In the context of payment processing, a void transaction cancels a transaction before it is finalized or settled. When a transaction is voided, it nullifies the operation and does not charge the cardholder’s account.

Below, we’ll cover what businesses need to know about void transactions: why they happen, how they affect accounting practices, and how to handle them effectively.

What’s in this article?

- Void transactions vs. refunds

- Why void transactions happen

- How void transactions affect accounting

- Tips for handling void transactions effectively

- Void transaction rights and protections

Void transactions vs. refunds

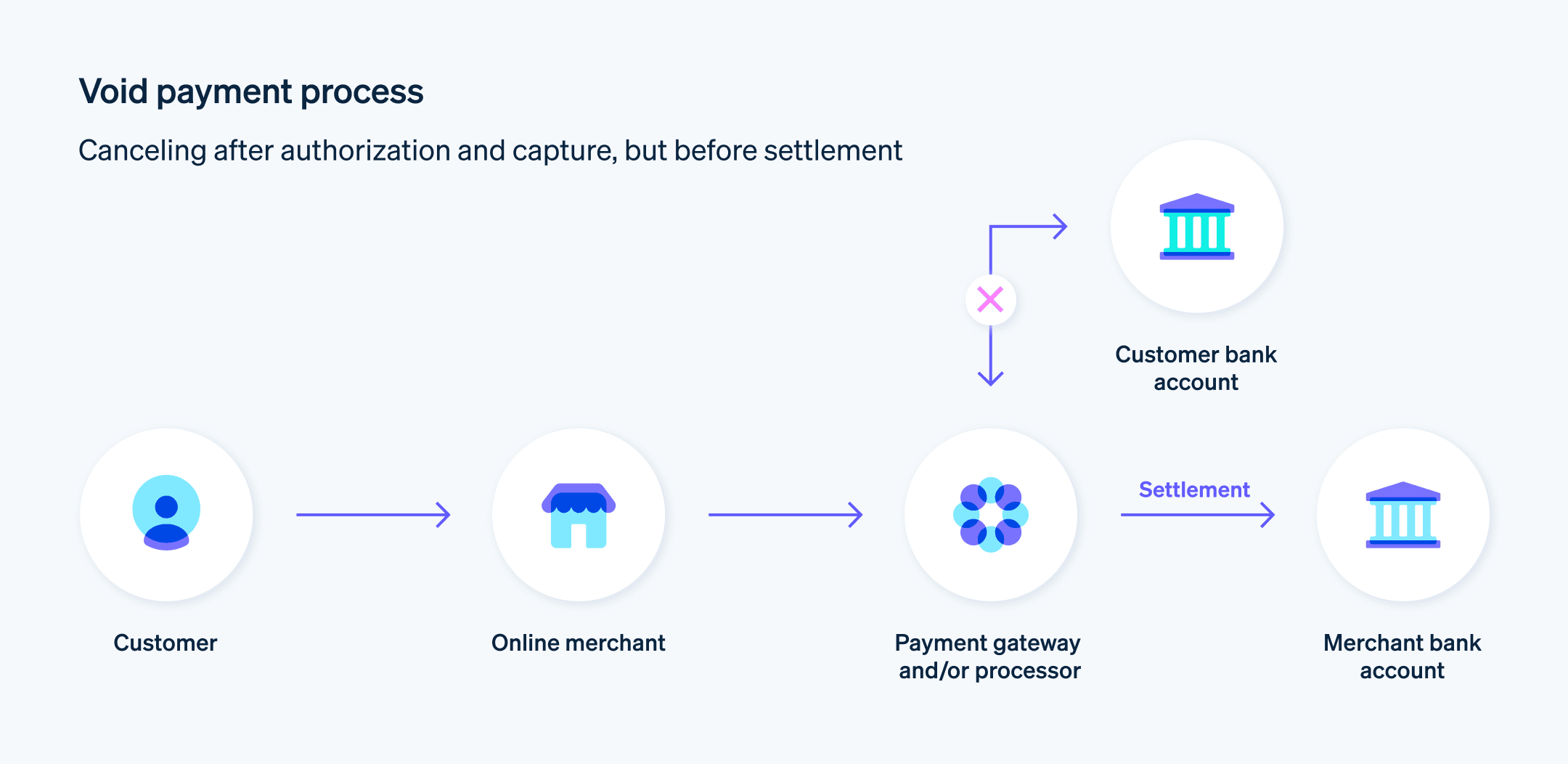

Void transactions and refunds involve reversing a customer sale, but they differ in timing, effects on customer accounts, and merchant processing requirements. Voids are typically simpler and less time-consuming for both parties because they prevent the transaction from completing in the first place; refunds, on the other hand, require more processing time and effort, affecting the customer’s available balance and the business’s revenue and accounting.

Differences between void transactions and refunds are outlined below.

Void transactions

A void transaction cancels a credit or debit card transaction before the funds have been transferred from the customer’s account to the business’s account.

Timing: Voiding is typically done shortly after the transaction is initiated, often within the same business day. Voiding must be done before the transaction is batch processed or settled and will typically disappear from a customer’s bank statement within 24 hours.

Customer account: When a transaction is voided, the customer’s account is not charged. If the transaction amount was initially held as a pending transaction, that hold is released.

Merchant processing: For the business, a void transaction means the funds will not be received and the sale will not be included in the batch of transactions that are processed for settlement.

Records: The transaction might appear on the customer’s account as pending but will drop off. Businesses typically have records of voided transactions reflected separately from completed sales.

Refunds

A refund reverses a transaction after it was completed. The funds that were transferred from the customer’s account to the business’s account are returned to the customer’s account.

Timing: Refunds can happen days, weeks, or even months after the original transaction. The process is not immediate and can take several business days to reflect in the customer’s account.

Customer account: The customer’s account is credited with the amount of the transaction once the refund is processed, reversing the original charge.

Merchant processing: For businesses, issuing a refund means sending the funds back to the customer’s account. Businesses must adjust their accounting records to reflect the return of funds.

Records: Refunds will appear on the customer’s statement as a credit from the business. Businesses must keep detailed records of refunds for accounting reconciliation purposes.

Why void transactions happen

Void transactions occur in various scenarios but are primarily seen in retail and service industries, where payments are processed immediately. Common void transaction scenarios are outlined below.

Entry errors: If a cashier or salesperson enters the wrong amount or selects the wrong product, the transaction must be voided so a customer is not charged the incorrect amount.

Duplicate transactions: Sometimes, a transaction might be processed more than once because of a technical glitch or human error. Voiding the duplicate transaction ensures the customer is not charged multiple times for the same purchase.

Customer decisions: A customer might change their mind about making a purchase immediately after the transaction. The business can void the transaction to cancel the sale and prevent the customer from being charged. The customer might also change their mind about their payment method; if the transaction has not been settled, the original transaction can be voided so the customer can pay with their preferred method.

Technical issues: Point-of-sale (POS) system glitches or errors can lead to incorrect transactions that need to be voided.

Fraud prevention: If a business suspects a transaction is fraudulent, they might void the transaction to prevent financial loss and protect the customer’s account.

Authorization holds: In industries such as hospitality or car rentals, transactions are often preauthorized to ensure fund availability. If the final transaction amount is different or the service is canceled, the preauthorization charge might be voided.

Unavailable product: If a product is sold that turns out to be out of stock or unavailable, the transaction might be voided.

Policy requirements: Certain industries have specific compliance standards or store policies that might necessitate voiding transactions under particular circumstances, such as age-restricted sales if the age requirement isn’t met.

How void transactions affect accounting

Void transactions should be included in a business’s accounting in the following ways.

Transaction records: Voided transactions should be included in the accounting system to ensure all financial activities are transparently and accurately reported.

Sales reconciliation: Despite not contributing to revenue, voided transactions should be accounted for during sales reconciliation to ensure sales figures match the money received.

Inventory management: In retail, a void transaction should be noted in inventory records to reflect that the item from the voided sale is still in stock.

Tax reporting: Voided transactions do not contribute to taxable income. Those transactions must be differentiated from completed sales to ensure accurate tax reporting.

Financial statements: Void transactions must be recorded to avoid inflated sales or accounts receivable figures, ensuring financial reports accurately reflect the business’s financial position and performance.

Audit trails: Auditors might examine void transaction records to ensure they were legitimate and not used to conceal inappropriate financial practices.

Cash flow: Void transactions do not affect cash flow and should not be included in cash flow calculations.

Customer records: Accurately recording void transactions is important for maintaining customer trust.

Tips for handling void transactions effectively

Understand your systems: Familiarize yourself with your POS or payment processing system’s features.

Act quickly: Act promptly to void a transaction before it gets batch-processed. This prevents the need for a more complicated refund process.

Communicate with customers: Communicate clearly with customers about the void process to maintain good customer relations. Make sure they understand the transaction will be canceled and what they should expect on their bank statements. Consider following up with customers after a void transaction to confirm they see the correction on their end.

Train your staff: Regularly train staff on the correct procedure for voiding transactions—how to complete it and why it’s important.

Document void procedures: Have a well-documented process for void transactions to which staff can refer, including how to void the transaction, how to record the void transaction, and how to report the void transaction internally.

Maintain records: Maintain detailed records of all void transactions, including who voided the transaction and why. This is useful for auditing purposes and for resolving disputes.

Set internal controls: Implement checks and balances to prevent misuse of the void function. This might include requiring managerial approval for voids above a certain amount.

Reconcile with financial records: Regularly reconcile voided transactions with your financial records to ensure accuracy in your reporting and to catch discrepancies early.

Use available technology: Consider using available technology or software features to simplify or automate the voiding process for greater speed and accuracy and lower administrative burdens.

Review for process improvements: Periodically review voided transactions as a part of your business’s financial analysis. Identifying patterns or trends can help show where more training might be needed or flag potential issues with your sales process.

Void transaction rights and protections

Exact rights related to void transactions vary depending on the type of transaction (e.g., credit card, debit card, ACH) and the laws of your jurisdiction. Rights that typically apply are outlined below for businesses and customers.

Business rights and protections

Businesses have the right to void transactions under the following circumstances.

Mutual agreement: Both parties agree to cancel an order.

Pricing error: The advertised price was incorrect.

Out of stock: The purchased item is unavailable.

Suspected fraud: There are red flags indicating fraudulent activity.

Consumer rights and protections

Customers have the right to request voided transactions under the following circumstances.

Unauthorized or incorrect charges: Customers have the right to dispute any transaction they believe is unauthorized or erroneous. This can trigger a voiding process if initiated within the timeframe allowed (for credit cards, this is usually 60 days).

Suspected or confirmed fraud: Laws such as the Fair Credit Billing Act in the US protect customers from fraudulent credit card charges. If a transaction is fraudulent, the customer has the right to have it voided and not to be held liable.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.