Self-employment in Germany falls into two categories: freelancer professions and trades. Some occupations can easily be classified as either freelance professions or trades, but the situation can be more complicated, particularly with newer professions in the fields of IT, marketing, or coaching. In this article, we’ll look at questions regarding freelance professions, trades, and self-employment.

What’s in this article?

- What is a trade?

- What is a freelance profession?

- What is the difference between a freelance professional and a trader?

- What is a combined activity?

- Freelance professional or trader: The pros and cons

- How do you register as a trader?

- How do you register as a freelance professional?

What is a trade?

Anyone wishing to work in a self-employed capacity in fields of industry, trade, or business will need to register their activity. All activities are initially classified as trades, unless they are explicitly acknowledged by the tax office to be freelance activities. Regardless of the type of activity, corporations (GmbHs and Aktiengesellschaften—or, private and public) are automatically classified as commercial due to their legal form.

What is a freelance profession?

A freelance activity is a subcategory of self-employment. In order to be classified as “freelance,” the activity must be of an artistic, editorial, educational, or scientific nature. As a rule, holding personal liability for performing an activity forms a prerequisite for acting as a freelancer. The freelancer’s liability always lies with the person themselves.

Employees may only be recruited in exceptional circumstances involving “highly specialized services”—for example, medical practices or tax consultancies. However, responsibility for each task lies with the director; otherwise, it would no longer be classified as working under your own responsibility.

Freelancers are not classified as merchants, so the provisions of the Commercial Code do not apply.

Differences in tax law between a freelancer and a tradesperson

Freelancers do not need to pay trade tax, nor become members of a chamber of commerce. In addition, their accounts only need to be prepared with simple cash based accounting. This is more straightforward than for traders, since freelancers are exempt from having to prepare double-entry bookkeeping.

Once a commercial trader’s profits exceed the annual allowance of 24,500 euros within the course of one year, they become subject to trade tax. Moreover, businesses need to observe more monitoring and auditing provisions and use double-entry bookkeeping once their sales exceed 600,000 euros or their profits exceed 60,000 euros (pursuant to section 141(1) of the Tax Code) within a year.

What is the difference between a freelance professional and a trader?

Both commercial traders and freelance professionals are classed as self-employed. Differentiating between these occupational categories can be tricky. But the difference comes down to professional qualification.

There are no set criteria for being classified as a freelance professional. However, the law governing partnerships of freelance professionals contains a frequently used definition:

“The term freelance professionals has the general meaning of persons who, as a result of a specific professional qualification or creative vocation, provide specialist services independently under their own personal responsibility and in the interests of a client and the general public.”

Professional occupations are listed in the catalog of professions in Section 18 of the Income Tax Act. According to this, the following activities are classified as freelance professions:

- Medical professions: Doctors, midwives, medical practitioners, physiotherapists, medical masseurs, and qualified psychologists

- Legal, tax, and economic consultancy professions: Lawyers, notaries public, auditors, tax consultants, and other financial and business advisers

- Technical/scientific professions: Engineers, architects, pilots, and professional subject specialists

- Cultural/communication professions: Journalists, translators, interpreters, academics, press photographers, teachers, kindergarten teachers, artists, and writers

The concluding reference to “similar professions” makes it clear that other professions not listed can also be registered as freelance professions, provided they are accepted by the tax office. Given that the catalog of professions is now some 50 years old, several new occupations are not included. For example, web designers, online coaches, and people working in marketing or IT are often able to register as self-employed even though these professions are not explicitly listed.

On the other hand, typical trades include the following economic activities:

- Accommodation and catering

- Industrial production

- Wholesale and retail

- Manual crafts and similar occupations, excluding artistic vocations

- Domestic home services (e.g., cleaning or repairs)

- Representatives, brokers, and agents

- Financial and wealth advisers

How do I know which group I belong to?

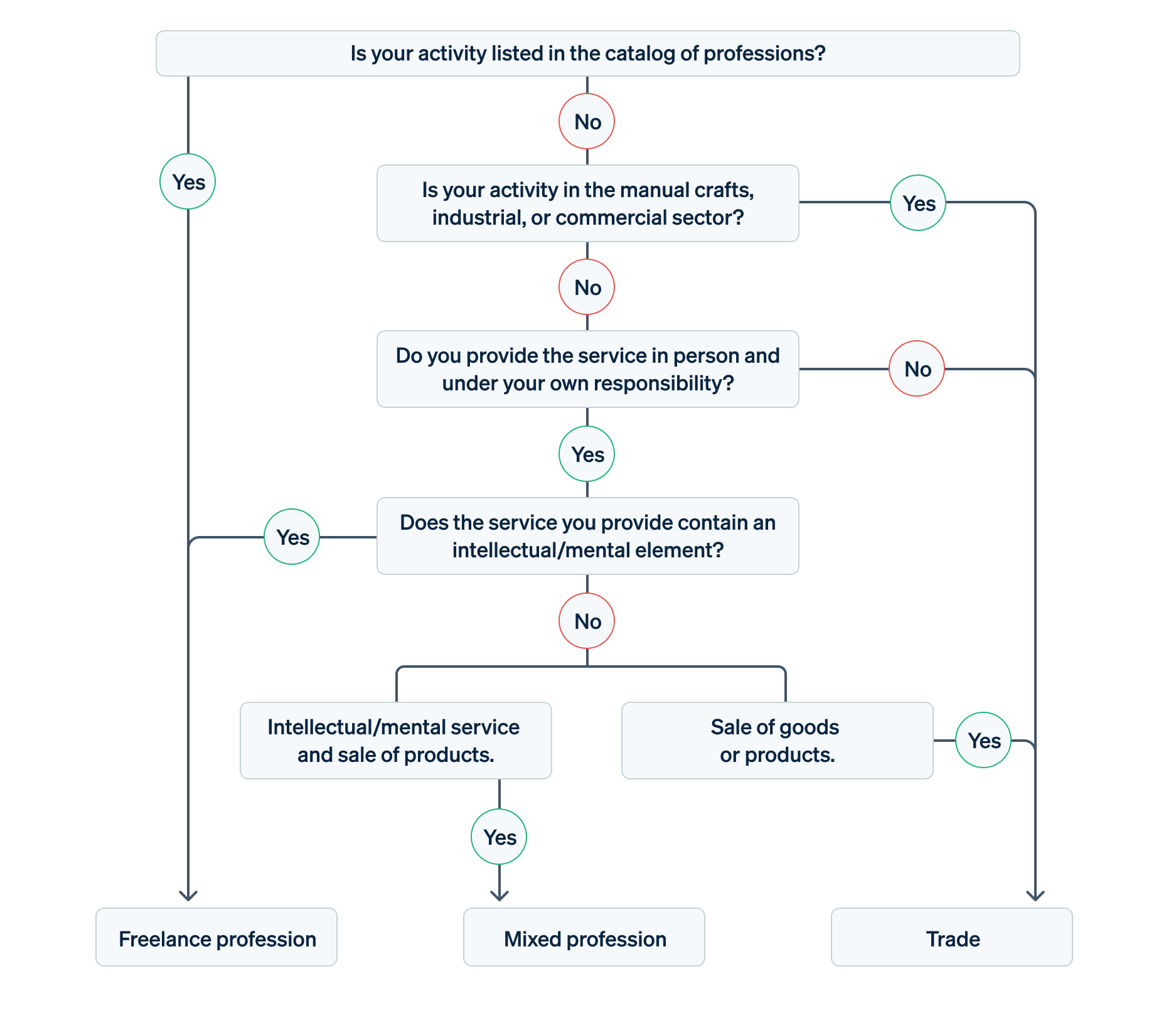

If you are not sure whether you need to register as a freelance professional or a trader, these questions might help you:

- Is your activity in the manual crafts, commercial, or industrial sector? If yes, you need to register as a trader.

- Do you provide your services in person and under your own responsibility? If not, you need to register your activity as a trade.

- Does the service you provide contain an intellectual/mental element (including planning, consultancy, educational, and artistic services)? If yes, it may be a freelance profession. If not, you need to register your activity as a trade. If you provide intellectual/mental services and also sell products, then your occupation is classified as a combined activity and is usually registered as a trade.

In case of doubt regarding whether to register as a freelance professional or trader, consult a tax consultant or the tax office.

What is a combined activity?

A clear example of a combined activity is an online coach who sells defined online courses as a product, and also advises customers individually. While selling a course would be classified as a trade, personal consultancy would be classified as a freelance profession.

A distinction is made between separable combined activities, and inseparable combined activities. An example of a separable combined activity would be someone who runs a guesthouse (trade) but also writes novels (freelance profession) on the side. There is no connection between the two activities. This means that the respective incomes can be declared separately on a tax return. Trade tax is only due on the trade income. However, the prerequisite for this is separate accounting, separate bank accounts, and a spatial separation of activities.

This is not the case with inseparable combined activities. “Inseparable” tasks are those that are mutually dependent on each other, or those that pursue a single goal.

For example, an internal designer who not only designs rooms (freelance profession), but who also implements and fits their designs (trade). Both activities are connected economically and in terms of their content, and are mutually dependent on each other. As a result, they cannot be separated for tax purposes. If the majority of income stems from the trade, then the activity should be registered as such.

Another example is an optician (freelance profession) who also sells contact lenses, glasses, and accessories from their practice (trade). If the majority of income comes from medical treatment and advice, then the practice remains a freelance profession.

In the case of German partnerships (OHG, KG, GbR), the “income requalification theory” applies. When a partnership performs both freelance professional and trade activities, it is always classified as a trade operation.

Freelance professional or small trader?

Because small business owners do not pay trade tax, do not have to observe double-entry bookkeeping, and are personally liable, it does not make much difference whether their activity is registered as a trade or freelance profession. This applies on the provision that the activity is expected to remain under the sales threshold for small businesses of 22,000 euros per year. If the income is expected to exceed this limit, businesses should first check whether a freelance profession or trade activity is planned and act accordingly.

Are all “freelancers” professionals?

In Germany, the terms “Freiberufler” (freelance professional) and “Freelancer,” and “Freier Mitarbeiter” or “Freie Mitarbeiterin” (contract workers) are used interchangeably. However, the term “Freiberufler” refers to certain occupations, whereas the term “Freelancer” only describes the employment status.

“Freie Mitarbeiter” are not employed by a company, but they instead work for companies on the basis of individual contracts. A specific “freelance contract” is concluded for each project.

Freelancers have to register as self-employed with the tax office. However, whether they register as a “freelance professional” or a “trader” has no bearing on the term “freelancer.”

Freelance professional or trader: The pros and cons

There are some occupations, such as doctors or tax advisers, who are prohibited from performing trade activities. They perform a freelance profession and can only register as such.

This contrasts with the situation in the fields of design, coaching, or marketing, for example. In many cases, both a trade and a professional activity can be registered in this case, depending on the scope of the business. An overview of the individual pros and cons can help make a decision.

In the case of a professional activity, exemption from trade tax is a major benefit. In addition, it is easier to prepare cash-based rather than double-entry accounts. However, employees can only be recruited if the freelance professional continues to perform their activity themselves under their own responsibility. Outsourcing is not possible. Moreover, selling products (digital products such as online courses and physical products) no longer counts as a freelance profession.

In order to sell products, delegate responsibility to employees, and establish companies or partnerships with limited liability, businesses need to register as a trader.

How do you register as a trader?

To register as a trader, you first need to register your trade with your local municipal authority. These days, the relevant form can normally be downloaded from your local authority’s website. Alternatively, you can call or visit the town hall in person.

Depending on your state, registering a trade costs between 20 and 60 euros. In addition to the completed registration form and a copy of your personal ID, you may also need to submit a certificate of good conduct, a license to perform your trade (e.g., a master craftsman’s diploma), or other documents.

Once you have received a trading license, the tax office will issue a request to complete a form for tax purposes. However, it is advisable to be proactive and submit the tax form immediately after registering your trade in order to avoid a delay. After this, you will receive your tax number from the tax office as well as your value-added tax (VAT) ID number from the Federal Central Tax Office (BZSt), if you have applied for this.

How do you register as a freelance professional?

To register a freelance profession, you do not need to register a trade. You simply need to fill out the tax form for the tax office. After this, you will receive your tax number from the tax office as well as your VAT ID number from the Federal Central Tax Office (BZSt), if you have applied for this.

The tax office also checks whether the activity is a freelance profession and if it requires membership in a professional association and—where necessary—the tax office will require the applicant to submit evidence of their qualifications to the relevant association.

Learn more about founding a company. And if you’d like to discuss how Stripe can help your business drive growth, get in touch with our sales team.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.