在德国,自雇职业分为两类:自由职业和个体经营。有些职业可明确归类为自由职业或个体经营,但对于 IT、市场营销或教练等新兴领域,情况可能更为复杂。本文将探讨有关自由职业、个体经营和自雇的相关问题。

本文内容

- 什么是个体经营?

- 什么是自由职业?

- 自由职业者和个体经营者有什么区别?

- 什么是综合活动?

- 自由职业者与个体经营者的利弊分析

- 如何注册为个体经营者?

- 如何注册为自由职业者?

什么是个体经营?

任何希望在工业、贸易或商业领域以自雇身份开展活动的人均需进行经营注册。除非获得税务局明确认定为自由职业,否则所有活动初始均被归类为个体经营。无论活动类型如何,公司实体(有限责任公司和股份公司-或私营和公营)因其法律形式自动被划分为商业类别。

什么是自由职业?

自由职业是自雇的一个子类别。被归类为“自由职业”活动必须具有艺术、编辑、教育或科学性质。通常,个人对执行活动承担责任是作为自由职业者的先决条件。自由职业者的责任始终由个人承担。

仅在涉及“高度专业化服务”(例如医疗诊所或税务咨询)的特殊情况下方可雇佣员工。但每项任务的最终责任仍由负责人承担;否则,该活动将不再被归类为自负责任。

自由职业者不属于商人,因此不适用《商法典》的规定。

自由职业者和个体经营者适用税法的差异

自由职业者既不需要缴纳贸易税,也无须加入商会。在账目方面,他们只需采用简单的现金收付制,比个体经营者的会计要求更为简便——因为自由职业者不必使用复式记账法。

当个体经营者的利润在一年内超过 24,500 欧元的年度免税额时,就必须缴纳贸易税。此外,如果企业销售额一年内超过 60 万欧元或利润超过 6 万欧元(根据《税法》第 141(1) 条),则需遵守更多监管审计规定并采用复式记账法。

自由职业者和个体经营者有什么区别?

个体经营者与自由职业者均被归类为自雇人士。这两种职业类别不易区分,但其根本区别在于专业资质。

虽然目前没有界定自由职业者的固定标准,但[《自由职业者合伙关系管理法》](https://www.gesetze-im-internet.de/partgg/__1.html "gesetze-im-internet.de | Gesetz über Partnerschaftsgesellschaften Angehöriger Freier Berufe (Partnerschaftsgesellschaftsgesetz - PartGG)第 1 条“合伙关系前提条件”提供了常用的定义:

“自由职业者通常指凭借特定专业资质或创造性职业,以独立身份自主承担责任,并为客户及公众利益提供专业服务的人员。”

《所得税法》第 18 条的职业目录中列出了职业类型。根据该条款,以下活动被认定为自由职业:

- 医疗专业:医生、助产士、执业医师、物理治疗师、医疗按摩师及具备资质的心理学家

- 法律、税务及经济咨询职业:律师、公证人、审计师、税务顾问及其他财务与商业顾问

- 技术/科学专业:工程师、建筑师、飞行员和专业领域专家

- 文化/传播专业:记者、笔译员、口译员、学者、新闻摄影师、教师、幼儿园教师、艺术家和作家

最后提到的“类似职业”明确指出,其他未列入目录的职业也可以注册为自由职业,只要税务局认可即可。鉴于职业目录已有约 50 年的历史,一些新的职业并未包括在内。例如,网页设计师、在线教练以及从事市场营销或 IT 工作的人员往往可以注册为自雇人士,尽管这些职业并未明确列出。

另一方面,典型的商业活动包括以下经济活动:

- 住宿和餐饮

- 工业生产

- 批发和零售

- 手工艺和类似职业,不包括艺术职业

- 家庭服务(如清洁或维修)

- 代表、经纪人和代理人

- 金融和财富顾问

如何判断自己属于哪一类?

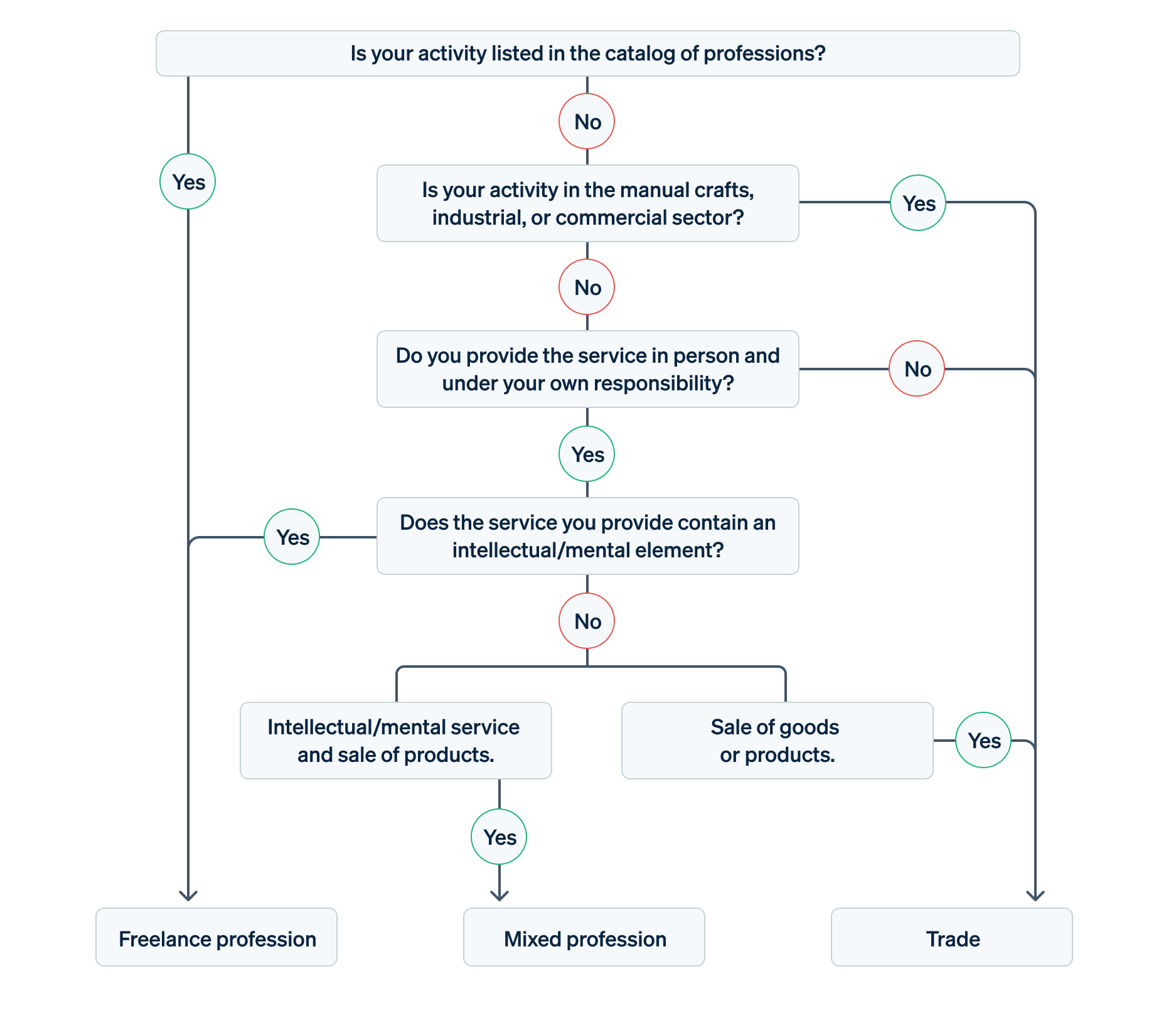

如果您不确定应注册为自由职业者还是个体经营者,以下问题可供参考:

- 您的活动是否属于手工艺、商业或工业领域?如果是,需注册为个体经营。

- 您是否以个人身份独立承担责任提供服务?如果不是,需注册为个体经营。

- 您提供的服务是否包含智力/精神要素(包括规划、咨询、教育和艺术服务)?如果是,则可能属于自由职业。如果不是,则需将您的活动注册为个体经营。如果您既提供智力/精神服务又销售产品,则您的职业将被归类为综合活动,通常需注册为个体经营。

如果对是否注册为自由职业者或个体经营者存在疑问,请咨询税务顾问或税务局。

什么是综合活动?

综合活动的典型示例之一是在线教练:他既销售标准化在线课程产品,又为客户提供个性化咨询。销售课程属于个体经营,而个人咨询则属于自由职业。

综合活动可分为可分离与不可分离两类。可分离综合活动的示例之一:某人经营民宿(个体经营),同时也写小说(自由职业)。这两种活动毫无关联,因此相关收入可在报税时分别申报。贸易税仅针对个体经营收入征收。但前提是需实现分账核算、分设银行账户以及物理空间上的经营活动分离。

不可分离混合活动则不符合上述特征。“不可分离”是指任务相互依存或共同服务于单一目标的活动。

例如:室内设计师不仅进行空间设计(自由职业),还亲自实施并安装设计方案(个体经营)。这两类活动在经济和内容上相互关联、彼此依存,因此在税务上不可分割。若大部分收入来自个体经营部分,则整体活动应注册为个体经营。

另一个示例是配镜师(自由职业),同时在自己的诊所销售隐形眼镜、镜架及配件(个体经营)。如果主要收入来源于诊疗和咨询,则该诊所仍可认定为自由职业。

对于德国合伙企业(OHG、KG、GbR),“收入性质重新认定原则”适用。当合伙企业同时从事自由职业和个体经营活动时,始终被整体归类为个体经营实体。

自由职业者还是小型个体经营者?

由于小型个体经营者无需缴纳贸易税、不必采用复式记账法且承担个人责任,其注册为个体经营或自由职业差异不大——前提是年销售额预计保持在 22,000 欧元的小微企业限额以下。如果预期收入超出该限额,则应先确认经营活动性质并进行相应的注册。

所有“自由职业者”都是专业人士吗?

在德国,“Freiberufler”(自由职业专业人士)和“Freelancer”以及 “Freier Mitarbeiter”或“Freie Mitarbeiterin”(合同工作者)常被混用。但“Freiberufler”一词是指特定职业,而“Freelancer”只描述职业状态。

“Freie Mitarbeiter”不受雇于公司,而是根据个人合同为公司工作。每个项目都要签订专门的“自由职业合同”。

自由职业者必须在税务局登记为自雇人士。不过,无论他们登记为“自由职业专业人士”还是“个体经营者”,都与“自由职业者”这个称谓无必然关联。

自由职业者与个体经营者的利弊分析

某些职业(如医生、税务顾问)被禁止从事个体经营活动。他们只能以自由职业者身份注册并开展专业活动。

相比之下,在设计、教练或市场营销等领域则存在灵活性。根据业务范围,许多情况下既可注册为个体经营也可注册为专业活动。权衡各自的优缺点有助于做出决策。

开展专业活动的一大优势是免征贸易税。此外,采用现金收付制记账比复式记账更为简便。但自由职业者只有在亲自承担责任的前提下才能招募员工,且不得将核心业务外包。需特别注意的是:销售产品(包括在线课程等数字产品和实体产品)不再被认定为自由职业。

如果需要销售产品、将职责授权给员工、成立有限责任公司或合伙制企业,则必须注册为个体经营者。

如何注册为个体经营者?

注册个体经营者首先需向当地市政当局提交商业登记。如今通常可在市政网站下载登记表格,也可通过电话或亲自前往市政厅办理。

根据所在州的不同规定,注册费在 20 至 60 欧元之间。除填写完整的登记表和个人身份证件副本外,可能还需提供良好行为证明、从事该行业的许可证(如技师证书)等文件。

取得经营许可证后,税务局将发出税务登记表填写通知。但为了避免延误,建议您在完成商业注册后,立即主动提交税务登记表。此后,您将从税务局获取税号,并从联邦中央税务局 (BZSt) 获得增值税税号(如果您已申请)。

如何注册为自由职业者?

注册自由职业不需要注册个体经营。您只需填写税务局的税表。其后,您将从税务局获得税号,并从联邦中央税务局 (BZSt) 获得增值税税号(如果您已申请)。

税务局还会核查活动是否属于自由职业范畴,是否需要加入专业人士协会,必要时,税务局会要求申请人向相关协会提交资格证明。

了解有关成立公司的更多信息。如果您想咨询 Stripe 如何助力您的业务增长,请联系我们的销售团队。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。