ธุรกิจในปัจจุบันจำเป็นต้องให้ความสำคัญกับการประมวลผลการชำระเงินที่เรียบง่ายและปลอดภัย ด้านหนึ่งที่สำคัญของการประมวลผลการชำระเงินคือกระบวนการเริ่มต้นใช้งานของผู้ค้า กระบวนการนี้ผสานการทํางานกับผู้ให้บริการชําระเงิน (PSP) หรือเกตเวย์การชําระเงิน โดยเป็นรากฐานสําหรับระบบประมวลผลการชําระเงินที่มีประสิทธิภาพ เป็นไปตามข้อกําหนด และมีประสิทธิภาพ

กลยุทธ์สำหรับกระบวนการเริ่มต้นใช้งานของผู้ค้าที่ดีจะช่วยเพิ่มประสบการณ์และความไว้วางใจของลูกค้า ขณะเดียวกันก็ลดความเสี่ยงในการฉ้อโกง การทำธุรกรรมล่าช้า และค่าปรับจากการไม่ปฏิบัติตามกฎระเบียบ ธุรกิจต่างๆ ต้องวางแผนและดําเนินการตามกระบวนการเริ่มต้นใช้งานของผู้ค้าอย่างรอบคอบ เพื่อสร้างการตั้งค่าการชําระเงินที่เหมาะกับความต้องการของตนเอง แม้ว่ารายละเอียดของกระบวนการเริ่มต้นใช้งานของผู้ค้าจะซับซ้อน แต่ขั้นตอนนี้ก็ไม่จําเป็นต้องซับซ้อนแต่อย่างใด ต่อไปนี้คือสิ่งที่คุณต้องรู้

บทความนี้ให้ข้อมูลอะไรบ้าง

- กระบวนการเริ่มต้นใช้งานของผู้ค้าคืออะไร

- กระบวนการเริ่มต้นใช้งานของผู้ค้า: ผู้มีส่วนเกี่ยวข้องและองค์ประกอบหลัก

- ธุรกิจต้องการเอกสารอะไรบ้างสําหรับกระบวนการเริ่มต้นใช้งานของผู้ค้า

- กระบวนการเริ่มต้นใช้งานของผู้ค้าเป็นอย่างไร

- กระบวนการ "รู้จักลูกค้าของคุณ" (KYC) คืออะไร

- กระบวนการเริ่มต้นใช้งานของผู้ค้ากับ Stripe: วิธีเริ่มใช้งาน

กระบวนการเริ่มต้นใช้งานของผู้ค้าคืออะไร

กระบวนการเริ่มต้นใช้งานของผู้ค้าคือกระบวนการที่บริษัทด้านการชําระเงินจัดตั้งธุรกิจเพื่อรับและจัดการการชําระเงินของลูกค้าอย่างง่ายดายและปลอดภัย ขั้นตอนนี้ส่งผลอย่างมีนัยสำคัญต่อประสิทธิภาพการดำเนินงานของธุรกิจ ประสบการณ์ของลูกค้า และการจัดการความเสี่ยง

กระบวนการเริ่มต้นใช้งานที่ดำเนินการไม่ดีอาจนำไปสู่ธุรกรรมที่ล่าช้าหรือล้มเหลว ความเสี่ยงต่อการฉ้อโกงที่เพิ่มมากขึ้น และการไม่ปฏิบัติตามกฎระเบียบของอุตสาหกรรม ซึ่งท้ายที่สุดแล้วอาจส่งผลเสียต่อชื่อเสียงของธุรกิจ และอาจทำให้เกิดค่าปรับทางการเงินหรือสูญเสียลูกค้า

ธุรกิจต่างๆ ควรใช้แนวทางที่รอบคอบในกระบวนการเริ่มต้นใช้งานของผู้ค้า เพื่อให้ประสบความสำเร็จในภูมิทัศน์การชำระเงินที่มีการแข่งขันสูงและมีการกำกับดูแลอย่างเข้มงวดในปัจจุบัน ซึ่งจะช่วยให้ธุรกิจสามารถมอบประสบการณ์สำหรับลูกค้าที่เรียบง่ายและปลอดภัย รักษาความสัมพันธ์กับพาร์ทเนอร์ด้านการชำระเงิน ซึ่งท้ายที่สุดแล้วจะเป็นแรงผลักดันการเติบโตทางธุรกิจและการรักษาลูกค้า

กระบวนการเริ่มต้นใช้งานของผู้ค้า: ผู้มีส่วนเกี่ยวข้องและองค์ประกอบหลัก

เพื่อประสบการณ์การเริ่มต้นใช้งานของผู้ค้าที่ประสบความสําเร็จ เราจําเป็นต้องทําความเข้าใจบทบาทของผู้มีส่วนเกี่ยวข้องหลักหลายๆ ฝ่าย และวิธีที่พวกเขามีปฏิสัมพันธ์กันระหว่างกระบวนการ ฝ่ายเหล่านี้ทำงานร่วมกันเพื่อดำเนินการสภาพแวดล้อมการประมวลผลการชำระเงินที่ปลอดภัยและทำงานได้ โดยฝ่ายต่างๆ มีดังนี้

ผู้ค้า

ผู้ค้าคือธุรกิจ ผู้ค้าปลีก หรือผู้ให้บริการที่ต้องรับชําระเงินจากลูกค้า พวกเขาสร้างความสัมพันธ์กับผู้ให้บริการชำระเงินหรือเกตเวย์การชำระเงินเพื่ออำนวยความสะดวกในธุรกรรมผ่านช่องทางต่างๆ เช่น ทางออนไลน์ ในร้านค้า หรือการชำระเงินผ่านอุปกรณ์เคลื่อนที่ผู้ให้บริการชําระเงิน

ผู้ให้บริการชําระเงิน (PSP) คือบริษัทที่ให้บริการโซลูชันการประมวลผลการชําระเงินสําหรับธุรกิจ บริษัทผู้ออกบัตรจะจัดการแง่มุมทางเทคนิคของการประมวลผลธุรกรรม เช่น การอนุมัติ การหักบัญชี และการชําระเงิน และยืนยันว่าได้ปฏิบัติตามระเบียบข้อบังคับและมาตรฐานของอุตสาหกรรม นอกจากนี้ PSP ยังอาจเสนอบริการเพิ่มเติม เช่น การตรวจจับการฉ้อโกงและการจัดการความเสี่ยงเกตเวย์การชําระเงิน

เกตเวย์การชําระเงินคือแพลตฟอร์มเทคโนโลยีที่ช่วยอํานวยความสะดวกในการถ่ายโอนข้อมูลธุรกรรมระหว่างระบบต่างๆ ของธุรกิจอย่างปลอดภัย เช่น ร้านค้าออนไลน์ ระบบบันทึกการขาย (POS) หรือแอปบนอุปกรณ์เคลื่อนที่ และ PSP หรือธนาคารผู้รับชําระเงิน โดยพวกเขาจะมีหน้าที่เข้ารหัสข้อมูลที่ละเอียดอ่อน เช่น ข้อมูลบัตรเครดิต และตรวจสอบให้มั่นใจว่ามีการส่งข้อมูลนี้อย่างปลอดภัยระหว่างกระบวนการทําธุรกรรมธนาคารผู้รับบัตร

ธนาคารผู้รับบัตร หรือที่เรียกว่า "สถาบันผู้รับบัตรของผู้ค้า" คือสถาบันการเงินที่เป็นพาร์ทเนอร์กับ PSP เพื่อประมวลผลและชําระธุรกรรมในนามของธุรกิจ โดยสถาบันนี้จะทำหน้าที่ประเมินและควบคุมบัญชีผู้ค้า ประเมินความเสี่ยงที่เกี่ยวข้องกับธุรกิจ และดูแลให้มั่นใจว่าได้ปฏิบัติตามกฎระเบียบเครือข่ายบัตร

เครือข่ายบัตร เช่น Visa, Mastercard, American Express และ Discover คือองค์กรที่ตั้งกฎและมาตรฐานสําหรับธุรกรรมผ่านบัตร โดยจะอํานวยความสะดวกในการสื่อสารและการชําระเงินสำหรับธุรกรรมระหว่างธนาคารผู้รับบัตรและธนาคารผู้ออกบัตร (ธนาคารที่ออกบัตรชําระเงินของลูกค้า)ธนาคารผู้ออกบัตร

ธนาคารผู้ออกบัตร หรือที่เรียกว่า "ผู้ออกบัตร" คือสถาบันทางการเงินที่ออกบัตรชําระเงิน ซึ่งหมายถึงบัตรเครดิต บัตรเดบิต หรือบัตรเติมเงินให้แก่ลูกค้า บริษัทมีหน้าที่อนุมัติธุรกรรม ตรวจสอบว่าลูกค้ามีเงินทุนหรือเครดิตที่ใช้ได้ และในท้ายที่สุด ก็จะโอนยอดเงินดังกล่าวให้กับธนาคารผู้รับบัตรหน่วยงานกํากับดูแล

หน่วยงานกํากับดูแลและหน่วยงานในอุตสาหกรรม เช่น สภามาตรฐานการรักษาความปลอดภัยอุตสาหกรรมบัตรชําระเงิน (PCI SSC) จัดทําและบังคับใช้กฎระเบียบและมาตรฐานที่กํากับดูแลการประมวลผลการชําระเงิน พวกเขามีจุดมุ่งหมายเพื่อปกป้องลูกค้า รวมทั้งรับรองความปลอดภัยและความถูกต้องสมบูรณ์ของระบบนิเวศการชําระเงิน

ธุรกิจต้องการเอกสารอะไรบ้างสําหรับกระบวนการเริ่มต้นใช้งานของผู้ค้า

ธุรกิจควรเตรียมเอกสารและสิ่งที่จําเป็นก่อนเริ่มกระบวนการเริ่มต้นใช้งานของผู้ค้า การรวบรวมสิ่งเหล่านี้ล่วงหน้าอาจช่วยเร่งความเร็วและลดความล่าช้าที่อาจเกิดขึ้นในกระบวนการซึ่งกินเวลานาน

ต่อไปนี้นี่คือรายการเอกสารสําคัญและสิ่งที่ธุรกิจควรวางแผนเอาไว้ให้พร้อม

เอกสารการจดทะเบียนธุรกิจ

สำเนาเอกสารการจดทะเบียนธุรกิจ เช่น หนังสือสำคัญการจดทะเบียนบริษัท ใบรับรองการจัดตั้ง หรือเอกสารอื่นๆ ที่เกี่ยวข้อง ซึ่งยืนยันการมีอยู่ตามกฎหมายของธุรกิจหมายเลขประจําตัวผู้เสียภาษี

หมายเลขประจําตัวผู้เสียภาษีของธุรกิจ เช่น หมายเลขประจําตัวนายจ้าง (EIN) ในสหรัฐอเมริกา หรือข้อมูลเทียบเท่าในประเทศอื่นๆข้อมูลการเป็นเจ้าของ

ข้อมูลเกี่ยวกับโครงสร้างความเป็นเจ้าของธุรกิจ รวมถึงรายละเอียดเกี่ยวกับเจ้าของ หุ้นส่วน หรือกรรมการ การดําเนินการนี้อาจเกี่ยวข้องกับการส่งเอกสารประจําตัวประชาชนของผู้มีส่วนเกี่ยวข้องหลักๆ เช่น บัตรประจําตัวที่ออกโดยรัฐบาล หนังสือเดินทาง หรือใบอนุญาตขับขี่งบการเงิน

งบการเงินล่าสุด เช่น งบดุล งบกําไรขาดทุน และงบกระแสเงินสด เพื่อให้ข้อมูลเชิงลึกเกี่ยวกับสถานะทางการเงินของธุรกิจข้อมูลบัญชีธนาคาร

รายละเอียดเกี่ยวกับบัญชีธนาคารของธุรกิจ ซึ่งรวมถึงหมายเลขบัญชี, Routing Number และชื่อและที่อยู่ของธนาคารใบอนุญาตประกอบกิจการ

สําเนาใบอนุญาตประกอบกิจการ ใบอนุญาตหรือใบรับรองที่เกี่ยวข้องซึ่งจําเป็นต่อการดําเนินธุรกิจในอุตสาหกรรมหรือเขตอํานาจศาลของคุณเว็บไซต์ธุรกิจและตัวตนบนโลกออนไลน์

ข้อมูลเกี่ยวกับเว็บไซต์ของธุรกิจ ร้านค้าออนไลน์ หรือแอปบนอุปกรณ์เคลื่อนที่ ซึ่งรวมถึง URL และคําอธิบายของผลิตภัณฑ์หรือบริการที่นําเสนอประวัติการประมวลผลการชําระเงิน

หากธุรกิจมีประวัติการประมวลผลการชําระเงินก่อนหน้านี้ โปรดส่งรายการเดินบัญชีหรือข้อมูลสรุปยอดธุรกรรมที่ผ่านมา อัตราการดึงเงินคืน และข้อมูลอื่นๆ ที่เกี่ยวข้องแผนธุรกิจและการคาดการณ์รายรับ

อาจมีการขอแผนธุรกิจโดยละเอียด รวมถึงการคาดการณ์รายได้และปริมาณธุรกรรมที่คาดการณ์ไว้ โดยเฉพาะสำหรับธุรกิจสตาร์ทอัพหรือธุรกิจที่มีประวัติการดำเนินงานจำกัดเอกสารประกอบการปฏิบัติตามข้อกําหนด

เอกสารใดๆ ที่เกี่ยวข้องกับการปฏิบัติตามข้อกําหนดของธุรกิจหรือมาตรฐานอุตสาหกรรม เช่น มาตรฐานการรักษาความปลอดภัยข้อมูลสําหรับอุตสาหกรรมบัตรชําระเงิน (PCI DSS), กฎระเบียบว่าด้วยการคุ้มครองความเป็นส่วนตัวของข้อมูลส่วนบุคคล (GDPR) หรือนโยบายการคุ้มครองข้อมูลและความเป็นส่วนตัวอื่นๆ

กระบวนการเริ่มต้นใช้งานของผู้ค้าเป็นอย่างไร

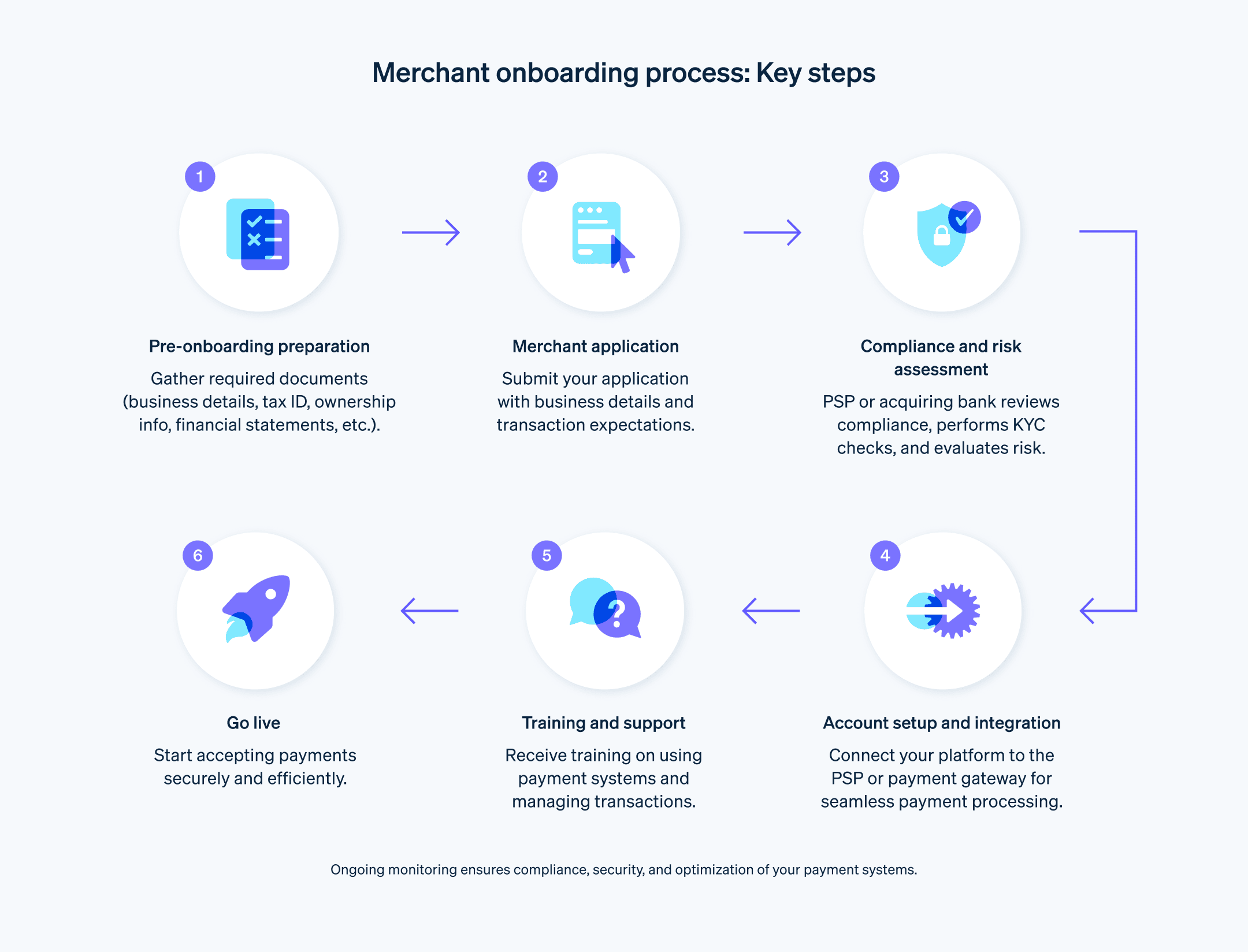

กระบวนการเริ่มต้นใช้งานของผู้ค้าประกอบด้วยหลายขั้นตอนในการสร้างความสัมพันธ์ระหว่างธุรกิจกับ PSP หรือเกตเวย์การชําระเงิน

ต่อไปนี้คือภาพรวมเกี่ยวกับกระบวนการเริ่มต้นใช้งานของผู้ค้าโดยทั่วไป

1. การเตรียมพร้อมก่อนเริ่มต้นใช้งาน

รวบรวมข้อมูลที่จําเป็นและเอกสารประกอบตามที่ระบุไว้ในส่วนก่อนหน้า นอกจากนี้คุณควรศึกษา PSP และเกตเวย์การชําระเงิน เพื่อค้นหาตัวเลือกที่เหมาะสมที่สุดสําหรับความต้องการเฉพาะของคุณ

2. ใบสมัครและการตรวจสอบผู้ค้า

ส่งใบสมัครไปยัง PSP หรือเกตเวย์การชําระเงิน โดยให้ข้อมูลเกี่ยวกับธุรกิจของคุณ เจ้าของธุรกิจ และปริมาณธุรกรรมที่คาดการณ์ไว้ PSP หรือเกตเวย์การชําระเงินจะตรวจสอบใบสมัครเพื่อให้มั่นใจว่าธุรกิจของคุณมีคุณสมบัติตามข้อกําหนดที่จําเป็นและเป็นผู้สมัครที่เหมาะสมกับบริการของพวกเขา

3. การประเมินการปฏิบัติตามข้อกําหนดและความเสี่ยง

PSP หรือธนาคารผู้รับบัตรจะตรวจสอบสถานะธุรกิจคุณเพื่อประเมินความเสี่ยงที่เกี่ยวข้อง โดยพิจารณาจากปัจจัยต่างๆ อย่างเช่น ประเภทของธุรกิจ ปริมาณธุรกรรม ประวัติการดึงเงินคืน และการปฏิบัติตามข้อกําหนดที่เกี่ยวข้องและมาตรฐานของอุตสาหกรรม โดยขั้นตอนนี้อาจเกี่ยวข้องกับการตรวจสอบประวัติ การตรวจสอบเครดิต และการยืนยันข้อมูลที่คุณส่งให้

4. การสร้างและการผสานการทํางานบัญชี

เมื่ออนุมัติแล้ว ให้ตั้งค่าบัญชีของคุณด้วย PSP หรือเกตเวย์การชําระเงินนั้นๆ โดยต้องเชื่อมต่อร้านค้าออนไลน์ ระบบ POS หรือแอปบนอุปกรณ์เคลื่อนที่เข้ากับเกตเวย์การชําระเงินของ PSP เพื่อการประมวลผลการชําระเงินที่ราบรื่น การผสานการทํางานอาจต้องได้รับการสนับสนุนทางเทคนิคจาก PSP หรือเกตเวย์การชําระเงิน รวมทั้งมีการทดสอบเพื่อให้มั่นใจว่าทุกอย่างทํางานได้ตามที่คาดหวัง

5. การฝึกอบรมและการสนับสนุน

PSP และเกตเวย์การชําระเงินส่วนใหญ่จะมอบการฝึกอบรม ทรัพยากร และการสนับสนุนอย่างต่อเนื่องแก่ทีมของคุณ เพื่อให้มั่นใจว่าการทํางานจะเป็นไปอย่างราบรื่นและประสบความสําเร็จ ซึ่งอาจรวมถึงคําแนะนําเกี่ยวกับการใช้แพลตฟอร์มการชําระเงิน การจัดการธุรกรรม การจัดการการโต้แย้งการชําระเงินและการดึงเงินคืน พร้อมด้วยการดำเนินงานตามข้อกําหนดด้านความปลอดภัยและการปฏิบัติตามระเบียบข้อบังคับต่างๆ

6. การตรวจสอบและการเพิ่มประสิทธิภาพอย่างต่อเนื่อง

หลังจากกระบวนการเริ่มต้นใช้งานเสร็จสมบูรณ์แล้ว ให้คอยตรวจสอบและเพิ่มประสิทธิภาพระบบประมวลผลการชําระเงินของคุณอย่างต่อเนื่อง เพื่อให้มั่นใจถึงประสิทธิภาพสูงสุด ความปลอดภัย และการปฏิบัติตามข้อกําหนด โดยอาจต้องทำการอัปเดตซอฟต์แวร์ การใช้มาตรการป้องกันการฉ้อโกงใหม่ๆ หรือการปรับวงเงินธุรกรรมโดยอิงตามความต้องการทางธุรกิจที่เปลี่ยนแปลงไป

กระบวนการ "รู้จักลูกค้าของคุณ" (KYC) คืออะไร

"รู้จักลูกค้าของคุณ" (KYC) คือข้อกําหนดทางกฎหมายและกระบวนการจัดการความเสี่ยงที่สถาบันการเงิน PSP และธุรกิจอื่นๆ นําไปใช้เพื่อยืนยันตัวตนของลูกค้า เป้าหมายหลักของ KYC คือการป้องกันการฟอกเงิน การจัดหาเงินทุนแก่การก่อการร้าย และกิจกรรมฉ้อโกงอื่นๆ ด้วยการรับรองว่าธุรกิจต่างๆ กำลังให้บริการบุคคลและธุรกิจที่ถูกต้องตามกฎหมาย

KYC มีบทบาทสําคัญในกระบวนการเริ่มต้นใช้งานของผู้ค้า เนื่องจาก PSP และธนาคารผู้รับบัตรจําเป็นต้องทําการตรวจสอบ KYC กับธุรกิจต่างๆ ก่อนที่จะสร้างความสัมพันธ์ KYC ช่วยประเมินความเสี่ยงที่เกี่ยวข้องกับธุรกิจ จากนั้นก็จะช่วยให้ PSP และธนาคารผู้รับบัตรสามารถตัดสินใจได้อย่างมีข้อมูลว่าจะอนุมัติหรือปฏิเสธใบสมัครผู้ค้าของธุรกิจรายนั้นๆ หรือไม่

โดยทั่วไปแล้วในระหว่างกระบวนการเริ่มต้นใช้งานของผู้ค้า KYC จะประกอบด้วยขั้นตอนต่อไปนี้

1. เอกสารประจำตัว

ธุรกิจให้ข้อมูลและเอกสารที่จําเป็น เช่น รายละเอียดการจดทะเบียนบริษัท หมายเลขประจําตัวผู้เสียภาษี และโครงสร้างการเป็นเจ้าของ นอกจากนี้ยังอาจต้องส่งเอกสารประจําตัวประชาชนของเจ้าของธุรกิจหรือผู้มีส่วนเกี่ยวข้องหลักด้วย เช่น บัตรประจําตัวที่ออกโดยรัฐบาล หนังสือเดินทาง หรือใบอนุญาตขับขี่

2. การยืนยัน

PSP หรือธนาคารผู้รับบัตรจะยืนยันข้อมูลของธุรกิจ โดยใช้แหล่งข้อมูลที่เชื่อถือได้และอิสระ เช่น ระเบียนข้อมูลสาธารณะ เครดิตบูโร หรือฐานข้อมูลทางการค้า การทำเช่นนี้จะช่วยให้มั่นใจว่าธุรกิจดังกล่าวเป็นธุรกิจที่ชอบด้วยกฎหมาย และบุคคลที่มีส่วนเกี่ยวข้องคือบุคคลนั้นจริงๆ

3. การประเมินความเสี่ยง

PSP หรือธนาคารผู้รับบัตรจะประเมินความเสี่ยงที่เกี่ยวข้องกับธุรกิจโดยพิจารณาจากปัจจัยต่างๆ เช่น ประเภทของธุรกิจ ปริมาณธุรกรรม ตําแหน่งที่ตั้งทางภูมิศาสตร์ และประวัติการปฏิบัติตามข้อกําหนด ธุรกิจที่มีความเสี่ยงสูงอาจต้องผ่านขั้นตอนการตรวจสอบสถานะที่มากขึ้น รวมถึงการตรวจสอบภูมิหลังที่ละเอียดขึ้นและการติดตามตรวจสอบอย่างต่อเนื่อง

4. การติดตามตรวจสอบอย่างต่อเนื่อง

หลังจากขั้นตอนการตรวจสอบและกระบวนการเริ่มต้นใช้งาน KYC เริ่มแรก แล้ว ทาง PSP และธนาคารผู้รับบัตรก็จําเป็นต้องติดตามกิจกรรมของธุรกิจอย่างสม่ําเสมอ ข้อมูลนี้จะช่วยระบุการเปลี่ยนแปลงต่างๆ ในโปรไฟล์ความเสี่ยง รวมถึงสัญญาณอันตรายที่อาจเกิดขึ้น หรือกิจกรรมที่น่าสงสัยที่อาจต้องมีการตรวจสอบเพิ่มเติม

คุณน่าจะต้องผ่านขั้นตอน KYC ในระหว่างกระบวนการเริ่มต้นใช้งานของผู้ค้า และดำเนินการอีกเป็นระยะๆ หลังจากนั้น

กระบวนการเริ่มต้นใช้งานของผู้ค้ากับ Stripe: วิธีเริ่มใช้งาน

เมื่อเริ่มกระบวนการเริ่มต้นใช้งานกับ Stripe คุณจะได้รับสิทธิ์เข้าถึงชุดเครื่องมือและฟีเจอร์ที่มีประสิทธิภาพสําหรับรับชําระเงิน จัดการการชําระเงินตามรอบบิล และป้องกันการฉ้อโกง ต่อไปนี้คือภาพรวมเกี่ยวกับกระบวนการเริ่มต้นใช้งานของผู้ค้ากับ Stripe

1. ลงทะเบียนใช้บัญชี Stripe

เริ่มต้นด้วยการลงทะเบียนบัญชี Stripe ใหม่ คุณจะต้องระบุที่อยู่อีเมล สร้างรหัสผ่าน และกรอกแบบสอบถามสั้นๆ เกี่ยวกับธุรกิจของคุณ

2. ระบุรายละเอียดของธุรกิจ

หลังจากลงทะเบียน คุณจะต้องป้อนข้อมูลธุรกิจ รวมถึงชื่อทางกฎหมาย ที่อยู่ หมายเลขประจําตัวผู้เสียภาษี และประเภทผลิตภัณฑ์และบริการที่คุณเสนอ

3. ยืนยันตัวตนของคุณ

Stripe กําหนดให้ธุรกิจใหม่ๆ ต้องยืนยันตัวตนในฐานะส่วนหนึ่งของกระบวนการ KYC เช่นเดียวกับ PSP อื่นๆ คุณอาจได้รับการติดต่อเพื่อขอให้ส่งเอกสารประจําตัว เช่น บัตรประจําตัวที่รัฐบาลออกให้ หนังสือเดินทาง หรือใบอนุญาตขับขี่

4. เชื่อมโยงบัญชีธนาคารของคุณ

หากต้องการรับการเบิกจ่ายจาก Stripe คุณจะต้องระบุข้อมูลบัญชีธนาคาร รวมถึงหมายเลขบัญชีและ Routing Number Stripe รองรับการเบิกจ่ายในมากกว่า 135 สกุลเงิน และทํางานร่วมกับบัญชีธนาคารจากหลายประเทศ

5. ผสานการทํางาน Stripe กับแพลตฟอร์มของคุณ

Stripe มอบตัวเลือกการผสานการทํางานหลากหลายแบบ รวมถึงปลั๊กอินสําเร็จรูปสําหรับแพลตฟอร์มอีคอมเมิร์ซยอดนิยมอย่าง Shopify, WooCommerce และ Magento พร้อมด้วยการผสานการทํางานแบบกําหนดเองที่ใช้ API และ SDK ของ Stripe คุณสามารถเลือกตัวเลือกที่ดีที่สุดตามความเชี่ยวชาญทางเทคนิคและความต้องการทางธุรกิจของคุณ

6. ทดสอบการผสานการทํางาน

ก่อนที่จะใช้งานจริง โปรดตรวจสอบให้แน่ใจว่าการผสานการทํางาน Stripe ของคุณทํางานอย่างถูกต้อง Stripe มีสภาพแวดล้อมการทดสอบที่คุณสามารถจําลองธุรกรรมและตรวจสอบปัญหาต่างๆ ได้

7. ใช้งานจริงและรับการชําระเงิน

เมื่อเสร็จสิ้นกระบวนการเริ่มต้นใช้งานและทดสอบการผสานการทํางานแล้ว คุณจะเริ่มรับชําระเงินจากลูกค้าได้ Stripe จัดการด้านการประมวลผลธุรกรรม ความปลอดภัย และการปฏิบัติตามข้อกําหนด คุณจึงมีเวลาไปมุ่งเน้นกับการดําเนินธุรกิจและขยายกิจการ

กระบวนการเริ่มต้นใช้งานสําหรับผู้ค้าของ Stripe นั้นไม่ซับซ้อนและใช้งานง่าย ทําให้ธุรกิจทุกขนาดสามารถตั้งค่าและเริ่มรับการชําระเงินได้อย่างรวดเร็ว หากต้องการข้อมูลเพิ่มเติม โปรดเริ่มต้นที่นี่

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ