Installment payments spread the cost of a good or service over a period of time. With this method, a total sum owed is divided into smaller amounts that the buyer pays on a set schedule, instead of paying a single, lump sum. This payment method is often used for larger purchases, giving individuals and businesses more control over aligning payments with their financial planning and cash management goals. The payment schedule is agreed upon by the seller and the buyer at the time of purchase, and its interval is variable. This type of payment plan may include interest and other charges, depending on the terms set by the lender or business.

In this article, we’ll cover what businesses need to know about installment payments: what they are, how they work, how they interact with other customer payment trends, and how to create a thoughtful strategy for implementing and using installment payments for your specific business needs.

What’s in this article?

- Are installment payments and buy now, pay later (BNPL) the same thing?

- How do installment payments work?

- When should businesses offer installment payments?

- Advantages and challenges of installment payments

- Overview of popular installment payment services

- How installment payments can integrate into your business

- Installment payment best practices for businesses

- How Stripe can help

Are installment payments and buy now, pay later (BNPL) the same thing?

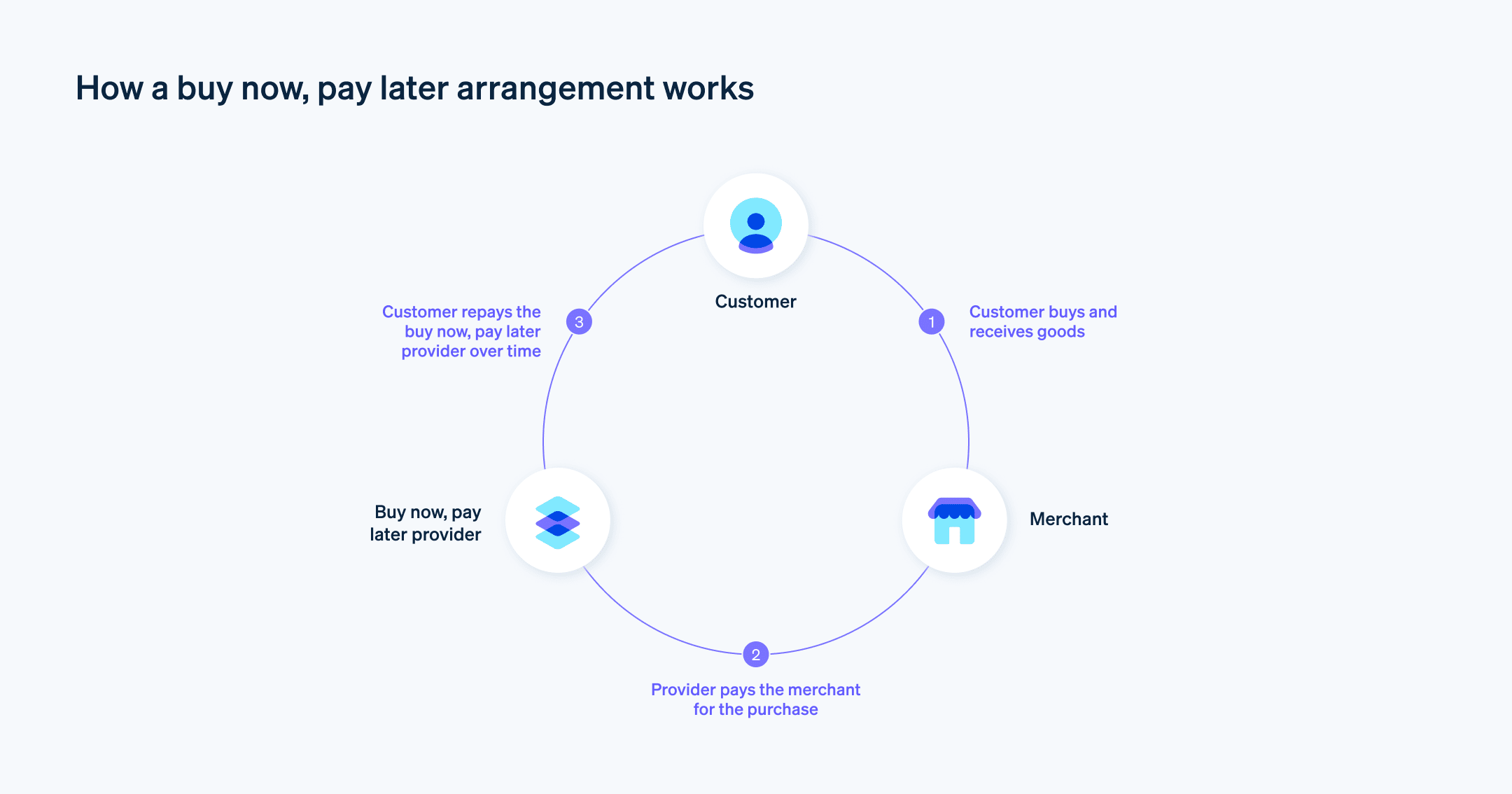

Installment payments allow customers to pay for the total sum of a product or service through multiple payments, which are scheduled when the purchase is made and usually include an initial down payment. This method operates on the premise of deferred payment, letting customers acquire products or services immediately while distributing their payment across multiple future dates. This financial flexibility is also at the heart of the buy now, pay later (BNPL) model, which is an extension of the installment concept, but it relies more heavily on the deferred payment aspect. BNPL typically involves no up-front costs and is designed for quick and easy integration into ecommerce platforms. Over time, customers fulfill their payment obligations in predetermined, often interest-free installments. This simplifies customers’ personal finance management and also empowers them to make purchases without immediate financial strain.

BNPL is particularly appealing to customers who value instant gratification but are also budget-conscious. And for businesses, including BNPL as a payment method can expand their reach, in addition to increasing sales volumes and customer loyalty. In 2022, the global BNPL market was estimated at over $6.2 billion USD. The key is having a clear agreement up front and not charging hidden fees, which satisfies customers’ desires for transparency and control in their financial engagement.

Both installment payments and BNPL are not just financial mechanisms—they’re also strategies that can help businesses grow, tap into new market segments, and build customer loyalty through flexible financial solutions.

How do installment payments work?

Installment payments break down the total cost of a transaction into more manageable, scheduled payments over time. This method is favorable for both businesses and customers in facilitating access to goods or services that might be financially out of reach if a single payment was the only option. Here’s how it works:

Step-by-step breakdown

Agreement on terms

The foundation of installment payments is the agreement between the buyer and seller on the payment structure. This includes the total purchase price, the schedule of payments, and any interest or fees. This stage is about transparency and setting expectations for both parties.Down payment

As a commitment to the purchase, buyers often make an initial payment. This down payment reduces the overall balance to be paid in installments and can influence the buyer’s installment amounts and interest applied over time.Scheduled payments

Following the down payment, the buyer adheres to a regular payment schedule. Each installment lessens the remaining balance, and when interest is applied, it’s divided across the installments to make sure the full cost of borrowing is covered by the end of the term.Interest and additional fees

Interest compensates the seller for the delay of the full payment and reflects the time value of money. Additional fees may be applied for processing or as penalties for late payments, which incentivizes timely adherence to the payment schedule.Completion of payments

The cycle concludes when the buyer has made all the installments, fulfilling their financial obligation. The asset or service is then fully paid off, transferring full ownership or finalizing the service agreement.Adherence to contractual obligations

Throughout the installment process, maintaining the agreed-upon terms is imperative for both parties. Nonadherence can lead to financial penalties or legal implications.

When should businesses offer installment payments?

Businesses should consider installment payments when they recognize a match between what they sell and their customers’ purchasing behavior. If their products or services carry a substantial price tag—one that customers may not comfortably pay all at once—installment payments can make these more accessible.

The decision to adopt installment agreements as a payment option can be influenced by several factors, including:

Business model and pricing structure

For businesses with high-value items or services (such as electronics, furniture, or educational courses), installment payments can make these more approachable by reducing the immediate financial burden on the customer.Customer base

If a business’s target market includes younger demographics or those with less static purchasing power, installment payments can match their financial habits, which often favor flexibility.Ecommerce and online presence

Because the digital checkout process can seamlessly integrate installment and/or BNPL options—meeting the customer at their moment of decision—online businesses may especially benefit from this method.Market competitiveness

In industries where the market is saturated and competition is intense, offering installment payments can differentiate a business and provide a competitive edge that may influence a customer’s choice.Subscription services

For businesses operating on subscription models, particularly where up-front costs are significant, allowing installment payments for the initial sign-up fee can reduce barriers to entry and increase subscriptions.Luxury goods and services

Companies selling premium products often find that installment payments can expand their customer base beyond those who can afford to pay in full, tapping into a broader market.

The ideal timing for implementing installment payments takes several factors into account:

Product launch

When launching a new, high-value product, installment options can entice early adopters who are interested but might be hesitant about the cost.Market expansion

As a business looks to reach broader markets, especially those with varying economic backgrounds, installment payments can be a decisive factor for customers on the edge of a purchasing decision.Seasonal peaks

During times of traditionally high spending, such as holiday seasons, installment payments can encourage customers to make larger purchases without the immediate financial hit.Consumer demand

Pay attention to consumer trends. A surge in demand for BNPL services indicates that customers are looking for more flexibility in how they manage their spending. If your competitors offer BNPL, it may be time to consider doing the same in order to stay relevant and competitive.Sales plateaus or declines

If a business notices a stagnation or decline in sales, particularly of higher-priced items, installment payments can reinvigorate interest and increase affordability for potential buyers.

It’s ultimately about understanding what your customers want and what makes the most sense for your business based on what you’re selling and who you’re selling it to. Providing installment payments at a time when customers are actively seeking out BNPL options can support both customer satisfaction and business growth. But if it’s not relevant to your particular business—say, if you sell $5 candles—then it’s probably not worth the operational effort involved.

Advantages and challenges of installment payments

For businesses considering installment payments, the blend of increased accessibility for customers and the potential for increased revenue must be weighed against the need for more sophisticated financial tracking and risk management. Careful implementation—perhaps starting with a pilot program or a third-party partnership—can test the waters and provide insights on how installment payments might fit into your existing business model.

When thinking through your options, here are some possible upsides and risks to be aware of:

Advantages

Increased sales volume

By breaking down the cost barrier, businesses open the door to customers who might otherwise walk away from a pricey purchase. The option to spread out payments can lead to larger average order values and more frequent purchases, as customers are more willing to buy immediately rather than save over time.Broader market reach

Installment plans are not just for those who can’t afford to pay in full up front; they also appeal to savvy spenders who prefer to manage their monthly budgets. This can extend a business’s reach into markets that prioritize financial flexibility. According to Juniper Research, the number of global BNPL users is projected to surpass 900 million by 2027.Improved cash flow management for customers

Customers can match payment outflows with their income inflows, making high-value items more attainable without disrupting their financial stability. This may also lead to stronger loyalty as customers appreciate being accommodated.

Challenges

Complexity in management

Allowing installment payments means entering into a minifinancing operation. Businesses must keep track of multiple payment streams, which can complicate accounting processes and require more robust systems and procedures.Risk of default

Not every customer who chooses to pay in installments will complete their payments. Each defaulted payment is a direct hit to the expected revenue, which can affect financial forecasting and overall business stability.Administrative costs

There are costs associated with setting up and maintaining the infrastructure needed to manage installment payments—from investing in new software to allocating human resources for oversight on the process.

Overview of popular installment payment services

The cohort of installment payment service providers is growing, and each has distinct features that cater to different aspects of the customer and business experience. Here are some of the leaders in this space:

Klarna

Klarna has a range of flexible payment options—some of which depend on location—including immediate payment, pay after delivery, and installment plans. Its model is designed to be as straightforward as possible, with a focus on a smooth user experience. For customers, Klarna’s market appeal lies in its user-friendly app and the ability to postpone the full payment without interest or fees, provided they meet the payment deadlines. Businesses benefit from Klarna’s appeal to a demographic that values transparent and manageable payment methods.Afterpay/Clearpay

Afterpay—also known as Clearpay in the UK—offers the option to break down a transaction into four equal installments paid over six weeks, and it also has other longer-term financing options (depending on location). The service entices customers with its no-interest approach, provided payments are made on time. For retailers, Afterpay presents an opportunity to attract customers who might be hesitant to make larger purchases by offering a pay-over-time solution that integrates with their lifestyle and spending habits.Affirm

Affirm differentiates itself by providing longer-term financing options, which can range from one month to three years. Its interest rates vary based on credit, financing option, and purchase amount, but they are made clear to the customer up front. This transparency, along with the option for longer payment periods, makes Affirm attractive to customers planning substantial purchases. From a business’s perspective, Affirm can help to close sales that have a higher average order value by providing customers with a flexible and predetermined payment schedule.

These services are reshaping how customers approach purchases, creating a bridge between desire and affordability. As businesses integrate these services, they not only provide value to their customers, but they also use these platforms to secure more sales and enhance the shopping experience. Each service’s features—from payment schedules to interest rates—should be matched with the business’s products and customer base to find the best fit.

How installment payments can integrate into your business

Building installment payments into your business operations can enhance your service and support customers’ financial preferences—as long as you tackle it in the right way. Here’s how you can go about it in a structured manner:

Select a service provider

Choose a payment service provider that makes sense with your business size, customer base, and product range. Providers such as Stripe have comprehensive solutions that can fit various business models and include support for installment payments. It’s important to look for a provider with a straightforward application programming interface (API) and reliable support to ease the integration process. The provider should also create a simple experience for your customers, from checkout to the final installment payment.Implement technical integration

Work with your IT team or the service provider’s technical support to integrate the installment payment option into your existing payment gateway. The integration process involves setting up the installment payment method, updating the checkout interface to include this option, and making sure your accounting system can record installment payments.Make operational considerations

Train your team to manage installment payment processes, including customer inquiries and payment tracking. This involves understanding the nuances of installment payments—from handling initial customer queries to managing late or missed payments. Having a well-informed team provides your customers with a resource for assistance, which in turn can lead to better experiences for them and increased trust in your business.Provide customer communication

Clearly communicate to your customers about the new payment option, outlining the benefits and any terms that apply. Transparency is important; your marketing and customer service communications should clearly describe how installment payments work, any interest or fees involved, and what customers can expect in terms of payment schedules.Maintain compliance and security

Confirm that your installment payment system is compliant with financial regulations and that customer data is securely handled. Adhering to financial regulations and maintaining high security standards for customer data is not just a legal obligation—it’s also an important way to build trust with customers. This aspect should be a top priority in the integration process.

By following these steps, businesses can integrate installment payments in a way that complements their operations, meets customer needs, and abides by regulatory standards.

Installment payment best practices for businesses

Incorporating installment agreements into a business’s payment options requires thoughtful execution. Here’s a rundown of best practices to ensure these agreements are beneficial for both the customer and the business:

Transparency in terms

All conditions of the installment plan should be plainly stated up front. Customers need to understand the payment schedule, any interest or fees, and what happens if a payment is late or missed. This clarity can build trust and prevent future misunderstandings.Intuitive processes

Complex procedures can dissuade use, so keeping the process straightforward is key. The easier it is for a customer to set up and understand their payment plan, the more likely they are to complete their purchase.Customer service

Providing excellent support for installment plans is necessary. Customers may have questions or run into issues with their payments, and quick, helpful responses can improve their overall experience and perception of the business.Flexible payment options

Flexibility can be a competitive edge. Giving the option of installment plans with different frequencies and interest rates caters to different customer needs.Robust infrastructure

The business should confirm that its systems can handle installment payments. This means integrating the right technology to manage and track payments over time and training staff to deal with installment-specific queries.Regulatory compliance

It’s imperative to comply with all financial regulations related to credit and financing. This includes fair advertising, clear terms and conditions, and privacy laws concerning customer data.Financial health checks

Before implementing installment payments, a business should assess its financial health to make sure it can afford the delayed revenue stream, and that all relevant stakeholders know how installment sales will impact revenue recognition and accounting.

By adhering to these best practices, businesses can create installment agreements that are beneficial for both parties, leading to increased sales and customer loyalty while maintaining operational integrity and financial health.

How Stripe can help

Stripe has a comprehensive solution for businesses to integrate BNPL services. Here’s how Stripe can assist businesses with this type of installment payment:

Immediate payment to businesses

With Stripe’s BNPL services, businesses receive full payment immediately, while customers have the flexibility to pay over time. This can be especially beneficial for retailers that sell high-value items that customers may not be able to pay for all at once, as well as those that offer less expensive products and want to sell larger volumes.Checkout integration

The customer experience at checkout is straightforward: customers select the BNPL option, sign in to their account with the provider, agree to the repayment terms, and then return to the business’s website to complete the transaction.Flexible repayment options

Stripe supports various BNPL providers such as Affirm, Afterpay/Clearpay, Klarna, and Zip. These services have multiple repayment structures, including interest-free installments and the possibility of longer-term financing—with options suitable for a range of purchase sizes.

By integrating BNPL options, Stripe helps businesses adapt to customers’ preferences, potentially boosting conversion rates and customer acquisition. Learn more about how Stripe supports BNPL.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.