerenciamento de relacionamento com o cliente) e ferramentas de marketing.

Análise custo-benefício: realize regularmente uma análise de custo-benefício do programa de incentivo para que ele seja financeiramente sustentável e entregue o retorno sobre investimento desejado.

Transparência sobre mudanças: se o programa mudar, comunique imediatamente os ajustes aos clientes para manter a confiança e a integridade do programa.

Conteúdo educativo: fornecer conteúdo educativo que ajude os clientes a entender o valor dos incentivos e a aproveitar o programa.

Considerações jurídicas para a recuperação de pagamentos com falha

A questão da falha nos pagamentos está ligada a questões legais e de conformidade, que todas as empresas devem conhecer para gerenciar pagamentos de clientes. Outros detalhes sobre essas intersecções:

Compreensão das leis locais e internacionais: as empresas precisam conhecer as estrutura legais sobre cobrança de dívidas e o processamento de pagamentos nas jurisdições em que operam. Isso inclui o conhecimento das leis locais e regulamentos internacionais, especialmente para multinacionais.

Conformidade com práticas de cobrança de dívidas: cumprir práticas justas de cobrança de dívidas é importante. É preciso entender o que constitui prática legal e ética ao cobrar dívidas não pagas, como restrições ao contato com clientes e proibição de assédio.

Proteção de dados e privacidade: garantir a conformidade com leis de proteção de dados, como o Regulamento Geral de Proteção de Dados da União Europeia (GDPR) ou a Lei de Privacidade do Consumidor da Califórnia (CCPA), é essencial para manter as operações. É preciso saber como usar e armazenar os dados dos clientes durante o processo de recuperação de pagamentos.

Termos e condições claros: as empresas devem verificar se os termos e condições de pagamentos e possíveis ações de recuperação são facilmente acessíveis e reconhecidos pelos clientes. Essa clareza pode evitar contestações judiciais por mal-entendidos sobre obrigações de pagamento.

Registro e documentação: é importante manter registros precisos de todas as comunicações e transações com os clientes. Essa documentação pode ser especialmente útil em caso de processos judiciais ou disputas sobre recuperação de pagamentos.

Compreender as leis de falência e insolvência: a familiaridade com as leis de falência e insolvência é fundamental porque é possível que um cliente declare falência. Saber como essas leis afetam os processos de recuperação de dívidas pode ajudar as empresas.

Treinamento e políticas para sua equipe: fornecer treinamento para a equipe envolvida na recuperação de pagamentos sobre requisitos legais e práticas éticas melhora a conformidade e reduz o risco de problemas legais decorrentes de conduta imprópria.

Contratos com agências terceirizadas: se usar agências terceirizadas para cobrança de dívidas, as empresas devem garantir que essas agências também cumpram todas as leis e regulamentos relevantes. Os contratos com essas agências devem estabelecer claramente esses requisitos.

Juros e tarifas: juros ou tarifas cobrados sobre pagamentos atrasados devem respeitar limites legais e ser explicitamente comunicados aos clientes com antecedência. Cobranças excessivas podem resultar em contestações legais e danos à reputação.

Mecanismos de resolução de conflitos: a implementação de mecanismos justos de resolução de litígios para os clientes que contestam a validade da dívida ou do processo de recuperação é importante. Isso ajuda na resolução de problemas sem recorrer a ações judiciais.

Leis de defesa do consumidor: as leis de proteção ao consumidor são projetadas para proteger os clientes de práticas comerciais desleais, e as empresas devem cumpri-las. Isso inclui publicidade honesta de produtos e transparência nas práticas de cobrança.

Acessibilidade e não discriminação: é importante garantir que o processo de recuperação de pagamentos seja acessível e não discriminatório. Isso significa considerar as necessidades de todos os clientes, como aqueles com deficiência ou aqueles que falam línguas diferentes.

Revisão legal das estratégias de recuperação: a revisão legal regular de estratégias e táticas de recuperação de pagamentos ajuda na verificação de conformidade e adaptação a quaisquer mudanças na lei.

Comunicação com assessoria jurídica: manter linhas de comunicação abertas com advogados ajuda a resolver rapidamente quaisquer problemas jurídicos e garantir que as estratégias de recuperação cumpram a legislação.

Como a Stripe pode ajudar

As soluções de pagamento da Stripe incluem vários recursos que ajudam as empresas a prevenir e responder a falhas em pagamentos, como:

Prevenção de falhas de pagamento

Radar: o Radar, ferramenta de machine learning da Stripe para prevenção de fraudes, consegue identificar e bloquear transações suspeitas antes que ocorram, reduzindo consideravelmente o risco de fraudes e falhas nos pagamentos.

Payment Intents: este recurso permite que as empresas coletem todos os dados de pagamento necessários de forma antecipada e garantam a autorização, evitando problemas como insuficiência de fundos ou cartões vencidos no momento do pagamento.

Autenticação Forte de Cliente (SCA): a Stripe trabalha com SCA, um padrão de segurança que ajuda a verificar a identidade dos titulares de cartão e reduzir ainda mais fraudes e falhas em pagamentos.

3D Secure dinâmico (3DS): essa implementação avançada de 3DS proporciona uma experiência de pagamento segura e aprimora a proteção contra fraudes.

Códigos de recusa personalizáveis: as empresas podem definir seus próprios códigos de recusa para receber informações mais específicas sobre pagamentos com falha, identificando e tratando a causa raiz.

Responder a pagamentos malsucedidos

Novas tentativas automáticas: a Stripe pode repetir pagamentos malsucedidos com diferentes formas de pagamento ou após um período específico, aumentando as chances de recebimento.

Payment Links: as empresas podem criar e compartilhar facilmente Payment Links com os clientes para facilitar novas tentativas de pagamento.

E-mails de cobrança: a Stripe oferece emails de cobrança personalizáveis que podem ser enviados automaticamente aos clientes com pagamentos pendentes, lembrando-os de pagar e oferecendo opções de pagamento convenientes.

Serviços de recuperação de pagamentos: a Stripe tem parceria com várias empresas de recuperação de pagamentos para fornecer serviços adicionais, como cobrança de dívidas e assistência com estornos.

Insights detalhados: a Stripe fornece painéis e relatórios abrangentes com informações valiosas sobre tendências de pagamentos, taxas de recusa e outras métricas importantes, ajudando a identificar oportunidades de melhoria.

Outras vantagens

Alcance global: a Stripe aceita pagamentos em mais de 135 moedas, permitindo alcançar clientes em todo o mundo e minimizar o risco de falhas nos pagamentos por incompatibilidade de moedas.

Escalabilidade: a tecnologia da Stripe foi projetada para gerenciar grandes volumes de transações, garantindo processamento eficiente durante o crescimento.

Segurança: a Stripe segue os mais rigorosos padrões e regulamentos de segurança, protegendo empresas e clientes contra fraudes e violações de dados.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.