The OHG (from the German “offene Handelsgesellschaft”) is a suitable legal form for entrepreneurs starting a business with like-minded partners. It provides many benefits but also presents certain challenges.

This article explains what an OHG is, who it is suitable for, and the conditions required to set it up. We’ll also cover how liability is regulated in an OHG, the step-by-step process of its formation, and the advantages this legal form offers.

What’s in this article?

- What is an OHG?

- Who is the formation of an OHG suitable for?

- What conditions must be met to form an OHG?

- How is liability regulated in an OHG?

- How do you form an OHG?

- What are the advantages of an OHG?

What is an OHG?

According to Section 105 of the HGB (German Commercial Code), a general partnership, or OHG for short, is a company established to operate a commercial business under a shared name.

The OHG is a partnership formed by the union of at least two individuals or legal entities. The partners of an OHG have equal rights and share the responsibilities and obligations that come with this legal form. These responsibilities include, among other things, personal and unlimited liability for the business’s debts.

Who is the formation of an OHG suitable for?

Forming a general partnership is ideal for entrepreneurs who want to work together as partners. With its clear legal structure and ability to make decisions together, the OHG is a suitable form for this purpose.

Because the partners share responsibility and decision-making authority, the OHG relies on close cooperation and mutual trust. In these situations, the OHG can be an excellent choice for long-term alliance and enduring business relationships.

However, it’s important that all partners are willing to participate in managing the business. Ideally, their diverse skills and experience will complement each other, resulting in balanced and effective management.

The OHG is also well-suited for small and medium-sized businesses that need to make quick decisions and adjustments. The partners of an OHG enjoy considerable flexibility in organizing the business processes, as there are no specific legal requirements for management. This allows the business to respond quickly to market changes. The distribution of profits and losses can also be arranged flexibly by specifying it in the articles of association.

By definition, the OHG is designed to operate a commercial business. It is particularly well-suited for commercial activities that comply with the requirements of the HGB. This includes, for example, wholesale and retail businesses, banks and insurance companies, manufacturing firms, and commercial craft enterprises—provided their activities do not require a commercial operation. However, freelance professionals cannot form an OHG. The same applies to small businesses, which are not classified as merchants under the HGB.

Since forming a general partnership doesn’t require any minimum capital, it’s especially appealing to entrepreneurs with limited financial resources. However, they must be willing to accept the risk of personal liability.

What conditions must be met to form an OHG?

Several legal and formal requirements must be met to establish a general partnership:

- At least two partners: An OHG must be established by at least two individuals or legal entities. There is no maximum limit on the number of partners.

- Commercial trade as the purpose of the business: An OHG must conduct a commercial business. A commercial business is one that, due to its nature and size, requires a commercially organized operation. The OHG is, therefore, designed for traders who conduct operations as defined by the HGB.

- Business name must include “OHG”: The business’s name must have the term “OHG” or “offene Handelsgesellschaft,” to indicate the legal form to the public. The company name must also comply with the legal requirements of the HGB, meaning it must be suitable for identifying the business and be distinctive.

- Partnership agreement: Forming an OHG requires creating a partnership agreement. This outlines the rights and obligations of the partners, management, profit and loss distribution, and the representation of the company. Although not legally necessary, it is advisable to put the articles of association in writing.

- Sufficient capital: Unlike corporations such as the limited liability company (GmbH), the OHG has no minimum capital requirements. However, the partners must contribute enough capital to ensure the business can function effectively. The amount and type of contributions are detailed in the articles of association.

- Business registration: Since the OHG runs a commercial business, it must be registered with the relevant trade office. This registration must be completed before starting the business activity.

- Entry in the Commercial Register: The OHG only gains its legal capacity once it is registered in the Commercial Register. This is a mandatory step for the company to be established and recognized as a legal entity.

- Tax registration: The OHG must register with the tax office after formation. This includes registration for income tax, trade tax, and value-added tax (VAT). As a partnership, the OHG is fiscally transparent, meaning that its profits are directly attributed to the partners and taxed individually. If you want to manage your bookkeeping quickly and accurately, explore Stripe Revenue Recognition. Revenue Recognition automates the posting of transactions and invoicing terms regularly, streamlining and enhancing your revenue accounting.

How is liability regulated in an OHG?

Liability in an OHG is a key characteristic of this legal form and differs markedly from other kinds of businesses, such as a GmbH or a stock corporation. The following principles apply:

- Unlimited liability: All partners in an OHG have unlimited liability for the business’s debts. This means they are liable not just for their contributed capital but also for all their personal assets. Liability is not restricted to the business’s assets.

- Personal liability: The partners of an OHG are personally liable for the business’s debts. If the company’s assets are insufficient to cover liabilities, creditors can pursue the individual partners directly to recover their claims.

- Joint and several liability: In an OHG, liability is joint and several. All partners are responsible for the full extent of the OHG’s debts, regardless of their share in the company’s assets. Creditors can hold any partner responsible for the entire debt, but they can seek compensation from the other partners internally. In principle, the following applies: limiting liability toward third parties cannot be done. Agreements that limit liability are solely relevant to the internal relationship between the partners.

- Liability after leaving the business: Partners remain liable for debts incurred during their membership in the OHG, even after they leave the company. Section 137 of the HGB states that this residual liability lasts five years after leaving the company.

- Residual liability in the case of transformation: If the OHG is transformed into a different company form, the former partners remain liable for debts incurred before the transformation unless agreed otherwise.

- Liability on joining the company: When new partners join an existing OHG, they become responsible for any company debts that occurred before their arrival. They then assume full liability for the OHG’s existing debts, regardless of when they were incurred.

How do you form an OHG?

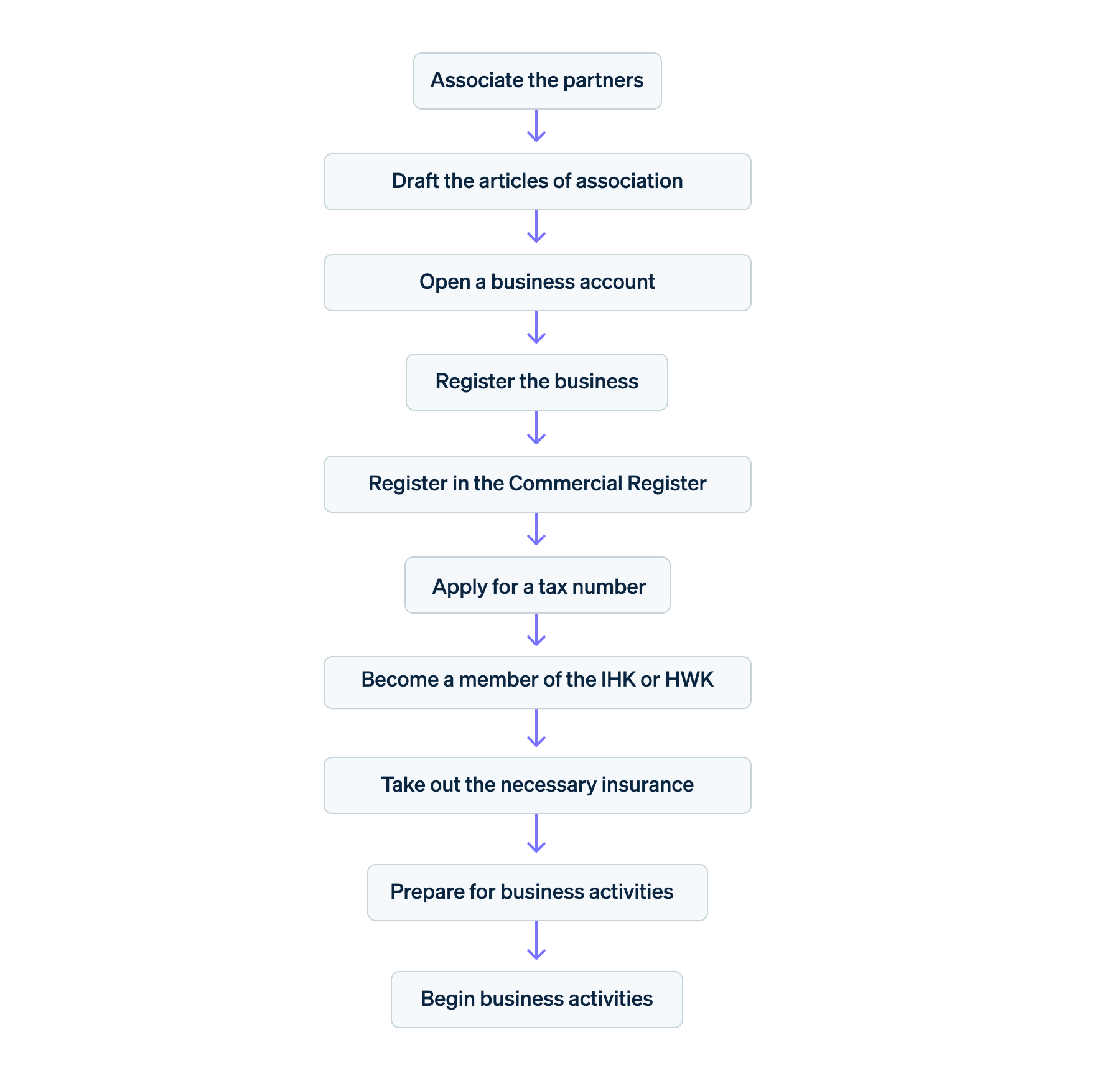

Forming a general partnership involves several steps, covering both legal and organizational aspects. Here is an overview of the key steps involved in establishing one:

- Associate the partners: Since forming a general partnership requires at least two people, the first step is to find a suitable partner. The future partners need to agree on the company’s purpose, as well as the distribution of responsibilities and profits.

- Draft the articles of association: The partnership agreement is the key document for the OHG, outlining the rights and obligations of the partners. It defines, among other things, the company’s name, registered office and purpose, the partners’ contributions, the management and representation rules, the distribution of profits and losses, the conditions for admitting new partners, and the conditions for dissolving the OHG and withdrawing partners.

- Open a business account: Although not legally required, opening a business account for the OHG to separate business and personal finances is advisable.

- Register the business: Since an OHG operates as a commercial enterprise, it must be registered with the appropriate trade office. The costs for this vary depending on the municipality or city. After successful registration, the trade office automatically notifies the tax office, the Chamber of Commerce and Industry (IHK) or the Chamber of Crafts (HWK), and the employers’ liability insurance association.

- Register in the Commercial Register: The OHG must be registered in the Commercial Register at the appropriate local court. The application for registration must be submitted by all partners and needs to be notarized. The OHG gains its legal capacity and can officially operate as a business exclusively after entering in the Commercial Register.

- Apply for a tax number: The trade office notifies the tax office, which sends the OHG a questionnaire for tax registration. Once the questionnaire is completed, a company tax number can be obtained from the tax office.

- Become a member of the IHK or HWK: Once the OHG is registered for tax purposes, the relevant IHK or HWK will reach out to you. Membership in one of the two chambers is compulsory. The partners need to, therefore, complete the necessary documents to establish the OHG as soon as possible.

- Take out the required insurance: Given that OHG partners hold personal liability, it is advisable for them to obtain insurance to cover operational risks. For example, business or professional liability insurance can be beneficial.

- Prepare for business activities: All important operational preparations need to be completed before starting business activities. This includes establishing business premises, purchasing equipment, and hiring employees.

- Begin business activities: Once all legal and organizational requirements have been fulfilled, the OHG can begin its business activities.

Forming an OHG: Step by step

What are the advantages of an OHG?

Forming an OHG provides entrepreneurs with several benefits. Here’s a quick look at some of the main benefits:

- Ideal for small and midsized companies

- Straightforward and inexpensive formation with no minimum capital requirement

- Both individuals and legal entities can be partners

- Partnership-based management and equal decision-making authority

- High flexibility in internal organization

- Quick decision-making

- Simple admission of new partners

- Strong reputation with business partners due to partners’ personal liability

You can explore other potential legal forms for founders in our resource portal.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.