To offer customers a secure, efficient, and integrated payment experience, businesses—especially those that process sales on multiple channels—must understand the payment industry ecosystem.

An optimized payment experience not only enhances customer satisfaction but also impacts a business’s bottom line and growth prospects. In addition to allowing a business to accept payments in more markets, an efficient payments system can help businesses reduce operational costs and improve cash flow management.

This guide offers insights into the payment industry ecosystem, enabling businesses to develop a better payment strategy that improves the customer experience across every channel.

What’s in this article?

- Payment industry ecosystem

- Payment industry trends and predictions

- How businesses can work with the payment industry ecosystem

Payment industry ecosystem

The payment industry ecosystem is a complex network of stakeholders, technologies, processes, and regulations that facilitate the exchange of monetary value for goods and services. It’s designed to enable secure, efficient, and seamless transactions between customers, businesses, and financial institutions.

Within the payment industry ecosystem, issuing banks, acquiring banks, payment processors, payment gateways, and payment networks collaborate to ensure smooth operations. The ecosystem constantly adapts to and embraces emerging trends, technologies, and customer preferences, like contactless payments, digital wallets, and real-time transactions. Additionally, the ecosystem operates under the guidance of global and regional regulatory bodies that enforce compliance, security, and consumer protection measures to maintain the integrity and stability of the financial system.

Key players

The payment ecosystem consists of several components and participants, including:

Customers

Customers, of course, are individuals or organizations that use payment services to make purchases, pay bills, or transfer funds.Businesses

Businesses accept payments for goods and services, whether online or in-person.Payment networks

Payment networks, also known as card networks or payment schemes, are the systems that facilitate electronic transactions between different parties in the payment ecosystem. They provide the infrastructure, rules, and standards necessary to process payments, such as credit and debit cards or digital wallet transactions. Examples of major payment networks include Visa, Mastercard, American Express, and Discover.Issuing banks

Issuing banks, also known as card issuers, are financial institutions that provide payment cards, such as credit cards and debit cards, to customers. They are responsible for underwriting the credit risk associated with the cards, setting cardholders’ credit limits, and managing cardholders’ accounts. Issuing banks play an important role in the payment ecosystem by authorizing transactions and assuming responsibility for the funds during the payment process.Acquiring banks

Acquiring banks, also known as merchant banks or acquirers, are financial institutions that partner with businesses to process electronic payments, such as credit card and debit card transactions. These banks facilitate the acceptance of electronic payments by establishing and maintaining merchant accounts, settling transactions, and transferring funds from the cardholders’ accounts to the businesses’ accounts. Acquiring banks are important to the payment ecosystem because they ensure that electronic transactions are processed and settled smoothly.Payment processors

Payment processors are companies that manage the electronic payment transaction process on behalf of businesses and their acquiring banks. They handle the technical aspects of authorizing, clearing, and settling transactions between the issuing banks, acquiring banks, and businesses. Payment processors play an important role in the payment ecosystem by enabling businesses to accept various forms of electronic payments, such as credit cards, debit cards, and mobile wallets.Payment gateways

Payment gateways are digital services that transmit payment information between businesses, payment processors, and acquiring banks during an electronic transaction. They act as a bridge between the business website or point-of-sale (POS) system and the payment processor. Payment gateways are an important part of the payment ecosystem: they ensure the secure exchange of sensitive payment data and facilitate the authorization, capture, and settlement of transactions for online and in-person purchases.Merchant services providers (MSPs)

These are companies that provide a range of services to help businesses accept and process electronic payments. MSPs often work closely with acquiring banks and may provide additional services such as payment gateways, POS systems, and fraud protection. Typically, they offer a variety of payment solutions tailored to the needs of different businesses and industries.Independent sales organizations (ISOs)

ISOs are third-party companies that act as intermediaries between businesses and acquiring banks. They are responsible for selling merchant accounts and payment processing services on behalf of acquiring banks or payment processors. ISOs usually have a network of sales agents or resellers who market their services to businesses. They may also provide value-added services such as POS systems, payment gateways, and business management tools. ISOs are regulated by payment networks like Visa and Mastercard and must meet certain compliance standards to maintain their status.Payment facilitators (payfacs)

Payfacs, also known as payment service providers (PSPs), are companies that enable businesses to accept electronic payments without the need to establish a direct relationship with an acquiring bank or a dedicated merchant account. Payfacs aggregate multiple businesses under a single master merchant account, simplifying the onboarding process and reducing costs for businesses. They handle different aspects of payment processing, including transaction authorization, settlement, and fraud management.Regulatory bodies

Within the payment industry ecosystem, regulatory bodies are government agencies and organizations that create and enforce rules and regulations to maintain the integrity, security, and efficiency of the payment industry. Multiple global regulatory bodies influence the payment industry, including the Financial Action Task Force (FATF), Consumer Financial Protection Bureau (CFPB), European Central Bank (ECB), Financial Conduct Authority (FCA), European Banking Authority (EBA), the Network for Greening the Financial System (NGFS), and central banks of different countries. These organizations play a central role in shaping the payment industry by setting standards, enforcing compliance, and ensuring a secure and stable financial ecosystem.

These diverse components work together to enable various types of transactions, such as card-present, card-not-present, and digital wallet transactions. The payment industry ecosystem is constantly adapting, driven by technological advances, changes in customer behavior, and regulatory shifts, leading to the emergence of new payment methods, services, and business models.

How the payment ecosystem works to process payments

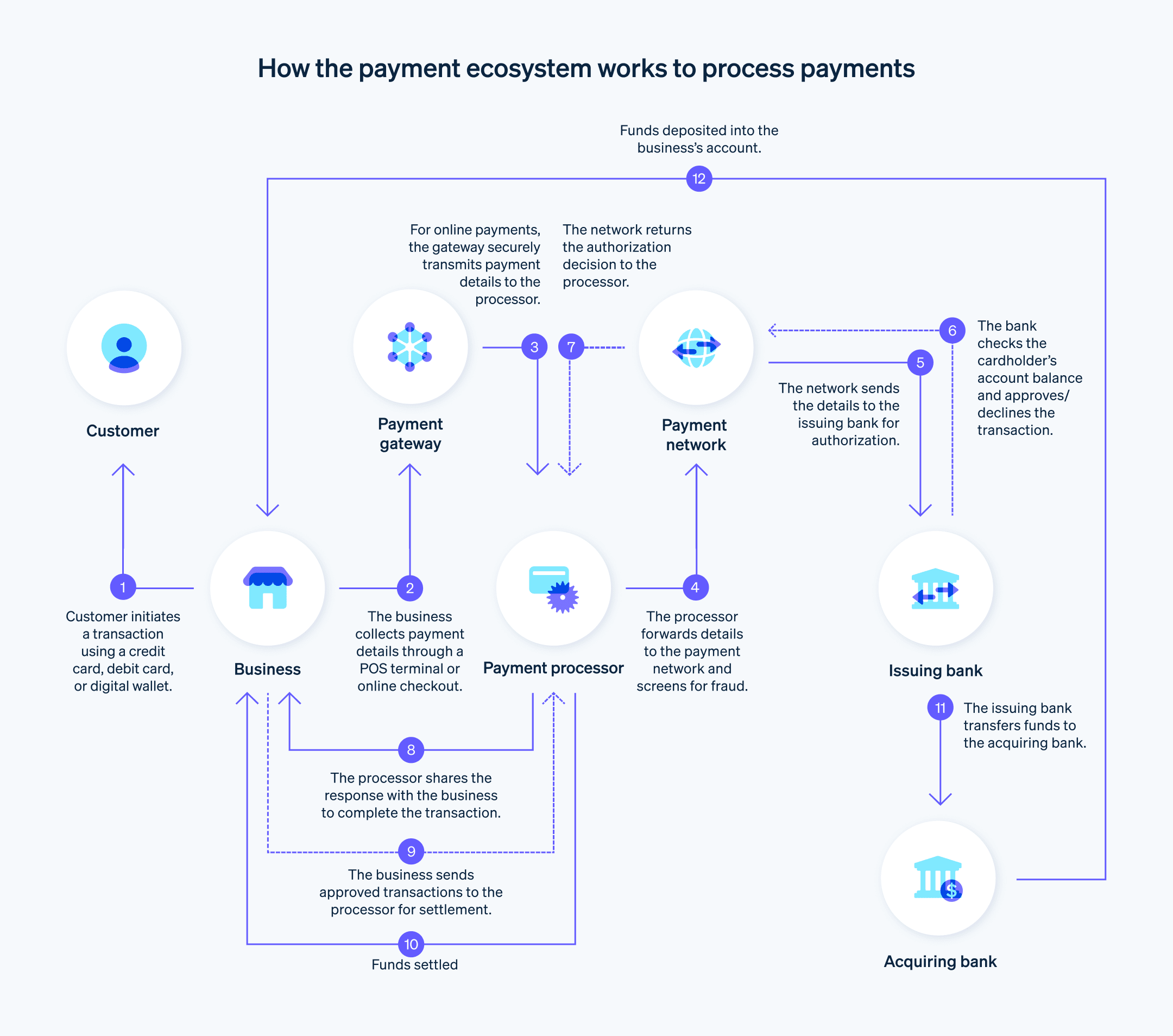

The payment processing ecosystem is a complex web of relationships between players who work together to enable seamless and secure transactions. As the term “ecosystem” suggests, there are interconnected relationships and functions at play. Here’s an overview of how these stakeholders interact during payment processing:

- Customer: The process begins when the customer decides to make a purchase using a payment method such as a credit card, debit card, or digital wallet.

- Business: The customer presents their payment method to the business, either by swiping, dipping, or tapping their card at a physical POS terminal, entering their card details online, or using a digital wallet.

- Payment gateway: In online transactions, the payment gateway securely transmits the payment information from the business’s website or app to the payment processor.

- Payment processor: The payment processor receives the transaction details and forwards them to the relevant payment network (Visa, Mastercard, American Express, etc.) for authorization. The processor also checks for potential fraud and compliance with security standards.

- Payment network: The payment network receives the transaction details from the payment processor and routes them to the issuing bank for authorization.

- Issuing bank: The issuing bank checks the transaction details, such as the cardholder’s account balance. Based on this information, the issuing bank either approves or declines the transaction and sends the decision back to the payment network.

- Payment network: Upon receiving the response from the issuing bank, the payment network forwards the approval or decline message to the payment processor.

- Payment processor: The payment processor receives the response from the payment network and sends it to the business, either directly or through the payment gateway (for online transactions).

- Business: The business receives the authorization response and completes the transaction accordingly. If approved, the business delivers the goods or services to the consumer. The approved transaction is then added to a batch of transactions that will be settled later.

- Settlement: At the end of the day or at a predetermined period, the business sends the batch of approved transactions to the payment processor for settlement. The payment processor forwards the batch to the payment network, which then routes the transactions to the respective issuing banks.

- Issuing bank and acquiring bank: The issuing banks transfer the funds for the approved transactions to the acquiring bank. This process usually takes 1–3 business days. The acquiring bank then deposits the funds, minus any fees, into the business’s account.

Throughout the payment processing journey, each player has a unique role in ensuring that transactions are fast, secure, and compliant according to industry standards and regulations. The collaboration between these players is essential for the payment ecosystem to function smoothly.

Payment industry trends and predictions

Here’s what businesses need to know about the state of the payments industry today and key trends that will influence it going forward:

Competitive landscape

The payments industry is highly competitive, with traditional players like banks and payment networks vying for market share alongside fintech businesses and tech giants. This competition has led to increased innovation and a focus on improving the customer experience. Businesses should use this to their advantage and choose payment partners that offer competitive pricing, powerful technology, and excellent customer support.

Contactless payments

The demand for contactless payments, including tap-to-pay credit cards and digital wallets, has grown significantly in recent years, driven by customers’ desire for convenience, speed, and hygiene. Businesses should continue to invest in contactless payment solutions and cater to customer preferences, thereby enhancing the overall shopping experience.

Retail channel convergence

The lines between online, in-store, and mobile shopping are becoming more blurred as customers have come to expect a seamless experience across all channels. Businesses should focus on creating a unified commerce experience by integrating their sales channels, inventory management, and payment systems. This will not only improve the customer experience but also streamline operations and facilitate data-driven decision-making.

Digital wallets

The adoption of digital wallets, such as Apple Pay, Google Pay, and Samsung Pay, is on the rise, with more customers choosing to use their smartphones for transactions. Businesses should ensure they accept digital wallet payments to cater to this growing customer base and offer a frictionless checkout experience.

Cryptocurrency

The use of cryptocurrencies like Bitcoin, Ethereum, and stablecoins for payments is gaining traction, albeit at a slower pace compared to other trends. As the regulatory environment and public perception of cryptocurrencies evolve, businesses should stay informed and be prepared to accept cryptocurrencies as a form of payment, especially if their customers are particularly tech-savvy or international.

Biometric authentication

Increasingly, biometric authentication methods, including fingerprint scans, facial recognition, and voice recognition, are being used for payment authorization. These technologies enhance security and reduce the risk of fraud. Businesses should consider adopting biometric authentication for in-person transactions and explore its potential applications for online and mobile payments.

Internet of Things (IoT) payments

As IoT devices become more prevalent, new payment opportunities are emerging, such as connected cars that enable in-car payments or smart appliances that can order and pay for items automatically. Businesses should explore relevant IoT payment opportunities and be prepared to embrace this emerging trend.

Artificial intelligence (AI) and machine learning

In the payments industry, AI and machine learning are widely used for fraud detection, risk management, and personalized customer experiences. Businesses should use these technologies to enhance their payment processes, reduce fraud, and better understand customer behavior.

Cross-border payments and remittances

The demand for efficient, low-cost cross-border payments is growing as ecommerce and global trade expand. Businesses should work with payment processors that support cross-border transactions and understand the unique challenges and regulatory requirements of international payments.

Real-time payments

Real-time payment systems that enable instant fund transfers are becoming more common, driven by customer demand for speed and convenience. Businesses should be aware of real-time payment initiatives in their markets and consider implementing them to improve the customer experience and streamline their cash flow.

How businesses can work with the payment industry ecosystem

Businesses that want to use the payment ecosystem to their full advantage should consider the following steps:

Assess business needs and goals

Start by analyzing your business’s unique requirements, such as target customer base, sales channels, average transaction value, and expected payment volume. Consider your growth plans and potential expansion into new markets or channels.Research payment options

Evaluate different payment methods (e.g., credit cards, debit cards, mobile wallets, bank transfers) and identify the ones most relevant to your customer base and business model. If you plan to serve international markets, consider offering multiple currencies and cross-border payment capabilities.Choose a merchant services provider

Look for a comprehensive merchant services provider that offers a wide range of interlocking payment solutions. A provider like Stripe can streamline payments and provide a seamless customer experience while reducing redundancies.Integration and customization

Stripe offers APIs and developer tools that make it easy to integrate payment processing solutions into your existing website, mobile app, and POS system. This gives you the power to customize the payment experience to match your brand and offer a consistent user interface across all channels.Fraud protection

By working with a provider that prioritizes fraud protection, you can ensure the security of your customers’ data and maintain their trust. For example, Stripe Radar’s advanced machine learning algorithms and security features help protect your business from fraudulent transactions, reducing chargebacks and associated costs.Scalability and flexibility

As your business grows, your payment processing needs may change, so look for a payment processing provider that is equipped to support you now and in the future. Stripe’s suite of payment solutions are conceived to scale with your business, offering additional features and services as needed, such as invoicing, subscription management, and marketplace payment facilitation.Reporting and analytics

Data-backed learnings are at the heart of any solid strategy, so you want to find a provider that offers comprehensive reporting and analytics features to help you monitor your payment performance, identify trends, and make data-driven decisions to optimize your payment strategy.Customer support

Ensure that your chosen merchant services provider offers reliable and responsive customer support to address any issues or concerns that may arise during the integration process or while using their services.Regulatory compliance

Different merchant services providers will offer varying levels of support when it comes to compliance considerations, so opt for a provider that gives you what you need. Stripe’s payment solutions are engineered to support regulatory compliance, such as Payment Card Industry Data Security Standard (PCI DSS) and General Data Protection Regulation (GDPR), which helps reduce the burden of managing these complex requirements internally.Cost analysis

Compare the pricing and fee structures of different merchant services providers to find one that aligns with your business’s budget and transaction volume. For information about Stripe’s pricing model, go here.

By working with a comprehensive merchant services provider like Stripe, businesses can create an integrated unified commerce experience that streamlines payments, reduces redundancies, and protects against fraud. This approach supports a wide range of use cases for growing businesses, allowing them to efficiently accept and process customer payments across channels and markets.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.