Delbetalningar fördelar kostnaden för en vara eller tjänst över en tidsperiod. Med denna metod delas ett totalt skuldbelopp upp i mindre belopp som köparen betalar enligt ett fast schema, istället för att betala ett engångsbelopp. Denna betalningsmetod används ofta vid större köp och gör det lättare för privatpersoner och företag att anpassa betalningar efter sin ekonomiska planering och kontanthanteringsmål. Säljaren och köparen kommer överens om betalningsplanen vid köptillfället och intervallen för när inbetalningar behöver göras kan variera. Denna typ av betalningsplan kan inkludera ränta och andra avgifter, beroende på de villkor som långivaren eller företaget har fastställt.

I den här artikeln tar vi upp vad företag behöver veta om delbetalningar: vad de är, hur de fungerar, hur de interagerar med andra kundbetalningstrender samt hur du skapar en genomtänkt strategi för att införa och använda delbetalningar för dina specifika affärsbehov.

Vad innehåller den här artikeln?

- Är delbetalning och köp nu, betala senare samma sak?

- Hur fungerar delbetalningar?

- När ska företag erbjuda delbetalningar?

- Fördelar och utmaningar med delbetalningar

- Översikt över populära delbetalningstjänster

- Så här kan delbetalningar integreras i ditt företag

- Bästa praxis för delbetalningar för företag

- Så kan Stripe hjälpa dig

Är delbetalning och köp nu, betala senare samma sak?

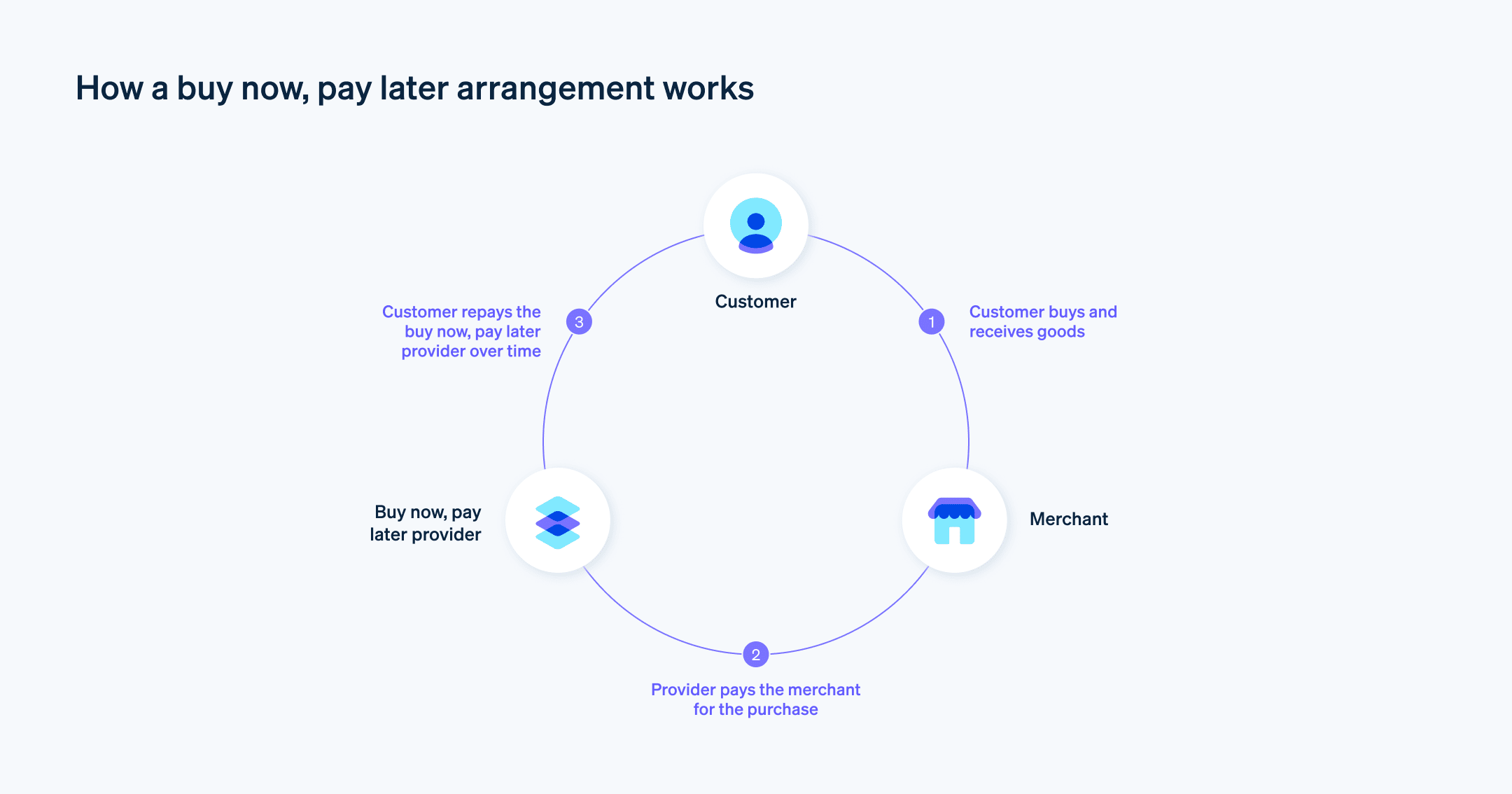

Med delbetalningar kan kunder betala den totala summan av en produkt eller tjänst genom flera betalningar, som schemaläggs när köpet görs och vanligtvis inkluderar en första handpenning. Denna metod fungerar under premissen att betalningen skjuts upp och låter kunder förvärva produkter eller tjänster omedelbart samtidigt som de delar upp sin betalning över flera framtida datum. Denna finansiella flexibilitet är också kärnan i modellen köp nu, betala senare, som är en förlängning av delbetalningskonceptet, men den förlitar sig ännu mer på aspekten att betalningen är uppskjuten. Köp nu, betala senare innebär vanligtvis inga initiala kostnader och är utformad för snabb och enkel integration i e-handelsplattformar. Med tiden fullgör kunderna sina betalningsskyldigheter i förutbestämda, ofta räntefria delbetalningar. Detta förenklar kundernas hantering av den personliga ekonomin och ger dem också möjlighet att göra inköp utan att det belastar dem ekonomiskt omedelbart.

Köp nu, betala senare är särskilt tilltalande för kunder som värdesätter att få sina behov tillfredsställda med en gång men som också är budgetmedvetna. Och för företag kan betalningsmetoden köp nu, betala senare, utöka deras kundkrets förutom att öka försäljningsvolymerna och kundlojaliteten. År 2022 uppskattades den globala marknaden för köp nu, betala senare till över 6,2 miljarder USD. Nyckeln är att ha ett tydligt redan utformat avtal och inte ta ut dolda avgifter. Detta tillfredsställer kundernas önskemål om transparens och kontroll i sitt ekonomiska engagemang.

Både delbetalningar och köp nu, betala senare är inte bara finansiella mekanismer, de är också strategier som kan hjälpa företag att växa, ta sig in i nya marknadssegment och bygga kundlojalitet genom flexibla finansiella lösningar.

Hur fungerar delbetalningar?

Delbetalningar delar upp den totala kostnaden för en transaktion i mer hanterbara, schemalagda betalningar över tid. Den här metoden är gynnsam för både företag och kunder eftersom den underlättar tillgången till varor eller tjänster som kan vara ekonomiskt utom räckhåll om en engångsbetalning var det enda alternativet. Så här fungerar det:

En översikt steg-för-steg

Överenskommelse om villkor

Grunden för delbetalningar är avtalet mellan köparen och säljaren om betalningsstrukturen. Detta inkluderar den totala köpeskillingen, betalningsplanen och eventuella räntor eller avgifter. Det här steget handlar om transparens och att ställa förväntningar på båda parter.Handpenning

Som ett åtagande för köpet gör köparna ofta en första betalning. Denna handpenning minskar det totala beloppet som ska betalas i delbetalningar och kan påverka köparens delbetalningsbelopp och ränta som tillämpas över tid.Schemalagda betalningar

Efter handpenningen följer köparen en regelbunden betalningsplan. Varje delbetalning minskar det återstående beloppet, och om ränta tillämpas delas den upp på delbetalningarna för att säkerställa att hela lånekostnaden har täckts i slutet av löptiden.Ränta och ytterligare avgifter

Ränta kompenserar säljaren för att betalningen av det fullständiga beloppet försenas och återspeglar pengarnas tidsvärde. Ytterligare avgifter kan tillkomma för behandling eller som påföljder vid försenade betalningar och fungerar som ett incitament för att följa betalningsplanen.Betalningsplanen slutförs

Cykeln avslutas när köparen har gjort alla delbetalningar och uppfyllt sin ekonomiska skyldighet. Tillgången eller tjänsten är sedan helt betald, vilket överför full äganderätt eller avslutar serviceavtalet.Efterlevnad av avtalsförpliktelser

Under hela delbetalningsprocessen är det absolut nödvändigt för båda parter att följa de överenskomna villkoren. Bristande efterlevnad kan leda till ekonomiska påföljder eller rättsliga konsekvenser.

När ska företag erbjuda delbetalningar?

Företag bör överväga delbetalningar när de ser en matchning mellan vad de säljer och deras kunders köpbeteende. Om deras produkter eller tjänster har en betydande prislapp (en prislapp som kunderna kanske inte enkelt kan betala på en gång) kan delbetalningar göra dessa mer tillgängliga.

Beslutet att använda sig av delbetalningsavtal som betalningsalternativ kan påverkas av flera faktorer, bland annat:

Affärsmodell och prisstruktur

För företag med varor eller tjänster med högt värde (t.ex. elektronik, möbler eller utbildningar) kan delbetalningar göra dessa mer lättillgängliga genom att minska den omedelbara ekonomiska bördan för kunden.Kundbas

Om ett företags målmarknad inkluderar yngre demografi eller de med mindre statisk köpkraft kan delbetalningar matcha deras ekonomiska vanor, vilket ofta gynnar flexibilitet.E-handel och närvaro online

Eftersom den digitala kassaprocessen sömlöst kan integrera alternativ för delbetalningar och/eller köp nu, betala senare, och möta kunden i beslutsögonblicket, kan särskilt onlineföretag dra nytta av den här metoden.Konkurrenskraft på marknaden

I branscher där marknaden är mättad och konkurrensen är intensiv kan delbetalning differentiera ett företag och ge en konkurrensfördel som kan påverka en kunds val.Abonnemangstjänster

För företag som använder abonnemangsmodeller, särskilt där de initiala kostnaderna är betydande, kan delbetalning på den initiala registreringsavgiften minska inträdesbarriärerna och öka antalet abonnemang.Lyxvaror och tjänster

Företag som säljer premiumprodukter upptäcker ofta att delbetalningar kan utöka deras kundbas till att även inkludera dem som inte har råd att betala hela beloppet på en gång och på så sätt nå ut till en bredare marknad.

Den idealiska tidpunkten för att införa delbetalningar beror på flera faktorer:

Produktlansering

När du lanserar en ny produkt med högt värde kan delbetalningsalternativ locka tidiga användare som är intresserade men kanske är tveksamma till kostnaden.Marknadsexpansion

När ett företag försöker nå bredare marknader, särskilt de med varierande ekonomisk bakgrund, kan delbetalningar vara en avgörande faktor för kunder som står inför ett köpbeslut.Säsongstoppar

Under tider där folk traditionellt spenderar mycket som inför julen, kan delbetalningar uppmuntra kunder att göra större inköp utan den omedelbara ekonomiska smällen.Konsumentefterfrågan

Var uppmärksam på konsumenttrender. En ökad efterfrågan på tjänster som köp nu, betala senare tyder på att kunderna vill ha mer flexibilitet i hur de hanterar sina utgifter. Om dina konkurrenter erbjuder köp nu, betala senare kan det vara dags att överväga att göra detsamma för att förbli relevant och konkurrenskraftig.Försäljningen planar ut eller minskar

Om ett företag märker en stagnation eller nedgång i försäljningen, särskilt av dyrare varor, kan delbetalningar återuppliva intresset och öka överkomligheten för potentiella köpare.

Det handlar i slutändan om att förstå vad dina kunder vill ha och vad som är mest meningsfullt för ditt företag baserat på vad du säljer och vem du säljer det till. Att erbjuda delbetalningar i en tid då kunderna aktivt söker efter alternativ som köp nu, betala senare kan främja både kundnöjdhet och företagstillväxt. Men om det inte är relevant för just ditt företag, säg om du säljer ljus för 5 USD, är det förmodligen inte värt den operativa insatsen.

Fördelar och utmaningar med delbetalningar

För företag som överväger delbetalningar måste blandningen av ökad tillgänglighet för kunder och potential för ökade intäkter vägas mot behovet av mer sofistikerad finansiell spårning och riskhantering. Noggrann implementering – kanske börja med ett pilotprogram eller ett tredjepartspartnerskap – kan sondera terrängen och ge insikt i hur delbetalningar kan passa in i din befintliga affärsmodell.

Här är några möjliga fördelar och risker att ta med i beaktande när du tänker över dina alternativ:

Fördelar

Ökad försäljningsvolym

Genom att bryta ner kostnadsbarriären öppnar företag dörren för kunder som annars kanske inte skulle genomföra ett dyrt köp. Möjligheten att dela upp betalningarna kan leda till större genomsnittliga ordervärden och mer frekventa köp, eftersom kunderna är mer villiga att köpa direkt snarare än att spara över tid.Bredare marknadsräckvidd

Delbetalningsplaner är inte bara för dem som inte har råd att betala hela beloppet med en gång. De tilltalar också smarta köpare som föredrar att månadsbudgetera. Detta kan utöka ett företags räckvidd till marknader som prioriterar finansiell flexibilitet. Enligt Juniper Research beräknas antalet globala användare av köp nu, betala senare överstiga 900 miljoner år 2027.Förbättrad kassaflödeshantering för kunderna

Kunderna kan matcha sina utgifter med sina inkomstflöden, vilket gör varor med högt värde mer uppnåeliga för dem utan att störa deras finansiella stabilitet. Detta kan också leda till starkare lojalitet eftersom kunderna uppskattar när man tillmötesgår dem.

Utmaningar

Komplex hantering

Att tillåta delbetalningar innebär att man inleder en minifinansiering. Företag måste hålla koll på flera betalningsflöden, vilket kan komplicera redovisningsprocesser och kräver mer robusta system och förfaranden.Risk för uteblivna betalningar

Inte alla kunder som väljer att göra delbetalningar kommer att slutföra sina betalningar. Varje utebliven betalning är en direkt slag mot de förväntade intäkterna, och kan påverka finansiella prognoser och den övergripande affärsstabiliteten.Administrativa kostnader

Det finns kostnader förknippade med att konfigurera och underhålla den infrastruktur som behövs för att hantera delbetalningar, från investeringar i ny programvara till att allokera personalresurser för övervakning av processen.

Översikt över populära delbetalningstjänster

Den grupp leverantörer som erbjuder delbetalningstjänster växer, och var och en har olika funktioner som tillgodoser olika aspekter av kund- och affärsupplevelsen. Här är några av ledarna inom detta område:

Klarna

Klarna har en rad flexibla betalningsalternativ, varav vissa är platsberoende, till exempel betala direkt, betalning efter leverans och delbetalningsplaner. Dess modell är utformad för att vara så enkel som möjlig, med fokus på en smidig användarupplevelse. För kunderna ligger Klarnas marknadsattraktion i dess användarvänliga app och möjligheten att skjuta upp hela betalningen utan ränta eller avgifter, förutsatt att betalningsfristerna uppfylls. Företag gynnas av Klarnas dragningskraft på ett marknadssegment som värdesätter transparenta och hanterbara betalningsmetoder.Afterpay/Clearpay

Afterpay, som även kallas Clearpay i Storbritannien, erbjuder möjligheten att dela upp en transaktion i fyra lika stora delbetalningar som betalas under sex veckor, och även andra långfristiga finansieringsalternativ erbjuds (beroende på plats). Tjänsten lockar kunder med sin räntefria strategi, förutsatt att betalningarna görs i tid. För detaljhandlare innebär Afterpay en möjlighet att locka kunder som kanske är tveksamma till att göra större köp genom att erbjuda en lösning där man betalar över tid och som integrerar med deras livsstil och konsumtionsvanor.Affirm

Affirm differentierar sig genom att tillhandahålla långfristiga finansieringsalternativ, som kan sträcka sig från en månad till tre år. Dess räntor varierar beroende på kredit, finansieringsalternativ och köpbelopp, men de klargörs för kunden i förväg. Denna transparens, tillsammans med möjligheten till längre betalningsperioder, gör Affirm attraktivt för kunder som planerar att göra större inköp. Ur ett företagsperspektiv kan Affirm hjälpa till att få igenom köp som har ett högre genomsnittligt ordervärde genom att ge kunderna en flexibel och förutbestämd betalningsplan.

Dessa tjänster omformar hur kunder närmar sig köp och skapar en bro mellan vad kunder vill ha och vad de kan betala. När företag integrerar dessa tjänster ger de inte bara värde till sina kunder, utan de använder också dessa plattformar för att säkra en större försäljning och förbättra shoppingupplevelsen. Varje tjänsts funktioner, från betalningsplaner till räntor, bör matchas med företagets produkter och kundbas för att hitta det som passar bäst.

Så här kan delbetalningar integreras i ditt företag

Genom att integrera delbetalningar i din affärsverksamhet kan du förbättra din service och stödja kundernas ekonomiska preferenser, så länge du hanterar det på rätt sätt. Så här kan du gå tillväga på ett strukturerat sätt:

Välj en tjänsteleverantör

Välj en betaltjänstleverantör som är vettig med tanke på ditt företags storlek, kundbas och produktsortiment. Leverantörer som Stripe har heltäckande lösningar som kan passa olika affärsmodeller och inkluderar stöd för delbetalningar. Det är viktigt att leta efter en leverantör med ett enkelt applikationsprogrammeringsgränssnitt (API) och tillförlitlig support för att underlätta integrationsprocessen. Leverantören bör också skapa en enkel upplevelse för dina kunder, från kassan till den sista delbetalningen.Integrera tekniskt

Arbeta med ditt IT-team eller tjänsteleverantörens tekniska support för att integrera delbetalningsalternativet i din befintliga betalningsgateway. Integrationsprocessen innebär att konfigurera delbetalningsmetoden, uppdatera kassagränssnittet för att inkludera detta alternativ och se till att ditt bokföringssystem kan registrera delbetalningar.Gör operativa överväganden

Utbilda ditt team i att hantera delbetalningsprocesser, inklusive kundförfrågningar och betalningsspårning. Det handlar om att förstå nyanserna i delbetalningar, från att hantera inledande kundfrågor till att hantera sena eller uteblivna betalningar. Att ha ett välinformerat team ger dina kunder en resurs när de behöver hjälp, vilket i sin tur kan leda till bättre upplevelser för dem och ökat förtroende för ditt företag.Kommunicera med kunderna

Informera kunderna tydligt om det nya betalningsalternativet och beskriv fördelarna och eventuella villkor som gäller. Transparens är viktigt. Din marknadsförings- och kundtjänstkommunikation bör tydligt beskriva hur delbetalningar fungerar, eventuella räntor eller avgifter och vad kunderna kan förvänta sig i form av betalningsplaner.Upprätthåll efterlevnad och säkerhet

Bekräfta att ditt delbetalningssystem följer finansiella regler och att kunduppgifter hanteras på ett säkert sätt. Att följa finansiella regler och upprätthålla höga säkerhetsstandarder för kunddata är inte bara en juridisk skyldighet, det är också ett viktigt sätt att skapa förtroende hos kunderna. Denna aspekt bör ha högsta prioritet i integrationsprocessen.

Genom att följa dessa steg kan företag integrera delbetalningar på ett sätt som kompletterar deras verksamhet, uppfyller kundernas behov och följer lagstadgade standarder.

Bästa praxis för delbetalningar för företag

Att införliva delbetalningsavtal i ett företags betalningsalternativ kräver ett genomtänkt införande. Här är en sammanfattning av bästa praxis för att säkerställa att dessa avtal är fördelaktiga för både kunden och företaget:

Villkorstransparens

Alla villkor i delbetalningsplanen bör anges tydligt från början. Kunderna måste förstå betalningsplanen, eventuella räntor eller avgifter och vad som händer om en betalning försenas eller uteblir. Denna tydlighet kan bygga förtroende och förhindra framtida missförstånd.Intuitiva processer

Komplexa procedurer kan avskräcka från användning, så det är viktigt att hålla processen enkel. Ju enklare det är för en kund att konfigurera och förstå sin betalningsplan, desto mer sannolikt är det att de slutför köpet.Kundservice

Det är nödvändigt att servicen vid avbetalningsplaner håller en hög standard. Kunder kan ha frågor eller stöta på problem med sina betalningar. Snabba, hjälpsamma svar kan förbättra deras övergripande upplevelse och uppfattning om företaget.Flexibla betalningsalternativ

Flexibilitet kan vara en konkurrensfördel. Att ge möjlighet till delbetalningsplaner med olika betalningsfrekvenser och räntor tillgodoser olika kundbehov.Robust infrastruktur

Företaget bör bekräfta att dess system kan hantera delbetalningar. Detta innebär att integrera rätt teknik för att hantera och spåra betalningar över tid och utbilda personal för att hantera delbetalningsspecifika frågor.Efterlevnad av regelverk

Det är absolut nödvändigt att följa alla finansiella regler som rör kredit och finansiering. Detta inkluderar god reklamsed, tydliga villkor och integritetslagar om kunddata.Kontroll av den ekonomiska hälsan

Innan ett företag inför delbetalningar bör det bedöma sin ekonomiska ställning för att se till att det har råd med det försenade intäktsflödet, och att alla relevanta intressenter vet hur delbetalningsförsäljning kommer att påverka intäktsredovisning och bokföring.

Genom att följa dessa metoder kan företag skapa delbetalningsavtal som är fördelaktiga för båda parter, vilket leder till ökad försäljning och kundlojalitet samtidigt som den operativa integriteten och den ekonomiska hälsan bibehålls.

Så kan Stripe hjälpa dig

Stripe erbjuder en heltäckande lösning för företag för att integrera tjänster som köp nu, betala senare. Så här kan Stripe hjälpa företag med den här typen av delbetalning:

Omedelbar betalning till företagen

Med Stripes tjänster för köp nu, betala senare erhåller företag full betalning omedelbart, medan kunderna har flexibiliteten att betala över tid. Detta kan vara särskilt fördelaktigt för återförsäljare som säljer varor med högt värde som kunderna kanske inte kan betala för på en gång, samt de som erbjuder billigare produkter och vill sälja större volymer.Kassaintegrering

Kundupplevelsen i kassan är okomplicerad: kunderna väljer alternativet köp nu, betala senare, loggar in på sitt konto hos leverantören, godkänner återbetalningsvillkoren och återvänder sedan till företagets webbplats för att slutföra transaktionen.Flexibla återbetalningsalternativ

Stripe stöder olika leverantörer av köp nu, betala senare, såsom Affirm, Afterpay/Clearpay, Klarna och Zip. Dessa tjänster har flera återbetalningsstrukturer, inklusive räntefria delbetalningar och möjlighet till långfristig finansiering, med alternativ som passar en rad olika köpstorlekar.

Genom att integrera alternativ för köp nu, betala senare hjälper Stripe företag att anpassa sig till kundernas preferenser, vilket potentiellt kan öka konverteringsgraden och kundförvärven. Läs mer om hur Stripe stöder köp nu, betala senare.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.